Global Building-integrated Photovoltaics Facade Market Size, Share Analysis Report By Type (Thin Film, Crystalline Materials, Others), By Material (Glass, Polymer, Ceramic, Metal, Composite), By Installation Type (New Construction, Retrofit), By Application (Commercial Buildings, Residential Buildings, Industrial Buildings, Educational Institutions, Healthcare Facilities) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154895

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

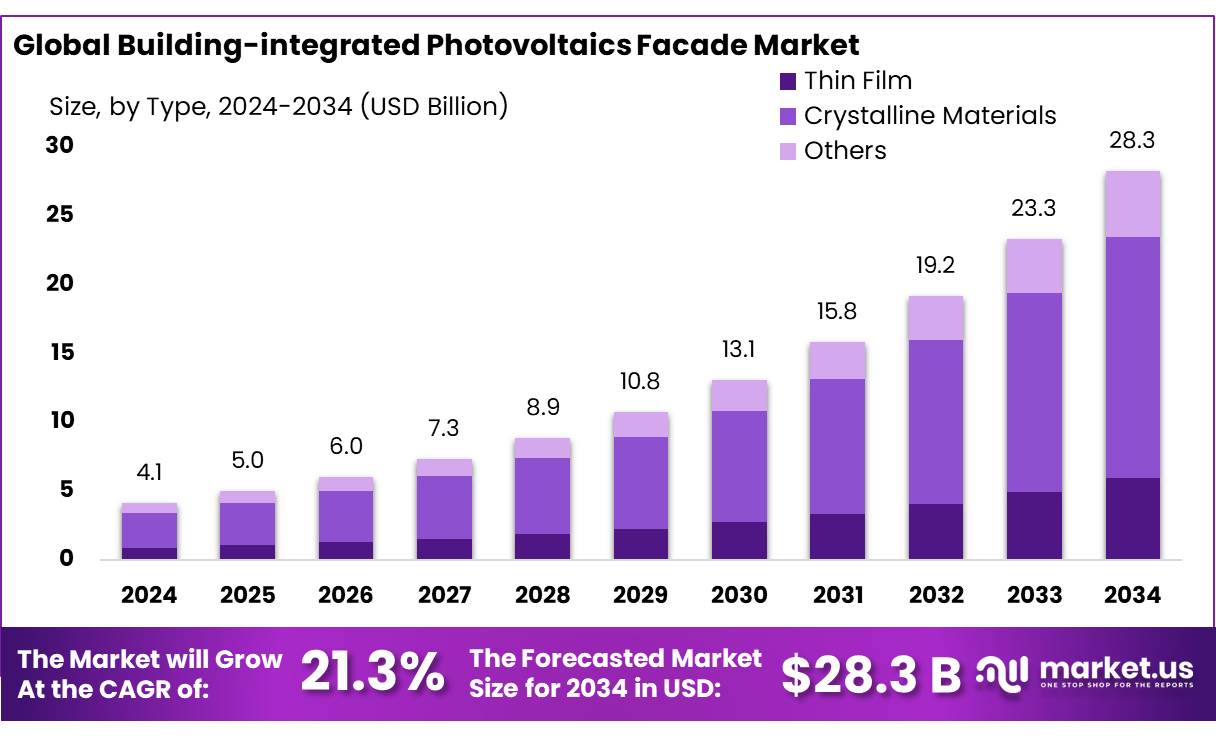

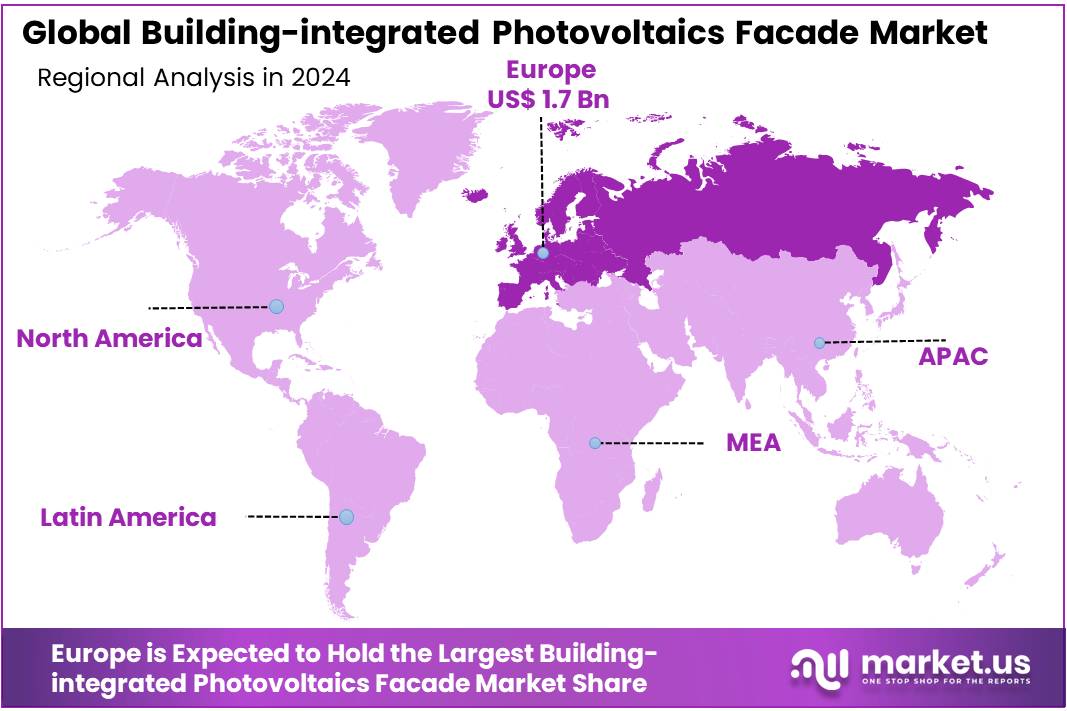

The Global Building-integrated Photovoltaics Facade Market size is expected to be worth around USD 28.3 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 21.3% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 41.9 % share, holding USD 1.7 Billion revenue.

Building-Integrated Photovoltaics (BIPV) represent a transformative approach in sustainable architecture, integrating photovoltaic systems directly into building envelopes such as facades, roofs, and windows. Unlike traditional solar panels, BIPV systems serve dual purposes—acting as structural components while generating renewable energy. This integration enhances aesthetic appeal and contributes to energy efficiency, aligning with global trends towards decarbonization and energy independence.

Government initiatives play a crucial role in promoting BIPV adoption. For instance, the U.S. federal government offers tax credits for solar energy systems, including BIPV installations. The Inflation Reduction Act of 2022 provides a 30% refundable Investment Tax Credit (ITC) for clean technology investments, which can be applied to BIPV projects. Similarly, the European Union’s REPowerEU plan aims to increase solar photovoltaic capacity to over 320 GW by 2025 and nearly 600 GW by 2030, supporting BIPV integration in buildings.

