Global Bioprocess Validation Market By Testing Type (Extractables/Leachables Testing, Microbiological Testing, Integrity Testing, Viral Clearance Testing, Physicochemical Testing, Residuals Testing, Compatibility Testing and Others), By Process Stage (Process Design, Process Qualification and Continued Process Verification), By Process Component (Filter Elements, Media Containers & Bags, Freezing & Thawing Process Bag, Mixing Systems, Bioreactors and Others), By Mode (In-House Validation and Outsourced Validation), By End-User (Pharmaceutical & Biotechnology Companies, Medical Device Companies, CROs and CDMOs, and Academic Institutions and Research Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172130

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Testing Type Analysis

- Process Stage Analysis

- Process Component Analysis

- Mode Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

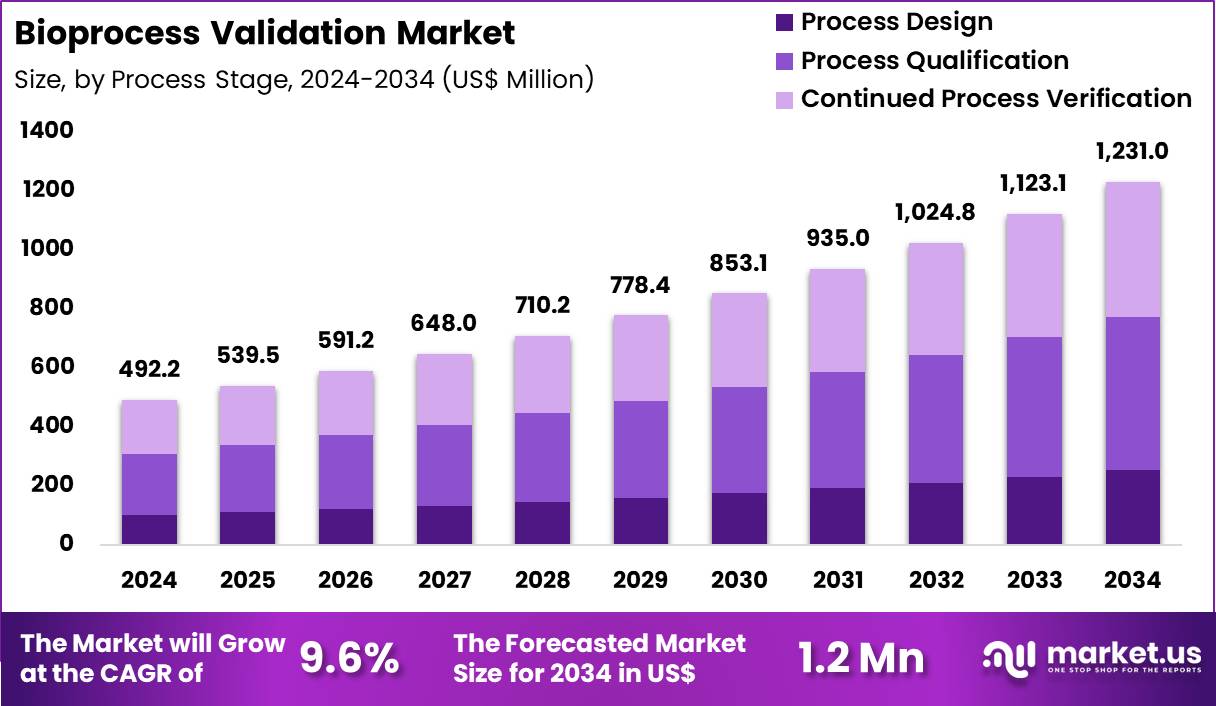

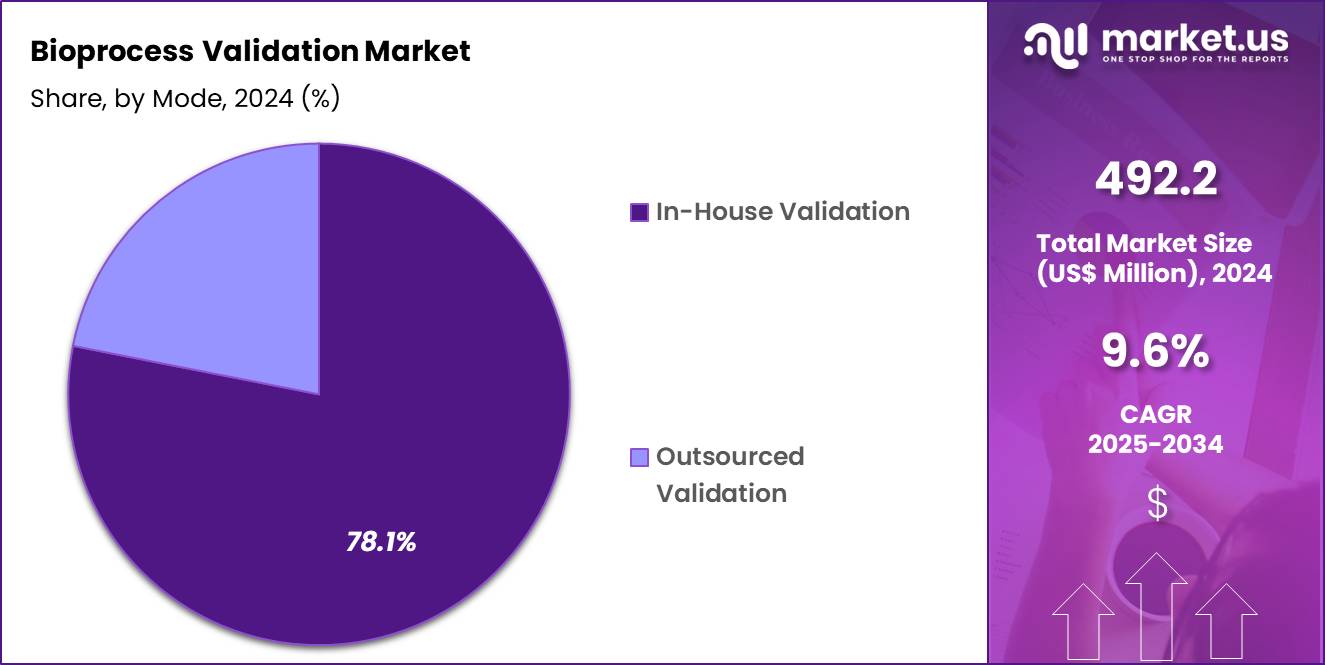

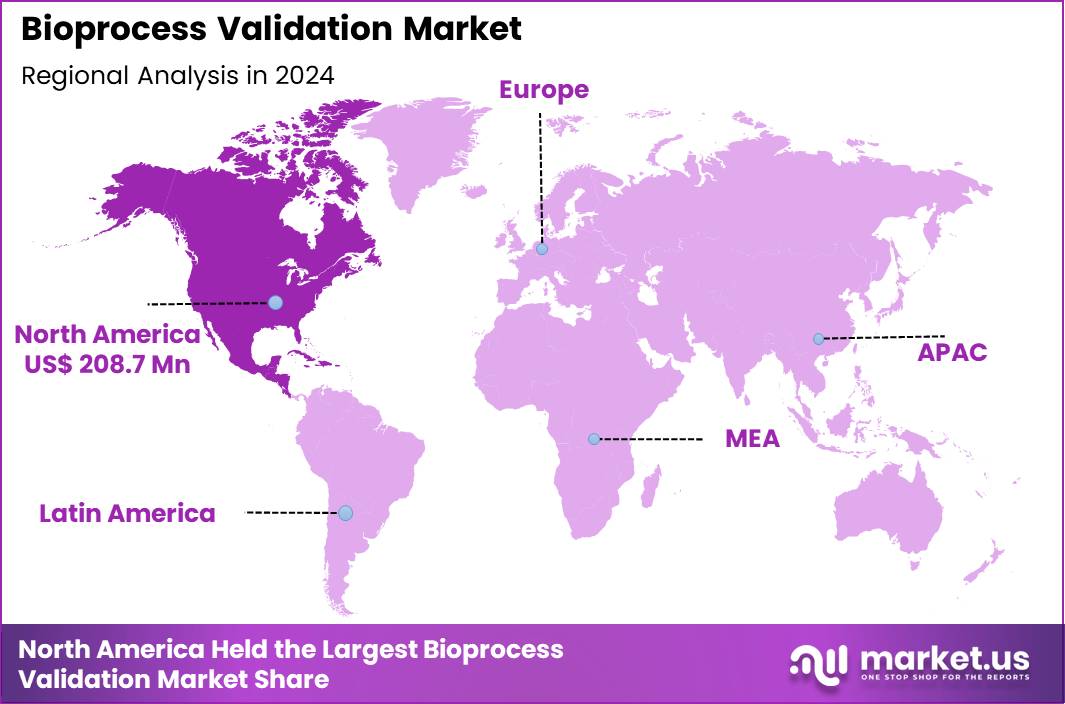

The Global Bioprocess Validation Market size is expected to be worth around US$ 1231.0 Million by 2034 from US$ 492.2 Million in 2024, growing at a CAGR of 9.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.4% share with a revenue of US$ 208.7 Million.

Growing complexity of biologics manufacturing processes compels pharmaceutical companies to prioritize robust validation protocols that ensure consistent product quality and regulatory compliance. Manufacturers increasingly adopt validation strategies to confirm reproducibility in monoclonal antibody production, where upstream cell culture and downstream purification steps demand stringent controls to mitigate variability.

