Global Bopet Film Market Size, Share, And Business Benefits By Thickness (Below 15 Micron BOPET Packaging Films, 15-30 Micron BOPET Packaging Films, 30-50 Micron BOPET Packaging Films, Above 50 Micron BOPET Packaging Films), By Application (Labels, Tapes, Wraps, Bags and Pouches, Laminates), By End-use (Food, Beverages, Cosmetics and Personal Care, Electrical and Electronics, Pharmaceuticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164733

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

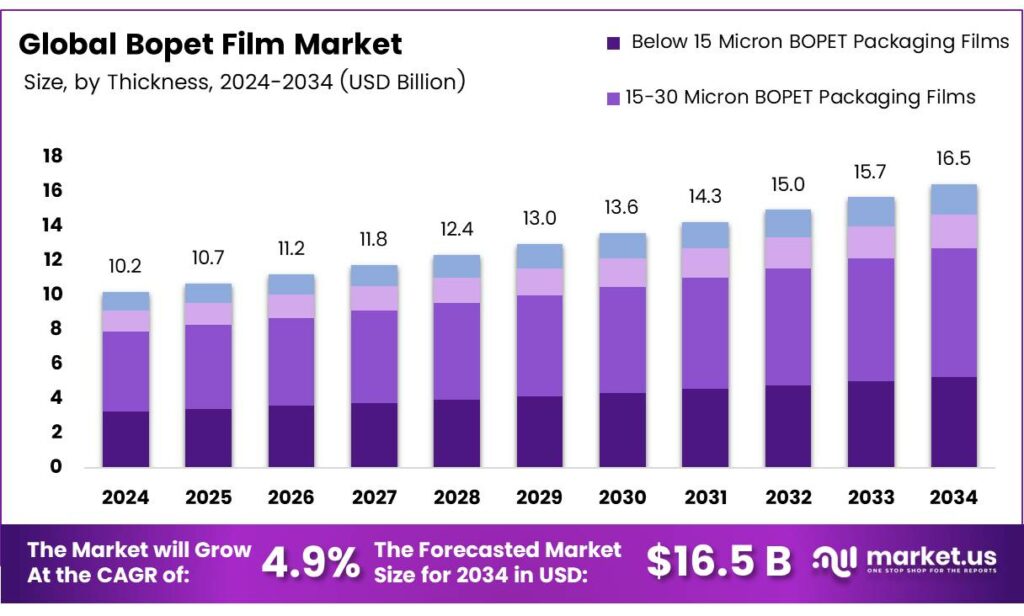

The Global BOPET Film Market size is expected to be worth around USD 16.5 billion by 2034, from USD 10.2 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

BOPET films have become the unsung backbone of modern life, powering critical applications across consumer electronics, automotive, green energy, and medical devices. Yet their largest impact is in flexible packaging, where they form the high-performance core of multi-layer plastic (MLP) structures. Despite representing only 5–10% of packaging weight, BOPET films are integral to up to 25% of all packs, delivering outsized resource efficiency and enabling the fast-paced convenience we take for granted.

The applications of Cosmo BOPET Films are virtually limitless and surround us daily. In flexible packaging, metalized BOPET laminates shield food from oxidation and aroma loss, delivering the long shelf lives we expect in coffee pouches, stand-up convenience foods, and FMCG products. Silver BOPET has replaced traditional foil for candy wrappers, while white BOPET serves as lids for yogurt, cup noodles, mineral water, soups, and desserts.

Transparent grades act as microwave- and oven-safe lidding for ready meals, and ultra clear versions provide premium thermal lamination for mono cartons and luxury catalogs. Beyond food, metalized and non-metalized BOPET has replaced nylon in party balloons, revolutionized bag-in-box wine packaging, and become the printable media of choice for photobooks and security printing. The PET-G variant dominates uniform shrink-sleeve labeling, proving that with imagination, brands can incorporate Cosmo BOPET into virtually any product strategy.

- The manufacturing process begins with melted PET resin extruded onto a chill roll, instantly quenching it into an amorphous state. The film is then biaxially oriented typically through a sequential process where it is first stretched in the machine direction using heated rollers, then drawn orthogonally in a heated oven. Finally, the film is heat-set under tension at temperatures above 200°C (392°F), crystallizing the structure and locking in molecular orientation. This orientation is what gives BOPET its remarkable strength and stiffness.

