Global Autonomous Security Tower Market Size, Share Report By Component (Hardware, Software, Services), By Power Source (Solar-Powered, Electric Grid-Powered, Hybrid (Solar + Grid), By End-User (Construction, Critical Infrastructure, Government & Defense, Industrial & Manufacturing, Transportation, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169185

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Performance and Effectiveness

- Market and Cost Statistics

- Role of Generative AI

- Investment and Business Benefits

- Component Analysis

- Power Source Analysis

- End-User Analysis

- Regional Insight

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

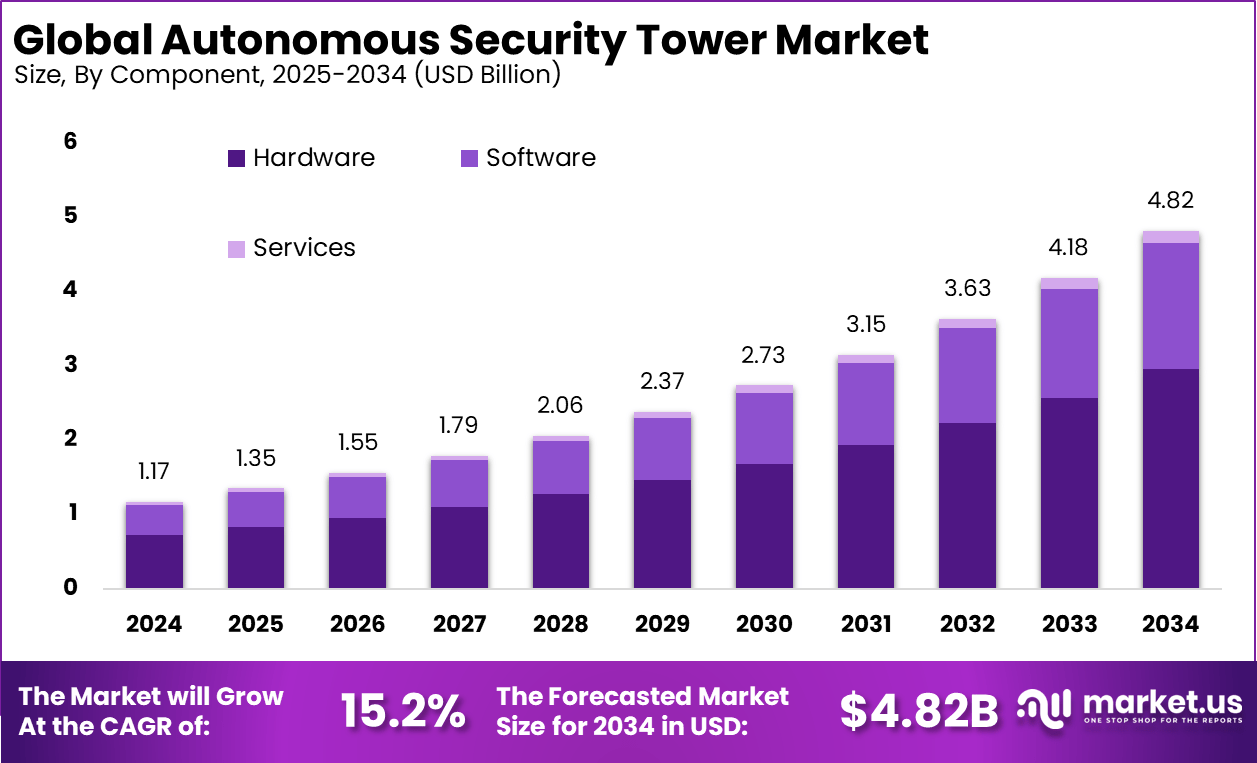

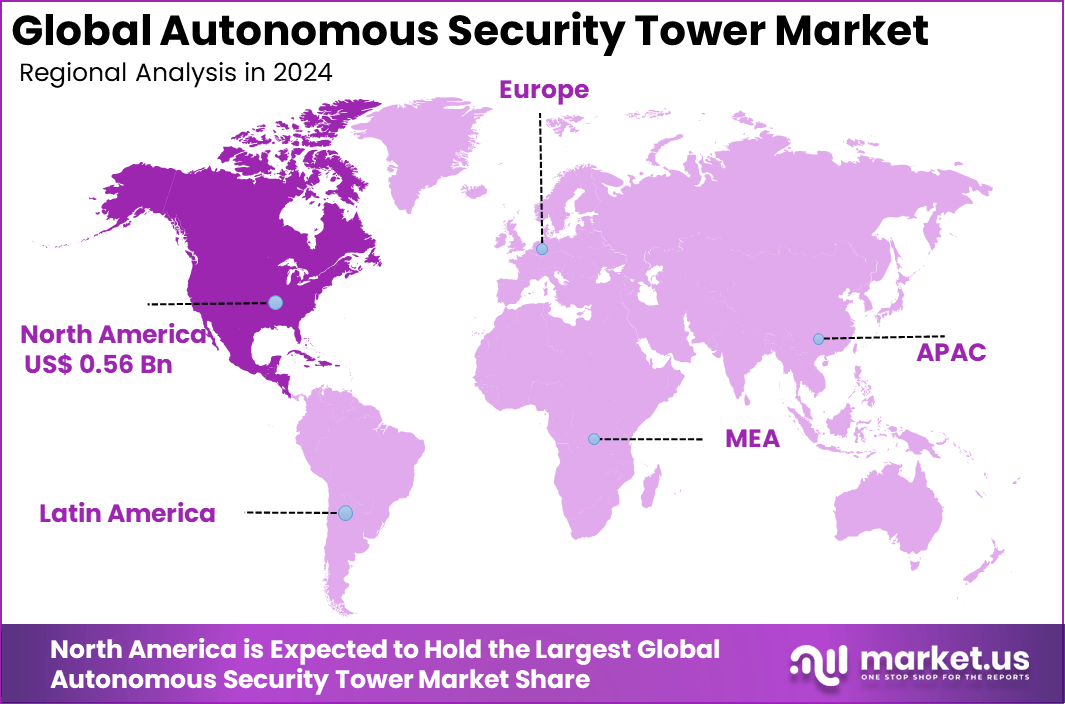

The Global Autonomous Security Tower Market size is expected to be worth around USD 4.82 billion by 2034, from USD 1.17 billion in 2024, growing at a CAGR of 15.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 48.4% share, holding USD 0.56 billion in revenue.

The autonomous security towers market has expanded as organisations deploy self powered, intelligent surveillance units to monitor large outdoor areas without permanent infrastructure. Growth reflects rising security concerns, increasing use of remote worksites and broader adoption of automated monitoring systems. These towers combine cameras, sensors, analytics and communication modules to provide real time oversight with minimal human involvement.

The main drivers for autonomous security towers include rising security threats and the growing demand for advanced perimeter surveillance. For example, critical infrastructure, military sites, and public event locations require constant protection that manual security cannot efficiently provide. The integration of AI and sensor fusion technologies enables these towers to detect, track, and respond to threats with minimal human input, which is essential in high-risk or remote areas.

The market for autonomous security towers is driven by the increasing need for advanced security solutions that provide reliable, real-time surveillance without the limitations of human monitoring. Growing safety concerns in various sectors, such as infrastructure, commercial properties, and critical facilities, are pushing the adoption of these automated systems. Equipped with AI and sensor technology, autonomous towers offer improved threat detection, faster response times, and operational efficiency.

For instance, in September 2025, Bosch demonstrated an expanded Intelligent Video Analytics Pro suite featuring deep neural network-based video analytics to improve autonomous tower situational awareness and proactive security responses. Their latest software versions enable precise, reliable detection and alerting capabilities critical for autonomous security towers.

Key Takeaway

- The hardware segment accounted for 61.5% in 2024, showing that physical tower systems remain central to autonomous surveillance deployments.