Bioprocess validation supports vaccine development by verifying sterility and potency across fermentation and inactivation phases. Companies apply these protocols to gene therapy vectors, validating viral clearance and transduction efficiency during vector production. Validation extends to biosimilar comparability exercises, demonstrating equivalence in critical quality attributes through parallel process runs.

In December 2024, Eppendorf’s collaboration with DataHow strengthened the Bioprocess Validation Market by embedding advanced AI driven analytics into bioprocess development workflows. This integration improves data traceability, model based decision making, and cross functional collaboration, which are critical for validation readiness. By reducing manual data handling and variability, the partnership supports faster process qualification, higher reproducibility, and stronger compliance with regulatory validation requirements across biologics manufacturing.

Biopharmaceutical firms capitalize on opportunities to implement continuous manufacturing systems that require ongoing validation to maintain process performance qualification over extended runs. Developers integrate single-use technologies into validation frameworks, confirming extractables and leachables profiles to safeguard product integrity in disposable bioreactors. Validation protocols enable scalable production of cell therapies by qualifying expansion and harvest procedures for autologous and allogeneic products.

Companies explore advanced analytical tools to enhance validation of purification trains, ensuring effective removal of impurities in recombinant protein workflows. Opportunities emerge in validating viral filtration steps for advanced therapies, optimizing retention studies to achieve reliable safety margins. Firms leverage risk-based approaches to streamline validation for plasmid DNA production, focusing on critical parameters that influence yield and purity.

Industry leaders deploy artificial intelligence and machine learning algorithms to predict process outcomes and facilitate proactive validation adjustments in real time. Manufacturers incorporate digital twins into validation strategies, simulating bioreactor performance to anticipate deviations before commercial scaling. Companies advance paperless validation systems that automate documentation and enhance audit readiness across multi-step biologics processes.

Researchers refine multivariate statistical tools to monitor cleaning validation endpoints, minimizing cross-contamination risks in shared facilities. Market innovators emphasize hybrid modeling techniques that combine mechanistic and data-driven insights for robust validation of chromatography operations. Ongoing initiatives prioritize lifecycle management approaches that sustain validation status through post-approval changes in therapeutic protein manufacturing.

Key Takeaways

- In 2024, the market generated a revenue of US$ 492.2 Million, with a CAGR of 9.6%, and is expected to reach US$ 1231.0 Million by the year 2034.

- The testing type segment is divided into extractables/leachables testing, microbiological testing, integrity testing, viral clearance testing, physicochemical testing, residuals testing, compatibility testing and others, with extractables/leachables testing taking the lead in 2023 with a market share of 29.8%.

- Considering process stage, the market is divided into process design, process qualification and continued process verification. Among these, process qualification held a significant share of 42.3%.

