Global Blood Group Typing Market By Product (Instruments, Consumables, and Services), By Techniques (Assay-Based Techniques, PCR-Based and Microarray Techniques, Massively Parallel Sequencing Techniques, and Other Techniques), By Test Type (ABO Blood Tests, Antibody Screening, HLA Typing, Antigen Typing, and Cross Matching Tests), By End-User (Hospitals, Blood Banks, Clinical Laboratories, and Other End-Users) and By Region - Forecast, 2023-2032

- Published date: Nov 2023

- Report ID: 37178

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

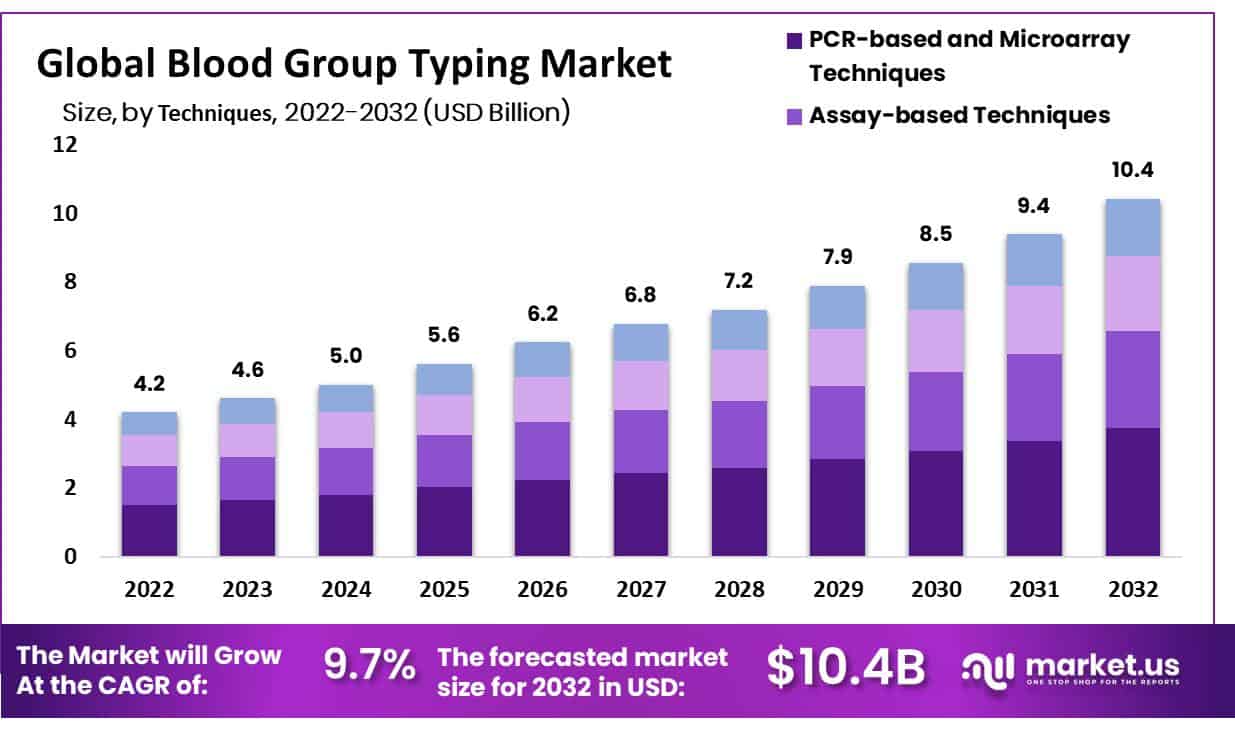

In 2022, the Global Blood Group Typing Market accounted for USD 4.2 Billion and is expected to reach around USD 10 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 9.76%.

The increase in the number of trauma cases and road accidents that require blood transfusions globally is a major factor in the development of the blood group typing market. Blood group typing’s rising use in forensic studies and prenatal testing, as well as rising demand for it, are some of the other factors boosting the market’s expansion.

However, the high cost of blood group typing and the lack of awareness of blood grouping among developing countries are anticipated to restrain the growth of the global market.

