Bioinformatics Services Market Product Type (Sequencing Services, Data Analysis Services, Gene Expression, Drug Discovery Services, Data Base Management and Other Product Types) By Application (Metabolomics, Chemoinformatics & Drug design, Proteomics, Transcriptomics, Genomics and Other Applications) By End-User (Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Academic Institutes & Research Centers and Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 59978

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

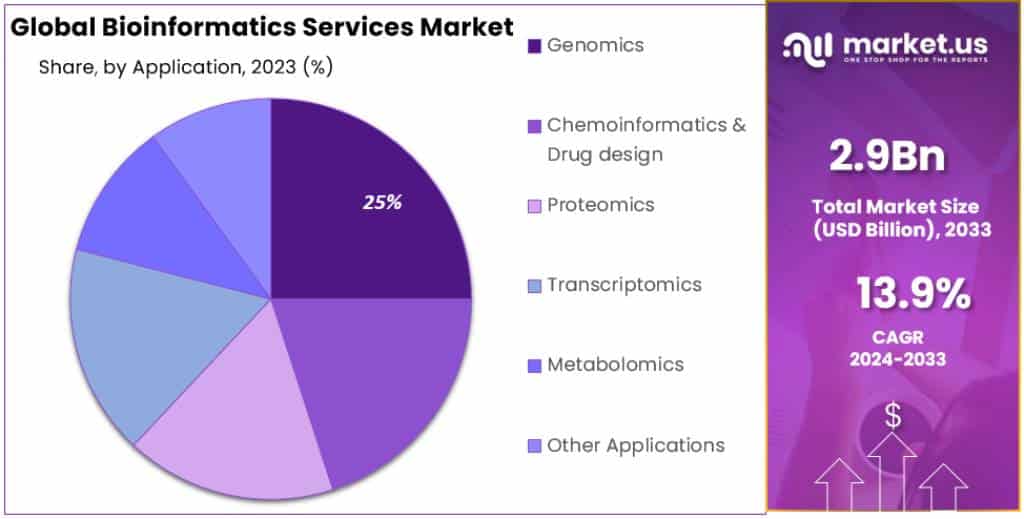

The Global Bioinformatics Services Market size is expected to be worth around USD 10.7 Billion by 2033, from USD 2.9 Billion in 2023, growing at a CAGR of 13.9% during the forecast period from 2023 to 2033.

Bioinformatics services refer to the use of bioinformatics tools and pipelines to analyze biological data generated from various sources, such as next-generation sequencing (NGS), genomics, transcriptomics, proteomics, and microarray data. These services help scientists interpret complex data, identify patterns, and draw conclusions about biological systems, aiding in the understanding of diseases, diagnostics, and drug development.

The growth of genomics-oriented R&D and the growing use of technology in drug discovery, and biomarker development are expected to drive this industry. This industry is expected to see significant progress due to a gradual decrease in the costs of DNA sequencing.

Key Takeaways

- The Bioinformatics Services Market is predicted to grow at a CAGR of 13.9% annually.

- By 2033, the market is expected to reach a value of approximately USD 10.7 billion, up from USD 2.9 billion in 2023.

- In 2023, Sequencing Services held the largest market share, at over 27%.

- In 2023, Genomics dominated the market by application, with over 25% share.

- North America led the market with a 37.7% share, valued at USD 1 billion in 2023.

Product Type Analysis

In 2023, the Bioinformatics Services Market observed Sequencing Services holding a dominant market position, capturing more than a 27% share. This segment’s growth is fueled by the escalating demand for next-generation sequencing in clinical and research domains.

Data Analysis Services followed closely, reflecting the increasing necessity for intricate analysis of complex biological data. The proliferation of genomic data has intensified the need for these services, contributing significantly to market expansion.

Gene Expression services also played a crucial role in the market. This segment benefits from the growing research in understanding the role of genes in diseases and the development of targeted therapies. The demand in this segment is driven by advancements in gene editing and molecular biology techniques.

Drug Discovery Services, another key segment, leverages bioinformatics for efficient drug development processes. This segment’s growth is propelled by the integration of bioinformatics in identifying novel drug targets and personalizing medical treatments, marking a shift in the pharmaceutical industry’s approach.

Database Management emerged as an essential segment, addressing the challenges of storing, managing, and interpreting vast biological datasets. The surge in data volumes from genomic projects necessitates robust database management solutions, underscoring its importance in the market.

Application Analysis

In 2023, the Bioinformatics Services Market by application saw Genomics holding a dominant market position, capturing more than a 25% share. This prominence is due to the escalating demand for genomic analysis in various sectors, including healthcare and agriculture.

Metabolomics emerged as another significant segment. This field’s growth is driven by its crucial role in understanding metabolic processes and their implications in disease mechanisms. The increasing use of metabolomics in personalized medicine and drug development further underscores its market importance.

Chemoinformatics & Drug Design has also seen notable growth. This segment benefits from the integration of bioinformatics in streamlining drug discovery and development processes. The use of computational tools in chemoinformatics significantly accelerates the identification of potential drug candidates.

