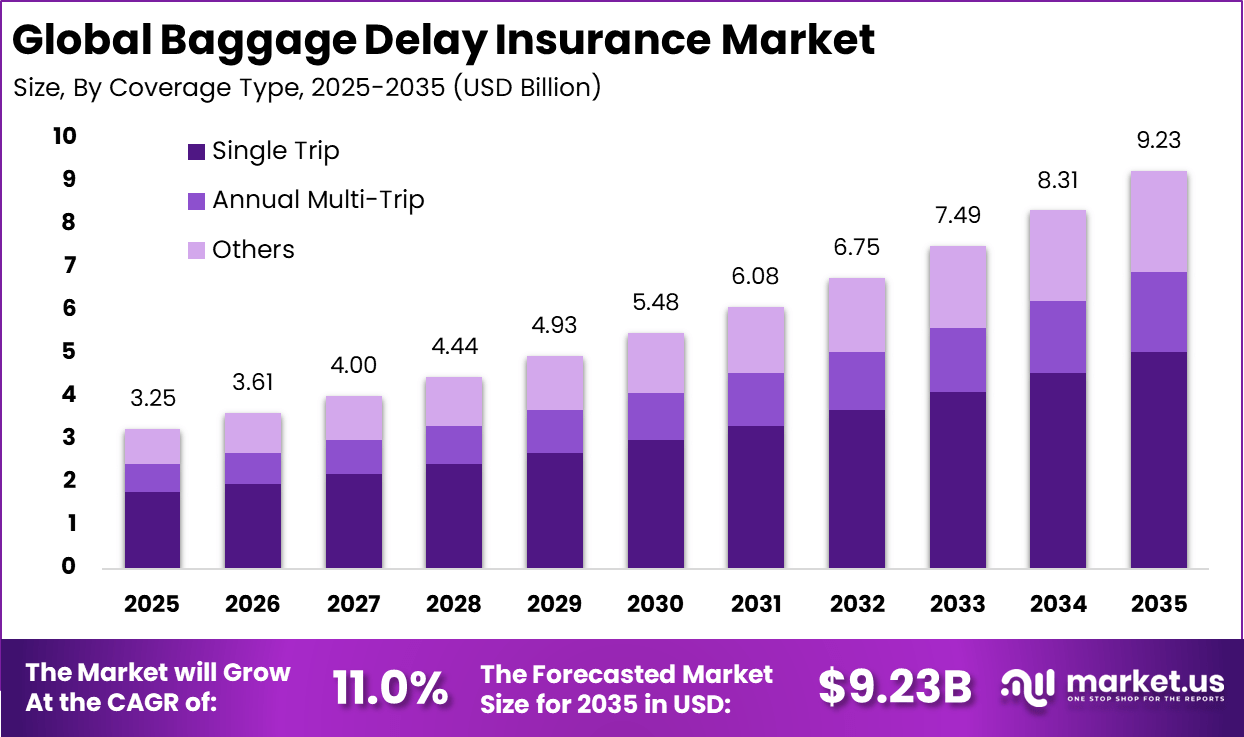

Global Baggage Delay Insurance Market Size, Share and Analysis Report By Coverage Type (Single Trip, Annual Multi-Trip, Others), By Distribution Channel (Insurance Companies, Online Travel Agencies, Direct Sales, Others), By End User (Individual, Corporate, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175855

