Global Bioremediation Market By Type(In Situ Bioremediation, Ex Situ Bioremediation), By Technology (Biostimulation, Phytoremediation, Bioreactors, Fungal Remediation, Bioaugmentation, Land-based Treatment, Others), By Applications (Soil Remediation, Oilfield Remediation, Wastewater Remediation, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123135

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

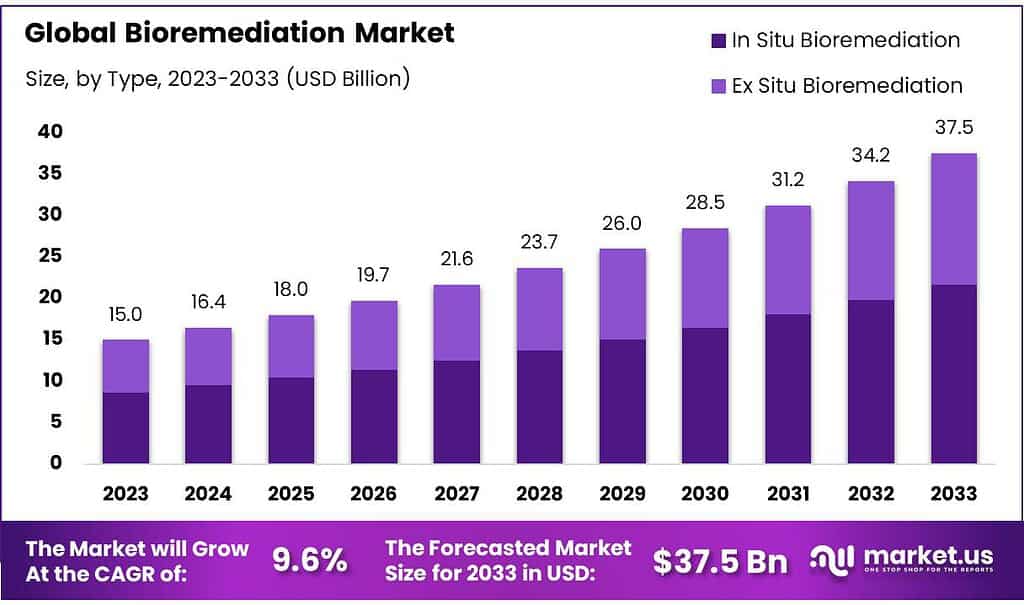

The global Bioremediation Market size is expected to be worth around USD 37.5 billion by 2033, from USD 15 billion in 2023, growing at a CAGR of 9.6% during the forecast period from 2023 to 2033.

The bioremediation market focuses on using biological processes to clean up contaminated environments. This method typically involves microorganisms like bacteria, fungi, or plants to break down pollutants into less harmful substances. The bioremediation market is an essential part of the environmental services sector, providing solutions for industries such as oil and gas, manufacturing, and agriculture, which often encounter pollutants affecting soil, water, and air.

The rising demand for bioremediation reflects a growing recognition of its effectiveness and environmental benefits. Unlike conventional remediation methods that rely on chemical or physical processes and can pose environmental risks, bioremediation offers a more natural and often safer alternative for pollution control.

One of the prominent contributors to this market is the Chinese Academy of Sciences. With 347 published papers and 52 collaborative relationships in petroleum-contaminated soil remediation research, the institution has established itself as a leader in the field. This level of involvement highlights the academy’s crucial role in advancing bioremediation technologies and practices.

The market is expected to continue its growth trajectory, driven by the need for sustainable solutions to environmental contamination. The global bioremediation market is projected to grow at a compound annual growth rate (CAGR) of 8.71% through 2027. This robust growth is fueled by increasing environmental regulations, public awareness about pollution, and the ongoing development of innovative bioremediation technologies.

Key drivers for this market include the stringent regulations imposed by governments worldwide to address environmental pollution and the rising public awareness about the harmful effects of pollutants. Additionally, advancements in bioremediation technologies are making these solutions more efficient and cost-effective, further propelling market growth.

Key Takeaways

- The global bioremediation market is anticipated to grow from USD 15 billion in 2023 to USD 37.5 billion by 2033, at a CAGR of 9.6%.

- In Situ, Bioremediation Dominates the market with a 57.8% share in 2023. It treats contamination directly at the site, making it ideal for organic pollutants.

