Global Browser Security Platform Market By Component (Solution(Remote Browser Isolation,Browser Extension Security,Others), Services (Professional Services,Managed Security Services)) By Deployment Mode (On-Premises,Cloud) By Organization Size (Large Enterprises,Small and Medium Enterprises) By End-User (BFSI, Healthcare, Retail, IT and Telecommunications, Government, Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 168808

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Statistics

- By Component

- By Deployment Mode

- By Organization Size

- By End-User

- Key Reasons for Adoption

- Benefits

- Usage Trends

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

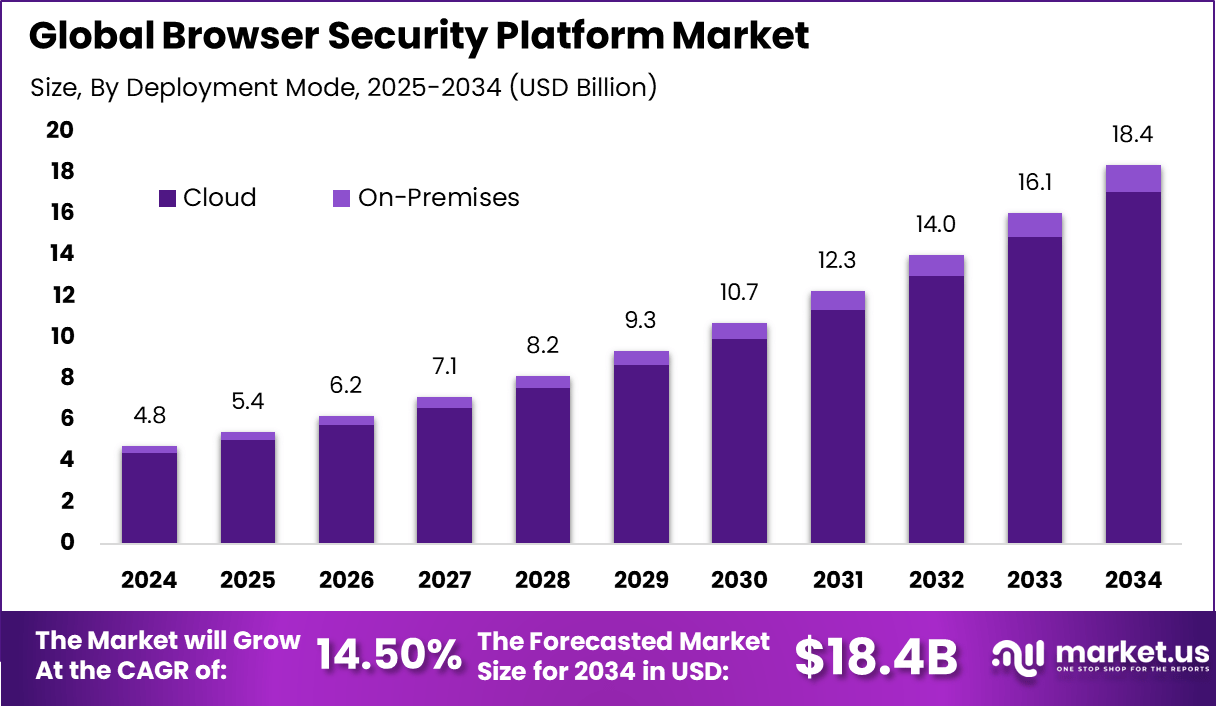

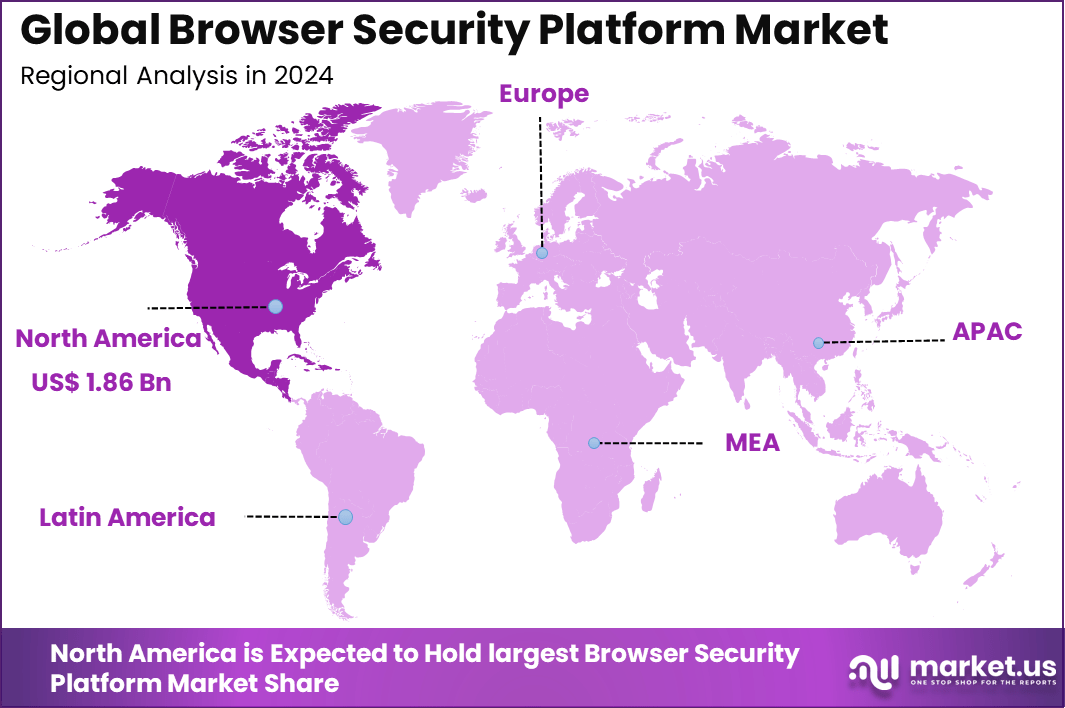

The Global Browser Security Platform Market generated USD 4.8 billion in 2024 and is predicted to register growth from USD 5.4 billion in 2025 to about USD 18.4 billion by 2034, recording a CAGR of 14.50% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.2% share, holding USD 1.86 Billion revenue.

The browser security platform market has expanded as organisations focus on securing web activity, protecting employees from online threats and preventing data loss. Growth reflects the rise of browser based work environments, remote work adoption and increasing reliance on SaaS applications. Browser security platforms now act as an important layer of defence by controlling website access, isolating risky content and monitoring user actions in real time.

The growth of the market can be attributed to rising phishing attacks, increased exposure to malicious websites and greater use of unmanaged devices. As work shifts toward the browser, organisations require tools that protect users even when traditional perimeter security is not present. Regulatory pressure to safeguard sensitive data and maintain audit readiness also strengthens demand.

Top Market Takeaways

- By component, solutions dominate with 82.9% share, including comprehensive platforms that protect against web-based threats, data leakage, and malicious extensions directly within the browser environment.

- By deployment mode, cloud-based solutions hold 92.8% share, favored for rapid deployment, centralized management, scalability, and integration with SASE frameworks, making them ideal for hybrid and remote work environments.

