Global Bicycle Market Report By Type (Mountain Bikes, Hybrid Bikes, Road Bikes, Cargo Bikes, Others), By Technology (Electric, Conventional), By End-User (Men, Women, Kids), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 22815

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

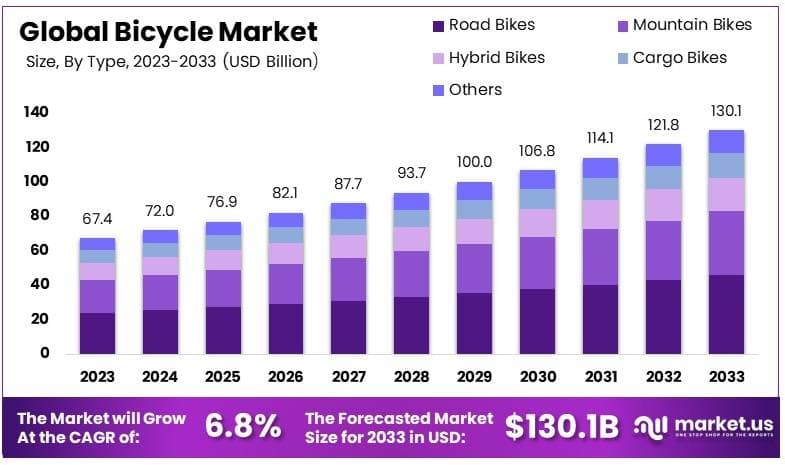

The Global Bicycle Market size is expected to be worth around USD 130.1 Billion by 2033, from USD 67.4 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

A bicycle is a two-wheeled vehicle powered by human pedaling. It is one of the most popular means of transportation and is used for commuting, exercise, and leisure. Bicycles are environmentally friendly, cost-effective, and contribute to physical health. They are made from a range of materials, such as steel, aluminum, or carbon fiber, designed for durability and efficiency.

The bicycle market refers to the global industry involved in the production, distribution, and sale of bicycles and related accessories. This market includes various segments, such as mountain bikes, road bikes, electric bicycles (e-bikes), and kids’ bikes. It also covers spare parts and maintenance services. The industry is driven by trends like rising health consciousness, urban mobility needs, and environmental sustainability.

The bicycle market’s growth is influenced by several factors. Increased awareness about health and fitness encourages more people to ride bicycles for exercise. Rising urbanization and concerns over traffic congestion are pushing cities to promote bicycles as an efficient means of transportation. The growing popularity of electric bikes (e-bikes) is also expanding the market, as they provide a convenient option for long-distance and uphill travel.

Demand for bicycles is rising due to multiple reasons. People are seeking alternatives to cars due to rising fuel costs and environmental concerns. Urban dwellers prefer bicycles to avoid traffic and parking issues. There is also an increasing trend in cycling for fitness, especially among younger and health-conscious populations. Electric bicycles, in particular, are witnessing high demand due to their ease of use and extended travel range.

Globally, more than 488 bicycles are sold every minute, highlighting the significant and ongoing demand across various categories. In 2020, France alone recorded over 500,000 electric bike sales, reflecting the growing adoption of eco-friendly commuting and recreational options. Manufacturers such as Giant produce over 6 million bicycles annually, solidifying their dominant position in the global market.

The rise in electric bicycles (e-bikes), particularly electric mountain bikes (e-MTBs), has further contributed to market expansion. Advances in battery technology have made these bikes capable of handling a wide range of terrains.

With battery capacities ranging from 460Wh to 1010Wh and ranges of 22 to 50 miles, e-MTBs are gaining popularity among adventure enthusiasts and casual riders alike. The increasing consumer interest in outdoor activities, combined with technological improvements, is expected to drive continued growth in the electric bike segment.

Government initiatives have played a significant role in promoting cycling and increasing bicycle adoption. Programs like the UK’s £50 bike repair voucher scheme and Italy’s €500 bici bonus have made cycling more affordable by reducing the cost of ownership and maintenance. These initiatives, coupled with broader efforts to reduce carbon emissions, are helping to create a more favorable environment for bicycle usage.

According to the International Energy Agency (IEA), the transportation sector contributed 29% of global CO₂ emissions in 2021, with cars and trucks being major sources. This has led to increased support for cycling as a means to reduce these emissions. Governments are expected to continue investing in cycling infrastructure, such as bike lanes and repair incentives, further boosting the appeal of bicycles as a sustainable transport option.

