Global Broaching Machine Market Size, Share, Growth Analysis By Type (Horizontal Broaching Machine, Vertical Broaching Machine, Surface Broaching Machine, Others), By Material (Metal, Plastic, Composite, Others), By End-use (Automotive, Aerospace & Defense, Industrial Machinery, Metalworking & Fabrication, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176480

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

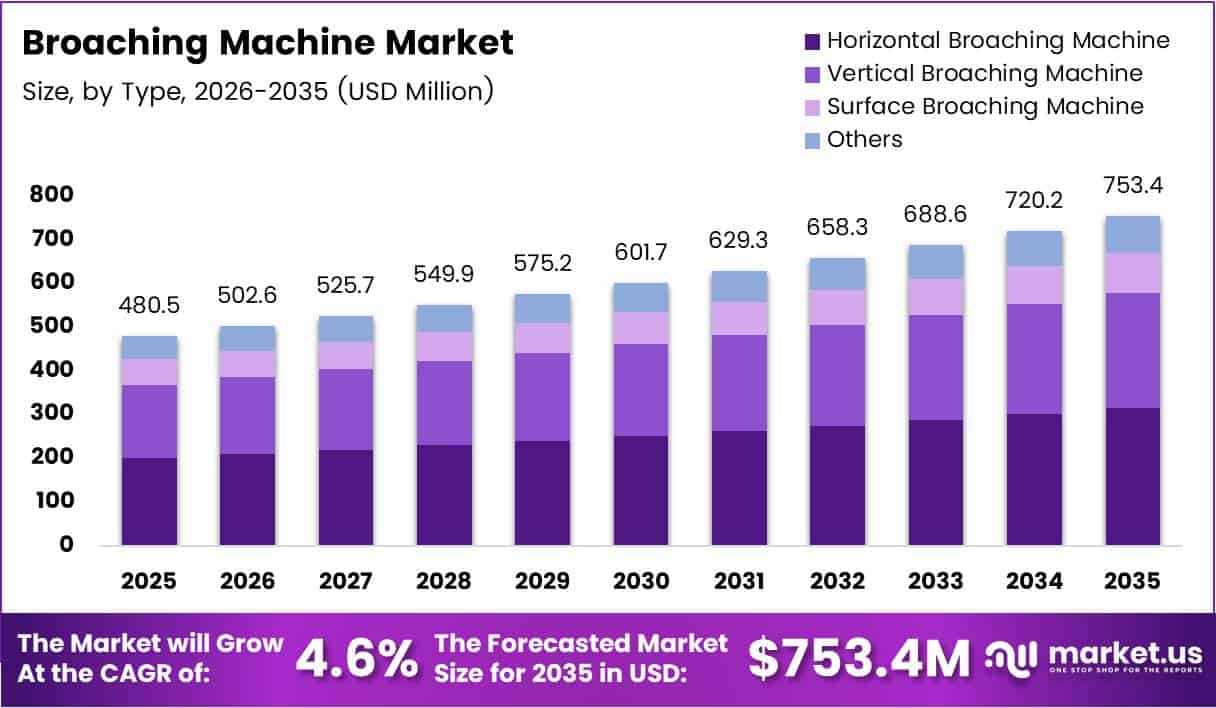

Global Broaching Machine Market size is expected to be worth around USD 753.4 Million by 2035 from USD 480.5 Million in 2025, growing at a CAGR of 4.6% during the forecast period 2026 to 2035.

Broaching machines represent specialized metalworking equipment designed to remove material through linear cutting motion. These systems utilize multi-tooth cutting tools called broaches to create precise internal and external profiles in a single pass. Manufacturers deploy broaching technology for high-volume production requiring tight tolerances and exceptional surface finish quality.

The market encompasses horizontal, vertical, surface, and specialized broaching configurations serving diverse industrial applications. Automotive transmission components, aerospace structural parts, and industrial machinery housings represent primary application areas. Metal processing dominates material usage, though composite and plastic broaching applications are emerging in specialized sectors.

Demand acceleration stems from automotive electrification trends requiring precision drivetrain components. Electric vehicle powertrains demand complex internal splines and profiles achievable through broaching operations. Additionally, aerospace manufacturers increasingly adopt broaching for lightweight structural components meeting stringent dimensional specifications.

Government infrastructure investments across emerging economies drive industrial machinery production capacity expansion. Manufacturing sector growth in Asia Pacific, particularly China and India, creates substantial demand for metalworking equipment. Moreover, defense modernization programs worldwide necessitate precision machining capabilities for military vehicle components and weapons systems.

