Global Blockchain Technology In BFSI Market By Type(Public, Private, Consortium), By Deployment Mode (Cloud, On-Premise), By Enterprise Size (SMEs, Large Enterprises), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120012

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

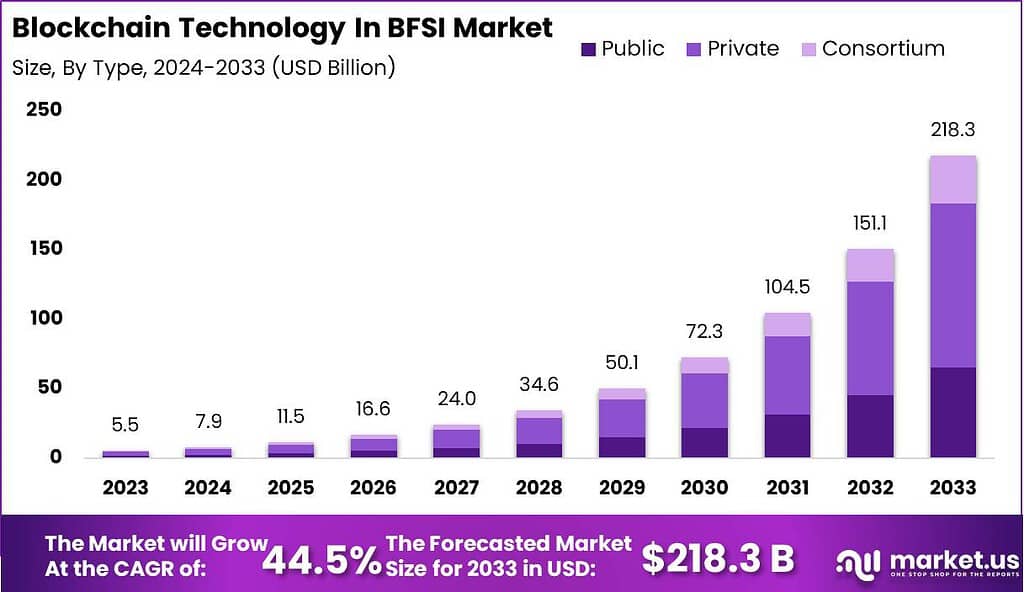

The Global Blockchain Technology In BFSI Market size is expected to be worth around USD 218.3 Billion By 2033, from USD 5.5 Billion in 2023, growing at a CAGR of 44.5% during the forecast period from 2024 to 2033.

Blockchain technology in the Banking, Financial Services, and Insurance (BFSI) sector represents a transformative force, offering numerous benefits such as enhanced security, increased transparency, and improved efficiency of operations. This technology underpins cryptocurrencies and extends to other applications including smart contracts, identity management, and fraud prevention.

The global blockchain technology market in BFSI is experiencing significant growth, driven by the increasing adoption of distributed ledger technology to reduce fraud, streamline processes, and decrease operational costs. Factors contributing to this growth include the rising demand for streamlined business processes, the need for secure transaction platforms in banking and finance, and regulatory changes favoring digital ledger technologies.

Financial institutions are particularly keen on blockchain for its potential to drastically reduce transaction times and enhance the security of financial exchanges, positioning blockchain as a core technology in the future of financial services. Furthermore, the blockchain technology market in BFSI is driven by the growing demand for innovative solutions in areas like cross-border payments, trade finance, identity verification, and insurance claim processing.

Blockchain’s real-time visibility, transparency, and ability to facilitate secure and efficient transactions make it an attractive choice for these applications. Financial institutions are actively exploring and implementing blockchain-based solutions to overcome the limitations of traditional systems and offer enhanced services to their customers.

Blockchain technology is revolutionizing the banking sector, providing significant cost-saving opportunities. Blockchain is reported to reduce bank infrastructure costs by 30%, which could result in annual savings exceeding $27 billion by 2030. An Accenture report highlights that investment banks could save up to $12 billion a year through blockchain implementation.

Notably, more than 90% of European and US banks are exploring blockchain technology. Approximately 69% of banks are experimenting with permissioned blockchains, indicating a strong trend towards integrating this technology into their operations.

