Global Breast Pump Market By Product Type (Wearable, and Non-wearable), By Technology (Manual, and Automatic), By End-user (Hospitals, Maternity Clinics, Homecare, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 20824

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

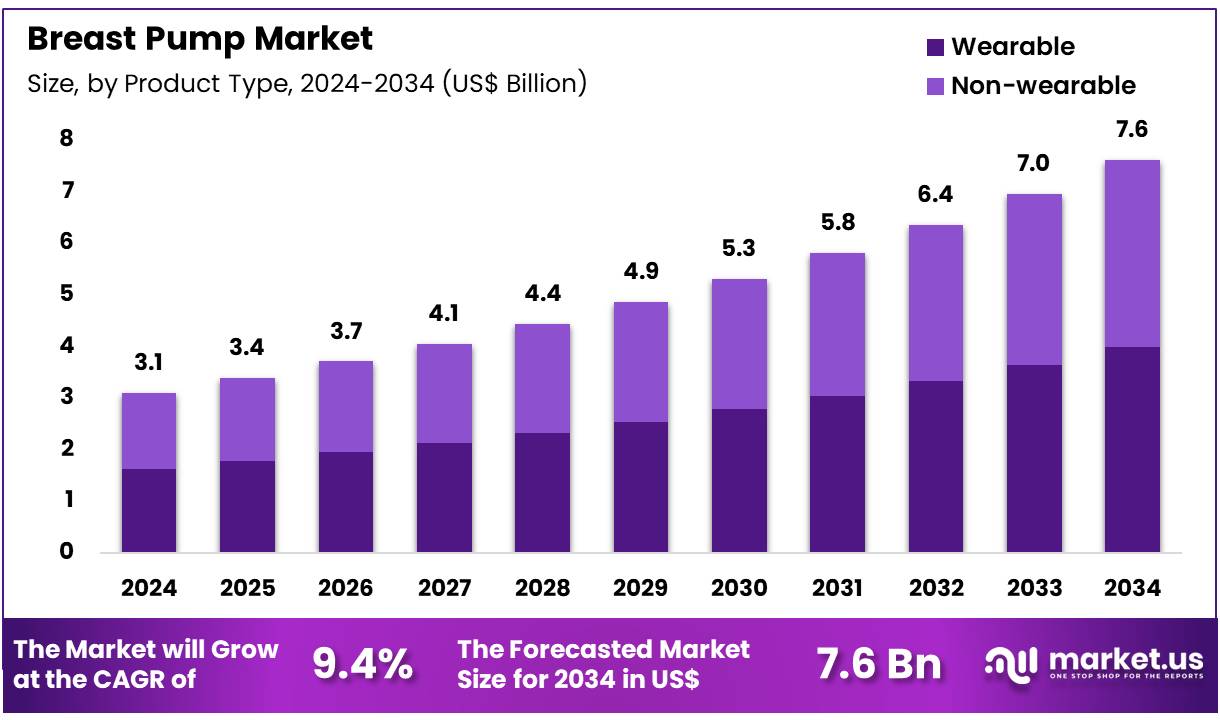

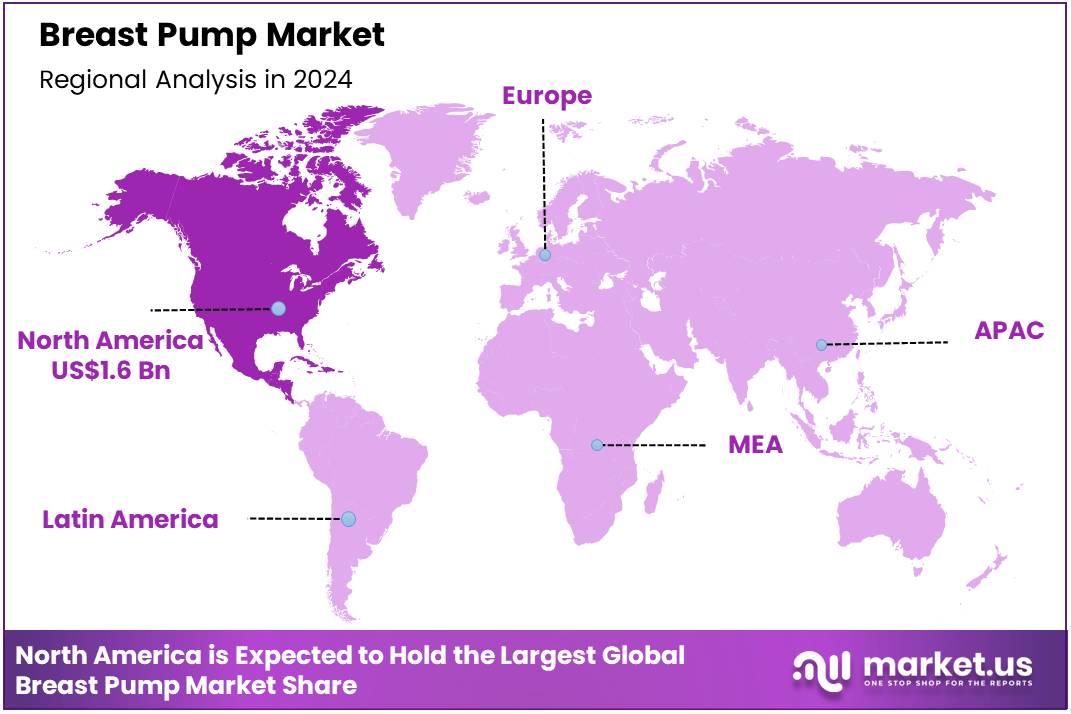

The Global Breast Pump Market size is expected to be worth around US$ 7.6 Billion by 2034 from US$ 3.1 Billion in 2024, growing at a CAGR of 9.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.5% share with a revenue of US$ 1.6 Billion.

Rising awareness of breastfeeding benefits drives the breast pump market as parents seek convenient solutions to support infant nutrition. Mothers increasingly utilize breast pumps for workplace lactation, enabling milk expression to maintain feeding schedules during work hours. The growing emphasis on maternal health fuels demand, with pumps supporting milk supply maintenance for preterm infants in neonatal care.

Hospitals deploy these devices for postpartum support, assisting mothers with latch difficulties to ensure consistent feeding. In January 2024, Annabella secured USD 8.5 million in seed funding to launch its patented, FDA-cleared breast pump, enhancing efficiency and comfort for users. According to the CDC, 83.8% of infants born in 2021 were breastfed at some point, underscoring the critical need for accessible pumping solutions.

