Global Biodegradable Packaging Market Report By Type (Recycled Content Packaging, Reusable Packaging, Degradable Packaging), By Material (Plastic, Paper & Paperboard), By Application (Food & Beverages, Consumer Product, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 60739

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

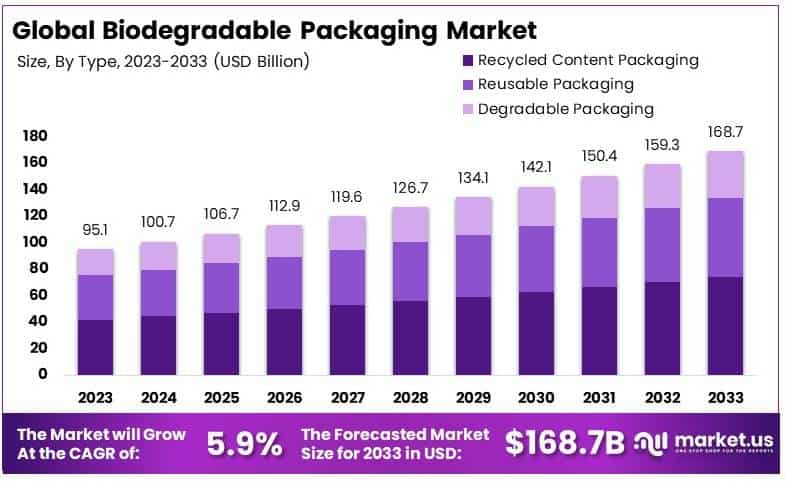

The Global Biodegradable Packaging Market size is expected to be worth around USD 168.7 Billion by 2033, from USD 95.1 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

Biodegradable packaging refers to packaging materials that can naturally decompose and return to the environment without harming it. These materials include plant-based plastics, paper, and starch blends. Biodegradable packaging is designed to reduce the environmental impact of packaging waste, supporting sustainability efforts.

The biodegradable packaging market focuses on the production and sale of eco-friendly packaging solutions. Companies across sectors like food, retail, and cosmetics are increasingly adopting biodegradable materials to reduce plastic waste and meet environmental regulations. The market is growing rapidly as both consumers and businesses prioritize sustainability.

Biodegradable packaging is gaining traction as businesses and governments seek sustainable solutions to reduce plastic pollution. The packaging industry is a significant contributor to global plastic use, responsible for around one-third of all plastic consumption. This has led to increased focus on eco-friendly alternatives, such as biodegradable plastics.

For instance, cellulose-based packaging can decompose within 28 to 120 days, depending on its coating, making it a viable replacement for conventional plastic. Many companies, including Chipotle and A&W, have already adopted compostable packaging, signaling a growing demand for sustainable packaging in the food industry.

The growth of the biodegradable packaging market is driven by several factors. Government regulations banning single-use plastics, such as the European Union’s 2021 ban on items like plates and straws, are pushing companies to adopt biodegradable solutions. In India, a similar ban was introduced in 2022, creating significant opportunities for companies offering sustainable packaging material alternatives.

On a broader scale, the adoption of biodegradable packaging is expected to have a significant environmental impact by reducing plastic waste. Globally, over 353 million tonnes of plastic waste are generated each year, and biodegradable packaging offers a viable solution to mitigate this issue.

Locally, countries with stringent regulations, such as Germany, which has a 99% return rate for plastic bottles, are seeing positive results in reducing plastic waste. Moreover, countries like Canada, which aims for zero plastic waste by 2030, are leading the charge in promoting circular economy practices that prioritize waste elimination through sustainable packaging solutions.

Government regulations and investment are key forces behind the growth of the biodegradable packaging market. The European Union has set ambitious targets, aiming for 55-80% of packaging waste to be recycled, with most EU countries already meeting the 55% target by 2021.

Similar regulations, such as bans on single-use plastics, have been introduced in more than 170 countries as part of a global effort to reduce plastic use by 2030. Additionally, initiatives like the U.S. Inflation Reduction Act and EU policies are encouraging businesses to invest in sustainable solutions.

Key Takeaways

- The Biodegradable Packaging Market was valued at USD 95.1 billion in 2023 and is expected to reach USD 168.7 billion by 2033, with a CAGR of 5.9%.

- In 2023, Recycled Content Packaging led the type segment, driven by increasing consumer demand for eco-friendly solutions.

