Biobanking Market By Product Type (Laboratory Information Management Systems, Biobanking Equipment, Biobanking Consumables), By Service (Biobanking & Repository, Qualification/ Validation, Lab Processing, Cold Chain Logistics, Other), By Biospecimen Type (Stem Cells, Human Tissues, Human Organs), By Application (Drug Discovery & Clinical Research, Therapeutics, Clinical Diagnostics, Other Applications), By Biobanks Type (Physical/Real Biobanks, Virtual Biobanks), By End-user (Pharmaceutical & Biotechnology Companies, Hospitals, CROs & CMOs, Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 21442

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Service Analysis

- Biospecimen Type Analysis

- Application Analysis

- Biobank Type Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

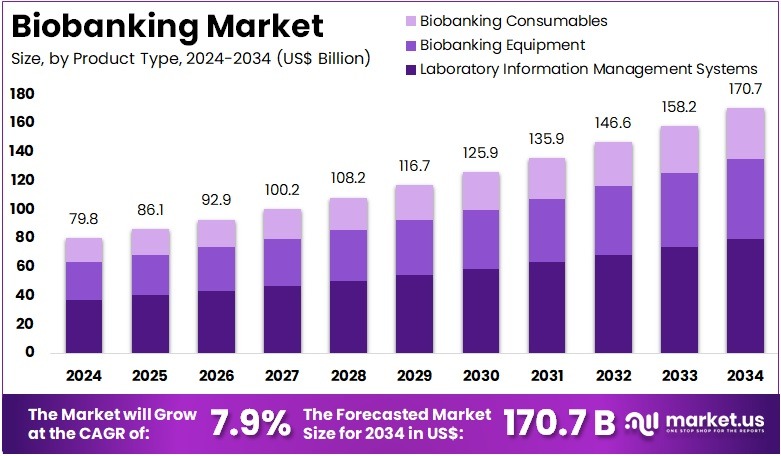

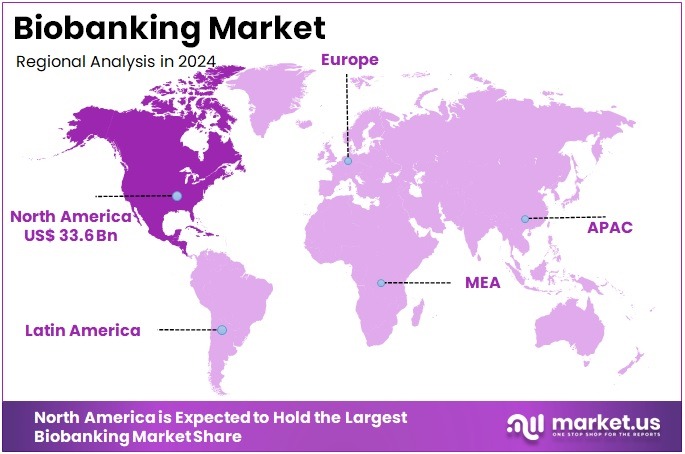

The Biobanking Market Size is expected to be worth around US$ 170.7 billion by 2034 from US$ 79.8 billion in 2024, growing at a CAGR of 7.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 42.1% share and holds US$ 33.6 Billion market value for the year.

Increasing demand for personalized medicine drives the Biobanking Market, as researchers rely on diverse biological samples to develop tailored therapies. Biobanks supply tumor tissue samples for oncology studies, enabling the identification of biomarkers for targeted cancer treatments. These repositories support genetic research by providing DNA and RNA for large-scale genomic sequencing projects.

Pharmaceutical companies utilize biobanked specimens to validate drug efficacy in preclinical trials, accelerating therapeutic development. In December 2023, Charles River Laboratories International, Inc. partnered with CELLphenomics, accessing over 500 in vitro tumor models for rare cancer research. This collaboration enhances biobanking’s role in precision oncology, fueling market growth through expanded access to specialized samples.

Growing investment in genomic research creates opportunities in the Biobanking Market, as institutions prioritize comprehensive data integration for drug discovery. Biobanks facilitate population health studies by storing blood and plasma samples, enabling longitudinal analysis of disease risk factors. These repositories support regenerative medicine by providing stem cell samples for tissue engineering applications.