- Phytoremediation Leading technology with a 31.2% market share in 2023. Plants absorb and degrade contaminants, proving effective for widespread surface pollution.

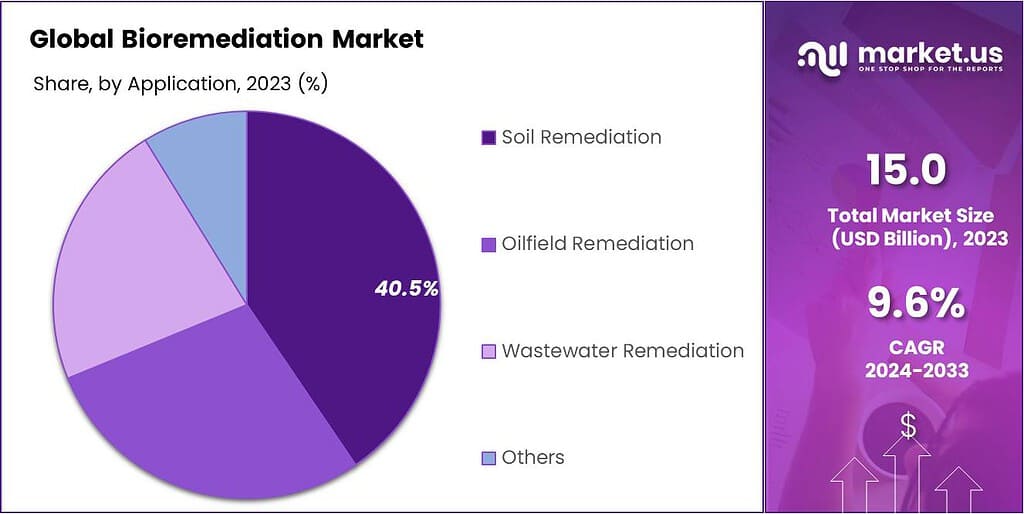

- Soil Remediation Captured 40.5% of the market in 2023. This method uses biological processes to clean contaminated land, making it suitable for agricultural and construction purposes.

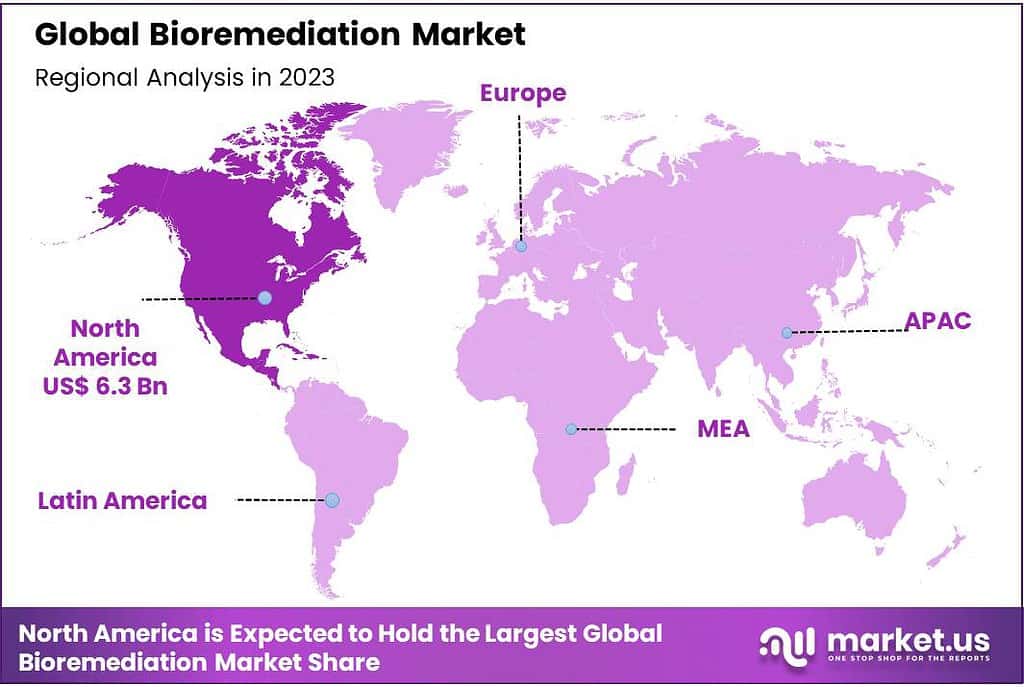

- North America’s Market Share Dominates with 42.3% of the market, valued at approximately USD 6.345 billion, driven by stringent environmental regulations and industrial demand.

