Global Benzene Market By Derivative (Ethylbenzene, Cumene, Alkylbenzene, Cyclohexane, Nitrobenzene, and Other Derivatives), By Manufacturing Process, By Application, By End-user Industries By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 101293

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

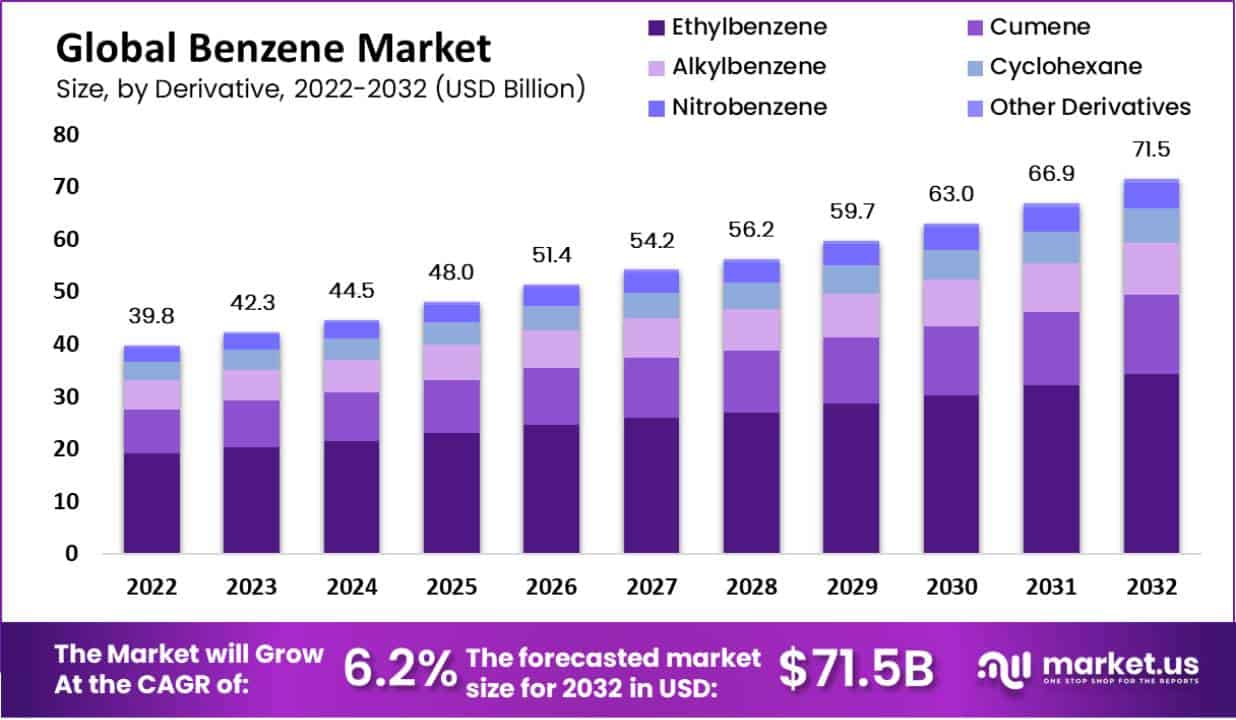

In 2022, the global benzene market accounted for USD 39.8 billion and is expected to reach a valuation of USD 71.5 billion by 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 6.2%.

Benzene is a highly flammable, colorless liquid material that is widely used in the chemical industry as a starting material for the production of a number of chemical materials like rubber, synthetic fibers, plastics, pharmaceuticals, and detergents.

The benzene market is mostly influenced by the overall performance of the global chemical industry, and also by demand and supply factors for benzene. The prices of benzene tend to be volatile and will be influenced by a number of factors, including changes in demand and supply, geopolitical factors, and the prices of gas and oil.

Key Takeaways

- Market Size: The global benzene industry size is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2032.

- Market Trend: Benzene usage has seen a notable surge, particularly fueled by its applications in the production of various chemicals and polymers.

- Derivative Analysis: The segment related to cumene derivatives exhibits the highest growth rate, featuring a notably elevated CAGR over the forecast period.