- Solar-powered models captured 56.2%, reflecting strong demand for energy-efficient and off-grid security solutions across remote and temporary sites.

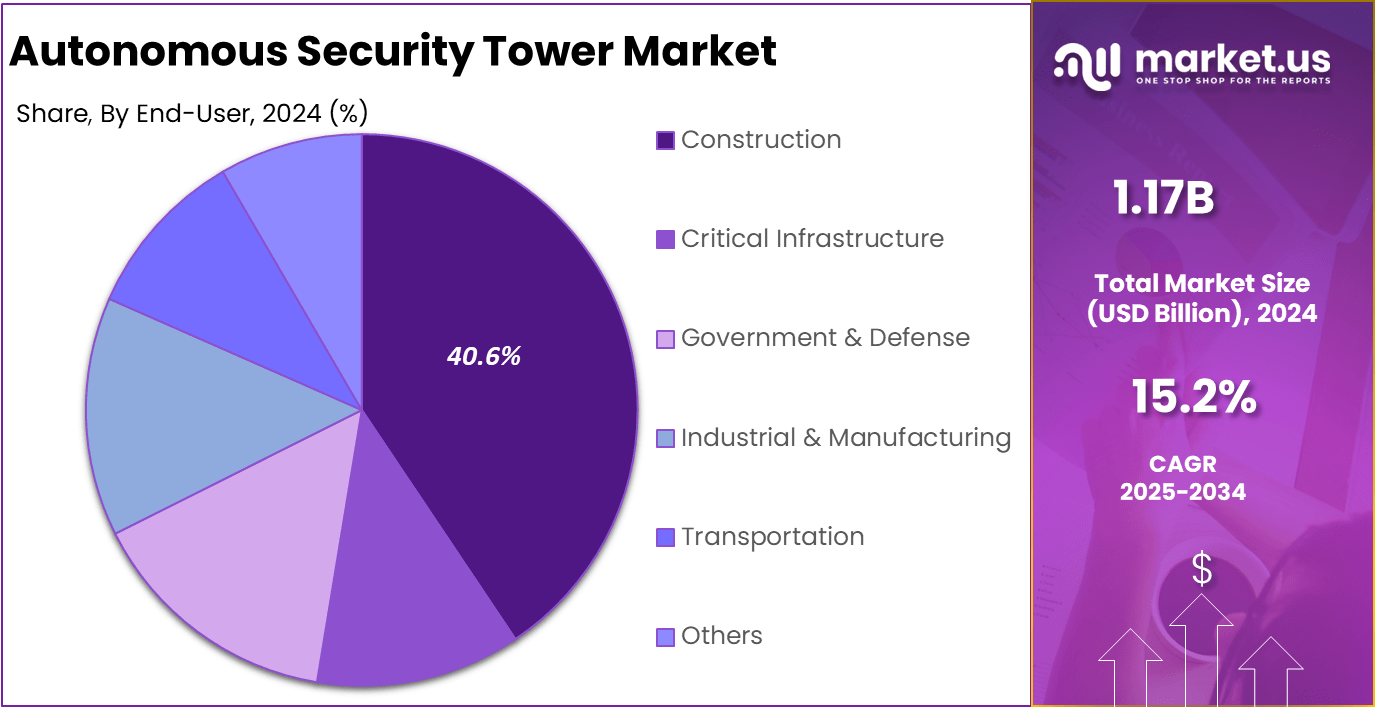

- The construction sector held 40.6%, driven by the need for continuous monitoring on active job sites where theft prevention and safety visibility are critical.

