Global Awning Market Size, Share, Growth Analysis By Type (Fixed, Retractable), By Product (Patio, Window, Freestanding, Others), By Nature (Manual, Motorized), By Material (Fabric, Metal, Wood, Composites, Plastic), By Installation Type (Wall-Mounted, Roof-Mounted, Portable), By End-Use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175949

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

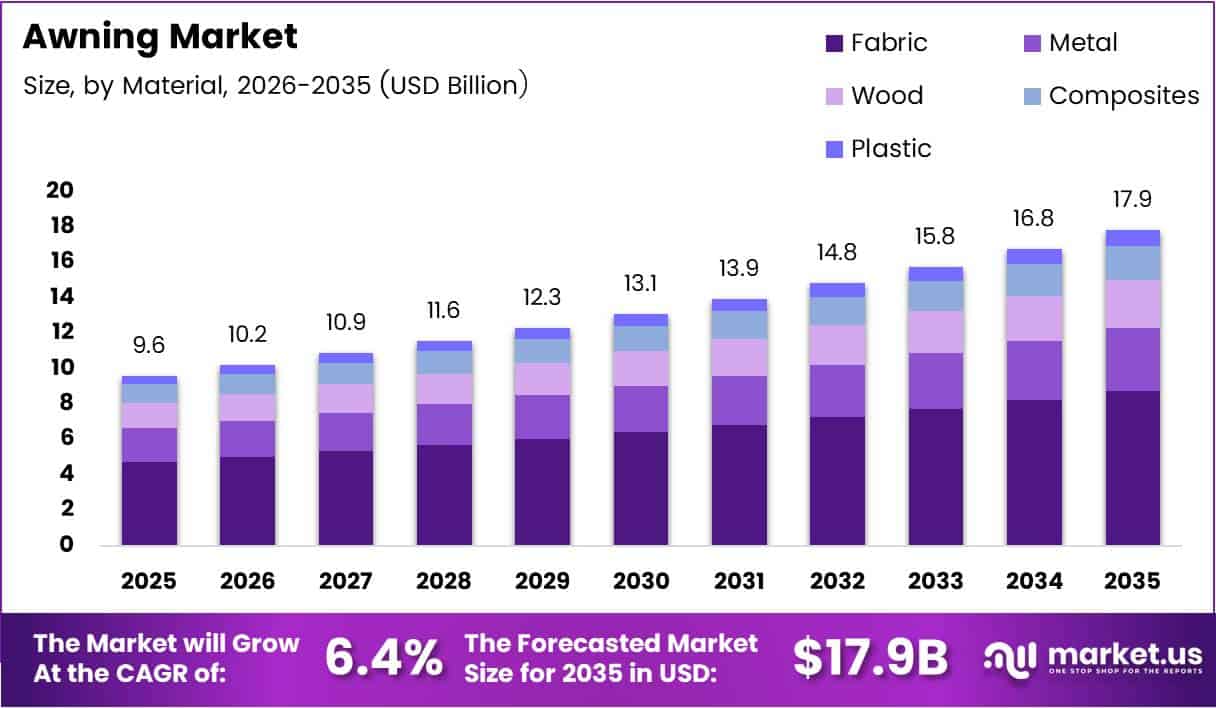

Global Awning Market size is expected to be worth around USD 17.9 Billion by 2035 from USD 9.6 Billion in 2025, growing at a CAGR of 6.4% during the forecast period 2026 to 2035.

Awnings represent functional architectural extensions that provide shade, weather protection, and aesthetic enhancement for residential and commercial properties. These structures consist of durable fabric or solid materials mounted on frames. Property owners install awnings to reduce heat, protect outdoor spaces, and enhance curb appeal.

The market experiences robust growth driven by urbanization and outdoor lifestyle trends. Homeowners increasingly invest in outdoor living enhancements to maximize property utilization. Moreover, commercial establishments adopt awnings for branding and customer comfort purposes.

Energy efficiency concerns accelerate awning adoption across multiple sectors. Building owners recognize significant cooling cost reductions through strategic shading solutions. Additionally, environmental regulations encourage sustainable building practices that incorporate natural temperature control methods.

Technological innovations transform traditional awning systems into smart, automated solutions. Manufacturers integrate sensors and motorized mechanisms for enhanced functionality. Consequently, consumers gain weather-responsive protection that adjusts automatically to environmental conditions.

