Global Big Data Finance Market Size, Share, Growth Analysis By Component (Software [Big Data Analytics Software, Data Management Software, Data Mining Software, Data Visualization Software, Others], Services [Professional Services, Managed Services]), By Deployment Mode (Cloud-based, On-Premises), By Application (Fraud Detection & Security, Risk & Compliance Management, Financial Forecasting, Credit Scoring, Others), By Data Type (Unstructured Data, Structured Data, Semi-Structured Data), By End-User (Retail Banking, Investment Banking & Capital Markets, Insurance, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162525

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of AI

- AI Industry Adoption

- Analysts’ Viewpoint

- Emerging trends

- US Market Size

- Investment and Business Benefit

- By Component

- By Deployment Mode

- By Application

- By Data Type

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

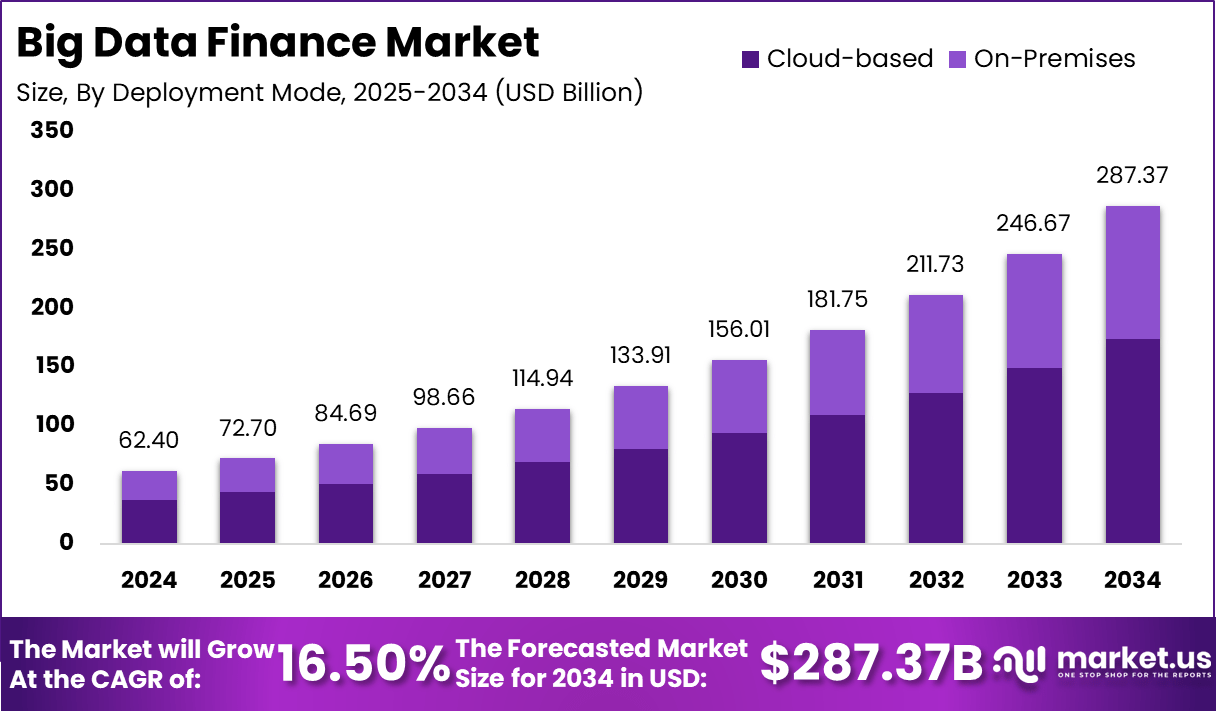

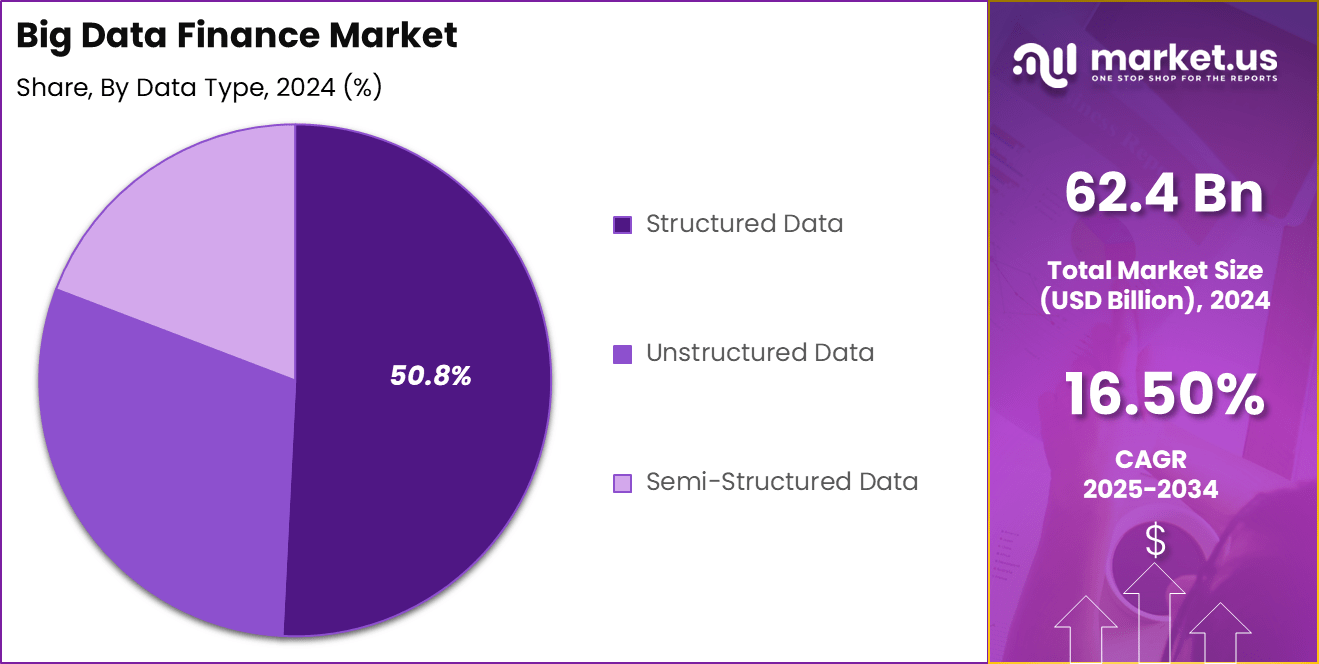

The Big Data Finance Market was valued at USD 62.4 billion in 2024 and is projected to grow at a CAGR of 16.5%, reaching approximately USD 287.37 billion by 2034. This growth reflects the accelerating adoption of advanced analytics, AI-driven financial modeling, and real-time data processing within banking, insurance, and investment management.

