Global Autopilot Deployment Tools Market Size, Share, Growth Analysis By Component (Software, Hardware, Services), By Deployment Mode (Cloud, On-Premises, Hybrid), By Application (Automotive, Aerospace, Maritime, Drones & UAVs, Industrial Automation, Others), By End-User (Commercial, Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172888

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

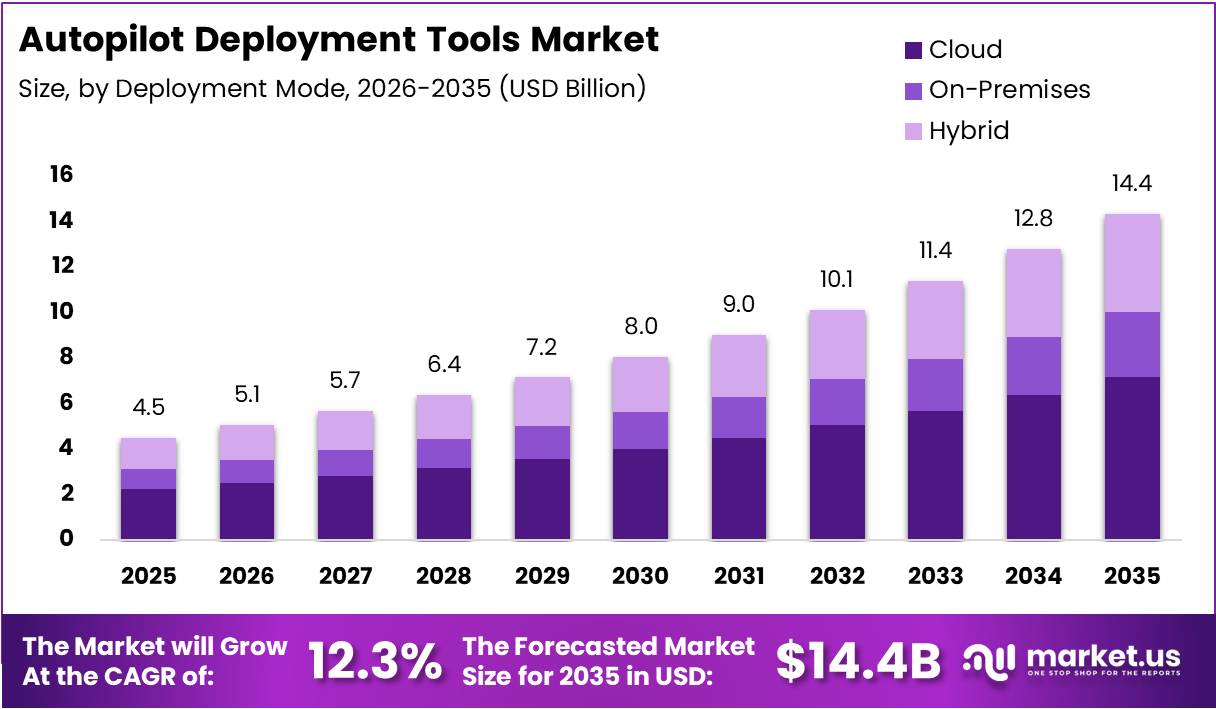

The Global Autopilot Deployment Tools Market size is expected to be worth around USD 14.4 Billion by 2035, from USD 4.5 Billion in 2025, growing at a CAGR of 12.3% during the forecast period from 2026 to 2035.

The Autopilot Deployment Tools Market encompasses sophisticated software solutions enabling automated vehicle control systems across automotive and aviation sectors. These platforms streamline implementation, testing, and management of self-driving technologies. Market participants leverage deployment tools to accelerate integration cycles while ensuring regulatory compliance and safety standards throughout operational environments.

Growth prospects appear robust as manufacturers increasingly prioritize autonomous capabilities within transportation infrastructure. Demand accelerates driven by consumer preferences for enhanced safety features and operational efficiency improvements. Investment inflows continue expanding as stakeholders recognize long-term value propositions associated with automation technologies and intelligent transportation systems.

Furthermore, government initiatives substantially influence market trajectories through funding allocations and infrastructure modernization programs. Regulatory frameworks evolve to accommodate emerging technologies while establishing safety benchmarks for autonomous operations. Policymakers worldwide implement standards that balance innovation encouragement with public safety requirements, thereby shaping deployment strategies across regions.

