Global Beer Adjuncts Market By Type(Unmalted Grains, Unmalted Corn, Unmalted Rice, Others, Sugar, Cassava, Potatoes, Others), By Form(Dry, Liquid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124174

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

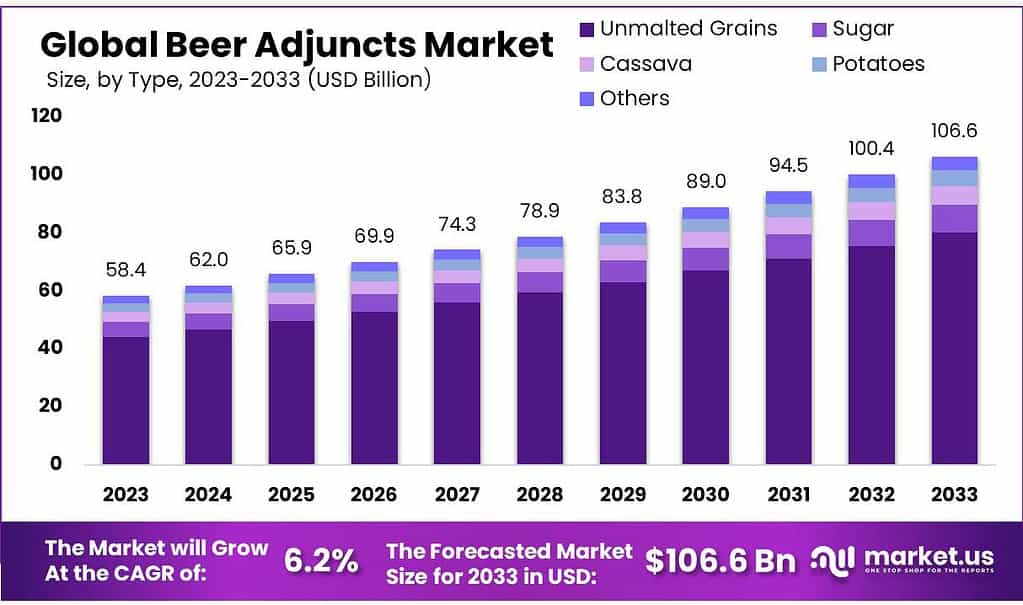

The global Beer Adjuncts Market size is expected to be worth around USD 106.6 billion by 2033, from USD 58.4 billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2023 to 2033.

The Beer Adjuncts Market refers to the segment within the brewing industry that involves the use of additional ingredients, known as adjuncts, alongside the primary malted barley in beer production. These adjuncts include unmalted grains like corn, rice, and wheat, as well as sugars and starchy materials such as cassava and potatoes.

The use of adjuncts offers several advantages, including cost reduction, as these ingredients are often cheaper than malted barley. Moreover, adjuncts allow brewers to create unique flavors and textures, catering to diverse consumer preferences and expanding the variety of beer products available. For example, the incorporation of rice and corn can lighten the body and flavor of beers, making them more appealing to a broader audience.

The market is driven by consumer demand for innovative and craft beers, technological advancements that facilitate the use of adjuncts, and regulatory environments that can support or hinder their use. In terms of import-export data, the U.S. Department of Commerce releases detailed monthly reports on beer imports and exports, such as the July 2022 Import-Export Report, which outlines specific quantities and values, indicating trade volumes and market impacts.

Government regulations and taxes significantly impact the beer adjuncts market. In the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) regulates the beer industry under various federal laws. Beer producers must adhere to strict guidelines, including those for labeling, which can affect product packaging and marketing strategies. Specific tax rates are also applied, directly influencing pricing and market entry.

Sustainable brewing practices are increasingly significant, with breweries aiming to reduce water usage and energy consumption as part of their environmental sustainability commitments. Industry reports highlight a trend toward decreased resource use and increased investment in renewable energy sources.