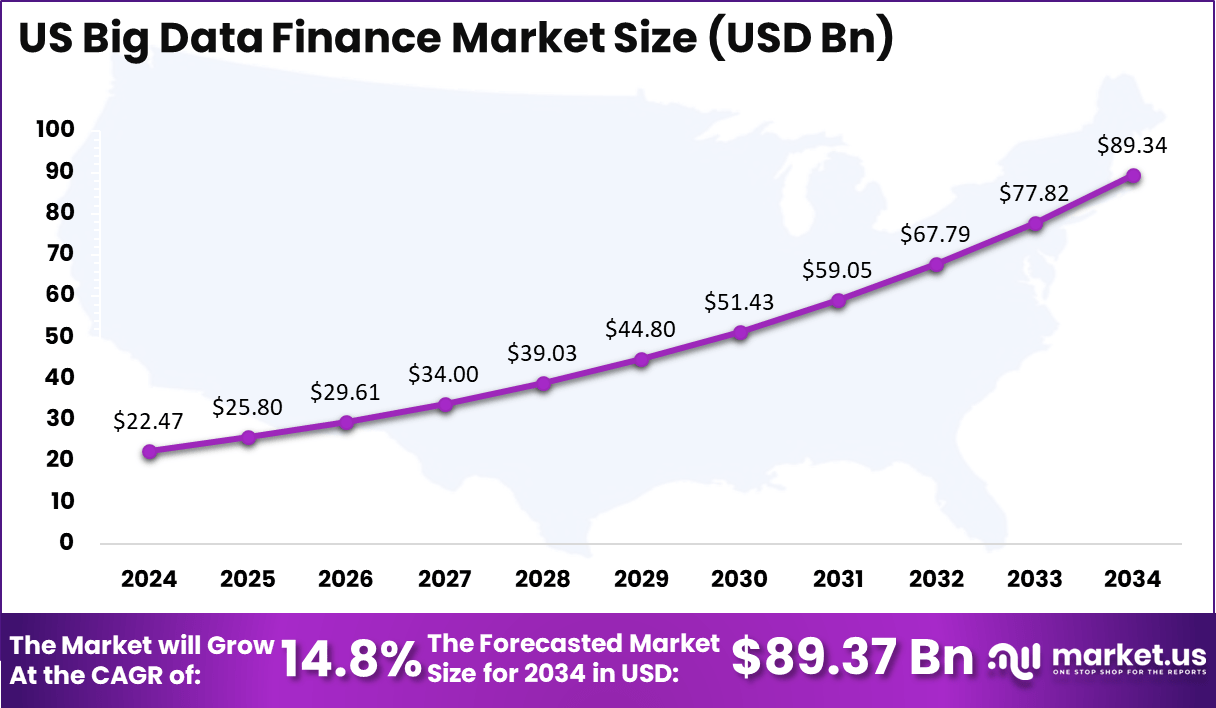

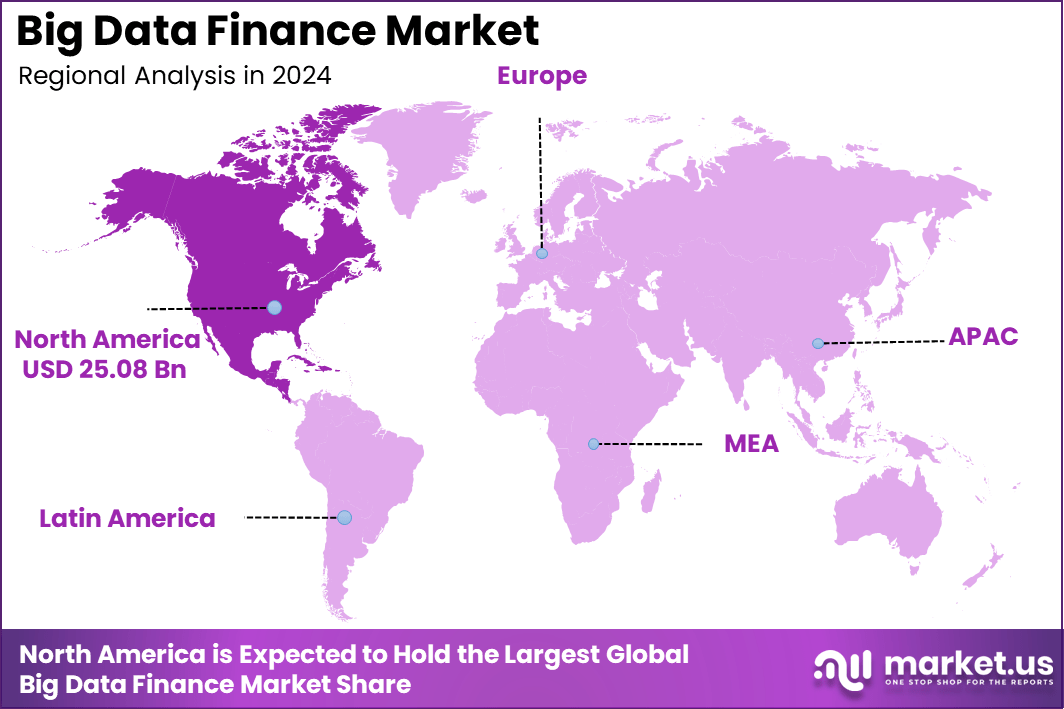

North America accounted for 40.2% of the market, with a valuation of around USD 25.08 billion in 2024, supported by a strong presence of major financial institutions and fintech innovation hubs. The United States dominated the regional market, valued at USD 22.47 billion in 2024, and is expected to reach USD 89.34 billion by 2034, expanding at a CAGR of 14.8%.

The Big Data Finance industry encompasses the integration of advanced analytics, artificial intelligence, and data management technologies to process and interpret massive volumes of financial information. It enables institutions to gain deeper insights into customer behavior, risk assessment, fraud detection, and investment strategies.

By leveraging predictive analytics and machine learning, financial organizations can make faster, more informed decisions and optimize their operations. The growing need for real-time analytics, regulatory compliance, and personalized financial services has made big data an indispensable tool for banks, insurance firms, asset managers, and fintech companies worldwide.

The Big Data Finance sector represents the convergence of data science and financial analytics, transforming how institutions analyze, manage, and utilize vast datasets. Financial organizations increasingly rely on big data tools to enhance decision-making accuracy, detect market patterns, and strengthen risk management frameworks.

The integration of machine learning, predictive modeling, and natural language processing allows firms to uncover hidden insights from structured and unstructured data, driving efficiency and innovation across banking, investment, and insurance sectors. Moreover, the rise of digital transactions, online banking, and algorithmic trading has accelerated the demand for real-time analytics and automated data processing systems.