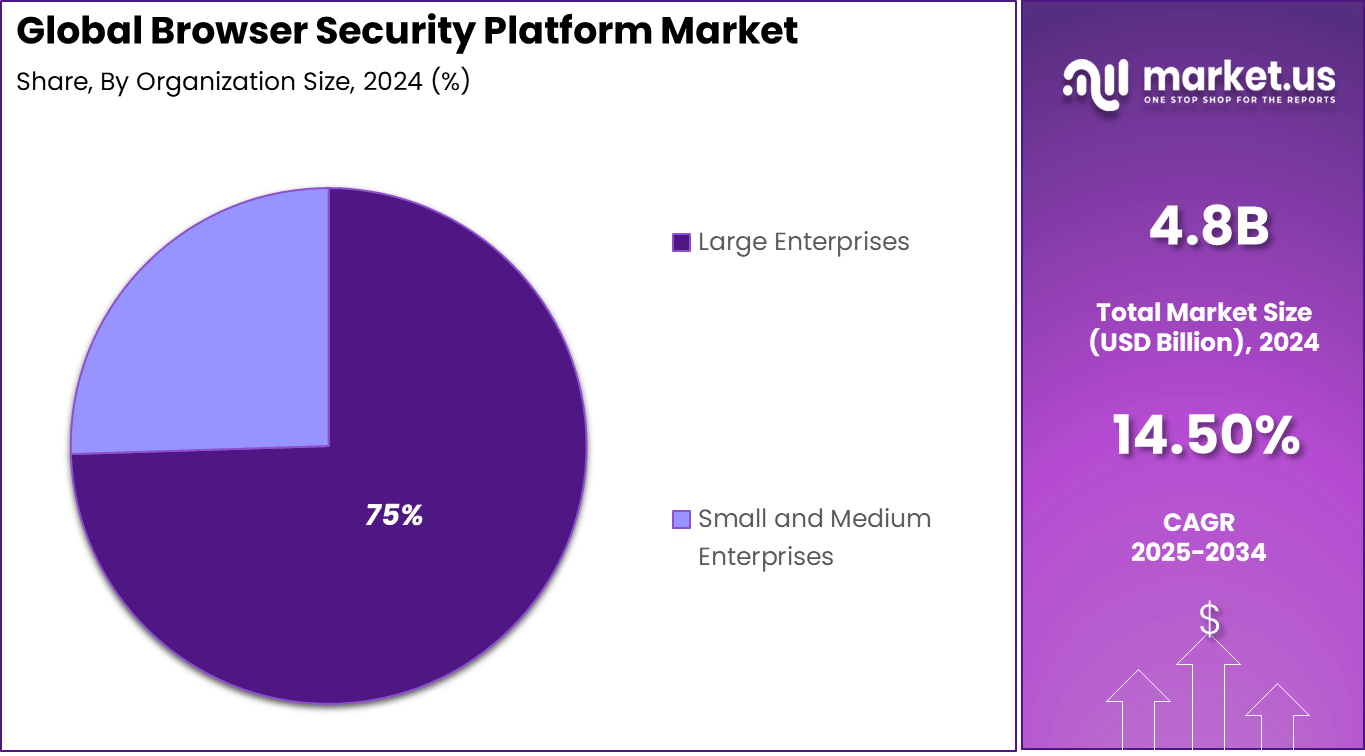

- By organization size, large enterprises account for 74.5% share, driven by their complex IT environments, stringent compliance needs, and substantial investments in advanced browser security platforms for centralized policy enforcement and threat detection.

- By end-user, BFSI leads with 30.2% share, due to the sector’s reliance on secure web-based banking, payment, and trading platforms, regulatory mandates like PCI DSS and PSD2, and the need to protect sensitive customer data from phishing, malware, and data breaches.

- Regionally, North America commands about 39.2% market share.