Technological innovations enhance broaching machine productivity and operational efficiency significantly. According to Crankshaft.net, vertical broaching machines currently achieve cycle times of 3-5 seconds for high-volume parts, compared to 10-15 seconds for milling operations. This cycle time advantage translates directly into higher throughput and reduced per-unit manufacturing costs for producers.

Advanced automation integration transforms traditional broaching operations into intelligent manufacturing processes. In May 2025, Star SU expanded its technical partnership with REGO-FIX Center for Machining Excellence to showcase advanced tool-holding capabilities for high-precision broaching applications. Such collaborative developments accelerate technology adoption across precision manufacturing sectors.

Production efficiency gains demonstrate broaching technology’s competitive advantages in mass manufacturing environments. According to Gear Technology, live motorized-slotter broaching tools operate at speeds of 400-800 strokes per minute for runs exceeding several thousand pieces monthly. These throughput capabilities position broaching as the preferred solution for high-volume automotive and industrial component production.

Key Takeaways

- Global Broaching Machine Market projected to reach USD 753.4 Million by 2035 from USD 480.5 Million in 2025

- Market expected to grow at CAGR of 4.6% during forecast period 2026-2035

- Horizontal Broaching Machine segment dominates By Type category with 41.8% market share

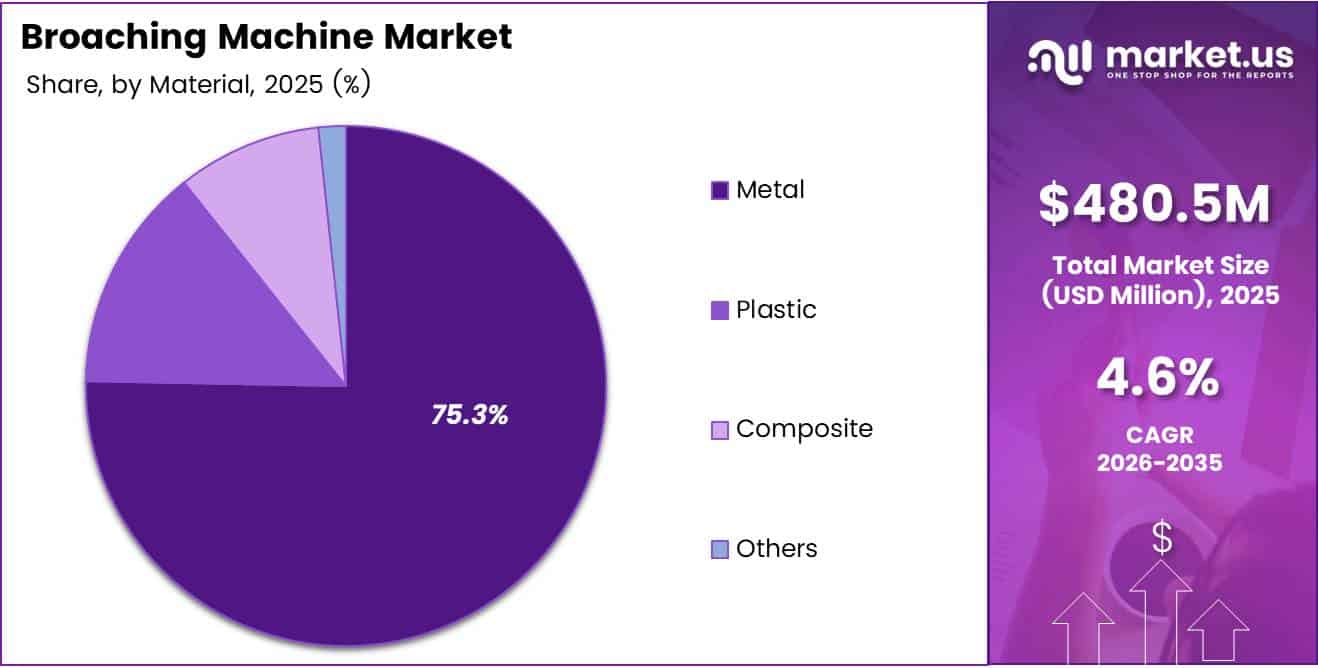

- Metal material segment leads with 75.3% share in By Material segmentation

- Automotive sector commands 45.7% market share in By End-use segment

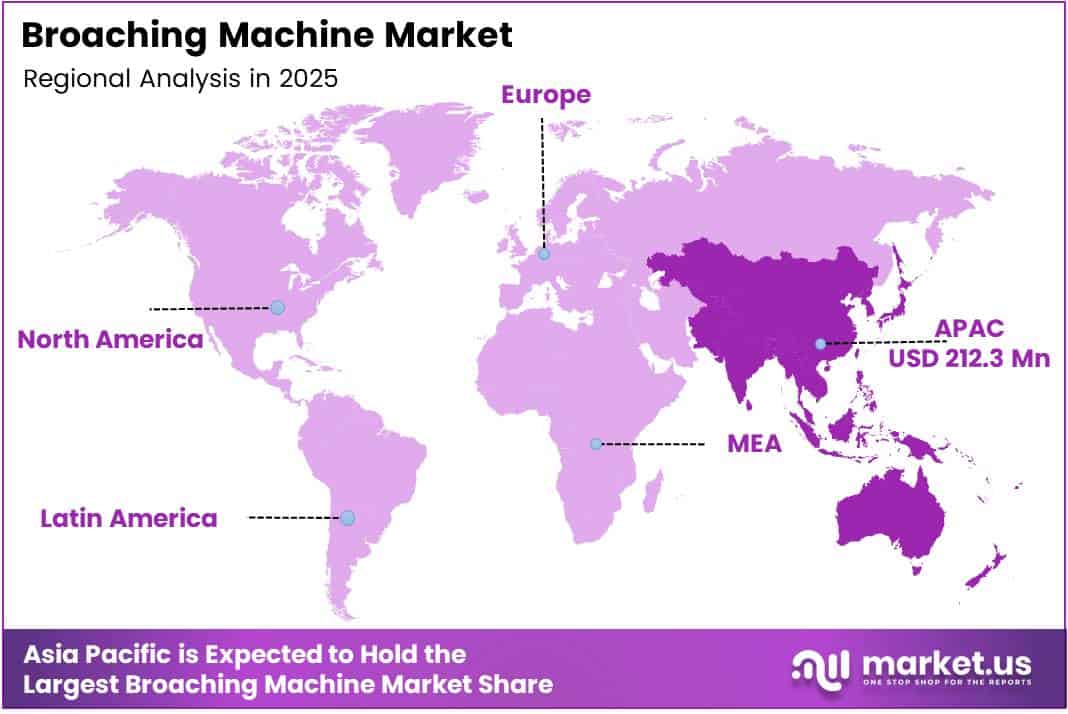

- Asia Pacific region dominates globally with 44.20% market share, valued at USD 212.3 Million

Type Analysis

Horizontal Broaching Machine dominates with 41.8% due to superior performance in long-stroke internal machining applications.