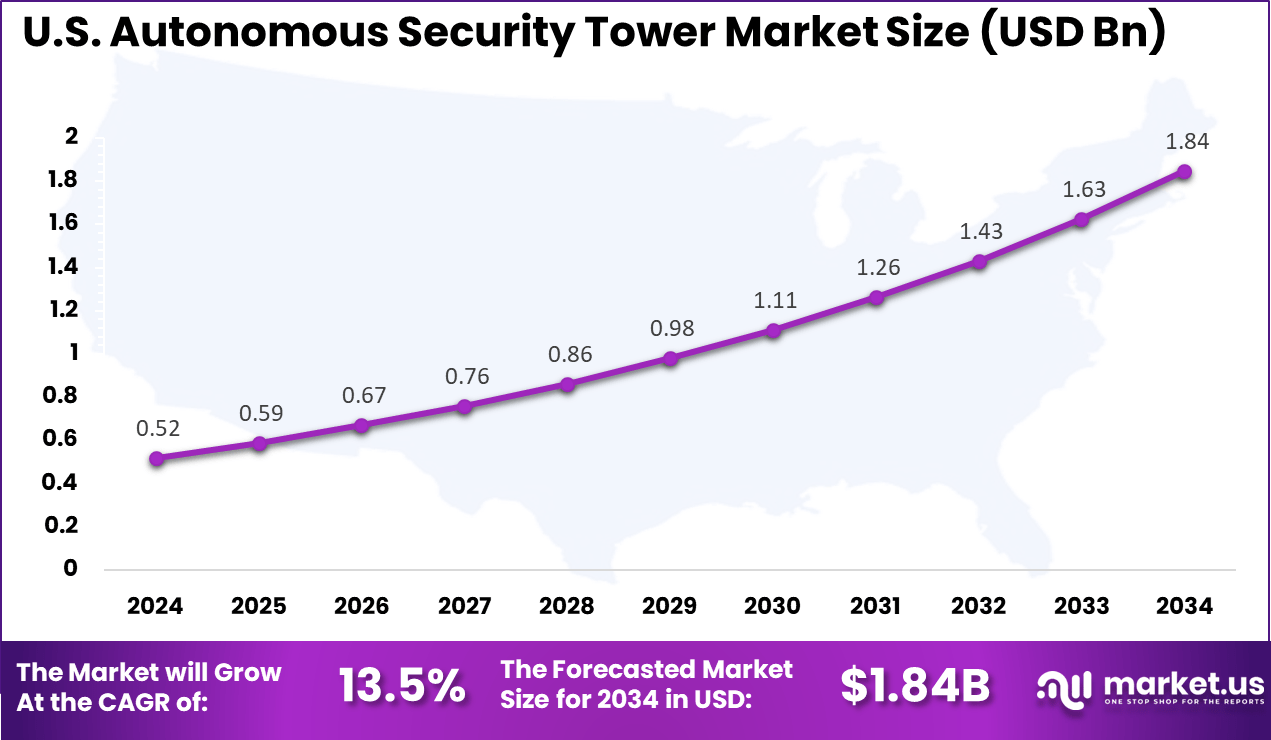

- The U.S. market reached USD 0.52 billion in 2024 and expanded at a 13.5% CAGR, indicating strong investment in automated perimeter protection.

- North America captured 48.4%, supported by advanced security infrastructure and rising adoption of autonomous monitoring technologies.

Performance and Effectiveness

- AI surveillance towers along the U.S. Mexico border have shown strong operational performance.

- In the Big Bend Sector, towers detected 18,339 border activity events and supported 12,192 apprehensions since April 2021.

- Anduril estimates its autonomous towers now cover about 30% of the southern U.S. land border.

- In one field incident, a single tower tracked 25 individuals, allowing agents to apprehend 19 people in dense brush within 15 minutes.

- In the United Kingdom, AI-enhanced CCTV towers have contributed to notable crime reductions:

- 34% decrease in property crime

- 32% decline in vehicle crime

- 15% reduction in violent crime

- AI analytics are effective at filtering out harmless triggers such as wildlife or wind, leading to a major reduction in false alarms compared to standard motion-based systems.

Market and Cost Statistics

- Autonomous security systems provide strong cost savings over traditional guarding models.

- Mobile CCTV towers can reduce security-related operating costs by up to 88% compared with on-site human guards.

- Some autonomous security robots cost about USD 11 per hour, while security personnel typically cost USD 35 to USD 85 per hour, highlighting significant long-term savings for operators.

