Global Blenders Market Size, Share, Growth Analysis By Type (Countertop Blenders, Personal Blenders, Hand Blenders), By Power Outlook (400 to 699 Watts, > 200 Watts, 200 to 399 Watts, 700 to 999 Watts, >1000 Watts), By Material Type (Plastic, Stainless Steel, Glass, Others), By Sales Channel (Offline Channel, Online Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169789

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

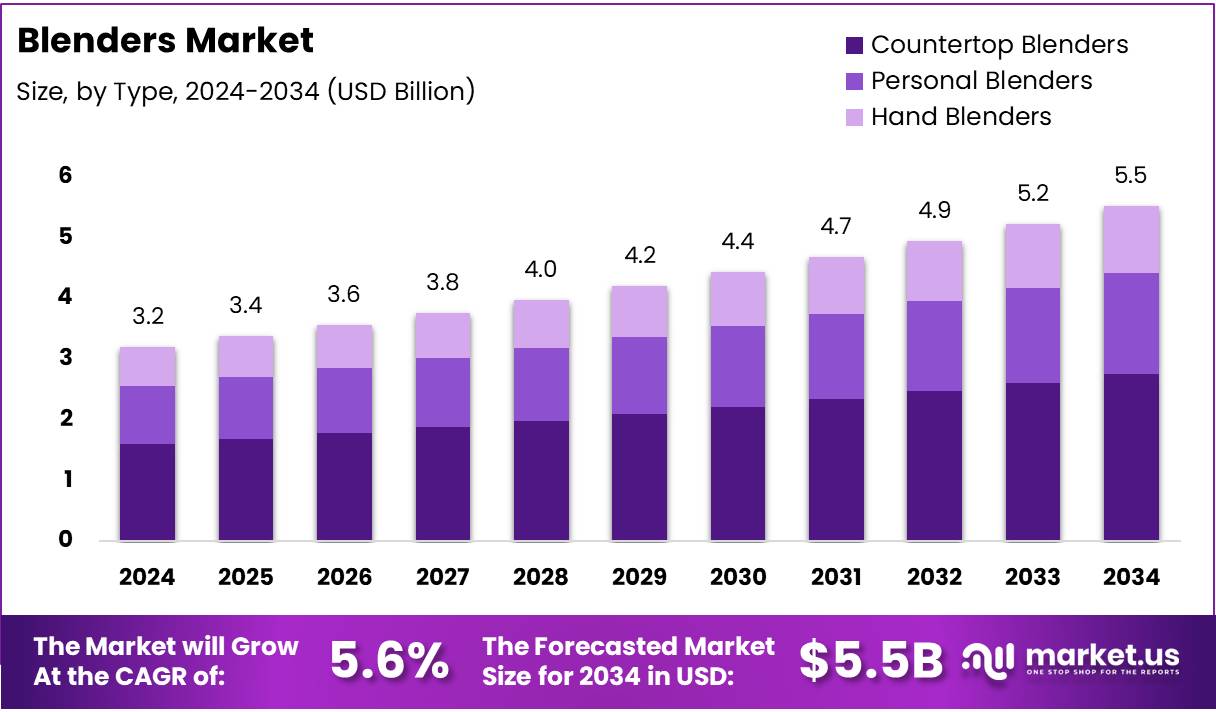

The Global Blenders Market size is expected to be worth around USD 5.5 Billion by 2034, from USD 3.2 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Blenders market refers to retail and industrial segments supplying personal and full‑size blenders to households and commercial kitchens. This appliance segment is a key part of the household kitchen appliances category, supporting meal preparation, smoothies, purees, and food processing needs across global households. Hence this market belongs to broader home appliance industry addressing convenience and efficiency requirements consumer.

Rising busy lifestyles and demand for quick meal solutions have accelerated blender adoption across urban households. Additionally increasing consumer trends toward healthy lifestyles drive consumers to blend smoothies shakes and fresh juices daily regularly. Consequently the blender market sees steady growth backed by consumer preferences for convenience and nutrition.

Expanding urbanization and rising disposable incomes open growth opportunities for blender manufacturers in emerging markets. Moreover increasing demand in small business catering and shared kitchens creates additional sectors needing blenders. Thus blender market growth remains robust offering attractive returns for investors and producers alike globally.