Automated storage systems improve sample integrity, meeting the needs of high-throughput research environments. In October 2023, AstraZeneca’s research leveraged UK Biobank data from over 50,000 participants to uncover plasma protein-genetic variant associations. This breakthrough underscores biobanking’s critical role in identifying novel therapeutic targets, driving market expansion through enhanced research capabilities.

Rising adoption of advanced automation propels the Biobanking Market, as technologies streamline sample processing and storage. Biobanks enable liquid biopsy research by preserving circulating tumor DNA, supporting non-invasive cancer diagnostics. These repositories aid neurodegenerative disease studies by storing cerebrospinal fluid samples for biomarker discovery.

Trends toward integrated platforms enhance data traceability, ensuring compliance with regulatory standards. In July 2023, Tecan launched the Phase Separator, a technology optimizing sample processing for proteomics and genomics in biobanking. This innovation strengthens market growth by improving efficiency and data quality in oncology and neurodegenerative research applications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 79.8 billion, with a CAGR of 7.9%, and is expected to reach US$ 170.7 billion by the year 2034.

- The product type segment is divided into laboratory information management systems, biobanking equipment, and biobanking consumables, with laboratory information management systems taking the lead in 2023 with a market share of 46.7%.

- Considering service, the market is divided into biobanking & repository, qualification/validation, lab processing, cold chain logistics, and other. Among these, biobanking & repository held a significant share of 43.9%.

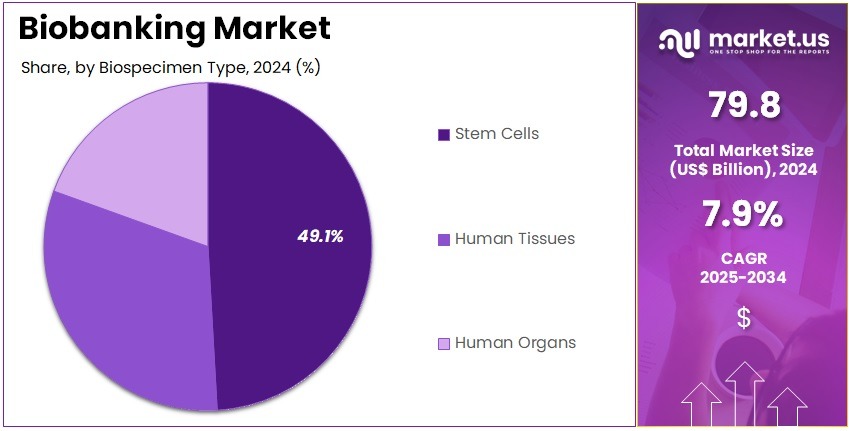

- Furthermore, concerning the biospecimen type segment, the market is segregated into stem cells, human tissues, and human organs. The stem cells sector stands out as the dominant player, holding the largest revenue share of 49.1% in the market.

- The application segment is divided into drug discovery & clinical research, therapeutics, clinical diagnostics, and other applications, with drug discovery & clinical research taking the lead in 2023 with a market share of 52.8%.

- The biobanks type segment is segregated into physical/real biobanks and virtual biobanks, with the physical/real biobanks segment leading the market, holding a revenue share of 56.3%.

- Considering end-user, the market is divided into pharmaceutical & biotechnology companies, hospitals, CROs & CMOs, and academic & research institutes. Among these, pharmaceutical & biotechnology companies held a significant share of 48.5%.

- North America led the market by securing a market share of 42.1% in 2023.

Product Type Analysis

Laboratory Information Management Systems (LIMS) hold 46.7% of the Biobanking market and are expected to lead due to their critical role in automating data collection, tracking biospecimens, and ensuring regulatory compliance. LIMS platforms enhance sample traceability, streamline workflows, and support large-scale data integration across biobanks. The increasing volume of biospecimens and demand for data-driven insights in biomedical research are projected to drive adoption.

