Biomaterials Market By Product Type (Metallic, Polymers, Natural, and Ceramics) By Application (Orthopedic (Viscosupplementation, Spine Biomaterials, Orthobiologics, Joint Replacement Biomaterials, Bioresorbable Tissue Fixation Products, and Others), Cardiovascular (Vascular Grafts, Stents, Sensors, Pacemakers, Implantable Cardiac Defibrillators, Guidewires, and Others), Dental (Tissue Regeneration Materials, Dental Membranes, Dental Implants, Bone Grafts & Substitutes, and Others), Wound Healing (Surgical Hemostats, Skin Substitutes, Internal Tissue Sealant, Fracture Healing Device, Adhesion Barrier, and Others), Tissue Engineering, Plastic Surgery (Facial Wrinkle Treatment, Soft Tissue Fillers, Peripheral Nerve Repair, Craniofacial Surgery, Bioengineered Skins, Acellular Dermal Matrices, and Others), and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 104352

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

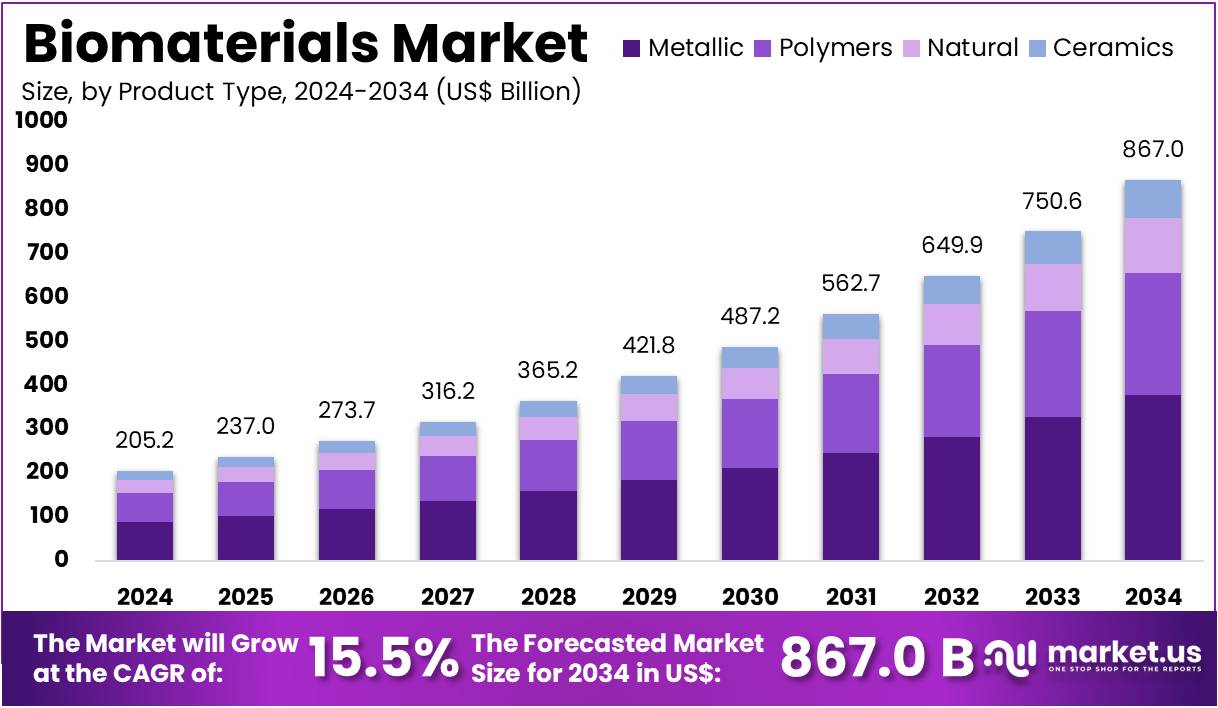

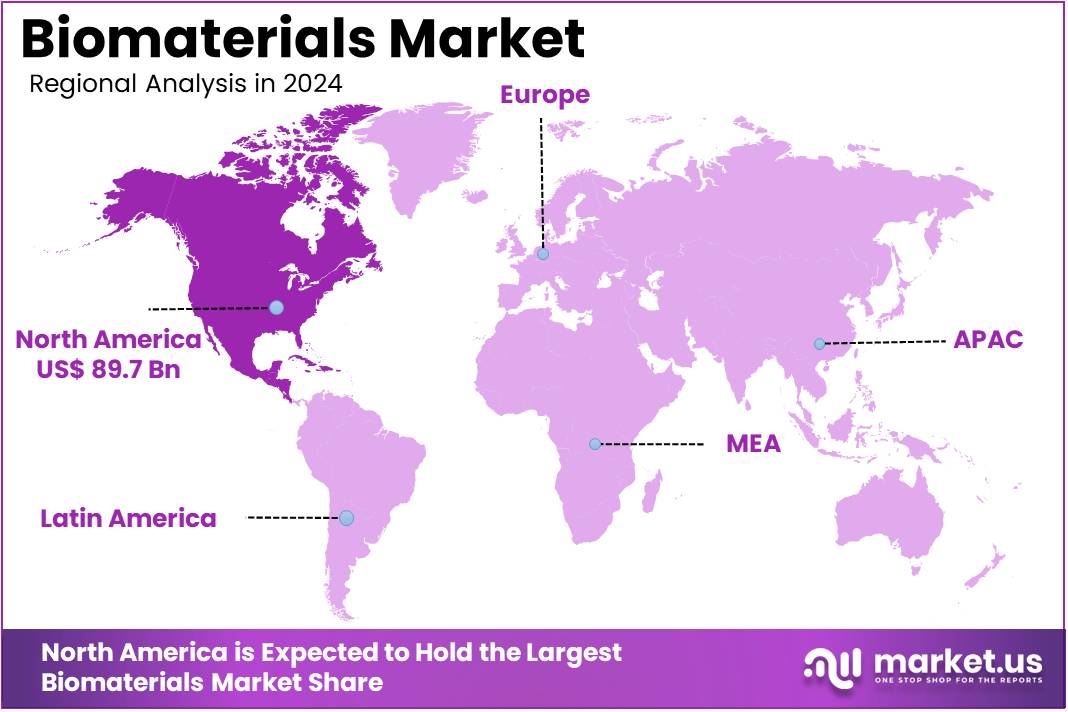

The Biomaterials Market Size is expected to be worth around US$ 867.0 billion by 2034 from US$ 205.2 billion in 2024, growing at a CAGR of 15.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.7% share and holds US$ 89.7 Billion market value for the year.

Rising healthcare expenditure and the increasing prevalence of chronic diseases are key drivers for the biomaterials market. The global demand for medical implants, surgical devices, and regenerative therapies is surging due to the aging population and the growing burden of conditions such as cardiovascular disease, arthritis, and orthopedic injuries.

The World Health Organization (WHO) reports that musculoskeletal conditions affect approximately 1.71 billion people globally, a figure that highlights the immense and sustained need for biomaterial-based solutions. These materials are crucial for applications ranging from joint replacements and dental implants to cardiovascular stents and wound healing products, making them a foundational component of modern medical care.