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- U.S. Market Size

- Coverage Type Analysis

- Distribution Channel Analysis

- End User Analysis

- Investment Opportunities

- Business Benefits

- Emerging Trends Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

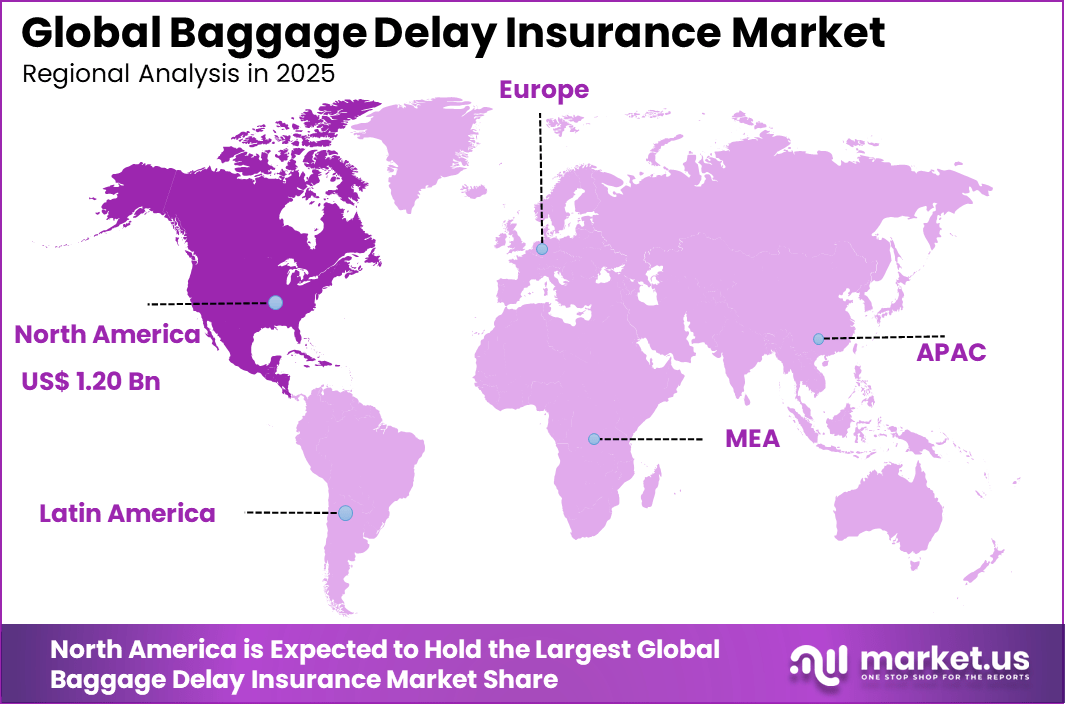

Global Baggage Delay Insurance Market represents an attractive travel insurance investment opportunity, growing from USD 3.25 billion in 2025 to nearly USD 9.23 billion by 2035 at a CAGR of 11.0%. North America’s market leadership, capturing more than 37.2% share and USD 1.20 billion in revenue, underscores strong adoption across frequent travelers, airlines, and online booking platforms.

The Baggage Delay Insurance Market refers to the segment of travel and risk protection services that provide financial compensation when a traveler’s checked baggage arrives later than expected at the destination. Baggage delay insurance is typically offered as part of a travel insurance policy or as an independent add-on that reimburses the insured for essential expenses incurred during the period of baggage delay.

One primary factor driving the baggage delay insurance market is the persistent increase in passenger air travel globally and domestically. With more people traveling by air for business or leisure, the likelihood of operational challenges such as handling errors and delayed baggage has risen, creating stronger awareness of financial protection needs. This trend drives travelers to seek insurance that mitigates out-of-pocket expenses when belongings fail to arrive as scheduled.

Demand for baggage delay insurance is closely linked to overall travel activity and consumer behavior regarding trip planning. As leisure and business travel continue to expand, travelers increasingly recognize the financial impact of unexpected events like baggage delays and opt for coverage that offers reimbursement for such disruptions. This correlation between travel frequency and insurance demand suggests that the more people travel, the more likely they are to include baggage delay protection in their travel plans.

According to industry survey, Baggage delay remains a major driver of travel insurance claims worldwide. Baggage delays and flight disruptions account for approximately 23% to 26% of total travel insurance claims by volume, highlighting their frequent impact on travelers. During 2024 to 2025, delayed baggage represented the largest share of mishandling incidents, accounting for about 74% of all cases. Damaged or pilfered bags made up 18%, while 8% were reported as lost or stolen.

Recovery performance has improved due to better tracking and handling systems. Around 66% of delayed bags are returned to passengers within 48 hours, reducing prolonged inconvenience. Short term recovery remains strong, with nearly 25% of delayed bags resolved within 12 hours and 38% within 24 hours. Despite an 8.2% increase in global passenger traffic, the mishandling rate improved to 6.3 bags per 1,000 passengers in 2025, reflecting operational efficiency gains across the aviation industry.

Key Takeaway

- In 2025, the single trip segment led the global baggage delay insurance market, capturing 54.6% share, as travelers favored coverage tailored to individual journeys.