Cosmo BOPET Films earn their place as the right choice through a compelling combination of performance and sustainability. FDA-compliant grades ensure food safety when proper conversion and recycling protocols are followed. The oriented polymer chains deliver shock resistance and durability that outlast other films, especially when paired with polyethylene. Metalized versions create excellent oxygen and UV barriers, while high-gloss surfaces elevate point-of-sale and lamination aesthetics.

Key Takeaways

- The Global BOPET Film Market is expected to grow from USD 10.2 billion in 2024 to USD 16.5 billion by 2034 at a 4.9% CAGR.

- The 15-30 Micron thickness segment leads with 45.3% market share in 2024 for superior barrier properties.

- Labels application dominates with 23.7% share in 2024 due to clarity and scratch resistance.

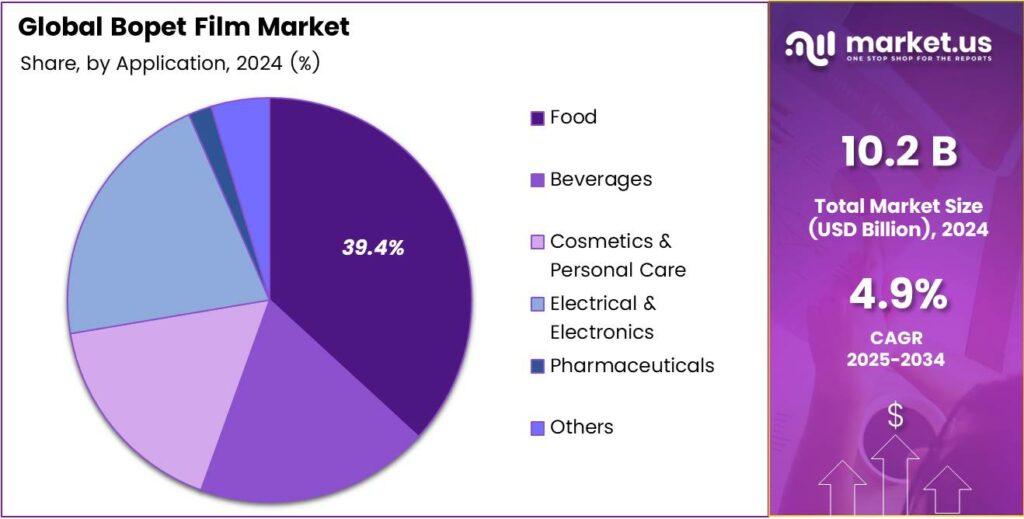

- The Food End-Use segment holds the largest share at 39.4% in 2024, protecting snacks, dairy, and meats.

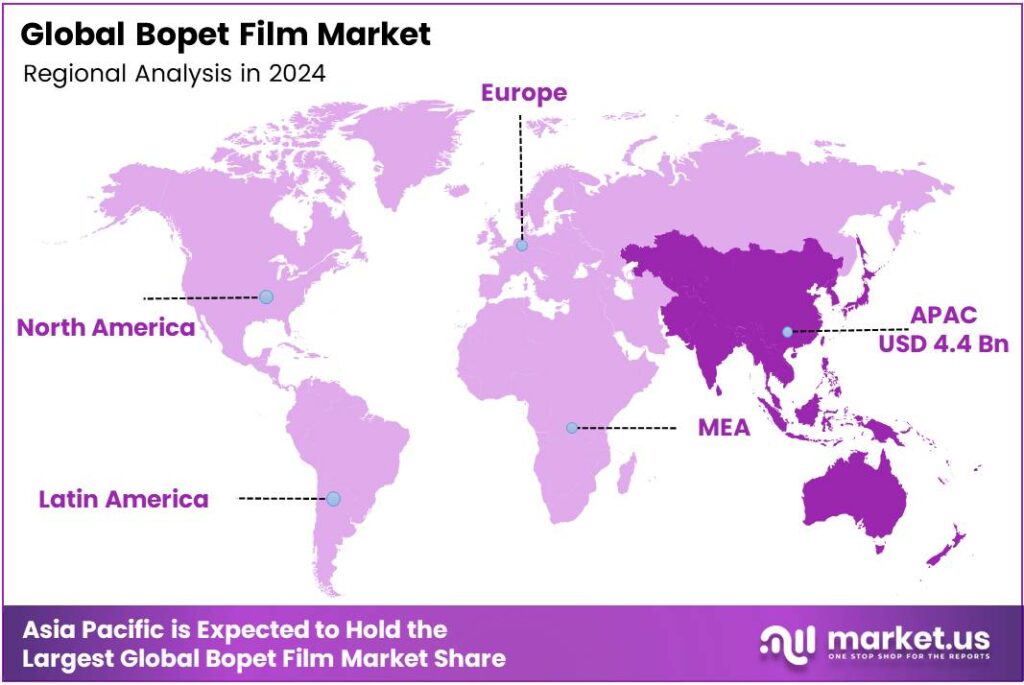

- Asia-Pacific commands 43.9% of the global market, valued at USD 4.4 billion in 2024.