Supportive energy efficiency regulations and appliance safety standards encourage innovation in efficient blender motor technologies. In some regions government subsidies for energy saving home appliances reduce purchase costs for consumers significantly. Consequently regulatory compliance becomes competitive advantage for producers entering global blender markets especially those targeting energy conscious segments.

Blender usage is frequent and widespread. Full-size blenders are used an average of 6.3 times per month, while personal blenders are used about 8.7 times monthly. This high utilization indicates strong recurring demand and highlights opportunities for product upgrades, replacement cycles, and enhanced consumer engagement.

Speed settings and versatility are key factors influencing consumer choices. Approximately 57% of full-size blenders offer four or more speed settings, and 85% have at least three. Among personal blenders, 22% provide four or more settings, while 50% offer three or more, demonstrating a clear opportunity for innovation in performance and customization.

With more than 90% of households owning at least one blender, market penetration is high, ensuring a stable foundation for growth. Manufacturers can leverage this adoption rate to introduce advanced models and features, catering to evolving consumer preferences and driving consistent revenue across regions.

Key Takeaways

- Global Blenders Market size expected to reach USD 5.5 Billion by 2034 from USD 3.2 Billion in 2024, at a CAGR of 5.6%.

- Countertop Blenders dominate the market with a 49.2% share in the By Type segment.

- Blenders with 400 to 699 Watts power dominate the By Power Outlook segment with 31.8% share.

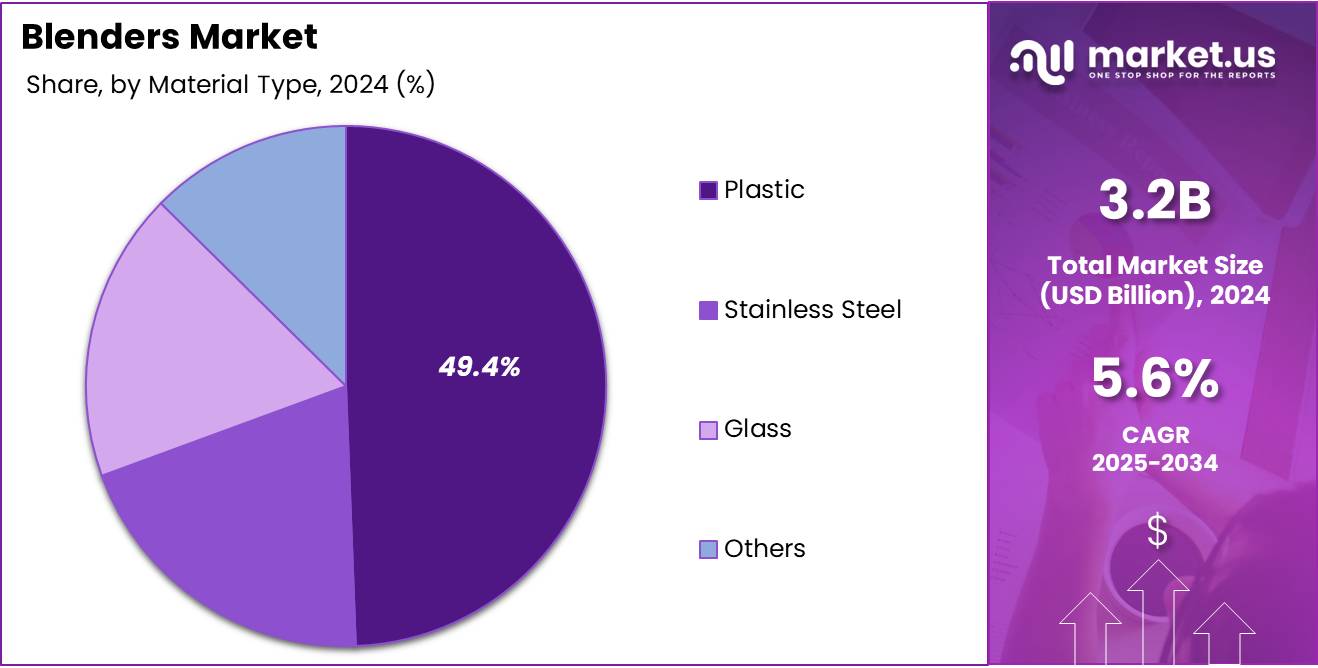

- Plastic material leads the By Material Type segment with a 49.4% share.

- Offline sales channel dominates with a 67.9% share in the By Sales Channel segment.

