Biosecurity Market By Product Type (Biocides & Disinfectants, Personal Protective Equipment (PPE), Detection & Monitoring Equipment, Decontamination Systems, Others), By Application (Quarantine and Disease Surveillance, Bioterrorism and Biodefense, Lab Biosafety, Food Safety, Others), By End-User (Government & Regulatory Bodies, Healthcare Institutions, Agricultural Sector, Research & Academia, Private & Commercial Sectors), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 151238

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

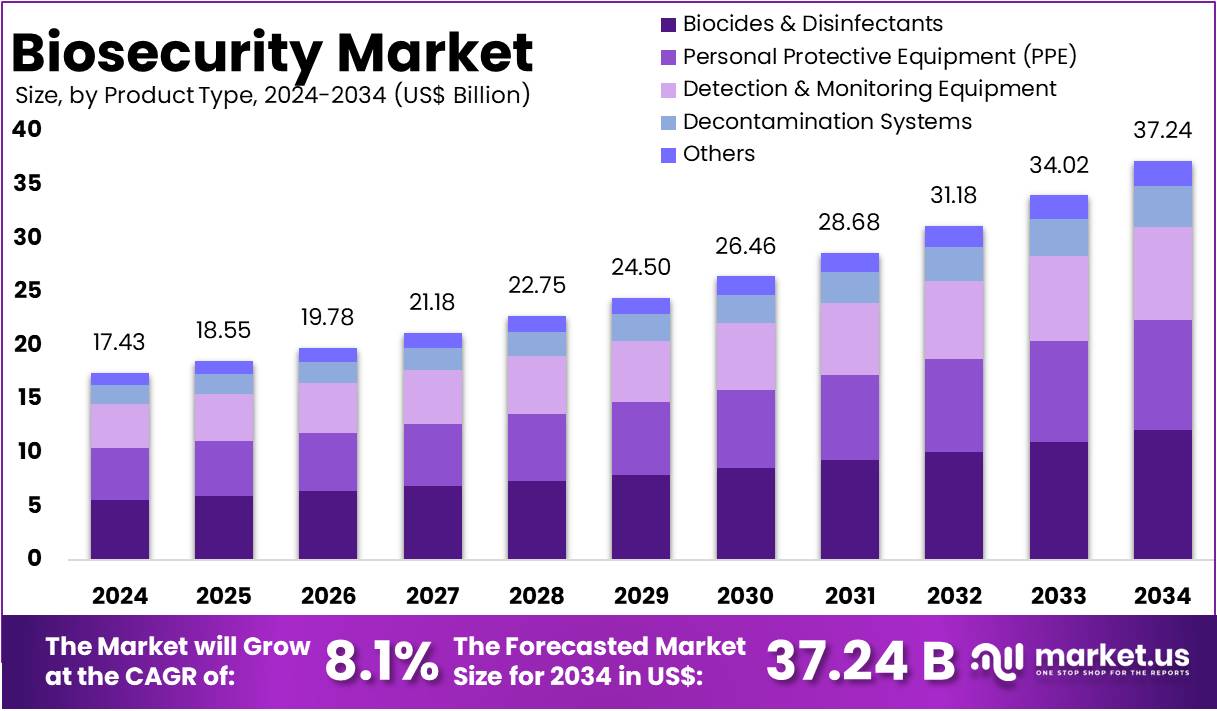

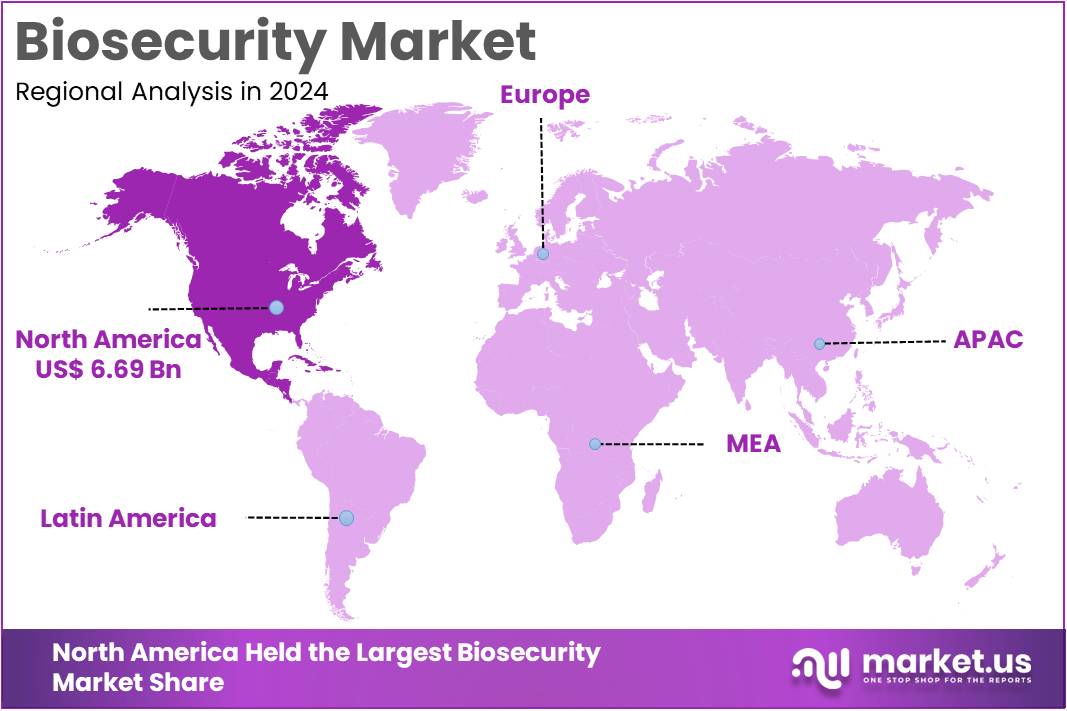

The Biosecurity Market size is expected to be worth around US$ 37.24 billion by 2034 from US$ 17.43 billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.4% share and holds US$ 6.69 Billion market value for the year.

The market encompasses solutions, technologies, and services aimed at preventing, detecting, and managing risks to human, animal, and plant health, as well as protecting the environment from biological threats.

Biosecurity is a strategic and integrated approach that includes policy frameworks, regulatory compliance, surveillance, diagnostics, laboratory testing, decontamination, and risk management practices. It addresses challenges such as the introduction of transboundary diseases, invasive species, contamination of food and feed, and the spread of zoonotic pathogens. With globalization, increased international trade, and rising cross-border movement of people, animals, and agricultural products, the risk of disease outbreaks and biosecurity hazards has grown significantly, fueling market demand.

Regulatory pressure from frameworks such as the World Health Organization (WHO) International Health Regulations, SPS Agreement, and national biosecurity standards encourages the adoption of harmonized, risk-based control measures. Additionally, the rising use of infection-prevention products, rapid molecular diagnostics, decontamination solutions, and advanced surveillance platforms across healthcare, agriculture, and food industries is boosting market growth. Increasing private-sector demand for supply chain resilience and food safety assurance further supports the expansion of biosecurity solutions. Examples include AI-enabled outbreak prediction platforms, point-of-care diagnostic devices, and centralized biosecurity hubs such as FAO’s IPFSAPH and WHO’s INFOSAN.

Biosecurity Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 15.99 15.59 15.86 16.53 17.43 8.1% Key Takeaways

- In 2024, the market generated a revenue of US$ 43 billion, with a CAGR of 8.1%, and is expected to reach US$ 37.24 billion by the year 2034.

- By product type segment, Biocides & Disinfectants dominated the market with a share of 32.5% in 2024.

- Based on application, the largest segment holder was Quarantine and Disease Surveillance capturing a market share of 31.1% in 2024.

