Global Azotobacter-Based Biofertilizer Market Size, Share, Growth Analysis By Product Type (Liquid, Powder, Granules), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Application (Soil Treatment, Seed Treatment, Foliar Application), By End Use ( Farmers/Cultivators, Research Institutions, Agricultural Cooperatives) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158339

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

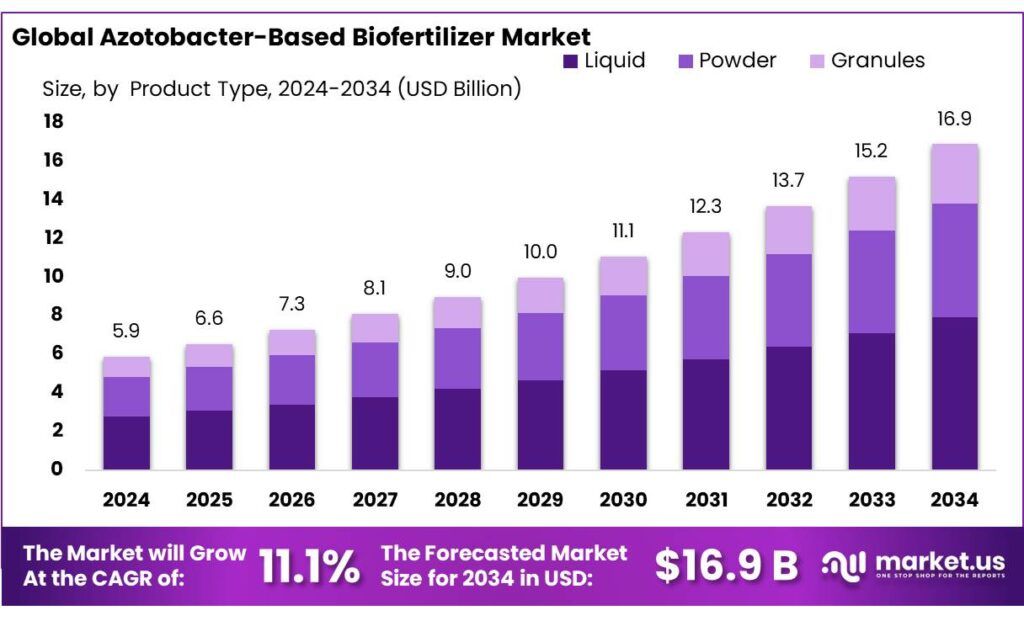

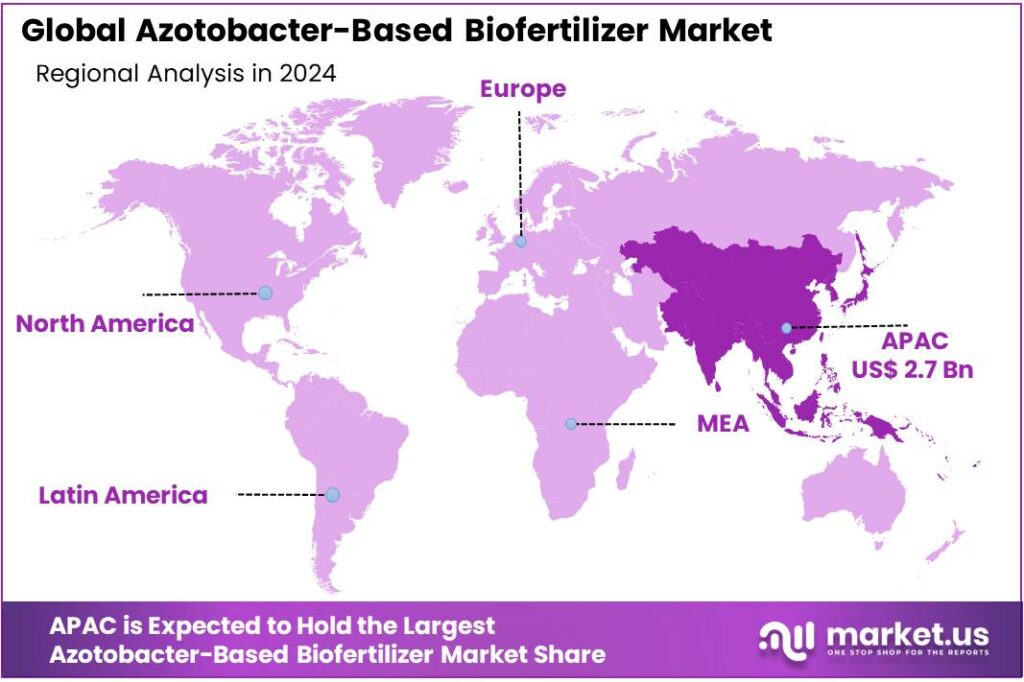

The Global Azotobacter-Based Biofertilizer Market size is expected to be worth around USD 16.9 Billion by 2034, from USD 5.9 Billion in 2024, growing at a CAGR of 11.1% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 46.8% share, holding USD 2.7 Billion in revenue.

