Global Big data in EdTech Market Size, Share Analysis Report By Solution (Software (Cloud-Based, On-Premises), Services (Professional Services, Managed Services)), By Application (Behavior Detection, Skill Assessment, Course Recommendation, Student Attrition Rate Detection, Others), By Sector (K-12, Preschool, Higher Education), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 137846

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

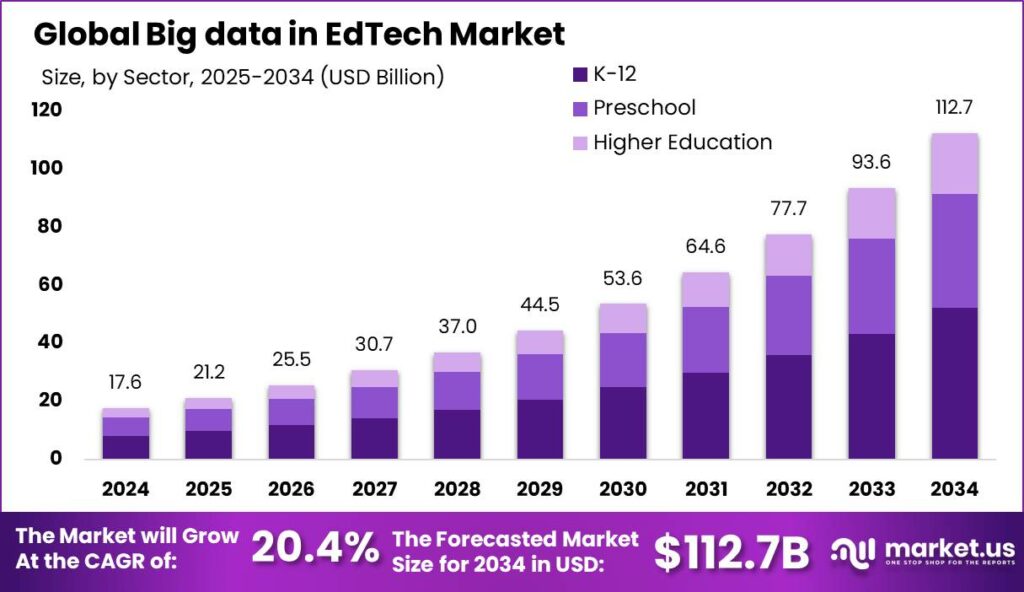

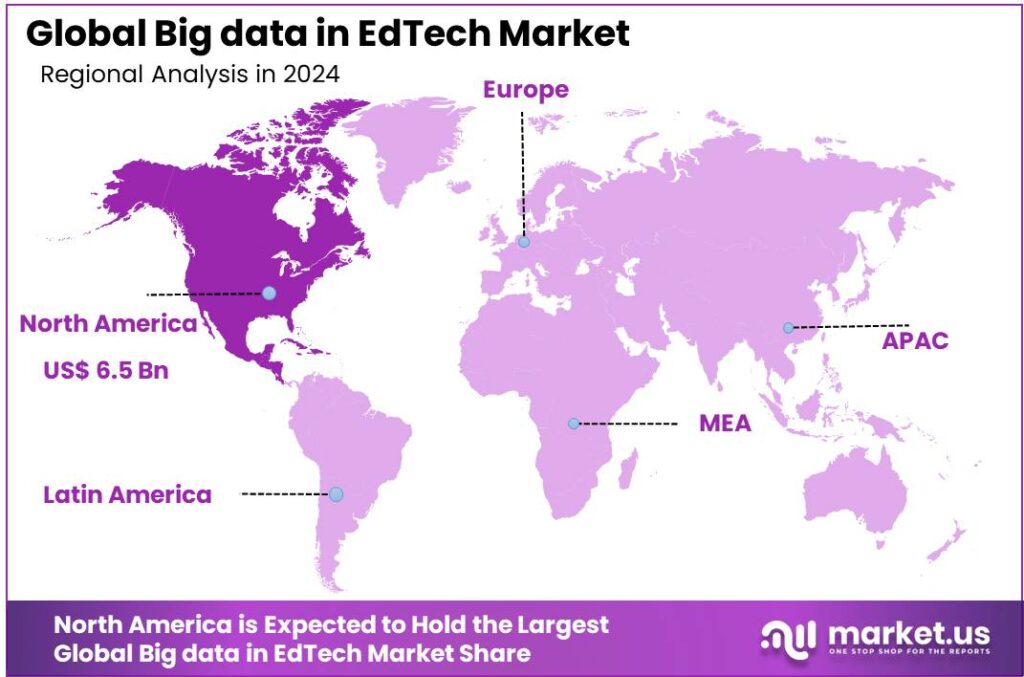

The Global Big data in EdTech Market size is expected to be worth around USD 112.7 Billion By 2034, from USD 17.6 Billion in 2024, growing at a CAGR of 20.40% during the forecast period from 2025 to 2034. In 2024, North America dominated the big data in EdTech sector, accounting for over 37.2% of the market share and generating revenues of approximately USD 6.5 billion.

Big data in the EdTech sector refers to the large amounts of data gathered from digital learning tools, including student engagement, performance, content interactions, and personalized learning paths. Through advanced algorithms and analytics, EdTech companies convert this data into actionable insights to improve educational outcomes, personalize learning, and enhance teaching methods.

The growth of big data in the EdTech market is driven by factors such as the increasing digitization of education through online and hybrid learning models, generating vast amounts of data. Additionally, the demand for personalized learning experiences is rising, with big data enabling more detailed insights and customization to meet individual student needs and learning styles.