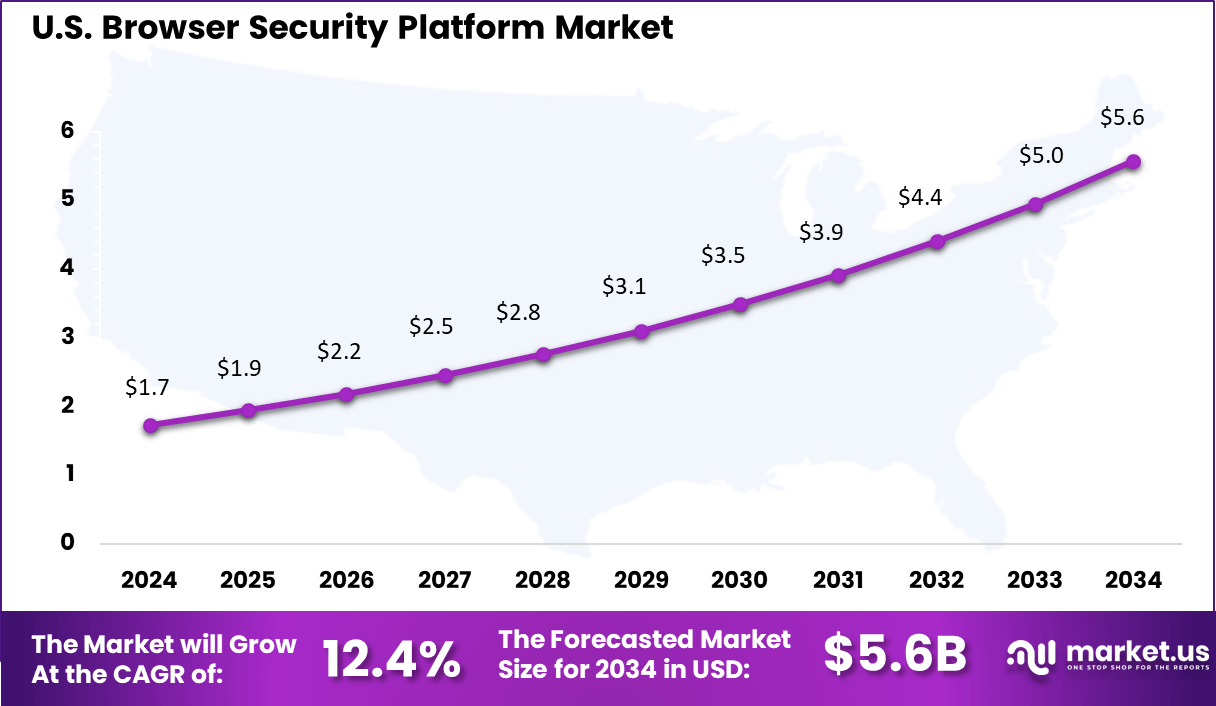

- The U.S. market size is estimated at approximately USD 1.73 billion in 2025.

- The market is growing at a CAGR of 12.4%, driven by rising cyber threats, regulatory compliance, digital transformation, and the shift to cloud-first and hybrid work models.

Key Statistics

- Browser-based malware accounted for 70% of observed attacks in 2024, showing that browsers have overtaken email as the leading entry point for threats.

- Security control remains fragmented because browser activity is spread across many SaaS tools and cloud services, making oversight weaker than email’s centralized gateways.

- Nearly 99% of enterprise users have extensions installed, and more than half grant high or critical permissions that increase exposure.

- Extension governance remains weak as 26% of extensions are sideloaded, 54% are published using personal Gmail accounts, and 51% have gone a year without updates.

- Around 6% of GenAI-related extensions are flagged as malicious, raising concerns about the rapid adoption of unverified tools.

- About 68% of corporate logins happen outside SSO, which reduces visibility and increases identity-based risks.

- Nearly 43% of SaaS logins rely on personal accounts, weakening policy enforcement and increasing data leakage risks.

- Around 26% of users reuse passwords across different accounts, leaving a large portion of the workforce exposed to credential-based compromise.

By Component

In 2024, the solution segment accounted for 82.9 % of the Browser Security Platform Market, supported by rising adoption of threat-prevention tools that protect users from phishing, malicious websites, and browser-based malware. Organisations increasingly relied on browser security solutions because they delivered real-time defence, URL filtering, and isolation capabilities that helped reduce infection risk at the point of access.

Demand continued to grow as solutions became more advanced, integrating sandboxing, behavioural analysis, and policy-based controls. Enterprises preferred comprehensive solutions over standalone tools because they offered unified protection across multiple browsers and devices. The shift toward remote work and SaaS adoption increased exposure to web-borne threats, making browser security solutions an essential component of corporate cybersecurity.

By Deployment Mode

In 2024, cloud deployment held 92.8% share, driven by organisations choosing cloud-native browser security to support distributed workforces and simplify management. Cloud platforms allowed security teams to deploy policies instantly, monitor user activity, and protect endpoints without depending on local installations. This model aligned well with hybrid work and web-based workflows, making cloud-delivered browser security the preferred deployment choice.

The dominance of cloud deployment was reinforced by lower infrastructure needs and faster updates delivered directly by vendors. Cloud-based platforms also offered scalability, enabling organisations to protect large user bases with minimal operational burden. As threat landscapes evolved rapidly, cloud systems gave enterprises greater flexibility to adopt new controls and maintain stronger browser-level protection.