Azotobacter-based biofertilizers are gaining prominence in India as sustainable agricultural solutions, aligning with the nation’s objectives to enhance soil fertility and reduce chemical fertilizer dependency. Azotobacter, particularly Azotobacter chroococcum, is a free-living, nitrogen-fixing bacterium that contributes significantly to soil health by converting atmospheric nitrogen into forms accessible to plants. This process not only improves soil fertility but also promotes plant growth through the production of phytohormones like auxins and gibberellins.

The Azotobacter-based biofertilizers in India is evolving, with increasing production and availability. The Fertilizer Control Order (FCO) under the Ministry of Agriculture and Farmers Welfare mandates quality standards for biofertilizers, including a minimum viable cell count of 1 × 10⁷ per gram, a contamination limit not exceeding 0.02%, and a pH range of 6.5 to 7.5. This regulatory framework ensures the efficacy and safety of biofertilizers in the market.

The Indian government has implemented several initiatives to promote the use of biofertilizers, including Azotobacter-based formulations. Under the National Project on Organic Farming (NPOF), financial assistance of up to 25% of the total financial outlay, with a ceiling of ₹40 lakh, is provided as a credit-linked back-ended subsidy for setting up biofertilizer production units.

Additionally, the Integrated Scheme of Oilseeds, Pulses, Oil Palm, and Maize (ISOPOM) offers assistance for the supply of Rhizobium culture, Phosphate Solubilizing Bacteria, Azotobacter, and Azospirillum culture at 50% of the cost or ₹100 per hectare, whichever is less. These measures aim to reduce reliance on chemical fertilizers and improve soil health.

The biofertilizer industry in India is experiencing significant growth, driven by the increasing adoption of sustainable agricultural practices. The market for biofertilizers is projected to expand from $110.07 million in 2022 to USD 138 million in 2024, reaching $213.9 million by 2029, with a compound annual growth rate (CAGR) of 9.15%. This growth is attributed to factors such as the rising awareness among farmers about the benefits of biofertilizers, government incentives, and the need for eco-friendly farming solutions.

Key Takeaways

- Azotobacter-Based Biofertilizer Market size is expected to be worth around USD 16.9 Billion by 2034, from USD 5.9 Billion in 2024, growing at a CAGR of 11.1%.

- Liquid held a dominant market position, capturing more than a 46.8% share of the Azotobacter‑based biofertilizer.

- Cereals & Grains held a dominant market position, capturing more than a 45.2% share of the Azotobacter‑based biofertilizer market.

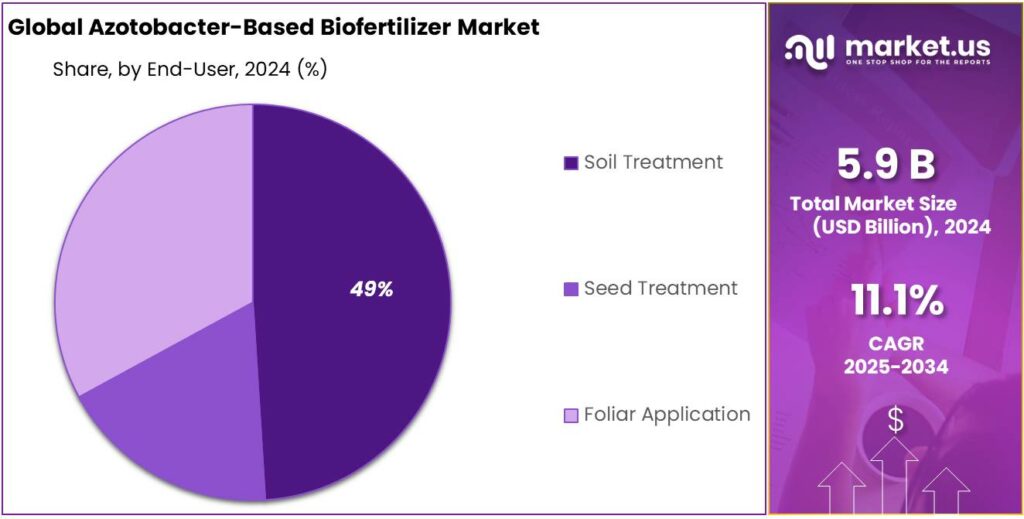

- Soil Treatment held a dominant market position, capturing more than a 49.1% share of the Azotobacter-based biofertilizer market.