Growing technological advancements, particularly in areas like 3D printing and biofabrication, are creating significant opportunities for market expansion. Companies are leveraging these innovations to develop highly specialized biomaterials with enhanced properties and functionality.

In March 2022, Evonik enhanced its 3D-printable biomaterials portfolio by introducing the osteoconductive VESTAKEEP iC4800 3DF PEEK filament. This advanced material is designed to promote better fusion between implants and bone, offering substantial potential for growth in the orthopedic and dental sectors. This trend towards creating materials that actively promote healing and integration, rather than simply acting as inert replacements, is a major force shaping the market’s future.

Increasing investments in regenerative and personalized medicine are also fueling the market’s growth trajectory. The National Institutes of Health (NIH) consistently invests billions of dollars in research related to tissue engineering, regenerative medicine, and materials science, accelerating the development of novel biomaterials.

For instance, the NIH’s National Institute of Biomedical Imaging and Bioengineering (NIBIB) has funded numerous projects aimed at creating biocompatible scaffolds for organ regeneration and advanced drug delivery systems. The Agency for Healthcare Research and Quality (AHRQ) has also documented a consistent rise in orthopedic procedures, with over 1.6 million arthroplasties performed annually in the United States, underscoring the high volume of surgical applications that rely on these advanced materials. This combination of public funding, private innovation, and clinical demand ensures a robust and dynamic market for biomaterials.