In terms of spending, global investment in blockchain solutions is projected to reach nearly $15.9 billion in 2023. The technology has also proven effective in reducing error rates by 50%, especially for transactions processed manually. Furthermore, the average transaction cost could decrease by 99% with the widespread adoption of blockchain.

Key Takeaways

- The global Blockchain Technology in BFSI (Banking, Financial Services, and Insurance) market is projected to reach USD 218.3 billion by 2033, a significant increase from USD 5.5 billion in 2023. This growth is driven by a robust CAGR of 44.5% from 2024 to 2033.

- Simultaneously, the broader Global Blockchain Technology market is forecasted to expand to USD 12,895 billion by 2033, starting from USD 123 billion in 2023. This market is anticipated to grow at an impressive CAGR of 68% over the same period.

- In 2023, the Private Blockchain segment dominated the blockchain technology market in BFSI, accounting for more than 54.2% of the market share.

- Similarly, the Cloud segment led the market with a commanding share of 56.6% in 2023.

- Furthermore, SMEs (Small and Medium-sized Enterprises) held a significant market position in 2023, capturing over 57.8% of the market share within the BFSI sector.

- Geographically, North America was the leading region in 2023, securing more than 38.5% of the market share in the blockchain technology market in BFSI.

- Blockchain technology is increasingly being recognized for its potential to revolutionize financial transactions. Notably, 40% of the world’s top 50 banks plan to leverage this technology to enhance their operations. This significant interest underscores blockchain’s promise in transforming financial systems.

- In addition, 50% of financial firms are exploring blockchain to improve system transparency and efficiency. This interest reflects a broader industry trend towards embracing innovative technologies to streamline processes and ensure secure transactions.

- Furthermore, 46% of financial and banking businesses have identified blockchain as a top priority. This prioritization indicates a strategic shift towards integrating blockchain into core business functions to stay competitive and meet evolving customer expectations.

- It is also noteworthy that approximately 90% of banks in North America and Europe are currently exploring blockchain applications. This widespread exploration highlights the region’s proactive approach in adopting cutting-edge technologies to enhance their financial systems.

Type Analysis

In 2023, the Private Blockchain segment held a dominant market position within the blockchain technology market in BFSI, capturing more than a 54.2% share. This dominance is attributed to its enhanced security and privacy features, which are crucial for financial institutions that handle sensitive financial data and require strict control over access and permissions.

Private blockchains offer an environment where transactions are processed and validated by a limited number of participants, reducing the risks associated with exposure to unknown entities that could potentially compromise data integrity.

The preference for private blockchains in the BFSI sector is also driven by their scalability and efficiency. Unlike public blockchains, which are open to anyone and can face scalability issues due to the extensive consensus mechanisms required, private blockchains can handle a higher volume of transactions more swiftly. This is essential for financial services operations that demand immediate processing times.

Additionally, the regulatory compliance and auditability provided by private blockchains align well with the stringent regulatory frameworks governing the BFSI sector. Moreover, the tailored nature of private blockchains allows for customized solutions that can be adapted to specific institutional needs, further enhancing their appeal.

Financial institutions leverage private blockchains for tasks ranging from improving the efficiency of payment systems to securing the transmission of insurance data, underpinning a robust growth trajectory for this segment in the blockchain technology market. As blockchain technology continues to evolve, the scalability, privacy, and regulatory compliance offered by private blockchains are expected to drive their continued adoption and maintain their leading position in the market.

Deployment Mode Analysis

In 2023, the Cloud segment held a dominant market position in the blockchain technology market in BFSI, capturing more than a 57% share. The substantial adoption of cloud-based blockchain solutions can be attributed to their cost-effectiveness and scalability.

Cloud platforms allow financial institutions to deploy blockchain technology without the need for substantial upfront capital investments in infrastructure, which is particularly appealing to small and medium-sized enterprises that may have limited IT resources. The leadership of the cloud segment is further bolstered by its flexibility and ease of integration.