- The insurance companies segment held a dominant position with 38.8% share, reflecting strong consumer trust in traditional insurance providers.

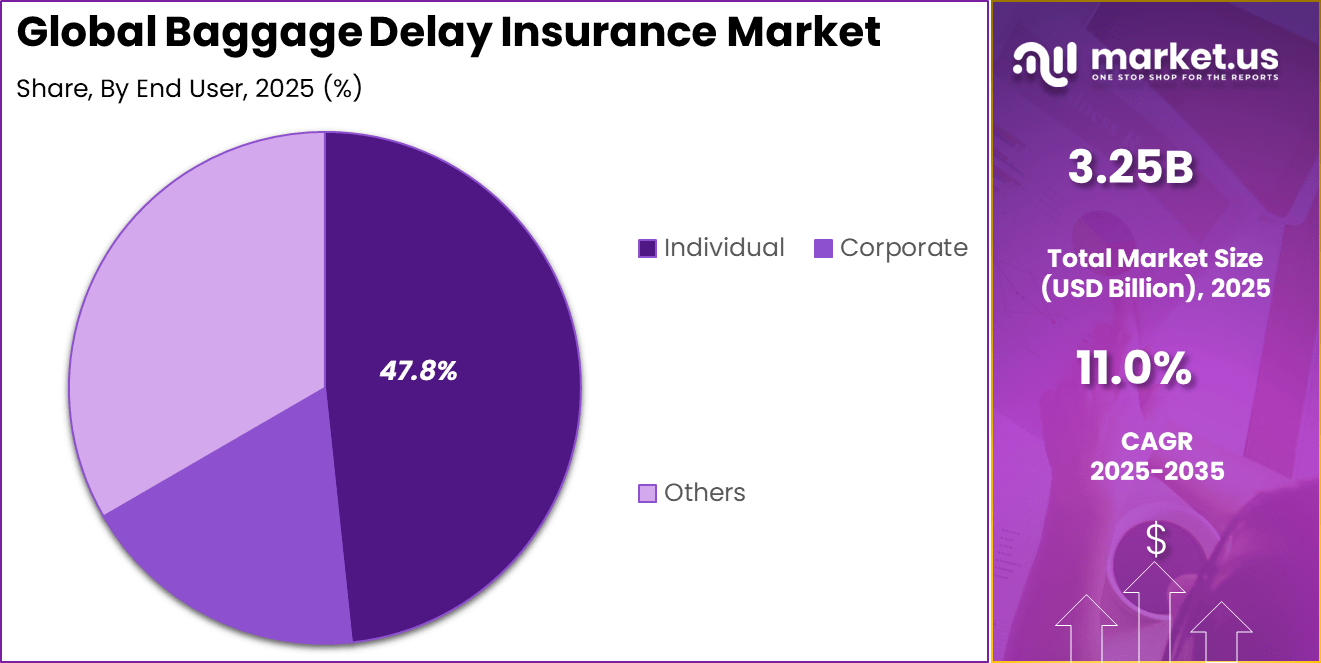

- The individual segment accounted for 47.8%, driven by rising awareness of travel related risks and demand for personal coverage.