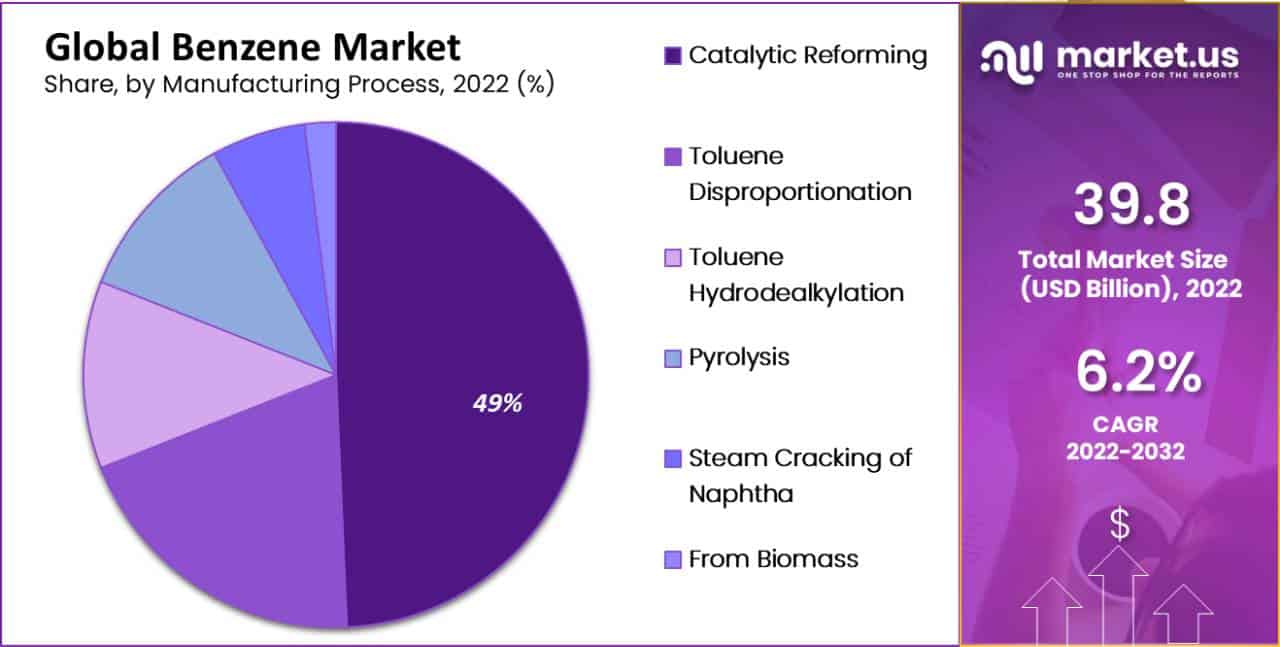

- Manufacturing Process Analysis: The catalytic reforming segment proves to be the most profitable in the market, holding a dominant revenue share of 49%.

- Application Analysis: Benzene has various applications, including in plastics, solvents, chemical intermediates, surfactants, rubber manufacturing, detergents, explosives, lubricants, pesticides, and other uses.

- End User Analysis: Benzene serves end-user industries such as packaging, pharmaceuticals, agriculture, construction, textiles, and various other sectors.

- Drivers: Increasing demand for petrochemicals and their derivatives, alongside growth in automotive and construction sectors, are key drivers propelling the benzene market.

- Restraints: Environmental concerns and stringent regulations regarding benzene exposure, as well as volatility in crude oil prices, pose significant restraints for market growth.

- Opportunities: Growing benzene demand in emerging economies and advancements in production technologies offer promising growth opportunities for the benzene market.

- Challenges: Health and environmental risks associated with benzene usage, along with fluctuating feedstock prices, present challenges to the benzene market.