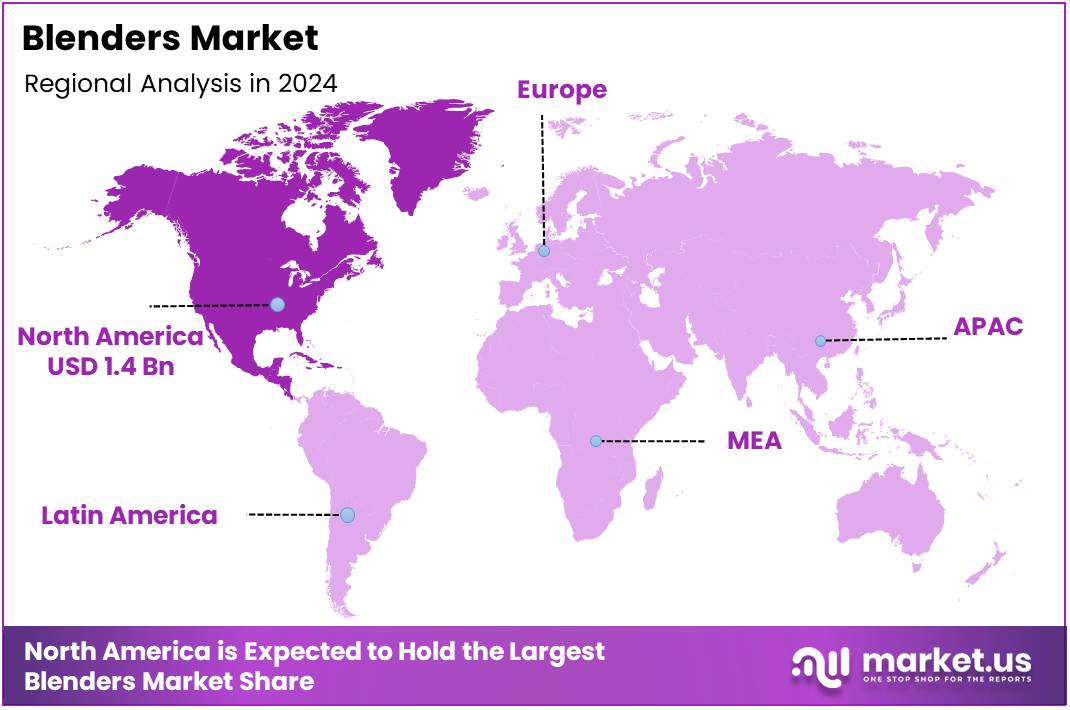

- North America is the leading region with a 45.9% share, valued at USD 1.4 Billion in 2024.

Type Analysis

Countertop Blenders dominate with 49.2% due to their versatility and superior blending capacity for households.

In 2024, Countertop Blenders held a dominant market position in the By Type Analysis segment of Blenders Market, with a 49.2% share. These blenders command the largest market presence owing to their robust motor capabilities and large-capacity jars that accommodate family-sized portions. Households prefer countertop models for preparing smoothies, soups, and sauces efficiently. Their stability during operation and diverse speed settings make them indispensable kitchen appliances for everyday cooking needs.

Personal Blenders represent a growing segment driven by health-conscious consumers seeking convenient, single-serve solutions. These compact devices appeal to individuals with active lifestyles who prioritize portability and quick cleanup. Their space-saving design and affordability make them ideal for small apartments and offices, enabling users to blend nutritious drinks directly in travel-ready containers without transferring contents.

Hand Blenders offer exceptional maneuverability for in-pot blending and food preparation tasks. These immersion-style devices provide precise control when pureeing soups, emulsifying dressings, or mixing batters directly in cooking vessels. Their ergonomic design and easy storage capabilities attract consumers seeking multifunctional tools that minimize dishwashing while delivering consistent results for various culinary applications.

Power Outlook Analysis

400 to 699 Watts dominates with 31.8% due to optimal balance between performance and energy efficiency.

In 2024, 400 to 699 Watts held a dominant market position in the By Power Outlook Analysis segment of Blenders Market, with a 31.8% share. This power range delivers adequate blending strength for most household requirements while maintaining reasonable energy consumption. Consumers appreciate these mid-range motors for handling everyday tasks like crushing ice, blending frozen fruits, and processing vegetables without excessive electricity costs or overwhelming noise levels during operation.