By Type

In 2023, In Situ Bioremediation held a dominant market position, capturing more than a 57.8% share of the bioremediation market. This method is highly preferred due to its ability to treat contamination directly at the site without the need to remove soil or water for treatment elsewhere.

In situ, bioremediation is especially effective for dealing with organic pollutants like petroleum hydrocarbons, pesticides, and solvents, as it utilizes natural processes facilitated by microorganisms already present in the environment or introduced specifically for the process.

On the other hand, Ex Situ Bioremediation, which involves excavating contaminated soil or pumping out contaminated water and treating it off-site, holds a smaller share of the market. This approach is often chosen when in situ treatments are impractical or insufficient, such as in cases of heavy metal contamination or when rapid remediation is required.

Despite being more costly and labor-intensive due to the need for excavation and transportation, ex situ bioremediation is critical for addressing contaminants that are too concentrated or deeply buried to be treated on-site effectively.

By Technology

In 2023, Phytoremediation held a dominant position in the bioremediation technologies market, capturing more than a 31.2% share. This method leverages the natural abilities of plants to absorb, degrade, or contain contaminants in soils, sediments, and water. Phytoremediation is particularly valued for its environmental friendliness and cost-effectiveness, making it a popular choice for managing widespread surface contamination such as heavy metals and pesticides.

Biostimulation, another key technology in bioremediation, involves the modification of the environment to stimulate existing bacteria capable of biodegradation. This method is employed to enhance the microbial activity and speed up the natural degradation process by adjusting nutrients, oxygen, or other conditions that limit microbial growth.

Bioaugmentation adds specific strains of bacteria to contaminated sites to speed up the rate of degradation. This approach is used when the naturally occurring organisms are incapable of degrading the pollutants at a sufficient rate.

Fungal remediation takes advantage of fungi’s robust enzyme systems to decompose complex contaminants, often used for pollutants like heavy metals that are not readily handled by bacteria.

Bioreactors involve treating contaminated water or soil within a controlled, reactor-based setting, allowing for faster and more precise contaminant removal than in situ methods.

Land-based treatments cover a range of techniques, including soil washing and landfarming, which utilize the soil’s natural bioremediation capabilities to degrade organic pollutants over time.

By Application

In 2023, Soil Remediation held a dominant market position in the bioremediation sector, capturing more than a 40.5% share. This method is crucial for treating contaminated land by using biological mechanisms to degrade pollutants found in the soil, making it safe for agriculture, construction, and other land uses. Soil remediation techniques include phytoremediation, where plants are used to absorb contaminants, and bioaugmentation, which involves introducing specific microorganisms to accelerate contaminant breakdown.

Oilfield Remediation is another significant application, focusing on the cleanup of oil spills and other hydrocarbon residues that can severely impact environmental health. This segment applies bioremediation techniques to break down hydrocarbons into less harmful substances, restoring oil-contaminated environments.

Wastewater Remediation uses bioremediation to treat sewage or industrial wastewater through biological means to remove or neutralize pollutants like organic materials and chemicals before the water is released back into the environment. This process is essential for maintaining water quality and preventing waterborne pollution.

Key Market Segments

By Type

- In Situ Bioremediation

- Ex Situ Bioremediation

By Technology

- Biostimulation

- Phytoremediation

- Bioreactors

- Fungal Remediation

- Bioaugmentation

- Land-based Treatment

- Others

By Applications

- Soil Remediation

- Oilfield Remediation

- Wastewater Remediation

- Others

Driving Factors

Regulatory Pressure and Environmental Awareness Drive Bioremediation Market Growth

A significant driver for the bioremediation market is the increasing regulatory pressure on industries to adopt environmentally sustainable practices, particularly in pollution management. Governments around the world are implementing stricter regulations that mandate the cleanup of contaminated sites, which has significantly boosted the demand for bioremediation services.

Bioremediation, which involves using natural organisms to break down pollutants in the environment, is favored due to its effectiveness and minimal ecological impact compared to traditional chemical and physical methods.

