Global Bioactive Wound Care Market By Product Type (Moist Wound Care (Hydrogel, Hydrocolloid, Foam, Film, and Alginate), Active Dressings (Skin Substitutes and Biomaterials), and Antimicrobial Wound Care (Silver-Based and Non-Silver-Based)), By Application (General Surgery (Plastic, Pediatric, and Dermatological) and Minimally Invasive Surgery), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151739

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

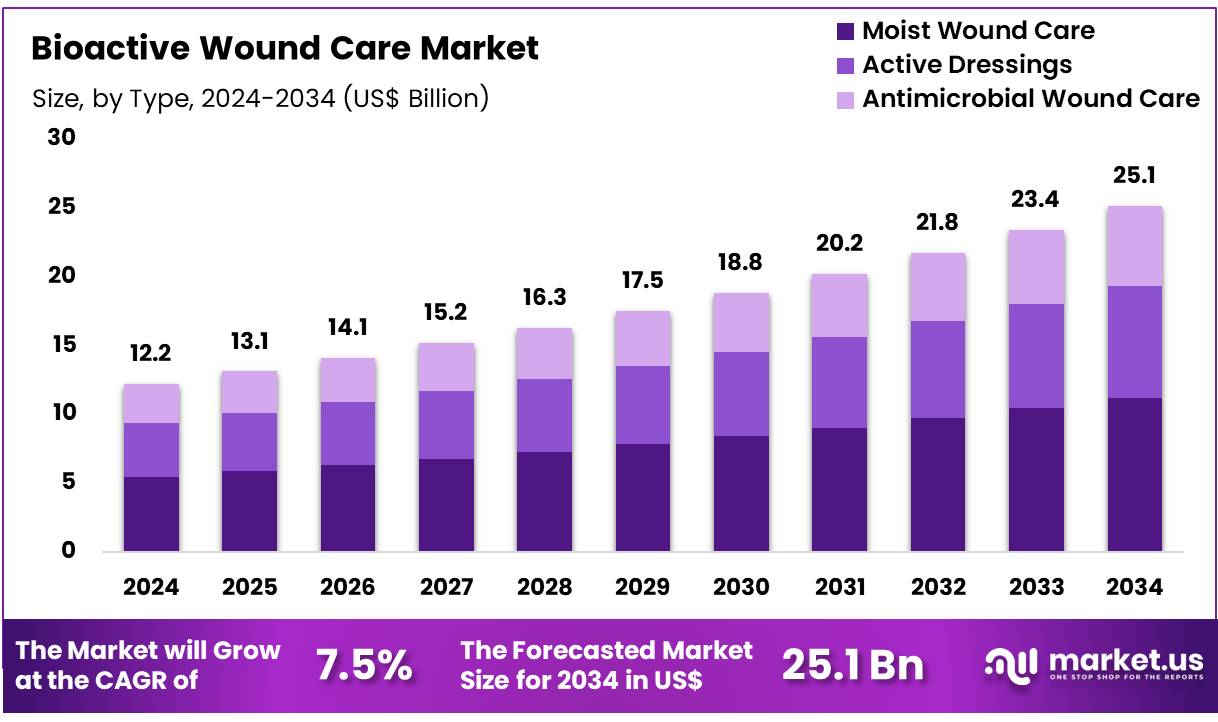

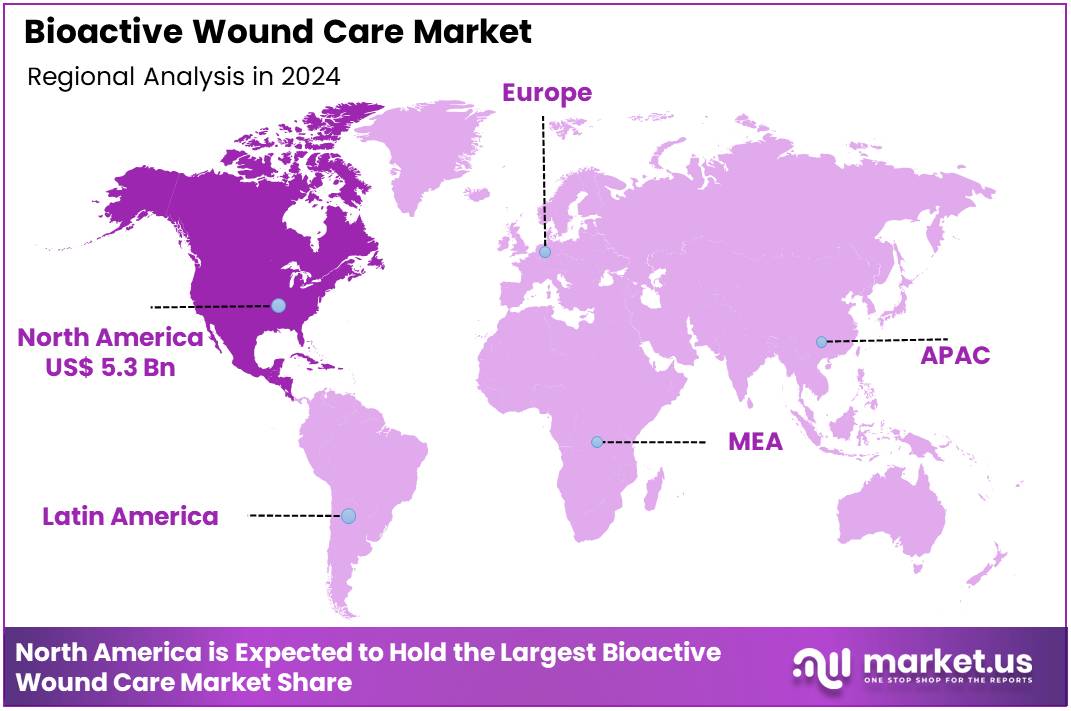

Global Bioactive Wound Care Market size is expected to be worth around US$ 25.1 Billion by 2034 from US$ 12.2 Billion in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.4% share with a revenue of US$ 5.3 Billion.

Increasing demand for advanced wound care solutions and the rising prevalence of chronic wounds, such as diabetic foot ulcers and pressure sores, are driving the growth of the bioactive wound care market. Bioactive wound care products, including enzyme-based hydrogels, antimicrobial dressings, and growth factor-infused therapies, provide enhanced healing by promoting tissue regeneration, reducing infection risks, and improving overall wound management.

These products offer targeted therapeutic benefits, accelerating the healing process and minimizing complications. The market benefits from a shift toward more personalized and effective treatments, with bioactive solutions offering tailored care for various wound types, especially in patients with chronic conditions. Recent advancements in bioactive materials and the increasing focus on improving patient outcomes have further expanded market opportunities.

In January 2025, the FDA awarded Fast Track Designation to SolasCure’s Aurase Wound Gel for treating calciphylaxis ulcers, a severe and difficult-to-treat condition. This designation accelerates the path to market for this enzyme-based hydrogel, offering a promising solution for a challenging medical condition and further advancing wound care options. The continued innovation of bioactive products, coupled with growing awareness of their effectiveness, positions the bioactive wound care market for continued expansion and success in addressing complex wound management needs.

Key Takeaways

- In 2024, the market for bioactive wound care generated a revenue of US$ 12.2 billion, with a CAGR of 7.5%, and is expected to reach US$ 25.1 billion by the year 2034.

- The product type segment is divided into moist wound care, active dressings, and antimicrobial wound care, with moist wound care taking the lead in 2024 with a market share of 44.6%.

