Global Bio-Refinery Market Size, Share and Report Analysis By Feedstock Type (Lignocellulosic Biomass, Sugars And Starches, Oil And Lipid Feedstocks, Organic Waste, Algae And Microorganisms, and Others), By Conversion Technology (Biochemical Conversion, Thermochemical Conversion, Chemical Conversion, and Physical Conversion), By Product Output (Biofuels, Biochemicals, and Others), By End-Use Industry (Transportation And Aviation, Energy And Utilities, Chemicals And Materials, Agriculture, Food And Beverages, Pharmaceuticals, Cosmetics And Personal Care, Industrial Manufacturing, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176333

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

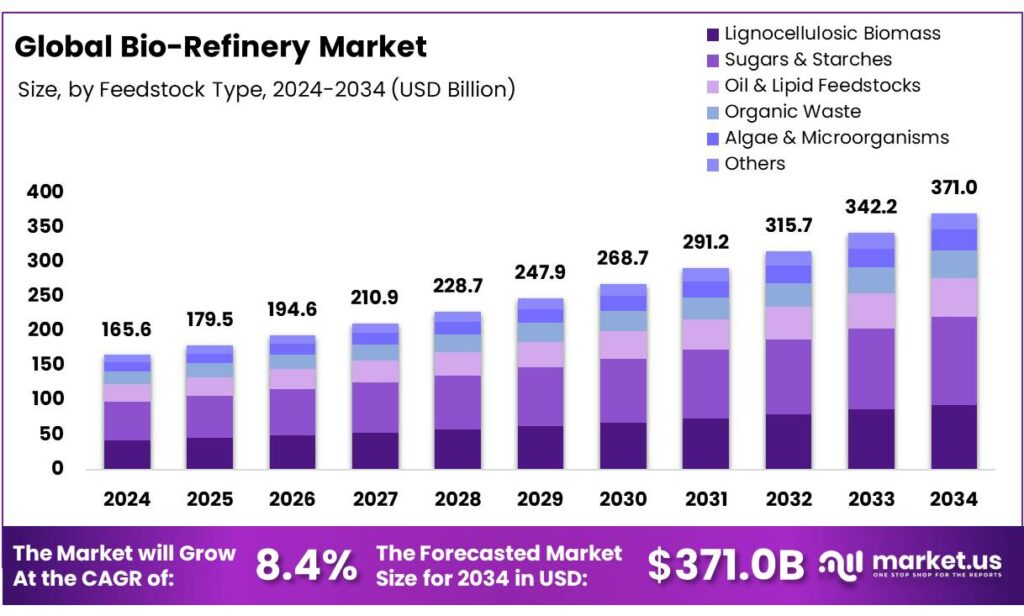

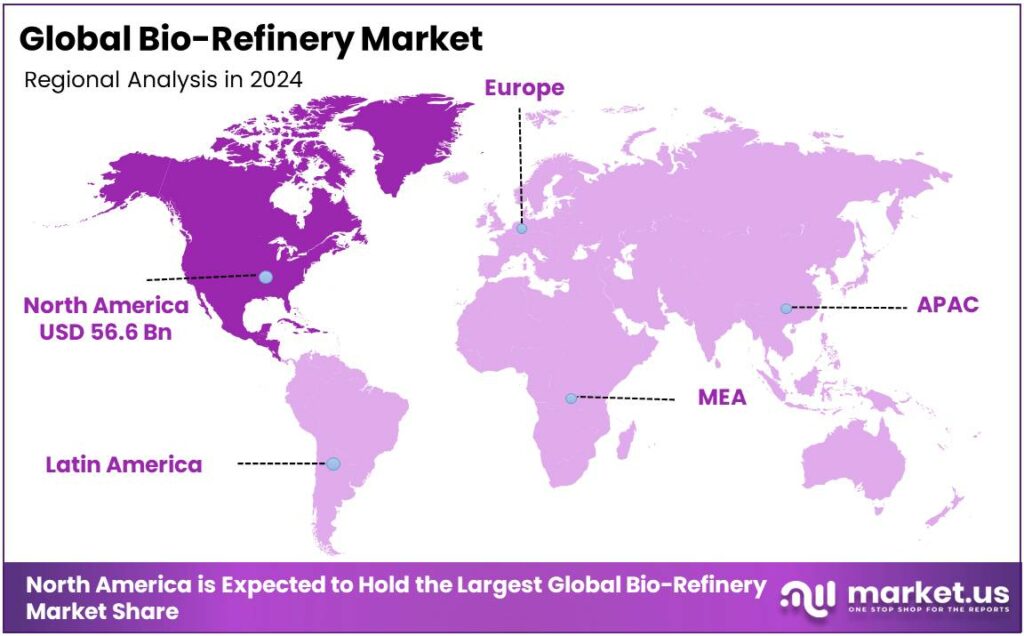

Global Bio-Refinery Market size is expected to be worth around USD 371.0 Billion by 2034, from USD 165.6 Billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 39.2% share, holding USD 1.3 Billion in revenue.

A biorefinery is a facility that processes renewable biomass, such as plants, agricultural waste, or organic waste, into a spectrum of valuable products. The market is primarily driven by the demand for sustainable energy sources, with biofuels being the most widely produced product due to their direct application in the transportation and aviation industries.

- According to the International Energy Agency, in 2023, in the renewable energy industry, modern solid bioenergy use accounted for the majority of renewable fuel demand (75%), followed by liquid biofuels (20%) in the transport sector and biogases (5%).