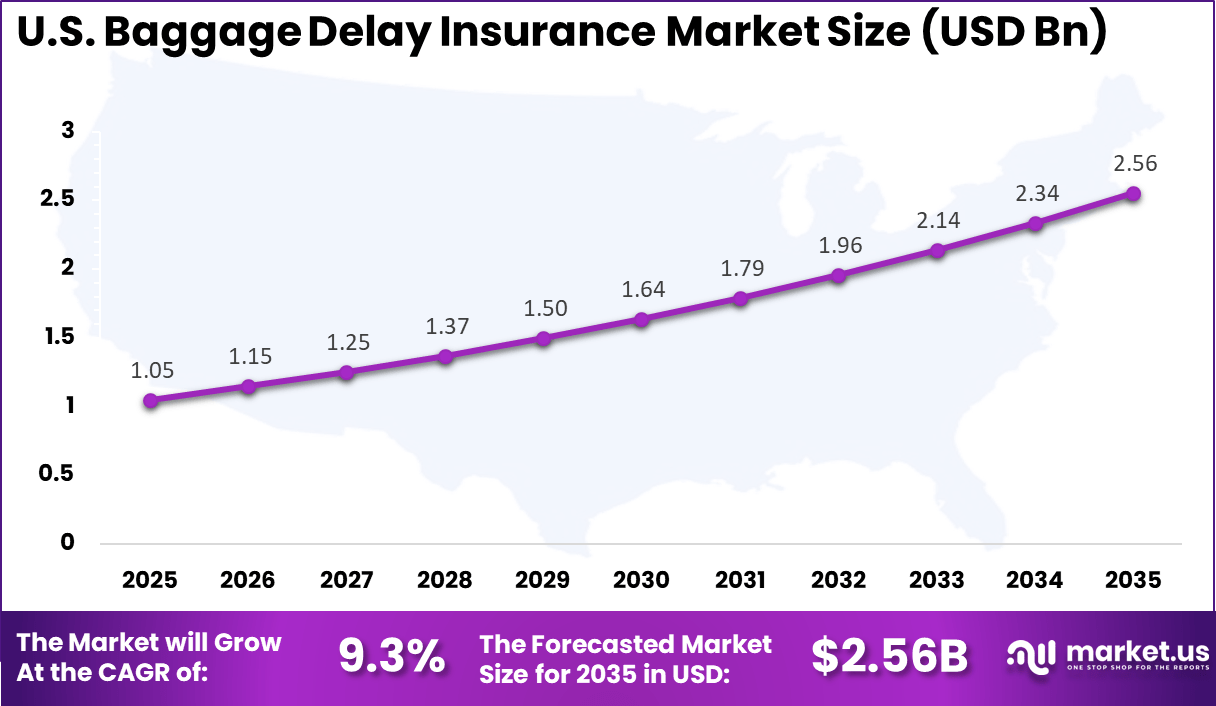

- The US baggage delay insurance market was valued at USD 1.05 billion in 2025 and is expanding at a 9.3% CAGR, supported by high air travel volumes and increased uptake of travel insurance products.

- North America held more than 37.2% of the global market in 2025, supported by a well established travel insurance ecosystem and high penetration of air travel services.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Regional Relevance Impact Timeline Rising air passenger traffic and frequent flight disruptions +3.2% Global, with strong impact in North America and Europe Short to medium term Growth of online travel booking platforms offering embedded insurance +2.6% North America, Europe, Asia Pacific Short term Increasing awareness of travel inconvenience coverage among frequent travelers +2.1% North America and developed Asian markets Medium term Airline partnerships and automated claims processing adoption +1.8% North America and select European markets Medium to long term Expansion of international tourism and cross border travel +1.3% Asia Pacific, Middle East, Europe Long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Low awareness in emerging and price sensitive markets -2.4% Africa, parts of Asia Pacific and Latin America Medium term Claim rejection concerns and trust issues among first time buyers -1.9% Global, more visible in developing regions Short to medium term Limited baggage liability coverage already provided by airlines -1.6% North America and Europe Short term Regulatory variations in travel insurance policies -1.2% Europe and selected Asian countries Medium term High dependency on air travel volumes during economic slowdowns -1.0% Global Medium to long term U.S. Market Size

The market for Baggage Delay Insurance within the U.S. is growing tremendously and is currently valued at USD 1.05 billion, the market has a projected CAGR of 9.3%. The market is growing due to surging air travel volumes, with millions more flights leading to frequent delays from weather, staffing shortages, and crowds.

Travelers face real costs for hotels, meals, and essentials when bags vanish for hours, pushing demand for quick reimbursements up to hundreds per day. Rising awareness via apps and news, plus policy shifts leaving airlines off the hook for compensation, makes insurance a must for peace of mind.

For instance, in October 2025, Chubb Travel Insurance launched Travel Pro, a digital-first parametric insurance suite featuring enhanced baggage delay coverage with real-time tracking, quick payouts, and assistance. This innovation addresses common traveler disruptions, reinforcing U.S. leadership in advanced travel protection solutions from its White Plains, New York operations.

In 2025, North America held a dominant market position in the Global Baggage Delay Insurance Market, capturing more than a 37.2% share, holding USD 1.20 billion in revenue. This dominance is due to the region’s high air travel volume, strong consumer awareness of travel insurance, and well-established insurance infrastructure.