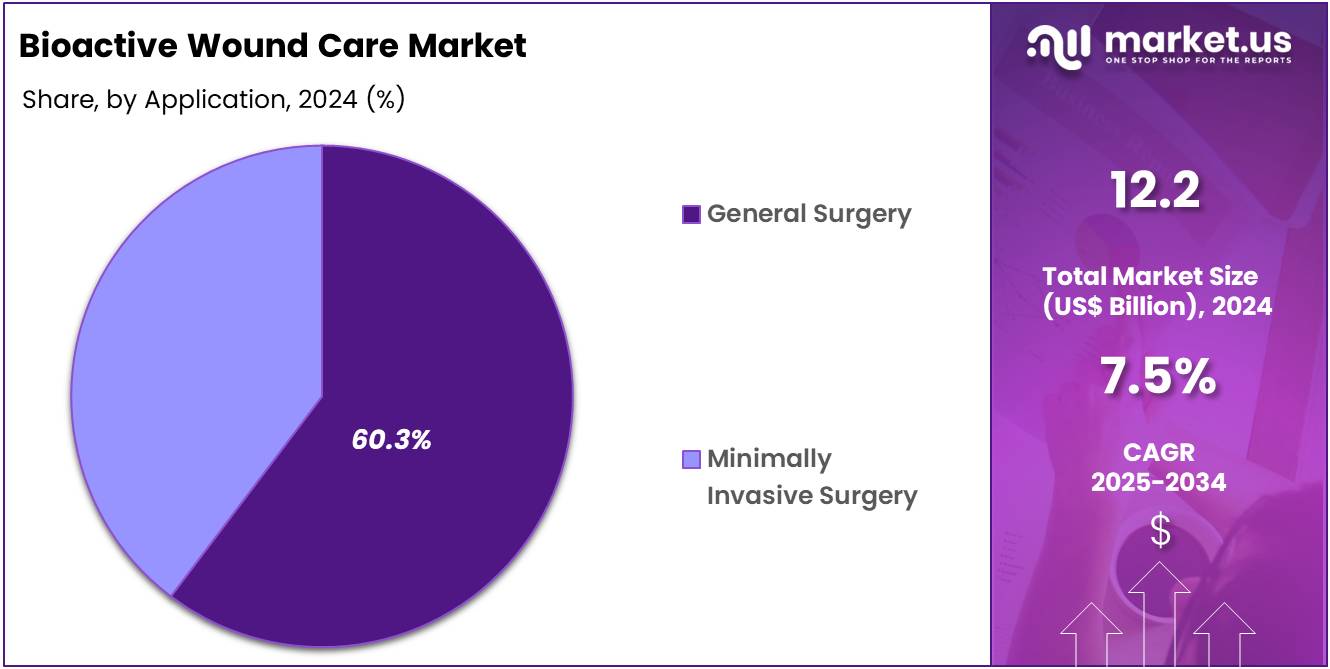

- Considering application, the market is divided into general surgery and minimally invasive surgery. Among these, general surgery held a significant share of 60.3%.

- North America led the market by securing a market share of 43.4% in 2024.

Product Type Analysis

Moist wound care is expected to dominate the bioactive wound care market, accounting for 44.6% of the market share. This type of wound care has gained significant traction due to its effectiveness in promoting faster healing by maintaining an optimal moisture balance, which prevents wound dehydration and accelerates tissue regeneration. The growth of this segment is anticipated to be driven by the increasing adoption of moist wound dressings in both chronic and acute wound care management.

As the benefits of moist wound care continue to be recognized by healthcare professionals, including reduced pain and scarring, the demand for these products is likely to rise. Additionally, advancements in wound care technologies and the development of new moist wound care products that offer enhanced healing properties will further fuel the growth of this segment.

Application Analysis

General surgery is projected to be the largest application segment in the bioactive wound care market, holding 60.3% of the market share. The use of bioactive wound care products in general surgery is expected to grow as these products play a critical role in post-surgical wound healing, helping to reduce infection risk and promote tissue regeneration. As surgical procedures become more complex and patients seek faster recovery times, the demand for advanced wound care products that provide optimal healing environments will likely increase.

Moreover, the growing emphasis on reducing hospital stays and enhancing patient outcomes after surgery will drive the adoption of bioactive wound care products in general surgery. With the increasing number of surgeries performed worldwide, the general surgery application is projected to continue expanding as more hospitals and surgical centers integrate bioactive wound care solutions into their standard postoperative care protocols.

Key Market Segments

By Product Type

- Moist Wound Care

- Hydrogel

- Hydrocolloid

- Foam

- Film

- Alginate

- Active Dressings

- Skin Substitutes

- Biomaterials

- Antimicrobial Wound Care

- Silver-Based

- Non-Silver-Based

By Application

- General Surgery

- Plastic

- Pediatric

- Dermatological

- Minimally Invasive Surgery

Drivers

Increasing Prevalence of Chronic Wounds is Driving the Market

The rising global prevalence of chronic wounds, such as diabetic foot ulcers, pressure injuries, and venous leg ulcers, is a primary driver for the bioactive wound care market. These complex wounds often fail to heal through conventional methods and require advanced interventions that interact with the biological healing process to promote tissue regeneration.

The burden of chronic wounds is substantial; for instance, a 2022 compendium of estimates published in “Advances in Wound Care” noted that chronic wounds affect 10.5 million U.S. Medicare beneficiaries alone, representing a significant portion of the patient population requiring specialized care. The increasing global aging population and the rising incidence of chronic diseases like diabetes contribute directly to the growing number of individuals suffering from these persistent wounds, thereby fueling the demand for advanced bioactive wound care products.

Restraints

High Cost of Bioactive Dressings is Restraining the Market

A significant restraint on the bioactive wound care market is the comparatively high cost associated with these advanced dressings and therapies. Bioactive products, which often incorporate growth factors, living cells, or sophisticated biomaterials, are typically more expensive than traditional wound dressings. This higher price point can limit their accessibility, especially in healthcare systems with budget constraints or for patients without adequate insurance coverage.