By Thickness Analysis

15-30 Micron BOPET Packaging Films dominate with 45.3% due to their perfect balance of strength, flexibility, and cost-efficiency in high-volume packaging.

In 2024, 15-30 Micron BOPET Packaging Films held a dominant market position in the By Thickness Analysis segment of the BOPET Film Market, with a 45.3% share. This range shines in flexible packaging, delivering superior barrier properties against oxygen and moisture. Moreover, it supports high-speed lamination processes, making it ideal for snacks, coffee pouches, and retort applications.

Below 15 Micron BOPET Packaging Films emerges as the ultra-lightweight champion for metallization and thin-gauge laminates. Offering excellent clarity and puncture resistance, it reduces material usage by up to 30% while maintaining performance. Additionally, its low thickness enables down-gauging trends, cutting costs, and environmental impact. Consequently, converters prefer it for yogurt lids and candy wrappers.

30-50 Micron BOPET Packaging Films steps up for heavy-duty needs like stand-up pouches and industrial sacks. Providing enhanced stiffness and tear resistance, it handles rigorous filling lines without failing. Furthermore, this thicker grade excels in hot-fill and microwaveable packs, ensuring product safety. Thus, it remains essential for frozen foods and pet care packaging.

By Application Analysis

Labels dominate with 23.7% thanks to outstanding print quality, durability, and pressure-sensitive adhesion in branding.

In 2024, Labels held a dominant market position in the By Application Analysis segment of the BOPET Film Market, with a 23.7% share. BOPET labels deliver crystal-clear graphics and scratch resistance that outlast paper alternatives. Moreover, they withstand harsh conditions like moisture and chemicals in beverages and cosmetics. Shifting focus, their shrink-sleeve variants create 360-degree branding magic.

Tapes rely on BOPET for high tensile strength in insulation and strapping applications. Delivering reliable adhesion under extreme temperatures, these tapes secure heavy loads effortlessly. Additionally, transparent versions allow visibility during bundling operations. Therefore, the electrical and carton-sealing industries depend on them daily.

Wraps utilize BOPET’s flexibility for overwraps and bundle packaging solutions. Offering tight seals that protect against dust and tampering, they extend shelf life naturally. Furthermore, high-clarity wraps showcase products beautifully in retail displays. As a result, fresh produce and multipacks benefit immensely from this versatile format.

By End-Use Analysis

Food dominates with 39.4% driven by unmatched barrier protection that keeps flavors fresh and extends shelf life dramatically.

In 2024, Food held a dominant market position in the By End-Use Analysis segment of the BOPET Film Market, with a 39.4% share. BOPET laminates shield snacks, dairy, and meats from oxidation and contamination. Moreover, metallized versions reflect light to prevent spoilage in sensitive items. Moving ahead, microwave-safe options add convenience for ready meals.

Beverages leverage BOPET for pouch and label stability in carbonated drinks and juices. Providing aroma retention and UV protection, it maintains taste integrity over long distribution chains. Additionally, flexible stand-up pouches reduce plastic usage versus rigid bottles. Hence, wine bag-in-box systems thrive with this reliable material.

Cosmetics and Personal Care embrace BOPET for luxurious sachets and shrink labels on premium products. Delivering high-gloss finishes and chemical resistance, it protects creams and shampoos effectively. Furthermore, tamper-evident features build consumer trust instantly. Ultimately, its recyclability aligns perfectly with clean beauty trends.