According to ICFA, 85% of households reported having some type of outdoor space such as a porch, patio, balcony, or deck. This widespread availability creates substantial demand for protective and decorative outdoor enhancements that extend usable living areas.

However, According to ICFA, 77% of consumers underutilize their outdoor living space, highlighting unmet demand for usable outdoor enhancements. This gap represents significant market opportunity for awning manufacturers targeting underserved residential segments seeking functional outdoor improvements.

In April 2024, RedAwning acquired Awning.com to set new standards for short-term rentals, demonstrating industry consolidation trends. This strategic move reflects growing recognition of outdoor amenities in property management and vacation rental marketplaces.

Key Takeaways

- Global Awning Market projected to reach USD 17.9 Billion by 2035 from USD 9.6 Billion in 2025 at 6.4% CAGR

- Fixed awnings dominate type segment with 59.1% market share due to structural durability

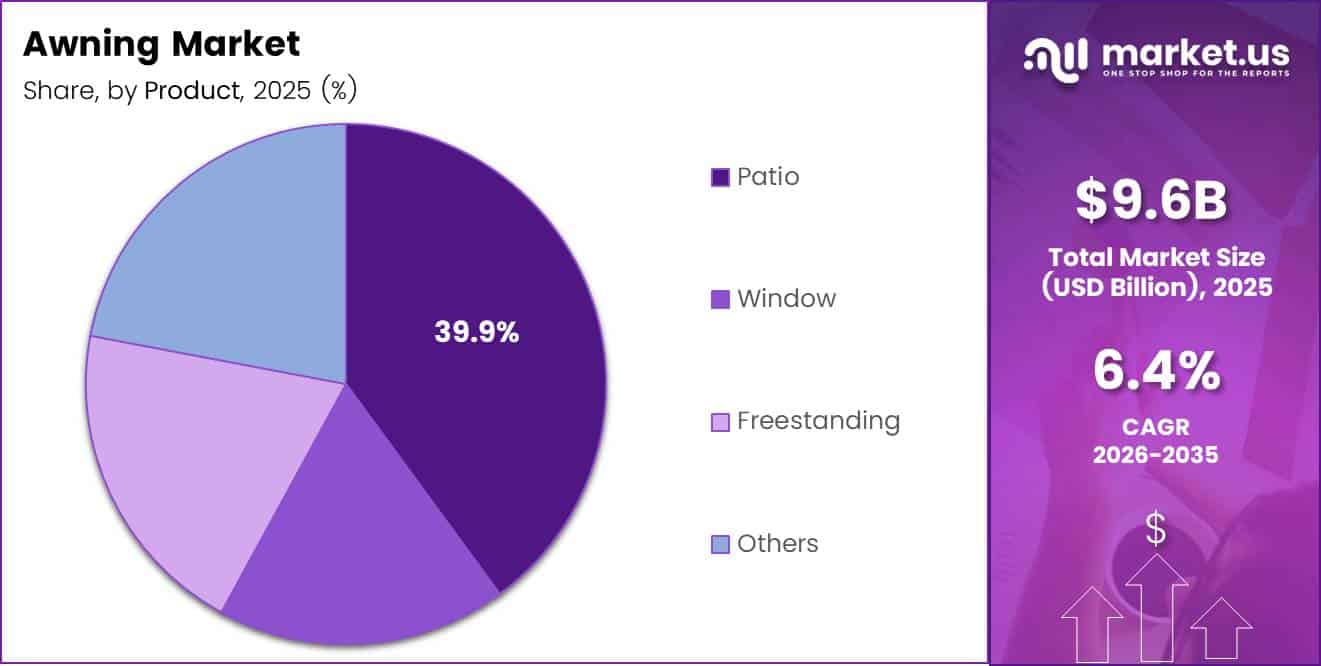

- Patio awnings lead product category with 39.9% share driven by outdoor living trends

- Manual awnings hold 59.3% share in nature segment reflecting cost-effectiveness preferences

