Global Autonomous Ships Market By Autonomy Level (Semi-autonomous and Fully Autonomous), By Component (Hardware, Software), By End-use (Commercial and Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 12641

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

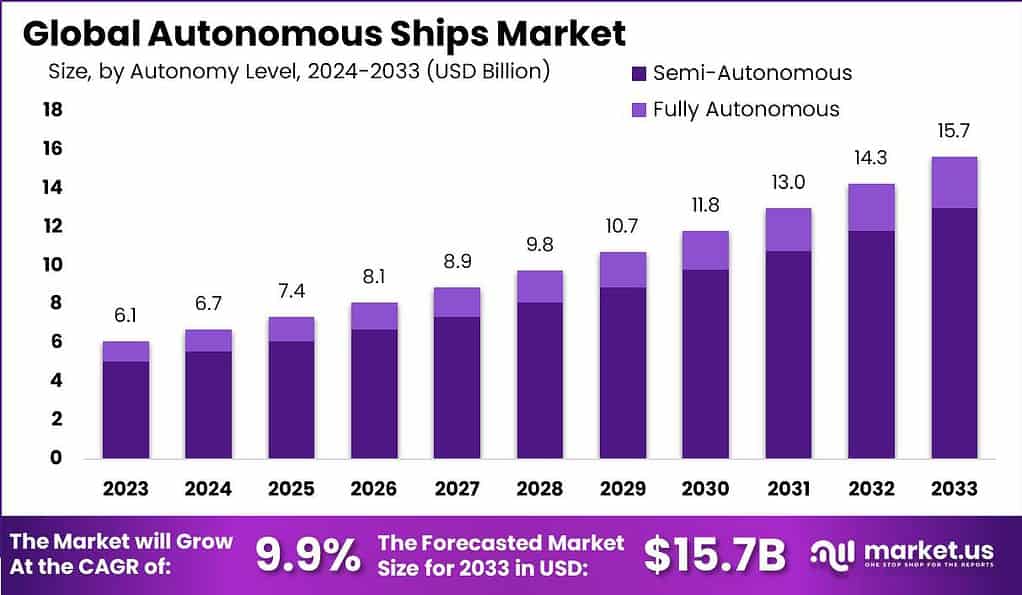

The Global Autonomous Ships Market size is expected to be worth around USD 15.7 Billion by 2033, from USD 6.1 Billion in 2023, growing at a CAGR of 9.9% during the forecast period from 2024 to 2033.

Autonomous ships are unmanned vessels that utilize advanced technologies such as artificial intelligence, machine learning, and sensors to navigate and operate without human intervention. These ships have the potential to revolutionize the maritime industry by improving efficiency, safety, and sustainability. Autonomous ships can optimize routes, reduce human errors, enhance fuel efficiency, and enable continuous operations.

The autonomous ships market is witnessing significant growth due to various driving factors. First and foremost, the need for increased efficiency and productivity in the shipping industry is pushing the adoption of autonomous ships. These vessels can operate 24/7, reducing downtime and increasing overall productivity. Additionally, autonomous ships offer improved safety by minimizing the risk of human errors, fatigue-related accidents, and collisions.

Furthermore, the potential cost savings associated with autonomous ships are driving market growth. These vessels can reduce labor costs, as they do not require crew members on board. Moreover, autonomous ships can optimize fuel consumption by utilizing advanced algorithms, leading to substantial fuel savings and lower operational costs.

Analyst Viewpoint

The autonomous ships market presents significant opportunities. The growing focus on sustainability and environmental regulations in the maritime industry creates an opportunity for autonomous ships to reduce carbon emissions and support green initiatives. Additionally, the integration of advanced technologies such as AI and machine learning opens doors for further innovation and optimization in autonomous ship operations.

Furthermore, the development of autonomous ships also brings opportunities for collaboration between technology providers, shipbuilders, and shipping companies. Partnerships and collaborations can foster the exchange of expertise and accelerate the development and deployment of autonomous ships. According to the European Maritime Safety Agency (EMSA), human error in shipboard operations is a significant factor in a large portion of accidental maritime accidents. EMSA estimates that human error contributes to between 58% and 70% of accidental accidents

Key Takeaways

- The Autonomous Ships market is expected to grow at a CAGR of 9.9% from 2024 to 2033, reaching a projected revenue of USD 15.7 billion by 2033, up from USD 6.1 billion in 2023.

- In 2023, the Semi-Autonomous segment emerged as the dominant player in the Autonomous Ships market, capturing more than an 82.9% share of the total market.

- In 2023, the Hardware segment established its dominance in the Autonomous Ships market, capturing more than a 77.5% share of the total market.