In 2025, Horizontal Broaching Machine held a dominant market position in the By Type segment of Broaching Machine Market, with a 41.8% share. These systems excel in processing automotive transmission components, gears, and complex internal profiles requiring extended cutting strokes. Manufacturers prefer horizontal configurations for high-volume production lines where footprint efficiency and automated part handling prove essential. Additionally, horizontal machines accommodate longer broach tools, enabling deeper cuts and more complex geometries in single operations.

Vertical Broaching Machine systems offer compact footprints ideal for operations with limited floor space constraints. These configurations facilitate gravity-assisted chip removal and simplified part loading for shorter stroke applications. Consequently, job shops and precision manufacturers favor vertical setups for keyway cutting, spline generation, and surface finishing operations requiring quick changeover capabilities.

Surface Broaching Machine variants specialize in creating flat surfaces, slots, and contours on external workpiece geometries. These machines deliver exceptional surface finish quality and dimensional accuracy for automotive connecting rods and industrial pump housings. Moreover, surface broaching eliminates secondary finishing operations, reducing overall production time and manufacturing costs significantly.

Material Analysis

Metal dominates with 75.3% due to widespread automotive and aerospace applications requiring ferrous and non-ferrous component machining.

In 2025, Metal held a dominant market position in the By Material segment of Broaching Machine Market, with a 75.3% share. Steel, aluminum, and titanium alloys represent primary materials processed through broaching operations across automotive, aerospace, and industrial sectors. These materials demand precision machining capabilities that broaching technology delivers consistently. Furthermore, metal’s mechanical properties allow optimal broach tool engagement, ensuring long tool life and repeatable dimensional accuracy.

Plastic material broaching addresses growing demand for lightweight automotive interior components and consumer product manufacturing. Thermoplastics and engineering polymers increasingly replace metal parts in non-structural applications requiring weight reduction. Therefore, specialized broaching tools with modified geometries accommodate plastic’s unique cutting characteristics, preventing material deformation and ensuring clean profile generation.

