Global Barite Market; By Form(Powder, Lumps), Grade(Up to SP 3.9, SP 4.0, SP 4.1, SP 4.2, SP 4.3, Above SP 4.3), Application(Drilling Mud, Rubbers And Plastics, Paints And Coatings, Pharmaceutical, Others); and By Region (North America, Europe, Asia Pacific, and etc) and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Dec 2023

- Report ID: 59965

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

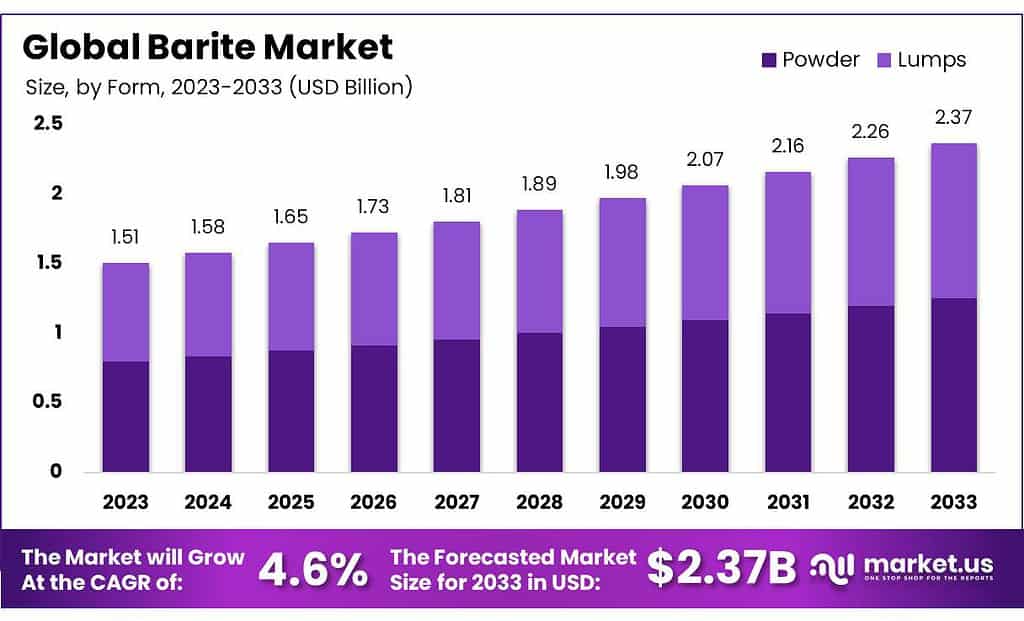

The Barite Market size is expected to be worth around USD 2.37 billion by 2033, from USD 1.51 billion in 2023, growing at a CAGR of 4.6% during the forecast period from 2023 to 2033.

Barite is used extensively in drilling operations as a weighting agent. In 2023, the COVID-19 pandemic significantly impacted product demand. This was reflected in a decline in barite market growth. Barite demand is expected to grow on account of increasing investments. The United States is one of the largest consumers of barite.

This barite product is used primarily as a weighting agent for fluids when drilling for oil & gas. It can also be used to fill in rubber, and paints. In 2023, the US consumed approximately 3 million tons of barite, of which, a bulk amount was imported.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: Barite market is set to grow significantly, with an expected worth of around USD 2.37 billion by 2033, marking an impressive increase from USD 1.51 billion in 2023, at a CAGR of 4.6%.