Growing demand for portable and discreet devices creates significant opportunities in the breast pump market. Innovators develop wearable pumps that support active lifestyles, allowing mothers to express milk during daily activities like commuting. Healthcare providers explore these systems for telehealth integration, guiding mothers remotely on pumping techniques for low milk supply.

Opportunities also arise in pediatric nutrition programs, where pumps facilitate donor milk collection for community milk banks. In November 2023, Pigeon launched its second-generation GoMini Plus Electric Breast Pump, offering enhanced portability to meet modern parenting needs. The WHO reports 44% of infants under six months are exclusively breastfed globally, highlighting the potential for innovative pumping solutions to bridge feeding gaps.

Recent trends in the breast pump market emphasize smart technology and user-centric designs to enhance functionality. Manufacturers integrate app-connected pumps for lactation tracking, enabling mothers to monitor milk output and feeding schedules in real-time. In August 2023, Lansinoh introduced its Wearable Pump, a portable solution designed to simplify breastfeeding for busy mothers.

Trends also include ergonomic designs for hospital-grade pumps, supporting high-frequency use in maternity wards. Industry insights note a 32% increase in demand for wearable breast pumps in 2023, reflecting a shift toward convenient, tech-driven solutions. These advancements signal a dynamic market evolution toward flexible, mother-focused breastfeeding support systems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.1 Billion, with a CAGR of 9.4%, and is expected to reach US$ 7.6 Billion by the year 2034.