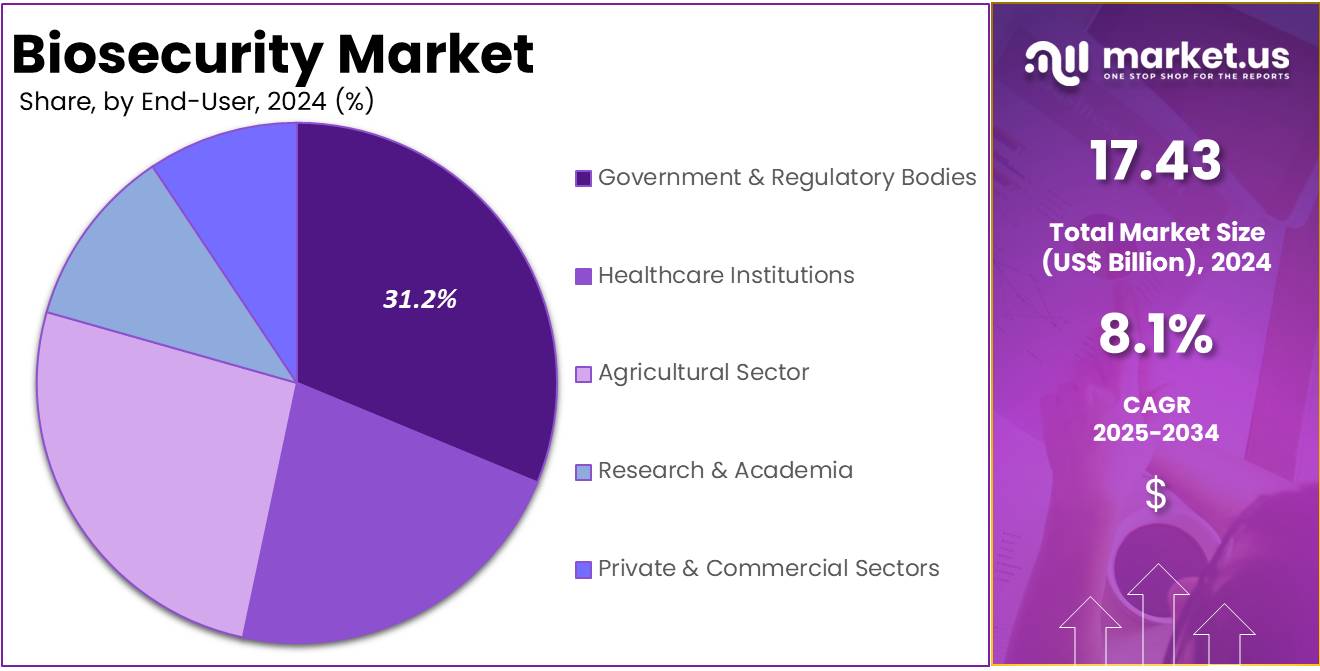

- Among the end-user segment, Government & Regulatory Bodies held the largest revenue share of 31.2% in 2024.

- North America dominated the regional market with 38.4% share in 2024, and holds US$ 6.69 Billion market value for the year.

Product Type Analysis

The biocides and disinfectants plays a crucial role in biosecurity, offering essential solutions for controlling microbial threats across various industries such as healthcare, agriculture, and food safety. In 2024, this segment held a share of 32.5%.

The market is driven by the growing need for effective infection control, particularly in light of global health threats, as well as rising awareness regarding hygiene and safety standards. In healthcare settings, biocides and disinfectants are integral to maintaining sterile environments, especially in hospitals, clinics, and pharmaceutical facilities. For example, products like hydrogen peroxide and quaternary ammonium compounds (quats) are widely used to disinfect surfaces and prevent hospital-acquired infections (HAIs).

In January 2021, LANXESS, a leading global specialty chemicals company, strengthened its position as a top manufacturer of biocides and antimicrobials by acquiring INTACE SAS, a French company. INTACE specializes in producing fungicides for the packaging industry. LANXESS and the seller signed an agreement, though the purchase price has not been disclosed. LANXESS anticipates completing the transaction by the end of the first quarter of 2021.

Biosecurity Market, Product Type Analysis, 2020-2024 (US$ Billion)

Product Type 2020 2021 2022 2023 2024 Biocides & Disinfectants 5.24 5.10 5.18 5.41 5.67 Personal Protective Equipment (PPE) 4.41 4.30 4.38 4.56 4.82 Detection & Monitoring Equipment 3.69 3.59 3.66 3.83 4.08 Decontamination Systems 1.63 1.59 1.61 1.67 1.76 Others 1.03 1.00 1.02 1.06 1.11 Application Analysis

The quarantine and disease surveillance segment in the biosecurity market was the dominating segment holding 31.1% in 2024. It significantly helps in preventing the spread of infectious diseases, especially in agriculture, human health, and wildlife management. This segment includes monitoring and controlling diseases that could cause significant damage to economies, food security, and public health. Surveillance systems focus on detecting pathogens early and preventing their spread through quarantine measures.