Pharmaceutical and biotechnology companies rely on LIMS for managing multi-site repositories and ensuring data integrity during clinical trials. The growing trend of digital transformation in laboratory environments accelerates investment in advanced software solutions. Integration with artificial intelligence and cloud computing enables real-time analytics and predictive sample utilization. Regulatory frameworks such as FDA’s 21 CFR Part 11 and GDPR compliance further promote LIMS adoption.

Enhanced security features and interoperability with electronic health records improve transparency and collaboration. The need for standardized documentation and audit trails in biobanking strengthens the use of LIMS. Increasing partnerships between software developers and biobanks for customized solutions support innovation. As the complexity of biospecimen data rises, LIMS is anticipated to remain the backbone of efficient biobank operations worldwide.

Service Analysis

Biobanking and repository services account for 43.9% of the service segment and are projected to dominate due to their indispensable function in the collection, processing, and long-term storage of biospecimens. These services ensure sample integrity for downstream applications such as drug discovery, clinical research, and genomics. Growing demand for high-quality biological materials in personalized medicine and regenerative therapies is expected to fuel expansion.

Pharmaceutical and biotech companies increasingly outsource repository functions to specialized service providers to reduce costs and maintain compliance with international quality standards. The rise in clinical trials and translational research drives demand for advanced storage and retrieval systems. Government-funded biobanking initiatives aimed at creating population-level biorepositories enhance market growth. The adoption of cryogenic technologies and automated sample handling ensures consistent temperature control and reduces human error.

Expansion of global cold chain networks further supports efficient biospecimen transportation. The increasing emphasis on sample standardization and accreditation, such as ISO 20387, boosts service reliability. Continuous technological innovation in preservation methods improves sample viability over extended durations. As biobanks expand into diverse therapeutic areas, biobanking and repository services remain the cornerstone of operational efficiency and scalability.

Biospecimen Type Analysis

Stem cells represent 49.1% of the biospecimen type segment and are anticipated to remain dominant owing to their immense potential in regenerative medicine, cell therapy, and disease modeling. The rapid growth of stem cell-based research, clinical trials, and therapeutic applications is expected to drive biobanking demand. Stem cell preservation supports the development of advanced treatments for neurological, cardiovascular, and autoimmune disorders.

Pharmaceutical and biotech companies invest heavily in stem cell biobanks to ensure accessibility for future research and drug validation. Technological advancements in cryopreservation and controlled freezing systems enhance stem cell viability and recovery rates. Government and private sector initiatives promoting cord blood banking expand the availability of high-quality samples. Academic and research institutions increasingly utilize stem cell repositories for studying developmental biology and genetic disorders.

The integration of AI-driven analytics enables precise characterization and cataloging of stem cell lines. International collaborations among biobanks improve global accessibility and data sharing. Rising public awareness regarding stem cell therapy benefits strengthens donor participation. As clinical applications advance and regulatory frameworks evolve, stem cells are likely to remain central to biobanking activities worldwide.

Application Analysis

Drug discovery and clinical research hold 52.8% of the application segment and are projected to dominate due to the growing reliance on biobanked samples for preclinical validation and biomarker discovery. Biobanks provide well-characterized biospecimens essential for developing targeted therapies and evaluating drug efficacy. Pharmaceutical companies leverage biobanking to accelerate clinical trials and ensure reproducible results across global research sites.

The integration of molecular profiling and next-generation sequencing technologies enhances the translational value of stored samples. Expanding research in precision medicine and oncology drives the need for diverse genetic and phenotypic specimen collections. Collaboration between academia, CROs, and biobanks fosters large-scale research consortia aimed at identifying novel therapeutic targets. Regulatory authorities increasingly recognize biobanked materials as validated resources for clinical research.

The use of biobanked samples in real-world evidence studies and post-market surveillance strengthens their strategic value. Investment in public-private partnerships for biorepository development supports innovation. The growing demand for longitudinal patient data and biospecimen-linked health information reinforces biobanking’s role in drug development pipelines. As pharmaceutical R&D intensifies globally, biobanks are anticipated to remain vital to accelerating discovery and clinical research initiatives.