- Fabric material captures 43.4% market share offering versatile design options

- Wall-mounted installation commands 49.8% share as preferred mounting method

- Residential sector dominates end-use with 67.6% share across property types

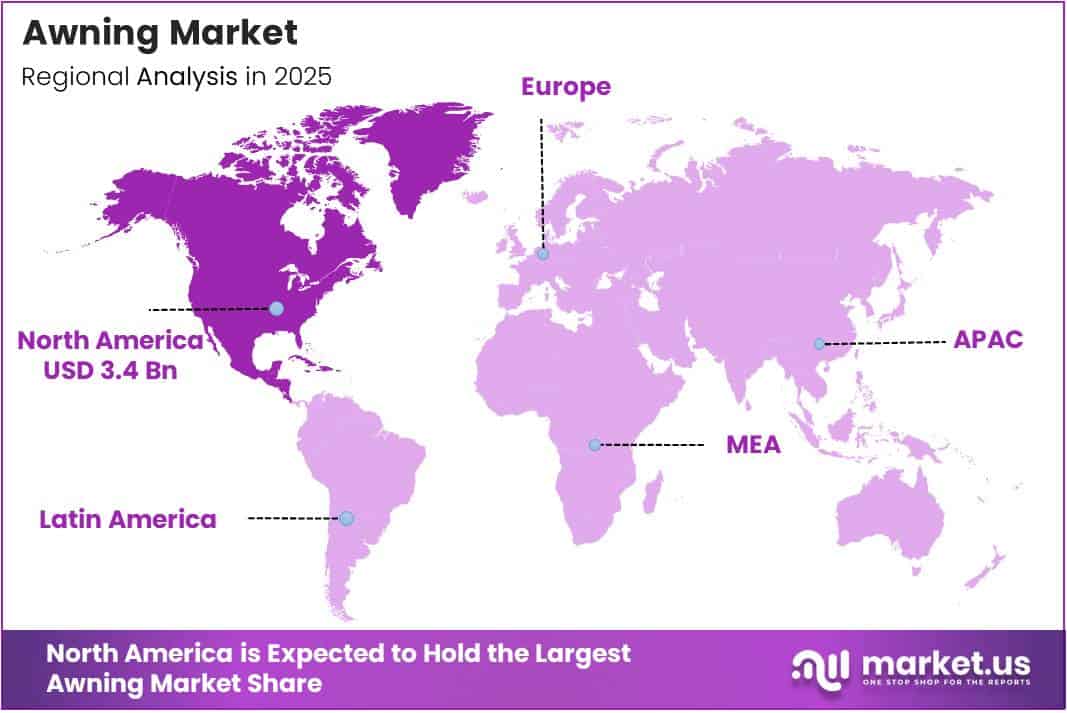

- North America leads regional market with 35.50% share valued at USD 3.4 Billion

Type Analysis

Fixed awnings dominate with 59.1% due to permanent installation advantages and structural reliability.

In 2025, Fixed held a dominant market position in the By Type segment of Awning Market, with a 59.1% share. Property owners prefer permanent awning installations for long-term weather protection and consistent aesthetic appeal. These structures offer superior wind resistance and require minimal maintenance compared to alternative options. Additionally, commercial establishments favor fixed awnings for reliable branding visibility throughout seasonal changes.

Retractable awnings gain popularity among residential users seeking flexible shade control options. These adjustable systems allow property owners to extend coverage during sunny periods and retract during inclement weather. Moreover, retractable mechanisms protect fabric from storm damage and extend product lifespan. Consumers appreciate the versatility these awnings provide for varying outdoor entertainment needs.

Product Analysis

Patio awnings dominate with 39.9% due to outdoor living space expansion trends.

In 2025, Patio held a dominant market position in the By Product segment of Awning Market, with a 39.9% share. Homeowners invest heavily in patio enhancements to create comfortable outdoor entertainment areas. These large-format awnings provide extensive coverage for furniture and gatherings. Therefore, residential properties prioritize patio awnings to maximize usable square footage throughout warmer seasons.

Window awnings deliver targeted sun protection and energy efficiency for building facades. These compact installations reduce direct sunlight penetration through glass surfaces. Consequently, property owners experience lower cooling costs and improved indoor comfort. Commercial buildings frequently install window awnings to enhance architectural character while maintaining functional benefits.

Freestanding awnings offer portable shade solutions for flexible outdoor arrangements. These independent structures require no building attachment and relocate easily across properties. Moreover, event venues and temporary commercial spaces utilize freestanding awnings for versatile coverage. Customers value the installation simplicity these products provide without permanent construction modifications.