Greater than 200 Watts blenders cater to budget-conscious consumers seeking basic blending functionality for simple tasks. These entry-level devices suit occasional users who prepare soft ingredients like bananas, yogurt, and leafy greens. Their lower power output limits performance with harder ingredients but provides sufficient capability for light-duty blending needs in cost-sensitive market segments.

200 to 399 Watts blenders bridge the gap between basic and mid-range performance categories. These models attract consumers upgrading from entry-level devices who require improved blending consistency for varied ingredients. Their moderate power output handles softer frozen items and basic smoothie preparation while remaining affordable for price-conscious households seeking better performance than minimal-wattage options.

700 to 999 Watts blenders deliver enhanced performance for demanding blending tasks requiring greater motor strength. These powerful units efficiently process tough ingredients like nuts, hard vegetables, and dense frozen items. Serious home cooks and smoothie enthusiasts invest in this category for consistent texture achievement and reduced blending time across diverse recipe applications.

Greater than 1000 Watts represents the premium segment offering professional-grade blending capabilities for discerning consumers. These high-performance machines excel at creating silky-smooth textures, grinding grains, and processing the most challenging ingredients effortlessly. Their commercial-quality construction and extended warranties justify higher price points for users prioritizing exceptional durability and uncompromising blending results.

Material Type Analysis

Plastic dominates with 49.4% due to its lightweight design and affordable manufacturing costs.

In 2024, Plastic held a dominant market position in the By Material Type Analysis segment of Blenders Market, with a 49.4% share. Plastic containers dominate because they offer excellent durability against accidental drops while remaining significantly lighter than alternative materials. Manufacturers favor plastic for its cost-effective production capabilities, enabling competitive pricing that attracts budget-conscious consumers. Modern BPA-free formulations address previous health concerns, making plastic jars safe for food contact applications across various temperature ranges.

Stainless Steel appeals to consumers prioritizing longevity and premium aesthetics in their kitchen appliances. These containers resist staining from pigmented ingredients like berries and turmeric while maintaining elegant appearances over extended usage periods. Their superior thermal properties keep blended contents cooler during processing, though higher manufacturing costs result in elevated retail prices that target quality-focused consumer segments.

Glass containers attract health-conscious consumers seeking chemically inert materials that won’t leach substances into food. These transparent vessels allow users to monitor blending progress visually while offering scratch-resistant surfaces that maintain clarity throughout years of service. Their substantial weight provides stability during high-speed operation, though fragility concerns require careful handling to prevent breakage.

Others encompass specialized materials like ceramic-coated options and hybrid constructions combining multiple material benefits. These innovative alternatives target niche consumer preferences seeking unique performance characteristics or aesthetic distinctions. Their limited availability reflects ongoing material experimentation within the blender manufacturing industry as brands explore novel solutions for differentiation.

Sales Channel Analysis

Offline Channel dominates with 67.9% due to consumer preference for physical product examination before purchase.

In 2024, Offline Channel held a dominant market position in the By Sales Channel Analysis segment of Blenders Market, with a 67.9% share. Traditional retail environments including department stores, appliance specialty shops, and hypermarkets continue commanding substantial market presence as consumers value hands-on evaluation opportunities. Shoppers appreciate physically assessing blender weight, jar capacity, and control interface ergonomics before committing to purchases. In-store demonstrations and immediate product availability further strengthen offline channel dominance despite growing digital commerce trends.

Online Channel experiences rapid growth as e-commerce platforms expand product selections and streamline delivery services. Digital marketplaces offer extensive customer reviews, detailed specifications, and competitive pricing comparisons that empower informed purchasing decisions. Younger demographics particularly embrace online shopping for kitchen appliances, appreciating doorstep delivery convenience and hassle-free return policies that reduce perceived purchase risks associated with buying sight-unseen products.

Key Market Segments

By Type

- Countertop Blenders

- Personal Blenders

- Hand Blenders

By Power Outlook

- 400 to 699 Watts

- > 200 Watts

- 200 to 399 Watts

- 700 to 999 Watts

- >1000 Watts

By Material Type

- Plastic

- Stainless Steel

- Glass

- Others

By Sales Channel

- Offline Channel

- Online Channel

Drivers

Rising Consumer Preference for Healthy Home-Made Beverages and Meals Drives Blender Market Growth

Consumers are increasingly focused on preparing healthy beverages and meals at home, driving the demand for versatile kitchen appliances like blenders. The shift towards home-cooked smoothies, juices, and soups has encouraged households to invest in high-quality blenders that support their wellness goals.