Biobank Type Analysis

Physical biobanks account for 56.3% of the biobank type segment and are expected to maintain their dominance due to the continued requirement for tangible storage facilities housing millions of biological samples. These biobanks provide the infrastructure needed for cryogenic storage, sample validation, and retrieval for research and clinical applications. Increasing demand for high-quality, temperature-controlled storage facilities drives expansion.

The rising prevalence of chronic and genetic diseases necessitates long-term storage of patient-derived samples for future therapeutic use. Pharmaceutical and biotechnology firms depend on physical biobanks for supporting multicenter studies and ensuring sample consistency. Investments in advanced cold storage equipment, including liquid nitrogen tanks and automated retrieval systems, enhance capacity and reliability. The trend toward integrating robotics and IoT sensors for real-time monitoring strengthens operational efficiency.

Physical biobanks play a critical role in population health studies and epidemiological surveillance. Regulatory requirements for physical traceability of samples ensure sustained relevance. The combination of infrastructure robustness, technological upgrades, and global collaborations positions physical biobanks as foundational assets in the biobanking ecosystem. As biopharma research expands, the need for physical repositories is likely to remain essential for ensuring data integrity and sample preservation.

End-User Analysis

Pharmaceutical and biotechnology companies hold 48.5% of the end-user segment and are projected to lead the Biobanking market due to their extensive involvement in drug discovery, biomarker research, and precision medicine. These organizations rely on biobanks for accessing high-quality, well-characterized biospecimens critical to developing targeted therapies.

The increasing number of clinical trials and the shift toward personalized treatment strategies drive collaboration between biobanks and biopharma firms. Companies use biobanked samples for validating companion diagnostics and conducting genomic studies. Strategic partnerships with academic institutions and CROs enable efficient sample sharing and data integration. The emphasis on translational research and predictive modeling enhances reliance on biobanking systems. Biopharma players invest in proprietary biorepositories to support R&D pipelines and regulatory submissions.

The growing adoption of LIMS and AI-based analytics optimizes sample management and accelerates decision-making. Pharmaceutical companies also support the creation of disease-specific biobanks for oncology, neurology, and infectious disease research. As precision medicine expands globally, the demand for reliable biospecimen storage and analytics solutions increases. Strong regulatory compliance and commitment to innovation ensure that pharmaceutical and biotechnology companies remain at the forefront of biobanking market growth.

Key Market Segments

By Product Type

- Laboratory Information Management Systems

- Biobanking Equipment

- Temperature Control Systems

- Thawing Equipment

- Freezers & Refrigerators

- Cryogenic Storage Systems

- Accessories & Other Equipment

- Alarms & Monitoring Systems

- Incubators & Centrifuges

- Temperature Control Systems

- Biobanking Consumables

By Service

- Biobanking & Repository

- Qualification/ Validation

- Lab Processing

- Cold Chain Logistics

- Other

By Biospecimen Type

- Stem Cells

- IPS Cells

- Embryonic Stem Cells

- Adult Stem Cells

- Others

- Human Tissues

- Human Organs

By Application

- Drug Discovery & Clinical Research

- Therapeutics

- Clinical Diagnostics

- Other Applications

By Biobanks Type

- Physical/Real Biobanks

- Tissue Biobanks

- Population Based Biobanks

- Genetic (DNA/RNA)

- Disease Based Biobanks

- Virtual Biobanks

By End-user

- Pharmaceutical & Biotechnology Companies

- Hospitals

- CROs & CMOs

- Academic & Research Institutes

Drivers

Rising Demand for Precision Medicine is Driving the Market

The escalating demand for precision medicine has significantly propelled the biobanking market, as high-quality biospecimens are indispensable for genomic profiling and personalized therapeutic development. Biobanks serve as repositories for diverse samples, enabling researchers to correlate genetic variations with clinical outcomes, thereby accelerating biomarker discovery and tailored interventions. This driver is particularly evident in oncology and rare diseases, where annotated specimens facilitate large-scale cohort studies to validate prognostic models.

Healthcare institutions are expanding biobanking capacities to support real-world evidence generation, aligning with regulatory emphases on stratified patient care. The integration of multi-omics data from biobanks further enhances its utility, providing comprehensive insights into disease mechanisms. Public and private funding prioritizes its infrastructure, fostering collaborations between academic centers and pharmaceutical entities.