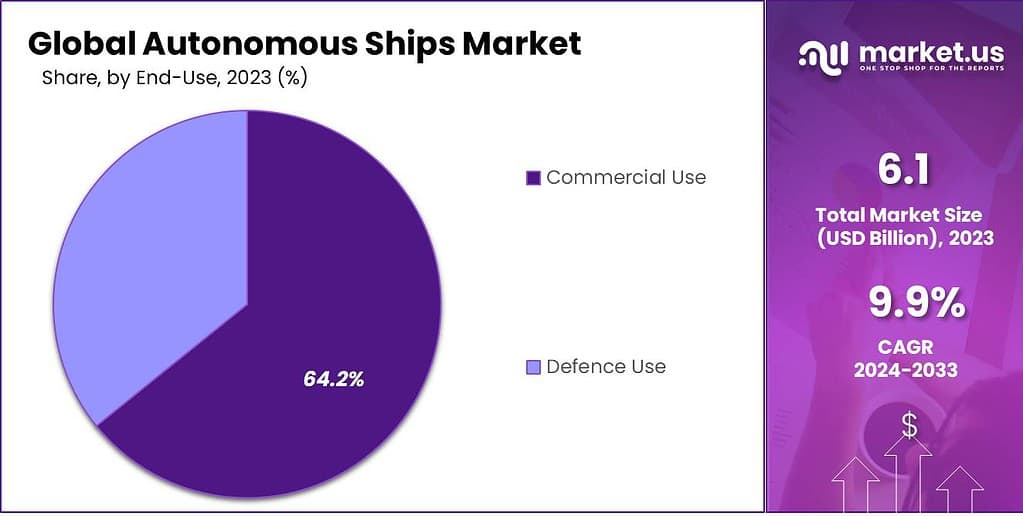

- In 2023, the Commercial segment established its dominance in the Autonomous Ships market, capturing more than a 64.2% share of the total market.

- In 2023, the Asia-Pacific (APAC) region held a dominant market position, capturing more than a 43.0% share, driven by investments in maritime infrastructure, strong shipbuilding industries, and government support for autonomous ship projects.

Autonomy Level Analysis

In 2023, the Semi-Autonomous segment emerged as the dominant player in the Autonomous Ships market, capturing more than an 82.9% share of the total market.

This segment’s significant market position can be attributed to several key factors that drive its adoption in the maritime industry. Semi-autonomous ships offer a balanced approach that combines human expertise and advanced automation capabilities. These vessels are equipped with technologies that assist and augment human decision-making and operations. They can perform specific tasks autonomously, such as navigation, collision avoidance, and monitoring systems. The presence of human operators on board allows for manual intervention and control when necessary, ensuring a higher level of safety and reliability.

The dominance of the Semi-Autonomous segment can be attributed to the gradual adoption of autonomous technologies in the shipping industry. Shipping companies and maritime authorities are progressively embracing semi-autonomous solutions as a stepping stone towards fully autonomous operations. Semi-autonomous ships provide a level of familiarity and trust among stakeholders, enabling a smoother transition from traditional manned vessels to full autonomy.

Furthermore, the Semi-Autonomous segment offers operational and economic advantages to shipping companies. These vessels can optimize fuel consumption, route planning, and cargo management, leading to increased efficiency and cost savings. Semi-autonomous ships also address concerns regarding crew fatigue and shortage by reducing the number of crew members required on board. This results in lower labor costs and improved crew welfare.

Component Analysis

In 2023, the Hardware segment established its dominance in the Autonomous Ships market, capturing more than a 77.5% share of the total market. The significant market position of the Hardware segment can be attributed to several key factors that drive its adoption and demand in the maritime industry.

The Hardware segment encompasses the physical components and equipment required for the operation of autonomous ships. This includes sensors, cameras, radars, communication systems, propulsion systems, and other hardware elements that enable autonomous functionalities. These hardware components form the foundation of autonomous ship systems, providing essential data inputs, connectivity, and control mechanisms.

The dominance of the Hardware segment can be attributed to the critical role of physical components in enabling autonomous ship operations. These components are essential for capturing and processing real-time data, detecting obstacles, ensuring accurate positioning, and maintaining communication with other vessels and shore-based systems. The reliability, accuracy, and robustness of hardware components are crucial for the safe and efficient operation of autonomous ships.

Furthermore, the Hardware segment is witnessing significant growth due to advancements in sensor technologies, communication systems, and navigation equipment. As technology continues to evolve, hardware components are becoming more sophisticated, compact, and cost-effective. This trend has made it easier for shipping companies to adopt and integrate autonomous ship systems into their existing vessels.

Additionally, the Hardware segment is driven by regulatory requirements and industry standards. Maritime authorities and regulatory bodies often mandate the installation of specific hardware components to ensure compliance with safety, navigation, and communication regulations. Adhering to these requirements drives the demand for hardware components in the autonomous ships market.