Key Takeaways

- In 2024, the market for biomaterials generated a revenue of US$ 205.2 billion, with a CAGR of 15.5%, and is expected to reach US$ 867.0 billion by the year 2034.

- The product type segment is divided into metallic, polymers, natural, and ceramics, with metallic taking the lead in 2023 with a market share of 43.6%.

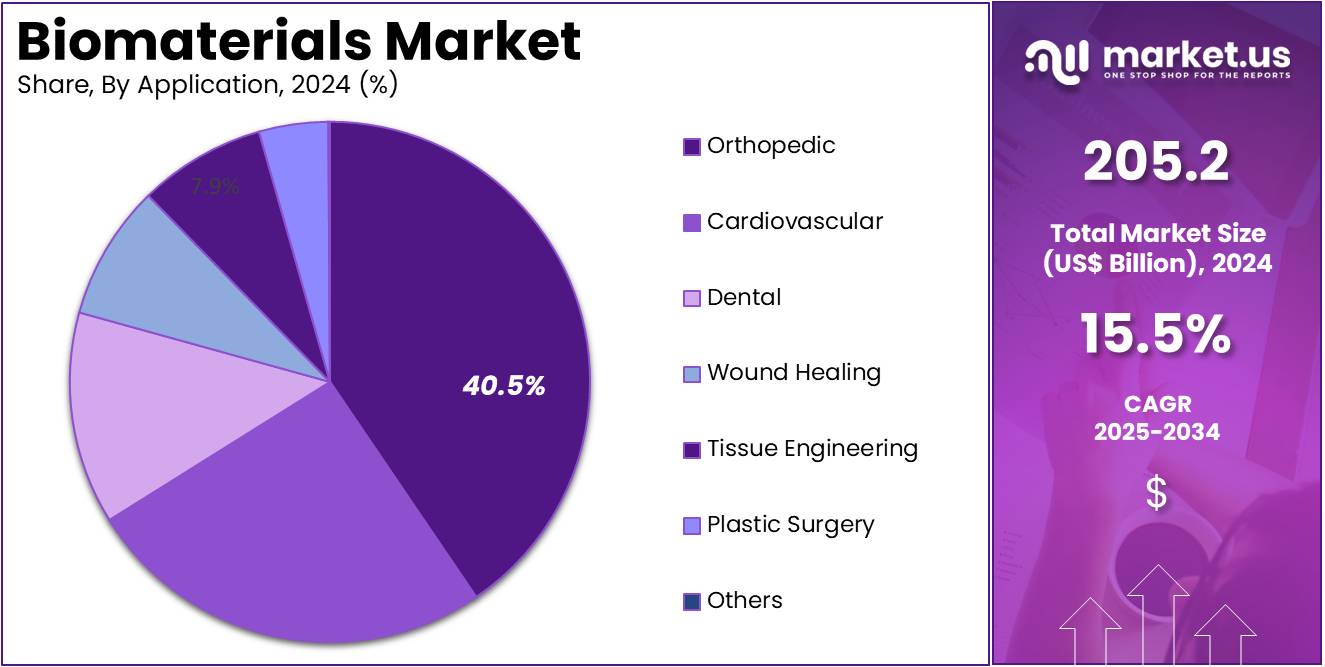

- Considering application, the market is divided into orthopedic, cardiovascular, dental, wound healing, tissue engineering, plastic surgery, and others. Among these, orthopedic held a significant share of 40.5%.

- North America led the market by securing a market share of 43.7% in 2023.

Product Type Analysis

Metallic biomaterials account for 43.6% of the product type segment in the biomaterials market. This growth is expected to continue due to the significant use of metals in medical applications, particularly in orthopedic and cardiovascular devices.

Metals like titanium, stainless steel, and cobalt-chromium are widely used in implants, prosthetics, and surgical instruments because of their strength, durability, and biocompatibility. As the global population ages and the prevalence of musculoskeletal disorders and cardiovascular diseases increases, the demand for metallic biomaterials is anticipated to rise.

Additionally, ongoing advancements in metal alloys and surface coatings are expected to improve the performance and longevity of metallic implants, further driving growth in this segment. The use of metallic biomaterials in minimally invasive surgeries is likely to contribute to their increasing adoption. Furthermore, the expanding healthcare infrastructure and the growing number of elective and reconstructive surgeries globally are projected to support the continued demand for metallic biomaterials in the market.