Opportunities emerge particularly within advanced driver-assistance systems integration and commercial aviation applications. Enterprises seek scalable solutions that reduce implementation complexities while maintaining performance reliability. Additionally, cloud-based deployment architectures gain traction, offering flexibility and cost-effectiveness for organizations transitioning toward automated operations across diverse vehicle platforms.

Market adoption demonstrates compelling momentum as behavioral patterns shift toward automation acceptance. Industry data reveals that 70% of drivers activate an ADAS feature most or all of the time when driving, reflecting strong consumer confidence in automated assistance technologies. Similarly, aviation statistics indicate autopilot systems are used for approximately 90% of flight time, underscoring operational dependence on automated control mechanisms across commercial and private aviation segments.

These utilization metrics validate the critical role deployment tools play in facilitating widespread automation adoption. As technological maturity advances and regulatory landscapes stabilize, market participants anticipate sustained expansion driven by enhanced functionality requirements and operational efficiency mandates.

Key Takeaways

- Global Autopilot Deployment Tools Market is projected to reach USD 14.4 Billion by 2035 from USD 4.5 Billion in 2025, growing at a CAGR of 12.3%.

- By Component, Software dominates with a 53.9% market share in 2025.

- By Deployment Mode, Cloud leads with a 43.6% share in 2025.

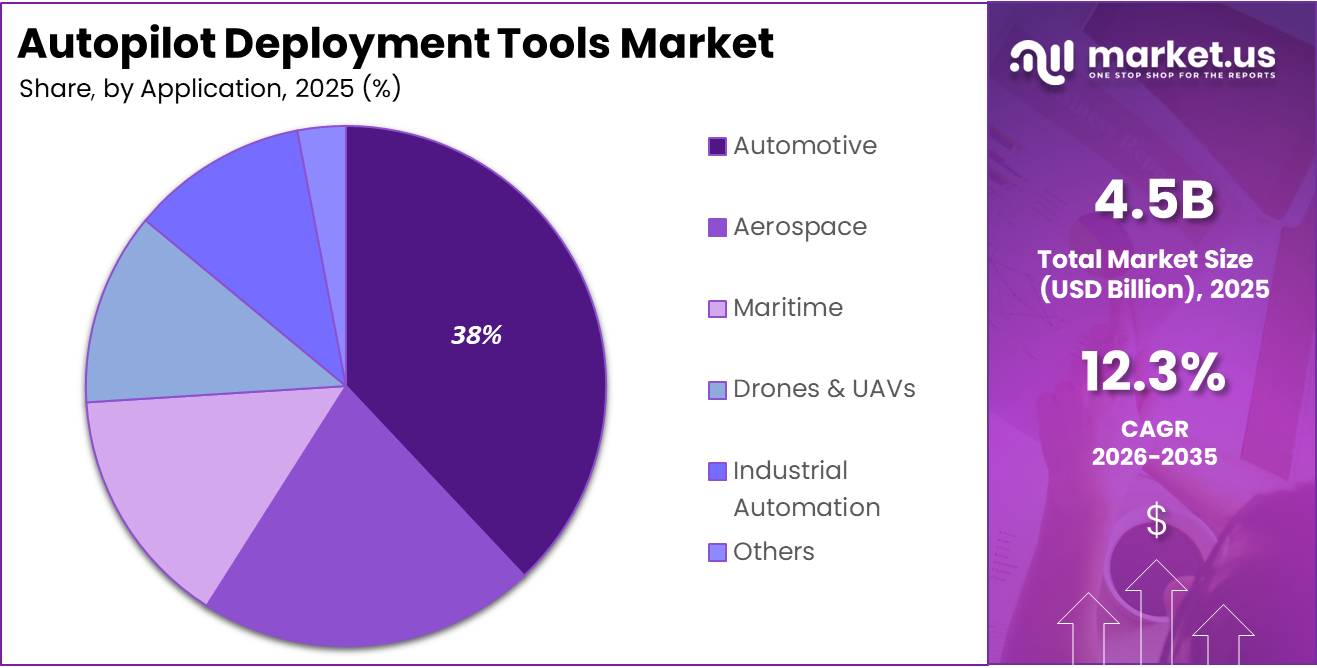

- By Application, Automotive accounts for the largest segment with 38.0% in 2025.

- By End-User, Commercial dominates with a 59.7% share in 2025.