Governments and regulatory bodies are also encouraging data transparency and compliance through advanced analytics platforms. As financial ecosystems grow more complex, big data plays a pivotal role in enabling institutions to anticipate market shifts, manage systemic risks, and deliver personalized financial experiences that improve customer engagement and trust.

In 2025, the big data finance sector is experiencing rapid growth, marked by major funding rounds, strategic mergers and acquisitions (M&A), and the launch of advanced AI-powered analytics tools. AI data center startup Crusoe raised $1.38 billion in a Series E round at a $10 billion valuation, with major investors including Nvidia and Fidelity, highlighting strong confidence in data infrastructure for financial AI applications.

Global fintech funding is rebounding, with $44.7 billion raised in the first half of 2025 across 2,216 deals, signaling renewed investor confidence after a downturn in previous years. In India, financial sector M&A activity surged by 127%, with $8 billion in deals completed between January and September 2025, driven by digital transformation and financial inclusion initiatives.

M&A trends show a 9% decline in global deal volume in early 2025 compared to the same period in 2024, but deal values rose 15%, indicating a shift toward larger, strategic transactions, particularly in technology and financial services. Notable deals include Interpublic Group’s acquisition of Mumbai-based retail analytics firm Intelligence Node for nearly $100 million to strengthen e-commerce capabilities, and Oracle’s $29.6 billion purchase of health IT firm Cerner to expand data analytics in financialized healthcare services.