End-use Insight

In 2023, the Commercial segment established its dominance in the Autonomous Ships market, capturing more than a 64.2% share of the total market. The significant market position of the Commercial segment can be attributed to several key factors that drive its adoption and demand in the maritime industry.

The Commercial segment encompasses the use of autonomous ships for various commercial purposes, including cargo transportation, logistics, offshore operations, and passenger transportation. This segment caters to the needs of shipping companies, port operators, logistics providers, and other commercial entities involved in maritime activities.

The dominance of the Commercial segment can be attributed to the wide range of economic and operational benefits it offers. Autonomous ships in commercial applications provide opportunities for increased efficiency, cost savings, and improved productivity. These vessels can optimize routes, reduce fuel consumption, enhance cargo management, and enable continuous operations, leading to improved profitability for commercial entities.

Furthermore, the Commercial segment is driven by the growing demand for efficient and sustainable transportation solutions. The shipping industry plays a vital role in global trade, and there is a growing need for more reliable, cost-effective, and environmentally friendly shipping options. Autonomous ships offer the potential to address these needs by optimizing operations, reducing emissions, and minimizing the environmental impact of maritime activities.

Key Market Segments

Autonomy Level

- Semi-autonomous

- Fully Autonomous

Component

- Hardware

- Software

End-use

- Commercial

- Defense

Driving Factor

“Rising Demand for Efficient and Sustainable Maritime Transportation”

The Autonomous Ships market is being driven by the rising demand for efficient and sustainable maritime transportation. As the world focuses more on environmental sustainability, there is a growing need for transportation solutions that minimize greenhouse gas emissions and optimize fuel consumption. Autonomous ships have the potential to address these concerns by leveraging advanced technologies to optimize routes, improve operational efficiency, and reduce human errors.

By removing the need for human crew members, autonomous ships can also increase vessel utilization and reduce operational costs. These benefits make autonomous ships an attractive option for industries such as shipping, logistics, and offshore exploration. Furthermore, autonomous ships can contribute to reducing traffic congestion in ports and waterways by enabling more precise navigation and efficient use of available infrastructure. The rising demand for efficient and sustainable maritime transportation is expected to propel the growth of the Autonomous Ships market in the coming years.

Restraining Factor

“Complex Regulatory Framework and Safety Concerns”

A significant restraint for the Autonomous Ships market is the complex regulatory framework and safety concerns associated with autonomous ship operations. The development and deployment of autonomous ships require compliance with strict regulations and safety standards to ensure the protection of human life, property, and the environment. Establishing comprehensive regulations that address aspects such as collision avoidance, communication protocols, cybersecurity, liability, and emergency response is a complex and time-consuming process.

Achieving consensus among different stakeholders, including regulatory bodies, industry players, and technology providers, adds further complexity. Safety concerns related to autonomous ships include the potential for system failures, cyber attacks, and navigational errors. Ensuring the safety and reliability of autonomous ship systems is crucial to gain public trust and regulatory approval. Overcoming the challenges posed by the complex regulatory framework and addressing safety concerns will be essential for the widespread adoption of autonomous ships.

Opportunity

“Integration of Artificial Intelligence and IoT for Enhanced Ship Autonomy”

One of the significant opportunities in the Autonomous Ships market is the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) to enhance ship autonomy. AI algorithms can analyze vast amounts of data collected through IoT sensors, such as weather conditions, vessel performance, and navigational data, to make real-time decisions and improve ship operations. By leveraging AI and IoT technologies, autonomous ships can achieve advanced navigation capabilities, optimize routes based on real-time conditions, and enhance energy efficiency.

Predictive maintenance systems powered by AI can also help prevent equipment failures and reduce downtime. Additionally, AI algorithms can enable autonomous ships to learn and adapt to changing environments, improving their performance over time. The integration of AI and IoT technologies offers significant potential for enhancing the efficiency, safety, and overall performance of autonomous ships, making it a compelling opportunity for the market.

Challenge

“Cybersecurity Threats and Vulnerabilities in Autonomous Ship Systems”

Regional Analysis

In 2023, APAC (Asia-Pacific) held a dominant market position in the Autonomous Ships market, capturing more than a 43.0% share. This region’s leading position can be attributed to several factors. Firstly, APAC countries have been actively investing in developing their maritime infrastructure and transportation systems, which has created a conducive environment for the adoption of autonomous ships. Countries like China, Japan, and South Korea, known for their strong shipbuilding and maritime industries, have been at the forefront of embracing autonomous technologies.

The demand for Autonomous Ships in APAC (Asia-Pacific) reached US$ 2.6 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future. Moreover, APAC has witnessed a significant increase in international trade and cargo transportation, driving the demand for efficient and sustainable maritime transportation solutions.