- In 2023, Plastic was the dominant material due to its flexibility and growing innovations in biodegradable plastic alternatives.

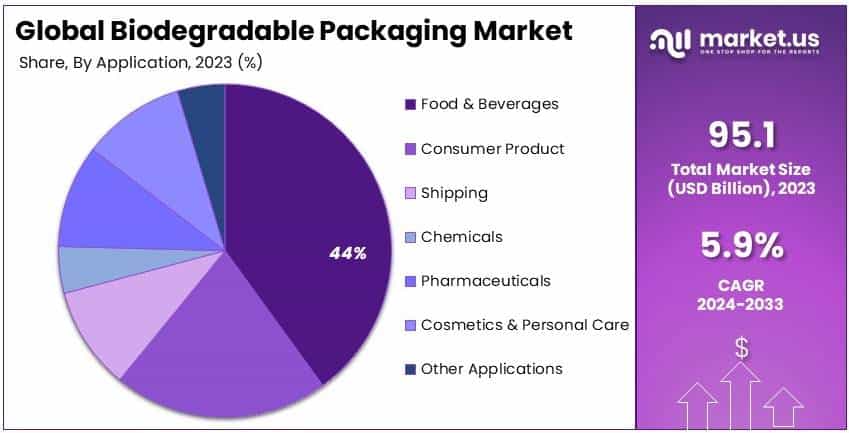

- In 2023, Food & Beverages dominated the application segment with 44%, reflecting the industry’s focus on sustainable packaging solutions.

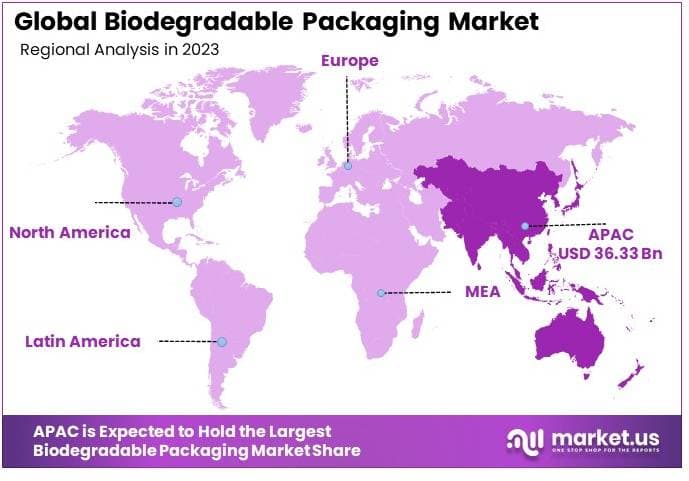

- In 2023, Asia Pacific held 38.2% of the market, driven by increasing regulatory support for sustainable packaging practices.

Type Analysis

Recycled content packaging dominates due to its substantial role in reducing environmental impact and supporting sustainability initiatives.

The biodegradable packaging market is segmented by type into recycled content packaging, reusable packaging, and degradable packaging. Recycled content packaging leads the market because it directly reduces the demand for virgin materials, significantly lowering the environmental footprint associated with production.

This type of packaging utilizes materials that have been previously used and processed to create new packaging solutions. It is highly valued in industries that are actively seeking to enhance their sustainability practices due to its effectiveness in waste reduction and resource conservation.

Reusable packaging, although not as dominant, is gaining traction due to its potential for multiple uses, reducing the need for single-use packaging solutions. This segment is particularly appealing in consumer goods and food service industries, where durable and sustainable packaging alternatives are in high demand.

Degradable packaging is designed to break down under specific conditions, which reduces its longevity in landfills and its impact on the environment. This type of packaging is essential for applications where disposal in environmentally sensitive ways is necessary.

Material Analysis

Plastics dominate due to their versatility and wide range of applications across various industries.

In the material segment, plastics take the lead, primarily because of their adaptability and functionality in packaging applications. Biodegradable plastics such as starch-based plastics, cellulose-based plastics, polylactic acid (PLA), poly-3-hydroxybutyrate (PHB), and polyhydroxyalkanoates (PHA) offer the benefits of conventional plastics without the long-term environmental harm.

Starch-based plastics are widely used due to their cost-effectiveness and ease of production, making them suitable for a variety of packaging needs.