The big data industry attracted robust investment, with an average of $22 million per funding round and over $10 billion invested by top firms like Insight Partners, SoftBank Vision Fund, and Goldman Sachs. On the product front, companies launched AI-driven financial tools such as LSEG’s AI Analytics Assistant and StarMine predictive models, which enhance real-time risk assessment and investment forecasting.

Additionally, platforms like Prezent use AI to convert raw financial data into branded, board-ready presentations, improving communication efficiency for finance teams. These developments reflect a broader trend where financial institutions leverage big data for automation, personalization, and regulatory compliance, positioning data analytics as a core driver of innovation and competitive advantage in 2025.

Key Takeaways

- The Big Data Finance Market is projected to grow from USD 62.4 billion in 2024 to USD 287.37 billion by 2034, expanding at a strong CAGR of 16.5%, driven by increasing adoption of data analytics and AI in financial services.

- North America accounted for 40.2% of the global market in 2024, valued at around USD 25.08 billion, supported by the presence of leading fintech companies and advanced financial infrastructure.

- The US dominated the regional market with a 2024 valuation of USD 22.47 billion and is expected to reach USD 89.34 billion by 2034, registering a CAGR of 14.8% owing to high digitalization and cloud-based analytics adoption.

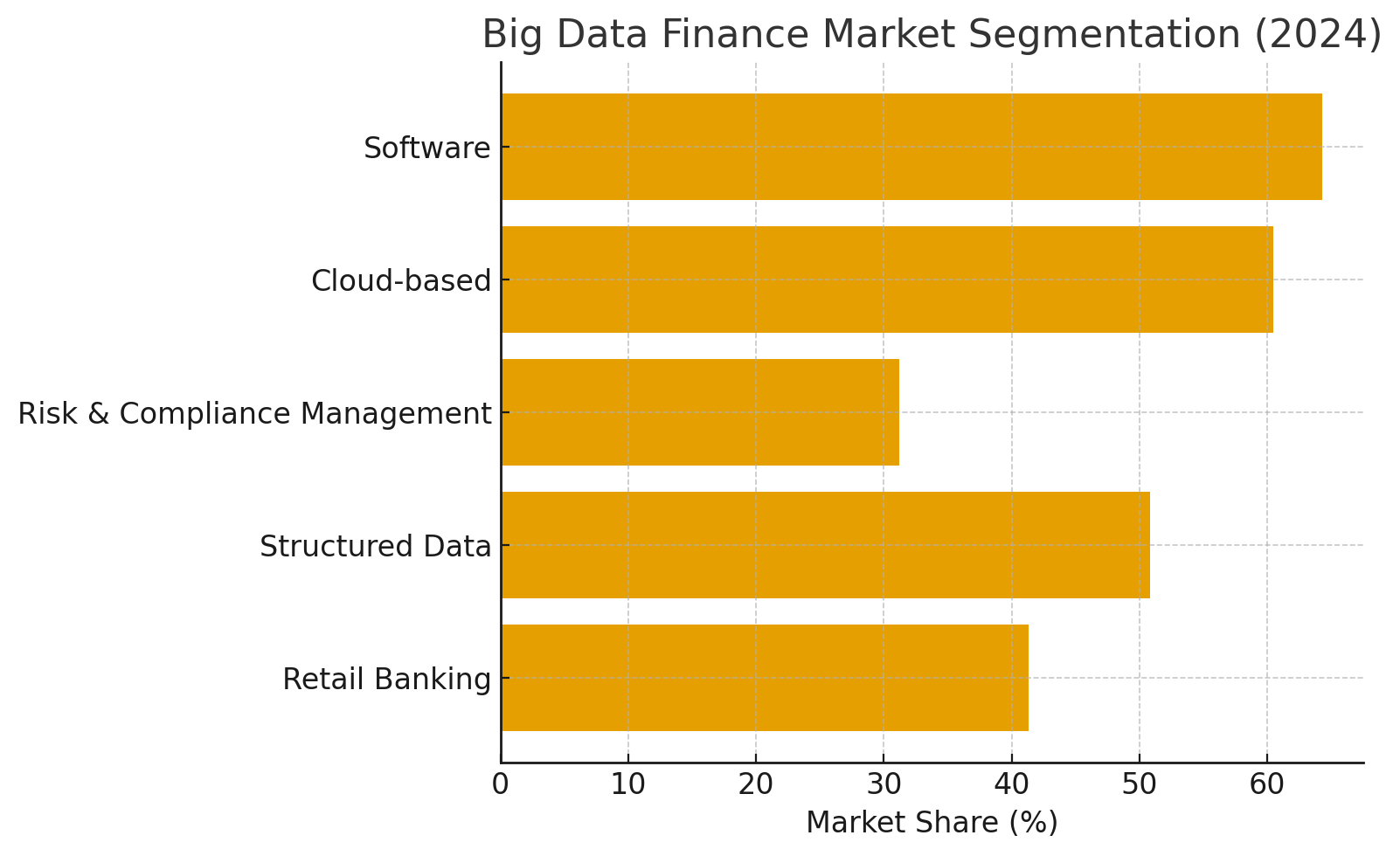

- By Component, software held the largest share at 64.3%, reflecting strong demand for advanced analytics platforms and AI-driven financial modeling tools.