Advancements in data analytics and AI have made big data solutions more affordable and feasible in education. Support from regulations and governments has further encouraged the adoption of these tools, driving improved educational outcomes and more efficient learning environments in EdTech.

Big data is gaining popularity in the EdTech market for its ability to enhance educational strategies and outcomes. As stakeholders see the value of data-driven approaches, big data technologies are increasingly integrated into education systems worldwide. This trend is fueled by digital transformation in education, emphasizing the importance of data in evolving teaching methods.

The EdTech market offers significant opportunities for innovation in big data applications, such as creating predictive models to optimize student learning paths, using AI for automated feedback, and improving administrative systems through analytics. The growing volume of educational data also paves the way for developing tools that can revolutionize assessment, engagement, and management in education.

The big data EdTech market is set to grow as technology advances and digital education expands globally. Cloud-based solutions will drive scalable implementation, while increased collaborations between institutions and tech companies will foster innovations in learning and efficiency. This trend points to a future where data-driven technologies become central to education, enhancing learning through empirical insights.

Key Takeaways

- The Global Big Data in EdTech Market size is expected to reach approximately USD 112.7 Billion by 2034, growing from USD 17.6 Billion in 2024, at a CAGR of 20.40% during the forecast period from 2025 to 2034.

- In 2024, the software segment held a dominant position in the Big Data in EdTech market, capturing more than 68.3% of the market share.