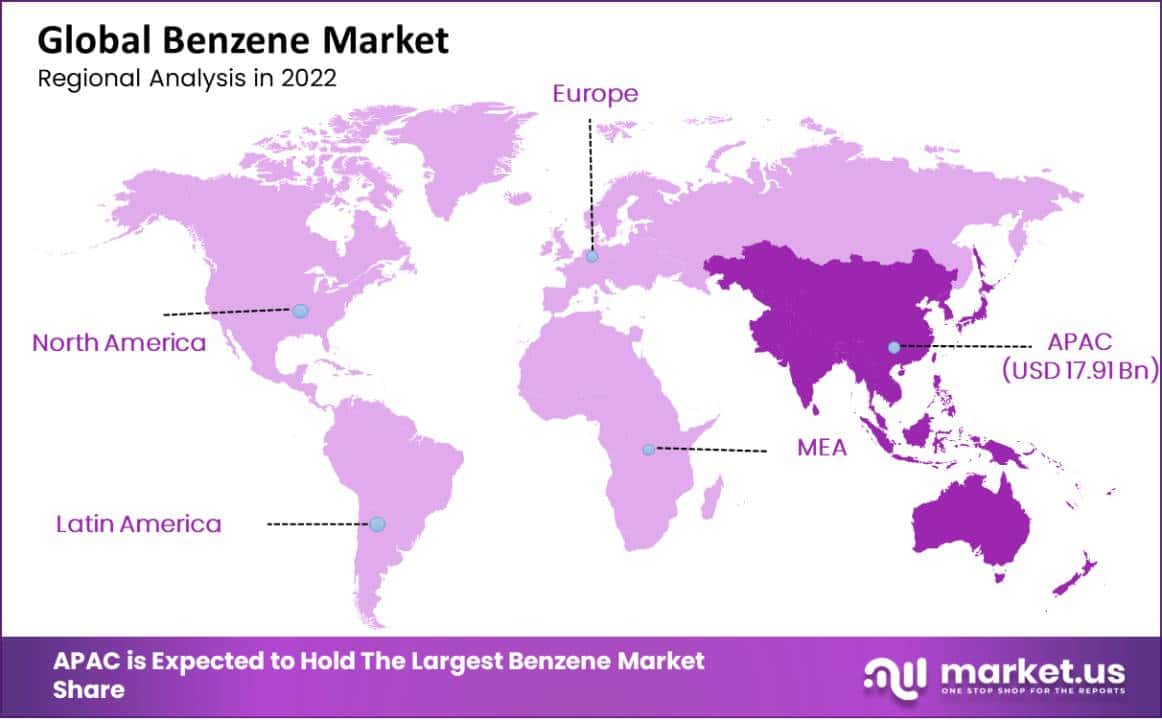

- Regional Analysis: According to the International Institute for Sustainable Development, the chemical industry in the Asia Pacific region is expected to constitute 45% of global chemical manufacturing in 2021.

- Key Players Analysis: Major players in the benzene market include Dow, INEOS Group, LyondellBasell Industries Holdings B.V., BASF SE, Royal Dutch Shell Plc, Reliance Industries Limited, Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, Marathon Petroleum Corporation, LG Chem, Other Key Players.

Driving Factors

Demand and supply, prices of gas and oil

The global benzene market is driven by a combination of factors, like demand and supply dynamics, geopolitical factors, and prices of oil and gas. The global chemical industry influences the demand for benzene, as benzene is starting material for the production of a number of chemicals.

Industries like construction, automotive, and electronics are the major consumers of benzene, as it is used in the manufacturing of synthetic fibers, plastics, and other materials.

In addition to this, the other factor demand and supply of benzene is also influencing the market. Benzene is produced as a byproduct of petroleum refining or from coal tar. The availability of these materials is influencing the benzene market.

Another driving factor is changes in geopolitical factors such as political stability, or sanctions in key producing regions.

Restraining Factors

Environmental regulations

The global benzene market has a number of restraints that impact its growth and prices. One of the key restraints is regulations for the environment. Benzene is a toxic product and direct exposure to it can cause a number of health problems such as cancer. Hence it has strict regulations for its use and disposal. The availability and cost of feedstocks are also another restraint.

Changes in the availability or price of feedstocks can impact production levels and prices of benzene. The competition for this raw material from other industries can limit the supply and increase costs. New processes for the production of chemicals, such as using biocatalysts or other enzymes, also influence the demand for benzene.

By Derivative Analysis

Based on the derivatives, the market for benzene is segmented into ethylbenzene, cumene, alkylbenzene, cyclohexane, nitrobenzene, and other derivatives. The ethylbenzene segment will be dominant in the market over the forecast period. Ethylbenzene is a colorless liquid that is primarily used in the production of styrene, which is used to make a variety of plastics, resins, and synthetic rubber.

The cumene derivative is the fastest-growing segment over the forecast period with a higher CAGR. Cumene is also a colorless liquid and is used to produce phenol and acetone. Alkylbenzenes are a group of compounds that are used in detergents and surfactants for a wide range of industrial and consumer applications.

Nitrobenzene is a pale-yellow liquid, that is a precursor to aniline. This is used for dyes, pharmaceuticals, and other chemicals. Apart from this derivative, there are many other derivatives produced from benzene like xylene, toluene, and benzene itself.

By Manufacturing Process Analysis

By manufacturing process, the market is divided into catalytic reforming, toluene disproportionation, toluene hydrodealkylation, pyrolysis, steam cracking of naphtha, and from biomass. The catalytic reforming segment is the most lucrative in the market with a revenue share of 49%.