Tariff impacts also play a role in the market dynamics. For instance, in Malaysia, the average bound tariff rate for agricultural products, including certain beer ingredients, stands at 53.6%, affecting cost structures and pricing strategies for breweries operating within and exporting to Malaysia. For non-agricultural products, the rate is lower, at 14.9%.

Key Takeaways

- The Beer Adjuncts Market is projected to expand from USD 58.4 billion in 2023 to USD 106.6 billion by 2033, growing at a 6.2% CAGR.

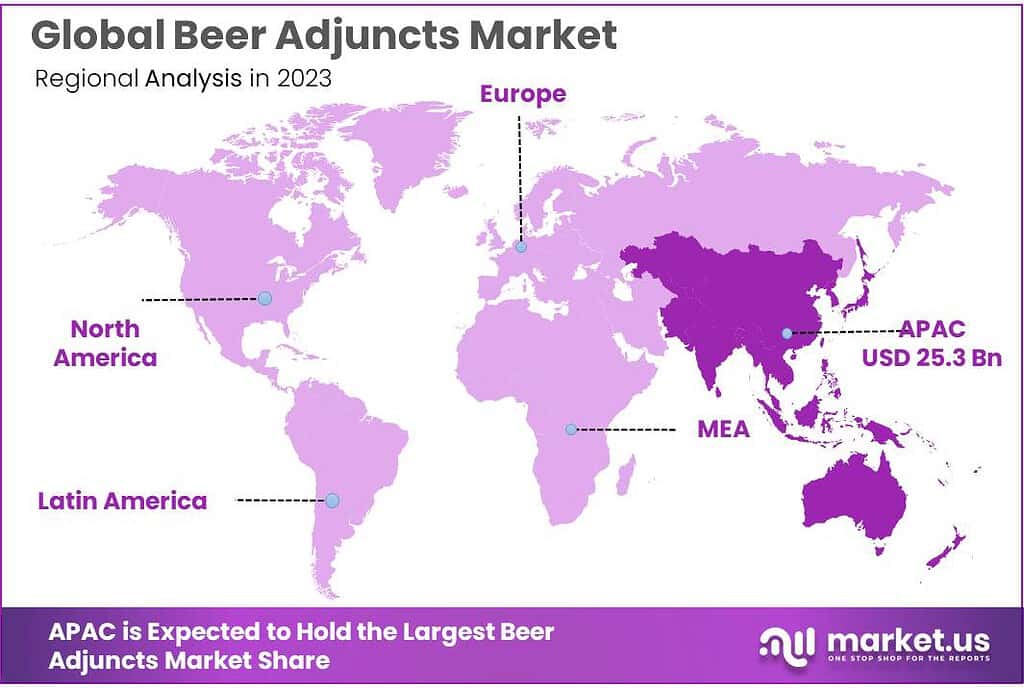

- In 2023, the APAC region led with a 43.4% market share, valued at USD 25.34 billion, driven by rising beer consumption.

- In 2023, unmalted grains held a 75.4% market share, favored for cost-effectiveness and enhancing craft beer characteristics.