Application Analysis

Orthopedic applications account for 40.5% of the application segment in the biomaterials market. This segment’s growth is expected to continue as the global prevalence of orthopedic conditions, such as arthritis, osteoporosis, and sports-related injuries, rises. Orthopedic biomaterials, including metallic implants, polymers, and ceramics, are essential for joint replacement surgeries, bone fracture repairs, and spinal fusion procedures.

The increasing number of orthopedic surgeries, particularly joint replacements, is likely to drive the demand for biomaterials in this field. As the global elderly population increases, the demand for orthopedic treatments, particularly hip and knee replacements, is projected to grow significantly.

Additionally, innovations in 3D printing technologies for custom implants and the development of advanced biomaterials that offer better compatibility and faster recovery times are expected to enhance the growth of the orthopedic segment. The focus on improving patient outcomes and the longevity of orthopedic implants is anticipated to further contribute to the segment’s growth. Increased healthcare investments in orthopedic surgeries in both developed and emerging markets will likely propel demand in this area.

Key Market Segments

By Product Type

- Metallic

- Polymers

- Natural

- Ceramics

By Application

- Orthopedic

- Viscosupplementation

- Spine Biomaterials

- Orthobiologics

- Joint Replacement Biomaterials

- Bioresorbable Tissue Fixation Products

- Others

- Cardiovascular

- Vascular Grafts

- Stents

- Sensors

- Pacemakers

- Implantable Cardiac Defibrillators

- Guidewires

- Others

- Dental

- Tissue Regeneration Materials

- Dental Membranes

- Dental Implants

- Bone Grafts & Substitutes

- Others

- Wound Healing

- Surgical Hemostats

- Skin Substitutes

- Internal Tissue Sealant

- Fracture Healing Device

- Adhesion Barrier

- Others

- Tissue Engineering

- Plastic Surgery

- Facial Wrinkle Treatment

- Soft Tissue Fillers

- Peripheral Nerve Repair

- Craniofacial Surgery

- Bioengineered Skins

- Acellular Dermal Matrices

- Others

- Others

Drivers

The rising global incidence of chronic diseases and an aging population is driving the market

The biomaterials market is experiencing significant growth, primarily driven by the escalating global burden of chronic diseases and the demographic shift towards an older population. Conditions such as cardiovascular diseases, orthopedic disorders, and dental ailments are becoming more prevalent, creating a sustained demand for implants, prosthetics, and regenerative products. For instance, the demand for joint replacements has consistently increased due to arthritis and age-related wear and tear.

According to the American Academy of Orthopaedic Surgeons (AAOS), there were approximately 1.3 million total hip and knee replacement surgeries performed in the US in 2023, a figure that continues to rise annually. Similarly, the aging population is at a higher risk for fractures and other skeletal issues, which require advanced materials for repair and reconstruction. This demographic trend, coupled with advancements in surgical techniques, ensures a persistent and expanding patient base that relies on these materials for life-improving and life-saving interventions.

Restraints

The stringent and complex regulatory approval processes are restraining the market

A significant restraint on the market is the highly stringent and complex regulatory landscape governing the use of new materials in medical applications. Because these products are intended for permanent or long-term implantation within the human body, government agencies enforce rigorous standards to ensure patient safety and product efficacy. This results in lengthy and expensive approval pathways, which can deter innovation and delay market entry for new technologies.

For example, the US Food and Drug Administration (FDA) requires extensive preclinical and clinical data for Premarket Approval (PMA) of Class III devices, a process that can take a substantial amount of time. According to a 2024 analysis of FDA data, the average PMA application takes over 240 days for a decision. This prolonged timeline, combined with the substantial financial investment required for clinical trials, poses a major hurdle for smaller companies and can limit the speed at which groundbreaking new materials can reach patients who need them.

Opportunities

The increasing adoption of 3D printing and additive manufacturing is creating growth opportunities

The market is presented with significant opportunities from the rapid adoption of 3D printing and additive manufacturing technologies for medical applications. These advanced manufacturing techniques allow for the creation of patient-specific, customized implants and surgical tools with unprecedented precision and geometric complexity. This is a game-changer for orthopedic and dental applications, where a perfect fit is critical for a positive patient outcome.