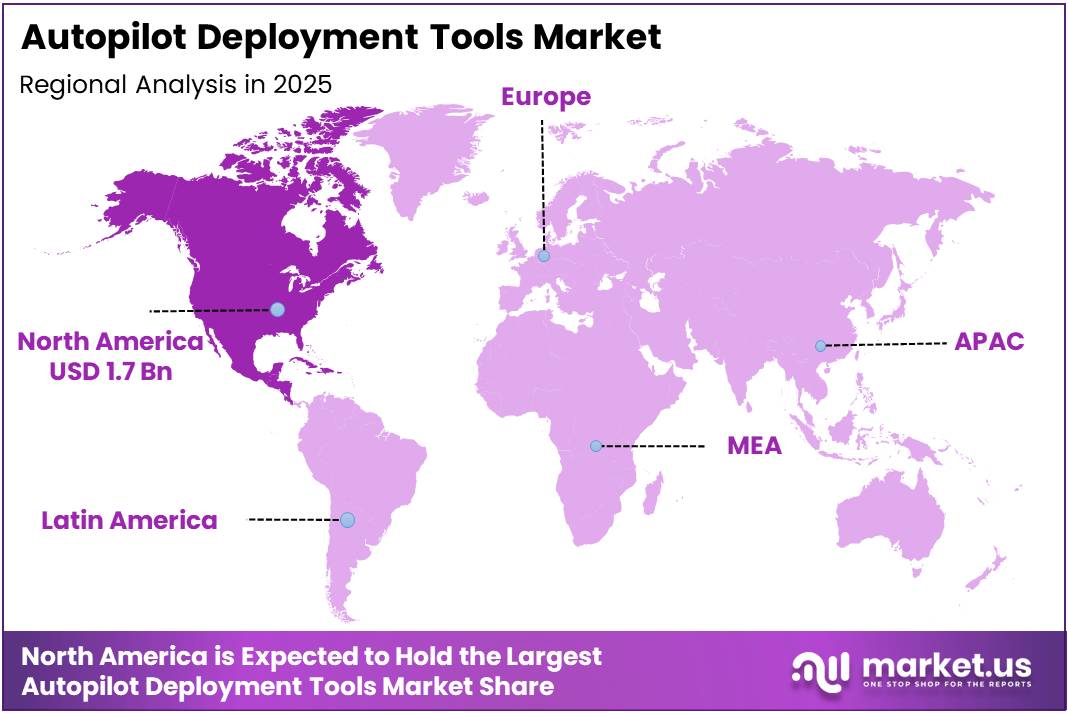

- North America holds the largest regional market with 37.8% share, valued at USD 1.7 Billion in 2025.

By Component Analysis

Software dominates with 53.9% due to its critical role in enabling intelligent automation and decision-making capabilities.

In 2025, Software held a dominant market position in the By Component Analysis segment of Autopilot Deployment Tools Market, with a 53.9% share. Software solutions provide essential algorithms, machine learning models, and artificial intelligence frameworks that enable autonomous operation. These platforms facilitate real-time data processing, predictive analytics, and adaptive control mechanisms.

Hardware components encompass sensors, processors, actuators, and communication modules that physically enable autopilot functionality. Advanced technologies such as LiDAR systems, high-performance computing units, and GPS receivers capture environmental data and execute automated commands. Continuous miniaturization and performance enhancement enable sophisticated autopilot applications across diverse industries, supporting increasingly capable autonomous systems.

Services provide implementation support, maintenance, training, and consulting expertise. Professional services help organizations successfully deploy autopilot technologies, optimize system performance, and ensure regulatory compliance. Managed services and ongoing technical support reduce operational complexities while maximizing return on investment, making this segment increasingly valuable for enterprises navigating digital transformation.

By Deployment Mode Analysis

Cloud dominates with 43.6% due to its scalability, cost-efficiency, and seamless remote accessibility.

In 2025, Cloud held a dominant market position in the By Deployment Mode Analysis segment of Autopilot Deployment Tools Market, with a 43.6% share. Cloud-based deployment offers unparalleled flexibility, enabling rapid scaling of computational resources to handle complex autopilot algorithms and massive data volumes. This model eliminates substantial upfront infrastructure investments while providing continuous software updates and global accessibility.

On-Premises deployment remains preferred by organizations requiring stringent data security, regulatory compliance, and complete operational control. Industries handling sensitive information opt for on-premises solutions that provide dedicated infrastructure and enhanced data sovereignty. This deployment mode offers reduced latency for time-critical autopilot operations and ensures consistent performance without dependency on external network conditions.