For instance, in agriculture, quarantine measures are enforced to prevent the entry of plant diseases or pests into new regions. The U.S. Department of Agriculture (USDA) operates stringent quarantine measures to protect U.S. crops from foreign pests and diseases like the Asian longhorned beetle, which could devastate hardwood trees. In human health, disease surveillance systems, such as the World Health Organization’s Global Outbreak Alert and Response Network (GOARN), track disease outbreaks like the Ebola virus or COVID-19, enabling rapid containment strategies.

Furthermore, in August 2025, the Albanese Labor Government is continuing its targeted investments to strengthen Australia’s biosecurity, allocating $12 million to enhance response capabilities for a potential H5 bird flu outbreak. This funding will be provided to states and territories to acquire critical equipment such as mobile laboratories, drones, and response trailers, enabling rapid deployment in the event of an outbreak, including in remote areas.

Biosecurity Market, Application Analysis, 2020-2024 (US$ Billion)

Application 2020 2021 2022 2023 2024 Quarantine and Disease Surveillance 4.95 4.83 4.92 5.13 5.43 Bioterrorism and Biodefense 3.75 3.66 3.73 3.91 4.14 Lab Biosafety 2.47 2.41 2.45 2.54 2.66 Food Safety 3.96 3.86 3.92 4.08 4.28 Others 0.86 0.83 0.85 0.88 0.91 End-User Analysis

Government and regulatory bodies held 31.2% share in 2024 and play a pivotal role in shaping the biosecurity landscape by establishing policies, enforcing regulations, and coordinating responses to biological threats. These agencies operate across various sectors, including agriculture, public health, defense, and environmental protection.

For example, in the United States:

- Department of Health and Human Services (HHS): Oversees the Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA), which regulate laboratory safety, food safety, and pharmaceuticals. The National Science Advisory Board for Biosecurity (NSABB) advises on dual-use research and potential misuse of biotechnology.

- Department of Agriculture (USDA): Through the Animal and Plant Health Inspection Service (APHIS), it manages agricultural biosecurity, including disease surveillance and control measures. The National Institute of Food and Agriculture (NIFA) supports research and extension services to enhance biosecurity in agriculture.

In UK:

- Department for Environment, Food & Rural Affairs (DEFRA): Leads efforts in animal health and biosecurity. A significant initiative is the establishment of the National Biosecurity Centre, a US$ 1.35 billion (£1 billion) project aimed at enhancing the UK’s defenses against pandemics and biological threats.

Biosecurity Market, End-User Analysis, 2020-2024 (US$ Billion)

End-User 2020 2021 2022 2023 2024 Government & Regulatory Bodies 4.89 4.77 4.86 5.11 5.45 Healthcare Institutions 3.63 3.54 3.59 3.70 3.85 Agricultural Sector 4.14 4.03 4.11 4.29 4.54 Research & Academia 1.86 1.82 1.84 1.89 1.96 Private & Commercial Sectors 1.47 1.43 1.46 1.54 1.63 Key Market Segments

By Product Type

- Biocides & Disinfectants

- Personal Protective Equipment (PPE)

- Detection & Monitoring Equipment

- Decontamination Systems

- Others

By Application

- Quarantine and Disease Surveillance

- Bioterrorism and Biodefense

- Lab Biosafety

- Food Safety

- Others

By End-User

- Government & Regulatory Bodies

- Healthcare Institutions

- Agricultural Sector

- Research & Academia

- Private & Commercial Sectors

Drivers

Rising Public and Government Investment in Preparedness Post-COVID-19 and Zoonotic Outbreaks

The COVID-19 pandemic reshaped global perspectives on biosecurity, making preparedness a political, economic, and social priority. Governments worldwide are investing heavily in strengthening diagnostics, surveillance, and laboratory infrastructure to avoid being caught unprepared again.

According to the World Health Organization (WHO), zoonotic diseases already account for 60% of emerging infectious diseases globally, and outbreaks such as Ebola, MERS, SARS, and avian influenza highlight the persistent risks. COVID-19 alone has cost the global economy over $12 trillion, underscoring the immense financial and societal impact of biosecurity failures.

