Global Bovine Lactoferrin Market By Product Form (Freeze-dried powder, Spray-dried powder, Liquid/soluble forms) By Function (Iron-binding/Iron-transport, Immunomodulation/Immune-support, Antimicrobial/Antiviral/Antiparasitic, Antioxidant/Anti-inflammatory, Others) By Application (Infant nutrition, Functional foods & beverages, Dietary supplements & Nutraceuticals, Pharmaceuticals, Others) By Distribution Channel (Supermarkets & Hypermarkets, Pharmacy/Drug stores, E-commerce platforms, Specialty stores, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164346

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

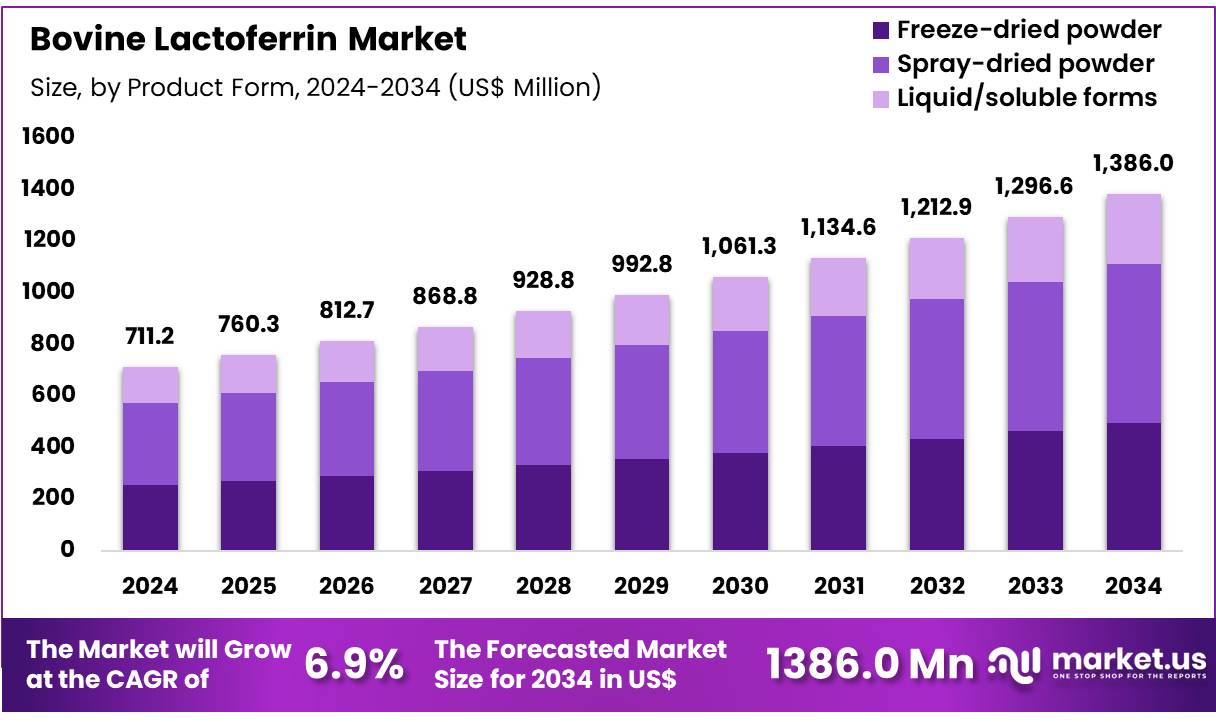

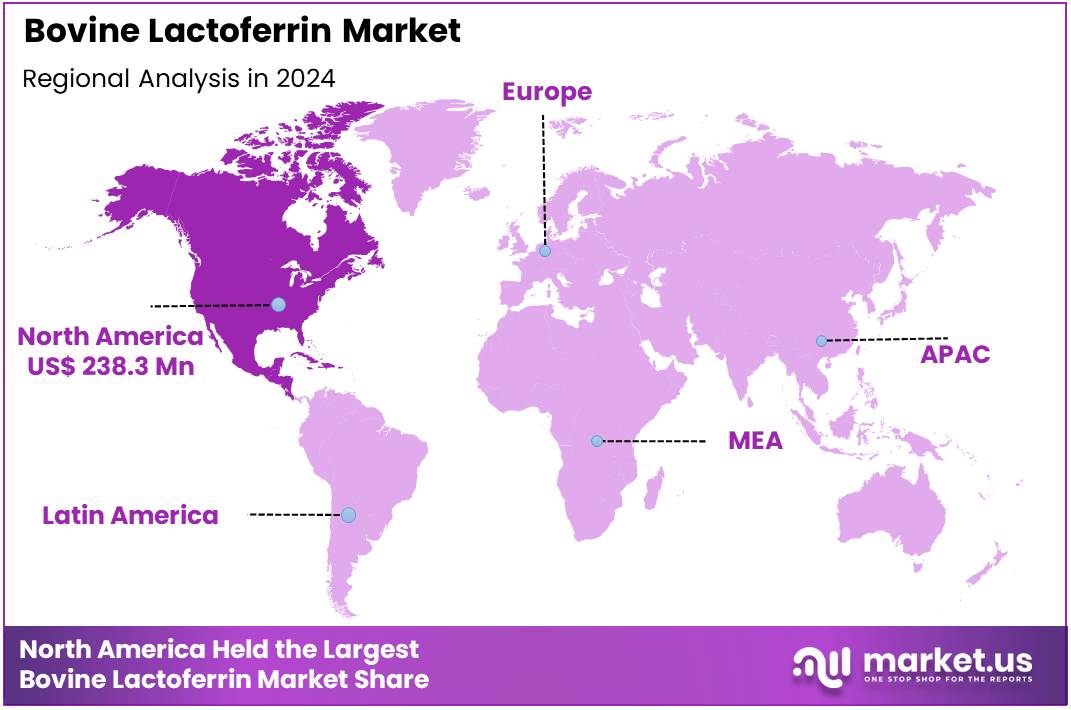

Global Bovine Lactoferrin Market size is expected to be worth around US$ 1386.0 Million by 2034 from US$ 711.2 Million in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 33.5% share with a revenue of US$ 238.3 Million.

Demand for bovine lactoferrin is being lifted by global nutrition gaps in women and children. Anaemia remains widespread: an estimated 40% of children 6–59 months, 37% of pregnant women, and 30% of women 15–49 years are affected worldwide.

Programs and products that support iron status therefore see sustained need, and lactoferrin is studied as a supportive option in iron management. These high burdens create steady use cases in infant and maternal nutrition, strengthening market growth baselines.