In addition, biochemical conversion technologies, such as fermentation and enzymatic hydrolysis, dominate the market as they efficiently convert biomass feedstocks, such as sugar and starch, into biofuels with lower energy requirements. However, challenges, including the unavailability and variability of biomass feedstock, remain, particularly lignocellulosic materials, which require more complex and costly processing methods.

- It is projected by IEA that liquid biofuels (+1.1 EJ) would account for the most growth in the transport sector, as they are compatible with the existing vehicle fleet. Furthermore, while biofuels for road transport dominate expansion, new policies for aviation and maritime biofuels would spur around 30% of new demand in the transport sector overall.

While biofuels remain the focus, biorefinery systems are expanding to produce diverse products, including biochemicals and biomaterials; however, these markets are still emerging due to technical and scalability issues. Furthermore, regulatory frameworks and the integration of circular economy principles are expected to continue supporting the growth and sustainability of biorefineries globally.

- The share of biofuels in total liquid fuel transport demand would expand from 5.6% in 2023 to 6.4% in 2030 to reach 215 billion liters a year (5.7 EJ) by 2030 in the main case. This growth would be concentrated in the United States, Europe, Brazil, Indonesia, and India, which together would account for 85%.

Key Takeaways

- The global bio-refinery market was valued at USD 165.6 Billion in 2024.

- The global bio-refinery market is projected to grow at a CAGR of 8.4% and is estimated to reach USD 371.0 Billion by 2034.

- Based on feedstock type, sugars & starches dominated the bio-refinery market, constituting 34.2% of the total market share.

- Based on the conversion technology, biochemical conversion dominated the bio-refinery market, with a substantial market share of around 40.9%.