For example, in the United States, the Environmental Protection Agency (EPA) has detailed guidelines and support for bioremediation under various programs aimed at environmental restoration. These include the Superfund program, which is dedicated to the cleanup of land contaminated by hazardous waste and is a critical area where bioremediation is applied. The urgency for compliance with such environmental standards is prompting more companies to invest in bioremediation to avoid penalties and potential legal actions.

Moreover, the market for bioremediation technologies is seeing substantial growth. According to a 2021 report from a leading global chemical organization, the bioremediation sector is projected to reach a market size of approximately $253 billion by 2025, growing at a compound annual growth rate (CAGR) of around 15%. This growth is attributed to the rising awareness of the environmental impact of industrial activities and the global push towards reducing carbon footprints.

The rise in environmental awareness among the public and corporations is another crucial driver. There is a growing demand for green technologies as stakeholders become more conscious of the need for sustainable development. This societal shift is reflected in increased investments from both private and public sectors in bioremediation research and projects. These investments are not only aimed at fulfilling regulatory requirements but also at improving corporate social responsibility profiles.

Additionally, international environmental agreements and local government initiatives promoting sustainable waste management practices further reinforce the market. For instance, European Union directives on waste management emphasize the reduction of environmental damage without transferring it from one environmental medium (like air or soil) to another. This promotes the use of bioremediation as it effectively detoxifies pollutants without producing harmful byproducts.

Restraining Factors

Technological and Economic Limitations as Major Restraints in the Bioremediation Market

One significant restraint impacting the growth of the bioremediation market is the technological and economic challenges associated with the deployment and efficiency of bioremediation techniques. Bioremediation, which involves using biological processes to degrade or detoxify environmental contaminants, faces hurdles in terms of effectiveness, predictability, and speed, particularly when compared to traditional remediation methods.

A key issue is the variability in the effectiveness of bioremediation techniques, which largely depend on environmental conditions such as temperature, pH, soil type, and the presence of necessary nutrients and microbial communities. These conditions can be difficult to control in the natural environment, leading to inconsistent and sometimes inadequate treatment outcomes. For instance, bioremediation is generally slower than physical or chemical methods, making it less suitable for situations where rapid remediation is required.

Economically, while bioremediation can be cost-effective over the long term, the initial investment in research and development, site evaluation, and custom treatment design can be substantial. The need for extensive site-specific assessments to ensure the viability of bioremediation adds to the costs and complexity of projects. Furthermore, there may be additional expenses related to monitoring the progress and long-term maintenance of treated sites to ensure that contaminants are fully degraded and do not pose a recurring risk.

Moreover, the market for bioremediation technologies is also constrained by a lack of awareness and technical expertise required to implement and manage bioremediation projects effectively. Although governmental bodies like the U.S. Environmental Protection Agency (EPA) provide guidelines and support for bioremediation, there is still a significant knowledge gap in many parts of the world concerning the potential and limitations of these biological treatments.

This restraint is further complicated by regulatory challenges. While the regulatory environment is generally supportive of bioremediation due to its environmental benefits, stringent regulations can also make the approval and implementation process lengthy and uncertain. This is particularly true in regions with less developed regulatory frameworks for environmental technologies, where the approval process can be unpredictable and hinder the adoption of bioremediation solutions.

Growth Opportunities

Expanding Global Environmental Regulations Present Opportunities for the Bioremediation Market

A major opportunity for the bioremediation market is the expansion of environmental regulations across the globe. As countries become increasingly aware of the need to address environmental pollution, the demand for effective and sustainable remediation technologies is rising, providing a significant growth opportunity for bioremediation. This biological process, which utilizes microorganisms to degrade or detoxify pollutants naturally, is gaining favor for its eco-friendly approach and effectiveness in restoring contaminated environments.

In recent years, there has been a noticeable increase in the enactment of stringent environmental laws and guidelines by governments worldwide. For instance, the European Union has been at the forefront with its Environmental Liability Directive, which holds businesses accountable for environmental damage and encourages the use of natural remediation methods as a way to prevent and remedy ecological threats.

Similarly, the United States Environmental Protection Agency (EPA) supports bioremediation through its Superfund program, aimed at cleaning up some of the nation’s most contaminated lands. The EPA not only promotes the use of bioremediation but also funds research to advance these technologies.