Childhood diarrhoeal disease also sustains demand for ingredients linked with gut and immune health. Diarrhoea causes about 443,832 deaths in children under five each year and nearly 1.7 billion cases, underscoring the need for preventive nutrition in early life, where lactoferrin is often positioned. As health systems work to cut mortality, producers of formulas and supplements with immunity and gut-support claims can see continued adoption in high-burden regions.

Safety and regulatory acceptance have reduced barriers to formulation. The U.S. Food and Drug Administration has recognized cow’s milk–derived lactoferrin as Generally Recognized as Safe (GRAS) for specific uses, and the European Food Safety Authority has concluded that bovine lactoferrin is safe under proposed uses and levels. Such opinions enable standardized inclusion in infant formulas and functional foods, encouraging wider manufacturer uptake and cross-border commercialization.

A final driver is the search for alternatives that support antimicrobial stewardship. Antimicrobial resistance is a top global threat, with an estimated 1.27 million deaths directly attributable in 2019 and millions more associated, which has intensified interest in adjuncts that help maintain microbial balance and host defense.

Lactoferrin’s broad antimicrobial and anti-inflammatory properties align with this focus, supporting its use in preventive nutrition and clinical nutrition pipelines. These trends together indicate steady, persified growth for the bovine lactoferrin sector.