In response, governments are significantly increasing biosecurity funding. The U.S. passed the American Rescue Plan Act, allocating $1.75 billion for genomic sequencing and surveillance. The European Union established HERA (Health Emergency Preparedness and Response Authority) with an annual budget of €1.3 billion for pandemic preparedness. Meanwhile, Australia committed $1.5 billion in biosecurity funding over 10 years to strengthen agricultural and health defenses.

This surge in funding is driving demand for diagnostic kits, PCR platforms, rapid testing systems, and digital epidemiology tools. For instance, companies like Cepheid and Bio-Rad reported exponential growth in molecular diagnostic sales during and after COVID-19. At the same time, public health labs and veterinary networks are being upgraded with biosafety level-3 (BSL-3) and biosafety level-4 (BSL-4) facilities to enhance pathogen detection.

Beyond COVID-19, zoonotic outbreaks continue to drive investments, examples include avian influenza (H5N1) outbreaks in Europe in 2023 and the Nipah virus surge in India, both prompting new funding for surveillance and laboratory strengthening. International organizations such as WHO, FAO, and OIE jointly promote the One Health approach, integrating animal, human, and environmental health surveillance.

Restraints

High Upfront Costs for Advanced Labs, Containment Facilities, and Surveillance Infrastructure

A major restraint in the global biosecurity market is the substantial capital investment required to establish and maintain advanced infrastructure. High-containment laboratories (Biosafety Level-3 and Level-4), national disease surveillance systems, and modern diagnostic facilities involve enormous upfront costs, limiting adoption, particularly in low- and middle-income countries. For example, a single BSL-3 laboratory can cost $1–2 million to build, with annual operational costs exceeding $500,000. Biosafety Level-4 laboratories, which handle the most dangerous pathogens such as Ebola, can cost over $10 million to construct, with multi-million-dollar yearly operating budgets.

In addition, creating nationwide surveillance networks to monitor human, animal, and plant health demands investments in diagnostic equipment, laboratory personnel, IT infrastructure, and sample transportation systems. Many developing nations struggle to fund such integrated biosecurity systems, leaving them vulnerable to outbreaks. For instance, during the 2014–2016 Ebola outbreak in West Africa, insufficient laboratory infrastructure delayed diagnosis and containment, resulting in over 11,000 deaths and highlighting the consequences of underinvestment.

Opportunities

Integration of Multi-Sector Data for Interoperable Surveillance and Risk Management

The integration of data from multiple sectors, human, animal, plant, and environmental health, presents a significant opportunity in the global biosecurity market. By consolidating surveillance information across sectors into a single interoperable platform, governments, researchers, and private companies can gain a holistic view of emerging threats, improve response times, and reduce redundancies in monitoring and control efforts.

Platforms that enable multi-sector data integration allow for early detection of cross-domain biosecurity hazards. For example, zoonotic pathogens often move from wildlife to livestock and then to humans, as seen with the Nipah virus in Southeast Asia. An integrated system that combines wildlife surveillance, livestock health records, and human epidemiological data can detect outbreaks earlier and prevent broader public health crises. Similarly, plant pathogen surveillance, such as monitoring for Wheat Rust or Fall Armyworm, can benefit from combined agricultural and environmental data to optimize intervention strategies.

International initiatives like FAO’s IPFSAPH portal, INFOSAN, and GLEWS exemplify the benefits of integrated platforms by enabling the sharing of real-time data on food safety, animal diseases, and plant health across countries and sectors. Private-sector solutions are also emerging; for instance, AI-enabled platforms integrate IoT sensor data from farms, processing plants, and transport systems to monitor pathogen risks, pesticide residues, and environmental hazards simultaneously, ensuring comprehensive biosecurity management.

Impact of Macroeconomic / Geopolitical Factors

Political tensions and security concerns, including the threat of bioterrorism, drive investments in advanced biosecurity measures. Countries are increasingly focused on strengthening defenses against biological weapons, leading to the growth of the defense and security sectors in biosecurity.

Bioterrorism involves the intentional release of viruses, bacteria, or toxins to harm humans, livestock, or crops. Bacillus anthracis, the cause of anthrax, is a potential threat. While another anthrax attack’s timing is uncertain, federal agencies, in partnership with state and local health departments, are preparing for a possible emergency. The CDC and other federal agencies will coordinate with local partners in response.