These regulatory trends are complemented by public and private sector investments in environmental sustainability initiatives, which are increasing globally. As reported by leading chemical organizations, investments in technologies that aid environmental protection and sustainability are expected to grow substantially. The global market for bioremediation technologies alone is projected to reach billions of dollars over the next decade, with an annual growth rate exceeding 15% in some regions. This growth is driven by a combination of regulatory pressure, increased environmental awareness, and advancements in biotechnological research that enhance the efficiency and applicability of bioremediation methods.

Moreover, the shift towards sustainable industrial practices in sectors such as oil and gas, manufacturing, and agriculture further augments the demand for bioremediation. Industries are increasingly adopting greener practices not only to comply with legal requirements but also to improve their public image and reduce operational risks associated with pollution.

Furthermore, the rise in incidents of environmental pollution, such as oil spills and industrial leaks, has led to a greater demand for immediate and effective remediation solutions. Bioremediation offers a viable solution that aligns with the global push towards natural and less invasive environmental interventions. It is particularly effective in treating a wide range of organic pollutants and heavy metals, which are common byproducts of industrial processes.

Trending Factors

The Rise of Genetic Engineering in Bioremediation Technologies

A significant trend shaping the bioremediation market is the increasing use of genetic engineering to enhance the effectiveness of microbial strains used in the cleanup of contaminated environments. This innovative approach leverages advancements in molecular biology and genetic science to develop microorganisms specifically designed to degrade pollutants more efficiently and in a wider range of environmental conditions.

The application of genetic engineering in bioremediation, often referred to as ‘bioaugmentation,’ involves the modification or enhancement of natural bacterial, fungal, or plant species to boost their pollutant-degrading capabilities. For instance, certain bacteria can be genetically modified to possess a greater capacity to metabolize specific hazardous substances such as heavy metals or petroleum products, which are commonly found in industrial waste.

This trend is driven by the growing demand for more robust and versatile bioremediation methods capable of addressing the complex mixtures of contaminants often found at polluted sites. Traditional bioremediation techniques, while effective, sometimes fall short when faced with particularly resilient or toxic pollutants. Genetic engineering offers a promising solution to these challenges by creating ‘super’ microbial strains that can survive and thrive in harsh environmental conditions and transform hazardous substances into harmless compounds more quickly.

The market impact of genetically engineered bioremediation solutions is significant, with industry reports forecasting a substantial increase in the adoption of these technologies. According to data from reputable chemical organizations, the segment of the bioremediation market that involves genetically engineered solutions is expected to grow at a compound annual growth rate (CAGR) of over 10% in the next decade. This growth is indicative of the increasing confidence in genetic engineering as a reliable and efficient approach to pollution mitigation.

Government agencies and regulatory bodies are also recognizing the potential of genetically engineered bioremediation. For example, the U.S. Environmental Protection Agency (EPA) has established guidelines and protocols for the use of genetically modified organisms (GMOs) in environmental applications, ensuring their safe and controlled use. These regulations are crucial in maintaining ecological balance and preventing potential negative impacts on native species and ecosystems.

Furthermore, the integration of genetic engineering into bioremediation aligns with global environmental goals and the sustainable development agenda. As industries and governments continue to prioritize green technologies and pollution reduction, the demand for advanced bioremediation solutions is expected to rise. This trend not only highlights the innovative trajectory of the bioremediation market but also underscores the broader commitment to employing science and technology in solving environmental problems.

Regional Analysis

In the bioremediation market, North America is the dominating region, holding a substantial 42.3% market share, which translates to approximately USD 6.345 billion. This significant market presence is bolstered by rigorous environmental regulations and a strong focus on sustainable practices in the United States and Canada. North American industries, particularly those related to oil and gas and manufacturing, are major contributors to the demand for bioremediation due to their need to comply with stringent pollution control standards.

Europe follows closely, characterized by advanced environmental policies and a high adoption rate of green technologies. The European Union’s directives on environmental liability and waste management strongly support the growth of the bioremediation sector, driving demand for these services across contaminated industrial and urban sites.

Asia Pacific presents a dynamic growth area for the bioremediation market, driven by rapid industrialization and increasing environmental awareness. The region is experiencing substantial investments in infrastructure development that comply with new environmental regulations, pushing the need for bioremediation services to mitigate industrial pollution.