Key Takeaways

- Market Size: Global Bovine Lactoferrin Market size is expected to be worth around US$ 1386.0 Million by 2034 from US$ 711.2 Million in 2024.

- Market Growth: The market growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

- Product Form Analysis: Spray-dried powder is the leading segment and is estimated to account for approximately 44.6% of global market share in 2024.

- Function Analysis: The iron-binding/iron-transport segment dominates with an estimated 35.3% market share in 2024.

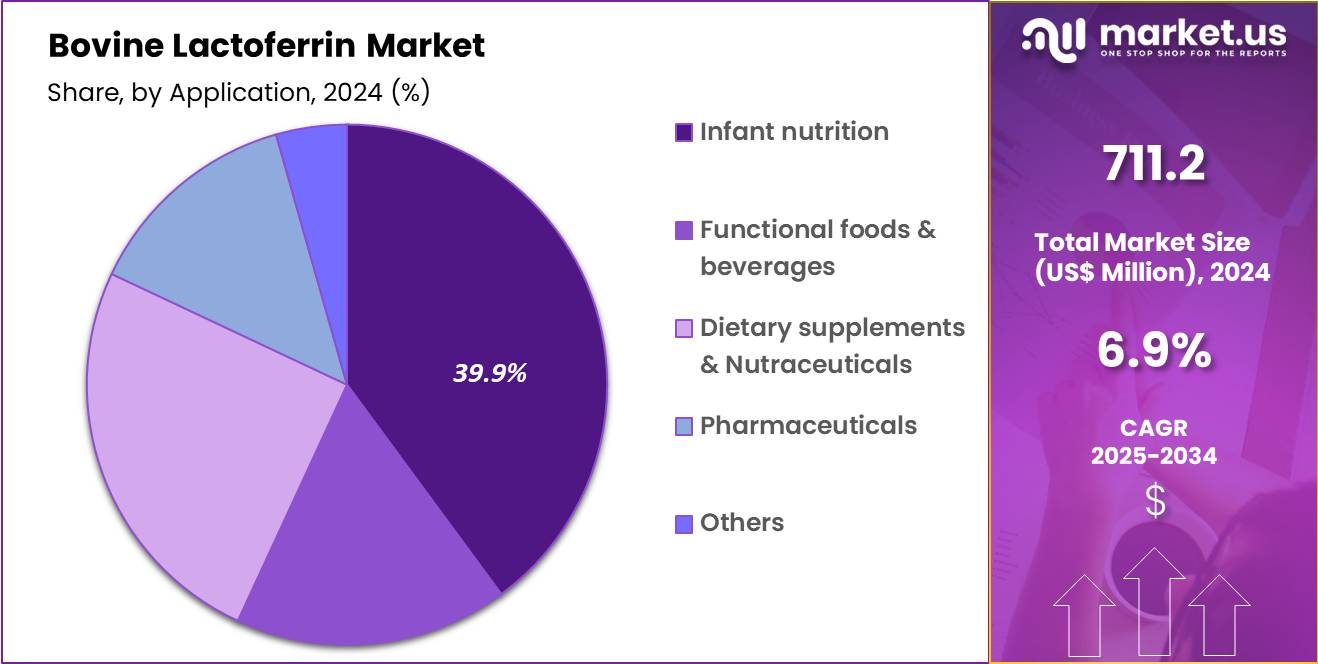

- Application Analysis: The infant nutrition segment leads with an estimated 39.9% market share in 2024.

- Distribution Channel Analysis: Pharmacy and drug stores dominate with an estimated 31.0% market share in 2024.

- Regional Analysis: In 2024, North America led the market, achieving over 33.5% share with a revenue of US$ 238.3 Million.

Product Form Analysis

The market for bovine lactoferrin is segmented by product form into spray-dried powder, freeze-dried powder, and liquid/soluble variants. Spray-dried powder is the leading segment and is estimated to account for approximately 44.6% of global market share in 2024.