The National Institutes of Health’s All of Us Research Program aims to collect biological samples from over one million participants to advance precision medicine initiatives, with significant enrollment progress reported through 2024. This ambitious scale underscores the market’s momentum, as specimen accrual supports diverse genomic analyses. Technological upgrades, such as automated annotation systems, streamline sample accessibility, accommodating variable quality metrics.

Economically, its application reduces trial inefficiencies, justifying sustained investments in preservation technologies. International networks harmonize consent protocols, promoting global data sharing. This precision imperative not only amplifies specimen utilization but also embeds biobanking within innovative healthcare paradigms. Ultimately, it catalyzes advancements toward equitable, data-driven clinical decisions.

Restraints

Ethical and Regulatory Hurdles is Restraining the Market

The stringent ethical and regulatory requirements governing sample collection and data privacy continue to impede the biobanking market’s seamless expansion, complicating informed consent processes and cross-institutional sharing. These frameworks, designed to protect donor rights, demand comprehensive documentation and re-consent mechanisms, prolonging operational timelines and escalating compliance expenditures. This restraint disproportionately affects smaller biobanks, where resource limitations hinder adherence to evolving standards like GDPR in Europe.

Variability in jurisdictional guidelines fragments interoperability, deterring multinational collaborations essential for large-scale studies. Developers must navigate audits and risk assessments, diverting funds from core activities to legal consultations. The resultant delays exacerbate sample degradation risks, undermining research timelines.

The European Union’s In Vitro Diagnostic Regulation, implemented in 2022, introduced enhanced requirements for clinical evidence and post-market surveillance, increasing compliance costs by approximately 15% for molecular diagnostics providers. Such mandates reflect broader scrutiny, as privacy breaches could erode public trust. Stakeholder hesitancy, stemming from potential liabilities, favors conservative sample acquisition over expansive cohorts.

Advocacy for harmonized ethics guidelines progresses incrementally, hindered by cultural divergences. These regulatory barriers not only constrain throughput but also perpetuate inequities in biospecimen availability. Consequently, they necessitate fortified governance models to balance innovation with ethical imperatives.

Opportunities

Expansion of Government-Funded Genomic Initiatives is Creating Growth Opportunities

The proliferation of state-sponsored genomic programs has unlocked substantial prospects for the biobanking market, institutionalizing large-scale specimen repositories to underpin population health research and therapeutic advancements. These initiatives, focusing on diverse ethnic biobanks, leverage public funding to accrue longitudinal samples, bridging gaps in underrepresented genomic datasets.

Opportunities emerge in infrastructure subsidies for automation, enabling scalable storage amid escalating sample volumes. Public-private synergies validate interoperability standards, subsidizing expansions to encompass microbiome and epigenomic profiles. This governmental backing addresses health disparities, positioning biobanks as catalysts for equitable precision initiatives.

Fiscal endowments for cohort expansions catalyze procurements, diversifying toward disease-specific collections. The U.S. government allocated over US$45 billion to health research and development in 2022, underscoring commitments to biobanking within broader NIH-funded genomic efforts. This investment exemplifies replicable models, with analogous programs anticipating amplified specimen demands.

Innovations in cryogenic preservation enhance longevity, mitigating logistical voids in remote collections. As federated databases evolve, metadata analytics refine matching, unlocking collaborative revenues. These programmatic thrusts not only elevate repository scopes but also interweave the market into resilient public health architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and reduced access to funding are pressuring operators in the biobanking market to delay cryogenic storage expansions while focusing on maintaining accurate sample audits amid limited research budgets. Trade restrictions between the U.S. and China, along with disruptions in Panama Canal shipping routes, are constraining the supply of liquid nitrogen tanks from Asian manufacturers, lengthening validation processes and increasing certification expenses for international research collaborations.

To overcome these challenges, several operators are collaborating with tank producers in Texas, adopting stronger durability standards that accelerate FDA approvals and attract precision medicine funding. The growing focus on personalized therapies is driving investments from health agencies into automated aliquot systems, encouraging adoption in academic and clinical biorepositories.