- Furthermore, concerning the process component segment, the market is segregated into filter elements, media containers & bags, freezing & thawing process bag, mixing systems, bioreactors and others. The filter elements sector stands out as the dominant player, holding the largest revenue share of 24.5% in the market.

- The mode segment is segregated into in-house validation and outsourced validation, with the in-house validation segment leading the market, holding a revenue share of 78.1%.

- Considering end-user, the market is divided into pharmaceutical & biotechnology companies, medical device companies, CROs and CDMOs, and academic institutions and research laboratories. Among these, pharmaceutical & biotechnology companies held a significant share of 47.7%.

- North America led the market by securing a market share of 42.4% in 2024.

Testing Type Analysis

Extractables and leachables testing, holding 29.8%, is expected to dominate the testing type segment because regulatory agencies increasingly emphasize patient safety and product integrity in biopharmaceutical manufacturing. Single-use systems, polymer-based containers, and flexible tubing introduce potential risks of chemical migration, which drives consistent demand for extractables and leachables studies.

Biologics, vaccines, and cell and gene therapies rely heavily on advanced materials, increasing the complexity of contamination risk assessment. Pharmaceutical manufacturers prioritize early identification of leachable compounds to avoid late-stage regulatory setbacks and costly product recalls. Growing adoption of disposable bioprocess components further strengthens testing frequency across development and commercial stages.

Regulatory guidance from global health authorities reinforces mandatory testing expectations. Analytical method advancements improve detection sensitivity and compound characterization. These factors keep extractables and leachables testing anticipated to remain the leading testing category.

Process Stage Analysis

Process qualification, holding 42.3%, is projected to dominate the process stage segment because it serves as the critical link between development and commercial manufacturing. Regulatory frameworks require robust qualification to demonstrate that bioprocesses consistently operate within defined parameters. Biopharmaceutical companies invest heavily in qualification activities to secure approvals and accelerate time-to-market.

Increased production of complex biologics heightens the need for rigorous validation of equipment, systems, and workflows. Process qualification supports risk mitigation by ensuring reproducibility and compliance before large-scale manufacturing begins. Lifecycle-based validation models continue to reinforce the importance of this stage. Digital monitoring tools improve documentation and traceability, strengthening adoption. These drivers keep process qualification expected to remain the dominant stage in bioprocess validation.

Process Component Analysis

Filter elements, holding 24.5%, are expected to dominate the process component segment because filtration plays a central role in sterility assurance and product purity. Biomanufacturing workflows rely extensively on filters for clarification, sterilization, and viral removal across upstream and downstream operations. Regulatory scrutiny around contamination control strengthens validation requirements for filter performance and integrity.

Increasing biologics production volumes raise filter usage frequency, directly increasing validation demand. Single-use filtration systems further expand the need for component-specific validation. Advances in membrane materials increase complexity, reinforcing the need for comprehensive testing. Manufacturers prioritize validated filters to protect high-value biologic products. These factors keep filter elements anticipated to remain the leading process component.

Mode Analysis

In-house validation, holding 78.1%, is projected to dominate the mode segment because pharmaceutical and biotechnology companies seek tighter control over critical quality and compliance activities. Internal validation teams ensure faster response times, improved data security, and direct alignment with manufacturing operations. Growing regulatory complexity encourages organizations to build internal expertise rather than relying entirely on third-party services.

Continuous manufacturing models require ongoing validation support, favoring in-house capabilities. Large biopharma companies invest in dedicated validation laboratories and skilled personnel to support pipeline expansion. Integration with quality management systems improves efficiency and audit readiness. These advantages keep in-house validation expected to remain the preferred approach.

End-User Analysis

Pharmaceutical and biotechnology companies, holding 47.7%, are expected to dominate the end-user segment because they represent the primary developers and manufacturers of regulated biologic products. Expanding pipelines in monoclonal antibodies, vaccines, and advanced therapies increase validation workloads across multiple facilities. Regulatory approval success depends heavily on robust validation data, driving sustained investment in validation activities.

Capacity expansion projects further elevate demand for bioprocess validation services and tools. These companies adopt advanced technologies and quality-by-design frameworks that require continuous validation support. Global manufacturing footprints amplify compliance complexity, strengthening internal validation efforts. These dynamics keep pharmaceutical and biotechnology companies anticipated to remain the dominant end users in the bioprocess validation market.