- The product type segment is divided into wearable and non-wearable, with wearable taking the lead in 2023 with a market share of 52.4%.

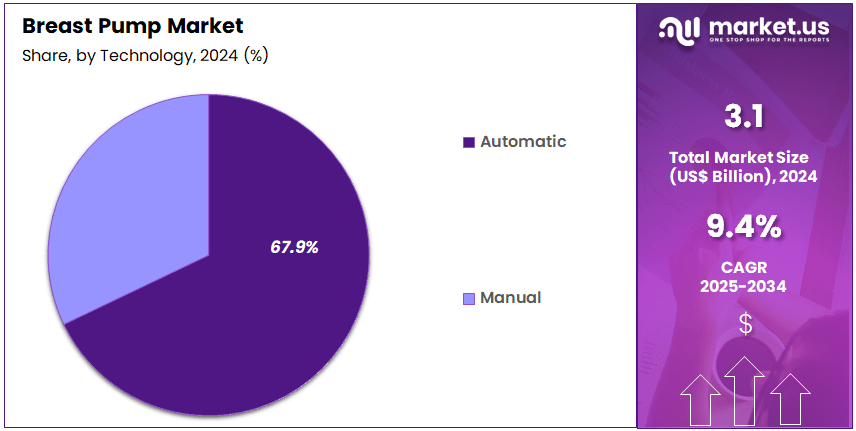

- Considering technology, the market is divided into manual and automatic. Among these, automatic held a significant share of 67.9%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, maternity clinics, homecare, and others. The homecare sector stands out as the dominant player, holding the largest revenue share of 36.2% in the market.

- North America led the market by securing a market share of 43.5% in 2023.

Product Type Analysis

Wearable breast pumps dominate the market with a 52.4% share and are expected to continue growing due to their convenience and portability, especially for mothers who need to pump while on the go. The rising trend of working mothers and their need for discreet, efficient pumping solutions is projected to drive the demand for wearable pumps. Wearable devices offer comfort, flexibility, and hands-free use, which are key factors for mothers with busy schedules.

The increasing focus on supporting breastfeeding and pumping in various environments, such as offices or public spaces, is likely to fuel further growth in this segment. Additionally, advancements in wearable breast pump technology, including improved battery life, quieter operation, and more comfortable designs, are expected to contribute to the segment’s growth. As more companies innovate in this space, the wearable segment is expected to capture an even larger portion of the market, driven by the rising adoption of portable, user-friendly devices.

Technology Analysis

Automatic breast pumps hold a 67.9% market share and are projected to remain the largest segment due to their enhanced efficiency and ease of use. Automatic pumps offer more control and convenience, allowing mothers to express milk more quickly and comfortably compared to manual pumps. This technology is expected to be increasingly preferred by both new and experienced mothers due to the speed and convenience it offers, especially for those with busy lifestyles.

Automatic breast pumps often feature adjustable settings for suction levels and speed, providing personalized pumping experiences, which enhances their appeal. The growing awareness of the health benefits of breast milk and the increasing focus on supporting breastfeeding mothers, particularly in maternity clinics and hospitals, is likely to drive demand for automatic breast pumps. With innovations in design and features, such as quieter pumps, better portability, and improved ergonomics, the automatic segment is expected to continue growing rapidly.

End-User Analysis

Hospitals represent 28.3% of the end-user market and are expected to remain a significant segment in the breast pump market due to their critical role in supporting new mothers, particularly those in neonatal care or those facing breastfeeding challenges. Hospitals are increasingly adopting advanced breast pump systems, both manual and automatic, to offer a variety of options for mothers who may need assistance with lactation. The growing emphasis on maternal and infant care in hospitals, combined with rising rates of breastfeeding initiatives, is expected to contribute to the growth of this segment.

Hospitals provide essential resources for mothers in postpartum care, making breast pumps an integral part of the post-delivery process. The increasing adoption of lactation support services and breastfeeding education is likely to drive demand for hospital-grade breast pumps. Additionally, hospitals are investing in better infrastructure to support new mothers, which is expected to contribute to the continued growth of breast pump usage in healthcare settings.