By Organization Size

In 2024, large enterprises represented 74.5% of the market, supported by their higher cybersecurity risk exposure and stricter compliance demands. These organisations required advanced browser security to protect large employee bases, sensitive data flows, and critical applications accessed through web interfaces. The complexity of their operations encouraged adoption of robust solutions that provided visibility into browsing behaviour and ensured strong policy enforcement.

Growing digital transformation programs further strengthened adoption among large enterprises. With increasing use of SaaS tools, cloud applications, and remote access channels, enterprises needed stronger control over browser-side vulnerabilities. Investment in scalable, enterprise-grade platforms helped reduce attack surfaces and maintain consistent security governance across global locations.

By End-User

In 2024, the BFSI sector accounted for 30.2% share, making it the largest end-user group due to its heavy reliance on browser-based banking systems, digital onboarding, and customer-facing applications. Financial institutions faced high cyber-risk exposure and stringent regulatory obligations, which increased the need for advanced browser security.

The sector adopted isolation technologies, anti-phishing tools, and strong authentication layers to protect sensitive financial transactions. Growing adoption of fintech applications and cloud-based financial services also contributed to demand.

Institutions in banking, insurance, and securities needed continuous monitoring to prevent credential theft, fraudulent redirects, and session-based attacks. These requirements encouraged BFSI organisations to use browser-security platforms capable of protecting both internal employees and external users accessing financial services.

Key Reasons for Adoption

- Organizations are facing a surge in browser-based attacks, including phishing, malware, and zero-day exploits, making browser security platforms essential for frontline defense.

- The rise of remote work and BYOD (Bring Your Own Device) increases exposure to web threats, pushing companies to secure all endpoints through browser-level protection.

- Compliance requirements in sectors like finance and healthcare demand advanced controls over browser activity to prevent data leaks and unauthorized access.

- Shadow IT and unsanctioned SaaS app usage are hard to track, and browser security platforms help monitor and control access to risky web applications.

- Integration with zero trust and SASE frameworks is now a baseline expectation, and browser security platforms support these architectures by enforcing strict access policies.

Benefits

- Real-time threat detection and prevention block phishing, malware, and evasive attacks before they reach the endpoint, reducing breach risk.

- Deep browser telemetry and analytics give security teams rich insights into user behavior, policy violations, and suspicious web activity for faster incident response.

- Automated policy management and configuration ensure browsers stay compliant with security standards without manual intervention.

- Secure access to corporate and third-party apps is maintained, even on unmanaged or personal devices, without compromising user productivity.

- Protection extends to AI-driven and GenAI tools, blocking shadow AI and unmonitored usage that could expose sensitive data.

Usage Trends

- Enterprises are adopting specialized browser security platforms like Chrome Enterprise Premium, Island, and Microsoft Edge for Business to meet advanced security and compliance needs.

- Zero trust browser security and browser isolation are now standard, especially in regulated industries and organizations with distributed workforces.

- Continuous monitoring of browser extensions and SaaS app access helps reduce the risk of data leakage and unauthorized integrations.

- AI-powered threat detection and automated workflows are increasingly used to respond to new and evolving web-based threats in real time.

- Browser security platforms are being integrated into broader security ecosystems, such as SIEM, SOAR, and SASE, to provide unified protection across all endpoints.

Emerging Trends

Key Trends Description AI and Machine Learning Integration Use of AI to detect and respond to browser-based threats in real time, including phishing and malware. Browser Isolation Technologies Adoption of remote browser isolation to protect endpoints from web-based attacks and zero-day exploits. Cloud-Native and SaaS Platforms Shift to cloud-based security platforms for scalable, flexible, and centralized browser protection. Enhanced Privacy Features Growing integration of privacy controls, tracker blocking, and encrypted browsing by default in major browsers. Enterprise-Specific Security Solutions Development of specialized browser security platforms tailored for enterprise environments and compliance needs. Growth Factors