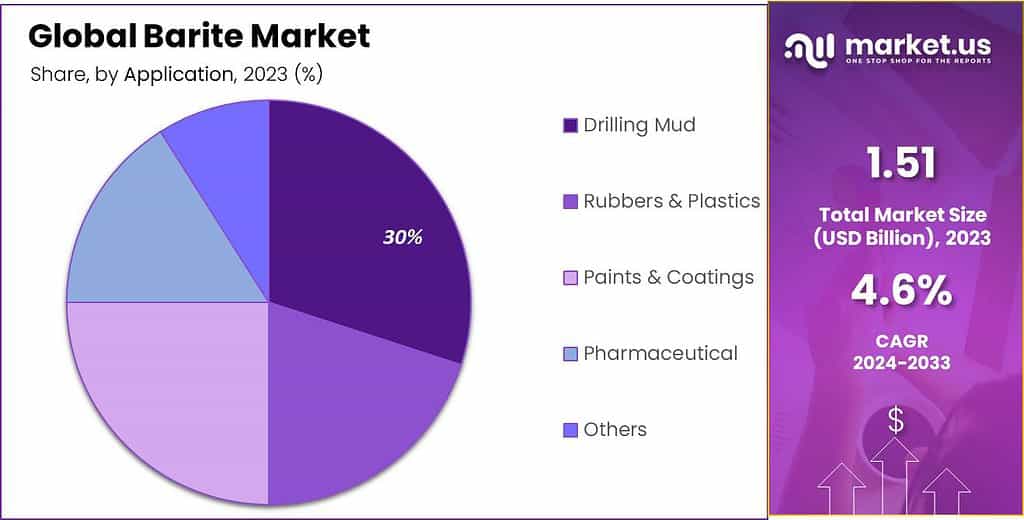

- Application Diversity: Barite’s versatility drives its demand across multiple industries. Its primary use in drilling operations for oil & gas, as well as applications in rubbers, plastics, paints, coatings, pharmaceuticals, and more, showcases its extensive utility.

- Preferred Forms and Grades: Powdered Barite dominated the market in 2023, holding over 53% due to its adaptability across various industries. Among grades, SP 4.2 grade stood out significantly, capturing more than 26% market share, specifically valued for its precise properties in drilling.

- Market Drivers: The thriving oil and gas exploration industry remains a primary driver for Barite’s demand, along with its expanding applications in various sectors. Additionally, adherence to stringent industry standards and eco-friendly materials contributes to sustained demand.

- Opportunities for Growth: Barite’s opportunities lie in healthcare usage for imaging procedures, construction industry applications like heavyweight concrete production, innovative uses in glass and ceramics, and technological advancements in mining and processing techniques.

- Challenges Faced: Fluctuating oil prices, environmental concerns in mining, competition from substitutes, geopolitical instabilities in mining regions, and industry-specific dependencies pose hurdles to sustained market growth.

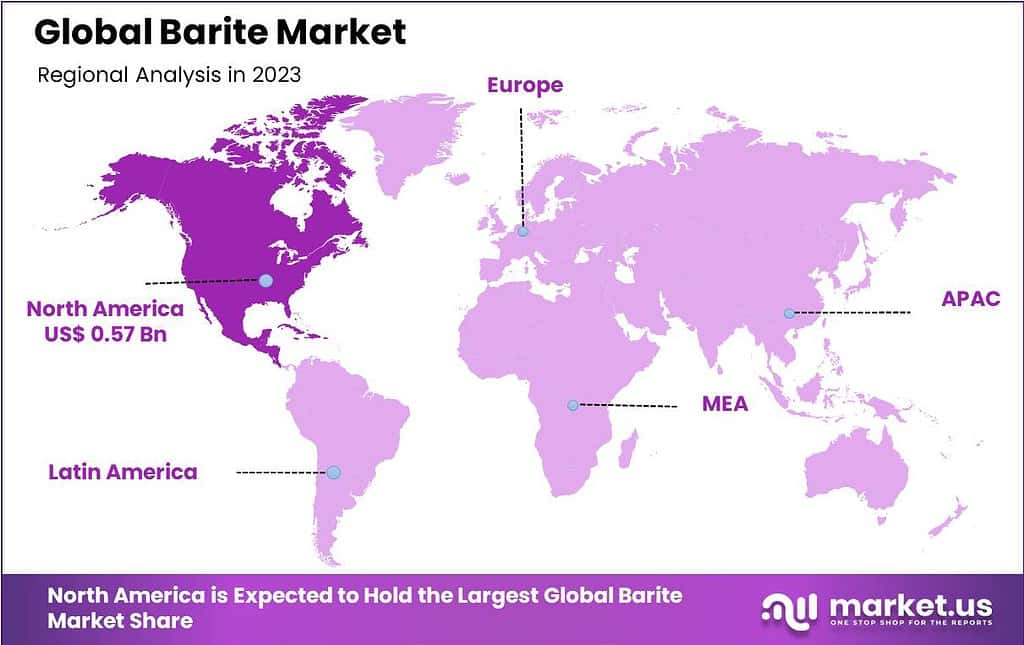

- Regional Insights: North America, especially the United States and Canada, currently dominates the market due to significant oil and gas industry consumption. However, the Asia Pacific region, notably China and India, presents a high growth rate, with India approving substantial oil & gas projects.