Key Market Segments

Product Type

- Wearable

- Non-wearable

Technology

- Manual

- Automatic

End-user

- Hospitals

- Maternity Clinics

- Homecare

- Others

Drivers

Increased Female Labor Force Participation is driving the market

The sustained global increase in the number of women participating in the workforce, particularly in their primary career years, is a powerful and direct driver for the breast pump market. As more mothers return to their professional roles shortly after childbirth, they require a reliable, efficient, and discreet method to express and store breast milk to maintain their supply and continue providing for their infant while away.

The breast pump transforms breastfeeding from a continuous, geographically tethered activity into a manageable process that accommodates a professional schedule. This necessity has spurred demand not only for pumps but also for double-electric models that reduce pumping time and advanced battery-operated or wearable models that offer mobility and discretion. This demographic’s need for time-saving devices is directly supported by the latest government labor statistics.

According to the U.S. Bureau of Labor Statistics (BLS), the annual average labor force participation rate for all women (16 years and over) showed a clear upward trend, increasing from 56.1% in 2021 to 57.3% in 2023, with the 2023 rate being the highest since 2019. This rising employment rate in the post-pandemic recovery era provides a verifiable numerical indicator of the expanding customer base that relies on breast pumps for maintaining their work-life balance and fulfilling their feeding goals.

Restraints

Risk of Device Malfunction and Injury is restraining the market

A significant restraint on the breast pump market stems from the documented issues of product performance and the potential for user injury or device malfunction, which can erode consumer trust and discourage adoption. Reports of devices failing to maintain adequate suction, battery life prematurely degrading, or components breaking are a critical concern for new mothers who depend on the pump to establish and maintain their milk supply. If a pump fails, it can result in missed sessions, reduced milk output, and a mother’s anxiety about her ability to feed her child.

Furthermore, an improperly functioning or used pump can cause physical issues such as nipple trauma, pain, or mastitis, leading some mothers to discontinue pumping altogether. These issues highlight a quality control challenge for manufacturers, especially with the influx of newer, complex wearable models.

For example, a 2022 article analyzing reports from the Manufacturer and User Facility Device Experience (MAUDE) dataset indicated that a substantial number of issues are reported, with 66.0% of the devices in one specific study category experiencing a malfunction. Such widely reported reliability and performance issues pose a tangible barrier to market growth as consumers may be hesitant to invest in a product with a notable risk of failure when their infant’s nutrition is dependent on its consistent operation.

Opportunities

The Expansion of Human Milk Banks is creating growth opportunities

The global expansion of human milk banking provides a substantial and ethically driven growth opportunity, particularly for manufacturers of high-performance, hospital-grade breast pumps. Milk banks collect, screen, process, and dispense donor human milk to premature and critically ill infants, for whom breast milk is a vital, life-saving medicine. The growing recognition by medical and public health organizations of the critical role of donor milk in neonatal care has led to an increase in the establishment of new milk banks worldwide.

Each of these centers requires a fleet of powerful, multi-user-approved breast pumps to ensure the efficient and hygienic collection of milk from volunteer donors. This creates a high-value B2B market for robust, reliable devices that operate under strict medical protocols, distinct from the consumer market. This opportunity is demonstrated by the quantitative growth of the infrastructure in key regions; as reported by the European Milk Bank Association, as of 2021, there were 282 established human milk banks in the European region alone, with an additional 18 under development, highlighting a clear and expanding institutional demand for high-quality pumping equipment.

Impact of Macroeconomic / Geopolitical Factors

Labor shortages and rising energy costs are putting pressure on manufacturers in the breast pump market. As a result, companies are shifting their focus from improving ergonomic designs to building inventory to manage fluctuating demand. Volatility in supply chains, especially in the Indo-Pacific region and Baltic grain routes, is making it difficult to access key polypropylene feedstocks, delaying product development and exposing businesses to exchange rate risks. To adapt, some manufacturers are partnering with resin recyclers in the Appalachian region and focusing on eco-friendly practices to appeal to environmentally conscious consumers.