The region’s growing population and urbanization have also contributed to the rise in demand for goods and commodities, further emphasizing the need for advanced transportation capabilities. Additionally, the APAC region benefits from a large pool of skilled professionals in the fields of technology and engineering, providing a strong foundation for the development and implementation of autonomous ship systems.

Furthermore, supportive government initiatives and favorable regulatory frameworks have played a crucial role in promoting the adoption of autonomous ships in APAC. Governments in countries like Singapore and China have been actively supporting research and development efforts, offering subsidies and incentives for companies engaged in autonomous ship projects. These initiatives have encouraged collaboration between industry players, research institutions, and government bodies, fostering innovation and accelerating the growth of the Autonomous Ships market in APAC.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Autonomous Ships market is characterized by the presence of several prominent players that contribute to its growth and innovation. These key players continuously invest in research and development activities to develop advanced technologies and solutions for autonomous ships.

Some of the Top Market Leaders Are:

- ABB Ltd.

- Wärtsilä Oyj Abp

- Rolls-Royce Holdings plc

- Kongsberg Gruppen

- L3Harris Technologies, Inc.

- RH Marine

- Siemens AG

- Sea Machines Robotics

- Yara International ASA

- BAE Systems plc

- DNV GL

- Other Key Players

Recent Developments

1. L3Harris Technologies, Inc.:

- March 2023: Partnered with Sea Machines Robotics to integrate L3Harris’ navigation and sensor technologies into Sea Machines’ autonomous vessel control systems, enhancing situational awareness and navigation capabilities for unmanned vessels.

2. RH Marine:

- June 2023: Launched the world’s first commercially available autonomous workboat, the RH700, designed for offshore wind farm operations and other maritime tasks requiring remote data acquisition and inspection.

3. Siemens AG:

- September 2023: Unveiled the Seafast Ferry, a fully electric and autonomous ferry prototype showcasing integrated onboard sensors, navigation systems, and AI-powered decision-making for passenger transportation.

- December 2023: Signed a collaboration agreement with Rolls-Royce and Kongsberg Maritime to develop and standardize key technologies for autonomous shipping, aiming to accelerate industry adoption.

4. Yara International ASA:

- February 2023: Successfully completed the world’s first autonomous container ship voyage with the Yara Birkeland, marking a significant milestone in the development of autonomous cargo transportation.

- October 2023: Announced plans to expand its autonomous shipping fleet with two additional vessels planned for launch in 2024, further demonstrating their commitment to sustainable and autonomous maritime operations.

Report Scope

Report Features Description Market Value (2023) US$ 6.1 Bn Forecast Revenue (2033) US$ 15.7 Bn CAGR (2024-2033) 9.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Autonomy Level (Semi-autonomous and Fully Autonomous), By Component (Hardware, Software), By End-use (Commercial and Defense) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Wärtsilä Oyj Abp, Rolls-Royce Holdings plc, Kongsberg Gruppen, L3Harris Technologies Inc., RH Marine, Siemens AG, Sea Machines Robotics, Yara International ASA, BAE Systems plc, DNV GL, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are autonomous ships?Autonomous ships, also known as unmanned or self-driving ships, operate without onboard human crews. They utilize advanced technologies such as AI, sensors, and communication systems for navigation and decision-making.

How big is Autonomous Ships Industry?The Global Autonomous Ships Market size is expected to be worth around USD 15.7 Billion by 2033, from USD 6.1 Billion in 2023, growing at a CAGR of 9.9% during the forecast period from 2024 to 2033.

What are the key driving factors behind the growth of the autonomous ships market?Factors driving the autonomous ships market include the pursuit of operational efficiency, advancements in sensor technologies, and the potential for cost savings through reduced crewing and enhanced safety.

Who are the key players in Autonomous Ships Market?ABB Ltd., Wärtsilä Oyj Abp, Rolls-Royce Holdings plc, Kongsberg Gruppen, L3Harris Technologies Inc., RH Marine, Siemens AG, Sea Machines Robotics, Yara International ASA, BAE Systems plc, DNV GL, Other Key Players are the major companies operating in the Autonomous Ships Market.

Which is the leading segment in Autonomy Level Analysis of Autonomous Ships market?In 2023, the Semi-Autonomous segment emerged as the dominant player in the Autonomous Ships market, capturing more than an 82.9% share of the total market.

Which region held the highest share of the market?In 2023, APAC (Asia-Pacific) held a dominant market position in the Autonomous Ships market, capturing more than a 43.0% share.

-

-

- ABB Ltd.

- Wärtsilä Oyj Abp

- Rolls-Royce Holdings plc

- Kongsberg Gruppen

- L3Harris Technologies, Inc.

- RH Marine

- Siemens AG

- Sea Machines Robotics

- Yara International ASA

- BAE Systems plc

- DNV GL

- Other Key Players