Travelers in North America frequently face baggage delays linked to busy airports, complex flight networks, and weather related disruptions, which increases the need for financial protection. The presence of mature digital booking platforms makes baggage delay coverage highly visible during ticket purchases.

For instance, in January 2025, Travel Insured International unveiled new Worldwide Trip Protector plans with expanded baggage delay benefits up to $500 after 12 hours, offering flexible bundles for comprehensive protection. Based in Connecticut, this underscores North American dominance in customizable travel insurance.

Region Primary Growth Driver Relative Growth Influence Adoption Maturity North America High frequency air travel and embedded insurance at booking Very High Mature Europe Strong consumer protection awareness and cross border travel High Mature Asia Pacific Rapid growth in outbound tourism and digital bookings Medium to High Developing Middle East Expansion of international hub airports and premium travel Medium Developing Latin America Rising low cost carrier usage and tourism recovery Low to Medium Early stage Africa Gradual increase in international travel connectivity Low Early stage

Coverage Type Analysis

In 2025, The Single Trip segment held a dominant market position, capturing a 54.6% share of the Global Baggage Delay Insurance Market. Most travelers prefer coverage that matches a single planned journey rather than an annual commitment. Leisure travelers and occasional business flyers see value in paying only for the trip they are taking. Delayed baggage often leads to immediate expenses for clothing and essentials, and single-trip policies address this concern directly.

Growth in this segment is also supported by its easy availability during flight or holiday bookings. Travelers often add single trip coverage as a quick add-on when confirming tickets. This timing aligns well with traveler anxiety about delays, especially during peak travel seasons. The short term nature of the policy and clear benefits encourage wider adoption, making single trip coverage a preferred choice across different age groups and travel purposes.

For Instance, in October 2025, AXA Assistance rolled out new single trip policies featuring baggage delay cover after 10 hours. Customers claim costs for clothes and items easily at destinations, perfect for short getaways. The move targets vacationers hit by misdirected bags, strengthening single trip dominance with simple protection.

Distribution Channel Analysis

In 2025, the Insurance Companies segment held a dominant market position, capturing a 38.8% share of the Global Baggage Delay Insurance Market. Many customers feel more confident purchasing baggage delay insurance directly from insurers that follow strict regulatory standards. These providers often bundle baggage delay protection with broader travel insurance plans, which increases visibility and acceptance.

Long standing relationships between insurers and customers also support repeat purchases, especially among frequent travelers. This segment continues to grow as insurance companies improve digital access and simplify policy explanations. Online portals and mobile apps allow users to buy coverage quickly and track claims easily.

Clear policy terms and dedicated customer support help reduce confusion during stressful travel disruptions. These factors strengthen consumer trust and make insurance companies a preferred channel compared to less formal distribution options.

For instance, in October 2025, Chubb launched Travel Pro via company platforms, offering real-time baggage delay tracking and quick payouts. Direct buyers choose miles or vouchers for delays, simplifying buys at branches. It helps insurance firms meet rising demand from disruption-prone travelers.

End User Analysis

In 2025, The Individual segment held a dominant market position, capturing a 47.8% share of the Global Baggage Delay Insurance Market. The demand for personal travel continues to rise for vacations, family visits, and solo trips. Individuals face direct inconvenience when baggage is delayed, which pushes them to seek personal protection.

Unlike corporate travelers, individuals cannot rely on employer support, so they prefer to manage risks themselves. Growing awareness of travel related disruptions has made baggage delay insurance a practical choice for personal trip planning. This segment benefits from increasing digital awareness and self driven purchasing behavior.

Individuals now research travel risks online and understand the financial impact of baggage delays. Easy comparison of policies and transparent pricing helps them make informed decisions. The desire for peace of mind during travel encourages individuals to include baggage delay insurance as a standard part of their travel expenses.

For Instance, in December 2025, InsureMyTrip debuted Intrip Annual but highlighted single trip add-ons for individuals with baggage delay up to $500. Solo users save time on multiple vacations, claiming meals or kennel fees fast. It fits personal travelers seeking flexible cover for leisure risks.

Investment Opportunities

Investment opportunities in the baggage delay insurance market are emerging from the ongoing digital transformation of travel and insurance ecosystems. Fintech and insurtech firms are developing modular insurance APIs that integrate smoothly with airline booking engines and travel planning platforms. This integration expands distribution channels and lowers barriers to offering customized coverage at scale.