- Major Players and Developments: The market is competitive, with key players like CIMBAR Performance Minerals making strategic acquisitions and expansions. Collaborations and agreements, such as Cimbar’s long-term supply agreement, shape the market landscape.

By Form

In 2023, the Barite market was significantly influenced by the widespread adoption of the Powder form,

holding a commanding share of more than 53%. This form of Barite emerged as the preferred choice due to its versatility and convenience across multiple industries.Powdered Barite finds extensive usage in the oil and gas sector, where it’s employed as a weighting agent in drilling fluids, enhancing drilling efficiency and wellbore stability. Additionally, its applications in paints, coatings, and plastics industries, where it serves as a filler, pigment extender, and radiation shielding, further bolstered its market dominance. The ease of handling and its adaptability to various industrial needs contributed to Powdered Barite’s substantial market presence.

By Grade

In 2023, the Barite market showcased a notable dominance of the SP 4.2 grade, capturing a substantial share of more than 26%. This grade stood out for its exceptional characteristics, positioning itself as a preferred choice for numerous industrial applications.

Particularly valued in the oil and gas exploration sector, SP 4.2 grade Barite offered precise properties, including specific gravity and particle size distribution, essential for enhancing drilling operations. Its role as an additive in drilling fluids ensured stability in wells and optimized drilling efficiency, solidifying its pivotal position in the industry.

The prevalence of SP 4.2 grade Barite underscored its relevance and reliability, meeting stringent quality standards and catering to diverse industrial needs with precision.

Application Analysis

In 2023, the Barite market witnessed the preeminence of the Drilling Mud application, securing a commanding share of more than 30%. This application played a pivotal role in the oil and gas industry, where Barite serves as an integral component in drilling fluids.

Its unique properties, including high specific gravity and particle size distribution, are essential in controlling well pressure, ensuring borehole stability, and averting blowouts during drilling operations.

The widespread adoption of Barite in Drilling Mud underscores its indispensable nature in facilitating safe and efficient drilling processes, cementing its leading position in the market among various applications.

Barite-derived compounds are used in many industries such as glass, ceramics, and construction. They are used as a melting agent in the glass industry to reduce bubbles and improve transparency and luminosity. Barite-containing glass is brighter and clearer than lead. Barite’s properties enhance the final product’s characteristics. It is expected to have a positive impact on its use in various chemicals over the forecast period.

Barite can also be used as a filler for a variety of applications such as paints, plastics, coatings, and paper. It helps in paints by adjusting the viscosity/thickness, increasing its stability, as well as in brightening them. It can also be used to smoothen undercoats and provide chemical resistance to walls.

Due to the increase in spending on renovations and new constructions, the paints & coatings market is expected to experience high growth, thus positively influencing product demand in the barite market in the process.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

Form

- Powder

- Lumps

Grade

- Up to SP 3.9

- SP 4.0

- SP 4.1

- SP 4.2

- SP 4.3

- Above SP 4.3

Application

- Drilling Mud

- Rubbers & Plastics

- Paints & Coatings

- Pharmaceutical

- Others

Drivers

The Barite market is influenced by several key drivers that significantly impact its growth and demand. One primary driver is the thriving oil and gas exploration industry. Barite plays a crucial role in drilling operations by stabilizing wells and enhancing drilling fluid properties, directly correlating its demand with the pace of exploration activities.

Another prominent driver is the expanding applications of Barite across various industries. Its use in paints, coatings, rubbers, plastics, and pharmaceuticals due to its properties like high specific gravity and chemical inertness fuels market growth. The versatility of Barite in these sectors contributes to its steady demand and market expansion.

Moreover, stringent regulations and standards in certain industries, such as the paints and coatings sector, require eco-friendly and low-VOC materials. Barite, with its characteristics and ability to meet these regulatory standards, experiences heightened demand as industries increasingly opt for environmentally sustainable materials.

The market is further propelled by technological advancements in mining and processing techniques, enhancing Barite’s quality and purity. These advancements improve extraction efficiency, lower production costs, and ensure better product quality, thus stimulating market growth.