Others category includes specialized awning applications for unique architectural requirements. Custom designs serve niche markets including marine, industrial, and transportation sectors. Additionally, innovative hybrid awning systems combine multiple product features for specific user needs.

Nature Analysis

Manual awnings dominate with 59.3% due to cost-effectiveness and mechanical simplicity.

In 2025, Manual held a dominant market position in the By Nature segment of Awning Market, with a 59.3% share. Budget-conscious consumers select hand-operated awnings to minimize initial investment costs. These mechanical systems eliminate electrical components and associated maintenance expenses. Therefore, residential markets especially favor manual options for straightforward functionality without technological complications.

Motorized awnings attract premium customers seeking convenience and smart home integration. Automated systems respond to remote controls and programmed schedules effortlessly. Moreover, commercial properties adopt motorized awnings for consistent operation across multiple installations. Technology-focused consumers appreciate the enhanced user experience these advanced systems deliver.

Material Analysis

Fabric materials dominate with 43.4% due to design versatility and cost advantages.

In 2025, Fabric held a dominant market position in the By Material segment of Awning Market, with a 43.4% share. Textile-based awnings offer extensive color patterns and customization possibilities for diverse architectural styles. These lightweight materials facilitate easier installation and reduced structural support requirements. Additionally, fabric awnings provide superior UV filtering while maintaining air circulation beneath covered areas.

Metal awnings deliver exceptional durability and modern aesthetic appeal for commercial applications. Aluminum and steel constructions withstand harsh weather conditions with minimal degradation. Moreover, metal options require less frequent replacement compared to fabric alternatives. Industrial and high-traffic locations prefer metal awnings for long-term performance reliability.

Wood awnings create traditional architectural character for heritage and residential properties. Natural timber materials provide organic warmth and visual distinction from synthetic alternatives. However, wooden structures demand regular maintenance including sealing and protective treatments. Consumers seeking authentic craftsmanship appreciate wood awnings despite higher upkeep requirements.

Composites and Plastic materials emerge as innovative alternatives combining durability with affordability. These engineered solutions resist moisture, insects, and fading better than traditional options. Consequently, manufacturers develop composite awnings targeting maintenance-averse consumers seeking lasting value.

Installation Type Analysis

Wall-mounted awnings dominate with 49.8% due to structural stability and widespread applicability.

In 2025, Wall-Mounted held a dominant market position in the By Installation Type segment of Awning Market, with a 49.8% share. Building facade attachments provide secure anchoring points that distribute weight efficiently. Property owners prefer wall installations for permanent coverage extending from existing structures. Therefore, residential and commercial markets widely adopt wall-mounted configurations for reliable long-term performance.

Roof-Mounted awnings suit properties where wall attachment proves impractical or insufficient. These installations extend coverage beyond building perimeters using overhead support structures. Moreover, roof-mounted systems accommodate larger awnings spanning multiple windows or outdoor areas. Commercial establishments utilize roof attachments for extensive storefront coverage requirements.

Portable awnings offer temporary shade solutions without permanent installation commitments. These standalone units serve events, markets, and seasonal business operations effectively. Additionally, portable awnings allow users to reposition coverage based on changing sun angles. Flexibility-focused customers value portable options for dynamic outdoor space utilization.

End-Use Analysis

Residential sector dominates with 67.6% due to homeowner investment in outdoor living enhancements.

In 2025, Residential held a dominant market position in the By End-Use segment of Awning Market, with a 67.6% share. Homeowners increasingly transform patios, decks, and entryways into functional living extensions. These property improvements enhance comfort while increasing real estate value and curb appeal. Therefore, residential markets drive substantial awning demand across single-family homes and multi-unit housing developments.

Commercial establishments install awnings for customer attraction and brand visibility enhancement. Restaurants, cafés, and retail stores utilize branded awnings for weather protection and marketing purposes. Moreover, commercial awnings extend usable outdoor seating areas, generating additional revenue opportunities. Business owners recognize awnings as cost-effective investments improving customer experience and property differentiation.

Industrial facilities employ awnings for functional coverage of loading docks and equipment storage areas. These utilitarian installations protect valuable assets from weather exposure and sun damage. Additionally, industrial awnings create shaded work environments that improve employee comfort and safety.