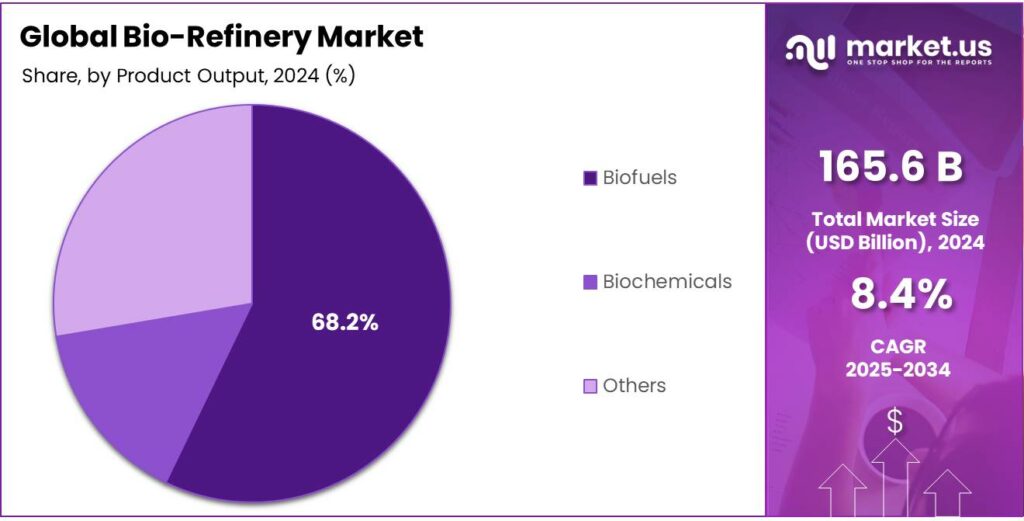

- Based on the product output, biofuels led the bio-refinery market, comprising 68.2% of the total market.

- Among the end-use industries, the transportation & aviation sector held a major share in the bio-refinery market, 41.5% of the market share.

- In 2024, North America was the most dominant region in the bio-refinery market, accounting for 34.2% of the total global consumption.

Feedstock Type Analysis

Sugars & Starches are the Prominent Feedstocks for the Bio-Refineries.

The bio-refinery market is segmented based on feedstock type into lignocellulosic biomass, sugars & starches, oil & lipid feedstocks, organic waste, algae & microorganisms, and others. The sugars & starches led the bio-refinery market, comprising 34.2% of the market share, primarily due to their simpler chemical composition and ease of conversion. These feedstocks are rich in fermentable carbohydrates, which can be readily broken down through enzymatic hydrolysis or fermentation to produce biofuels such as ethanol.

Alternatively, lignocellulosic biomass, while abundant, requires more complex pretreatment processes to break down its tough cellulose and hemicellulose structures, making it more costly and energy-intensive to process. Similarly, oil and lipid feedstocks, though valuable for biofuels such as biodiesel, are often in limited supply and compete with food production. Furthermore, organic waste, algae, and microorganisms hold potential; however, their use is constrained by factors like scalability, consistency, and technical limitations in harvesting and processing, making sugar and starch a more accessible and cost-effective option for large-scale biorefineries.

Conversion Technology Analysis

Biochemical Conversion Dominated the Bio-Refinery Market.

On the basis of conversion technology, the bio-refinery market is segmented into biochemical conversion, thermochemical conversion, chemical conversion, and physical conversion. The biochemical conversion dominated the bio-refinery market, comprising 40.9% of the market share, due to its ability to efficiently process biomass into biofuels and bioproducts through biological processes such as fermentation and enzymatic hydrolysis. This method is particularly favored as it operates at relatively low temperatures and pressures, reducing energy requirements and making it more cost-effective compared to thermochemical conversion, which often involves higher temperatures and pressures to break down complex biomass.

Moreover, biochemical conversion offers greater selectivity in producing valuable products, such as bioethanol, organic acids, and bioplastics, from a wide range of feedstocks. While thermochemical and chemical conversion technologies can produce a diverse range of outputs, they often involve more complex processes and higher costs. Biochemical processes provide a more scalable and sustainable approach for large-scale bio-refinery operations.

Product Output Analysis

Biofuels Held a Major Share of the Bio-Refinery Market.

Based on the product output, the bio-refinery market is divided into biofuels, biochemicals, and others. Biofuels dominated the bio-refinery market, with a notable market share of 68.2%, as they directly address the global demand for alternative energy sources, particularly in the transportation sector. The infrastructure for biofuel production, such as bioethanol and biodiesel, is well-established, with clear market demand driven by regulations, such as renewable fuel mandates, and the urgent demand for decarbonization.

Additionally, biofuels can be produced from a variety of feedstocks, such as sugar, starch, and agricultural residues, making them more accessible and scalable. Biochemicals, while valuable, require more complex processes to produce and often compete with petrochemical alternatives in established industries, which limits their immediate commercial viability. The biofuels offer a more direct path to sustainability and energy security, making them the primary focus for biorefinery operations globally.