Key Takeaways

- In 2022, the global blood group typing market was valued at USD 4.2 billion.

- It is expected to reach USD 10 billion in 2032.

- The projected CAGR for the market between 2023 and 2032 is 9.76%.

- The consumables sector had a market share of 46%.

- PCR-based and microarray techniques had a 38% market share in 2022.

- The antibody screening sector had the highest revenue share in 2022 and is expected to have a profitable CAGR over the forecast period.

- Blood banks and hospitals are the primary end-users of blood typing products and services.

- In 2022, North America had the largest market share in blood typing at 42%.

- In Europe, countries like the United Kingdom, Germany, and France are among the largest markets.

- Asia Pacific, including countries like China, India, and Japan, is a rapidly growing market for blood typing.

- In Latin America, countries like Brazil and Mexico are some of the biggest markets.

Product Analysis

By the product analysis, the consumables sector dominates the market, with a 46% market share.

Due to the rise in surgical procedures like organ transplantation and the use of serological fluids and reagents in laboratories, the consumables sector, which had the highest market share in 2022, is expected to dominate the blood group typing market over the course of the forecast period. The high blood donation rates that result in more blood sample analysis are another factor contributing to the development.

Furthermore, it is anticipated that the growth will be aided by the creation of novel molecular diagnostic test reagents and kits that reduce the turnaround time required for definitive results.

Techniques Analysis

By the techniques analysis, the PCR-based and microarray techniques generated the largest revenue share in 2022 and had a profitable CAGR over the forecast period, with a 38% market share.

The market is divided into assay-based, PCR-based, microarray-based, massively parallel sequencing-based, and other methods based on the techniques used. The sector for PCR-based and microarray techniques generated the largest revenue share in 2022 and had a profitable CAGR over the forecast period.

This is attributed to a rise in R&D projects focusing on antibody-antigen interactions as well as the widespread prevalence of chronic diseases. The market for assay-based techniques is anticipated to expand profitably over the projection period. This is due to key biotechnology and pharmaceutical manufacturers investing more money globally in the assay-based method.

Test Type Analysis

By the Test type analysis, the antibody sector dominates the market with the highest market shares and profitable CAGR over the forecast period.

The market is divided into ABO blood tests, antibody screening, HLA typing, antigen typing, and cross-matching tests based on the sort of test used. The sector for antibody screening had the highest revenue share in 2022 and a profitable CAGR over the forecast period.

This is because initial analysis is in higher demand and chronic illnesses are becoming more prevalent globally. Due to the growing use of ABO blood tests for blood grouping, it is expected that the ABO blood tests market will expand at a profitable CAGR during the forecast period.