Catalytic reforming is the process of converting a mixture of hydrocarbons into aromatic, octane gasoline components, including benzene. The toluene disproportionation process converts toluene into methane and benzene.

In the pyrolysis process, it breaks down organic material into smaller molecules. In this process, benzene is produced from petroleum feedstocks and involves heating feedstock to high temperatures in the absence of oxygen.

By Application Analysis

There are a number of applications of benzene like plastics, solvents, chemical intermediates, surfactants, rubber manufacturing, detergents, explosives, lubricants, pesticides, and other applications. Benzene is used in the production of various plastics such as ABS, nylon, and polystyrene. It is used as a solvent for various substances like resins, oils, and waxes.

The derivatives of benzene like, alkylbenzene sulfonates are used as surfactants in various cleaning agents and detergents. Alkylbenzenes are used as base oils in motor oils and lubricants. Benzene derivatives are also used in the production of adhesives, fragrances, coatings, and other industrial and consumer benzene products market.

By End-user Industries Analysis

The end-user industries of benzene are involving packaging, pharmaceuticals, agriculture, construction, textiles, and other end-user industries. Benzene derivatives like polystyrene and ABS are used in the production of packaging materials including consumer product packaging and food containers. Pharmaceutical drugs are also produced from benzene derivatives like phenol.

In agriculture pesticides and herbicides are used to protect crops which are derivatives of benzene. Construction materials such as adhesives, insulation, and coatings are also formed from benzene derivatives. Other industries which use benzene include energy, coatings, paints, food, and beverages.

Key Market Segments

Based on Derivative

- Ethylbenzene

- Cumene

- Alkylbenzene

- Cyclohexane

- Nitrobenzene

- Other Derivatives

Based on Manufacturing Process

- Catalytic Reforming

- Toluene Disproportionation

- Toluene Hydrodealkylation

- Pyrolysis

- Steam Cracking of Naphtha

- From Biomass

Based on Application

- Plastics

- Solvent

- Chemical Intermediates

- Surfactants

- Rubber Manufacturing

- Detergents

- Explosives

- Lubricants

- Pesticides

- Other Applications

Based on End-user Industries

- Packaging

- Pharmaceuticals

- Agriculture

- Constructions

- Textiles

- Other End-User Industries

Growth Opportunity

The benzene market has a number of growth opportunities throughout the forecast period. One of the major growth opportunities is the rising demand for plastics, particularly in developing economies. Benzene is the main element in the production of various types of plastics including nylon, polyurethane, and polystyrene.

Another significant opportunity for the benzene market is in the pharmaceutical industry. Several drugs including painkillers, antidepressants, and antipsychotics are produced from derivatives of benzene. With the increase in the prevalence of chronic diseases and the aging population, there is an increase in demand and hence it boosts the benzene market.

Furthermore, benzene is used in the production of synthetic rubber, which is used in the making of tires, belts as well as hoses. With the increasing demand for vehicles worldwide we see the rise in demand for synthetic rubber, which provides growth opportunities for the benzene market. Also, the textile industry shows growth opportunities for the benzene market.

Latest Trends

The major consumer of the benzene market is the automotive industry, because of that with the growing demand for vehicles market worldwide, automatically the demand for the benzene market increased as well. Construction is another large consumer of benzene. The chemical is used to produce insulation materials and plastics. The demand for benzene will increase as housing and infrastructure demand increases worldwide.

Benzene, a component of electronic components such as plastics and synthetic fibers, is being used to produce more electronics. The demand for benzene will increase with the growing demand for electronic devices around the world. Bio-based chemicals are becoming more popular: As the focus is increasingly on sustainability, the trend towards producing bio-based chemical products that come from renewable resources has increased.

This trend will have an impact on the benzene industry, as companies explore new ways to make benzene using bio-based resources. Benzene substitutes are becoming more available. Toluene, xylene, and other substitutes can be used in a variety of applications. The competition for benzene will increase as these substitutes become more available, affecting the growth of the market.

Regional Analysis

Asia Pacific Accounted for the Largest Revenue Share in Benzene Market in 2022.

The growth in end-use industries like the chemical, packaging, automotive, pharmaceutical, and other sectors is to be credited. According to the International Institute for Sustainable Development, in 2021 the chemical industry in Asia Pacific will account for 45% of the global chemical manufacturing.