Financial institutions are increasingly opting for cloud-based solutions because they can be seamlessly integrated with existing financial applications and systems. This integration capability enables banks, insurance companies, and other financial services providers to innovate and adapt to changing market conditions quickly, without the constraints of on-premise systems.

Moreover, cloud deployment offers enhanced disaster recovery and data redundancy, which are critical for maintaining the integrity and availability of financial data. The ability to manage and recover data efficiently in the event of a system failure or a security breach ensures continuous operation and builds trust among consumers. As blockchain technology continues to advance, the cloud segment is expected to maintain its market lead, driven by ongoing innovations and the growing recognition of its strategic advantages in the BFSI sector.

Enterprise Size Analysis

In 2023, the SMEs segment held a dominant market position in the blockchain technology market in BFSI, capturing more than a 57.8% share. This prominence is largely due to the scalability and flexibility that blockchain offers, which are particularly beneficial for small and medium-sized enterprises (SMEs).

These enterprises are often more agile and able to adopt new technologies quicker than their larger counterparts, allowing them to leverage blockchain to enhance efficiencies and reduce costs associated with traditional financial transactions. The adoption of blockchain by SMEs is further encouraged by the technology’s ability to provide enhanced security and transparency.

For SMEs in the BFSI sector, blockchain technology facilitates trustworthy transactions and a transparent audit trail, which are critical in gaining the confidence of stakeholders and customers. Moreover, blockchain enables these enterprises to access new financing options such as through smart contracts and tokenization, which can be less accessible via traditional banking methods.

Additionally, the lower operational costs associated with blockchain can provide a significant advantage to SMEs. By reducing expenses related to transaction processing and cross-border payments, blockchain technology helps SMEs compete more effectively both domestically and internationally. As the technology continues to mature, it is anticipated that its adoption among SMEs in the BFSI sector will continue to grow, driven by the need for more efficient, secure, and cost-effective business processes.

Key Market Segments

By Type

- Public

- Private

- Consortium

By Deployment Mode

- Cloud

- On-Premise

By Enterprise Size

- SMEs

- Large Enterprises

Driver

Increased Efficiency and Cost Reduction

One major driver for the adoption of blockchain technology in the BFSI sector is the significant increase in efficiency and reduction in operational costs it offers. Blockchain provides a decentralized platform that eliminates the need for intermediaries in financial transactions, leading to faster processing times and reduced costs.

Additionally, the inherent transparency and auditability of blockchain systems streamline compliance processes and reduce the likelihood of fraud and errors. This can result in substantial savings, particularly in sectors like banking, insurance, and capital markets, where traditional processes often involve multiple layers of verification and reconciliation.

Restraint

Regulatory Uncertainty

A significant restraint in the blockchain technology market in BFSI is regulatory uncertainty. Financial institutions operate under strict regulatory environments, and the lack of clear guidelines concerning blockchain can hinder its adoption. Regulators are still in the process of understanding the technology and figuring out how to incorporate it into the existing legal framework.

This uncertainty can make financial institutions hesitant to invest heavily in blockchain projects. The concern is particularly acute in regions with stringent data security and privacy laws, where deploying blockchain solutions might inadvertently lead to non-compliance with established financial regulations.

Opportunity

Growing Demand for Enhanced Security

The increasing number of cyber-attacks and security breaches within the BFSI sector presents a significant opportunity for blockchain technology. Blockchain’s decentralized nature and cryptographic security provide an enhanced security framework, making it highly resistant to attacks. This security aspect is crucial for protecting sensitive financial data and building trust with consumers.

As cyber threats continue to evolve, the demand for robust security solutions like blockchain is expected to grow, providing ample opportunities for its adoption in fraud prevention, secure payments, and identity management within the BFSI sector.

Challenge

Integration with Existing Systems

A major challenge in adopting blockchain technology in the BFSI sector is the difficulty of integrating it with existing legacy systems. Many financial institutions rely on outdated systems that are deeply embedded in their operations. Integrating blockchain requires significant technical expertise and can be costly and time-consuming. There is also the risk of disrupting existing operations during the integration process. Overcoming these technical and operational hurdles is essential for blockchain to move beyond pilot projects and be implemented at scale within the BFSI sector.