While specific government price lists are not publicly centralized, the general financial burden of chronic wound care is widely acknowledged. For example, a 2022 article on the cost of wounds in the U.S. indicated that the average annual Medicare spending for wound care was over US$31.3 billion, highlighting the overall financial challenge in this area, where expensive advanced therapies contribute significantly to the total cost. This economic barrier can impede the broader adoption of bioactive wound care solutions, particularly in regions with limited healthcare expenditure.

Opportunities

Advancements in Regenerative Medicine Create Growth Opportunities

Ongoing advancements in regenerative medicine, including breakthroughs in tissue engineering, stem cell therapies, and the development of novel biomaterials, present significant growth opportunities in the bioactive wound care market. These scientific and technological innovations enable the creation of more effective and targeted bioactive dressings that actively promote cellular proliferation, angiogenesis, and extracellular matrix remodeling, leading to faster and more complete wound closure.

A scholarly article discussing “Advances in regenerative medicine-based approaches for skin regeneration and rejuvenation,” published by PMC in 2024, highlights how innovative techniques such as stem cell therapy, tissue engineering, and growth factors are addressing conditions like chronic wounds and burns.

The National Institutes of Health (NIH) continuously funds research into these areas, accelerating the translation of laboratory discoveries into clinically viable products. These developments promise to revolutionize wound healing, offering superior outcomes for patients with complex and non-healing wounds.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the bioactive wound care market, primarily through their impact on healthcare expenditure, research and development funding, and patient affordability. During periods of robust economic growth, governments and private payers typically increase their healthcare budgets, which can facilitate greater reimbursement for advanced wound care products and encourage investment in research and development for new bioactive solutions.

Conversely, economic downturns or high inflation rates can lead to tightened healthcare budgets, potentially causing delays in product adoption or restricting patient access due to higher out-of-pocket costs. The International Monetary Fund (IMF) projects global growth to remain stable at around 3.1% in 2024, which, while not a rapid acceleration, provides a generally steady economic backdrop.

Geopolitical factors, such as international trade policies affecting the import and export of specialized raw materials or advanced manufacturing components, and the stability of global supply chains for complex biomaterials, also play a crucial role. Political instability or trade disputes can disrupt supply chains, increase manufacturing costs, and create uncertainty for global distribution, affecting the timely availability and pricing of these specialized products.

However, the critical need to effectively manage chronic and complex wounds, which represents a significant healthcare burden, ensures sustained focus and investment in the bioactive wound care market, fostering its continued innovation and expansion.

Current US tariff policies can directly impact the bioactive wound care market by altering the cost of imported raw materials, specialized biomaterials, and advanced manufacturing components used in the production of these complex dressings. Given the global nature of advanced medical material sourcing, many unique biological components or synthetic polymers for bioactive products are procured from various international suppliers.

The U.S. Census Bureau’s foreign trade data for 2023 and 2024 indicates substantial US imports of medical, surgical, and pharmaceutical goods, highlighting the market’s reliance on global supply chains for high-value components. Any new tariffs imposed on these specialized imports could directly increase the operational costs for US-based manufacturers of bioactive wound care products. This could translate to higher prices for these advanced dressings or reduced investment in research and development, potentially impacting patient access and the pace of innovation.

For example, reports on the medical device industry in April 2025 indicated that certain US tariff actions could result in increased costs for imported medical goods. Conversely, these tariff policies can act as a powerful incentive for manufacturers to invest in expanding or establishing domestic production capabilities for the specialized materials and components used in bioactive wound care products within the US.

This strategic shift towards localized manufacturing aims to create a more secure and resilient supply chain for essential healthcare technologies, reducing dependence on potentially volatile international sources and enhancing national medical self-sufficiency, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Integration of Nanotechnology for Enhanced Delivery is a Recent Trend

A prominent recent trend in the bioactive wound care market is the increasing integration of nanotechnology for enhanced drug delivery, antimicrobial properties, and improved wound healing environments. Nanomaterials, such as nanoparticles and nanofibers, can be engineered to precisely deliver therapeutic agents, growth factors, or antimicrobial compounds directly to the wound bed in a controlled and sustained manner.

A scholarly article on “Nanoformulations Loaded with Phytochemicals for Combating Wound Infections and Promoting Wound Healing,” published in MDPI in May 2024, explicitly discusses how nanotechnology-based systems can enhance the therapeutic efficacy of active molecules through improved bioavailability and targeted delivery. This approach minimizes systemic side effects, maximizes therapeutic efficacy, and can create smart dressings that respond to changes in the wound environment. This innovative application of nanoscale materials is poised to significantly improve the performance and versatility of advanced bioactive wound care products.