Cellulose-based plastics provide a robust opt ion for items requiring a barrier against air and oils, which is crucial in food packaging. PLA is popular in the packaging of perishable foods due to its clear appearance and protective barrier properties. PHB and PHA are gaining attention for their use in specialty packaging applications that require biodegradability and high strength.

Paper & paperboard is another critical material type, segmented further into kraft paper, flexible paper, corrugated fiberboard, boxboard, and other materials. These materials are fundamental in reducing plastic use and enhancing recyclability in the packaging sector.

Kraft paper is extensively used for its strength and durability, making it suitable for heavy or bulky items. Flexible paper is chosen for its pliability, ideal for wrapping and cushioning products. Corrugated fiberboard is crucial for shipping and storage, providing lightweight yet sturdy packaging solutions.

Application Analysis

Food & beverages dominate the application segment with a 44% share in 2023, driven by increasing regulatory requirements.

The application of biodegradable packaging is critical across various industries, with the food & beverages sector leading due to strict regulations on packaging waste and a growing consumer preference for eco-friendly products.

This segment’s dominance is bolstered by the widespread need to reduce food waste and enhance product shelf life through effective, sustainable packaging. Biodegradable packaging solutions in this sector are crucial for maintaining the quality and safety of food products while aligning with environmental goals.

Consumer products also represent a significant application area, with manufacturers increasingly adopting biodegradable packaging to appeal to environmentally conscious consumers. This move is often part of broader corporate sustainability strategies that enhance brand reputation and consumer loyalty.

Shipping applications utilize biodegradable packaging to decrease the environmental impacts associated with logistics and transportation. The use of biodegradable materials in this sector is motivated by the need to reduce waste in the supply chain and by the growing regulatory pressures to improve packaging sustainability.

Chemicals, pharmaceuticals, and cosmetics & personal care are other important applications. Each of these sectors has specific packaging requirements influenced by product sensitivity, safety standards, and consumer expectations. In pharmaceuticals and cosmetics, biodegradable packaging is not only a response to environmental concerns but also an essential aspect of product presentation and brand identity.

Key Market Segments

By Type

- Recycled Content Packaging

- Reusable Packaging

- Degradable Packaging

By Material

- Plastic

- Starch-Based Plastics

- Cellulose-Based Plastics

- Polylactic Acid (PLA)

- Poly-3-Hydroxybutyrate (PHB)

- Polyhydroxyalkanoates (PHA)

- Other Plastics

- Paper & Paperboard

- Kraft Paper

- Flexible Paper

- Corrugated Fiberboard

- Boxboard

- Other Materials

By Application

- Food & Beverages

- Consumer Product

- Shipping

- Chemicals

- Pharmaceuticals

- Cosmetics & Personal Care

- Other Applications

Drivers

Increasing Consumer Preference for Eco-Friendly Products Drives Market Growth

The biodegradable packaging market is driven by several key factors, including increasing consumer preference for eco-friendly products, strict government regulations, and the rise of sustainable packaging solutions.

As consumers become more environmentally conscious, they are actively seeking products that use biodegradable packaging. This growing preference is compelling businesses to switch from traditional plastic packaging to biodegradable alternatives.

Government regulations play a crucial role in driving the market. Many countries have introduced bans on single-use plastics, pushing companies to adopt biodegradable packaging solutions that comply with these regulations. Furthermore, sustainable packaging solutions are gaining traction as businesses aim to meet both consumer demand and regulatory requirements, leading to further market growth.

Additionally, rising awareness of environmental pollution, particularly plastic waste, has led to a shift in consumer behavior. More people are choosing products packaged in biodegradable materials to reduce their environmental footprint.

Restraints

High Production Costs Restrain Market Growth

One of the main challenges is the high cost of producing biodegradable packaging materials. Compared to traditional plastic packaging, biodegradable alternatives require more expensive processes and materials, making them less cost-effective for businesses.

Another restraint is the limited availability of raw materials needed to produce biodegradable packaging. Sourcing materials such as plant-based polymers can be challenging, particularly in regions where agricultural production is limited. This scarcity drives up costs and limits production capacity.

Additionally, the lack of infrastructure for effective waste management further hinders market growth. While biodegradable packaging offers environmental benefits, its effectiveness depends on proper disposal systems. Many regions lack the necessary composting or recycling infrastructure to process biodegradable materials, reducing their overall impact.

Lastly, the shorter shelf life of biodegradable materials compared to traditional plastics also limits their widespread use, particularly for long-term storage. These factors collectively restrain the growth of the market.