Growth Factors

- Increasing Emphasis on Transparency: Blockchain provides unparalleled transparency in financial transactions, which is increasingly demanded by regulators and consumers alike. This transparency helps in reducing fraud and ensuring compliance, thus driving the adoption of blockchain in the BFSI sector.

- Cost Reduction Needs: Blockchain technology can significantly reduce costs associated with financial transactions by eliminating intermediaries and reducing the need for reconciliation and audit processes. This cost efficiency is a powerful motivator for BFSI institutions looking to optimize operational expenditures.

- Rising Cryptocurrency Acceptance: As cryptocurrencies gain legitimacy and acceptance, financial institutions are prompted to integrate blockchain technology to handle these new types of transactions securely and efficiently. This trend is pushing traditional banks and insurers to adapt to a rapidly evolving financial landscape.

- Enhanced Security Measures: With the rise in cyber threats, blockchain’s inherent security features like immutability and encryption make it an attractive option for improving data security and integrity in financial transactions, thus propelling its adoption in the BFSI sector.

- Innovations in Financial Services Products: Blockchain is enabling new financial services innovations such as smart contracts, decentralized finance (DeFi), and tokenization. These advancements allow BFSI companies to offer new products and services, tapping into new markets and customer segments.

Emerging Trends

- Integration with AI and IoT: The convergence of blockchain with other technologies like artificial intelligence (AI) and the Internet of Things (IoT) is creating sophisticated solutions for enhanced automation and data analysis in finance, leading to smarter, more efficient operations.

- Growth of Blockchain as a Service (BaaS): Many technology companies are now offering Blockchain as a Service (BaaS), which allows BFSI institutions to use cloud-based solutions to build, host, and use their own blockchain apps and functions. BaaS is making blockchain more accessible and cost-effective for smaller BFSI players.

- Regulatory Technology (RegTech) Developments: Blockchain is increasingly being used in regulatory compliance solutions due to its ability to ensure transparency and immutability of records. This trend is expected to grow as compliance costs rise and regulatory environments become more complex.

- Expansion of Cross-Border Payments: Blockchain is improving the efficiency of cross-border payments, making them faster and less expensive than traditional methods. This capability is particularly appealing in global finance, where transaction speed and cost are critical.

- Sustainability Initiatives: There is a growing trend to utilize blockchain in enhancing the sustainability of financial operations through better tracking and reporting of environmental, social, and governance (ESG) metrics. Blockchain’s ability to provide transparent and verifiable records is proving valuable in sustainability reporting and compliance.

Regional Analysis

In 2023, North America held a dominant market position in the blockchain technology market in BFSI, capturing more than a 38.5% share. This leadership can be attributed to several key factors, including the high concentration of technological innovation and the presence of major financial and technological hubs such as Silicon Valley and New York. The demand for Blockchain Technology In BFSI in North America was valued at USD 2.1 billion in 2023 and is anticipated to grow significantly in the forecast period.

North America has been at the forefront of adopting new technologies to enhance financial operations and services, driven by a strong startup culture and the availability of substantial investment funding for blockchain initiatives. The regulatory environment in North America also supports the growth of blockchain in the BFSI sector.

Regulatory bodies in the U.S. and Canada are increasingly recognizing the potential of blockchain to enhance transparency and efficiency in financial services. This has led to more clear and favorable regulations which encourage financial institutions to adopt blockchain solutions. Furthermore, the partnership between technology giants and financial institutions in this region is fostering the development and integration of blockchain technology into traditional financial systems, ensuring its continued dominance in the market.

Additionally, the focus on cybersecurity and fraud prevention in North America has spurred the adoption of blockchain in the BFSI sector. With increasing digital financial transactions, there is a growing need for secure and immutable transaction mechanisms, which blockchain technology provides. This has led to its rapid adoption among banks, insurance companies, and investment firms in the region, securing North America’s leading position in the global blockchain in BFSI market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The integration of blockchain technology within the Banking, Financial Services, and Insurance (BFSI) sector is rapidly transforming the landscape, with several key players spearheading this evolution. Among these, IBM is a frontrunner, leveraging its blockchain platform to enhance transparency and streamline operations. Microsoft also plays a critical role through its Azure Blockchain Service, enabling BFSI clients to deploy and manage blockchain networks efficiently.