Internationally, countries like Germany are setting benchmarks in BIPV adoption. In early 2024, Germany’s solar power installations increased by 35%, with significant growth in commercial rooftop and open-space installations. This surge is attributed to supportive government policies and incentives aimed at achieving 80% renewable energy usage by 2030.

The sector’s expansion can be attributed to increasing global emphasis on renewable energy and low‑carbon construction. Governments have introduced incentives—including feed‑in tariffs and façade‑specific premiums—to encourage uptake. For instance, France has offered an additional €0.25 per kWh premium on BIPV over regular PV rates, while other European countries including the UK, Spain, and Italy have implemented varied incentives.

Concretely, as of April 2025, India had installed a total solar photovoltaic capacity of 107.94 GW_AC, producing approximately 144.15 TWh of solar electricity between April 2024 and March 2025. In the European Union, solar capacity rose from 164.19 GW in 2021 to 259.99 GW in 2023. The REPowerEU strategy targets over 320 GW by 2025 and nearly 600 GW by 2030. In Germany, solar installations surged 35% in the first four months of 2024, with more than 5 GW of new capacity added—driven by legislation aimed at meeting 80% renewable energy supply by 2030 and climate neutrality by 2045.

The momentum behind BIPV deployment is underpinned by robust national solar initiatives. Notably, the National Solar Mission, launched in 2010 and later expanded in 2015, established solar capacity targets rising from 20 GW to 100 GW by 2022. Utility‑scale solar capacity grew from 161 MW in March 2010 to over 21 650 MW by March 2018.

As of June 30, 2025, India’s overall solar installed capacity (including rooftop and ground‑mounted systems) reached 116.24 GW‑AC, and the country aimed to achieve 500 GW of renewable energy by 2030, with at least 250 GW from solar sources. In addition, the Pradhan Mantri Surya Ghar Muft Bijli Yojana, launched in early 2024, allocates a substantial budget of ₹75 021 crore to facilitate rooftop solar installation for approximately 1 crore households, further stimulating solar adoption at the building level.