Meanwhile, U.S. tariffs on imported medical devices and components are increasing the cost of vials and labeling systems, putting pressure on nonprofit biobanks and slowing international biospecimen-sharing efforts. In response, operators are utilizing federal innovation incentives to establish automation hubs in Colorado, improving RFID-tracked workflows and enhancing expertise in advanced cryopreservation techniques.

Latest Trends

Launch of UK Biobank’s Largest Protein Study is a Recent Trend

The advent of expansive proteomic datasets has signified a transformative trajectory in biobanking during 2025, democratizing access to molecular insights for disease risk modeling. The UK Biobank’s initiative, profiling 54,000 participants’ circulating proteins, integrates biospecimens with longitudinal phenotypes to elucidate causal pathways in chronic conditions. This endeavor embodies a maturation toward multi-omics repositories, accommodating high-dimensional analyses for predictive biomarker validation.

Regulatory affirmations confirm data integrity, expediting integrations in federated platforms amid global research demands. This scale resonates with epidemiological imperatives, tethering outputs to AI-enabled querying for accelerated discoveries. The study addresses translational gaps, prioritizing assays resilient to batch effects in archived samples.

The UK Biobank launched the world’s largest protein study in January 2025, leveraging data from 54,000 participants to advance disease risk identification through large-scale proteomics. Such milestones catalyze pipeline accelerations, as peers refine analogous cohorts for pan-omic explorations. Observers anticipate guideline incorporations, elevating its stature in consortium protocols.

Longitudinal validations affirm variance reductions, optimizing computational workflows. The progression envisions federated expansions, prognosticating polygenic risk integrations. This proteomic inflection not only augments biobanking acuity but also synchronizes with precision epidemiology visions.

Regional Analysis

North America is leading the Biobanking Market

In 2024, North America accounted for 42.1% of the global biobanking market, experiencing robust expansion due to federal commitments to precision medicine initiatives that prioritize biospecimen repositories for genomic research, enabling accelerated discoveries in oncology and rare diseases through standardized collection protocols.

Academic medical centers and pharmaceutical entities increasingly invested in automated cryogenic systems to maintain sample integrity for multi-omics studies, reducing degradation risks and supporting collaborative consortia that facilitate data sharing under the All of Us Research Program. Regulatory frameworks from the FDA streamlined approvals for biobank-derived biomarkers in clinical trials, fostering trust in longitudinal cohorts for therapeutic validation, while NIH-funded expansions in population-based repositories addressed diversity gaps in underrepresented groups.

The surge in regenerative medicine applications further propelled growth, as biobanks supplied high-quality tissues for cell therapy development, aligning with economic incentives for sustainable infrastructure upgrades. These factors solidified the region’s dominance in scalable biospecimen management. The National Institutes of Health allocated US$1.1 billion to the All of Us Research Program in fiscal year 2024, up from US$1.0 billion in fiscal year 2022, to enhance biobanking for diverse genomic datasets.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National agencies across Asia Pacific project the biobanking sector to advance significantly during the forecast period, as strategic funding bolsters population-scale repositories to tackle chronic illnesses in rapidly aging societies. Officials in China and Japan channel resources into automated storage facilities, equipping research institutes to preserve tissue samples for Alzheimer’s and diabetes studies in elderly demographics.

Biorepository operators collaborate with governmental labs to standardize nucleic acid banking, anticipating breakthroughs in pharmacogenomics for ethnic-specific drug responses. Regulatory bodies in India and South Korea subsidize hybrid physical-virtual platforms, positioning community centers to aggregate blood and DNA from rural cohorts without logistical barriers.