Key Market Segments

By Type

- Fixed

- Retractable

By Product

- Patio

- Window

- Freestanding

- Others

By Nature

- Manual

- Motorized

By Material

- Fabric

- Metal

- Wood

- Composites

- Plastic

By Installation Type

- Wall-Mounted

- Roof-Mounted

- Portable

By End-Use

- Residential

- Commercial

- Industrial

Drivers

Rising Adoption of Outdoor Living Spaces Drives Market Expansion

Residential properties increasingly prioritize outdoor living areas as extended home environments. Homeowners invest in patio furniture, cooking equipment, and protective structures to maximize property utilization. Consequently, awnings become essential components providing weather protection and temperature control for outdoor entertainment spaces.

Commercial hospitality sectors expand outdoor dining and event spaces to accommodate customer preferences. Restaurants and hotels create comfortable alfresco environments that generate additional revenue streams. Moreover, municipalities encourage outdoor business operations through favorable zoning and permitting policies that support awning installations.

Energy-conscious consumers adopt awnings as passive cooling solutions reducing electricity consumption. Strategic shading lowers indoor temperatures and decreases air conditioning requirements during peak heat periods. Therefore, environmentally aware property owners recognize awnings as sustainable investments delivering ongoing operational cost savings.

Restraints

High Initial Investment Costs Limit Market Adoption

Premium awning systems require significant upfront expenditure for materials, customization, and professional installation. Budget-constrained consumers often postpone purchases despite recognizing long-term benefits and energy savings. Additionally, motorized and automated awnings command substantial price premiums that restrict market accessibility for price-sensitive segments.

Extreme weather conditions accelerate wear and deterioration of awning materials and mechanisms. Harsh sun exposure fades fabric colors while wind and rain damage structural components. Moreover, property owners face recurring maintenance expenses including cleaning, repairs, and eventual replacement that increase total ownership costs.

Regional climate variations create durability concerns affecting product lifespan and performance reliability. Coastal areas experience salt corrosion while desert environments cause material brittleness from intense UV exposure. Consequently, consumers in challenging climates hesitate to invest in awnings without proven weather resistance guarantees.

Growth Factors

Technological Advancements Accelerate Market Expansion

Smart home integration transforms traditional awnings into automated climate-responsive systems. IoT sensors detect environmental conditions including sun intensity, wind speed, and precipitation levels. Therefore, motorized awnings adjust automatically without user intervention, providing optimal protection while conserving energy through intelligent operation.

According to ICFA, 59% of respondents with outdoor space plan to purchase new outdoor furniture or accessories in 2025, indicating rising consumer investment in outdoor areas. This spending trend directly benefits awning manufacturers as homeowners seek comprehensive outdoor living solutions that enhance comfort and property value.

In January 2026, FrontYard Group completed the acquisition of Mobau Markisen in Germany, demonstrating international market expansion strategies. This consolidation reflects growing global demand for quality awning products and manufacturers’ confidence in sustained market growth across diverse geographic regions.

Emerging Trends

Digital Innovation Reshapes Market Landscape

Manufacturers integrate weather sensors and smartphone connectivity into motorized awning systems. These intelligent solutions monitor real-time conditions and adjust coverage automatically for optimal performance. Moreover, users control awnings remotely through mobile applications, enabling convenient operation from anywhere on property grounds.

Contemporary architectural preferences favor clean lines and minimalist designs in outdoor structures. Awning manufacturers respond by developing sleek profiles and concealed hardware that complement modern building aesthetics. Additionally, custom color-matching services allow seamless integration with existing property color schemes and brand identities.

High-performance synthetic fabrics replace traditional materials offering superior UV resistance and longevity. Acrylic and polyester textiles maintain color vibrancy while resisting mold, mildew, and environmental degradation. Consequently, property owners experience extended product lifespans and reduced maintenance requirements compared to legacy fabric options.

Regional Analysis

North America Dominates the Awning Market with a Market Share of 35.50%, Valued at USD 3.4 Billion

North America leads global awning markets with a commanding 35.50% share, valued at USD 3.4 Billion, driven by strong residential construction and outdoor living culture. The region experiences high homeownership rates and disposable income levels supporting premium product adoption. Moreover, established distribution networks and experienced installation professionals facilitate widespread market penetration across urban and suburban communities throughout the United States and Canada.