The bicycle market offers significant growth opportunities. As governments promote green transportation through investments in cycling infrastructure, the demand for bicycles is expected to rise. The rise of bike-sharing programs and electric scooter and motorcycle rentals also presents new avenues for market expansion.

Moreover, innovations in bicycle design, such as foldable models or lightweight materials, offer manufacturers the chance to tap into niche segments. Increased participation in cycling sports and events can further boost market opportunities.

Key Takeaways

- Bicycle Market was valued at USD 67.4 Billion in 2023, and is expected to reach USD 130.1 Billion by 2033, with a CAGR of 6.8%.

- In 2023, Road Bikes dominated the type segment with 39.1%, driven by rising demand for efficient and fast cycling options.

- In 2023, Conventional bikes led the technology segment with 74.8%, owing to their lower costs and maintenance simplicity.

- In 2023, Men dominated the end-user segment with 46.7%, reflecting a higher participation rate in cycling activities.

- In 2023, APAC led the market with 35.7% share and USD 24.06 Billion, driven by a growing cycling culture and infrastructure development.

Type Analysis

Road bikes dominate with 39.1% due to their versatility and popularity among commuting and racing enthusiasts.

The bicycle market is segmented by various types, including mountain bikes, hybrid bikes, road bikes, cargo bikes, and others. Among these, road bikes emerge as the dominant sub-segment, holding a 39.1% market share.

The prominence of road bikes can be attributed to their design, which is optimized for speed and long-distance riding on paved surfaces. This makes them particularly appealing to both daily commuters and professional racers. The lightweight materials, narrow tires, and active aerodynamic positioning of road bikes enhance their efficiency and speed, factors that are highly valued by enthusiasts and casual riders alike.

Mountain bikes and hybrid bikes also play significant roles in the market. Mountain bikes, designed for off-road terrains, are favored for their durability and performance on rugged landscapes, which appeals to adventure seekers.

Hybrid bikes, combining features of road and mountain bikes, offer versatility and comfort, making them suitable for both urban and off-road environments. Cargo bikes and other specialized types, such as folding bikes, cater to niche markets focused on utility and portability.

Despite the dominance of road bikes, the growth in the bicycle market is collectively driven by advancements in bicycle motors, increasing environmental awareness, and a growing health consciousness among consumers.

Urbanization trends and the enhancement of cycling infrastructure globally also support the growth and diversification of the market, ensuring that other segments like hybrid and cargo bikes continue to expand their market presence.

Technology Analysis

Conventional bicycles dominate with 74.8% due to their affordability and low maintenance requirements.

In the bicycle market, technology plays a crucial role in defining segments, primarily split into electric and conventional bicycles. Conventional bicycles, accounting for 74.8% of the market, dominate due to their long-standing presence in the industry and the lower cost barrier compared to electric bikes. These bikes are favored for their reliability, ease of repair, and straightforward mechanical design, which does not rely on electrical systems, making them less expensive to maintain.

Electric bicycles, though holding a smaller share of the market, are rapidly growing in popularity due to technological advancements and increased consumer interest in sustainable commuting options. These bikes are equipped with electric motors that assist the rider, making it easier to cover longer distances and climb hills without excessive physical strain.

The growth in this segment is supported by improvements in battery technology, increasing the bikes’ range and efficiency, and by governmental policies promoting green transportation methods.

The expansion of the electric bicycle segment reflects a broader industry trend towards innovation and sustainability. However, the dominant conventional bicycle segment continues to benefit from consumer familiarity and a well-established global supply chain.

As technology evolves and consumer preferences shift towards more eco-friendly and health-conscious choices, the electric segment is expected to continue its growth trajectory, reshaping the market dynamics.

End-User Analysis

Men dominate the bicycle market with 46.7% due to a higher inclination towards cycling as a form of recreation and commuting.

The bicycle market is further segmented by end-user, including men, women, and kids. Men constitute the largest segment, accounting for 46.7% of the market. This dominance is driven by a higher rate of bicycle usage among men, who often use bikes for both recreational purposes and as a primary mode of transportation.

Women and children represent significant yet smaller segments of the market. Women’s participation in cycling is growing, supported by an increasing focus on health and fitness and more targeted marketing by bicycle manufacturers who are now producing bikes designed specifically for women.