Composite material processing through broaching serves aerospace and defense applications requiring high strength-to-weight ratios. Carbon fiber reinforced polymers and advanced composites demand specialized cutting strategies preventing delamination and fiber pullout. Additionally, composite broaching applications continue expanding as manufacturers seek alternatives to traditional metalworking in performance-critical applications.

End-use Analysis

Automotive dominates with 45.7% due to mass production requirements for transmission components and drivetrain systems.

In 2025, Automotive held a dominant market position in the By End-use segment of Broaching Machine Market, with a 45.7% share. Transmission gears, synchronizer rings, and CV joint housings require precision internal profiles achievable through broaching operations. Electric vehicle powertrain components particularly drive demand growth as manufacturers transition toward electrified platforms. Moreover, automotive producers prioritize broaching technology for achieving tight tolerances and high-volume throughput simultaneously.

Aerospace & Defense applications demand broaching capabilities for structural components, landing gear assemblies, and turbine engine parts. These sectors require exceptional dimensional accuracy and surface finish quality meeting stringent certification standards. Consequently, aerospace manufacturers invest in advanced broaching systems capable of processing titanium alloys and nickel-based superalloys under controlled conditions.

Industrial Machinery production utilizes broaching for hydraulic cylinder components, pump housings, and agricultural equipment parts. These applications benefit from broaching’s ability to create complex internal geometries without multiple setup operations. Additionally, industrial equipment manufacturers value broaching’s consistency in producing interchangeable components for assembly line efficiency.

Metalworking & Fabrication shops employ broaching machines for contract manufacturing services across diverse industries. These facilities provide specialized broaching capabilities for customers lacking in-house equipment investment justification. Furthermore, fabrication shops leverage broaching technology for prototyping and low-to-medium volume production runs requiring precision internal profiling.

Key Market Segments

By Type

- Horizontal Broaching Machine

- Vertical Broaching Machine

- Surface Broaching Machine

- Others

By Material

- Metal

- Plastic

- Composite

- Others

By End-use

- Automotive

- Aerospace & Defense

- Industrial Machinery

- Metalworking & Fabrication

- Others

Drivers

Rising Demand for High-Precision Internal Machining in Automotive Transmission Components Drives Market Growth

Automotive manufacturers increasingly require precision internal profiles for transmission gears, synchronizer assemblies, and differential components. Broaching technology delivers consistent dimensional accuracy and surface finish quality unattainable through alternative machining methods. Therefore, transmission producers worldwide invest in dedicated broaching lines supporting high-volume production requirements. Electric vehicle drivetrain components particularly demand tight tolerance machining capabilities that broaching systems provide efficiently.

Mass production environments demonstrate broaching’s superior cost-effectiveness compared to conventional machining alternatives. According to Crankshaft.net, high-volume production facilities using vertical broaching report 20% to 30% operational savings over milling or EDM processes. These savings result from broaching’s ability to complete complex shapes in single-pass operations, eliminating secondary machining steps. Consequently, automotive Tier 1 suppliers prioritize broaching investments for achieving competitive manufacturing costs.

Heavy machinery and industrial equipment manufacturing expansion worldwide creates substantial metalworking equipment demand. Infrastructure development projects across emerging markets require construction equipment, mining machinery, and agricultural implements. Additionally, aerospace component production growth necessitates precision machining capabilities for structural assemblies and propulsion system parts. Broaching machines address these requirements through high-productivity operations maintaining exceptional dimensional consistency across production runs.

Restraints

High Initial Capital Investment and Installation Cost of Broaching Machines Limit Market Adoption

Broaching machine acquisition represents significant capital expenditure for manufacturers, particularly small and medium-sized enterprises. System costs include base equipment, specialized tooling, automation integration, and facility infrastructure modifications. Moreover, broaching operations require dedicated floor space with structural reinforcement supporting machine weight and cutting forces. These upfront investments create financial barriers preventing widespread adoption across cost-sensitive manufacturing sectors.

Operational flexibility limitations constrain broaching technology application in low-volume and high-mix production environments. Each workpiece profile requires custom broach tool design and manufacturing, with tooling costs ranging from several thousand to tens of thousands of dollars. Therefore, production volumes must justify tool investment amortization over component lifecycle. CNC machining centers offer superior flexibility for prototype development and small batch production without specialized tooling requirements.