Overall, the Barite market’s upward trajectory is underpinned by a combination of factors, including its crucial role in drilling operations, expanding applications across industries, compliance with environmental regulations, and continuous technological advancements in extraction and processing methods.

Restraints

The Barite market faces various restraints that hinder its expansion. A significant challenge lies with fluctuating oil prices; as Barite is widely utilized by oil and gas exploration activities, any fluctuations directly influence exploration activities – in turn causing demand fluctuations that affect market dynamics.

Environmental issues surrounding Barite mining and processing also pose challenges to its producers, with compliance with stringent environmental standards requiring significant investments and adhering to stringent protocols impacting production costs and raising production costs overall.

Substitutes also pose a challenge to Barite’s market growth. While not identical in properties, alternatives like hematite, ilmenite, and celestite can often serve similar functions in certain applications; when available at competitive prices these alternatives can draw demand away from Barite altogether.

Geopolitical instability in regions where Barite mining occurs can also wreak havoc with supply chains and affect market stability. Political conflicts or regulatory changes in key producing regions could result in supply shortages or disruptions that wreak havoc with market pricing and stability.

Collectively, these restraints – such as oil price fluctuations, environmental concerns, availability of substitute products, and geopolitical instability in mining regions — present challenges to Barite’s market growth and stability. Addressing them effectively requires strategic planning, technological innovations, and proactive approaches to foster long-term market expansion.

Opportunities

The Barite market offers many opportunities for growth and expansion. A key source is healthcare usage of Barite; barium sulfate extracted from Barite is widely utilized in imaging procedures like X-rays and CT scans; thus increasing healthcare expenditure globally provides an ample window of opportunity for Barite use in this sector.

Barite presents another notable opportunity in the construction industry, especially concerning heavyweight concrete production. Due to its high specific gravity, barite has proven useful as an additive for radiation shielding in nuclear power plants and high-rise buildings – with rising construction activities, particularly in emerging economies creating an immense market for Barite usage in this realm.

The emergence of innovative applications such as glass and ceramic production provides new avenues for Barite’s market expansion. Barite properties enhance the durability and heat resistance of these materials, meeting various industrial and consumer requirements.

Barite manufacturers should seize this opportunity to produce more eco-conscious materials by investing in research and development of environmentally sustainable Barite products that align with market preference for eco-conscious materials.

Technological advancements in mining and processing techniques provide opportunities to enhance Barite quality, reduce production costs, and expand its application in niche sectors.

Overall, the Barite market offers great potential in healthcare, construction, innovative applications, and eco-friendly product development – as well as technological advancement. Tapping into these opportunities requires significant investments in research and innovation as well as targeted market expansion efforts.

Challenges

The Barite market faces numerous hurdles that limit its growth trajectory, with fluctuating global oil prices being one such hurdle. Since Barite is used extensively by oil and gas industries for drilling operations, any fluctuations can significantly disrupt operations, ultimately altering exploration activities – thus impacting demand for Barite.

Environment concerns associated with Barite mining present a formidable obstacle. Mining operations raise ecological concerns that require strict compliance with environmental regulations. Balancing mining activities with environmental sustainability necessitates significant investments into environmentally friendly mining practices that adhere to regulations as well as investment to reduce production costs – creating another significant hurdle.

Barite market competition comes from substitute materials like hematite, ilmenite, and celestite which provide similar functions but do not replace Barite directly; yet they remain viable alternatives that may reduce Barite market demand.

Geopolitical instability in areas where Barite mining occurs can disrupt supply chains. Conflict or regulatory changes that impact key producing regions could result in shortages or interruptions that affect market stability and pricing structures.

Additionally, the Barite market’s dependence on particular end-use industries such as oil and gas may impede its diversification efforts. Over-dependence on these sectors leaves the Barite market exposed to downturns within these sectors that impact overall market development.

Collectively, these obstacles present obstacles to Barite’s market growth and stability, including oil price fluctuations, environmental concerns, competition from substitutes, geopolitical instabilities, and industry-specific dependencies. Overcoming them requires strategic planning, innovation, and proactive measures to sustain its sustainable expansion.

Regional Analysis

North America accounted for the largest revenue share at 38%, in 2023. The largest barite market share belonged to the oil & gas industry. Three offshore oil drilling projects, operated jointly by Equinor, BHP, and Chevron, were approved by Canada’s Government in January 2023.