Key Factors Description Escalating Cyber Threats Surge in browser-based attacks, including zero-day vulnerabilities and social engineering, driving demand for security. Regulatory Compliance Requirements Stricter data protection laws and industry standards pushing organizations to adopt advanced browser security. Remote and Hybrid Work Models Increased adoption of remote work, necessitating robust browser-level security for distributed workforces. Expansion of Web-Based Applications Growth in cloud apps and SaaS platforms increases exposure to browser-centric threats. Rapid Digital Transformation Accelerated digitalization across industries creates new attack surfaces, boosting demand for browser security platforms. Key Market Segments

By Component

- Solution

- Remote Browser Isolation

- Browser Extension Security

- Data Loss Prevention

- Threat Intelligence & Phishing Prevention

- Services

- Professional Services

- Managed Security Services

By Deployment Mode

- On-Premises

- Cloud

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By End-User

- BFSI

- Healthcare

- Retail

- IT and Telecommunications

- Government

- Education

Regional Analysis

North America held a leading 39.2% share of the global browser security platform market, driven by high digital adoption, stringent regulatory requirements, and a mature cybersecurity ecosystem. The region’s enterprises are early adopters of browser security solutions, prioritizing robust protection against web-based threats such as phishing, malware, and data leakage.

The proliferation of cloud computing and web-based business applications, combined with the shift to remote and hybrid work models, amplifies demand for secure browsers, browser isolation, and anti-phishing tools. North America’s vibrant startup scene and presence of major cybersecurity vendors further foster innovation and rapid deployment of advanced browser security platforms.

The U.S. dominates within North America, valued at approximately USD 1.73 billion in 2024 and growing at a CAGR of 12.4%. The U.S. market is propelled by strict compliance frameworks like CCPA, HIPAA, and SOX, as well as heightened awareness of cyber risks among organizations. Enterprises leverage cloud-based browser security solutions for scalable, flexible, and cost-effective protection, enabling consistent security policies across distributed workforces.

The competitive landscape is marked by continuous innovation in AI-driven threat detection and behavioral analytics, ensuring proactive threat mitigation. These factors solidify the U.S. as the primary growth engine for the North American browser security platform market, setting global standards for web security adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growth in browser-based applications and rising cyber threats

The expansion of the browser security platform market is being supported by the growing adoption of web-based applications and cloud services across industries. As more business processes, collaboration tools, and enterprise applications shift to browser environments, the number of users accessing sensitive data via web browsers increases substantially.

At the same time, browsers remain a frequent target for cyberattacks because many vulnerabilities and exploits are aimed at browser security flaws. These dynamics create a pressing need for specialized security solutions that protect browser traffic, block malicious content, and enforce secure browsing behavior. The convergence of widespread browser usage and rising browser-targeted threats is motivating organizations to invest in browser security platforms.

Restraint

Challenges in standardization and solution overlap

A restraint on market growth arises from the lack of consistent standard definitions and overlap with other security categories. In many organizations, browser security is viewed as part of broader endpoint security, network security, or vulnerability management programs rather than as a distinct requirement.

This integration tendency can lead to uncertainty about when and why to deploy dedicated browser security platforms. As a result, some enterprises may prefer existing security suites rather than adopting standalone browser security solutions. This lack of clarity and overlap can slow down adoption of dedicated browser security offerings.

Opportunity

Demand for secure remote access and hybrid work security

An opportunity exists in the rising demand for secure remote access and secure browsing driven by hybrid work models and distributed workforces. With employees accessing corporate resources via web browsers from remote locations and varied devices, the risk of exposure increases.

Browser security platforms that offer secure browsing, isolation, and content filtering provide value by protecting against phishing, malware, data leakage, and other browser-based threats. Organizations seeking to enforce consistent security policies across remote and on-site users may increasingly adopt browser-centric security solutions to safeguard web access and minimize risk.

Challenge

Rapidly evolving browser vulnerabilities and extension risks

A key challenge for the market stems from the rapidly evolving nature of browser vulnerabilities, third-party extensions, and plugin-based risks. Web browsers and browser extensions change frequently, and new security flaws are discovered regularly. This requires browser security platforms to constantly update threat definitions, detection logic, and response mechanisms.