- Farmers/Cultivators segment held a dominant market position in the Azotobacter-based biofertilizer market, capturing more than a 69.4% share.

- Asia-Pacific (APAC) region held a dominant position in the Azotobacter-based biofertilizer market, capturing more than a 46.8% share, valued at approximately USD 2.7 billion.

By Product Type Analysis

Liquid holds over 46.8% share in 2024 due to its ease of use and higher viability.

In 2024, Liquid held a dominant market position, capturing more than a 46.8% share of the Azotobacter‑based biofertilizer product‑type segment. Farmers and distributors prefer liquid formulations because they allow for faster application, better dispersion of microbes, and typically higher survival of the bacteria until application. Liquid forms are also easier to tailor for seed coating, foliar sprays, or mixing with irrigation water, which makes them more flexible than powders or granules.

The growth is driven by improved formulation technologies that enhance shelf life of liquid Azotobacter products, better carrier materials, and increasing awareness among farmers about performance consistency. Also, as regulatory and subsidy frameworks in many countries begin to favour more sustainable inputs, liquid biofertilizers are often easier to certify and distribute, accelerating adoption.

By Crop Type Analysis

Cereals & Grains dominate with 45.2% share in 2024 thanks to their large-scale cultivation and staple status.

In 2024, Cereals & Grains held a dominant market position, capturing more than a 45.2% share of the Azotobacter‑based biofertilizer market by crop type. This is largely because staple crops like wheat, rice and maize cover huge agricultural areas, and farmers growing these crops are increasingly open to using biofertilizers like Azotobacter to boost nitrogen fixation, soil health and yields under rising cost and environmental pressures.

This rise reflects growing government support and subsidy programs aimed at staple food production, especially in large cereal‑producing nations. The incremental growth also owes to improved formulation of Azotobacter products tuned for cereals, better inoculation techniques (seed, soil treatments) and expanding irrigation infrastructure facilitating easier application.

By Application Analysis

Soil Treatment leads with 49.1% share in 2024 due to its direct impact on soil fertility and crop yield.

In 2024, Soil Treatment held a dominant market position, capturing more than a 49.1% share of the Azotobacter-based biofertilizer market by application method. This preference is primarily due to the direct and sustained benefits that soil application provides. By introducing Azotobacter directly into the soil, farmers enhance nitrogen fixation, improve soil structure, and promote overall soil health, leading to increased crop yields and reduced dependency on chemical fertilizers.

The continued dominance of Soil Treatment in the Azotobacter-based biofertilizer market underscores the critical role of soil health in sustainable agriculture. As the global agricultural community continues to prioritize eco-friendly and cost-effective solutions, soil application of Azotobacter is expected to remain a cornerstone of biofertilizer strategies worldwide.

By End Use Analysis

Farmers/Cultivators dominate with 69.4% share in 2024 due to their direct role in biofertilizer adoption.

In 2024, the Farmers/Cultivators segment held a dominant market position in the Azotobacter-based biofertilizer market, capturing more than a 69.4% share. This significant share underscores the pivotal role that end-users play in the adoption and utilization of biofertilizers. Farmers, being the primary decision-makers in agricultural practices, are increasingly turning to Azotobacter-based biofertilizers to enhance soil fertility, improve crop yields, and reduce dependence on chemical fertilizers. This shift is driven by a combination of factors, including the rising costs of chemical inputs, the growing emphasis on sustainable farming practices, and the availability of government incentives promoting organic farming.

This continued dominance is attributed to the expanding awareness among farmers about the benefits of Azotobacter-based biofertilizers, coupled with ongoing support from agricultural extension services and policy frameworks encouraging the adoption of eco-friendly farming inputs. Additionally, the increasing availability of these biofertilizers through various distribution channels ensures that farmers have easier access to these products, further driving their adoption.

Key Market Segments

By Product Type

- Liquid

- Powder

- Granules

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Application

- Soil Treatment

- Seed Treatment

- Foliar Application

By End Use

- Farmers/Cultivators

- Research Institutions

- Agricultural Cooperatives

Emerging Trends

Government Support Accelerates Adoption of Azotobacter-Based Biofertilizers in India

The Indian government’s initiatives have significantly boosted the adoption of Azotobacter-based biofertilizers, aligning with the nation’s commitment to sustainable agriculture. These biofertilizers, known for their nitrogen-fixing properties, are increasingly recognized for enhancing soil fertility and reducing dependency on chemical fertilizers.