Energy consumption considerations influence manufacturers’ equipment selection decisions in sustainability-focused markets. According to Crankshaft.net, broaching operations demonstrate low energy consumption relative to moderate milling and high EDM power requirements. However, initial installation electrical infrastructure and hydraulic system capacity upgrades represent additional capital expenditures. Consequently, manufacturers evaluate total cost of ownership including energy efficiency metrics when comparing metalworking technology alternatives.

Growth Factors

Growing Manufacturing Investments in Emerging Economies Across Asia and Eastern Europe Accelerate Market Expansion

Developing economies attract foreign direct investment in automotive and aerospace manufacturing infrastructure. China, India, Vietnam, and Eastern European nations establish production facilities serving domestic and export markets simultaneously. Consequently, metalworking equipment demand accelerates as manufacturers localize component production previously sourced from established markets. Government incentives supporting manufacturing sector development further stimulate capital equipment investments including precision machining systems.

Electric vehicle powertrain and drivetrain component manufacturing drives specialized broaching application growth. Battery electric vehicles require reduction gearboxes, motor shafts, and differential assemblies with precision internal profiles. According to Inotech Machining, AI-driven process optimization integration in modern broaching units improves production efficiency by up to 40% in precision applications. These efficiency gains prove essential for EV manufacturers achieving cost parity with conventional powertrains.

In June 2025, Nidec Machine Tool launched the GE25CF high-efficiency hobbing machine integrating cutting and chamfering into single process-intensive operations. This development demonstrates industry momentum toward automated gear manufacturing supporting electric vehicle production scalability. Additionally, technological advancements in tool materials extend broach life and operational efficiency. Modern coating technologies and substrate metallurgy improvements reduce tool wear rates, decreasing per-unit manufacturing costs significantly.

Emerging Trends

Integration of Automation and Robotics in Broaching Machine Operations Reshapes Market Landscape

Manufacturing facilities increasingly deploy robotic part handling systems interfacing with broaching machines for lights-out production. Automated workpiece loading, orientation verification, and post-process inspection eliminate manual intervention requirements. Consequently, manufacturers achieve continuous operation across multiple shifts while maintaining consistent quality standards. Collaborative robots particularly enable flexible automation implementation in facilities lacking dedicated transfer line infrastructure.

CNC-controlled and servo-driven broaching systems replace traditional hydraulic configurations in precision manufacturing applications. Servo technology delivers programmable stroke control, variable cutting speeds, and real-time force monitoring capabilities. Therefore, manufacturers achieve optimized cutting parameters for diverse materials and geometries without mechanical adjustments. Additionally, digital control interfaces facilitate integration with manufacturing execution systems for production data analytics and traceability.

Predictive maintenance technologies transform broaching machine reliability and operational planning strategies. According to ResearchGate, machine learning algorithms applied to broaching tool vibration signals achieve 99.5% classification accuracy in detecting tool faults. These capabilities enable condition-based maintenance scheduling, preventing unexpected downtime and optimizing tool replacement intervals. Moreover, digital monitoring systems provide real-time performance insights supporting continuous process improvement initiatives across manufacturing operations.

Regional Analysis

Asia Pacific Dominates the Broaching Machine Market with a Market Share of 44.20%, Valued at USD 212.3 Million

Asia Pacific commands the largest market position driven by China, Japan, and India’s extensive automotive and industrial machinery manufacturing bases. The region’s 44.20% share, valued at USD 212.3 Million, reflects substantial metalworking equipment investments supporting production capacity expansion. Moreover, government initiatives promoting manufacturing sector development and infrastructure modernization accelerate broaching machine adoption. Chinese automotive suppliers particularly invest heavily in precision machining capabilities supporting domestic electric vehicle production growth.

North America Broaching Machine Market Trends

North America maintains strong market presence through established aerospace, defense, and automotive manufacturing sectors. United States facilities prioritize advanced broaching systems for turbine engine components, landing gear assemblies, and transmission parts production. Additionally, reshoring initiatives encourage domestic component manufacturing, stimulating metalworking equipment demand. Canadian aerospace industry growth further supports regional market development through precision machining technology investments.

Europe Broaching Machine Market Trends

Europe demonstrates steady demand driven by German, Italian, and French automotive and industrial equipment manufacturing excellence. Premium automotive producers require high-precision broaching capabilities for performance transmission components and drivetrain systems. Furthermore, aerospace industry concentration in France, Germany, and UK sustains advanced machining technology adoption. Eastern European manufacturing expansion creates additional growth opportunities as production facilities establish operations across Poland, Czech Republic, and Hungary.