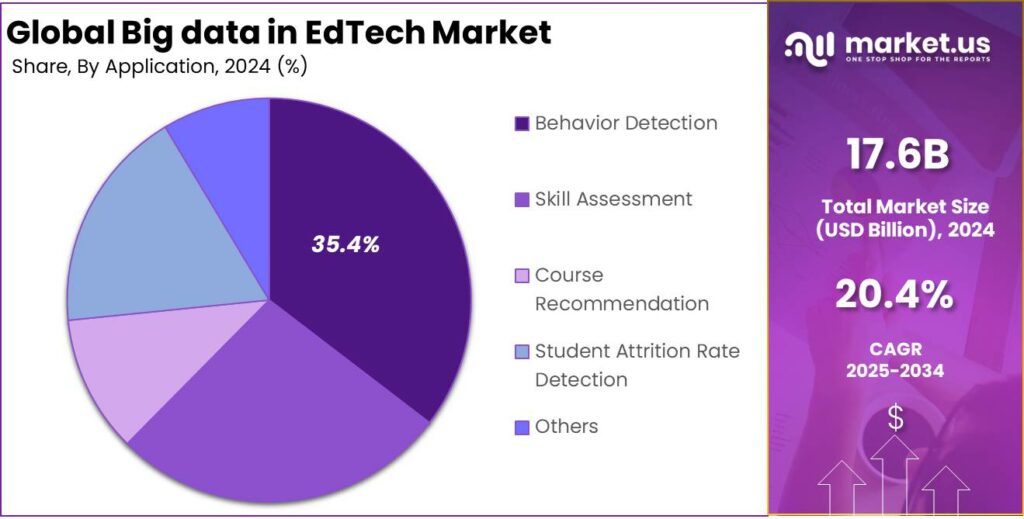

- The Behavior Detection segment held a significant position in the Big Data EdTech market in 2024, accounting for over 35.4% of the market share.

- In 2024, the K-12 segment was the largest market segment within Big Data in EdTech, holding more than 46.4% of the market share.

- In 2024, North America held a dominant market position in the Big Data in EdTech sector, accounting for more than 37.2% of the market share, with revenues reaching approximately USD 6.5 billion.

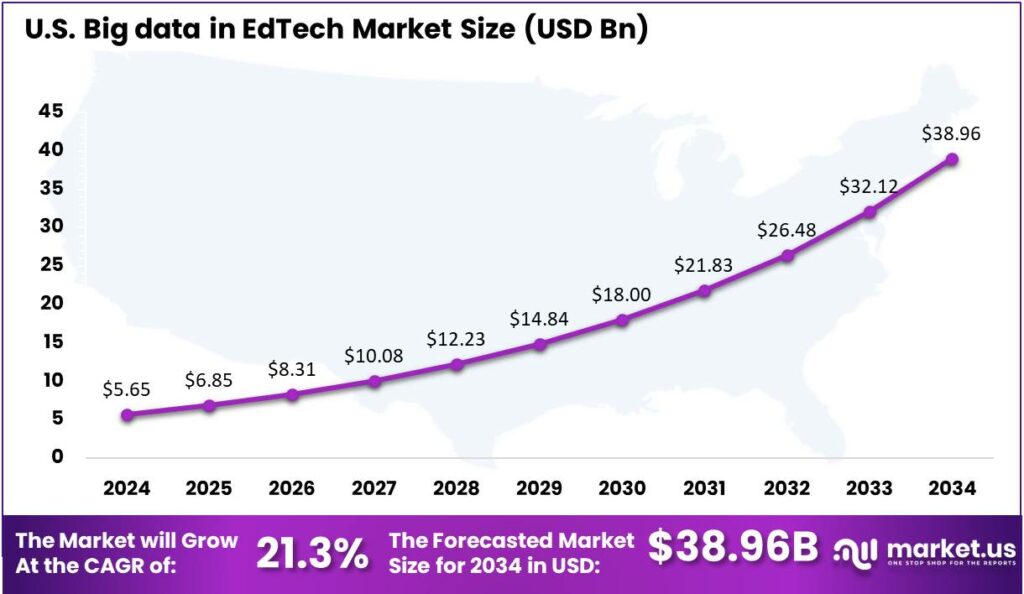

- The U.S. Big Data in EdTech market was valued at approximately USD 5.65 billion in 2024, with a strong CAGR of 21.3%.

U.S. Big data in EdTech Market

The U.S. big data in EdTech market was valued at approximately USD 5.65 billion in 2024, with a robust compound annual growth rate (CAGR) of 21.3%, reflecting the increasing adoption of data-driven technologies and solutions across educational institutions to enhance learning outcomes and operational efficiency.

The growing value of big data in EdTech is driven by the rise of digital learning tools from online and hybrid learning models, generating vast amounts of data. Educators use this data to enhance engagement, personalize learning, and improve outcomes. Additionally, advancements in data analytics technology have made big data solutions more accessible and affordable for educational institutions.