Europe Awning Market Trends

Europe maintains substantial market presence through architectural heritage and outdoor café culture. Mediterranean countries particularly embrace awning installations for sun protection and aesthetic enhancement. Additionally, strict building efficiency regulations encourage passive cooling solutions that reduce energy consumption across residential and commercial properties.

Asia Pacific Awning Market Trends

Asia Pacific demonstrates rapid market growth fueled by urbanization and rising middle-class prosperity. Densely populated cities adopt awnings to maximize limited outdoor spaces in high-rise residential developments. Moreover, hospitality sector expansion across tourism destinations drives commercial awning demand for hotels, resorts, and beachfront establishments.

Latin America Awning Market Trends

Latin America shows increasing adoption driven by tropical climates requiring sun and rain protection. Commercial sectors including restaurants and retail stores utilize awnings for customer comfort and branding visibility. Additionally, informal business operations adopt affordable portable awnings for market stalls and temporary commercial activities.

Middle East & Africa Awning Market Trends

Middle East & Africa markets experience growth through extreme climate conditions necessitating effective shade solutions. High temperatures drive demand for commercial awnings protecting outdoor seating areas and building facades. Moreover, luxury hospitality developments incorporate premium awning systems as essential amenities for guest comfort and architectural distinction.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Advanced Design Awnings & Signs operates as a comprehensive provider specializing in custom awning fabrication and commercial signage solutions. The company serves diverse markets including retail, hospitality, and residential sectors with tailored design capabilities. Moreover, their integrated approach combines branding elements with functional shade structures to deliver comprehensive exterior enhancement packages for business clients.

Aristocrat maintains strong market presence through premium product offerings targeting luxury residential and commercial segments. The manufacturer emphasizes superior craftsmanship and durable materials that justify premium pricing strategies. Additionally, their established dealer networks across multiple regions ensure consistent product availability and professional installation services that support brand reputation.

A&A International focuses on innovative awning technologies including motorized systems and smart home integration features. The company invests significantly in research and development to maintain competitive advantages in automated product categories. Consequently, their advanced offerings attract technology-focused consumers seeking convenience and modern functionality in outdoor living solutions.

Eide Industries Inc. leverages extensive manufacturing capabilities to produce cost-effective awning solutions at scale. The company serves both residential and commercial markets through value-oriented product lines emphasizing reliability and affordability. Moreover, their efficient production processes enable competitive pricing that appeals to budget-conscious consumers without compromising essential quality standards.

Key Players

- Advanced Design Awnings & Signs

- Aristocrat

- A&A International

- Eide Industries Inc.

- Gibraltar Industries

- Herculite Products Inc.

- Lewen

- Nulmage

- Orion Blinds

- Serge Ferrari Group

Recent Developments

- May 2024 – Metro Sign & Awning expanded its regional footprint through the strategic acquisition of ViewPoint Sign & Awning, strengthening market presence across multiple service territories. This consolidation enhances the company’s ability to serve commercial clients requiring comprehensive signage and awning solutions through combined technical expertise and expanded installation capabilities.

- April 2024 – A confidential buyer acquired Atlas Sign & Awning Company, demonstrating continued industry consolidation trends as established operators seek growth through strategic acquisitions. This transaction reflects investor confidence in stable cash flows and recurring revenue streams generated by commercial awning service businesses serving diverse client portfolios.

Report Scope

Report Features Description Market Value (2025) USD 9.6 Billion Forecast Revenue (2035) USD 17.9 Billion CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fixed, Retractable), By Product (Patio, Window, Freestanding, Others), By Nature (Manual, Motorized), By Material (Fabric, Metal, Wood, Composites, Plastic), By Installation Type (Wall-Mounted, Roof-Mounted, Portable), By End-Use (Residential, Commercial, Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Advanced Design Awnings & Signs, Aristocrat, A&A International, Eide Industries Inc., Gibraltar Industries, Herculite Products Inc., Lewen, Nulmage, Orion Blinds, Serge Ferrari Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Advanced Design Awnings & Signs

- Aristocrat

- A&A International

- Eide Industries Inc.

- Gibraltar Industries

- Herculite Products Inc.

- Lewen

- Nulmage

- Orion Blinds

- Serge Ferrari Group