Fitness and wellness lifestyle trends have further strengthened blender usage. As more people adopt exercise routines and balanced diets, blenders are becoming essential for creating protein shakes, meal replacements, and nutrient-rich drinks. This trend is especially strong among health-conscious millennials and working professionals.

Technological advancements in blender design are also boosting market growth. Improvements in motor efficiency allow blenders to handle tougher ingredients while consuming less power. Variable speed control systems give users flexibility to achieve different textures, from smooth purees to chunky mixes, making blenders more versatile and appealing.

Restraints

Limited Product Differentiation Challenges Brand Loyalty in Blenders Market

The blenders market faces challenges due to limited product differentiation. Many brands offer similar features, designs, and performance levels. This similarity makes it difficult for consumers to develop loyalty toward a single brand, often leading them to switch based on price or promotions rather than product superiority.

Another restraint is the low awareness of advanced blender features, especially among first-time buyers. Consumers often do not fully understand functions like variable speed control, pulse settings, or motor efficiency. This lack of knowledge can discourage investment in higher-end models, slowing overall market growth.

In a crowded marketplace, competing brands struggle to create a distinct identity. Without clear differentiation, marketing efforts may have limited impact. Consumers tend to view blenders as basic household appliances, rather than innovative tools for healthy lifestyles or culinary purposes.

Additionally, first-time buyers may perceive premium products as unnecessarily complex or expensive. This perception can reduce demand for technologically advanced models, affecting revenue potential for manufacturers investing in innovation.

Growth Factors

Rising Demand for Smart Kitchen Appliances Drives Blenders Market Growth

The growing interest in smart, app-connected blenders is creating significant opportunities for the market. Consumers are increasingly seeking devices that offer personalized recipes and automated blending programs. This trend allows manufacturers to introduce innovative features that enhance user convenience and cooking efficiency.

Urban markets are witnessing a surge in the adoption of portable and travel-friendly blenders. Busy lifestyles and the need for on-the-go nutrition are driving this demand. Compact designs, rechargeable batteries, and lightweight materials make these blenders appealing to millennials and working professionals.

Technological advancements in motor systems are further boosting growth opportunities. Manufacturers are focusing on low-noise operations and high-performance motors, ensuring smooth and efficient blending experiences. Such innovations attract consumers looking for durable and quiet appliances suitable for daily use.

Integration of smart features, portability, and improved motor efficiency collectively strengthen market potential for Smart Kitchen Appliances. Companies investing in these areas can capture emerging consumer segments. This aligns with the broader trend of health-conscious lifestyles and convenient cooking solutions, paving the way for sustained market expansion.

Emerging Trends

Rising Popularity of Multi-Function and Eco-Friendly Blenders Drives Market Growth

The blender market is witnessing a strong shift toward compact, space-saving designs. Consumers living in urban areas with smaller kitchens are increasingly seeking appliances that are easy to store and do not occupy much counter space. This trend is driving manufacturers to innovate smaller yet efficient blender models.

Multi-function blenders are gaining popularity as they combine blending, chopping, and cooking features in a single device. Buyers prefer products that can handle multiple kitchen tasks, reducing the need for several appliances. This convenience is boosting sales, especially among busy households and young professionals.

Sustainability is becoming a key factor in consumer choices. Rising awareness of health and environmental safety has led to growing use of eco-friendly and BPA-free materials in blender manufacturing. Consumers are increasingly prioritizing products that are safe, non-toxic, and environmentally responsible.

Regional Analysis

North America Dominates the Blenders Market with a Market Share of 45.9%, Valued at USD 1.4 Billion

In 2024, North America held a dominant position in the blenders market, accounting for 45.9% of the global share, valued at USD 1.4 Billion. The region’s growth is driven by rising health-conscious consumer behavior and the increasing adoption of smart and multifunctional blenders. Urban households with compact kitchens prefer advanced, space-saving designs. Moreover, the popularity of home-based cooking and fitness-oriented diets is fueling consistent demand. Retailers are also emphasizing product variety, energy efficiency, and eco-friendly features to attract consumers.