Hybrid deployment models combine cloud flexibility with on-premises security, offering organizations the best of both worlds. This approach enables businesses to maintain sensitive data locally while leveraging cloud resources for computationally intensive tasks and analytics. Hybrid solutions provide optimal resource allocation and risk mitigation strategies for enterprises navigating complex operational requirements.

By Application Analysis

Automotive dominates with 38.0% due to rapid adoption of autonomous driving technologies and smart transportation systems.

In 2025, Automotive held a dominant market position in the By Application Analysis segment of Autopilot Deployment Tools Market, with a 38.0% share. The automotive sector drives substantial demand through advanced driver assistance systems and self-driving vehicles. Major manufacturers invest heavily in autopilot technologies to enhance road safety and reduce traffic congestion. Regulatory support and continuous technological advancements accelerate market penetration.

Aerospace applications leverage autopilot systems for commercial aviation, flight control optimization, and pilot assistance functionalities. These sophisticated systems enhance flight safety, reduce pilot workload, and improve fuel efficiency through precise navigation. The aerospace industry’s stringent safety standards drive demand for advanced autopilot deployment tools ensuring reliable performance.

Maritime autopilot solutions enable autonomous vessel navigation, collision avoidance, and optimized route planning for commercial shipping. These systems enhance operational efficiency, reduce human error, and support sustainable maritime operations through intelligent fuel consumption management and weather-adaptive navigation capabilities.

Drones & UAVs represent rapidly growing applications across delivery services, surveillance, agriculture, and infrastructure inspection. Autopilot technologies enable precise flight control, autonomous mission execution, and safe operation in complex environments, expanding commercial drone capabilities significantly, while also allowing integration with AI-driven analytics for smarter decision-making.

Industrial Automation utilizes autopilot tools for autonomous mobile robots, automated guided vehicles, and smart manufacturing systems. These solutions enhance productivity, streamline warehouse operations, and improve workplace safety by reducing human intervention in hazardous environments, supporting real-time monitoring and adaptive operational efficiency.

Others include emerging applications in agriculture, construction, mining, and specialized industries. Autonomous systems in these sectors improve safety, operational outcomes, and resource management through intelligent automation and precision control capabilities, while enabling predictive maintenance and minimizing operational downtime.

By End-User Analysis

Commercial dominates with 59.7% due to widespread adoption across transportation, logistics, and industrial sectors.

In 2025, Commercial held a dominant market position in the By End-User Analysis segment of Autopilot Deployment Tools Market, with a 59.7% share. Commercial enterprises across transportation, logistics, agriculture, and manufacturing increasingly adopt autopilot technologies to enhance operational efficiency and reduce labor costs. Ride-sharing services, freight companies, and e-commerce platforms benefit from autopilot deployment, enabling scalable operations and improved service delivery.

Defense applications encompass military vehicles, unmanned aerial systems, naval vessels, and strategic equipment requiring sophisticated autonomous capabilities. Defense organizations prioritize autopilot technologies for reconnaissance missions, tactical operations, and personnel safety in hazardous environments. The sector demands highly secure, reliable systems with advanced threat detection capabilities.

Others include governmental agencies, research institutions, and public service organizations deploying autopilot systems for emergency response and environmental monitoring. These end-users focus on enhancing public safety, optimizing resource allocation, and supporting societal objectives through innovative autonomous solutions.

Key Market Segments

By Component

- Software

- Hardware

- Services

By Deployment Mode

- Cloud

- On-Premises

- Hybrid

By Application

- Automotive

- Aerospace

- Maritime

- Drones & UAVs

- Industrial Automation

- Others

By End-User

- Commercial

- Defense

- Others

Drivers

Escalating Adoption of Autonomous Vehicle Technologies Drives Autopilot Deployment Tools Market Growth

Commercial fleets are increasingly embracing autonomous vehicle technologies to improve operational efficiency and reduce human error. Logistics companies and public transportation operators are investing heavily in autopilot systems to optimize route management and lower operational costs. This widespread adoption is creating strong demand for sophisticated deployment tools that can seamlessly integrate autopilot features into existing fleet management systems.

Artificial intelligence and machine learning advancements are significantly improving autopilot precision and reliability. Companies are channeling substantial investments into developing smarter algorithms that can handle complex driving scenarios with greater accuracy. These technologies enable vehicles to learn from real-world data and continuously improve their decision-making capabilities, making autopilot deployment tools more attractive to manufacturers and fleet operators.