- In 2025, the government introduced the Organic Fertilizer Subsidy Scheme, offering financial assistance to farmers using biofertilizers like Azotobacter. Under this scheme, farmers receive subsidies ranging from ₹500 to ₹1,200 per tonne, depending on the fertilizer type. The subsidy is available for up to 2 hectares per farmer, with small and marginal farmers prioritized. This initiative is part of the Paramparagat Krishi Vikas Yojana (PKVY) and the National Mission for Sustainable Agriculture (NMSA), aiming to promote organic farming practices across the country.

Additionally, the government has increased its budget allocation for the Nutrient Based Subsidy (NBS) scheme, which supports the use of phosphatic and potassic fertilizers, including biofertilizers. For the 2025 Kharif season, the subsidy outlay was raised to ₹37,216.15 crore, approximately ₹13,000 crore more than the previous Rabi season. This substantial increase underscores the government’s commitment to enhancing soil health and supporting farmers in adopting eco-friendly farming practices.

These government-backed initiatives are complemented by the growing awareness among farmers about the benefits of Azotobacter-based biofertilizers. Studies have shown that the use of Azotobacter as a biofertilizer can increase the growth and yield of various crops under field conditions. This, coupled with the financial support provided, is encouraging more farmers to transition towards sustainable agricultural practices.

Drivers

Government Support and Policy Incentives

One of the most significant factors driving the adoption of Azotobacter-based biofertilizers in India is the robust support provided by the government through various initiatives and subsidies. Recognizing the importance of sustainable agriculture, the Indian government has implemented several programs to encourage the use of biofertilizers, including Azotobacter, among farmers.

Under the National Project on Organic Farming (NPOF), the government offers financial assistance of up to 25% of the total financial outlay, with a ceiling of ₹40 lakhs, as a credit-linked back-ended subsidy for setting up biofertilizer production units. This initiative aims to promote the production and use of biofertilizers, thereby enhancing soil fertility and reducing dependence on chemical fertilizers.

Additionally, the Integrated Scheme of Oilseeds, Pulses, Oil Palm, and Maize (ISOPOM) provides assistance for the supply of Rhizobium culture, Phosphate Solubilizing Bacteria, Azotobacter, and Azospirillum culture at 50% of the cost of the culture or ₹100 per hectare, whichever is less.

Furthermore, the National Food Security Mission (NFSM) on Pulses, including the Accelerated Pulses Production Programme (A3P), offers assistance for popularizing Rhizobium culture and Phosphate Solubilizing Bacteria through cluster demonstrations. Similarly, the Initiative for Nutritional Security through Intensive Millets Promotion (INSIMP) Programme provides Phosphate Solubilizing Bacteria and Azotobacter culture to farmers as part of technology demonstrations. These schemes are designed to promote the use of biofertilizers, thereby improving soil health and enhancing crop productivity.

The Fertilizer Control Order (FCO) has also notified biofertilizers like Rhizobium, Azotobacter, Azospirillum, Acetobacter, PSB, KMB, and Zinc Solubilizing Bacteria, ensuring their quality and efficacy in the market. This regulatory framework instills confidence among farmers regarding the reliability and effectiveness of biofertilizers.

Restraints

Limited Farmer Awareness and Technical Support

Despite the growing recognition of Azotobacter-based biofertilizers as sustainable agricultural inputs, their adoption faces significant challenges, primarily due to limited farmer awareness and inadequate technical support. This issue is particularly pronounced among smallholder farmers in rural areas, where access to information and resources is often constrained.

According to the Task Force Report by NITI Aayog, less than 1% of India’s cropped area is treated with biofertilizers, and less than a quarter is treated with organic fertilizers. This low adoption rate underscores the need for enhanced awareness and education among farmers regarding the benefits and proper usage of biofertilizers like Azotobacter.

The government’s initiatives, such as the Soil Health Card Scheme, aim to address this gap by providing farmers with detailed information about their soil’s nutrient status and recommendations for appropriate fertilizer use. Additionally, the PM-PRANAM Scheme encourages the use of eco-friendly alternatives like biofertilizers by offering incentives to states that successfully reduce chemical fertilizer consumption.

However, the effectiveness of these schemes is contingent upon their implementation at the grassroots level. There is a pressing need for localized training programs, demonstration plots, and extension services to educate farmers about the advantages of Azotobacter-based biofertilizers and how to integrate them into their farming practices.

Opportunity

Government Initiatives Fueling Growth in Azotobacter-Based Biofertilizers

The Indian government’s proactive stance in promoting sustainable agriculture has significantly boosted the adoption of Azotobacter-based biofertilizers. These biofertilizers, known for their ability to fix atmospheric nitrogen and enhance soil fertility, are gaining traction among farmers seeking eco-friendly alternatives to chemical fertilizers.