This includes considerations for different ergonomic needs and aesthetic preferences. The kids’ bicycle segment is driven by the use of bicycles as a popular form of leisure and physical activity for children, coupled with a global rise in awareness regarding the health benefits of cycling from a young age.

The growth within these segments is influenced by factors such as urban planning policies that encourage cycling, the development of safer cycling infrastructure, and initiatives aimed at promoting cycling among women and children. As the market continues to evolve, these factors will play crucial roles in determining the dynamics within each end-user segment, supporting broader market growth and diversification.

Key Market Segments

By Type

- Mountain Bikes

- Hybrid Bikes

- Road Bikes

- Cargo Bikes

- Others

By Technology

- Electric

- Conventional

By End-User

- Men

- Women

- Kids

Driver

Increasing Focus on Eco-friendly Transportation Drives Market Growth

The bicycle market is growing rapidly due to multiple driving factors. One of the main factors is the increasing global focus on eco-friendly transportation solutions. As more consumers become environmentally conscious, bicycles are emerging as a sustainable alternative to cars and motorcycles. This shift towards smart transportation aligns with worldwide efforts to reduce carbon emissions and decrease traffic congestion, thereby promoting the adoption of bicycles.

Government initiatives supporting cycling infrastructure also contribute significantly to market growth. Many cities are investing in dedicated bicycle lanes, bike-sharing programs, and parking facilities to encourage cycling as a practical mode of transportation. These measures are making urban cycling safer and more convenient for daily commuters.

Additionally, the growing awareness of health and fitness is pushing more consumers to adopt cycling as part of their fitness routine. The increasing emphasis on an active and healthy lifestyle has created a surge in demand for bicycles, especially in urban areas where fitness trends are prominent.

Technological advancements in bicycle design, particularly the development of electric bicycles (e-bikes), are also driving market growth. E-bikes cater to a broader range of users, including those looking for assistance on longer or more challenging rides, thereby expanding the market’s consumer base.

Restraint

High Cost of Electric Bicycles Restraints Market Growth

Several factors are restraining the growth of the bicycle market. One of the key restraints is the high cost of electric bicycles (e-bikes). While these bikes offer advanced features and convenience, their premium price tags make them inaccessible to a large portion of consumers, especially in price-sensitive markets. This limits the potential adoption of e-bikes, particularly in developing regions.

Another restraint is the lack of adequate bicycle infrastructure in many parts of the world. In developing regions, the absence of dedicated cycling lanes and parking spaces reduces the practicality of bicycles as a transportation option. This lack of infrastructure makes it difficult for consumers to choose cycling as a reliable commuting method.

Weather and seasonal constraints also pose challenges to market growth. Bicycles are less practical in harsh weather conditions, such as heavy rains or snow, leading to fluctuations in their usage throughout the year. Lastly, competition from motorized transport, such as cars, buses, and motorcycles, further restrains the growth of the bicycle market, particularly in areas where public transportation is well-developed.

Opportunity

Expansion of Bicycle-sharing Programs Provides Opportunities

The bicycle market offers several growth opportunities, particularly in expanding bicycle-sharing programs. Many cities worldwide are embracing shared mobility solutions to reduce traffic congestion and promote sustainable urban transport. The rise of bike-sharing services offers a significant opportunity for manufacturers to partner with municipalities and private companies to expand their presence in urban areas.

The growing demand for electric bicycles is another key opportunity. E-bikes offer convenience, especially for longer commutes or challenging terrains, making them attractive to a wider range of consumers. As the demand for electric mobility rises, manufacturers can capitalize on this trend by introducing innovative, cost-effective e-bike models.

Additionally, the penetration of bicycles into untapped rural markets presents an opportunity for growth. As rural areas develop and incomes rise, bicycles offer an affordable, sustainable mode of transportation for individuals in these regions. Manufacturers can leverage this demand by offering durable, low-cost bicycles tailored to rural needs.

Collaborating with health and wellness brands provides another growth opportunity. As consumers increasingly focus on fitness and healthy living, partnerships with wellness brands could boost the visibility and adoption of bicycles as part of a healthy lifestyle.

Challenge

Complexities in Global Supply Chains Challenge Market Growth

Several challenges could impact the growth of the bicycle market. One major challenge is the complexity of global supply chains, which affects the timely production and delivery of bicycles. Disruptions in the supply chain, particularly for raw materials such as steel, aluminum, and electronic components, can delay manufacturing schedules and increase costs.