The US Food and Drug Administration (FDA) has actively supported this trend, with the number of 3D-printed medical devices cleared for use steadily growing. In fact, by late 2024, the FDA had cleared over 100 3D-printed medical items. This technology enables the fabrication of porous, lightweight structures that promote better bone ingrowth and integration, which is a major advantage over traditional manufacturing methods. As costs for 3D printing equipment decrease and material properties improve, this technology is anticipated to become a standard for custom medical implants and scaffolds, driving significant growth.

Impact of Macroeconomic / Geopolitical Factors

The biomaterials market operates within a complex macroeconomic and geopolitical landscape that influences both research and development efforts as well as supply chain stability. A significant driver of growth is the U.S. government funding for medical research, particularly through the National Institutes of Health (NIH). Over the past decade, the NIH budget has consistently increased, with funding rising from US$30.3 billion in 2015 to over US$47.6 billion in 2023. This ongoing investment directly supports the development of advanced biomaterials and fosters innovation within the sector.

However, geopolitical tensions and evolving trade policies are introducing significant cost pressures. A notable example is the new EU regulation implemented in June 2025 under the International Procurement Instrument (IPI). This regulation restricts access to the EU’s public procurement market for medical devices originating from China for contracts exceeding €5 million. It also limits the share of Chinese-sourced inputs to no more than 50% for successful bids. Such measures have the potential to impact the cost and complexity of supply chains for a wide range of medical devices, introducing new challenges for manufacturers.

Despite these headwinds, the fundamental drivers of the market remain strong. Manufacturers continue to prioritize innovation, with consistent investment in research and development to advance new technologies and diversify supply chains. This commitment to innovation ensures the sector’s long-term growth and resilience, even amid a challenging economic and geopolitical environment.

Latest Trends

The shift towards biodegradable and bioresorbable polymers is a recent trend

A significant trend in 2024 is the shift away from permanent, non-degradable materials toward those that can safely dissolve or be absorbed by the body over time. This trend is driven by a desire to eliminate the need for secondary surgical procedures to remove implants once their purpose has been served. Biodegradable polymers, which gradually break down into non-toxic byproducts, are at the forefront of this movement.

For instance, temporary orthopedic scaffolds or drug-eluting stents can be designed to provide mechanical support or release medication for a specific period before disappearing, reducing the risk of long-term complications. A 2023 review of the field highlighted the exponential growth in research and development of these materials. The ability of biodegradable polymers to mimic the body’s natural healing processes and eliminate the need for follow-up surgeries is making them an increasingly preferred choice for a variety of applications, from sutures to bone fixation devices.

Regional Analysis

North America is leading the Biomaterials Market

The North American market for biomaterials held a commanding 43.7% share of the global market in 2024. This dominant position is a direct result of the region’s highly advanced healthcare infrastructure, significant government and private funding for research and development, and a high prevalence of chronic and age-related diseases. The demand for biomaterials is particularly strong in orthopedic and cardiovascular applications.

According to the American Heart Association, a staggering 127.9 million US adults had some form of cardiovascular disease between 2017 and 2020, with heart disease and stroke accounting for over 930,000 deaths in 2021. This substantial disease burden necessitates the use of advanced medical implants and devices, such as stents and vascular grafts, which are a key application for these materials.

Furthermore, a culture of innovation and collaboration between academic institutions, government bodies like the National Institutes of Health (NIH), and industry leaders propels the market forward. The NIH, for instance, allocated a significant portion of its nearly US$48 billion budget in 2023 to biomedical research, including the development of new and improved biomaterials. This funding supports basic and translational science, ensuring that laboratory discoveries are effectively translated into clinical applications.

The emphasis on regenerative medicine and personalized implants, alongside the presence of leading manufacturers, contributes to a robust pipeline of new products and technologies, solidifying North America’s position as a market leader.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific biomaterials market is anticipated to experience the fastest growth during the forecast period. This is largely a result of rapidly improving healthcare infrastructure, a large and aging population, and increasing government investments in the medical device sector. The World Health Organization’s (WHO) report on population aging highlights that the proportion of individuals aged 60 and above is expected to exceed 25% of the total population by 2050. This demographic shift is likely to create a significant and sustained demand for orthopedic implants, dental restorations, and cardiovascular devices, all of which rely heavily on advanced materials.