End-Use Industry Analysis

The Bio-Refinery Outputs Were Mostly Utilized for the Transportation & Aviation Industry.

Among the end-use industries, 41.5% of the total global consumption of output from bio-refinery is for the transportation & aviation industry. The transportation and aviation industries are the primary consumers of biorefinery products due to the sector’s significant reliance on liquid fuels for energy. Biofuels, such as bioethanol and biodiesel, can be directly integrated into existing fuel infrastructure and vehicles, making them a practical and scalable solution for reducing carbon emissions in transport.

In contrast, industries such as energy & utilities, chemicals & materials, or pharmaceuticals often have more established supply chains and are less dependent on renewable liquid fuels. Furthermore, the energy density required for transportation fuels is particularly suited to biofuels, whereas other sectors may require different forms of energy or raw materials, which makes biofuels the most suitable choice for transportation and aviation industries in the context of biorefinery products.

Key Market Segments

By Feedstock Type

- Lignocellulosic Biomass

- Forestry Residues

- Agricultural Residues

- Others

- Sugars & Starches

- Sugarcane

- Corn

- Beet

- Others

- Oil & Lipid Feedstocks

- Vegetable Oils

- Used Cooking Oil

- Others

- Organic Waste

- Municipal Solid Waste (MSW)

- Food Waste

- Others

- Algae & Microorganisms

- Others

By Conversion Technology

- Biochemical Conversion

- Thermochemical Conversion

- Chemical Conversion

- Physical Conversion

By Product Output

- Biofuels

- Bioethanol

- Biodiesel

- Bio-jet fuel

- Biogas / Biomethane

- Biochemicals

- Others

By End-Use Industry

- Transportation & Aviation

- Energy & Utilities

- Chemicals & Materials

- Agriculture

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Industrial Manufacturing

- Others

Drivers

Regulatory Frameworks Supporting Clean Energy Drive the Bio-Refinery Market.

The bio-refinery market is significantly influenced by the growing regulatory frameworks that promote clean energy initiatives. Governments worldwide have increasingly recognized the importance of transitioning towards sustainable energy sources, and consequently, numerous policies and regulations have been enacted to support bioenergy production.

For instance, the European Union’s Renewable Energy Directive (RED II) mandates that member states achieve a 32% share of renewable energy in their energy mix by 2030, with specific provisions encouraging the use of biofuels derived from waste and non-food crops. Similarly, in the United States, the Renewable Fuel Standard (RFS) program established by the Environmental Protection Agency (EPA) requires a minimum volume of renewable fuels to be blended into the transportation fuel supply, fostering demand for biofuels produced in biorefineries.

Additionally, the bio-refinery sector is benefiting from incentives such as tax credits and subsidies provided by governments to reduce the carbon footprint of energy production. These regulatory frameworks promote the adoption of bio-refinery technologies and drive investment, innovation, and the growth of sustainable energy solutions across the global market. For instance, more than 80 countries have liquid biofuel policies, and the European Union and the United Kingdom have e-fuel requirements.

- According to the International Energy Agency (IEA), to be in line with the IEA Net Zero by 2050 Scenario, liquid biofuel use would need to nearly double, and solid bioenergy would require a 30% increase.

Restraints

Feedstock Unavailability and Variability, and Technological Immaturity Might Pose a Challenge to the Bio-Refinery Market.

Feedstock unavailability and variability, alongside technological immaturity, present significant challenges to the successful development and commercialization of biorefineries. The sustainable supply of biomass feedstock is critical to the cost-effective operation of biorefineries, and issues such as seasonality, regional disparities, and competition among sectors for resources complicate the consistency and availability of suitable feedstock.

For instance, agricultural residues such as wheat straw or corn stover are often in limited supply or subject to fluctuations in quantity due to climate conditions. This affects supply chains and drives up transportation and processing costs. Moreover, feedstock variability, such as moisture content and composition, can reduce process efficiency and impact product quality.