Regulatory differences across regions also present challenges for bicycle manufacturers looking to expand internationally. Different safety standards, regulations, and certifications required in various countries create barriers to entry, complicating the process of launching new products in foreign markets.

Another challenge is the high initial investment required for developing bicycle infrastructure, such as dedicated lanes and parking facilities. While governments are investing in cycling infrastructure, the costs associated with these projects can slow down their implementation, limiting the growth of cycling as a mainstream transportation mode.

Lastly, increasing competition from emerging transportation solutions, such as electric scooters and ride-sharing services, poses a challenge to the bicycle market. As consumers explore these alternatives, bicycles face pressure to remain competitive in the evolving urban mobility landscape.

Growth Factors

Expansion of Urbanization and Congestion Issues Are Growth Factors

The bicycle market is experiencing significant growth due to several key factors. One major driver is the expansion of urbanization and increasing traffic congestion in cities worldwide. As more people move to urban areas, the need for efficient and eco-friendly transportation solutions becomes more pressing.

Another important growth factor is the rising awareness of sustainable living. Consumers are becoming increasingly conscious of their environmental impact and are seeking greener transportation options. Bicycles, as a zero-emission mode of transport, align with this shift towards more sustainable and eco-friendly lifestyles, thereby boosting demand.

The development of innovative bicycle accessories also contributes to market growth. Accessories such as smart motorcycle helmets, GPS tracking devices, and advanced security features enhance the cycling experience and attract more consumers. These innovations not only improve safety and convenience but also appeal to tech-savvy users looking for advanced functionality in their bicycles.

Finally, the strong growth of e-commerce platforms for bicycles has made it easier for consumers to access a wide range of products. Online shopping offers convenience, a variety of choices, and the ability to compare prices, which drives higher bicycle sales. The rise of e-commerce is particularly beneficial for reaching new markets and expanding the customer base, especially in regions with limited access to physical retail stores.

Emerging Trends

Rise in Demand for Smart Bicycles Is Latest Trending Factor

Several trends are shaping the future of the bicycle market, creating new growth opportunities. One of the most prominent trends is the rise in demand for smart and connected bicycles. Consumers are increasingly seeking bicycles equipped with GPS, fitness tracker, and app-based connectivity features, allowing them to monitor their performance and improve their riding experience.

The growth of subscription-based bicycle services is another trend driving the market. Many urban dwellers are opting for subscription models that offer access to bicycles without the need for ownership, providing a flexible and affordable alternative to purchasing a bicycle outright.

There is also a growing shift toward using sustainable and recycled materials in bicycle manufacturing. As environmental concerns continue to grow, manufacturers are focusing on eco-friendly production methods, creating bicycles made from recycled materials or using less energy-intensive processes.

Lastly, the increasing popularity of adventure and touring bicycles is driving market growth. With more people embracing cycling as a form of recreation and travel, the demand for bicycles suited for long-distance rides and challenging terrains is rising, opening new segments within the market.

Regional Analysis

Asia Pacific Dominates with 35.7% Market Share

Asia Pacific leads the Bicycle Market with a 35.7% share, contributing USD 24.06 billion. The dominance of this region is driven by increasing urbanization, rising health consciousness, and growing environmental concerns. Key markets like China and India are seeing significant adoption of bicycles for daily commuting and fitness. The availability of affordable bicycles and government initiatives promoting eco-friendly transportation are also boosting growth.

The region benefits from large-scale manufacturing capabilities and a growing middle-class population. High population density in cities makes bicycles a practical and sustainable transport solution. Additionally, the rising popularity of electric bicycles (e-bikes) in countries like Japan and South Korea further enhances the market dynamics in this region.

Asia Pacific’s strong presence in the bicycle market is expected to grow due to continued investment in cycling infrastructure, increasing disposable incomes, and the expansion of e-bikes. With these factors in place, the region will likely maintain or even increase its market share in the coming years.

Regional Mentions:

- North America: North America shows steady growth in the Bicycle Market, driven by rising demand for e-bikes and fitness trends. Urban cycling infrastructure expansion and growing environmental awareness are key contributors to this growth.

- Europe: Europe holds a significant share, benefiting from strong government policies supporting cycling as a sustainable transport option. The popularity of cycling for commuting and leisure, especially in countries like the Netherlands and Germany, continues to boost demand.