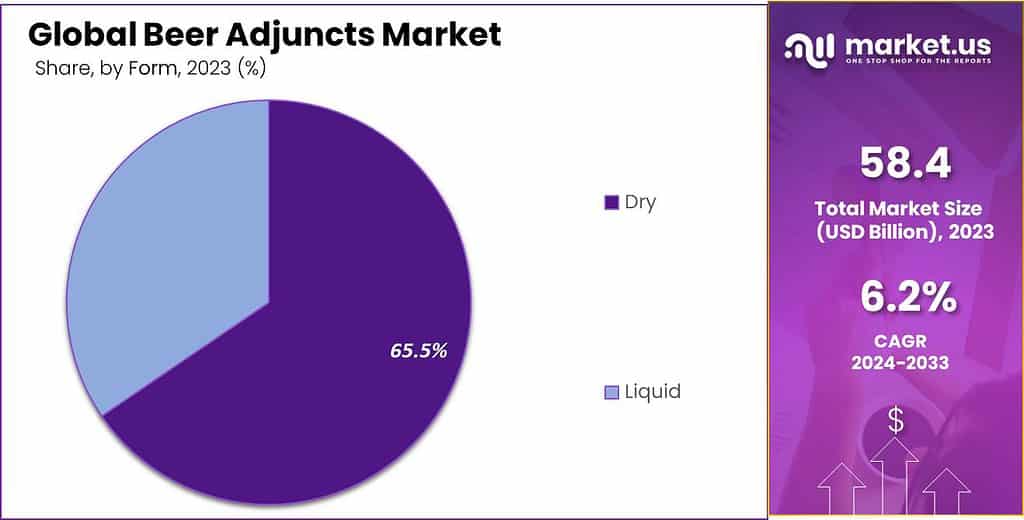

- Dry adjuncts captured over 65.5% of the market in 2023, preferred for ease of storage, longer shelf life, and consistent quality.

By Type

In 2023, Unmalted Grains held a dominant market position, capturing more than a 75.4% share. This segment includes grains like barley, wheat, and rye, which are pivotal in brewing for their ability to enhance flavor and body without the need for malting. Unmalted grains are favored for their cost-effectiveness and their contribution to the unique characteristics of craft beers.

Following closely, unmalted corn and unmalted rice are also significant contributors to the beer adjuncts market. Unmalted corn is utilized for its light flavor and ability to lighten the body of beer, making it a popular choice in the production of lighter lagers. Unmalted rice shares a similar application often used to produce dry, crisp beers and is particularly popular in Asian markets where its neutral flavor complements local tastes.

The segment labeled “Others,” which includes non-traditional adjuncts such as cassava and potatoes, is gradually gaining traction. Cassava is utilized in regions where it is abundantly available, offering a cost-efficient carbohydrate source for fermentation. Similarly, potatoes provide a high starch content that can be converted into fermentable sugars, though their use remains relatively niche compared to more conventional grains.

Sugar as an adjunct is primarily used to increase the alcohol content without impacting the beer’s body, making it a crucial ingredient for stronger beer variants.

By Form

In 2023, the dry form of beer adjuncts held a dominant market position, capturing more than a 65.5% share. Dry adjuncts are preferred for their ease of storage and longer shelf life compared to their liquid counterparts. They are widely used in various brewing processes due to their consistent quality and concentration, which ensure a stable end product. The dry form includes powdered or granulated substances such as dry corn and rice syrups, which are crucial for adjusting the fermentable sugar levels without altering the flavor profile significantly.

Conversely, liquid adjuncts also play a significant role in the market, favored for their ease of integration into the brewing process. Liquid adjuncts include items like high-fructose corn syrup and liquid malt extracts, which provide a quick and efficient means to alter the beer’s body, flavor, and alcohol content. Although they occupy a smaller market share, their convenience makes them a popular choice among brewers seeking to streamline production and achieve consistency in less time.

Key Market Segments

By Type

- Unmalted Grains

- Unmalted Corn

- Unmalted Rice

- Others

- Sugar

- Cassava

- Potatoes

- Others

By Form

- Dry

- Liquid

Driving Factors

Major Driving Factor for the Beer Adjuncts Market: Sustainability Initiatives

A key driving factor in the beer adjuncts market is the increasing focus on sustainability within the brewing industry. This movement is gaining momentum as both consumers and producers become more environmentally conscious. Breweries are actively reducing their environmental impact by implementing sustainable practices such as energy and water conservation, waste reduction, and sustainable sourcing of raw materials.

Reduction in Resource Use: Breweries are making significant strides in reducing water and energy usage. For instance, some breweries have managed to cut their annual operational costs substantially by adopting sustainability targets from industry-led studies, with savings ranging from $35,000 to $235,000 annually.

Renewable Energy Adoption: Large breweries like Asahi and AB InBev have set aggressive sustainability targets, including sourcing 100 percent of their purchased electricity from renewable sources by 2025, showcasing a commitment to reducing carbon emissions.