Its dominance can be attributed to strong commercial availability, stable shelf-life, and suitability for large-scale production in infant formula, dietary supplements, and functional food applications. Demand is further supported by cost-effectiveness and compatibility with conventional processing technologies in the nutraceutical and dairy sectors.

Freeze-dried powder represents a smaller yet steadily growing segment, driven by demand for high-purity and bioactive forms of lactoferrin used in premium infant nutrition, pharmaceutical formulations, and clinical research applications.

Liquid and soluble forms hold a niche position, primarily utilized in specialized formulations and liquid nutraceutical products where higher solubility and immediate absorption are required. Overall adoption across forms is expected to advance in line with evolving functional food and infant nutrition trends.

Function Analysis

The functional segmentation of the bovine lactoferrin market includes iron-binding/iron-transport, immunomodulation/immune-support, antimicrobial/antiviral/antiparasitic, antioxidant/anti-inflammatory, and other emerging therapeutic functions.

The iron-binding/iron-transport segment dominates with an estimated 35.3% market share in 2024, reflecting the extensive utilization of lactoferrin in infant formula and nutritional supplements for iron absorption enhancement and anemia prevention. This function has been widely validated in clinical nutrition, thereby strengthening its adoption across early-life nutrition and medical nutrition applications.

The immunomodulation/immune-support function represents a significant secondary segment, gaining traction due to rising preventive healthcare trends and increasing consumer preference for immune-enhancing ingredients. Antimicrobial, antiviral, and antiparasitic properties continue to drive usage in dietary supplements, food safety formulations, and pharmaceutical research.

The antioxidant and anti-inflammatory segment is expanding gradually, supported by growing demand in healthy aging and gut-health products. Other functional uses, including wound healing and gut microbiota modulation, are advancing through ongoing research, indicating potential future market expansion.

Application Analysis

The bovine lactoferrin market is categorized into infant nutrition, functional foods and beverages, dietary supplements and nutraceuticals, pharmaceuticals, and other emerging applications. The infant nutrition segment leads with an estimated 39.9% market share in 2024, driven by widespread incorporation of lactoferrin in premium infant formula to support immunity, iron absorption, and gut health.

The segment’s dominance is reinforced by increasing birth rates in emerging economies, higher spending on infant formula, and regulatory approvals for lactoferrin use in fortified products.

Functional foods and beverages represent a growing category, supported by rising consumer demand for natural bioactive ingredients in daily nutrition. Dietary supplements and nutraceuticals are expanding steadily as health-conscious consumers adopt lactoferrin for immune support and digestive well-being.

Pharmaceutical applications remain niche but are expected to advance due to clinical research in infection management, anti-inflammatory therapeutics, and anemia treatment. Other uses, including animal health and cosmetic formulations, are emerging with innovation-driven development.

Distribution Channel Analysis

The distribution network for bovine lactoferrin products encompasses pharmacy/drug stores, supermarkets and hypermarkets, e-commerce platforms, specialty stores, and other retail channels. Pharmacy and drug stores dominate with an estimated 31.0% market share in 2024, owing to strong consumer trust in regulated retail environments for infant nutrition, dietary supplements, and clinical nutrition products containing lactoferrin.

The dominance of this channel is supported by professional guidance from pharmacists, stringent product placement standards, and higher acceptance of premium nutritional offerings through healthcare-aligned outlets.

Supermarkets and hypermarkets hold a significant share, driven by broad accessibility and expanding shelf space for functional nutrition and infant formula brands. E-commerce platforms are experiencing rapid growth due to rising digital adoption, convenience, and increasing consumer preference for online health and wellness purchases.

Specialty stores, including nutrition and organic product retailers, cater to targeted consumer groups. Other channels, such as direct-to-consumer distribution and institutional sales, continue to evolve alongside broader market penetration initiatives.