Key Takeaways

- Building-integrated Photovoltaics Facade Market size is expected to be worth around USD 28.3 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 21.3%.

- Crystalline Materials held a dominant market position, capturing more than a 62.1% share in the Building-integrated Photovoltaics (BIPV) Facade market.

- Glass held a dominant market position, capturing more than a 43.8% share in the Building-integrated Photovoltaics (BIPV) Facade market.

- New Construction held a dominant market position, capturing more than a 71.2% share in the Building-integrated Photovoltaics (BIPV) Facade market.

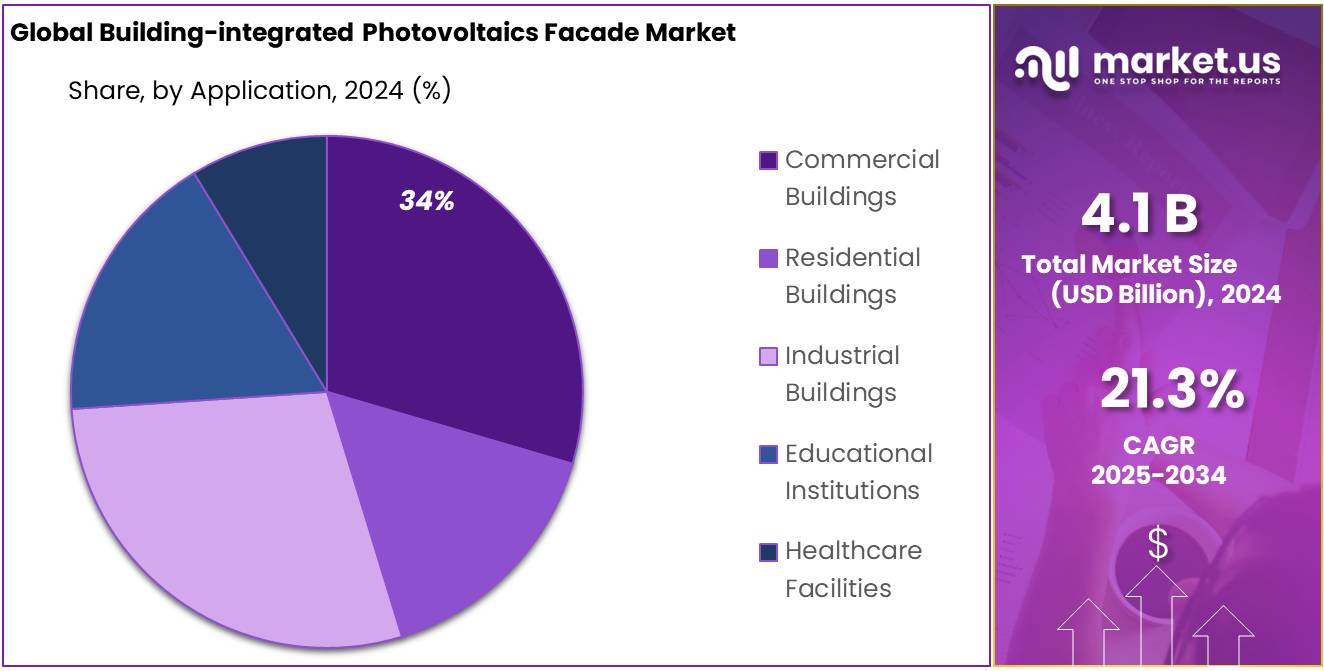

- Commercial Buildings held a dominant market position, capturing more than a 34.7% share in the Building-integrated Photovoltaics (BIPV) Facade market.

- Europe emerged as the dominant region in the Building‑integrated Photovoltaics (BIPV) facade market, capturing a leading 41.9 % share and generating revenue of around USD 1.7 billion.

By Type Analysis

Crystalline Materials dominate with 62.1% share in 2024 driven by high efficiency and structural compatibility.

In 2024, Crystalline Materials held a dominant market position, capturing more than a 62.1% share in the Building-integrated Photovoltaics (BIPV) Facade market. This strong performance is mainly due to their high energy conversion efficiency, durability, and compatibility with standard construction methods. Crystalline silicon—both monocrystalline and polycrystalline—has been widely adopted in façade systems, particularly in commercial and institutional buildings, where consistent energy yield and architectural uniformity are critical. The segment’s dominance reflects the mature supply chain and well-established manufacturing ecosystem that supports large-scale deployment.