Looking forward, the market is expected to maintain its growth trajectory, driven by ongoing technological innovations and increasing investments in EdTech. As big data transforms education, EdTech stakeholders can expect improved operational efficiencies and more targeted strategies, creating a more informed and adaptive learning environment.

In 2024, North America held a dominant market position in the big data in EdTech sector, capturing more than a 37.2% share with revenues reaching approximately USD 6.5 billion. This region’s leadership can be attributed to several interrelated factors.

The high adoption of advanced technologies in the U.S. and Canada has boosted big data integration in education, improving learning outcomes and efficiency. The presence of tech firms, EdTech startups, strong R&D investments, digital infrastructure, and supportive government policies further drive market growth in the region.

In contrast, Europe and the Asia-Pacific (APAC) regions have also shown significant growth in this market, driven by increasing digitalization of education and governmental support in countries such as Germany, the United Kingdom, China, and India.

However, North America remains ahead due to its early adoption of emerging technologies and the establishment of partnerships between educational institutions and tech companies to innovate and enhance educational tools with big data analytics.

Solution Analysis

In 2024, the software segment held a dominant market position within the Big Data in EdTech market, capturing more than a 68.3% share. This substantial market share can be attributed to the pivotal role software solutions play in the operational deployment of big data technologies in educational settings.

Software solutions, including cloud-based and on-premises systems, are essential for collecting, storing, processing, and analyzing the vast amounts of data generated by digital learning platforms. The scalability and flexibility offered by cloud-based solutions, in particular, have driven their adoption among educational institutions looking to leverage big data analytics without substantial upfront investments in IT infrastructure.

Cloud-based software solutions have driven the growth of the EdTech software segment by offering low entry costs, easy access, and scalability. They allow institutions to quickly integrate advanced data analytics and management tools without needing extensive hardware.

Conversely, on-premises software solutions continue to hold relevance, particularly among institutions that prioritize data control and security. These solutions enable schools and universities to manage sensitive data internally, mitigating risks associated with data breaches and unauthorized access that are more pertinent in cloud-based systems.

Application Analysis

In 2024, the Behavior Detection segment held a dominant position in the big data EdTech market, capturing more than a 35.4% share. This segment leads due to its critical role in enhancing student engagement and improving educational outcomes.

Analyzing behavioral data helps educators spot disengagement or academic struggles early, enabling timely interventions. The growing focus on maintaining high engagement in both online and traditional classrooms has driven the adoption of behavior detection technologies in EdTech.

The Skill Assessment segment in EdTech uses big data analytics to evaluate students’ skills in real-time, offering insights that help educators tailor instruction and support. This approach aligns content with individual needs and career readiness, creating a more adaptive learning environment.

Another vital application is the Course Recommendation segment. This area leverages big data to analyze student performance and learning preferences to suggest the most suitable courses and materials. By aligning course offerings with student needs and interests, educational institutions can enhance learning experiences and outcomes.

Sector Analysis

In 2024, the K-12 segment held a dominant market position within the Big Data in EdTech sector, capturing more than 46.4% of the market share. This substantial share can be attributed to several factors that underscore the integration of big data analytics in primary and secondary education.

Primarily, the surge in digital learning tools and educational software tailored for K-12 education has driven the adoption of data-driven strategies to enhance student engagement and learning outcomes. The implementation of adaptive learning technologies, which utilize big data to personalize the learning experience, has been pivotal in promoting the growth of this segment.

The focus on standardized testing and performance tracking in K-12 education has driven the adoption of big data solutions. Schools are using big data to analyze student performance and improve teaching methods, supported by government initiatives and funding promoting advanced technology use.

The rise of cloud-based solutions in education has enabled easy integration of big data technologies in K-12 schools. Cloud platforms provide scalable, cost-effective data storage and analytics, allowing even small and medium-sized schools to access and benefit from big data tools, driving widespread adoption in the K-12 sector.