Key Market Segments

By Testing Type

- Extractables/Leachables Testing

- Microbiological Testing

- Integrity Testing

- Viral Clearance Testing

- Physicochemical Testing

- Residuals Testing

- Compatibility Testing

- Others

By Process Stage

- Process Design

- Process Qualification

- Continued Process Verification

By Process Component

- Filter Elements

- Media Containers & Bags

- Freezing & Thawing Process Bag

- Mixing Systems

- Bioreactors

- Others

By Mode

- In-House Validation

- Outsourced Validation

By End-User

- Pharmaceutical & Biotechnology Companies

- Medical Device Companies

- CROs and CDMOs

- Academic Institutions and Research Laboratories

Drivers

Increasing FDA approvals of cellular and gene therapy products is driving the market

The bioprocess validation market is strongly driven by the growing number of regulatory approvals for cellular and gene therapy products, which demand highly controlled and reproducible manufacturing processes. These therapies are complex biological products with inherent variability, making rigorous validation essential to ensure consistency, safety, and efficacy.

According to the U.S. Food and Drug Administration’s publicly available listings, seven new cellular and gene therapy products were approved in 2023, followed by another seven approvals in 2024. Each approval requires comprehensive validation activities, including process performance qualification, viral clearance studies, and validation of critical quality attributes across batches. The sustained approval rate highlights a robust and expanding pipeline of innovative therapies targeting oncology, rare diseases, and genetic disorders.

Regulatory authorities place strong emphasis on reproducible manufacturing to protect patient safety, prompting manufacturers to invest heavily in validation infrastructure, expertise, and advanced analytical tools. As more therapies progress from clinical development to commercial production, the demand for specialized bioprocess validation services and technologies continues to increase, supporting long-term market growth.

Restraints

Stringent current good manufacturing practice regulations are restraining the market

Strict compliance with current good manufacturing practice regulations represents a significant restraint for the bioprocess validation market, as these requirements impose substantial operational, technical, and financial burdens on manufacturers. Regulatory agencies such as the U.S. Food and Drug Administration mandate extensive documentation, testing, and verification to demonstrate control over all critical process parameters.

Validation efforts often require large-scale sampling, multi-batch analysis, and comprehensive data traceability, extending across the entire manufacturing lifecycle. In addition to process validation, companies must also address facility design, equipment qualification, cleaning validation, computerized system validation, and continuous personnel training. For smaller and emerging biopharmaceutical companies, limited financial and technical resources can make compliance particularly challenging.

Validation timelines for complex biologics can span several years, and any process modification may trigger re-validation, further increasing costs and delays. The evolving nature of regulatory guidelines also requires frequent updates to validation protocols, adding to complexity and slowing time-to-market. Collectively, these factors restrict rapid scalability and can deter new entrants, acting as a restraint on market expansion.

Opportunities

Record number of biosimilar approvals by the FDA in 2024 is creating growth opportunities

The bioprocess validation market is witnessing strong growth opportunities due to the record number of biosimilar approvals granted by the U.S. Food and Drug Administration in 2024. Biosimilar development depends heavily on robust validation to demonstrate comparability with reference biologic products in terms of quality, safety, and efficacy. FDA approval records indicate that eighteen biosimilars received first approval in 2024, marking the highest annual total to date.

Each biosimilar approval requires extensive validation of analytical methods, manufacturing processes, stability profiles, and functional performance. This surge in approvals is encouraging increased participation from both established pharmaceutical companies and new market entrants, driving demand for specialized validation services focused on comparability and equivalence assessments.

Validation providers benefit from the need for customized physicochemical, biological, and immunogenicity studies. The growing biosimilar pipeline also supports the availability of cost-effective alternatives to originator biologics, improving patient access globally. As regulatory pathways continue to evolve, including requirements for interchangeability, innovation in validation strategies and technologies is further accelerated.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic currents advance the bioprocess validation market as robust biopharmaceutical expansion and stringent regulatory requirements worldwide compel manufacturers to invest heavily in qualification services, analytical testing, and risk-based process verification for reliable production scaling. Leading providers strategically enhance offerings with advanced digital tools and single-use system validations, capturing strong momentum from surging demand for biologics, cell therapies, and vaccine manufacturing in high-growth regions.