- By Deployment Mode, cloud-based solutions led with 60.5% share, driven by scalability, cost efficiency, and ease of integration with enterprise systems.

- By Application, risk and compliance management accounted for 31.2% of the market, as financial institutions prioritize regulatory adherence and fraud prevention.

- By Data Type, structured data dominated with 50.8% share, highlighting the importance of transactional and customer data for real-time analytics.

- By End-User, retail banking represented the largest segment at 41.3%, owing to growing use of big data for customer segmentation, personalized product offerings, and predictive risk analysis.

Role of AI

Artificial intelligence plays a transformative role in the Big Data Finance landscape by enabling faster, smarter, and more accurate decision-making across the financial ecosystem. AI algorithms process massive volumes of structured and unstructured financial data to identify trends, predict risks, and detect fraudulent activities in real time.

Through machine learning and natural language processing, financial institutions can automate tasks such as credit scoring, portfolio optimization, and customer service, reducing operational costs and human error. AI-driven predictive analytics empower banks and investment firms to anticipate market fluctuations and adjust strategies proactively. In risk and compliance management, AI helps analyze complex regulatory data and ensures adherence to evolving financial standards.

Furthermore, generative AI and deep learning models enhance data visualization, offering actionable insights for strategic planning. The growing integration of AI into big data systems strengthens transparency, efficiency, and personalization in financial services. As institutions continue to digitalize, AI is expected to become the backbone of intelligent finance, driving innovation in algorithmic trading, personalized banking experiences, and automated financial advisory systems.

AI Industry Adoption

The adoption of artificial intelligence across industries has accelerated rapidly as organizations seek to enhance efficiency, accuracy, and decision-making. In finance, AI supports fraud detection, risk assessment, and algorithmic trading, while in healthcare, it aids in predictive diagnostics, drug discovery, and personalized treatment.

The manufacturing sector leverages AI for predictive maintenance, quality control, and automation of production lines, improving uptime and reducing costs. Retailers employ AI for demand forecasting, inventory optimization, and personalized shopping experiences that increase customer engagement. In the energy and utilities sector, AI-driven analytics optimize grid management, energy distribution, and predictive fault detection.

Transportation and logistics rely on AI for route optimization, autonomous systems, and real-time tracking, enhancing supply chain visibility. Moreover, the rise of generative AI has revolutionized content creation, customer service, and data analysis across corporate environments. Governments and public institutions are also embracing AI for smart city planning, digital governance, and citizen service automation.

This widespread adoption reflects a fundamental shift toward data-driven ecosystems, where AI not only augments human capabilities but also reshapes traditional business models, creating more adaptive, intelligent, and sustainable industries globally.

Analysts’ Viewpoint

Analysts view the Big Data Finance market as a rapidly evolving domain that is reshaping how financial institutions operate, analyze, and make strategic decisions. The integration of big data analytics and artificial intelligence has moved beyond experimental adoption to becoming a core business function across banking, insurance, and asset management sectors.

Financial firms are increasingly prioritizing predictive analytics for risk mitigation, fraud detection, and customer segmentation. The strong shift toward cloud-based platforms reflects a growing need for scalability, real-time insights, and cost-efficient data management. Moreover, the surge in regulatory compliance requirements has heightened the importance of advanced data governance and analytics tools.

Analysts also note that the rising digitalization of payments and the proliferation of fintech startups are expanding data volumes, pushing institutions to leverage machine learning and AI for operational efficiency and competitive advantage.

North America continues to lead the market due to early technological adoption and mature financial infrastructure, while Asia-Pacific is emerging as a high-growth region driven by expanding digital banking and government-led data initiatives. Overall, the market is expected to evolve into a highly data-driven ecosystem where automation, intelligence, and personalization define future financial services.

Emerging trends

Emerging trends in the Big Data Finance market highlight a deep transformation of financial operations through advanced technologies and data intelligence. One major trend is the integration of artificial intelligence and machine learning into financial analytics, enabling institutions to automate risk assessments, detect fraud in real time, and deliver hyper-personalized banking services.

Cloud-based data platforms are also gaining traction, providing scalability, flexibility, and cost efficiency for large-scale data processing. Another growing trend is the rise of real-time analytics for instant decision-making, especially in areas like high-frequency trading and credit risk evaluation. Financial institutions are increasingly adopting predictive analytics to anticipate customer behavior and market fluctuations.

Moreover, the growing emphasis on data governance and compliance is driving the development of secure, transparent, and auditable data systems. The use of blockchain for transaction validation and data integrity is emerging as a complementary innovation in big data ecosystems.