Furthermore, the immaturity of biorefinery technologies present significant barrier. Despite advances, many conversion processes remain at early development stages and require optimization. Technologies involved in biomass pretreatment, enzymatic hydrolysis, and fermentation face scaling challenges, with limited integration across conversion pathways.

Opportunity

Circular Economy Integration Creates Opportunities in the Bio-Refinery Market.

The integration of circular economy principles into the bio-refinery market is creating significant opportunities by focusing on the sustainable use of waste streams from agriculture and municipal sources. For instance, biorefineries are increasingly leveraging agricultural residues, such as straw, corn stover, and rice husks, as feedstocks for biofuel and bioproduct production.

The U.S. Department of Energy’s Bioenergy Technologies Office (BETO) has supported initiatives aimed at converting such residues into valuable bioenergy, highlighting their potential to reduce waste while meeting renewable energy targets. Similarly, municipal solid waste (MSW) is becoming a key resource for bio-refineries, with technologies such as anaerobic digestion and gasification converting waste materials into biofuels, biogas, and chemicals.

- POET-DSM’s Project LIBERTY in Emmetsburg, which had cost-shared funding from the Bioenergy Technologies Office, produces 25 million gallons of cellulosic ethanol per year, which is enough to avoid approximately 210,000 tons of CO2 emissions annually.

Similarly, in the European Union, initiatives such as the European Commission’s Circular Economy Action Plan encourage member states to adopt waste-to-energy strategies, fostering investment in biorefineries that utilize waste materials. For instance, the U.K. government has supported the development of advanced bioenergy facilities that convert household waste into sustainable biofuels. These innovations reduce landfill waste and contribute to lower carbon emissions, creating a closed-loop system that aligns with sustainability goals. As municipalities and agricultural sectors embrace waste-to-value concepts, biorefineries are well-positioned to benefit from a circular economy model, driving environmental and economic gains.

Trends

Shift Towards Integrated Bio-Refineries.

The shift towards integrated bio-refineries represents a notable trend in the bio-refinery market, driven by the demand for more efficient, multi-output production processes. Integrated bio-refineries aim to optimize the conversion of biomass into a diverse range of products, including biofuels, biochemicals, and biomaterials, thereby enhancing economic viability and reducing waste. This integration reduces the dependency on traditional petrochemical products while boosting the efficiency of resource utilization.

In Europe, several biorefineries have moved towards integration, such as the Futurol project in France, which focuses on producing second-generation bioethanol from different biomass types. These integrated systems are designed to maximize the carbon and energy efficiency of production, as evidenced by the Swedish company, Chemrec, which has integrated gasification technologies to produce both renewable energy and bio-based products. By aligning bio-refinery outputs with industrial needs and renewable energy goals, integrated bio-refineries are enhancing sustainability and providing new economic opportunities.

Geopolitical Impact Analysis

Disrupted Oil Industry Affecting Bio-Refinery Market Amid Geopolitical Tensions.

The geopolitical tensions have had a notable impact on the bio-refinery market, influencing both supply chains and energy policy decisions globally. For instance, the conflict between Russia and Ukraine has disrupted the global energy market, particularly affecting the supply of natural gas and oil. Similarly, the Israel-Iran conflict focuses attention on immediate energy security risks. This has led many countries to accelerate their shift towards renewable energy sources, including biofuels, to enhance energy security.

Therefore, the European Union has increased its commitment to bioenergy, with member states investing more in domestic biofuel production to reduce reliance on fossil fuel imports. Additionally, trade restrictions and sanctions imposed by various countries have led to supply chain disruptions, making feedstock procurement for bio-refineries more challenging and costly. These geopolitical shifts have highlighted the importance of energy independence and sustainable fuel sources, encouraging governments in North America, Europe, and Asia to foster a more resilient bio-refinery industry.

Furthermore, global supply chain bottlenecks, particularly in transporting raw materials such as agricultural residues and waste, have increased costs and delayed project timelines. However, these challenges have accelerated innovation, with biorefineries focusing on more diversified and localized feedstock sources to mitigate the impact of external geopolitical events.

Regional Analysis

North America Held the Largest Share of the Global Bio-Refinery Market.