Waste Management Innovations: Breweries like New Belgium have developed effective waste management strategies, such as composting organic material and recycling packaging materials. These initiatives not only reduce landfill waste but also generate revenue, enough to cover significant operational costs like salaries.

Consumer Demand for Sustainable Products: There is a growing consumer willingness to pay more for sustainably produced beer. Studies indicate that a majority of beer consumers are open to paying a premium for sustainable beer, with an average added cost that consumers are willing to pay is around 7.4 cents more per ounce.

Local Sourcing and Adjunct Brewing: The use of local ingredients is another sustainability trend. This approach not only reduces transportation emissions but also supports local agriculture. Moreover, the use of enzymes in brewing helps in reducing the carbon footprint and water usage, significantly enhancing the sustainability of the brewing process.

Restraining Factors

Major Restraining Factor for the Beer Adjuncts Market: Regulatory Challenges

One significant restraining factor for the growth of the beer adjuncts market is the stringent regulatory environment that governs the production and sale of beer and its ingredients. Regulations affect various aspects of the brewing process, from the types of ingredients that can be used to how products are labeled and marketed.

Health Concerns and Regulatory Measures: Health concerns associated with alcohol consumption, such as the risks of liver disease, obesity, and cardiovascular problems, have led to stricter regulations. Governments and health organizations are intensifying efforts to reduce alcohol-related harm, which can restrict market growth by limiting consumer demand and imposing additional operational burdens on producers. For instance, many regions have legal restrictions on alcohol advertising and the allowable alcohol content in beverages, aiming to mitigate the public health impact of excessive alcohol consumption.

Environmental Regulations: The brewing industry is also facing increasing environmental regulations related to waste disposal, water use, and emissions. Breweries must invest in cleaner technologies and practices, which can be costly and complex to implement. For example, initiatives to reduce water usage and waste production are becoming mandatory in several countries, pushing breweries to alter their traditional brewing practices, which can increase operational costs.

Import-Export Regulations: The beer market is also heavily influenced by import-export regulations, which can include tariffs and trade barriers. These regulations affect the cost and availability of foreign beer adjuncts, impacting brewers who rely on specific imports for their production processes. For instance, changes in trade agreements or tariff rates can suddenly alter the cost structure of brewing, affecting profitability and pricing strategies.

Compliance and Legal Challenges: Breweries must navigate a complex web of local and international laws that can vary significantly by region. Compliance with these regulations requires legal expertise and can involve substantial costs. Failure to comply with legal standards can result in fines, legal disputes, and damage to a brewery’s reputation.

Growing Opportunities

Major Growth Opportunity for the Beer Adjuncts Market: Craft Beer and Diversification of Beer Types

A significant growth opportunity in the beer adjuncts market stems from the rising popularity of craft beers and the diversification of beer types, which is driving demand for a variety of beer adjuncts. This trend is particularly strong in regions like Asia Pacific, which has emerged as a dominant player in the market.

Craft Beer Movement: The craft beer movement continues to gain momentum globally, with consumers increasingly seeking unique and varied beer experiences. This shift is fostering greater use of different types of beer adjuncts, such as unmalted grains, sugar, cassava, and potatoes, to create distinctive flavors and textures.

Health and Dietary Preferences: There is also a growing consumer preference for beers that accommodate health and dietary concerns, such as gluten-free and low-calorie options. This shift is expanding the use of specific adjuncts that can modify the nutritional profile of beer without compromising on taste.

Technological Advancements in Brewing: Advances in brewing technology and processes have enabled the use of diverse adjuncts to enhance beer quality and reduce production costs. Innovations in manufacturing processes are helping brewers utilize these adjuncts more efficiently, contributing to market growth.

Regional Market Growth: The Asia Pacific region, in particular, has seen significant growth in the beer adjuncts market, driven by increasing beer consumption and the expanding presence of breweries. Countries like China and India are pivotal markets within this region, with local preferences and increasing disposable income fueling the demand for varied beer products.