Investors find potential in technology platforms that support dynamic insurance product bundles tailored to traveller profiles. Another investment area is the development of analytics platforms that use travel data to price risk more accurately.

By analyzing historical delay patterns and flight connection complexity, insurers can refine pricing models and reduce loss ratios. Data-driven underwriting also enables personalized coverage options that align with individual travel itineraries. These improvements can attract new customers and enhance portfolio performance in competitive insurance segments.

Business Benefits

Baggage delay insurance offers clear business benefits for insurers and travel partners by strengthening customer value and reducing revenue volatility. Insurers can attract a broader customer base by offering integrated travel insurance options at the point of sale. Providing additional protective products increases average revenue per traveller and enhances brand trust.

Partnerships with travel agencies and airlines can yield recurring distribution streams. For travellers and travel partners, baggage delay insurance reduces the financial risk associated with unexpected travel disruptions.

Reimbursement for essential items during a baggage delay lessens the stress and cost burden on the traveller. This benefit enhances overall travel satisfaction and contributes to improved loyalty toward travel service providers. When travellers feel protected, repeat travel and service engagement become more likely.

Emerging Trends Analysis

Digital integration across travel insurance platforms is reshaping how baggage delay coverage is offered and managed. Mobile-first claim filing, automated document verification, and real-time flight tracking are being adopted to shorten claim cycles and reduce manual effort. Insurers are increasingly aligning policy triggers with airport and airline data feeds, enabling faster eligibility checks once delays cross predefined thresholds such as 6 or 12 hours. This shift is improving transparency and customer trust during high-stress travel situations.

Another notable trend is the bundling of baggage delay insurance with broader travel protection plans and payment instruments. Coverage is being embedded into airline tickets, travel booking apps, and premium payment cards, which is expanding reach among frequent travelers. Simplified policy wording and fixed benefit payouts are being favored over reimbursement-only models. These approaches are designed to deliver predictable outcomes for travelers while improving operational efficiency for insurers.

Driver Analysis

The steady rise in air passenger volumes is a primary driver supporting demand for baggage delay insurance. Increased flight connections and airport congestion have raised the likelihood of luggage handling disruptions, especially on international routes. Travelers are becoming more aware of these risks and are seeking financial protection for essential purchases during delays. Coverage thresholds that activate after 6 hours are viewed as practical and relevant by most passengers.

Another important driver is the growing preference for hassle-free travel experiences. Consumers increasingly expect quick compensation without lengthy assessments or disputes. Fixed benefit policies that pay a predefined amount per delay period are gaining acceptance because they reduce uncertainty. This behavior is reinforcing adoption across both leisure and business travel segments.

Restraint Analysis

Limited consumer awareness remains a key restraint for the baggage delay insurance market. Many travelers still assume airlines will fully compensate for delayed luggage, which reduces perceived need for separate coverage. In reality, airline compensation is often limited or delayed, but this gap is not clearly understood by a large share of passengers. As a result, insurance uptake remains uneven across regions.

Pricing sensitivity also acts as a restraint, particularly among budget-conscious travelers. Short-haul and low-cost airline passengers often view add-on insurance as non-essential. When premiums are perceived as high relative to expected benefit payouts, purchase decisions are deferred or declined. This challenge is more visible in markets where average trip spending remains low.

Opportunity Analysis

Expanding international travel from emerging economies presents a strong opportunity for baggage delay insurance providers. First-time international travelers are more exposed to complex baggage transfer processes and unfamiliar airport systems. Education-led distribution through travel agencies and digital booking platforms can address this gap. Policies designed with clear triggers such as delays beyond 8 or 12 hours can improve perceived value.

Another opportunity lies in partnerships with airlines, airports, and digital travel platforms. Embedded insurance models can offer seamless opt-in during ticket purchase or check-in. This approach reduces friction and captures demand at the point of highest relevance. It also allows insurers to access verified travel data, improving claim accuracy and speed.

Challenge Analysis

Operational complexity in claims validation remains a major challenge for baggage delay insurance. Delays must be accurately confirmed using airline or airport data, which is not always standardized across regions. Inconsistent reporting timelines can create disputes over eligibility and delay payouts. Managing these issues at scale requires strong data integration and governance.