Key Market Segments

By Solution

- Software

- Cloud-Based

- On-Premises

- Services

- Professional Services

- Managed Services

By Application

- Behavior Detection

- Skill Assessment

- Course Recommendation

- Student Attrition Rate Detection

- Others

By Sector

- K-12

- Preschool

- Higher Education

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Personalized Learning

The integration of big data in educational technology (EdTech) has significantly advanced personalized learning. By analyzing extensive datasets, educators can tailor instructional content to meet individual student needs, thereby improving engagement and academic performance.

Moreover, data-driven insights enable educators to identify learning patterns and predict future performance, allowing for timely interventions and support. The application of big data in EdTech thus fosters an educational environment where teaching strategies are informed by empirical evidence, leading to enhanced learning outcomes.

Restraint

Data Privacy Concerns

Despite its benefits, the use of big data in EdTech raises significant data privacy concerns. The collection and analysis of student information necessitate stringent measures to protect sensitive data from unauthorized access and potential misuse. Instances of data breaches can lead to the exposure of personal information, undermining trust in educational institutions and technologies.

Additionally, the lack of standardized regulations governing data privacy in educational settings exacerbates these concerns, as inconsistent policies may result in inadequate protection measures. Therefore, while big data offers opportunities for educational enhancement, it also imposes the responsibility to implement robust data security protocols to safeguard student privacy.

Opportunity

Informed Decision-Making in Educational Policy

Big data presents a substantial opportunity to inform decision-making in educational policy. By analyzing large-scale educational data, policymakers can identify trends, assess the effectiveness of educational programs, and allocate resources more efficiently.

Furthermore, the evaluation of teaching methodologies through data analysis can guide curriculum development and pedagogical strategies, ensuring they are evidence-based and effective. The strategic use of big data thus empowers policymakers to make informed decisions that enhance the quality and equity of education systems.

Challenge

Integration with Existing Educational Systems

Integrating big data analytics into existing educational systems poses a significant challenge. Educational institutions often operate with legacy systems that may not be compatible with advanced data analytics tools, leading to difficulties in data integration and analysis.

Additionally, the implementation of big data solutions requires substantial investment in infrastructure and training, which may be prohibitive for some institutions. The complexity of managing and interpreting large datasets also demands specialized expertise, further complicating integration efforts. Effective integration of big data into education requires careful planning, resource allocation, and capacity building.

Emerging Trends

Big data is reshaping educational technology (EdTech) by introducing several emerging trends. One significant development is the emphasis on personalized learning. By analyzing extensive datasets, educational platforms can customize content to meet individual student needs, enhancing engagement and improving learning outcomes.

Another trend is the integration of artificial intelligence (AI) in classrooms. AI tools, such as intelligent tutoring systems, provide real-time feedback and support to students, facilitating independent practice and immediate assistance.

Additionally, the use of data analytics is becoming more prevalent in education. Schools are adopting advanced data systems to collect and analyze information, leading to improved decision-making processes. Predictive analytics help identify at-risk students early, enabling timely interventions to enhance student success.

Business Benefits

Incorporating big data into EdTech enhances educational outcomes by providing data-driven insights. Analyzing student performance helps identify effective teaching methods and personalize content, boosting engagement and success.

Big data enables personalized learning experiences by customizing content to match student preferences and learning styles. This personalization boosts user satisfaction, engagement, and leads to better learning outcomes and higher platform usage.

Operational efficiency is another significant benefit. Big data analytics enable EdTech companies to streamline their operations by identifying areas for improvement and optimizing resource allocation. This efficiency leads to cost savings and improved service delivery, enhancing the overall effectiveness of educational platforms.

Key Player Analysis

Several key players are leveraging big data to transform education by offering tools that help institutions make data-driven decisions, monitor student performance, and improve educational strategies.

Alteryx Inc. is a leading player in the data analytics space, providing powerful data blending and advanced analytics solutions. In the EdTech sector, Alteryx helps educational institutions harness the power of big data to gain actionable insights. By simplifying complex data processes, Alteryx enables educators to track student progress, identify at-risk students, and personalize learning.

Blackboard Inc. is a well-established name in the EdTech sector, known for its learning management system (LMS) and a suite of educational tools. The company integrates big data analytics into its platform, offering insights into student engagement, course completion rates, and performance trends.