Additionally, government-backed solar initiatives that favor efficient and long-lasting technologies have further encouraged the adoption of crystalline materials. As of 2025, this segment continues to maintain its lead, supported by falling module costs and integration into green building regulations across many regions. The trend indicates a steady preference for crystalline materials as a reliable and scalable solution for energy-generating façades.

By Material Analysis

Glass dominates with 43.8% share in 2024 due to its transparency, aesthetics, and structural strength.

In 2024, Glass held a dominant market position, capturing more than a 43.8% share in the Building-integrated Photovoltaics (BIPV) Facade market. This leadership is largely due to the growing preference for glass-based solar façades in modern architecture, where both design appeal and energy generation are important. Glass materials allow natural light into buildings while generating electricity, making them ideal for curtain walls, skylights, and large glass façades. The material’s durability, fire resistance, and ability to integrate with thin-film solar cells have made it a preferred choice for commercial and institutional construction projects.

In 2025, the demand for glass-integrated BIPV systems remains strong, supported by advancements in double and triple-glazed photovoltaic glass panels. These innovations not only improve insulation and energy yield but also align with green building certifications and energy efficiency targets set by governments. The continued push for sustainable construction, especially in urban areas, is expected to keep glass at the forefront of material choices for solar façades.

By Installation Type Analysis

New Construction dominates with 71.2% share in 2024 as builders focus on energy-efficient building designs from the start.

In 2024, New Construction held a dominant market position, capturing more than a 71.2% share in the Building-integrated Photovoltaics (BIPV) Facade market. This dominance is driven by the rising demand for energy-efficient and sustainable buildings being designed with solar integration from the early planning stages. Architects and developers are increasingly incorporating BIPV facades into new structures to meet stringent green building codes, lower long-term operational costs, and enhance property value. Unlike retrofitting, new construction allows for seamless integration of photovoltaic materials into the building envelope, offering better design flexibility and performance.

By 2025, this trend is expected to continue as more cities adopt net-zero building mandates and governments incentivize solar-ready construction. The widespread adoption of BIPV in new commercial offices, educational institutions, and high-rise residential complexes reflects a shift in construction priorities toward renewable energy and modern architecture.

By Application Analysis

Commercial Buildings dominate with 34.7% share in 2024 as businesses adopt solar facades to cut energy costs and meet green targets.

In 2024, Commercial Buildings held a dominant market position, capturing more than a 34.7% share in the Building-integrated Photovoltaics (BIPV) Facade market. This segment leads due to the increasing focus of businesses on energy efficiency, sustainability, and reducing long-term operating costs. Commercial properties such as office buildings, retail centers, airports, and hotels are adopting BIPV facades to generate clean energy while maintaining a modern architectural look. These buildings often have large surface areas that make them ideal for solar integration, and the return on investment is more attractive given their high energy consumption.

By 2025, the trend is expected to grow further as more corporate sustainability goals align with national energy policies and carbon reduction targets. Many commercial developers are also seeking LEED and other green certifications, which BIPV solutions help to achieve. This makes commercial buildings a key driver for the continued expansion of solar-integrated facade applications.

Key Market Segments

By Type

- Thin Film

- Crystalline Materials

- Others

By Material

- Glass

- Polymer

- Ceramic

- Metal

- Composite

By Installation Type

- New Construction

- Retrofit

By Application

- Commercial Buildings

- Residential Buildings

- Industrial Buildings

- Educational Institutions

- Healthcare Facilities

Emerging Trends

Integration of Building-Integrated Photovoltaics (BIPV) in Urban Infrastructure

A significant trend in the adoption of Building-Integrated Photovoltaics (BIPV) facades is their integration into urban infrastructure, transforming buildings into active energy producers. This approach not only enhances energy efficiency but also contributes to the aesthetic appeal of urban landscapes. In India, this trend is gaining momentum, particularly in metropolitan areas where space constraints make traditional solar installations challenging.

The Indian government has recognized the potential of BIPV systems in achieving its renewable energy targets. Under the Pradhan Mantri Surya Ghar Muft Bijli Yojana, launched in 2024, the government aims to provide 300 units of free electricity every month to 1 crore households through rooftop solar installations. While this scheme primarily focuses on rooftop solar, the inclusion of BIPV systems in building facades is encouraged, providing an avenue for urban buildings to contribute to the nation’s solar energy capacity.