Maternity health programs are gaining traction, encouraging insurers to support products like multi-user, antimicrobial breast pumps in workplaces. These programs are driving higher adoption of such devices. However, U.S. Section 301 tariffs, which impose a 25% tax on Chinese-made components, are creating uncertainty. Although the tariff is waived for some maternal products until November 29, 2025, it could lead to price hikes for compact travel units once the exemption ends. This uncertainty complicates long-term contracts with retailers and leads to supply bottlenecks during peak birthing seasons.

To navigate these challenges, some manufacturers are taking advantage of the tariff grace period by moving production to the Sun Belt. This strategy is allowing them to explore new innovations, such as vibration-dampening technology, and invest in sterile packaging skills. These steps help companies stay ahead in a rapidly changing market while meeting customer demand and managing supply chain risks.

Latest Trends

The Rise of Companion Apps and Digital Integration is a recent trend

A dominant and recent trend in the breast pump market is the development of companion applications and full digital integration, transforming the pump from a mechanical tool into a smart health device. Key manufacturers are leveraging mobile technology to add value beyond simple milk expression, creating a connected experience that appeals to the digitally native consumer. These companion apps allow mothers to perform a range of functions, including remote control of pump settings, real-time tracking of milk output and session duration, and personalized insights into pumping patterns and milk supply trends.

This focus on data and convenience aims to simplify the pumping journey and help mothers meet their breastfeeding goals. An illustration of this trend is the launch of the Willow 3.0 pump companion app for the Apple Watch by Willow Innovations, Inc. in January 2023, which enables users to track, control, and view their pumping sessions directly from their smartwatch. This type of digital product launch by a major player in the wearable space is a definitive sign that data collection and seamless digital integration are now central to the user experience and a primary focus for product development.

Regional Analysis

North America is leading the Breast Pump Market

In 2024, North America accounted for 43.5% of the global breast pump market, experiencing consistent advancement fueled by sustained public health campaigns promoting lactation support and the resurgence of hybrid work arrangements that accommodate maternal employment. Maternal health advocates collaborated with device manufacturers to introduce compact, hospital-grade models compatible with telehealth consultations, facilitating seamless expression during office returns and mitigating supply disruptions from earlier shortages.

Legislative expansions under the Affordable Care Act reinforced mandatory insurance coverage for durable pumps, empowering new parents in low-wage sectors to sustain feeding goals without financial strain. Technological refinements, including app-linked tracking for output volumes, appealed to tech-savvy demographics seeking data-informed routines amid rising gestational diabetes diagnoses. Community-based initiatives through local health departments amplified awareness via prenatal workshops, correlating with elevated continuation rates beyond maternity leave.

Fiscal analyses from payer perspectives validated the preventive value of accessible devices, curbing neonatal intensive care admissions linked to suboptimal nutrition. These multifaceted influences highlighted the area’s emphasis on inclusive lactation ecosystems. The Centers for Disease Control and Prevention indicated that 83.2% of United States infants born in 2022 initiated breastfeeding, with 55.8% receiving any breast milk at six months.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts anticipate the Asia Pacific breast pump sector to strengthen during the forecast period, as economic empowerment initiatives elevate female employment in manufacturing hubs and spur demand for portable expression aids. Policymakers in Thailand and the Philippines channel resources into family wellness subsidies, outfitting public clinics with demonstration units to guide usage amid cultural shifts toward extended maternal absences. Device innovators partner with regional cooperatives to engineer humidity-resistant variants, projecting durability enhancements for tropical storage challenges in agrarian communities.

National assemblies promote workplace lactation stations, positioning urban employers to integrate rental programs that sustain output during peak productivity hours. Authorities estimate broadening e-commerce platforms for rural deliveries, bridging gaps in remote provinces through drone-assisted logistics for timely restocks.