End User Analysis

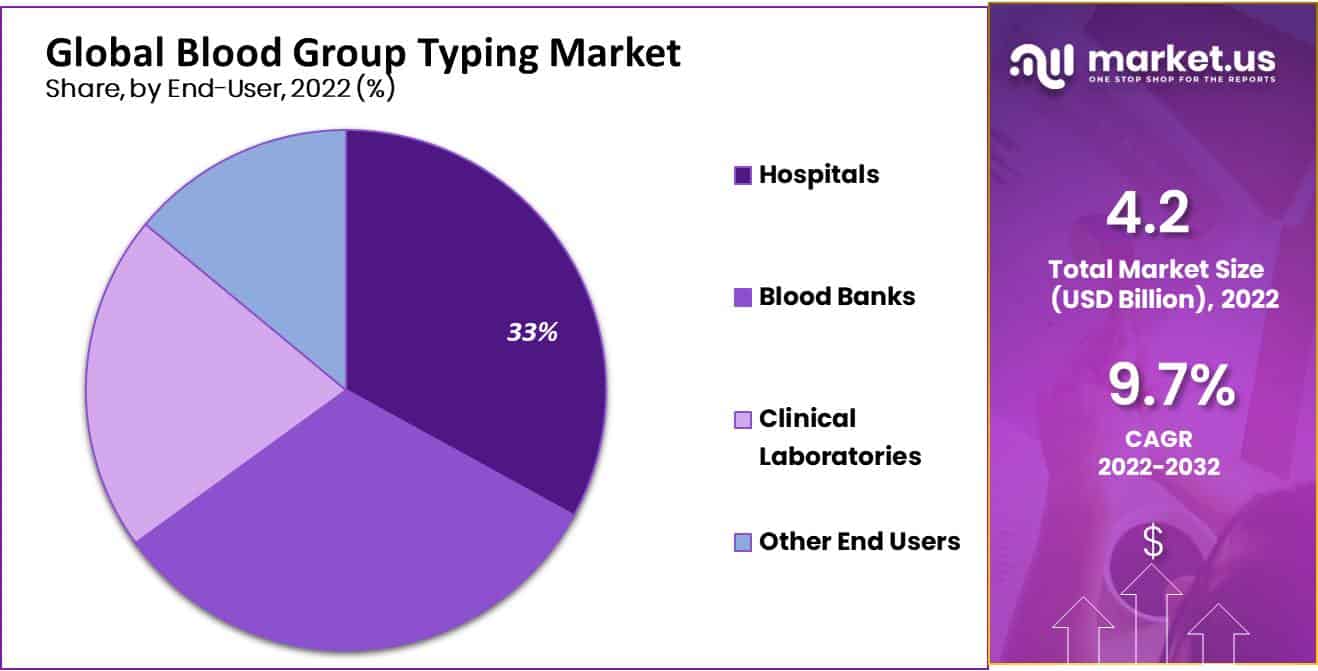

By end-user analysis, blood banks and hospitals are dominating the market.

The blood typing market serves a variety of end-users, including hospitals, blood banks, diagnostic laboratories, and research institutions. The demand for blood typing products and services is driven by the need for accurate and reliable blood typing results for transfusion and transplantation purposes.

Hospitals and blood banks are the primary end-users of blood typing products and services, as they require blood typing for blood transfusions and organ transplantations. Diagnostic laboratories also use blood typing products and services for disease diagnosis and monitoring. Research institutions also use blood typing products and services for various research purposes, such as studying blood group antigens and developing new blood typing methods.

When it comes to purchasing decisions, end-users of blood typing products and services typically prioritize factors such as accuracy, reliability, speed, and cost-effectiveness. They also consider factors such as ease of use, compatibility with existing equipment and systems, and regulatory compliance.

Key Market Segments

By Product

- Instruments

- Consumables

- Services

By Techniques

- Assay-based Techniques

- PCR-based and Microarray Techniques

- Massively Parallel Sequencing Techniques

- Other Techniques

By Test Type

- ABO Blood Tests

- Antibody Screening

- HLA Typing

- Antigen Typing

- Cross-matching Tests

By End User

- Hospitals

- Blood Banks

- Clinical Laboratories

- Other End Users

Drivers

The blood typing market is driven by several factors, including:

The rising prevalence of chronic diseases and traumatic injuries is leading to an increased demand for blood transfusions and organ transplantations. This is driving the demand for blood typing products and services to ensure compatibility between donors and recipients. The development of new and advanced blood typing technologies is leading to improved accuracy, speed, and efficiency of blood typing. This is driving the adoption of blood typing products and services by end-users.

The increasing awareness among healthcare professionals and the general public about the importance of blood typing for safe and effective transfusions and transplantations is driving the demand for blood typing products and services. The growing investments in healthcare infrastructure, especially in emerging economies, are leading to the establishment of new hospitals, blood banks, and diagnostic laboratories.

This is driving the demand for blood typing products and services to support these facilities. The favorable government policies and initiatives to improve healthcare access and infrastructure are driving the demand for blood typing products and services.

Restrains

The global blood group typing market is expected to experience rapid growth over the coming years, due to factors such as an increase in blood donations and rising demand for blood and related products. Nonetheless, certain challenges could hinder this market’s expansion. One potential barrier is the cost associated with blood group typing tests. Blood typing tests can be expensive, particularly if they employ more advanced technologies or equipment, making them inaccessible for certain populations such as those living in low-income countries.