Globalization and Market Expansion: The global expansion of breweries and the widespread availability of diverse beer types across international markets are further amplifying the demand for beer adjuncts. This globalization is not only increasing the volume of beer produced but also the variety, catering to a global palate.

Latest Trends

Major Latest Trend in the Beer Adjuncts Market: Increasing Use of Unmalted Grains

A major trend in the beer adjuncts market is the increasing use of unmalted grains, driven by their cost-effectiveness and ability to create diverse flavor profiles. This trend is particularly evident as breweries seek to reduce production costs while meeting consumer demand for unique beer varieties.

Cost Efficiency: Unmalted grains such as rice and corn are less expensive than malted barley. This cost advantage is significant, especially for large-scale breweries looking to lower production expenses. For example, unmalted rice is a popular choice because it can reduce costs and provide a clean, light flavor that appeals to many beer drinkers. By 2030, unmalted corn is expected to hold more than 50% of the market share, highlighting its growing importance in beer production.

Flavor Innovation: The use of unmalted grains allows brewers to experiment with different flavors and textures. This flexibility is essential for craft and microbreweries, which focus on producing distinctive and innovative beers. Unmalted grains can introduce subtle flavor nuances that differentiate products in a competitive market, catering to the evolving tastes of consumers who seek novel and unique beer experiences.

Technological Advancements: Advances in brewing technology have facilitated the efficient use of unmalted grains. Modern brewing equipment and techniques enable the precise control of brewing parameters, ensuring that the use of unmalted grains does not compromise the quality of the beer. These advancements support the consistent production of high-quality beers using a variety of adjuncts.

Regulatory Support: Government initiatives and regulations are also influencing the trend towards using unmalted grains. In many regions, there are incentives for breweries to use local, unmalted grains to support domestic agriculture and reduce reliance on imported ingredients. This regulatory support helps breweries manage costs while contributing to local economies.

Market Growth and Consumer Demand: The increasing demand for craft beers and the popularity of unique beer flavors are driving the growth of the beer adjuncts market. Consumers are more health-conscious and prefer beers with lower calorie content, which can be achieved by using unmalted grains. Additionally, the trend towards premium and craft beers is pushing breweries to innovate continuously, further boosting the demand for diverse adjuncts.

Regional Analysis

In 2023, the Asia Pacific (APAC) region held a dominant position in the Beer Adjuncts Market, capturing a significant 43.4% share, valued at USD 25.34 billion. This substantial market presence is driven by the region’s rapidly growing beer consumption, particularly in China, India, and Japan. The rising disposable incomes and changing consumer preferences towards premium and craft beers further bolster this growth. APAC’s market dominance is also attributed to the increasing number of breweries and the adoption of innovative brewing techniques that incorporate various adjuncts to enhance flavor and reduce costs.

North America follows closely, with significant market activity in the United States and Canada. The region’s robust craft beer industry heavily relies on adjuncts such as rice, corn, and barley to diversify their product offerings and cater to a wide range of taste preferences. According to industry reports, North America accounts for a substantial portion of the global beer adjuncts market, driven by a strong culture of beer consumption and innovation in brewing processes.

Europe also holds a notable share of the market, characterized by a long-standing tradition of beer production and consumption. Countries like Germany, the UK, and Belgium are prominent players, utilizing adjuncts to create unique beer styles and flavors. The European market benefits from a mature beer industry, extensive research and development in brewing techniques, and a consumer base with a high preference for diverse beer varieties.

The Middle East & Africa and Latin America regions are experiencing steady growth in the beer adjuncts market. The increasing urbanization and rising disposable incomes in these regions contribute to the growing demand for beer, thus driving the use of adjuncts in brewing. Countries like Brazil and South Africa are emerging markets with significant potential for future growth in the beer adjuncts sector.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

The Beer Adjuncts Market features several key players, each contributing significantly to the industry through their diverse product offerings and extensive market presence. Cargill, Incorporated, and Archer Daniels Midland Company are among the leading players in this market.