Government bodies worldwide are introducing favorable regulations and incentives to promote advanced driver assistance systems. These regulatory frameworks are making it easier for automotive companies to integrate autopilot technologies into their vehicles. Additionally, the growing need for real-time vehicle diagnostics and predictive maintenance solutions is pushing manufacturers to adopt comprehensive deployment tools that can monitor vehicle performance continuously and prevent potential failures before they occur.

Restraints

High Implementation Costs Restrain Autopilot Deployment Tools Market Expansion

Integrating autopilot deployment tools into legacy automotive systems presents significant financial challenges for manufacturers. Older vehicle architectures were not designed with autonomous capabilities in mind, requiring extensive hardware upgrades and software modifications. These retrofitting expenses can be prohibitively expensive, particularly for smaller automotive companies with limited budgets. The complexity of ensuring compatibility between new autopilot tools and existing vehicle electronics further increases implementation costs.

Data privacy and security compliance requirements pose substantial operational hurdles for connected vehicle technologies. Autopilot systems collect vast amounts of sensitive information about vehicle location, driver behavior, and operational patterns. Manufacturers must invest heavily in cybersecurity infrastructure to protect this data from breaches and comply with stringent regulations like GDPR and regional privacy laws. The continuous need to update security protocols and conduct thorough compliance audits adds ongoing costs. These regulatory burdens can delay product launches and create uncertainty for companies planning to deploy autopilot tools across multiple markets.

Growth Factors

Cloud-Based Deployment Platforms Create Growth Opportunities in Autopilot Tools Market

Cloud-based deployment platforms are emerging as powerful solutions for delivering scalable autopilot systems across diverse vehicle fleets. These platforms allow manufacturers to update and manage autopilot features remotely without requiring physical access to vehicles. The flexibility and cost-effectiveness of cloud infrastructure enable smaller automotive companies to access advanced autopilot technologies previously available only to large manufacturers.

Strategic collaborations between original equipment manufacturers and software providers are accelerating autopilot tool development. These partnerships combine hardware expertise with cutting-edge software capabilities, resulting in more integrated and reliable autopilot solutions. Joint development initiatives are shortening time-to-market and creating innovative products tailored to specific industry needs.

The establishment of standardized testing and validation frameworks is opening new market opportunities. Industry-wide standards help ensure autopilot systems meet consistent safety and performance benchmarks, building consumer confidence. Meanwhile, emerging markets experiencing rapid automotive modernization present untapped potential for autopilot deployment tools. Countries investing in smart city infrastructure and modern transportation networks are creating fertile ground for autonomous vehicle technologies.

Emerging Trends

Integration of Edge Computing Trends in Autopilot Deployment Tools Market

Edge computing integration is becoming a defining trend in autopilot deployment tools, significantly reducing system latency. By processing critical data directly within the vehicle rather than relying on distant cloud servers, edge computing enables faster decision-making in time-sensitive driving situations. This technology ensures autopilot systems can respond instantly to changing road conditions and potential hazards.

Digital twin technology is gaining traction for virtual autopilot performance simulation. Manufacturers are creating digital replicas of vehicles to test autopilot systems in simulated environments before real-world deployment. This approach reduces development costs and identifies potential issues early in the design process.

Over-the-air update capabilities are revolutionizing how autopilot functions are enhanced and maintained. Vehicle manufacturers can now push software improvements directly to vehicles, ensuring continuous performance optimization without requiring service center visits. Additionally, sensor fusion techniques are advancing rapidly, combining data from multiple sensors to create more accurate environmental perception. These sophisticated methods help autopilot systems better understand complex surroundings and make safer navigation decisions.

Regional Analysis

North America Dominates the Autopilot Deployment Tools Market with a Market Share of 37.8%, Valued at USD 1.7 Billion

North America leads the autopilot deployment tools market with a commanding share of 37.8%, valued at USD 1.7 billion. The region’s dominance stems from advanced technology infrastructure, significant R&D investments in autonomous systems, and early adoption of deployment automation solutions. The United States drives growth through robust demand from automotive, aerospace, and defense sectors, supported by favorable regulatory frameworks and substantial investments in AI and machine learning technologies.

Europe Autopilot Deployment Tools Market Trends

Europe represents a significant market driven by stringent safety regulations and strong commitment to autonomous vehicle advancement. Government initiatives promoting smart mobility across Germany, France, and the United Kingdom fuel market growth. European manufacturers increasingly invest in sophisticated deployment tools to meet rigorous testing standards and accelerate autonomous system commercialization.