Fintellix Solution Pvt. Ltd. focuses on providing data analytics solutions for the education sector in India. Known for its advanced data processing capabilities, Fintellix helps educational institutions manage and analyze large volumes of student data. The company offers unique insights into financial aid, student performance, and institutional efficiency.

Top Key Players in the Market

- Alteryx Inc.

- Blackboard Inc.

- Fintellix Solution Pvt. Ltd.

- LatentView Analytics

- International Business Machines Corporation (IBM)

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Tableau Software

- Tibco Software Inc.

- Others

Top Opportunities Awaiting for Players

The Big Data in EdTech market is poised for significant growth, offering numerous opportunities for industry players.

- Integration of AI and Personalized Learning: There is a growing demand for educational solutions that offer personalized learning experiences. The integration of artificial intelligence can provide tailored educational content that adapts to the individual learning pace and style of students. Companies that develop AI-driven platforms for personalized learning are likely to see increased market share.

- Blockchain in Education: Blockchain technology is increasingly being recognized for its potential to make educational transactions more secure and transparent. It can be used to manage and verify academic credentials, protect intellectual property, and facilitate secure transactions for learning materials. This opens up a lucrative market for EdTech companies that integrate blockchain into their solutions.

- Virtual and Augmented Reality: The use of virtual and augmented reality (VR/AR) in education is transforming traditional learning environments. These technologies offer immersive learning experiences that can enhance student engagement and improve learning outcomes. EdTech companies that invest in VR/AR technologies are well-positioned to capitalize on this trend.

- Expansion into Emerging Markets: Emerging markets present a significant growth opportunity for EdTech companies. With increasing internet penetration and a large young population, these markets offer a new customer base that is eager for educational advancements. Tailoring products to meet the specific needs of these regions can drive rapid growth.

- Corporate Training and Continuous Education: There is a rising trend in lifelong learning and professional development, with many businesses investing in continuous education for their employees. EdTech platforms that offer scalable and flexible learning solutions for the corporate sector are likely to experience increased demand.

Recent Developments

- In October 2024, During the SAP TechEd 2024 keynote, SAP showcased innovations aimed at simplifying customer experiences. These include leveraging generative AI to accelerate development projects, making informed business decisions with intelligent data applications, and enabling sales representatives with intelligent selling tools.

- In February 2024, Iris unveiled the first AI-enabled education tablet made in India, called MILKYWAY. The company also signed an agreement with Vedavaag Systems Limited to potentially reach 6,000 Citizen Service Centers across India.

- In April 2024, Follett School Solutions acquired MasterLibrary, a company that provides integrated facilities solutions for K-12 school districts. This acquisition allows Follett to offer more comprehensive services to schools, including facility management and work order systems.

- January 2024, Baims, a Kuwaiti EdTech company, acquired Orcas, an Egyptian online tutoring startup. This acquisition aims to enhance Baims’ presence in the Middle East and North Africa region and expand its offerings to include both pre-recorded courses and personalized one-on-one tutoring.

Report Scope

Report Features Description Market Value (2024) USD 17.6 Bn Forecast Revenue (2034) USD 112.7 Bn CAGR (2025-2034) 20.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Software (Cloud-Based, On-Premises), Services (Professional Services, Managed Services)), By Application (Behavior Detection, Skill Assessment, Course Recommendation, Student Attrition Rate Detection, Others), By Sector (K-12, Preschool, Higher Education) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alteryx Inc., Blackboard Inc., Fintellix Solution Pvt. Ltd., LatentView Analytics, International Business Machines Corporation (IBM), Oracle Corporation, SAP SE, SAS Institute Inc., Tableau Software, Tibco Software Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Big Data in EdTech MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Big Data in EdTech MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alteryx Inc.

- Blackboard Inc.

- Fintellix Solution Pvt. Ltd.

- LatentView Analytics

- International Business Machines Corporation (IBM)

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Tableau Software

- Tibco Software Inc.

- Others