Additionally, the expansion of open banking frameworks is fostering collaboration between traditional banks and fintech firms, leading to richer data exchanges and innovation in customer experience. Collectively, these trends are propelling the financial industry toward a data-driven, automated, and intelligent operational model.

US Market Size

The United States Big Data Finance market, valued at USD 22.47 billion in 2024, is projected to reach approximately USD 89.34 billion by 2034, growing at a CAGR of 14.8%. This growth is largely attributed to the rapid adoption of AI-driven analytics, machine learning, and predictive modeling across major financial institutions. The US banking, insurance, and investment sectors are increasingly leveraging big data tools for real-time fraud detection, risk management, customer profiling, and regulatory compliance.

The integration of cloud-based data platforms has further enabled scalability, faster data processing, and cost efficiency, fostering higher market penetration. The country’s well-established digital infrastructure, high fintech adoption rate, and robust cybersecurity frameworks are key enablers of this expansion.

In addition, the US government’s emphasis on financial transparency and data standardization supports the development of secure, compliant big data environments. Financial firms are also investing heavily in advanced data visualization and AI platforms to enhance decision-making and operational agility.

With major players such as JPMorgan Chase, Goldman Sachs, and PayPal utilizing predictive analytics and automation tools, the US is expected to remain the dominant contributor to the North American Big Data Finance market over the forecast period.

Investment and Business Benefit

Investment in the Big Data Finance market is rapidly increasing as financial institutions recognize the strategic value of data-driven decision-making. Banks, insurers, and fintech companies are allocating significant capital toward AI-powered analytics platforms, cloud infrastructure, and data governance systems.

These investments aim to enhance predictive accuracy, improve operational efficiency, and ensure compliance with evolving regulatory frameworks. Venture capital funding in fintech startups specializing in big data solutions is also rising, reflecting growing confidence in data-centric financial innovation. From an enterprise perspective, the business benefits of adopting big data analytics are substantial.

Institutions gain a competitive edge through real-time insights, enabling faster and more informed decisions in areas such as risk management, fraud detection, and customer engagement. Cost optimization and revenue growth are achieved by automating manual processes, improving loan underwriting precision, and tailoring products to customer needs.

Moreover, data transparency enhances regulatory reporting and investor confidence. As digital transactions, mobile banking, and open finance expand, investment in advanced analytics and AI tools will continue to deliver measurable business returns, positioning big data as a cornerstone of financial modernization and long-term profitability.

By Component

Software accounted for 64.3% of the Big Data Finance market, reflecting the growing reliance on advanced analytics and intelligent automation across financial operations. Big Data Analytics Software dominates this category, enabling real-time data interpretation for credit scoring, fraud detection, and investment forecasting.

Data Management Software plays a crucial role in organizing and integrating massive volumes of structured and unstructured financial data from multiple sources, ensuring consistency and accessibility. Data Mining Software is widely used for uncovering hidden correlations and trends, helping institutions identify profitable opportunities and mitigate risks.

Meanwhile, Data Visualization Software allows decision-makers to interpret complex datasets through interactive dashboards and graphical representations, improving clarity and strategic planning. The “Others” segment includes specialized AI-driven tools that enhance automation and model accuracy. The strong demand for software solutions is primarily driven by the need for agility, regulatory compliance, and customer-centric financial services.

In contrast, the services segment—comprising professional and managed services—supports implementation, customization, and maintenance of these software platforms. As financial institutions increasingly prioritize data-driven insights and automation, software solutions are expected to remain the backbone of big data integration, delivering higher value creation and operational intelligence across the financial ecosystem.

By Deployment Mode

Cloud-based deployment accounted for 60.5% of the Big Data Finance market, driven by its scalability, flexibility, and cost efficiency compared to traditional on-premises systems. Financial institutions are increasingly adopting cloud-based analytics platforms to handle vast amounts of structured and unstructured data, enabling real-time processing and decision-making.

These platforms allow seamless integration with AI, machine learning, and automation tools, empowering banks and fintechs to analyze market trends, customer behavior, and transaction risks more efficiently. Cloud infrastructure also supports remote accessibility, which has become essential as financial operations expand globally and digital transactions surge.

Additionally, leading cloud providers offer robust security frameworks and compliance certifications, addressing concerns related to data privacy and regulatory adherence. On-premises deployment, although still relevant for organizations with strict data control requirements, is gradually declining due to high maintenance costs and limited scalability.

The growing use of hybrid cloud models is bridging the gap, offering a balance between data sovereignty and agility. The shift toward cloud-based solutions is expected to accelerate further as financial institutions pursue digital transformation strategies aimed at improving speed, efficiency, and innovation while optimizing total cost of ownership.

By Application

Risk and compliance management accounted for 31.2% of the Big Data Finance market, underscoring the financial sector’s increasing emphasis on regulatory adherence and risk mitigation. Institutions are leveraging big data analytics to monitor transactions, detect irregularities, and ensure compliance with stringent frameworks such as Basel III, AML, and GDPR.