Meanwhile, the Middle East & Africa, and Latin America regions, though smaller in market share, are recognizing the potential of bioremediation. These regions are gradually implementing stricter environmental laws and are seeing a growing awareness of sustainable practices among their burgeoning industrial sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The bioremediation market is marked by the presence of several key players who are instrumental in advancing technologies and services aimed at environmental cleanup through biological means. These companies play crucial roles in addressing pollution challenges across various sectors, including oil and gas, manufacturing, and agriculture.

Drylet, Inc. stands out among these players for its innovative bioaugmentation products designed to enhance microbial activity in wastewater treatment and soil remediation. Sumas Remediation Service, Inc. specializes in comprehensive remediation services, offering expertise in both traditional and advanced bioremediation techniques. MicroGen Biotech Ltd. focuses on cutting-edge bioremediation solutions using microbial technologies tailored for specific contaminants, enhancing efficiency and effectiveness in environmental cleanup efforts.

Newterra Ltd. contributes significantly with its water treatment solutions that integrate bioremediation processes, emphasizing sustainability and environmental stewardship. Envirogen Technologies, Inc. provides integrated solutions for water treatment and soil remediation, leveraging bioremediation alongside other technologies. Xylem, Inc. offers a broad range of water and wastewater solutions, including bioremediation technologies that improve water quality and reduce environmental impact.

Probiosphere, Inc. specializes in bioaugmentation and biostimulation products, enhancing natural processes to degrade pollutants effectively. Regenesis Corp. focuses on advanced remediation technologies, including in situ bioremediation solutions tailored to specific site conditions.

Oil Spill Eater International, Inc. addresses oil spill cleanup with bioremediation products that accelerate the degradation of hydrocarbons in marine and terrestrial environments. Aquatech International Corp. rounds out the list with its expertise in water purification and wastewater treatment solutions that incorporate bioremediation principles.

Market Key Players

- Drylet, Inc.

- Sumas Remediation Service, Inc.

- MicroGen Biotech Ltd.

- Newterra Ltd.

- Envirogen Technologies, Inc.

- Xylem, Inc.

- Probiosphere, Inc.

- Regenesis Corp.

- Oil Spill Eater International, Inc.

- Aquatech International Corp.

Recent Developments

As of 2023, Newterra’s influence in the bioremediation industry continues to grow, underscored by several strategic acquisitions aimed at expanding its service offerings and technological capabilities.

In 2023, MicroGen Biotech continued to expand its impact in the bioremediation field by deploying its technologies in various international projects, demonstrating the global applicability and effectiveness of its solutions.

Report Scope

Report Features Description Market Value (2023) USD 15 Billion Forecast Revenue (2033) USD 37.5 Billion CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(In Situ Bioremediation, Ex Situ Bioremediation), By Technology (Biostimulation, Phytoremediation, Bioreactors, Fungal Remediation, Bioaugmentation, Land-based Treatment, Others), By Applications (Soil Remediation, Oilfield Remediation, Wastewater Remediation, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Drylet, Inc., Sumas Remediation Service, Inc., MicroGen Biotech Ltd., Newterra Ltd., Envirogen Technologies, Inc., Xylem, Inc., Probiosphere, Inc., Regenesis Corp., Oil Spill Eater International, Inc., Aquatech International Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Bioremediation Market?Bioremediation Market size is expected to be worth around USD 37.5 billion by 2033, from USD 15 billion in 2023,

What is the projected CAGR at which the Global Bioremediation Market is expected to grow at?The Global Bioremediation Market is expected to grow at a CAGR of 9.6% (2024-2033).List the key industry players of the Global Bioremediation Market?Drylet, Inc., Sumas Remediation Service, Inc., MicroGen Biotech Ltd., Newterra Ltd., Envirogen Technologies, Inc., Xylem, Inc., Probiosphere, Inc., Regenesis Corp., Oil Spill Eater International, Inc., Aquatech International Corp.

-

-

- Drylet, Inc.

- Sumas Remediation Service, Inc.

- MicroGen Biotech Ltd.

- Newterra Ltd.

- Envirogen Technologies, Inc.

- Xylem, Inc.

- Probiosphere, Inc.

- Regenesis Corp.

- Oil Spill Eater International, Inc.

- Aquatech International Corp.