In 2024, North America dominated the global bio-refinery market, holding about 34.2% of the total global consumption, driven by robust government policies, technological advancements, and significant investments in bioenergy. The U.S. government, through initiatives such as the Renewable Fuel Standard (RFS), has actively promoted the use of renewable fuels, providing substantial support to bio-refineries.

- In 2024, the U.S. biogas industry saw record growth with over USD 3 billion invested in 125 new projects, a 40% investment jump and 17% project increase from 2023, totaling nearly 2,500 facilities, primarily converting organic waste to Renewable Natural Gas (RNG) or electricity, driven by supportive policies and growing demand for clean energy sources, creating opportunities for biorefineries.

Additionally, the country has a well-established infrastructure for biofuel production, especially in regions such as the Midwest, which is rich in agricultural residues such as corn stover and wheat straw. Similarly, Canada has focused on developing bioenergy from its extensive forestry resources, with several biorefineries converting wood waste into biofuels and biochemicals.

Moreover, North America’s advanced research and development facilities, coupled with a favorable regulatory environment, continue to foster growth in the bio-refinery sector, esuring its leadership on the global stage.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Players in the biorefinery market put emphasis on investing in research and development to advance biorefinery technologies, such as improving feedstock processing, optimizing biochemical conversion methods, and developing multi-product facilities. Additionally, they focus on strategic partnerships and collaborations with agricultural producers, technology developers, and government bodies to secure a stable supply of feedstock and ensure regulatory compliance.

Furthermore, companies focus on geographical diversification, establishing operations in regions with abundant biomass resources or favorable regulatory environments. Additionally, integrating circular economy principles by utilizing agricultural and municipal waste streams enhances sustainability and reduces operational costs. Moreover, players focus on improving the scalability and economic feasibility of their operations to respond more effectively to global demand for renewable fuels and biochemicals.

Key Development

- In April 2024, Archer Daniels Midland and Solugen Inc. began construction on a 500,000-square-foot biorefinery in Marshall, Minnesota, to use corn syrup to produce low-carbon acids for agriculture, water treatment, energy, and personal care products.

- In July 2025, Neste collaborated with DHL Express, the world’s leading international express service provider, to supply them 7,400 tons (9.5 million liters) of neat, unblended Neste MY Sustainable Aviation Fuel at Singapore Changi Airport.

The Major Players in The Industry

- Chevron

- Neste

- Wilmar International Ltd.

- Clariant

- China Petrochemical Corporation

- Sekab

- ABF Sugar

- ADM

- TotalEnergies

- Versalis S.p.A.

- Godavari Biorefineries Ltd.

- Chempolis Biorefining Park

- Novozymes A/S

- Valero

- Green Plains Inc.

- Other Key Players

Report Scope

Report Features Description Market Value (2024) USD 165.6 Bn Forecast Revenue (2034) USD 371.0 Bn CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Feedstock Type (Lignocellulosic Biomass, Sugars & Starches, Oil & Lipid Feedstocks, Organic Waste, Algae & Microorganisms, and Others), By Conversion Technology (Biochemical Conversion, Thermochemical Conversion, Chemical Conversion, and Physical Conversion), By Product Output (Biofuels, Biochemicals, and Others), By End-Use Industry (Transportation & Aviation, Energy & Utilities, Chemicals & Materials, Agriculture, Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Industrial Manufacturing, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Chevron, Neste, Wilmar International Ltd., Clariant, China Petrochemical Corporation, Sekab, ABF Suger, ADM, TotalEnergies, Versalis S.p.A., Godavari Biorefineries Ltd., Chempolis Biorefining Park, Novozymes A/S, Valero, Green Plains Inc., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Chevron

- Neste

- Wilmar International Ltd.

- Clariant

- China Petrochemical Corporation

- Sekab

- ABF Sugar

- ADM

- TotalEnergies

- Versalis S.p.A.

- Godavari Biorefineries Ltd.

- Chempolis Biorefining Park

- Novozymes A/S

- Valero

- Green Plains Inc.

- Other Key Players