Cargill, known for its wide range of agricultural products, provides high-quality adjuncts like corn, rice, and barley, essential for brewing various beer styles. Archer Daniels Midland Company, another giant in the food processing sector, offers a comprehensive portfolio of ingredients that cater to the brewing industry’s needs, emphasizing sustainability and innovation in their product development.

Other notable players include Bairds Malt and Malteurop Group, both specializing in malt production. Bairds Malt, with its strong presence in the UK, supplies premium malt products that are crucial for brewing. Malteurop Group operates globally, offering a variety of malt products that support both craft and industrial brewers.

Similarly, Simpsons Malt and Viking Malt are key suppliers of malt and specialty grains, providing products that enhance the flavor and quality of beers. Great Western Malting Company, one of the oldest malting companies in North America, continues to play a pivotal role in supplying high-quality malt to the brewing industry.

Thomas Fawcett & Sons Ltd and Crisp Malting Group, both based in the UK, are renowned for their commitment to quality and innovation in malt production. Muntons plc and Briess Malt & Ingredients Co. also hold significant market shares, offering a wide range of malt products and brewing ingredients.

Weyermann Specialty Malts, known for its premium specialty malts, caters to the craft brewing segment with unique malt varieties that add distinctive flavors and colors to beers. These companies collectively drive the growth and innovation in the Beer Adjuncts Market, ensuring a steady supply of high-quality ingredients that meet the diverse needs of brewers worldwide.

Key Players Market

- Cargill, Incorporated

- Archer Daniels Midland Company

- Bairds Malt

- Malteurop Group

- Simpsons Malt

- Viking Malt

- Great Western Malting Company

- Thomas Fawcett & Sons Ltd

- Crisp Malting Group

- Muntons plc

- Briess Malt & Ingredients Co.

- Weyermann Specialty Malts

Recent Developments

In November 2023, Cargill announced a USD 2.6 million investment in the Philippines, further emphasizing their dedication to expanding their global footprint and supporting local brewing industries

In February 2023, ADM reported robust financial results with quarterly revenue of $21.85 billion, demonstrating its strong market presence and consistent growth.

Report Scope

Report Features Description Market Value (2022) USD 58.4 Bn Forecast Revenue (2032) USD 106.6 Bn CAGR (2023-2032) 6.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Unmalted Grains, Unmalted Corn, Unmalted Rice, Others, Sugar, Cassava, Potatoes, Others), By Form(Dry, Liquid) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cargill, Incorporated, Archer Daniels Midland Company, Bairds Malt, Malteurop Group, Simpsons Malt, Viking Malt, Great Western Malting Company, Thomas Fawcett & Sons Ltd, Crisp Malting Group, Muntons plc, Briess Malt & Ingredients Co., Weyermann Specialty Malts Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Beer Adjuncts Market?Beer Adjuncts Market size is expected to be worth around USD 106.6 billion by 2033, from USD 58.4 billion in 2023

What CAGR is projected for the Beer Adjuncts Market?The Beer Adjuncts Market is expected to grow at 6.2% CAGR (2024-2033).he key industry players of the Global Beer Adjuncts Market?Cargill, Incorporated, Archer Daniels Midland Company, Bairds Malt, Malteurop Group, Simpsons Malt, Viking Malt, Great Western Malting Company, Thomas Fawcett & Sons Ltd, Crisp Malting Group, Muntons plc, Briess Malt & Ingredients Co., Weyermann Specialty Malts

-

-

- Cargill, Incorporated

- Archer Daniels Midland Company

- Bairds Malt

- Malteurop Group

- Simpsons Malt

- Viking Malt

- Great Western Malting Company

- Thomas Fawcett & Sons Ltd

- Crisp Malting Group

- Muntons plc

- Briess Malt & Ingredients Co.

- Weyermann Specialty Malts