Key Market Segments

By Thickness

- Below 15 Micron BOPET Packaging Films

- 15-30 Micron BOPET Packaging Films

- 30-50 Micron BOPET Packaging Films

- Above 50 Micron BOPET Packaging Films

By Application

- Labels

- Tapes

- Wraps

- Bags and Pouches

- Laminates

By End-use

- Food

- Meat

- Fresh Produce

- Confectionery

- Dairy

- Others

- Beverages

- Cosmetics and Personal Care

- Electrical and Electronics

- Pharmaceuticals

- Others

Emerging Trends

High-PCR and Recycled-content BOPET moves from niche to mainstream

Brand owners now ask for film with real recycled content, not just a recyclable claim. Polyester is benefiting because credible rPET feedstock keeps scaling. In India, Indorama Ventures (a top PET player) and partners announced multiple PET recycling plants targeting a combined 100 kilotons/year of rPET capacity as facilities come online, directly enlarging the pool of feedstock suitable for film-grade via advanced purification.

- UFlex publicly showcased an rBOPET with 90% post-consumer recycled content and reported a 75% lower carbon footprint versus virgin BOPET, signalling that high-PCR films can meet performance and LCA thresholds for premium packaging. Earlier, Mylar Specialty Films introduced PET films with up to 50% PCR content, priming large CPGs to trial mid- to high-PCR structures across lidding, pouches, and labels.

The EU’s new Packaging and Packaging Waste Regulation requires all packaging to be recyclable and aims to increase recycled plastics use, pushing buyers toward mono-PET laminates that can accept PCR inputs and still be recycled. As recycling systems expand, Indorama alone reports cumulative milestones of >100 billion bottles recycled. Supply certainty improves, which de-risks long-term PCR commitments for film.

Drivers

Food-waste cuts and shelf-life performance keep BOPET indispensable

Retailers and food brands are under pressure to curb waste. The UNEP Food Waste Index 2024 estimates 1.05 billion tonnes of food were wasted, 19% of food available to consumers—making shelf-life extension a material issue, not a marketing claim. BOPET’s thermal window and mechanical stability enable tough, thin laminates that protect aroma, resist puncture, and run well on high-speed lines.

- PET film can tolerate −70 °C to +150 °C, covering deep-freeze, hot-fill, and retort, one substrate spanning multiple SKUs and processes. Policy adds momentum: the EU’s packaging plan requires all packaging to be recyclable, steering specifiers toward mono-PET or PET-dominant structures that can protect food and still meet recyclability criteria.

In parallel, big retailers are setting internal waste-reduction scorecards linked to supplier packaging performance; PCR-capable PET films let brands cut virgin resin, maintain optics, and hit corporate targets without retooling entire lines. Finally, recycling infrastructure is scaling in key demand centers—India’s announced PET recycling buildout will feed flake and pellets into film supply chains, making PCR specifications easier to source at volume.

Restraints

Collection and recycling gaps for films, not bottles, slow circularity

Europe collects and sorts PET bottles relatively well, but films and trays lag. Plastics Recyclers Europe reports that about 2.7 million tonnes of PET waste were sorted for recycling, a 54% sorted for recycling rate overall; yet only a few countries collected PET thermoformed trays at scale, highlighting a structural gap beyond bottles.

- Even if converters supply high-PCR films, post-use capture of flexible PET remains inconsistent, which depresses real recycling rates and the supply of high-quality rPET suitable for film. Regulation is tightening EU rules, aiming for all packaging to be recyclable and set higher overall recycling rates 70% for all packaging, sorting, and washing. Brands risk non-compliance or cost spikes to meet EPR and recycled-content obligations.

In practice, the restraint shows up as limited take-back for flexible laminates, contamination at MRFs, and insufficient sortation tech to separate PET films from mixed flexibles. Until tray- and film-collection programs scale broadly, PCR supply will prioritize bottles, leaving film makers to compete for feedstock or depend on chemical recycling routes that are not yet ubiquitous.

Opportunity

Electrification and solar create a second growth engine for BOPET

The electrification wave is expanding demand for technical PET films in EV motors, transformers, capacitors, and PV backsheets. The IEA notes that nearly one in five cars sold was electric, with sales nearing 14 million, a direct pull-through for insulation films and label/laminate applications across the EV supply chain.

- IEA-PVPS estimates 2,156.5 GW of cumulative PV capacity installed, with 554–602 GW commissioned. Each module needs a protective backsheet where PET layers are widely used. Technical literature and industry sources confirm PET’s central role in backsheets, and PET-only, fluorine-free backsheets are gaining share as cost-effective, recyclable options.