Additionally, some approaches – such as reliance on browser extensions for security – may themselves introduce new vulnerabilities or blind spots. This dynamic threat environment can make it difficult for security providers to maintain effective coverage, which may hinder confidence and slow adoption

Competitive Analysis

Broadcom, Cisco, Cloudflare, Forcepoint, and Menlo Security lead the browser security platform market with strong cloud-based isolation, threat filtering, and secure web access capabilities. Their platforms protect users from malware, phishing, and zero-day exploits by preventing harmful content from reaching endpoints. These companies focus on scalability, encrypted traffic inspection, and strong policy enforcement.

iboss, McAfee, Zscaler, Symantec, Google, and Microsoft strengthen the competitive landscape with integrated browser security built into secure access service edge (SASE) and endpoint protection ecosystems. Their solutions offer real-time threat intelligence, URL filtering, sandboxing, and data-loss prevention within everyday browsing activities. These providers help organizations secure distributed workforces and cloud applications.

Ericom Software, Authentic8, Cyberinc, Proofpoint, Bitdefender, and other participants broaden the market with lightweight, specialized browser isolation and secure browsing tools. Their offerings include remote rendering, zero-trust browser environments, and controlled web session monitoring. These companies emphasize easy deployment, privacy-focused architectures, and protection against targeted attacks.

Top Key Players in the Market

- Broadcom Inc.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- Forcepoint LLC

- Menlo Security

- iboss, Inc.

- McAfee, LLC

- Zscaler, Inc.

- Symantec (NortonLifeLock Inc.)

- Google LLC

- Microsoft Corporation

- Ericom Software

- Authentic8, Inc.

- Cyberinc (Aurionpro Solutions Limited)

- Proofpoint, Inc.

- Bitdefender

- Others

Future Outlook

The browser security platform market is set for strong growth as cyber threats targeting web browsers become more sophisticated and frequent. Organizations are increasingly prioritizing browser-level protection due to the rise of web-based applications, cloud services, and remote work environments.

Advanced features like real-time threat intelligence, behavioral analytics, and browser isolation are becoming essential, with growing adoption across enterprises, government, and SMEs. The market is also seeing increased innovation through integration with zero-trust and SASE frameworks, making browser security a critical component of modern cybersecurity strategies.

Opportunities lie in

- Integration of browser security with endpoint protection and identity management for unified threat defense.

- Expansion of cloud-native, easy-to-deploy solutions tailored for SMEs and emerging markets.

- Adoption of AI-driven threat detection and automated response capabilities for proactive browser security.

Recent Developments

- December, 2025, Cloudflare released emergency WAF updates to block critical remote code execution vulnerabilities and improved detection for PHP wrapper injection and unsafe deserialization, with additional rules deployed throughout November to cover exploits in Adobe Commerce, Magento, FortiWeb, and DELMIA Apriso.

- November, 2025, Broadcom issued critical security patches for VMware NSX and vCenter, addressing multiple high-severity vulnerabilities that could allow attackers to enumerate usernames and escalate privileges.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Bn Forecast Revenue (2034) USD 18.4 Bn CAGR(2025-2034) 14.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component(Solution(Remote Browser Isolation,Browser Extension Security,Others),Services(Professional Services,Managed Security Services)) By Deployment Mode(On-Premises,Cloud) By Organization Size(Large Enterprises,Small and Medium Enterprises)By End-User(BFSI,Healthcare,Retail,IT and Telecommunications,Government,Education,Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Broadcom Inc., Cisco Systems, Inc., Cloudflare, Inc., Forcepoint LLC, Menlo Security, iboss, Inc., McAfee, LLC, Zscaler, Inc., Symantec (NortonLifeLock Inc.), Google LLC, Microsoft Corporation, Ericom Software, Authentic8, Inc., Cyberinc (Aurionpro Solutions Limited), Proofpoint, Inc., Bitdefender, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Browser Security Platform MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Browser Security Platform MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Broadcom Inc.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- Forcepoint LLC

- Menlo Security

- iboss, Inc.

- McAfee, LLC

- Zscaler, Inc.

- Symantec (NortonLifeLock Inc.)

- Google LLC

- Microsoft Corporation

- Ericom Software

- Authentic8, Inc.

- Cyberinc (Aurionpro Solutions Limited)

- Proofpoint, Inc.

- Bitdefender

- Others