Regulatory variation across countries also creates challenges for product design and distribution. Insurance rules related to disclosures, benefit limits, and consumer protection differ widely by market. Ensuring compliance while maintaining simple and uniform policy terms is difficult. These constraints can slow product rollout and increase administrative costs, especially in multi-country travel corridors.

Key Market Segments

By Coverage Type

- Single Trip

- Annual Multi-Trip

- Others

By Distribution Channel

- Insurance Companies

- Online Travel Agencies

- Direct Sales

- Others

By End User

- Individual

- Corporate

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Global insurance groups such as Allianz Global Assistance, Allianz Partners, AXA Assistance, and Generali Global Assistance hold strong positions in the baggage delay insurance market. Their offerings are usually bundled with comprehensive travel insurance policies and provide fixed payouts after predefined delay periods. These players benefit from wide international presence, airline partnerships, and strong brand trust.

Specialty travel insurers including AIG Travel, Travel Guard (AIG), Chubb Travel Insurance, and Tokio Marine HCC focus on premium coverage and flexible policy structures. Their products often target frequent travelers, business travelers, and high-value trips. Strong underwriting expertise allows these companies to manage delay-related risks effectively.

Distribution-focused providers such as Berkshire Hathaway Travel Protection, Travel Insured International, Seven Corners, Travelex Insurance Services, and InsureMyTrip strengthen market access through online platforms and comparison tools. American Express Travel Insurance, Aviva, Sompo Holdings, and MAPFRE Asistencia expand reach through card-linked benefits and regional networks. These companies emphasize fast payouts and transparent coverage terms.

Top Key Players in the Market

- Allianz Global Assistance

- AIG Travel

- AXA Assistance

- Travel Guard (AIG)

- Generali Global Assistance

- Berkshire Hathaway Travel Protection

- Zurich Insurance Group

- Chubb Travel Insurance

- Travel Insured International

- Seven Corners

- InsureMyTrip

- CSA Travel Protection

- Tokio Marine HCC

- Travelex Insurance Services

- MAPFRE Asistencia

- American Express Travel Insurance

- Sompo Holdings

- Aviva

- Allianz Partners

- Hanover Insurance Group

- Others

Recent Developments

- In October 2025, Chubb Travel Insurance launched Travel Pro, a digital parametric insurance suite addressing travel disruptions like baggage delays with real-time tracking and quick payouts. Flexible options for airline miles or vouchers make it traveler-friendly, reinforcing Chubb’s innovation edge in protecting against common baggage headaches during flights.

- In May 2025, AXA Partners US rolled out Schengen-specific travel plans with enhanced baggage delay coverage alongside medical evacuation. These affordable options meet visa requirements while exceeding basics, boosting protection for U.S. travelers to Europe.

Report Scope

Report Features Description Market Value (2025) USD 3.2 Bn Forecast Revenue (2035) USD 9.2 Bn CAGR(2026-2035) 11% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Single Trip, Annual Multi-Trip, Others), By Distribution Channel (Insurance Companies, Online Travel Agencies, Direct Sales, Others), By End User (Individual, Corporate, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz Global Assistance, AIG Travel, AXA Assistance, Travel Guard (AIG), Generali Global Assistance, Berkshire Hathaway Travel Protection, Zurich Insurance Group, Chubb Travel Insurance, Travel Insured International, Seven Corners, InsureMyTrip, CSA Travel Protection, Tokio Marine HCC, Travelex Insurance Services, MAPFRE Asistencia, American Express Travel Insurance, Sompo Holdings, Aviva, Allianz Partners, Hanover Insurance Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Baggage Delay Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Baggage Delay Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz Global Assistance

- AIG Travel

- AXA Assistance

- Travel Guard (AIG)

- Generali Global Assistance

- Berkshire Hathaway Travel Protection

- Zurich Insurance Group

- Chubb Travel Insurance

- Travel Insured International

- Seven Corners

- InsureMyTrip

- CSA Travel Protection

- Tokio Marine HCC

- Travelex Insurance Services

- MAPFRE Asistencia

- American Express Travel Insurance

- Sompo Holdings

- Aviva

- Allianz Partners

- Hanover Insurance Group

- Others