As renewable additions accelerate, IEA projects annual renewable capacity additions rising from 666 GW in 2024 to 935 GW.. PET films benefit on two fronts: electrical insulation and PV module components. Qualify electrical-grade BOPET (high dielectric strength, low shrinkage) and PV-grade PET for backsheets and labels, then align with EV/PV OEM specs. The electrification build-out is multi-year and policy-anchored.

Regional Analysis

Asia-Pacific leads with a 43.9% share and a USD 4.4 Billion market value.

Asia-Pacific holds a commanding position in the global BOPET (Biaxially Oriented Polyethylene Terephthalate) film market, accounting for 43.9% of the total share, valued at approximately USD 4.4 billion in 2024. The region’s dominance is underpinned by the extensive presence of packaging, electronics, and automotive industries, which consume large volumes of BOPET films for flexible packaging.

The growing demand for packaged food and beverages across emerging economies has accelerated the consumption of BOPET films, particularly those offering superior barrier properties and durability. Moreover, increasing the adoption of eco-friendly and recyclable films aligns with regional sustainability goals and government regulations that promote recyclable materials in packaging.

Initiatives such as India’s Plastic Waste Management Rules and China’s plastic ban policy are further stimulating innovation in film recycling technologies. Technological advances in film processing, coupled with large-scale investments in polyester film manufacturing, are strengthening regional competitiveness.

The expansion of solar panels and electronic display manufacturing also contributes to sustained demand, as BOPET films serve as protective and insulating layers. Overall, Asia-Pacific’s high-volume manufacturing capacity, cost advantages, and government-backed industrialization programs ensure it remains the dominant growth engine in the global BOPET film market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Toray is renowned for its high-quality, innovative BOPET films. It invests heavily in R&D to produce advanced films for specialized sectors like flexible electronics, high-barrier packaging, and automotive applications. With a strong international presence and a focus on sustainability, Toray leverages its technological expertise to serve a premium, global clientele, often setting industry benchmarks for performance and pushing the boundaries of BOPET film functionality.

UFlex is a fully integrated BOPET powerhouse. It controls the entire production chain, from raw materials to finished products, ensuring cost efficiency and quality control. UFlex excels in producing value-added, specialty films for diverse packaging needs, including holographic and security applications. Its strong focus on recycling and sustainability, combined with a vast global manufacturing footprint, makes it a dominant and agile player in the international market.

Polyplex is a major global producer with a significant focus on commodity and specialty BOPET films. It operates large-scale, cost-effective manufacturing plants across Thailand, Turkey, and the United States, ensuring a robust global supply chain. The company serves a wide range of industries, from packaging to industrial applications, and is strategically expanding its portfolio to include more sustainable and recycled-content films.

Top Key Players in the Market

- Toray Industries, Inc.

- UFlex Limited

- Polyplex

- SRF Limited

- Jindal Poly Films Limited

- Mylar Specialty Films

- Mitsubishi Polyester Film GmbH

- SKC

- Vacmet India Limited

- Cosmo First Limited

Recent Developments

- In 2025, Toray continues to be a leading global producer of BOPET films under the Lumirror brand, used in packaging, industrial, and electronic applications. However, Toray’s subsidiary Toray Films Europe announced, part of its Torayfan OPP films portfolio will be formulated without certain additives, emphasizing sustainability—though this pertains to OPP rather than BOPET.

- In 2025, Polyplex has significantly strengthened its position in the BOPET film sector through a major brownfield expansion at its facility in the United States. The company successfully commissioned a new high-output BOPET film line—recognized as the world’s highest capacity PET line, along with a state-of-the-art offline coater.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 16.5 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Thickness (Below 15 Micron BOPET Packaging Films, 15-30 Micron BOPET Packaging Films, 30-50 Micron BOPET Packaging Films, Above 50 Micron BOPET Packaging Films), By Application (Labels, Tapes, Wraps, Bags and Pouches, Laminates), By End-use (Food, Meat, Beverages, Cosmetics and Personal Care, Electrical and Electronics, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Toray Industries, Inc., UFlex Limited, Polyplex, SRF Limited, Jindal Poly Films Limited, Mylar Specialty Films, Mitsubishi Polyester Film GmbH, SKC, Vacmet India Limited, Cosmo First Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Toray Industries, Inc.

- UFlex Limited

- Polyplex

- SRF Limited

- Jindal Poly Films Limited

- Mylar Specialty Films

- Mitsubishi Polyester Film GmbH

- SKC

- Vacmet India Limited

- Cosmo First Limited