Regional Analysis

North America is leading the Bioactive Wound Care Market

North America dominated the market with the highest revenue share of 43.4% owing to the high prevalence of chronic wounds, advancements in regenerative medicine, and increased healthcare expenditure. Data from the National Center for Biotechnology Information in December 2021 reported that an estimated 1.0 to 3.0 million people in the U.S. suffer from pressure injuries annually, while approximately 5.0% of diabetic patients in the U.S. develop a foot ulcer, driving demand for advanced solutions.

Government regulatory bodies continue to facilitate access to innovative treatments; for instance, Organogenesis Holdings Inc. received U.S. FDA 510(k) clearance for PuraPly MZ in August 2022, expanding its advanced wound care portfolio. Financial reports from key market players further underscore this growth; Organogenesis, a leader in regenerative medicine, reported net revenue from its Advanced Wound Care products of US$ 453.6 million for the full year 2024, an increase of 12% compared to US$405.5 million in 2023. This growth reflects the significant adoption of bioactive products, including cellular and tissue-based products, which enhance the healing process for complex wounds.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to a rapidly aging population, a rising incidence of chronic diseases like diabetes, and increasing healthcare spending coupled with a growing awareness of advanced wound treatment options. While specific government-issued chronic wound prevalence data for the entire Asia Pacific region from 2022-2024 is not centrally compiled, the World Health Organization (WHO) continuously highlights the increasing burden of non-communicable diseases, including diabetes, which significantly contributes to chronic wound cases across the region.

Governments in countries like Japan are actively promoting medical innovations, including those in regenerative medicine and advanced wound care, through policies designed to accelerate the adoption of new technologies. Leading global companies are also strengthening their presence and product offerings in Asia Pacific; Smith+Nephew reported strong underlying revenue growth in its Advanced Wound Management division for 2024, although regional breakdowns for bioactive products are not specifically detailed in public financial reports, their overall performance indicates a global trend towards advanced solutions.

This combination of demographic shifts, disease prevalence, and strategic investments is projected to drive the demand for sophisticated wound healing technologies across the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the bioactive wound care market employ various strategies to drive growth. They focus on expanding their product portfolios by developing novel therapies and research tools targeting wound healing. Companies invest in automation and high-throughput technologies to improve scalability and reproducibility in treatment processes.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices. Additionally, players aim to strengthen their market presence by establishing facilities and distribution networks in key regions, ensuring timely and efficient delivery of services to support the growing demand for wound care solutions.

Smith & Nephew plc is a prominent player in the bioactive wound care market. Headquartered in Watford, England, Smith & Nephew specializes in medical equipment manufacturing, including advanced wound management products. The company offers a wide range of innovative products and services designed to treat and manage different types of wounds. Smith & Nephew’s focus on innovation has enabled it to maintain a strong presence in the wound care market. The company’s commitment to research and development has resulted in the introduction of advanced wound care products over the years.

Top Key Players

- Integra LifeSciences Corporation

- Hollister Incorporated

- Essity Health & Medical

- DermaRite Industries LLC

- Covalon Technologies Ltd

- Convatec Group PLC

- Braun SE

- 3M

Recent Developments

- In May 2024, Convatec released results from a multinational randomized controlled trial (RCT), demonstrating significant advancements in venous leg ulcer healing with AQUACEL Ag+ Extra when compared to traditional dressing methods. This highlights the product’s effectiveness in improving wound healing and positions it as a strong contender in the wound care market.

- In March 2024, Integra LifeSciences Holdings Corporation introduced MicroMatrix Flex in the U.S. This dual-syringe system simplifies the blending and application of MicroMatrix paste, making it easier to treat hard-to-reach areas and ensuring a smoother wound surface in complex wound care scenarios, enhancing overall patient outcomes.

Report Scope

Report Features Description Market Value (2024) US$ 12.2 Billion Forecast Revenue (2034) US$ 25.1 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Moist Wound Care (Hydrogel, Hydrocolloid, Foam, Film, and Alginate), Active Dressings (Skin Substitutes and Biomaterials), and Antimicrobial Wound Care (Silver-Based and Non-Silver-Based)), By Application (General Surgery (Plastic, Pediatric, and Dermatological) and Minimally Invasive Surgery) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Integra LifeSciences Corporation, Hollister Incorporated, Essity Health & Medical, DermaRite Industries LLC, Covalon Technologies Ltd, Convatec Group PLC, B. Braun SE, 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bioactive Wound Care MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Bioactive Wound Care MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Integra LifeSciences Corporation

- Hollister Incorporated

- Essity Health & Medical

- DermaRite Industries LLC

- Covalon Technologies Ltd

- Convatec Group PLC

- Braun SE

- 3M