Key Market Segments

By Product Form

- Freeze-dried powder

- Spray-dried powder

- Liquid/soluble forms

By Function

- Iron-binding/Iron-transport

- Immunomodulation/Immune-support

- Antimicrobial/Antiviral/Antiparasitic

- Antioxidant/Anti-inflammatory

- Others

By Application

- Infant nutrition

- Functional foods & beverages

- Dietary supplements & Nutraceuticals

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Pharmacy/Drug stores

- E-commerce platforms

- Specialty stores

- Others

Driving Factors

The growth of the bovine lactoferrin market can be attributed to the increasing scientific recognition of its health-promoting properties, particularly its iron-binding capability and immune-support functions. Research indicates that lactoferrin enhances iron uptake in the intestine and supports gut barrier integrity. Furthermore, regulatory approvals in mature markets for its use in infant nutrition have created a commercial pathway.

For example, the Food Standards Australia New Zealand (FSANZ) approved voluntary addition of bovine lactoferrin (bLf) in infant formula as a nutritive substance. The convergence of public health nutrition initiatives (e.g., addressing iron deficiency) and product formulations designed for infants and adults is driving demand.

Trending Factors

A notable trend in the bovine lactoferrin market is its expansion beyond infant formula into adult nutrition, functional foods, dietary supplements and even personal-care applications. Studies demonstrate lactoferrin’s broader physiological activity, including antimicrobial and anti-inflammatory effects.

Regulatory frameworks are adapting: for example, the U.S. U.S. Food & Drug Administration issued a GRAS notice for cow’s-milk-derived lactoferrin in infant and toddler formulas. These developments support formulation innovation and market persification, consistent with consumer interest in immune-support and clean-label ingredients.

Restraining Factors

Despite promising growth, the market for bovine lactoferrin faces significant restraints. One major challenge lies in production and purification costs: the extraction of high-purity proteins from bovine milk is capital-intensive and subject to dairy-feedstock variability.

Additionally, regulatory complexity and stringent safety assessments for novel food ingredients restrict rapid adoption. As noted by FSANZ, while bovine lactoferrin was approved for use in infant formula, labelling and claims remain tightly regulated. Moreover, high cost may limit accessibility in price-sensitive regions, hindering penetration in large emerging-market segments.

Opportunity

Significant opportunities exist for bovine lactoferrin in addressing global nutritional deficits and disease-prevention applications. For example, studies show that bovine lactoferrin supplementation can improve iron status in populations with iron-deficiency anaemia and modulate gut health. Regulatory permissions such as in Australia/New Zealand for its use in infant formula demonstrate a pathway to market.

Additionally, the growing emphasis on functional nutrition, as well as interest in immune-supporting ingredients amid public-health focus, creates room for novel product formats (e.g., fortified beverages, sports nutrition) and geographic expansion into Asia-Pacific, Latin America and Africa where iron deficiency and malnutrition remain prevalent.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 33.5% share and holds US$ 238.3 Million market value for the year. Strong adoption of advanced dairy technologies supported this growth. High consumer awareness of immune-supportive ingredients contributed to rising demand. Increasing applications in infant formula and functional food products also supported market expansion.

The region benefited from well-established dairy processing infrastructure. A consistent supply chain for bovine milk ingredients ensured steady raw material availability. Regulatory guidance for infant nutrition and nutraceutical products remained well-structured, which encouraged product development. As a result, manufacturers continued to introduce premium-grade lactoferrin formulations.

Higher spending power reinforced demand for premium functional ingredients. Health-conscious consumers showed a preference for bioactive dairy compounds. The use of lactoferrin in dietary supplements expanded rapidly. Adoption increased further as clinical interest in immunity and gut health grew.

Ongoing investments in research and product innovation strengthened regional leadership. Nutritional brands and ingredient developers focused on safety, purity, and bioactivity. Local production facilities enhanced export capabilities, especially toward Europe and Asia.

Growing awareness of natural immune enhancers boosted product consumption. The influence of clean-label and wellness trends became prominent. Retail and e-commerce platforms also widened product accessibility. As a result, the region continued to serve as a key hub for commercial expansion.