Europe Blenders Market Trends

Europe shows steady growth in the blenders market due to rising demand for eco-friendly and BPA-free appliances. Consumers increasingly prefer high-performance blenders for home cooking and fitness-oriented meal preparation. Technological advancements in motor efficiency, low-noise operation, and multifunctional features are further encouraging adoption. Additionally, growing online retail channels and increasing awareness of healthy lifestyles are contributing to market expansion across key European countries.

Asia Pacific Blenders Market Trends

Asia Pacific is witnessing notable expansion driven by urbanization and growing awareness of healthy lifestyles. Rising disposable income and the popularity of multifunction blenders for home and semi-commercial use are fueling market growth. E-commerce platforms and social media influence are making blenders more accessible and popular among younger consumers. Furthermore, innovations such as travel-friendly and app-connected blenders are gradually gaining traction in metropolitan areas.

Middle East and Africa Blenders Market Trends

The Middle East and Africa region is gradually adopting advanced blenders, supported by increasing urban populations and modern kitchen trends. Consumers are showing rising interest in portable and smart blenders, while retailers focus on product variety and convenient distribution to enhance market penetration. Demand is also supported by growing awareness of health and wellness trends in urban centers.

Latin America Blenders Market Trends

Latin America is experiencing moderate growth in the blenders market, driven by rising awareness of home-based healthy cooking. Economic recovery and expanding e-commerce channels are improving blender accessibility. Consumers are increasingly opting for multifunctional, durable, and compact appliances. The demand for affordable yet high-performance blenders continues to expand across urban households, especially in countries with growing middle-class populations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Blenders Company Insights

Cuisinart continues to command a strong presence in the global blenders market by leveraging its long-established reputation for reliability and performance. Its mid-to-premium range appeals to households seeking durable, versatile appliances. Consistent incremental upgrades in motor power and design ensure Cuisinart retains steady brand loyalty among traditional consumers.

Sunbeam Products, Inc. maintains its position through widespread retail availability and competitive pricing. The brand’s strategy emphasizes value-oriented offerings that cater to cost-conscious segments without compromising basic functionality. This makes Sunbeam a go-to choice in emerging markets where affordability drives purchase decisions.

Hamilton Beach Brands, Inc. distinguishes itself by blending appliance versatility with feature-rich options suitable for both home and small commercial use. Its emphasis on robust build quality, combined with a diverse portfolio including smoothie blenders and food processors, helps it capture a broad user base. Hamilton Beach benefits from a balanced approach between affordability and performance.

BlendJet has emerged as a disruptive challenger by focusing on portability and convenience, targeting younger, on‑the‑go consumers. Its compact, battery-powered blenders address a niche demand for mobile blending solutions. This innovation-driven positioning allows BlendJet to differentiate itself from traditional countertop blender manufacturers.

Top Key Players in the Market

- Cuisinart

- Sunbeam Products, Inc.

- Hamilton Beach Brands, Inc.

- BlendJet

- nutribullet, LLC

- BLENDi

- Bella Housewares

- Conair Corporation

- Magic Bullet

- Vitamix Corporation

- Ninja Kitchen

Recent Developments

- In April 2025, Midea Group completed the acquisition of the Teka Group, a multinational appliance firm. This strategic move strengthened Midea’s presence in the global kitchen appliances market, expanding its product portfolio and market reach.

- In June 2025, KitchenAid introduced the KitchenAid Pure Power Blender, designed for both hot and cold recipes. The blender features a precision speed-control knob and a 360° asymmetrical blade design for smooth, consistent results.

- In September 2024, Vitamix launched its new Ascent X Series, representing the next evolution in blending technology. This series combines advanced motor performance with smart features for seamless home and professional use.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 5.5 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Countertop Blenders, Personal Blenders, Hand Blenders), By Power Outlook (400 to 699 Watts, > 200 Watts, 200 to 399 Watts, 700 to 999 Watts, >1000 Watts), By Material Type (Plastic, Stainless Steel, Glass, Others), By Sales Channel (Offline Channel, Online Channel) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cuisinart, Sunbeam Products, Inc., Hamilton Beach Brands, Inc., BlendJet, nutribullet, LLC, BLENDi, Bella Housewares, Conair Corporation, Magic Bullet, Vitamix Corporation, Ninja Kitchen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cuisinart

- Sunbeam Products, Inc.

- Hamilton Beach Brands, Inc.

- BlendJet

- nutribullet, LLC

- BLENDi

- Bella Housewares

- Conair Corporation

- Magic Bullet

- Vitamix Corporation

- Ninja Kitchen