Another potential obstacle could be a shortage of skilled personnel to perform blood typing tests. Blood typing requires highly qualified individuals with sufficient training and experience to accurately perform the tests, so if there are not enough experienced individuals available, it could restrict access to these services. Regulations may have an impact on the blood group typing market. Governments could impose limitations on the import or use of blood typing reagents, potentially restricting their availability in certain regions.

Opportunities

With the rise in surgeries, accidents, and other medical emergencies, there is an increasing need for blood and blood products. This presents blood typing companies with an opportunity to expand their services to meet this growing need. With the development of new technologies and techniques, blood typing tests are becoming more precise, efficient, and cost-effective. This presents a chance for blood typing companies to create and market products and services that take advantage of these advancements.

While blood typing services are widely available in some regions around the world, companies in this market could potentially benefit from expanding into these untapped markets. Collaboration between blood typing companies, healthcare providers, research institutions, and other stakeholders can lead to the development of new products and services as well as increased access to blood typing services.

Trends

There is an increasing trend towards automating and digitizing blood typing processes, including through robotics and AI technology. This can result in greater efficiency, accuracy, and speed of typing as well as lower costs. Advancements in genetic testing technology have led to the development of genotyping, a more precise and advanced method for blood typing. This trend is expected to continue as genotyping becomes more affordable and accessible.

As demand for point-of-care testing grows, which involves conducting blood typing tests on-site and providing results quickly, there is an increasing demand for point-of-care testing. This trend is driven by emergencies or locations where traditional laboratory testing may not be available. With the rise of personalized medicine, there is an increasing need for more accurate blood typing services that can identify a patient’s specific blood type and genetic characteristics. This trend is expected to spur the development of new blood typing technologies and services.

Regional Analysis

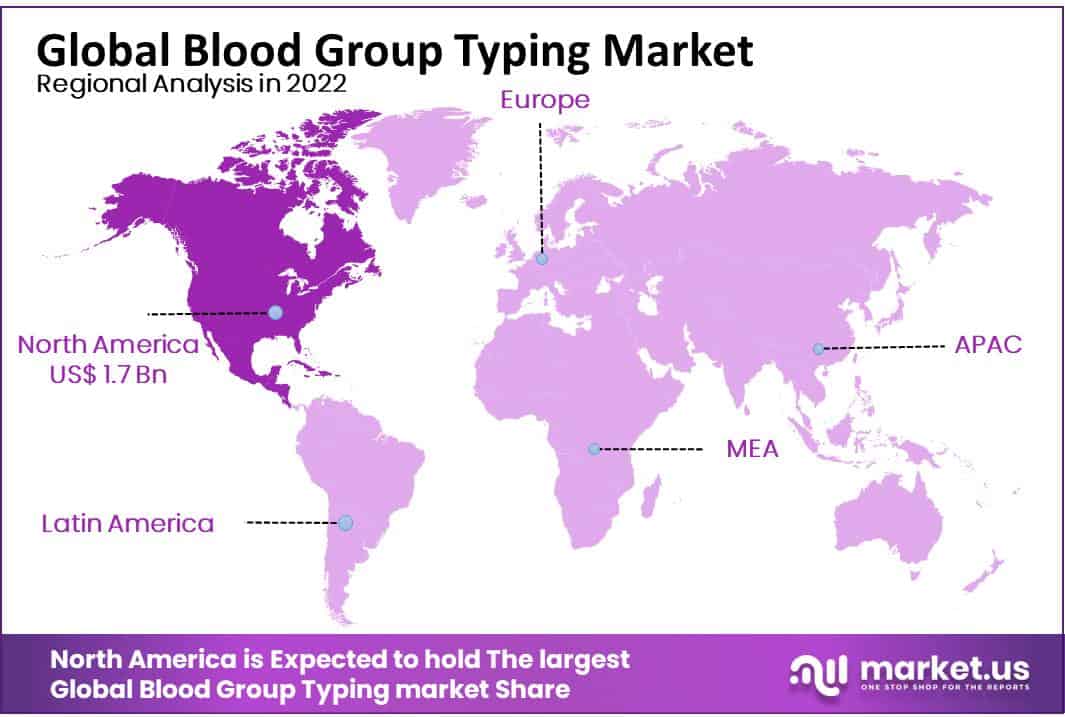

By regional analysis in 2022, North America held the largest market share in 2022 with a market share of 42%.