A notable policy supporting this shift is the National Mission on Oilseeds and Oil Palm (NMOOP), which offers a 50% subsidy (INR 300 per hectare) for biofertilizer applications, including Azotobacter. Additionally, the Promotion of Biofertilizers Scheme under the Department of Agriculture & Farmers Welfare provides financial incentives and mandates quality standards for biofertilizer products, ensuring accessibility and reliability for farmers.

These initiatives are complemented by the Soil Health Card Scheme, which assists farmers in understanding soil deficiencies and appropriate interventions, fostering informed decisions regarding biofertilizer use. Such comprehensive support underscores the government’s commitment to enhancing soil health and promoting sustainable farming practices.

Regional Insights

Asia-Pacific leads with 46.8% share in 2024, valued at USD 2.7 billion, driven by large-scale agriculture and supportive policies.

In 2024, the Asia-Pacific (APAC) region held a dominant position in the Azotobacter-based biofertilizer market, capturing more than a 46.8% share, valued at approximately USD 2.7 billion. This substantial market presence is primarily attributed to the region’s extensive agricultural activities, particularly in countries like China and India, where large-scale farming operations are prevalent. These nations have been increasingly adopting sustainable agricultural practices, including the use of biofertilizers like Azotobacter, to enhance soil fertility and reduce dependence on chemical fertilizers.

The growth in the APAC biofertilizer market is further supported by various government initiatives aimed at promoting organic farming and reducing chemical fertilizer usage. For instance, the Indian government has implemented the Soil Health Card Scheme, which encourages farmers to adopt balanced fertilization practices, including the use of biofertilizers. Similarly, China’s policies have been focusing on sustainable agriculture, leading to increased adoption of biofertilizers across the country.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Biotech International offers Azotobacter-based biofertilizers under the brand names Bioazoto and Bhoomi Rakshak. These products are available in various formulations, including aqueous suspension, wettable powder, and granules, with a minimum cell count of 1×10⁹ per ml or gm. The company focuses on providing nitrogen-fixing solutions to enhance soil fertility and promote sustainable agriculture practices.

GSFC, a government-owned company, offers Azotobacter-based biofertilizers under the ‘Sardar’ brand. Their products are formulated to fix nitrogen in the soil, enhancing fertility and supporting sustainable agriculture. GSFC’s extensive distribution network ensures wide availability of their biofertilizer products across India.

Growtech Agri Science manufactures ‘Grow Bacter’, an Azotobacter biofertilizer available in both liquid and powder forms. The product is designed to enhance soil fertility, increase crop yields, and improve plant health by providing essential nutrients. It is compatible with most pesticides and plant growth regulators, making it a versatile choice for farmers.

Top Key Players Outlook

- Biotech International

- FARMADIL INDIA LLP

- Green Vision Life Sciences

- Growtech Agri Science

- Gujarat State Fertilizers & Chemicals

- IFFCO

- Jaipur Bio Fertilizers

- MADRAS FERTILIZERS LTD.

Recent Industry Developments

In 2024, GSFC continued to enhance its biofertilizer offerings, including Azotobacter-based products. Their Azotobacter formulations are designed to fix 20–25 kg of nitrogen per acre, benefiting a range of crops such as cereals, cash crops, and horticultural plants.

In 2024, FARMADIL INDIA LLP reported an annual turnover of approximately ₹25 crores and employed between 50 to 100 staff members. The company’s manufacturing facility operates at a capacity of 40 metric tons per day, ensuring a steady supply of high-quality biofertilizers to meet the growing demand in both domestic and international markets.

Report Scope

Report Features Description Market Value (2024) USD 5.6 Bn Forecast Revenue (2034) USD 16.9 Bn CAGR (2025-2034) 11.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid, Powder, Granules), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By Application (Soil Treatment, Seed Treatment, Foliar Application), By End Use ( Farmers/Cultivators, Research Institutions, Agricultural Cooperatives) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Biotech International, FARMADIL INDIA LLP, Green Vision Life Sciences, Growtech Agri Science, Gujarat State Fertilizers & Chemicals, IFFCO, Jaipur Bio Fertilizers, MADRAS FERTILIZERS LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Azotobacter-Based Biofertilizer MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Azotobacter-Based Biofertilizer MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Biotech International

- FARMADIL INDIA LLP

- Green Vision Life Sciences

- Growtech Agri Science

- Gujarat State Fertilizers & Chemicals

- IFFCO

- Jaipur Bio Fertilizers

- MADRAS FERTILIZERS LTD.