Local enterprises advance voice-guided interfaces in indigenous dialects, synchronizing with community health apps for adherence reminders. These developments underpin a resilient framework for nutritional equity. The World Bank reported a female labor force participation rate of 58.1% across East Asia and the Pacific in recent assessments, reflecting progressive gains from 2022 onward.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent firms in the lactation support sector drive expansion by launching wearable, app-connected devices that offer customizable suction and remote monitoring for enhanced user convenience. They form strategic alliances with maternity care providers and e-commerce platforms to streamline distribution and integrate educational content, boosting consumer trust.

Companies invest heavily in ergonomic designs and noise-reducing technologies, addressing user comfort to differentiate their offerings in competitive segments. Executives target emerging markets in South Asia and Africa, tailoring affordable models to local economic conditions and cultural preferences. They acquire niche innovators to incorporate smart sensors, expanding functionality for data-driven feeding insights. Additionally, they introduce subscription-based lactation coaching and maintenance plans to foster brand loyalty and stabilize revenue flows.

Medela AG, founded in 1961 and headquartered in Baar, Switzerland, leads globally in breastfeeding technologies, delivering hospital-grade and personal-use solutions for nursing mothers. The company develops products like the Freestyle Flex, prioritizing portability and intuitive controls to support modern lifestyles.

Medela commits extensive resources to clinical research, collaborating with lactation experts to refine performance and safety standards. CEO Annette Brüls steers operations across 100 countries, emphasizing sustainable manufacturing and user-centric innovation. The firm partners with healthcare facilities to provide professional-grade equipment and training, enhancing maternal care outcomes. Medela solidifies its market leadership by blending advanced engineering with empathetic design to empower breastfeeding journeys.

Top Key Players

- Willow Innovations, Inc

- Motif Medical

- Medela AG

- Mamapump

- LaVie Mom

- Lansinoh Laboratories, Inc. (Pigeon Corporation)

- KISSBOBO

- Hygeia Health

- Haakaa

- Freemie

- Chiaro Technology Limited

- Ardo medical AG

Recent Developments

- In May 2025, Medela introduced the Magic InBra, a next-generation wearable breast pump offering hospital-grade performance. Equipped with FluidFeel Technology, it enhances comfort, efficiency, and hands-free convenience for mothers. This innovation is expected to drive the breast pump market by catering to the growing demand for advanced, user-centric breastfeeding solutions.

- In January 2025, Willow launched a series of products, including the Glass Breast Milk Pitcher, Silicone Wearable Breast Pump, and Breast Milk Storage Bags. These additions underscore Willow’s commitment to enhancing the maternal journey and position the company to capture a larger share of the breast pump market by offering comprehensive, high-quality solutions for new parents.

- In July 2024, KISSBOBO unveiled the M1 Breast Pump, featuring 19 adjustable suction levels for a more personalized and comfortable pumping experience. This customization addresses diverse user needs, thereby enhancing comfort and driving growth in the breast pump market by offering a tailored solution for mothers seeking better control over their breastfeeding experience.

- In March 2024, Willow Innovations launched the Willow 360, an advanced wearable breast pump system with improved leak-proof technology and a user-friendly app. This upgrade empowers mothers with more freedom and flexibility, contributing to the market’s growth by enhancing the overall pumping experience and offering mothers increased support.

Report Scope

Report Features Description Market Value (2024) US$ 3.1 Billion Forecast Revenue (2034) US$ 7.6 Billion CAGR (2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wearable, and Non-wearable), By Technology (Manual, and Automatic), By End-user (Hospitals, Maternity Clinics, Homecare, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Willow Innovations, Inc, Motif Medical, Medela AG, Mamapump, LaVie Mom, Lansinoh Laboratories, Inc. (Pigeon Corporation), KISSBOBO, Hygeia Health, Haakaa, Freemie, Chiaro Technology Limited, Ardo medical AG. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Willow Innovations, Inc

- Motif Medical

- Medela AG

- Mamapump

- LaVie Mom

- Lansinoh Laboratories, Inc. (Pigeon Corporation)

- KISSBOBO

- Hygeia Health

- Haakaa

- Freemie

- Chiaro Technology Limited

- Ardo medical AG