Global health crises, like the COVID-19 pandemic, significantly impact biosecurity priorities. Economic disruptions, changes in public health spending, and shifts in biosecurity policies are driven by these health threats. The market grows rapidly as governments and organizations invest in systems to prevent and manage outbreaks.

Latest Trends

Investments in National Hubs and Networks for Faster Information Sharing and Response

A significant trending factor in the global biosecurity market is the investment in national-level hubs and networks designed to enhance information sharing, coordination, and rapid response to biological threats. Centralized biosecurity centers, integrated data portals, and interconnected surveillance networks are becoming essential components for governments and organizations seeking to manage risks across human, animal, plant, and environmental health sectors.

For example, the International Portal on Food Safety, Animal and Plant Health (IPFSAPH), developed by FAO, provides a single access point for authorized national and international data, facilitating cross-sectoral and cross-border collaboration. Similarly, the International Food Safety Authorities Network (INFOSAN), operated by WHO and FAO, allows national food safety authorities to exchange information on contamination incidents, outbreaks, and recalls in real time, significantly reducing the time required to respond to emergencies.

The Global Early Warning and Response System (GLEWS), jointly managed by FAO, WHO, and OIE, exemplifies integrated surveillance for animal diseases, zoonoses, and cross-border threats. By pooling data from multiple sources, GLEWS enables predictive modeling, risk assessment, and coordinated interventions across countries. In addition, regional and national biosecurity hubs, such as the U.S. Biosecurity Hub and EU Animal and Plant Health Information System, centralize laboratory results, outbreak reports, and surveillance data to improve situational awareness and decision-making.

Regional Analysis

North America is leading the Biosecurity Market

North America market is driven by stringent regulatory frameworks, high public and private investments, and significant cross-sector integration in human, animal, and agricultural health. This region held a market share of 38.4% in 2024.

The United States and Canada have developed robust biosecurity infrastructures encompassing laboratories, surveillance networks, and national response centers. For example, the U.S. Centers for Disease Control and Prevention (CDC) and U.S. Department of Agriculture (USDA) coordinate large-scale disease surveillance programs, including Avian Influenza, African Swine Fever, and foodborne pathogen monitoring. The region has also invested heavily in point-of-care and rapid molecular diagnostic technologies, AI-enabled predictive surveillance, and centralized biosecurity hubs.

Post-COVID-19, North America has seen a surge in biosecurity spending for outbreak preparedness, laboratory capacity expansion, and PPE and decontamination solutions. Additionally, the U.S. government’s BioWatch program and Canada’s Canadian Food Inspection Agency (CFIA) initiatives demonstrate cross-sector collaboration for human and animal health.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia-Pacific region is experiencing rapid growth in the biosecurity market, driven by expanding agriculture, high population density, frequent zoonotic outbreaks, and increasing awareness of food safety. Countries like China, Japan, South Korea, and Australia are investing heavily in laboratory networks, rapid diagnostics, and surveillance systems to manage risks from livestock diseases, plant pests, and human pathogens. For example, China’s response to African Swine Fever and avian influenza outbreaks has included nationwide farm biosecurity programs, rapid molecular diagnostic deployment, and strengthened traceability systems.

India and Southeast Asian nations such as Thailand, Vietnam, and Indonesia are adopting AI-based outbreak forecasting, integrated pest management, and IoT-enabled farm monitoring to address the challenges of large-scale livestock farming and cross-border disease spread. The COVID-19 pandemic further accelerated investments in public health laboratories, PPE, and disinfection solutions. Australia’s biosecurity framework emphasizes strict border controls, surveillance of invasive species, and rapid response mechanisms, reflecting high preparedness for transboundary threats.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global biosecurity market is highly competitive and fragmented, featuring a mix of large industrial players, specialized technology providers, and innovative startups. Industry leaders like 3M and Thermo Fisher Scientific dominate key segments such as PPE and diagnostic instruments by leveraging large-scale manufacturing, global supply chains, and strong customer networks. Their ability to rapidly scale production during crises gives them a clear competitive edge.

Pharmaceutical companies contribute through cutting-edge biological innovation, with technologies like mRNA enabling the rapid development of countermeasures and creating high entry barriers through significant R&D investments and intellectual property portfolios. Meanwhile, agile tech-focused firms such as Ginkgo Bioworks are reshaping the market with AI-driven biosurveillance platforms and predictive analytics, shifting the industry’s focus from reactive measures to proactive prevention. Competition increasingly revolves around speed of innovation, data integration, and the delivery of comprehensive end-to-end solutions rather than just product quality or cost.