Furthermore, the government’s Production Linked Incentive (PLI) Scheme for High-Efficiency Solar PV Modules, with an outlay of ₹24,000 crore, aims to boost domestic manufacturing and reduce dependence on imported solar components. This initiative is expected to make BIPV systems more cost-competitive and accessible for integration into building facades.

The integration of BIPV systems into urban infrastructure presents a sustainable solution to the growing energy demands of cities. By utilizing building facades for solar energy generation, cities can reduce their carbon footprint, enhance energy security, and promote sustainable urban development. As government policies continue to support the adoption of renewable energy technologies, the role of BIPV in urban infrastructure is poised to expand, contributing significantly to India’s renewable energy goals.

Drivers

Government Incentives and Policies Driving the Adoption of Building-Integrated Photovoltaic (BIPV) Facades

One of the most significant factors propelling the growth of Building-Integrated Photovoltaics (BIPV) in facades is the robust support from governments worldwide. These initiatives are designed to reduce carbon footprints, promote renewable energy sources, and enhance energy efficiency in urban infrastructure.

In India, the government has launched several programs to encourage the adoption of solar energy. The National Solar Mission, initiated in 2010, aimed to achieve 20 GW of solar capacity by 2022, later revised to 100 GW. By 2021, India had installed approximately 46 GW of solar capacity, surpassing its original target. Additionally, the Production Linked Incentive (PLI) Scheme for High-Efficiency Solar PV Modules, with an outlay of ₹24,000 crore, aims to boost domestic manufacturing and reduce dependence on imports.

These government policies not only provide financial incentives but also create a conducive environment for the growth of BIPV technologies. By integrating photovoltaic systems into building facades, developers can benefit from reduced energy costs and contribute to the nation’s renewable energy targets. Moreover, such integration aligns with global trends towards sustainable and energy-efficient construction practices.

Restraints

High Initial Costs Hindering BIPV Facade Adoption

One of the primary challenges facing the widespread adoption of Building-Integrated Photovoltaics (BIPV) in facades is the high initial investment required. Unlike traditional building materials, BIPV systems serve a dual purpose—acting as both building components and energy generators—which contributes to their elevated costs. For instance, in India, the cost of installing a BIPV system can range from ₹19,000 to ₹22,000 per square meter, whereas conventional glass facades are priced between ₹12,000 and ₹14,000 per square meter.

This significant price difference poses a barrier, especially for developers and building owners who are cautious about the return on investment. While BIPV systems offer long-term energy savings and contribute to sustainability goals, the upfront costs can be a deterrent without sufficient financial incentives or clear economic benefits.

To address this issue, it’s essential for governments and industry stakeholders to collaborate on creating policies and incentives that reduce the financial burden of BIPV installations. Such measures could include subsidies, tax rebates, or low-interest financing options that make BIPV more accessible and appealing to a broader range of projects. By aligning economic incentives with environmental objectives, the adoption of BIPV facades can be accelerated, leading to more sustainable and energy-efficient buildings.

Opportunity

Government Incentives Driving BIPV Facade Adoption

A significant growth opportunity for Building-Integrated Photovoltaics (BIPV) facades lies in the robust support provided by government initiatives aimed at promoting renewable energy and sustainable urban development. In India, the government’s commitment to achieving 500 GW of non-fossil fuel-based capacity by 2030 underscores the pivotal role of solar energy in the nation’s energy transition. To facilitate this, the government has introduced various schemes and policies that directly benefit BIPV installations.

One such initiative is the Pradhan Mantri Surya Ghar Muft Bijli Yojana, launched in 2024 with an outlay of ₹75,021 crore. This scheme aims to empower 1 crore households by providing them with 300 units of free electricity every month through rooftop solar installations. Beneficiaries receive a one-time subsidy directly into their bank accounts and are eligible for bank loans at concessional rates. Notably, BIPV systems are included under this scheme, making them eligible for similar subsidies, thereby reducing the financial burden on homeowners and encouraging the adoption of solar technologies in building facades.

Additionally, the Production Linked Incentive (PLI) Scheme for High-Efficiency Solar PV Modules, with an outlay of ₹24,000 crore, aims to build a robust domestic manufacturing ecosystem for solar modules. This initiative not only reduces import dependence but also promotes the use of advanced technologies in solar module manufacturing, indirectly supporting the growth of BIPV systems by ensuring the availability of high-quality components at competitive prices.