Role of Generative AI

Generative AI is playing a pivotal role in enhancing autonomous security towers by providing advanced threat detection and real-time decision-making capabilities. It supports the security system by analyzing vast data streams from sensors and cameras, identifying unusual patterns rapidly, and generating actionable insights that help reduce human workload.

Recent research shows that generative AI reduces investigation time from hours to minutes, enabling faster, more efficient threat response and continuous monitoring without fatigue. Moreover, generative AI enables the autonomous security towers to operate collaboratively with human analysts, automating repetitive tasks and guiding junior staff in threat identification.

This integration increases operational efficiency and coverage, particularly in complex environments like borders and critical infrastructures, reducing dependency on senior analysts by automating initial investigations and enhancing training for newer staff members.

Investment and Business Benefits

Investment opportunities arise from the growing interest in autonomous security solutions spurred by expanding defense budgets, government incentives, and public-private partnerships. Capital investments are focusing on developing towers with enhanced AI capabilities, IoT integration, and energy-efficient designs.

The market’s growth is supported by strategic funding in research and development aimed at next-generation autonomous systems capable of adapting to evolving threat landscapes. Business benefits include significant cost savings by reducing the need for large security patrols and reallocating personnel to critical areas.

Enhanced security coverage, especially in hazardous or remote locations, minimizes risks and improves incident response. Automated operation and AI-driven analytics provide continuous monitoring, reducing downtime and false alarms by up to 20%. These systems also offer easy scalability and quick deployment options, allowing businesses to upgrade security infrastructure efficiently.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 61.5% share of the Global Autonomous Security Tower Market. This segment is vital because it includes all the physical components like cameras, sensors, communication units, and control systems that make the towers functional. These components are designed to provide dependable surveillance, accurate detection, and seamless data transmission.

Their importance increases as the demand grows for high-quality security solutions able to work efficiently under various conditions, such as extreme weather or remote locations. Continual advancements in hardware technology, such as thermal cameras and LiDAR sensors, are improving the towers’ detection accuracy and operational reliability.

The focus on rugged and modular designs allows these systems to operate with minimal downtime and easy maintenance. This strong emphasis on hardware development reflects its central role in enhancing security across industries like defense, industrial sites, and critical infrastructure, where reliable physical components are crucial.

For Instance, in September 2025, Axis Communications launched multisensory technologies at GSX 2025, including bispectral PTZ cameras with thermal and visual imaging. These hardware innovations boost detection accuracy for autonomous security towers. The rugged designs handle extreme conditions with AI analytics built in. This strengthens hardware’s role in reliable perimeter monitoring.

Power Source Analysis

In 2024, the Solar-Powered segment held a dominant market position, capturing a 56.2% share of the Global Autonomous Security Tower Market. These towers use solar panels paired with battery storage to ensure continuous power, even in places without access to traditional electricity sources. This energy setup guarantees reliable performance by powering the towers day and night, regardless of location challenges.

Choosing solar power reduces operating costs by eliminating the need for fuel deliveries or grid dependency. It also aligns with environmental goals by promoting renewable energy use. This makes solar-powered towers especially popular in remote or temporary sites like construction zones or border areas, where an autonomous energy supply is essential for maintaining consistent security coverage under varying conditions.

For instance, in November 2025, Dahua Technology showcased smart city solutions at SCEWC 2025, emphasizing sustainable AIoT systems. Solar-compatible surveillance hardware supports off-grid tower deployments. These setups ensure continuous power for remote monitoring needs. The focus aligns with the growing demand for eco-friendly energy in security.

End-User Analysis

In 2024, The Construction segment held a dominant market position, capturing a 40.6% share of the Global Autonomous Security Tower Market. These towers help construction companies protect their assets from theft, vandalism, and unauthorized access over large and often changing sites. They provide constant, real-time surveillance, which supports safety and security compliance at project locations.