Latin America Broaching Machine Market Trends

Latin America experiences moderate growth supported by Brazilian and Mexican automotive manufacturing operations. These markets serve domestic consumption and export requirements for North American automotive assembly plants. Therefore, Tier 1 and Tier 2 suppliers invest in metalworking capabilities supporting regional production networks. Additionally, agricultural equipment manufacturing in Brazil drives industrial machinery broaching applications.

Middle East & Africa Broaching Machine Market Trends

Middle East & Africa represents emerging opportunity driven by industrial diversification initiatives beyond petroleum sectors. GCC nations invest in manufacturing infrastructure supporting automotive assembly, aerospace maintenance, and defense production capabilities. South African automotive component manufacturing sustains metalworking equipment demand for regional and export markets. Moreover, infrastructure development projects across the region create industrial machinery production requirements.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

MITSUBISHI HEAVY INDUSTRIES, LTD. maintains significant market presence through comprehensive metalworking equipment portfolios serving automotive and aerospace sectors globally. The company leverages advanced engineering capabilities delivering high-precision broaching systems for complex component manufacturing applications. Moreover, MITSUBISHI’s extensive service network provides technical support and maintenance services ensuring optimal equipment performance. Their continuous innovation in automation integration and digital control technologies positions them competitively across international markets.

The Ohio Broach & Machine Co. specializes in custom broaching solutions serving diverse industrial applications requiring precision internal and external profiling. This company emphasizes engineering expertise and application-specific tool design supporting customer manufacturing requirements. Additionally, The Ohio Broach maintains strong relationships with automotive and aerospace manufacturers through responsive technical support. Their focus on quality and delivery reliability establishes them as trusted partners for critical component production operations.

AXISCO PRECISION MACHINERY CO., LTD. serves Asian markets through cost-effective broaching machine manufacturing and regional distribution networks. The company targets growing automotive component production in China, Southeast Asia, and India with competitively priced equipment offerings. Furthermore, AXISCO invests in technology partnerships enhancing product capabilities while maintaining price competitiveness. Their strategic positioning addresses emerging market manufacturers seeking reliable metalworking solutions without premium pricing premiums.

Colonial Tool Group Inc. provides specialized broaching tools and machines supporting North American manufacturing operations across multiple industries. This organization focuses on application engineering and custom tooling development for unique customer requirements. Additionally, Colonial Tool emphasizes rapid response capabilities and technical consultation services differentiating them in competitive markets. Their expertise in complex geometry broaching establishes strong customer loyalty across aerospace and industrial machinery sectors.

Key players

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Accu-Cut

- Apex Broaching Systems

- Broaching Machine Specialties

- Colonial tool group inc.

- The Ohio Broach & Machine Co.

- Pioneer Broach

- AXISCO PRECISION MACHINERY CO., LTD.

- YAO SHENG MACHINERY CO., LTD.

Recent Developments

- October 2024 – Nidec Machine Tool Corporation officially commenced operations at its new three-floor, 66,000 m² factory in Pinghu, China, strengthening its supply chain for gear-cutting tools and horizontal machining centers. The facility aims to meet rising demand in automotive and robotics sectors through enhanced production capacity.

- February 2025 – Horn USA Inc. showcased its AR15 magwell broaching system at PMTS 2025, enabling precise broaching operations directly within CNC cycles. This innovation eliminates separate vertical broaching machine requirements, streamlining production operations and reducing equipment footprint demands significantly.

Report Scope

Report Features Description Market Value (2025) USD 480.5 Million Forecast Revenue (2035) USD 753.4 Million CAGR (2026-2035) 4.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Horizontal Broaching Machine, Vertical Broaching Machine, Surface Broaching Machine, Others), By Material (Metal, Plastic, Composite, Others), By End-use (Automotive, Aerospace & Defense, Industrial Machinery, Metalworking & Fabrication, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape MITSUBISHI HEAVY INDUSTRIES, LTD., Accu-Cut, Apex Broaching Systems, Broaching Machine Specialties, Colonial tool group inc., The Ohio Broach & Machine Co., Pioneer Broach, AXISCO PRECISION MACHINERY CO., LTD., YAO SHENG MACHINERY CO., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Accu-Cut

- Apex Broaching Systems

- Broaching Machine Specialties

- Colonial tool group inc.

- The Ohio Broach & Machine Co.

- Pioneer Broach

- AXISCO PRECISION MACHINERY CO., LTD.

- YAO SHENG MACHINERY CO., LTD.