Top Key Players in the Biosecurity Market

- BASF SE

- Thermo Fisher Scientific Inc.

- 3M Company

- DuPont de Nemours, Inc.

- Ecolab Inc.

- Lonza Group Ltd.

- Agilent Technologies, Inc.

- EnviroTech Services, Inc.

- Johns Hopkins Applied Physics Laboratory

- Vetoquinol S.A.

- Merck & Co., Inc.

- Ginkgo Bioworks Holdings, Inc.

- Biochem Pharma

- Oxitec Ltd.

- Bio-Rad Laboratories, Inc.

Recent Developments

- In August 2025: The USDA’s APHIS is partnering with Merck Animal Health to enhance swine disease traceability through a five-year, $20 million initiative providing free RFID ear tags. Shipped directly to producers, these tags speed traceability, reduce outbreak impacts, and strengthen biosecurity, trade, and industry resilience, with allocations based on herd size and premises registration.

- In May 2025: Agilent Technologies inaugurated its first India Solution Centre at its LEED Platinum-certified facility in Manesar, Haryana. Spanning 12,500 sq. ft., the centre will deliver end-to-end scientific workflows, proof-of-concept demonstrations, and customized solutions for healthcare, life sciences, diagnostics, and applied markets. Key focus areas include GLP-1 analysis, PFAS detection, and testing for emerging food and environmental contaminants.

- In March 2025: Enviro Tech, an Arxada company, has made a significant advancement in combating Avian Influenza with the U.S. Environmental Protection Agency’s (EPA) approval for PeraGuard AH (EPA Reg. No. 63838-32). This label amendment allows PeraGuard AH to make claims against Avian Influenza and other animal viruses on surfaces. This development positions PeraGuard AH as an essential solution in addressing the ongoing Avian Influenza crisis, which has severely impacted poultry operations across the United States.

- In May 2024: Steen-Hansen, a leader in antifouling and aquaculture coatings, and Ecolab, a global sustainability and water solutions provider, announced a collaboration to strengthen aquaculture biosecurity through the NetCare Program. This initiative focuses on enhancing fish welfare, reducing pathogen cross-contamination, and improving farm productivity with sustainable practices. The program integrates specialized training, strict hygiene protocols, and measurable net disinfection results. By combining Ecolab’s aquaculture-approved products with Steen-Hansen’s NetCare certification framework, the partnership aims to combat biofouling, safeguard fish health, and ensure long-term sustainability in aquaculture—a sector critical for meeting global food demand and preserving ocean biodiversity.

Report Scope

Report Features Description Market Value (2024) US$ 17.43 billion Forecast Revenue (2034) US$ 37.24 billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Biocides & Disinfectants, Personal Protective Equipment (PPE), Detection & Monitoring Equipment, Decontamination Systems, Others), By Application (Quarantine and Disease Surveillance, Bioterrorism and Biodefense, Lab Biosafety, Food Safety, Others), By End-User (Government & Regulatory Bodies, Healthcare Institutions, Agricultural Sector, Research & Academia, Private & Commercial Sectors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF SE, Thermo Fisher Scientific Inc., 3M Company, DuPont de Nemours, Inc., Ecolab Inc., Lonza Group Ltd., Agilent Technologies, Inc., EnviroTech Services, Inc., Johns Hopkins Applied Physics Laboratory, Vetoquinol S.A., Merck & Co., Inc., Ginkgo Bioworks Holdings, Inc., Biochem Pharma, Oxitec Ltd., Bio-Rad Laboratories, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Thermo Fisher Scientific Inc.

- 3M Company

- DuPont de Nemours, Inc.

- Ecolab Inc.

- Lonza Group Ltd.

- Agilent Technologies, Inc.

- EnviroTech Services, Inc.

- Johns Hopkins Applied Physics Laboratory

- Vetoquinol S.A.

- Merck & Co., Inc.

- Ginkgo Bioworks Holdings, Inc.

- Biochem Pharma

- Oxitec Ltd.

- Bio-Rad Laboratories, Inc.