Asia Pacific Autopilot Deployment Tools Market Trends

Asia Pacific emerges as a rapidly growing market, propelled by smart city initiatives and autonomous vehicle development across China, Japan, South Korea, and India. The region’s expanding automotive manufacturing base, government support, and rising industrial automation drive demand. Large-scale urbanization and population growth create substantial opportunities for autonomous mobility solutions and advanced deployment infrastructure.

Middle East and Africa Autopilot Deployment Tools Market Trends

The Middle East and Africa show moderate growth, primarily driven by smart city projects and infrastructure modernization in GCC countries. Investment in autonomous transportation, particularly in the UAE and Saudi Arabia, supports expansion. However, limited technological infrastructure and regulatory uncertainties present challenges to broader market development.

Latin America Autopilot Deployment Tools Market Trends

Latin America represents an emerging market with gradual adoption led by Brazil and Mexico through autonomous vehicle pilot projects. Economic constraints and evolving regulations pose challenges, but growing safety awareness, foreign investments, and government modernization initiatives offer promising long-term growth potential for deployment tool providers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Autopilot Deployment Tools Company Insights

Tesla, Inc. continues to maintain a dominant position in the Autopilot Deployment Tools market, leveraging its extensive fleet data and advanced neural network algorithms to enhance real-time autonomous driving capabilities. Its over-the-air software updates provide a competitive edge by continuously refining autopilot functionalities across its vehicles.

Waymo LLC remains a frontrunner in autonomous vehicle technology with a strong focus on Level 4 and Level 5 deployment. Its extensive testing in urban environments and partnerships with logistics and ride-hailing services allow it to translate technological advancements into scalable commercial solutions.

Aptiv PLC has strengthened its footprint in the market through its sensor fusion systems and advanced driver-assistance platforms. The company’s collaborations with automotive OEMs enable it to integrate high-precision autopilot solutions into a wide range of vehicle models.

NVIDIA Corporation plays a pivotal role as a technology enabler, providing high-performance AI computing platforms essential for real-time processing in autonomous systems. Its DRIVE platform continues to attract partnerships from automakers and startups seeking to accelerate deployment of next-generation autopilot tools.

These key players collectively highlight a market trend where software sophistication, AI-driven analytics, and strategic collaborations are central to competitive positioning. Tesla and Waymo exemplify market leaders with direct vehicle deployment, while Aptiv and NVIDIA emphasize technology provision and integration, creating a balanced ecosystem that fuels the adoption of autonomous driving solutions globally.

Top Key Players in the Market

- Tesla, Inc.

- Waymo LLC

- Aptiv PLC

- NVIDIA Corporation

- Mobileye

- Uber Technologies, Inc.

- Aurora Innovation, Inc.

- General Motors

- Apple Inc.

- Bosch Group

Recent Developments

- In October 2025, Uber and NVIDIA announced a strategic partnership to deploy 5,000 Level 4 autonomous vehicles built by Stellantis onto the Uber network, leveraging the advanced NVIDIA DRIVE AGX Hyperion 10 architecture to enhance safety and efficiency in urban mobility.

- In September 2025, Bosch revealed plans to integrate the NVIDIA DRIVE AGX Thor platform into its next-generation ADAS and software-defined vehicle architectures, aiming to accelerate the adoption of autonomous and connected vehicle technologies globally.

- In July 2025, Lyft and BENTELER Mobility announced the rollout of next-generation autonomous shuttles across the Lyft network, designed to improve rider convenience and showcase advancements in scalable autonomous transport solutions.

Report Scope

Report Features Description Market Value (2025) USD 4.5 Billion Forecast Revenue (2035) USD 14.4 Billion CAGR (2026-2035) 12.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Hardware, Services), By Deployment Mode (Cloud, On-Premises, Hybrid), By Application (Automotive, Aerospace, Maritime, Drones & UAVs, Industrial Automation, Others), By End-User (Commercial, Defense, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Tesla, Inc., Waymo LLC, Aptiv PLC, NVIDIA Corporation, Mobileye, Uber Technologies, Inc., Aurora Innovation, Inc., General Motors, Apple Inc., Bosch Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autopilot Deployment Tools MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Autopilot Deployment Tools MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla, Inc.

- Waymo LLC

- Aptiv PLC

- NVIDIA Corporation

- Mobileye

- Uber Technologies, Inc.

- Aurora Innovation, Inc.

- General Motors

- Apple Inc.

- Bosch Group