In 2020, the U.S. was the largest barite consumer. This was primarily due to the oil & gas industry. This barite can also be used in fillers and extensions for various applications, such as paint & coatings, and plastic.

The Asia Pacific indexed the fastest growth rate of 4.4% in revenues between 2023 and 2033. Demand is expected to increase in India and China, particularly if oil & gas exploration activities play a role. In September 2023, for example, the Indian government approved US$13.3 billion worth of oil & gas projects in the northeast of India.

China’s oil & gas sector accounted for 69.6% of total barite demand in 2023. China registered the Asia Pacific region’s highest growth rate, 4.6%. China’s crude oil output saw a 5% increase in 2023 compared to 2020. This is due to the country’s increasing exploration activity, which is expected to have a positive effect on the global barite market.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Due to the existence of several players, this market is highly competitive. The United States Geological Survey (USGS) states that India and China are the two largest barite producers worldwide. To meet growing market demand, market players engage in capacity expansions as well as mergers & acquisitions.

In April 2023, CIMBAR Performance Minerals purchased the U.S. Barite Trihydrate manufacturing assets as well as the business of TOR Minerals. This acquisition will increase CIMBAR’s customer reach and expand its portfolio. The following are some of the key companies in global barite markets:

Market Key Players

- CMS Industries

- Shijiazhuang Oushun Mineral Products Company Limited

- Others

- V&P Corporation

- Shanghai Titanos Industry Company Limited

- Halliburton Company

- Mil-Spec Industries Corporation

- P&S Barite Mining Company Limited

- CIMBAR Performance Minerals

- Excalibar Minerals LLC

- Anglo Pacific Minerals

- Kaomin Industries

- Ashapura MineChem Limited

- International Earth Products LLC

- Desku Group Inc.

Recent Development

October 2022: Cimbar and Newpark have entered into a long-term barite supply agreement for Newpark’s U.S. drilling fluids business, with an initial term of four years following the closing of the transaction.May 2022: Andhra Pradesh Mineral Development Corporation (APMDC) signed a Memoranda of Understanding (MoU) worth Rs 750 crore ( USD 100.63 million) to supply 16 lakh metric tonnes of baryte to three firms in the United States.Report Scope

Report Features Description Market Value (2023) USD 1.51 Billion Forecast Revenue (2033) USD 2.37 Billion CAGR (2023-2032) 4.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form(Powder, Lumps), Grade(Up to SP 3.9, SP 4.0, SP 4.1, SP 4.2, SP 4.3, Above SP 4.3), Application(Drilling Mud, Rubbers & Plastics, Paints & Coatings, Pharmaceutical, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape CMS Industries, Shijiazhuang Oushun Mineral Products Company Limited, Others, V&P Corporation, Shanghai Titanos Industry Company Limited, Halliburton Company, Mil-Spec Industries Corporation, P&S Barite Mining Company Limited, CIMBAR Performance Minerals, Excalibar Minerals LLC, Anglo Pacific Minerals, Kaomin Industries, Ashapura MineChem Limited, International Earth Products LLC, Desku Group Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is barite?Barite is a mineral primarily composed of barium sulfate (BaSO4). It is commonly found in sedimentary rocks and is used in various industries due to its high density and chemical inertness.

Where is barite found?Barite is found worldwide, with significant deposits in countries like China, India, Morocco, the United States, Mexico, and others. It's often extracted through mining from sedimentary rocks or as a byproduct of the mining of lead, zinc, or other metals.

What factors affect the barite market?Factors influencing the barite market include the oil and gas exploration activities, construction industry demand, geopolitical factors affecting mining and export regulations, and the development of alternative materials in various industries.

What are the market trends in the barite industry?Market trends include a growing demand in the oil and gas sector due to increased drilling activities, efforts to discover new deposits or alternative sources, and research into more efficient processing methods.

-

-

- CMS Industries

- Shijiazhuang Oushun Mineral Products Company Limited

- Others

- V&P Corporation

- Shanghai Titanos Industry Company Limited

- Halliburton Company

- Mil-Spec Industries Corporation

- P&S Barite Mining Company Limited

- CIMBAR Performance Minerals

- Excalibar Minerals LLC

- Anglo Pacific Minerals

- Kaomin Industries

- Ashapura MineChem Limited

- International Earth Products LLC

- Desku Group Inc.