Proteomics, focusing on the study of proteomes, has become increasingly relevant. The demand in this segment is fueled by the need to understand protein functions and interactions, particularly in the context of disease pathology and therapy development.

Transcriptomics holds a key position in the market, driven by advancements in RNA-sequencing technologies. This segment’s growth is attributed to the rising interest in studying gene expression patterns and their role in disease and development.

Other Applications in the bioinformatics services market encompass a range of specialized areas that cater to emerging research and clinical needs. This segment’s diversity enables the market to address a broad spectrum of applications, contributing to the robust growth and dynamism of the bioinformatics services industry.

End-User Analysis

In 2023, the Bioinformatics Services Market by end-user observed Academic Institutes & Research Centers holding a dominant position, capturing more than a 35% share. This significant share is attributed to the extensive research activities and advancements in biological sciences conducted in these institutions.

Hospitals and clinics emerged as another vital segment. The integration of bioinformatics in clinical settings, especially for personalized medicine and genomic data analysis, has been a key driver for growth in this sector. This trend underscores the increasing role of bioinformatics in improving patient care and treatment outcomes.

Pharmaceutical and biotechnology Companies also constitute a major segment. These companies extensively utilize bioinformatics for drug discovery, development, and genomic research, making them significant consumers of these services. The growing investment in R&D activities by these companies further fuels this segment’s expansion.

Other End-Users in the bioinformatics services market include a diverse range of sectors such as agriculture, environmental biotechnology, and forensic biology. These areas benefit from bioinformatics applications in various ways, contributing to the market’s overall growth. The diversity of end-users reflects the broad applicability of bioinformatics across multiple fields and industries.

Key Market Segments

Product Type

- Sequencing Services

- Data Analysis Services

- Gene Expression

- Drug Discovery Services

- Data Base Management

- Other Product Types

Application

- Metabolomics

- Chemoinformatics & Drug design

- Proteomics

- Transcriptomics

- Genomics

- Other Applications

End-User

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Academic Institutes & Research Centers

- Other End-Users

Driver

Streamlined Processes and Enhanced Domain Knowledge

The bioinformatics services market is driven by the ability to streamline processes and expand domain knowledge. Contract research services in India, widely utilized by pharmaceutical and healthcare companies, are pivotal for lead optimization and enhancing manufacturing procedures. This streamlined approach not only accelerates workflows but also deepens field expertise.

Restraint

Complexity of Data Management

The market faces a significant challenge in managing sophisticated data. The deluge of biological data necessitates a shift from traditional hypothesis-driven methods to data-driven processes. This complexity requires substantial infrastructure for data storage, retrieval, and high-dimensional data processing, adding extra costs for service providers.

Opportunity

Decrease in Sequencing Costs and Increase in Data Volume

A major opportunity lies in the decreasing costs of genome sequencing, thanks to technological advancements. The reduced sequencing costs have broadened the usage of new sequencing technologies globally, generating an increased volume of data and opening up new avenues for the bioinformatics services market.

Challenge

Handling Complex Data

One of the biggest challenges in the bioinformatics services market is the complexity of data. Handling the surge in data from high-throughput biological experiments requires advanced tools and skilled professionals. The need for substantial infrastructure for data processing and storage, coupled with the necessity for rigorous analysis and appropriate software for visualization, poses a significant hurdle.

Trends

- Increasing Government Initiatives: Governments worldwide are increasingly investing in genomics-oriented R&D, boosting market growth.

- Rising Demand for Integrated Data Solutions: The need to manage large volumes of data from high-throughput sequencing technologies is fostering market growth.

- Growth in R&D Investments: Increasing investments in metabolomics, proteomics, and transcriptomics are expected to surge the demand for IT applications, data storage, and analysis capabilities.

- ICT Infrastructure Development: The development of Information and Communication Technology (ICT) infrastructure, including cloud computing, is driving R&D in this sector, influencing market progress.

- Skilled Personnel Shortage: The lack of skilled professionals capable of using bioinformatics tools effectively remains a challenge.

- Partnerships Between Pharmaceuticals and IT: Collaborations between IT and pharma companies are creating significant opportunities in the bioinformatics services market.

- Expanding Applications: The use of bioinformatics services in diverse industries like food, agriculture, and forensics is opening new revenue streams and driving market growth.

- In-House Bioinformatics Solutions: The trend of developing in-house bioinformatics expertise and open-source tools is supporting the overall bioinformatics market but limiting the growth of the services market.

- Cost-Effectiveness: Outsourcing bioinformatics, particularly in regions like India, offers cost advantages in clinical trials and contract research, reducing the need for full-time hiring and infrastructure investments.

Regional Analysis

In 2023, North America led the Bioinformatics Services Market, commanding a dominant 37.7% share with a valuation of USD 1 billion. This region’s dominance is attributed to a well-structured regulatory framework and high industry participant penetration, fueling revenue generation.