Administrative frameworks anticipate linking biobank data with national health databases, expediting biomarker discovery for cardiovascular risks in migrant populations. Regional scientists pioneer cryopreservation innovations, coordinating with international consortia to track environmental influences on specimen quality in tropical zones. These developments establish a foundational infrastructure for collaborative biomedical research. In November 2023, India’s ICMR launched a Rs 20 crore biobank in South India, the third national facility, to support disease prevention mapping.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major firms in the biological sample storage sector drive expansion by deploying automated cryogenic systems that ensure sample integrity for genomic and proteomic research, meeting stringent precision medicine demands. They forge strategic alliances with pharmaceutical giants to co-develop repositories tailored for rare disease cohorts, accelerating drug discovery pipelines. Enterprises invest in blockchain-integrated tracking software to enhance traceability and compliance with global data protection regulations.

Executives acquire niche automation providers to streamline sample retrieval, reducing operational costs and boosting throughput. They target high-growth regions like Southeast Asia and Africa, aligning with government-funded biorepository initiatives to capture emerging demand. Additionally, they offer tiered service contracts with analytics platforms, fostering long-term partnerships and generating stable revenue streams.

Thermo Fisher Scientific Inc., founded in 2006 through a merger and headquartered in Waltham, Massachusetts, leads in life sciences solutions, providing advanced storage and analytical tools for research and clinical applications worldwide. The company delivers its Matrix and CryoPlus systems, ensuring ultra-low temperature preservation for diverse biospecimens in academic and commercial settings.

Thermo Fisher channels significant R&D into digital integration, enhancing sample management with cloud-based inventory solutions. CEO Marc N. Casper directs operations across 50 countries, emphasizing sustainability and regulatory compliance. The firm collaborates with research consortia to support large-scale genomic studies, driving precision medicine advancements. Thermo Fisher reinforces its market dominance by combining robust infrastructure with innovative data solutions to meet evolving biorepository needs.

Top Key Players in the Biobanking Market

- Thermo Fisher Scientific Inc

- Tecan Trading AG

- Taylor-Wharton

- Qiagen

- Merck KGaA

- Hamilton Company

- Danaher Corporation

- Charles River Laboratories

- Biocision, LLC

- Becton, Dickinson, and Company (BD)

Recent Developments

- In July 2025: The German Biobank Node (GBN) joined the Network of University Medicine (NUM) as part of the NUM 3.0 initiative funded by the Federal Ministry of Education and Research. This integration strengthens national biobanking infrastructure in Germany, promoting standardized data sharing and improving access to high-quality biospecimens for research, which collectively enhance the efficiency and scale of biomedical studies.

- In May 2024: EIT Health launched the Biobanks and Health Data Portal to facilitate collaboration and increase the visibility and use of biobank resources across Europe. By connecting researchers, institutions, and healthcare partners, this initiative accelerates the translation of biobank data into real-world clinical and pharmaceutical applications, driving growth in the biobanking market.

Report Scope

Report Features Description Market Value (2024) US$ 79.8 Billion Forecast Revenue (2034) US$ 170.7 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Laboratory Information Management Systems, Biobanking Equipment (Temperature Control Systems (Thawing Equipment, Freezers & Refrigerators, and Cryogenic Storage Systems), Accessories & Other Equipment, Alarms & Monitoring Systems, and Incubators & Centrifuges), and Biobanking Consumables), By Service (Biobanking & Repository, Qualification/Validation, Lab Processing, Cold Chain Logistics, and Other), By Biospecimen Type (Stem Cells (IPS Cells, Embryonic Stem Cells, Adult Stem Cells, and Others), Human Tissues, and Human Organs), By Application (Drug Discovery & Clinical Research, Therapeutics, Clinical Diagnostics, and Other Applications), By Biobanks Type (Physical/Real Biobanks (Tissue Biobanks, Population Based Biobanks, Genetic (DNA/RNA), and Disease Based Biobanks), and Virtual Biobanks), By End-user (Pharmaceutical & Biotechnology Companies, Hospitals, CROs & CMOs, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc, Tecan Trading AG, Taylor-Wharton, Qiagen, Merck KGaA, Hamilton Company, Danaher Corporation, Charles River Laboratories, Biocision, LLC, Becton, Dickinson, and Company (BD). Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc

- Tecan Trading AG

- Taylor-Wharton

- Qiagen

- Merck KGaA

- Hamilton Company

- Danaher Corporation

- Charles River Laboratories

- Biocision, LLC

- Becton, Dickinson, and Company (BD)