Lingering inflation and global economic fluctuations, however, escalate expenses for specialized equipment and skilled personnel, leading biotechs to defer validation projects and prioritize core development in tightened budgets. Geopolitical frictions, especially U.S.-China trade tensions and regional supply constraints, routinely interrupt access to critical analytical instruments and reference standards, spawning delays and heightened risks for firms with global dependencies.

Current U.S. tariffs elevate landed costs on imported validation technologies and consumables, pressuring margins for American service providers and challenging affordability amid reliance on overseas expertise. These tariffs also invite reciprocal restrictions from trading partners that curb U.S. exports of specialized validation protocols and slow multinational regulatory harmonization efforts.

Still, the evolving landscape stimulates meaningful commitments to U.S.-based testing facilities and diversified partnerships, laying solid groundwork for enhanced resilience, technological progress, and enduring market strength ahead.

Latest Trends

Implementation of the European Medicines Agency’s new guideline for investigational advanced therapy medicinal products in 2025 is a recent trend

A notable recent trend shaping the bioprocess validation market is the implementation of the European Medicines Agency’s new guideline for investigational advanced therapy medicinal products, which came into effect on July 1, 2025. This guideline outlines updated quality, non-clinical, and clinical requirements for advanced therapies used in clinical trials, with a strong focus on early-stage process validation. It provides specific guidance for cell-based and gene therapies, emphasizing a risk-based approach to validation that aligns with product development stages.

The framework addresses comparability requirements following manufacturing changes and reinforces alignment with good manufacturing practice principles even during early clinical development. It also places increased importance on sterility assurance, potency testing, and consistency of manufacturing data submitted across European Union member states.

As a result, manufacturers are adapting their bioprocess design and validation strategies to comply with these requirements, influencing protocol development and analytical planning. This regulatory update reflects the ongoing evolution of standards for advanced therapies and underscores the growing role of validation in supporting innovative treatment development.

Regional Analysis

North America is leading the Bioprocess Validation Market

In 2024, North America retained a 42.4% share of the global bioprocess validation market, advanced by escalating demands for stringent quality assurance in monoclonal antibody and gene therapy production. Biopharmaceutical firms prioritize comprehensive process performance qualification to comply with Current Good Manufacturing Practice regulations, mitigating risks of batch variability in continuous manufacturing platforms. Federal incentives via the National Institutes of Health bolster analytical method validations, supporting scalable viral clearance studies for recombinant proteins.

Contract development organizations expand extractables and leachables testing services, addressing complexities in single-use bioreactor systems amid supply resilience efforts. Demographic-driven surges in oncology and rare disease therapies necessitate robust comparability protocols for post-approval changes, ensuring seamless technology transfers. Regulatory guidance updates from the Food and Drug Administration emphasize risk-based lifecycle approaches, streamlining validation master plans for accelerated timelines.

Industry consortia foster standardized viral inactivation benchmarks, enhancing confidence in adventitious agent controls. These elements fortify manufacturing integrity, sustaining innovation in complex biologic pipelines. The U.S. Food and Drug Administration’s Center for Drug Evaluation and Research approved 17 new therapeutic biological products in 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders forecast vigorous expansion in bioprocess validation services across Asia Pacific over the forecast period, as nations amplify domestic biomanufacturing capacities to meet therapeutic demands. Regulatory agencies in South Korea and Singapore harmonize guidelines with international standards, equipping facilities with advanced process analytical technologies for real-time release testing in vaccine production. Domestic enterprises pioneer hybrid continuous-downstream platforms, tailoring filter integrity validations to humid operational environments prevalent in Southeast Asia.

Bilateral partnerships expedite knowledge transfers on aseptic process simulations, empowering emerging hubs in Indonesia to support autologous cell therapy scales. Rising investments in biosimilar portfolios compel rigorous impurity profiling, aligning with pharmacopeial monographs for regional compliance. Academic-industry alliances refine statistical process control models, optimizing media fill validations for high-titer mammalian cultures.