North America is the largest market for blood typing, driven by the high prevalence of chronic diseases and increasing demand for blood transfusions and organ transplantations. The United States is the largest market in the region, with a well-established healthcare infrastructure and high adoption of advanced blood typing technologies. Europe is another significant market for blood typing, driven by the growing awareness about the importance of blood typing and increasing investments in healthcare infrastructure. The United Kingdom, Germany, and France are some of the largest markets in the region.

Asia Pacific is a rapidly growing market for blood typing, driven by the increasing prevalence of chronic diseases, rising demand for blood transfusions and organ transplantations, and growing investments in healthcare infrastructure. China, India, and Japan are some of the largest markets in the region. Latin America is another growing market for blood typing, driven by the increasing demand for blood transfusions and organ transplantations and favorable government policies and initiatives to improve healthcare infrastructure.

Brazil and Mexico are some of the largest markets in the region. The Middle East and Africa are also growing markets for blood typing, driven by the increasing demand for blood transfusions and organ transplantations and improving healthcare infrastructure. Saudi Arabia, South Africa, and UAE are some of the largest markets in the region.

Overall, the blood typing market is expected to continue to grow in all regions, driven by factors such as increasing demand for blood transfusions and organ transplantations, growing awareness about the importance of blood typing, and improving healthcare infrastructure.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In terms of market share, Grifols, Bio-Rad Laboratories, and Ortho Clinical Diagnostics are the leading players in the global blood typing market. These companies are focusing on expanding their product portfolios, developing advanced blood typing technologies, and expanding their geographical presence through strategic partnerships and collaborations. Other notable players in the market include BioMerieux, Beckman Coulter, and DiaSorin, among others.

Market Key Players

- Grifols, S.A.

- Bio-Rad Laboratories, Inc.

- Immucor, Inc.

- Beckman Coulter, Inc.

- BAG Diagnostics GmbH

- Other companies

Recent Development

- In 2021: Next-Generation Sequencing (NGS) Panels have experienced rapid advancement, providing thorough and rapid analysis of multiple blood group genes simultaneously. NGS panels facilitate detailed profiling of blood group antigens and genotypes that facilitate transfusion and transplantation decisions.

- In 2020: Automated systems for blood typing have become an invaluable asset to laboratory workflows and reducing human error, offering increased efficiency and accuracy in blood group typing for transfusion practices, thus improving patient safety.

- In 2019: Point-of-Care Testing Devices for Blood Group Typing have recently been developed, providing quick results and immediate decision-making in emergency and remote locations. These portable devices deliver fast results quickly allowing immediate decision-making when an immediate solution needs to be determined quickly.

Report Scope

Report Features Description Market Value (2022) USD 4.2 Billion Forecast Revenue (2032) USD 10 Billion CAGR (2023-2032) 9.76% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Components, By Technique, By test type, By End User. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Grifols, S.A., Bio-Rad Laboratories, Inc., Immucor, Inc., Beckman Coulter, Inc., BAG Diagnostics GmbH, Other companies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is dental blood group typing Market Size in the Year 2022?In 2022, the global blood group typing market accounted for USD 4.2 billion and is expected to reach around USD 10 billion in 2032

What is the Blood Group Typing Market CAGR During the Forecast Period 2022-2032?The Global Blood Group Typing Market size is growing at a CAGR of 9.76% during the forecast period from 2022 to 2032.What are some key players in the global blood group typing market?Some key players in the global blood group typing market include Grifols, S.A., Bio-Rad Laboratories, Inc., Immucor, Inc., Beckman Coulter, Inc., BAG Diagnostics GmbH, Other companies.

-

-

- Grifols, S.A.

- Bio-Rad Laboratories, Inc.

- Immucor, Inc.

- Beckman Coulter, Inc.

- BAG Diagnostics GmbH

- Other companies