These government initiatives are instrumental in creating a conducive environment for the widespread adoption of BIPV facades. By providing financial incentives and fostering domestic manufacturing capabilities, the government is addressing key barriers such as high initial costs and limited availability of quality components. As a result, BIPV facades are becoming a viable and attractive option for integrating renewable energy solutions into building designs, contributing to the nation’s sustainability goals.

Regional Insights

Europe commands the spotlight with 41.9% of the BIPV facade market, totaling approximately USD 1.7 billion in 2024.

In 2024, Europe emerged as the dominant region in the Building‑integrated Photovoltaics (BIPV) facade market, capturing a leading 41.9 % share and generating revenue of around USD 1.7 billion. This commanding position reflects the region’s robust policy framework anchored by the European Green Deal, which prioritizes energy-efficient building practices and advanced sustainability standards. Such regulatory momentum has rendered BIPV solutions more appealing to architects, developers, and policymakers across the continent.

Compared to other regions, Europe’s strong regulatory base, cultural emphasis on sustainability, and established supply chains for photovoltaic integration have combined to create a leading regional ecosystem for BIPV façades. These structural strengths are likely to reinforce its dominance in the near term, supporting continued growth even as competing markets in Asia-Pacific and North America expand their capacity.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGC Inc., a global leader in glass and high-tech materials, markets its SUNJOULE® BIPV glass solutions. In one application at Shizuoka Station, its BIPV glass generated up to 3.7 kW from the roof of a bicycle parking facility, enabling the site to function as a disaster-resistant energy hub. AGC emphasizes customizable, design-friendly glass façades that seamlessly integrate energy generation within building envelopes.

Ertex Solar combines expertise in photovoltaics and glass construction to deliver BIPV façade solutions that appear visually seamless yet actively generate energy. Since 2004, it has completed over 1,500 projects globally, including large-format PV laminated glass façades—some spanning up to 3 × 6 m—and semitransparent offerings with up to 50% transparency.

Hanwha Q CELLS, a South Korean photovoltaic manufacturer, has integrated BIPV solutions into its own Seoul headquarters. The façade includes approximately 275 m² of embedded Q.PEAK solar modules, enabling significant self‑generation of energy, resulting in a 35% reduction in CO₂ emissions and 40% energy use drop. The retrofit earned a ‘Renovation Award of Excellence’ from CTBUH in 2021.

Top Key Players Outlook

- AGC Inc.

- AVANCIS GmbH

- Ertex Solar

- Hanergy Thin Film Power Group Europe

- Hanwha Q CELLS

- Heliatek GmbH

- JinkoSolar

- LG Electronics

- Onyx Solar Group LLC.

- Polysolar

Recent Industry Developments

In 2024, AGC Inc. made notable strides in the BIPV facade sector by supplying its SUNJOULE® and SunEwat glass‑integrated photovoltaic solutions for architectural use. A key project saw SUNJOULE® installed as a 3.7 kW solar‑generating roof at Shizuoka Station’s bicycle parking area, where it also functions as a community-focused, disaster-resistant energy hub.

In 2024, AVANCIS GmbH, a pioneer in thin‑film CIGS photovoltaic technology, strengthened its leadership in the BIPV facade sector by expanding its SKALA module offerings — including two new colors Light Blue 7004 with an eye‑catching angle‑dependent hue change, and Terracotta 1202 for heritage buildings

Report Scope

Report Features Description Market Value (2024) USD 4.1 Bn Forecast Revenue (2034) USD 28.3 Bn CAGR (2025-2034) 21.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Thin Film, Crystalline Materials, Others), By Material (Glass, Polymer, Ceramic, Metal, Composite), By Installation Type (New Construction, Retrofit), By Application (Commercial Buildings, Residential Buildings, Industrial Buildings, Educational Institutions, Healthcare Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGC Inc., AVANCIS GmbH, Ertex Solar, Hanergy Thin Film Power Group Europe, Hanwha Q CELLS, Heliatek GmbH, JinkoSolar, LG Electronics, Onyx Solar Group LLC., Polysolar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Building-integrated Photovoltaics Facade MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Building-integrated Photovoltaics Facade MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AGC Inc.

- AVANCIS GmbH

- Ertex Solar

- Hanergy Thin Film Power Group Europe

- Hanwha Q CELLS

- Heliatek GmbH

- JinkoSolar

- LG Electronics

- Onyx Solar Group LLC.

- Polysolar