Policy frameworks incentivize facility upgrades with automated cleaning verifications, bridging gaps in legacy infrastructure. These dynamics harness regional expertise, establishing resilient frameworks for sophisticated biologic outputs. The United Nations Economic and Social Commission for Asia and the Pacific reported 670 million individuals aged 60 years or older in the region in 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Bioprocess Validation market accelerate growth by expanding end-to-end validation services that cover process design, qualification, and continued verification across biologics, vaccines, and cell and gene therapies. Companies operating in the Bioprocess Validation market invest in automation, digital documentation, and data-integrity platforms to help biopharma manufacturers meet tightening regulatory expectations while reducing cycle times.

Strategic partnerships with CDMOs and biotech innovators enable service providers in the Bioprocess Validation market to embed early in development programs and secure long-term engagements. Commercial teams drive adoption by offering modular, risk-based validation models that align cost with process complexity and scale.

Geographic expansion remains a priority as firms target emerging biomanufacturing hubs with localized expertise and regulatory support. Sartorius exemplifies leadership in the Bioprocess Validation market through its integrated portfolio of validation services, bioprocess equipment, and software solutions, supported by global application expertise and deep relationships with biopharmaceutical manufacturers.

Top Key Players

- Asahi Kasei Corporation

- Bio-Rad Laboratories

- Catalent, Inc.

- Charles River Laboratories

- Cobetter Filtration Equipment Co., Ltd.

- Danaher Corporation

- Eurofins Scientific

- Lonza Group

- Meissner Filtration Products, Inc.

- Merck KGaA

- Repligen Corporation

- Sartorius AG

- SGS S.A.

- Thermo Fisher Scientific Inc.

- Toxikon Corporation

- WuXi AppTec

Recent Developments

- In November 2024, Thermo Fisher Scientific’s establishment of a large scale bioprocess design center in Hyderabad directly supports growth of the Bioprocess Validation Market by expanding access to localized validation expertise in a high growth biopharma region. The facility enhances process characterization, scale up validation, and manufacturing readiness for regional and global clients, while enabling faster technology transfer and regulatory alignment for India focused and export oriented biologics production.

- In November 2024, Sartorius Stedim Biotech’s new bioprocess innovation centre in Marlborough advances the Bioprocess Validation Market by offering end to end process development and validation support within a collaborative environment. The center enables manufacturers to optimize and validate processes earlier in development, reduce scale up risks, and meet evolving regulatory expectations through hands on training, real time testing, and co development with technology providers and industry partners.

Report Scope

Report Features Description Market Value (2024) US$ 492.2 Million Forecast Revenue (2034) US$ 1231.0 Million CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Testing Type (Extractables/Leachables Testing, Microbiological Testing, Integrity Testing, Viral Clearance Testing, Physicochemical Testing, Residuals Testing, Compatibility Testing and Others), By Process Stage (Process Design, Process Qualification and Continued Process Verification), By Process Component (Filter Elements, Media Containers & Bags, Freezing & Thawing Process Bag, Mixing Systems, Bioreactors and Others), By Mode (In-House Validation and Outsourced Validation), By End-User (Pharmaceutical & Biotechnology Companies, Medical Device Companies, CROs and CDMOs, and Academic Institutions and Research Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sartorius AG, Thermo Fisher Scientific Inc., Merck KGaA, Danaher Corporation, Repligen Corporation, Meissner Filtration Products, Inc., Eurofins Scientific, SGS S.A., Lonza Group, Charles River Laboratories, Catalent, Inc., Asahi Kasei Corporation, Bio-Rad Laboratories, WuXi AppTec, Toxikon Corporation, Cobetter Filtration Equipment Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bioprocess Validation MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Bioprocess Validation MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Asahi Kasei Corporation

- Bio-Rad Laboratories

- Catalent, Inc.

- Charles River Laboratories

- Cobetter Filtration Equipment Co., Ltd.

- Danaher Corporation

- Eurofins Scientific

- Lonza Group

- Meissner Filtration Products, Inc.

- Merck KGaA

- Repligen Corporation

- Sartorius AG

- SGS S.A.

- Thermo Fisher Scientific Inc.

- Toxikon Corporation

- WuXi AppTec