The region’s significant contribution stems from the concurrent development of next-generation sequencing and chemical laboratories, primarily driving the high uptake of drug discovery-based informatics services.

Conversely, the Asia Pacific region is projected to experience the fastest growth in the bioinformatics services market. Anticipated to grow at a double-digit rate from 2016 to 2024, this surge is due to improvements in healthcare infrastructure and initiatives by pharmaceutical companies in the region.

With 60% of the world’s population, even a low disease prevalence translates into a large patient pool, particularly for infectious diseases, thereby driving market growth. Countries like India and Australia are significantly contributing to the revenue and progress in the Asia Pacific region. The growing trend of outsourcing services and the creation of necessary infrastructure, driven by government investment and academic innovation, are pivotal in shaping the market dynamics in this region.

In the United States, the FDA and CDER’s approval of 26 new molecular entities (NMEs) by mid-2021 highlights the region’s robust R&D activities. This trend necessitates advanced databases and software for drug design and development, further propelling market growth.

The introduction and increasing usage of advanced bioinformatics software, such as BALL, Bioclipse, RasMol, and AUTODOCK, particularly for biomarker discovery and toxicity detection in early drug development stages, are expected to fuel the industry’s growth. For instance, in June 2022, My Intelligent Machines (MIMs) launched sophisticated software for drug development in oncology.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The bioinformatics services market is characterized by a competitive landscape with the presence of numerous players. Major global entities like Illumina Inc., Thermo Fisher Scientific, and Agilent Technologies are prominent in the market, holding significant shares.

These key players are known for their technological advancements and innovative product offerings. Alongside these industry giants, other notable players such as Accelerys Inc., Qiagen Inc., GVK Biosciences, Life Technologies Corp., Celera Corp., IBM Life Sciences, FIOS Genomics, PerkinElmer Inc., Premier Biosoft, QIAGEN N.V., Gene Code Corporation, DNANEXUS, INC., and Biomax Informatics AG also make substantial contributions to the market.

These companies, ranging from large to mid-size and smaller firms, are enhancing their market presence by launching new and innovative products, thereby diversifying the competitive landscape of the bioinformatics services market.

Маrkеt Кеу Рlауеrѕ

- Accelerys Inc.

- Qiagen Inc.

- GVK Biosciences

- Illumina Inc.

- Agilent Technologies

- Life Technologies Corp.

- Celera Corp.

- IBM Life Sciences

- FIOS Genomics

- PerkinElmer Inc.

- Premier Biosoft

- QIAGEN N.V.

- Thermo Fisher Scientific

- Gene Code Corporation

- DNANEXUS, INC.

- Biomax Informatics AG

- Other Key Players

Recent Developments

- In January 2024: Qiagen announced a significant expansion of investments into its Qiagen Digital Insights (QDI) business. This investment is aimed at enhancing QDI’s market-leading position in bioinformatics, with plans to launch at least five new products and implement new enhancements across the existing product portfolio. This strategic move is supported by Qiagen’s robust sales in the bioinformatics sector, which were approximately $100 million in 2023. The expansion includes broadening the applications of Artificial Intelligence and Natural Language Processing capabilities within the sector.

- In January 2023: Agilent Technologies announced a substantial investment of $725 million to double its manufacturing capacity for nucleic acid-based therapeutics. This investment responds to the rapid growth in the therapeutic oligonucleotides market, which is projected to grow from $1 billion to $2.4 billion by 2027. The expansion will introduce two new manufacturing lines, enhancing Agilent’s capability to meet increasing demand for siRNA, antisense, and CRISPR guide RNA molecules.

Report Scope

Report Features Description Market Value (2023) US$ 2.9 Billion Forecast Revenue (2033) US$ 10.7 Billion CAGR (2023-2032) 13.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sequencing Services, Data Analysis Services, Gene Expression, Drug Discovery Services, Data Base Management and Other Product Types) By Application (Metabolomics, Chemoinformatics & Drug design, Proteomics, Transcriptomics, Genomics and Other Applications) By End-User (Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Academic Institutes & Research Centers and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Accelerys Inc., Qiagen Inc., GVK Biosciences, Illumina Inc., Agilent Technologies, Life Technologies Corp., Celera Corp., IBM Life Sciences, FIOS Genomics, PerkinElmer Inc., Premier Biosoft, QIAGEN N.V., Thermo Fisher Scientific, Gene Code Corporation, DNANEXUS, INC., Biomax Informatics AG, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bioinformatics Services MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Bioinformatics Services MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Accelerys Inc.

- Qiagen Inc.

- GVK Biosciences

- Illumina Inc.

- Agilent Technologies

- Life Technologies Corp.

- Celera Corp.

- IBM Life Sciences

- FIOS Genomics

- PerkinElmer Inc.

- Premier Biosoft

- QIAGEN N.V.

- Thermo Fisher Scientific

- Gene Code Corporation

- DNANEXUS, INC.

- Biomax Informatics AG

- Other Key Players