- Middle East & Africa: The Middle East & Africa region is seeing growing interest in bicycles, particularly in urban areas and among younger populations. However, extreme weather conditions and lack of cycling infrastructure limit widespread adoption.

- Latin America: Latin America is witnessing gradual growth in bicycle usage, largely driven by government programs promoting sustainable transport. However, economic instability and insufficient cycling infrastructure remain challenges for further expansion in the region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global bicycle market is highly competitive, with a few key players holding significant market influence. Among the top companies are Giant Bicycles, Trek Bicycle Corporation, and Hero Cycles Ltd. These companies dominate due to their strong brand presence, innovation in bicycle technology, and broad distribution networks.

Giant Bicycles is one of the largest bicycle manufacturers in the world. It holds a strategic position through its focus on innovation, with electric bikes (e-bikes) being a critical driver of its recent growth. Giant’s global presence and ability to meet diverse consumer needs make it a market leader. Its ability to offer high-quality bikes at various price points helps it capture a wide range of customers, from casual riders to professional cyclists.

Trek Bicycle Corporation is another major player known for its high-performance bicycles and strong brand reputation. The company is highly competitive in the premium and performance segments, particularly in road and mountain bikes. Trek’s strategic positioning in the U.S. and Europe, combined with its strong focus on research and development, has enabled it to consistently release cutting-edge products. Trek’s robust marketing campaigns also contribute to its leading market share.

Hero Cycles Ltd., based in India, is one of the world’s largest bicycle manufacturers by volume. It has a dominant market share in India and is expanding its presence globally, particularly in Europe and Africa. Hero’s strength lies in its mass-market appeal, offering affordable and durable bicycles tailored to developing regions. This strategic positioning allows Hero Cycles to maintain a strong influence in both domestic and international markets.

Together, these companies shape the bicycle market by addressing different consumer segments, ranging from premium and performance-oriented riders to mass-market consumers. Their ongoing investments in product innovation, electric bikes, and global expansion strategies ensure their continued dominance in the market.

Top Key Players in the Market

- Hero Cycles Ltd.

- Merida Industry Co., Ltd.

- Orbea

- Trek Bicycle Corporation

- Giant Bicycles

- Accell Group

- Mobility Holdings, Ltd.

- Derby Cycles

- BIONX International Corporation

- Robert Bosch GmbH

- Yamaha Motor Group

- KWANG YANG MOTOR CO., LTD.

- Lectric eBikes

- Other Key Players

Recent Developments

- Revolt Motors Launches RV1 E-Motorbike: In September 2024, Revolt Motors launched the RV1 e-motorbike, priced at ₹84,990, aiming to intensify competition in the electric two-wheeler market. The RV1 comes with two battery options, offering ranges of up to 100 km and 160 km, respectively, with a premium variant priced at ₹99,990. With a production capacity of 13,500 units per month, Revolt aims to expand its portfolio by launching one new product each year for the next five years.

- Ola Electric’s First Electric Motorcycle: Ola Electric confirmed that its first electric motorcycle will launch in the first half of fiscal year 2026. The company has patented three designs, one focusing on affordability and practical components like twin rear shock absorbers and a hub-mounted motor. Ola also plans to introduce two sportier models that will compete with Revolt and Ultraviolet in the Indian electric two-wheeler market.

Report Scope

Report Features Description Market Value (2023) USD 67.4 Billion Forecast Revenue (2033) USD 130.1 Billion CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mountain Bikes, Hybrid Bikes, Road Bikes, Cargo Bikes, Others), By Technology (Electric, Conventional), By End-User (Men, Women, Kids) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hero Cycles Ltd., Merida Industry Co., Ltd., Orbea, Trek Bicycle Corporation, Giant Bicycles, Accell Group, Mobility Holdings, Ltd., Derby Cycles, BIONX International Corporation, Robert Bosch GmbH, Yamaha Motor Group, KWANG YANG MOTOR CO., LTD., Lectric eBikes Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hero Cycles Ltd.

- Merida Industry Co., Ltd.

- Orbea

- Trek Bicycle Corporation

- Giant Bicycles

- Accell Group

- Mobility Holdings, Ltd.

- Derby Cycles

- BIONX International Corporation

- Robert Bosch GmbH

- Yamaha Motor Group

- KWANG YANG MOTOR CO., LTD.

- Lectric eBikes