Advanced analytics tools integrate vast datasets from multiple systems to identify potential compliance breaches and assess enterprise-wide exposure in real time. This approach enhances transparency and strengthens the integrity of financial operations. Fraud detection and security remain closely linked, with AI-driven systems analyzing behavioral patterns and transactional anomalies to prevent unauthorized access and financial crimes.

Financial forecasting and credit scoring applications are also gaining importance as predictive models help banks anticipate market movements, assess creditworthiness, and manage portfolio risks. The “Others” category includes audit analytics and operational risk tools designed to support data-driven governance.

The growing complexity of global financial regulations and the surge in digital transactions have made risk and compliance analytics indispensable for financial stability. As financial institutions prioritize proactive risk control and regulatory automation, this application segment is expected to retain its leadership in shaping data-centric financial governance.

By Data Type

Structured data held a dominant 50.8% share of the Big Data Finance market, reflecting its critical role in managing and analyzing standardized financial information such as transactions, customer records, and balance sheets. Structured data, organized in predefined formats like databases and spreadsheets, allows financial institutions to efficiently conduct real-time analytics, compliance reporting, and credit assessments.

Its predictable format makes it ideal for integration with big data analytics tools, enabling accurate forecasting, portfolio optimization, and automated decision-making. Unstructured data, which includes text, social media feeds, and emails, is gaining traction as institutions seek to understand customer sentiment and detect emerging risks through natural language processing and AI models.

Semi-structured data, such as XML and JSON files, serves as a bridge between the two, offering flexibility while maintaining partial organization for analytics compatibility. However, the dominance of structured data continues due to its reliability and precision in financial modeling and regulatory audits.

The growing shift toward hybrid data ecosystems—where structured, semi-structured, and unstructured formats coexist—reflects the sector’s evolution toward comprehensive, 360-degree financial intelligence. Structured data remains the backbone of financial analytics, ensuring accuracy, compliance, and trust in data-driven decision frameworks.

By End-User

Retail banking accounted for 41.3% of the Big Data Finance market, driven by the rising focus on customer-centric financial services and personalized digital experiences. Banks are increasingly utilizing big data analytics to understand consumer behavior, segment customers, and tailor products such as loans, credit cards, and savings plans based on individual needs.

Predictive analytics enables banks to forecast spending patterns, improve cross-selling, and enhance customer retention strategies. The integration of AI and machine learning in retail banking also supports fraud detection, credit risk analysis, and automated loan approvals, ensuring faster and more secure transactions.

Investment banking and capital markets are progressively adopting big data tools to analyze trading patterns, optimize portfolios, and detect market anomalies, thereby improving profitability and regulatory compliance. The insurance sector uses data analytics for risk underwriting, claims management, and fraud prevention, significantly improving operational efficiency.

The “Others” segment includes non-banking financial companies and fintech firms that leverage real-time analytics to drive innovation and agility. With the rapid expansion of digital banking, mobile payments, and open finance, the retail banking segment is expected to remain the key end-user, as institutions increasingly rely on data-driven insights to deliver smarter, faster, and more personalized financial solutions.

Key Market Segments

By Component

- Software

- Big Data Analytics Software

- Data Management Software

- Data Mining Software

- Data Visualization Software

- Others

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-based

- On-Premises

By Application

- Fraud Detection & Security

- Risk & Compliance Management

- Financial Forecasting

- Credit Scoring

- Others

By Data Type

- Unstructured Data

- Structured Data

- Semi-Structured Data

By End-User

- Retail Banking

- Investment Banking & Capital Markets

- Insurance

- Others

Regional Analysis

North America accounted for 40.2% of the Big Data Finance market in 2024, valued at approximately USD 25.08 billion, and is expected to maintain its dominance over the forecast period. The region’s leadership is driven by early adoption of advanced analytics, AI, and cloud technologies across banking, insurance, and investment sectors.

Financial institutions in the United States and Canada are increasingly investing in data infrastructure to enhance decision-making, risk management, and regulatory compliance. The presence of global technology leaders and fintech innovators such as IBM, Oracle, and Microsoft further accelerates market growth through advanced big data solutions tailored for financial applications.

The regulatory landscape in North America, governed by frameworks like the Dodd-Frank Act and Basel III, has encouraged greater transparency and data-driven reporting, strengthening the adoption of analytics in compliance management.

Additionally, the rise in digital banking, online payments, and open banking initiatives has increased data volumes, compelling financial firms to adopt AI-enabled analytics platforms for real-time insights. The US represents the largest contributor within the region due to its strong financial ecosystem and innovation-driven approach, while Canada is rapidly expanding its digital finance capabilities. Overall, North America remains the strategic hub for technological and financial integration.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

- Increasing digital transformation and adoption of AI-driven analytics in financial institutions are enhancing operational efficiency and predictive decision-making.

- Rising regulatory compliance requirements are pushing banks and insurers to implement data governance and analytics tools.