Opportunity

Technological Innovations in Packaging Provide Opportunities

Opportunities in the biodegradable packaging market are primarily driven by technological innovations, expansion into emerging markets, and growing demand from industries such as e-commerce and food packaging.

Technological advancements in the development of biodegradable materials, such as the creation of more durable and flexible bioplastics, offer significant opportunities for market growth. These innovations enable biodegradable packaging to compete more effectively with traditional packaging in terms of functionality and durability.

Emerging markets present another area of opportunity. As developing economies grow, there is increasing demand for sustainable packaging solutions, particularly in regions with expanding middle classes and heightened environmental awareness.

Additionally, the growing demand for sustainable packaging in the food industry, particularly for ready-to-eat meals and fresh produce, presents a major opportunity. Collaboration with e-commerce platforms, where sustainable packaging is increasingly valued, also opens new avenues for growth. These factors are expected to create considerable opportunities for companies in the biodegradable packaging market.

Challenges

Competition from Conventional Packaging Challenges Market Growth

Conventional packaging, particularly plastic, remains cheaper and more accessible, making it difficult for biodegradable alternatives to gain a larger market share. Many businesses are reluctant to switch to biodegradable packaging due to the higher costs involved.

Consumer misconceptions also pose a challenge. Many consumers are unclear about the difference between biodegradable, compostable, and recyclable packaging, leading to confusion and slower adoption rates. This lack of understanding hampers the market’s growth, as consumers may not fully recognize the benefits of biodegradable packaging.

Balancing the durability of biodegradable materials with their biodegradability is another challenge. While consumers demand strong, functional packaging, it must also decompose easily, creating a difficult balance for manufacturers. Additionally, regulatory compliance across different regions complicates market expansion, as companies must navigate varying environmental standards and certifications.

Growth Factors

Increasing Adoption of Circular Economy Practices Is Growth Factor

The growth of the biodegradable packaging market is fueled by several factors, including the increasing adoption of circular economy practices, growing consumer demand for health-conscious products, and the expansion of the organic packaged food market.

Circular economy practices, which focus on reducing waste and reusing materials, are driving demand for biodegradable packaging solutions that align with these principles.

As consumers become more health-conscious, they are paying closer attention to the packaging of their products. This has led to a rise in demand for biodegradable packaging that is perceived as safer and more environmentally friendly.

Investments in green packaging technologies are further boosting market growth. Companies are increasingly investing in research and development to create more efficient, cost-effective biodegradable materials. These growth factors are expected to contribute significantly to the expansion of the biodegradable packaging market in the coming years.

Emerging Trends

Adoption of Compostable Packaging Is Latest Trending Factor

Compostable packaging, which decomposes into nutrient-rich soil, is gaining popularity as consumers and businesses seek more sustainable alternatives to plastic.

The use of plant-based materials in packaging, such as cornstarch and sugarcane, is another growing trend. These materials are renewable and biodegradable, making them an attractive option for environmentally conscious brands.

The growth of biodegradable packaging in e-commerce is also noteworthy, as online retailers increasingly look for eco-friendly packaging solutions that appeal to sustainability-minded consumers.

Finally, the shift towards zero-waste packaging is becoming a key trend, driven by the desire to reduce waste throughout the supply chain. Brands that embrace these trends are likely to benefit from increased consumer demand for sustainable products, further driving the growth of the biodegradable packaging market.

Regional Analysis

Asia Pacific Dominates with 38.2% Market Share

Asia Pacific leads the Biodegradable Packaging Market with a 38.2% share, valued at USD 36.33 billion. This dominant position is driven by rising environmental awareness, government regulations supporting eco-friendly packaging, and a growing population demanding sustainable products. Major countries like China, India, and Japan contribute to the region’s strong market presence due to increasing consumption and industrial growth.

The region benefits from its large consumer base, rapid urbanization, and a shift towards sustainable living. Strict regulations on plastic waste and growing demand for biodegradable materials, particularly in the food and beverage sector, further drive the market. Investments in research and innovation for new packaging materials enhance the region’s competitiveness in the global market.

Asia Pacific’s dominance is expected to strengthen as governments and industries continue to promote green packaging solutions. With increasing investments in renewable materials and strong support for environmental regulations, the region will likely see further expansion in biodegradable packaging, maintaining its leadership in the market.