China, India, South Korea, and Japan are the major producers and consumers of benzene throughout Asia-Pacific. China, with USD 2,785,449 in imports, is the largest consumer of benzene. South Korea will account for USD 2,254,945 in exports by 2021. China’s increasing demand for benzene and its imports is due to an increase in the use of the substance in automobile and construction products, such as paints and flooring. According to China’s National Bureau of Statistics, in 2021 the Chinese construction industry produced around USD 4,091 billion. The increasing number of end-use industries within the country is driving demand for this product.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market is very competitive, with some key players dominating it. Market players adopt various strategic initiatives, such as increasing production capacities and forming technology partnerships to gain an edge.

Market Key Players

- Dow

- INEOS Group

- LyondellBasell Industries Holdings B.V.

- BASF SE

- Royal Dutch Shell Plc

- Reliance Industries Limited

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- Marathon Petroleum Corporation

- LG Chem

- Other Key Players

Recent Developments

- In 2022: INEOS has agreed to purchase a 50% stake in Shanghai SECCO Petrochemical Company Limited in July 2022. This is a subsidiary company of China Petroleum & Chemical Corporation. SECCO has a current production capacity of 4,2 MMT petrochemicals, including ethylene propylene polyethylene polypropylene styrene polystyrene butadiene benzene, and toluene. The 200-hectare site is located in the Shanghai Chemical Industry Park. The company will be able to increase its presence in China.

Report Scope

Report Features Description Market Value (2022) USD 39.8 Bn Forecast Revenue (2032) USD 71.5 Bn CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Derivative-Ethylbenzene, Cumene, Alkylbenzene, Cyclohexane, Nitrobenzene, and Other Derivatives; By Manufacturing Process-Catalytic Reforming, Toluene Disproportionation, Toluene Hydrodealkylation, Pyrolysis, Steam Cracking of Naphtha, and From Biomass; By Application-Plastics, Solvent, Chemical Intermediates, Surfactants, Rubber Manufacturing, Detergents, Explosives, Lubricants, Pesticides, and Other Applications; By End-user Industries-Packaging, Pharmaceuticals, Agriculture, Constructions, Textiles, and Other End-User Industries Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape The Dow Chemical Company, BASF SE, INEOS Oxide, Shell Plc., Adeka Corporation, Huntsman International LLC., LyondellBasell Industries, Archer Danials Midland Company, Global Bio-Chem Technology Group Co., Ltd., DuPont Tate & Lyle Bio Products LLC, Temix International S.R.L., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How large is the Benzene Market?The Benzene Market was estimated to be worth USD 39.8 billion in 2022 and is projected to increase at a CAGR of roughly 6.2% from 2023 to 2032.

Why is the market demand for benzene increasing?The wide range of uses for benzene in sectors like the automotive, building, electronics, and pharmaceuticals are driving up demand. Various chemicals, such as styrene, cumene, and cyclohexane, which are needed to make plastics, resins, and synthetic fibres, are also made using it as a feedstock.

What is benzene market outlook going forward?Due to its many uses in various industries, benzene has a bright future and is anticipated to remain in high demand. However, there are worries about how it will affect the environment and human health, which could prompt the creation of substitute chemicals.

What are 3 products of benzene?Styrene, cumene, and cyclohexane are three benzene byproducts that are used to make plastics, resins, and synthetic fibres.

What is the primary benzene source?Around 60% of all benzene production comes from the petrochemical industry, which is also where it is produced as a byproduct during the production of petrol.

What goods contain a lot of benzene?A few items high in benzene include tobacco smoke, petrol and a few solvents used in the paint and coatings sector.

What are the primary benzene market segments? TThe derivative, manufacturing process, application, and end-user industries comprise the major market segments of the benzene market.

What are the various benzene derivatives?Ethylbenzene, cumene, alkylbenzene, cyclohexane, nitrobenzene, and other derivatives are examples of various benzene derivatives.

What companies dominate the benzene market?The key players in the benzene market are LG Chem, China Petrochemical Corporation, Marathon Petroleum Corporation, Dow, INEOS Group, LyondellBasell Industries Holdings B.V., BASF SE, Royal Dutch Shell Plc, Reliance Industries Limited, and Chevron Phillips Chemical Company LLC.

-

-

- Dow

- INEOS Group

- LyondellBasell Industries Holdings B.V.

- BASF SE

- Royal Dutch Shell Plc

- Reliance Industries Limited

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- Marathon Petroleum Corporation

- LG Chem