Amazon Web Services (AWS) supports the BFSI market with scalable blockchain solutions, facilitating secure and cost-effective operations. Accenture’s blockchain services focus on interoperability, crucial for financial institutions seeking seamless integration with legacy systems. Infosys Limited offers bespoke blockchain solutions, aiding banks in fraud reduction and compliance management.

Top Key Players in the Market

- IBM

- Microsoft

- Amazon Web Services

- Accenture

- Infosys Limited

- SAP

- Oracle

- Auxesis Group

- Bitfury Group Limited

- JP Morgan

Recent Developments

- IBM: In April 2024, IBM launched its new blockchain-based digital identity solution aimed at enhancing security and efficiency in financial transactions. This solution integrates with existing financial infrastructure to provide seamless and secure digital identity verification.

- Microsoft: In January 2024, Microsoft expanded its Azure Blockchain Service to support more financial applications, making it easier for BFSI companies to deploy blockchain networks. This expansion includes enhanced security features and increased transaction speeds.

- Amazon Web Services (AWS): In October 2023, AWS introduced new features to its Amazon Managed Blockchain (AMB), reducing setup time by 60% and doubling transaction speeds. These enhancements have made it more attractive for BFSI institutions looking to streamline their operations using blockchain technology.

- Accenture: In February 2024, Accenture acquired a blockchain startup specializing in KYC (Know Your Customer) and anti-money laundering solutions. This acquisition aims to bolster Accenture’s blockchain capabilities in the BFSI sector, providing more comprehensive solutions to its clients.

- Infosys Limited: In March 2024, Infosys launched a blockchain-based trade finance platform that enhances transparency and reduces fraud in international trade. This platform is expected to significantly impact the BFSI sector by improving the efficiency and security of trade transactions.

Report Scope

Report Features Description Market Value (2023) USD 5.5 Bn Forecast Revenue (2033) USD 218.3 Bn CAGR (2024-2033) 44.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Public, Private, Consortium), By Deployment Mode (Cloud, On-Premise), By Enterprise Size (SMEs, Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, Microsoft, Amazon Web Services, Accenture, Infosys Limited, SAP, Oracle, Auxesis Group, Bitfury Group Limited, JP Morgan Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Blockchain Technology in BFSI Market?Blockchain technology in the BFSI (Banking, Financial Services, and Insurance) sector involves using distributed ledger technology to enhance processes like transactions, record-keeping, compliance, and contract management. It provides a decentralized, secure, and transparent method of managing financial operations.

How big is Blockchain Technology In BFSI Market?The Global Blockchain Technology In BFSI Market size is expected to be worth around USD 218.3 Billion By 2033, from USD 5.5 Billion in 2023, growing at a CAGR of 44.5% during the forecast period from 2024 to 2033.

What are the key drivers of the Blockchain Technology in BFSI Market?The primary drivers include the increasing digitalization of financial services, the need for secure and efficient transaction processes, and the demand for transparency and fraud reduction. Disintermediation of banking services and the rise of fintech innovations also significantly drive market growth.

Which segment holds the largest market share in blockchain technology in BFSI?The banking segment holds the largest market share due to the extensive use of blockchain for transaction processing, fraud prevention, compliance management, and customer identity verification. The platform component of blockchain technology is also dominant as it provides the necessary infrastructure for deploying blockchain solutions

What are the major challenges in the adoption of blockchain in BFSI?Challenges include concerns over network privacy and security, the complexity of integrating blockchain with existing systems, regulatory uncertainties, and the need for substantial initial investments. These factors can hinder the pace of blockchain adoption in the financial sector.

Blockchain Technology In BFSI MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Blockchain Technology In BFSI MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM

- Microsoft

- Amazon Web Services

- Accenture

- Infosys Limited

- SAP

- Oracle

- Auxesis Group

- Bitfury Group Limited

- JP Morgan