- Growth in online payments, mobile banking, and fintech platforms is fueling demand for real-time data processing and fraud detection.

- Expanding availability of cloud infrastructure is making big data deployment more cost-effective and scalable.

- The integration of advanced analytics with risk management and customer engagement tools is creating measurable business value.

Restraint Factors

- High implementation and maintenance costs of big data systems limit adoption among smaller financial institutions.

- Concerns over data privacy and cybersecurity risks create hesitancy in adopting cloud-based analytics solutions.

- Lack of skilled professionals in data science and AI analytics hampers effective utilization.

- Fragmented data sources and legacy IT infrastructure reduce integration efficiency.

- Stringent regulatory environments make cross-border data management complex and costly.

Growth Opportunities

- Rising adoption of AI and machine learning for fraud detection, risk prediction, and personalized financial products.

- Increasing collaboration between fintech firms and traditional banks to enhance data-driven innovation.

- Growing demand for predictive analytics in credit risk assessment and market forecasting.

- Expansion of open banking and API-driven ecosystems promoting secure data sharing.

- Advancements in blockchain and distributed ledgers enhancing data transparency and auditability.

Challenging Factors

- Managing unstructured and semi-structured financial data across multiple systems remains difficult.

- Ensuring compliance with diverse international data protection laws adds complexity.

- Rapid technology evolution requires continuous investment in infrastructure upgrades.

- Rising cyber threats and data breaches create operational vulnerabilities.

- Resistance to organizational change slows the adoption of big data practices in traditional institutions.

Competitive Analysis

Competition in Big Data Finance centers on platform breadth, AI depth, and regulatory credibility. Hyperscalers compete on elastic compute, native AI services, and global regions that satisfy data-residency needs, bundling analytics with security and identity to lower total cost of ownership. Enterprise software leaders differentiate through end-to-end data stacks—ingestion, governance, lineage, feature stores, and model ops—that integrate with core banking, trading, and risk engines.

Specialist risk and compliance vendors gain share with prebuilt models for AML, fraud, KYC, stress testing, and conduct surveillance, shortening time-to-value for regulated workloads. Cloud-native data warehouses and lakehouse providers win on performance, ecosystem connectors, and separation of storage and compute, enabling real-time and batch analytics on the same data.

Fintech analytics firms focus on use-case precision—credit decisioning, personalization, collections, and pricing—often delivered as APIs. Open-source tooling remains influential for flexibility and cost control, but buyers weigh support and security assurance. Go-to-market relies on co-innovation with banks, marketplace partnerships, and industry reference architectures.

Pricing competition intensifies around consumption models, data egress, and managed services. Winning vendors prove measurable lift in loss mitigation, fraud catch rates, and operational efficiency, while demonstrating auditability, Fair-AI controls, and model risk management to satisfy evolving supervisory expectations.

Top Key Players in the Market

- Microsoft Corporation

- Amazon Web Services (AWS)

- IBM Corporation

- Oracle Corporation

- SAS Institute

- SAP SE

- Salesforce

- Databricks

- Snowflake

- Cloudera

- Alteryx

- Palantir

- Others

Major Developments

- March 12, 2025: Citi appointed Dipendra Malhotra as head of wealth technology, bringing in a veteran from Morgan Stanley who led AI, machine-learning, and analytics in its wealth-management unit, signalling Citi’s increased push into advanced analytics in financial services.

- July 23, 2025: NatWest Group announced a five-year partnership with Accenture and Amazon Web Services to overhaul its customer-data systems and consolidate 20 million customer profiles into a unified cloud data platform, to accelerate fraud alerts and enable faster new-product roll-outs.

- September 23, 2025: London Stock Exchange Group (LSEG) entered into a strategic partnership with Databricks to integrate advanced AI tools into its financial services offerings for investment analytics, risk management, and algorithmic trading, emphasising the role of big data and AI in modern finance infrastructures.

Report Scope

Report Features Description Market Value (2024) USD 62.4 Billion Forecast Revenue (2034) USD 287.37 Billion CAGR(2025-2034) 16.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Software [Big Data Analytics Software, Data Management Software, Data Mining Software, Data Visualization Software, Others], Services [Professional Services, Managed Services]), By Deployment Mode (Cloud-based, On-Premises), By Application (Fraud Detection & Security, Risk & Compliance Management, Financial Forecasting, Credit Scoring, Others), By Data Type (Unstructured Data, Structured Data, Semi-Structured Data), By End-User (Retail Banking, Investment Banking & Capital Markets, Insurance, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Amazon Web Services (AWS), IBM Corporation, Oracle Corporation, SAS Institute, SAP SE, Salesforce, Databricks, Snowflake, Cloudera, Alteryx, Palantir, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Microsoft Corporation

- Amazon Web Services (AWS)

- IBM Corporation

- Oracle Corporation

- SAS Institute

- SAP SE

- Salesforce

- Databricks

- Snowflake

- Cloudera

- Alteryx

- Palantir

- Others