Future growth in North America is expected to be supported by infant formula innovation and rising adult nutrition trends. Expansion in sports nutrition and elderly nutrition segments is anticipated. The demand outlook remains strong as consumers continue to prioritize immunity and preventive health.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the bovine lactoferrin market focused on expanding production capabilities and enhancing product purity standards. Advanced filtration and extraction technologies were adopted to improve bioactivity and ensure consistent quality. Strategies emphasized long-term supply contracts with dairy suppliers to secure raw material availability.

Leading manufacturers strengthened global distribution networks to reach premium nutrition segments. Research and development activities targeted clinical validation to support claims related to immunity, gut health, and iron absorption. Partnerships with infant nutrition and functional food producers were prioritized to increase application adoption.

A shift toward clean-label and pharmaceutical-grade formulations was observed as quality and safety standards continued to rise. New entrants explored niche opportunities in sports and adult nutrition, while established firms focused on competitive pricing and regulatory compliance to maintain market leadership.

Market Key Players

- FrieslandCampina Ingredients

- Armor Protéines

- Ingredia SA

- Synlait Milk Ltd.

- Noumi Limited

- Bega Cheese Limited

- Hilmar Cheese Company, Inc.

- Valfoo AG

- Agropur Dairy Cooperative

- MILEI GmbH

- Lactoferrin Co.

- Ausnutria Dairy

- Farbest Brands

- Tatua Co-Operative Dairy Company, Ltd

- Glanbia Plc

- Fonterra Co-operative Group

- Inner Mongolia Yili Group

- Jarrow Formulas

Recent Developments

- FrieslandCampina Ingredients (March 2023): Opened a new lactoferrin production facility in Veghel, Netherlands, increasing annual capacity from 20 t to 80 t to meet rising demand in early-life and adult nutrition markets.

- Armor Protéines (February 2024): Published insights on women’s-health applications for bovine lactoferrin (Vitalarmor® brand), noting rising demand across infant, senior and sports nutrition markets.

- Noumi Limited (August 2024): Announced that its PUREnFERRIN™ bovine lactoferrin business will be scaled into new applications and markets, aligning with its nutrition-ingredients strategic priorities.

- MILEI GmbH (October 2020): The German subsidiary of Morinaga announced expansion of its lactoferrin production capacity to ~170 t/year (doubling prior levels) to support growing global demand.

Report Scope

Report Features Description Market Value (2024) US$ 711.2 Million Forecast Revenue (2034) US$ 1386.0 Million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Freeze-dried powder, Spray-dried powder, Liquid/soluble forms) By Function (Iron-binding/Iron-transport, Immunomodulation/Immune-support, Antimicrobial/Antiviral/Antiparasitic, Antioxidant/Anti-inflammatory, Others) By Application (Infant nutrition, Functional foods & beverages, Dietary supplements & Nutraceuticals, Pharmaceuticals, Others) By Distribution Channel (Supermarkets & Hypermarkets, Pharmacy/Drug stores, E-commerce platforms, Specialty stores, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape FrieslandCampina Ingredients, Armor Protéines, Ingredia SA, Synlait Milk Ltd., Noumi Limited, Bega Cheese Limited, Hilmar Cheese Company, Inc., Valfoo AG, Agropur Dairy Cooperative, MILEI GmbH, Lactoferrin Co., Ausnutria Dairy, Farbest Brands, Tatua Co-Operative Dairy Company, Ltd , Glanbia Plc, Fonterra Co-operative Group, Inner Mongolia Yili Group, Jarrow Formulas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- FrieslandCampina Ingredients

- Armor Protéines

- Ingredia SA

- Synlait Milk Ltd.

- Noumi Limited

- Bega Cheese Limited

- Hilmar Cheese Company, Inc.

- Valfoo AG

- Agropur Dairy Cooperative

- MILEI GmbH

- Lactoferrin Co.

- Ausnutria Dairy

- Farbest Brands

- Tatua Co-Operative Dairy Company, Ltd

- Glanbia Plc

- Fonterra Co-operative Group

- Inner Mongolia Yili Group

- Jarrow Formulas