Regional Mentions:

- North America: North America is a key player in the biodegradable packaging market, driven by consumer demand for sustainable products and strict environmental regulations. The region’s innovation in packaging technologies boosts market growth.

- Europe: Europe’s focus on sustainability and stringent regulations on plastic waste make it a strong contender in the biodegradable packaging market. The region’s efforts in reducing carbon footprints fuel market expansion.

- Middle East & Africa: The Middle East and Africa are seeing gradual growth in biodegradable packaging due to rising environmental awareness and increasing adoption of sustainable packaging in the food industry.

- Latin America: Latin America’s biodegradable packaging market is growing, driven by efforts to reduce plastic waste and an expanding food and beverage sector. Countries like Brazil and Mexico are key contributors to this market expansion.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Biodegradable Packaging Market is growing rapidly, with major players like Amcor Limited, Ball Corporation, and Mondi Group leading the way. The demand is driven by increasing environmental awareness and government regulations on plastic waste reduction, pushing businesses to adopt eco-friendly packaging.

Key players offer a wide range of biodegradable packaging solutions, including compostable plastics, paper-based packaging, and bio-based materials. These products cater to industries such as food & beverage, healthcare, and personal care, focusing on sustainability and recyclability.

Companies position themselves as eco-friendly innovators, aligning with global sustainability goals. Their strategies include forming partnerships with consumer goods companies and investing in research to develop more durable and flexible biodegradable materials.

Key players have a strong presence in North America, Europe, and Asia Pacific, where sustainability initiatives are gaining momentum. Emerging markets in Latin America and Africa show potential for growth as environmental awareness increases.

Innovation revolves around creating stronger, more versatile biodegradable materials, improving compostability, and extending shelf life. Investments in R&D help companies meet evolving consumer demands and regulatory requirements.

The competitive edge comes from being at the forefront of sustainability and innovation. Key players distinguish themselves by offering cutting-edge, eco-friendly packaging solutions that meet regulatory standards and align with consumer demand for green products.

Top Key Players in the Market

- Amcor Limited

- Ardagh Group SA

- Ball Corporation

- Braskem SA

- Cargill Incorporated

- Caraustar Industries Incorporated

- BASF SE Company Profile

- Mondi Group PLC

- Reynolds Group Holding Limited

- Tetra Pak International SA

- Other Key Players

Recent Developments

- Barley-Based Bioplastic: In October 2024, a breakthrough in bioplastic technology resulted in the development of 100% biodegradable material derived from barley, providing a sustainable alternative for food packaging and contributing to the circular economy.

- DRDO: In August 2024, the Defence Research and Development Organisation (DRDO) developed PBAT-based biodegradable packaging that decomposes within three months. This eco-friendly packaging is used in various applications, including food and medical waste bags.

- Bioelements: In June 2024, Bioelements expanded into the U.S. market, offering biodegradable, biobased, and compostable packaging solutions aimed at reducing plastic waste, in response to growing demand for sustainable materials.

- BioPowder: In September 2024, BioPowder introduced olive stone-derived powders, branded as Olea FP, for use in biodegradable packaging. These compostable powders are designed for various packaging applications, promoting circular economy practices.

Report Scope

Report Features Description Market Value (2023) USD 95.1 Billion Forecast Revenue (2033) USD 168.7 Billion CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Recycled Content Packaging, Reusable Packaging, Degradable Packaging), By Material (Plastic: Starch-Based Plastics, Cellulose-Based Plastics, Polylactic Acid (PLA), Poly-3-Hydroxybutyrate (PHB), Polyhydroxyalkanoates (PHA), Other Plastics; Paper & Paperboard: Kraft Paper, Flexible Paper, Corrugated Fiberboard, Boxboard, Other Materials), By Application (Food & Beverages, Consumer Product, Shipping, Chemicals, Pharmaceuticals, Cosmetics & Personal Care, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor Limited, Ardagh Group SA, Ball Corporation, Braskem SA, Cargill Incorporated, Caraustar Industries Incorporated, BASF SE Company Profile, Mondi Group PLC, Reynolds Group Holding Limited, Tetra Pak International SA, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biodegradable Packaging MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Biodegradable Packaging MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor Limited

- Ardagh Group SA

- Ball Corporation

- Braskem SA

- Cargill Incorporated

- Caraustar Industries Incorporated

- BASF SE

- Mondi Group PLC

- Reynolds Group Holding Limited

- Tetra Pak International SA

- Other Key Players