The market’s expansion is further supported by proactive government policies aimed at promoting domestic manufacturing and innovation. China’s total expenditure on R&D reached 3.6 trillion yuan (approximately US$496 billion) in 2024, demonstrating its commitment to becoming a leader in medical technology. Similarly, Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) is actively working to streamline regulatory processes to accelerate patient access to innovative medical devices. The rising prevalence of chronic diseases in the region, coupled with a growing awareness of the benefits of advanced medical treatments, is projected to fuel the adoption of these materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the biomaterials market are employing a multifaceted growth strategy centered on technological innovation, strategic acquisitions, and market diversification. Companies are consistently investing in research and development to create next-generation materials with enhanced biocompatibility, biodegradability, and structural properties, which improves the performance and safety of medical implants. They are also actively acquiring specialized firms to expand their product portfolios into high-growth areas like tissue engineering and regenerative medicine.

Furthermore, manufacturers are diversifying their applications, moving beyond traditional orthopedic and dental uses to target new opportunities in fields such as cardiology and plastic surgery. This approach reinforces their position as key innovators in the medical device and therapeutic sectors.

Terumo Corporation, a leading Japanese medical device company, holds a prominent position in the healthcare industry. Founded in 1921, the company is recognized for its broad range of medical disposables, cardiovascular systems, and blood management products.

Terumo’s strategic focus is on transforming its value proposition from simply selling devices to providing comprehensive solutions for its customers. This includes developing advanced technologies that support minimally invasive procedures and improving the quality of life for patients globally. Through a combination of internal development and targeted acquisitions, Terumo consistently strengthens its position in key healthcare segments.

Top Key Players in the Biomaterials Market

- Zimmer Biomet Holdings, Inc

- Stryker Corporation

- MycoWorks

- Medtronic plc

- Johnson & Johnson

- Jellagen

- Invibio Ltd

- Evonik Industries AG

- DentsplySirona

- Covalon Technologies Ltd

- Corbion

- CoorsTek Inc

- Carpenter Technology Corporation

- Berkeley Advanced Biomaterials

- BASF SE

Recent Developments

- In March 2023: Invibio Biomaterial Solutions unveiled its Peek-Optima Am filament, a polyetheretherketone (PEEK) polymer, aimed at advancing the production of 3D-printed medical devices.

- In January 2023: Zimmer Biomet Holdings, Inc. announced its acquisition of Embody, Inc. for US$ 155 million, with a potential total of US$ 275 million contingent on achieving specific milestones. This acquisition is poised to enhance Zimmer Biomet’s capabilities in sports medicine, specifically targeting soft tissue repair.

Report Scope

Report Features Description Market Value (2024) US$ 205.2 billion Forecast Revenue (2034) US$ 867.0 billion CAGR (2025-2034) 15.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Metallic, Polymers, Natural, and Ceramics) By Application (Orthopedic (Viscosupplementation, Spine Biomaterials, Orthobiologics, Joint Replacement Biomaterials, Bioresorbable Tissue Fixation Products, and Others), Cardiovascular (Vascular Grafts, Stents, Sensors, Pacemakers, Implantable Cardiac Defibrillators, Guidewires, and Others), Dental (Tissue Regeneration Materials, Dental Membranes, Dental Implants, Bone Grafts & Substitutes, and Others), Wound Healing (Surgical Hemostats, Skin Substitutes, Internal Tissue Sealant, Fracture Healing Device, Adhesion Barrier, and Others), Tissue Engineering, Plastic Surgery (Facial Wrinkle Treatment, Soft Tissue Fillers, Peripheral Nerve Repair, Craniofacial Surgery, Bioengineered Skins, Acellular Dermal Matrices, and Others), and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Biomet Holdings, Inc, Stryker Corporation, MycoWorks, Medtronic plc, Johnson & Johnson, Jellagen, Invibio Ltd, Evonik Industries AG, DentsplySirona, Covalon Technologies Ltd, Corbion, CoorsTek Inc, Carpenter Technology Corporation, Berkeley Advanced Biomaterials, BASF SE. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zimmer Biomet Holdings, Inc

- Stryker Corporation

- MycoWorks

- Medtronic plc

- Johnson & Johnson

- Jellagen

- Invibio Ltd

- Evonik Industries AG

- DentsplySirona

- Covalon Technologies Ltd

- Corbion

- CoorsTek Inc

- Carpenter Technology Corporation

- Berkeley Advanced Biomaterials

- BASF SE