Construction businesses appreciate the flexibility of these towers because they can be quickly deployed and relocated according to shifting site priorities. The integration of solar power and autonomous capabilities makes them cost-effective and simple to manage without requiring complex electrical setups. As safety regulations tighten and asset protection grows more important, the construction sector’s use of autonomous security towers continues to rise.

For Instance, in April 2025, Dedrone by Axon earned recognition as a leader in UAS security at Frost Radar 2025. Their mobile counter-drone systems protect construction sites from aerial threats. Integration with vehicles aids rapid site deployment for towers. This meets construction’s need for flexible, autonomous protection.

Regional Insight

In 2024, North America held a dominant market position in the Global Autonomous Security Tower Market, capturing more than a 48.4% share, holding USD 0.56 billion in revenue. The market stems from heavy investments in security infrastructure, advanced technological adoption, and a strong government focus on defense and critical infrastructure protection.

The region benefits from robust regulatory support, widespread deployment of smart city initiatives, and integration of AI-driven security systems. These factors create high demand for autonomous towers capable of reliable, autonomous monitoring. Together, they solidify North America’s leadership and continued growth in the autonomous security tower market worldwide.

For instance, in June 2025, Honeywell introduced new AI-driven digital technologies to accelerate the industrial shift from automation to autonomy, including autonomous security solutions that improve situational awareness and cyber resilience for operational technology environments. These solutions aim to enhance security tower functionalities in North America’s industrial and commercial sectors.

U.S. Market Size

The market for Autonomous Security Tower within the U.S. is growing tremendously and is currently valued at USD 0.52 billion, the market has a projected CAGR of 13.5%. The market is driven by increasing demand for advanced security solutions across defense, industrial, and commercial sectors.

Factors such as rising concerns over perimeter security, technological advancements in AI and sensor integration, and the push for smart city infrastructure are key growth catalysts. Additionally, the preference for sustainable power sources like solar energy and the need for autonomous, low-maintenance systems in remote or high-risk locations contribute to market expansion. These elements collectively support strong growth momentum in the U.S. market.

For instance, in October 2025, Honeywell debuted the SAMURAI counter-UAS (Unmanned Aerial System) autonomous security system at AUSA 2025, providing ground-level and aerostat-mounted continuous tracking and neutralization of low-altitude drone swarms. This cutting-edge autonomous security tower technology addresses rising drone threats, reinforcing U.S. security capabilities.

Emerging Trends

A growing trend in autonomous security towers is the integration of AI and IoT technologies to improve real-time threat detection and remote monitoring. These towers increasingly use advanced sensors such as thermal imaging, 4K cameras, and radar systems combined with AI analytics to provide faster, more accurate security assessments.

Increased wireless connectivity, including 5G, allows seamless data transmission and coordination between towers and control centers, improving responsiveness. Another rising trend is the use of autonomous towers in temporary or remote security setups such as events, construction sites, and disaster response scenarios.

This flexibility is supported by energy-efficient solutions like solar power, making the towers viable even in off-grid locations. The combination of smarter AI-driven analytics and renewable energy support is transforming surveillance from static to dynamic and adaptable operations.

Growth Factors

The increasing demand for 24/7 real-time security surveillance drives the growth of autonomous security towers. As security threats become more sophisticated and frequent, organizations seek reliable, unmanned systems capable of continuous operation, rapid detection, and immediate response, which towers equipped with AI can provide.

Enhanced sensor technologies paired with AI improve detection accuracy, reducing false alarms and operational costs. Additionally, the shift toward smart city initiatives and critical infrastructure protection fuels this growth.

Governments and industries prioritize safeguarding urban spaces and vital assets, pushing investments in smart, autonomous solutions. The ability of these towers to integrate with existing security frameworks and offer scalable deployment expands their adoption across diverse sectors requiring heightened situational awareness.

Key Market Segments

By Component

- Hardware

- Tower & Power System

- Sensors

- Actuators & Deterrents

- Others

- Software

- AI-Powered Video Analytics

- Sensor Fusion Platform

- Command & COntrol (C2) Software

- Services

- Installation & Integration Services

- Managed Security Services (MSS)

- Maintenance & Support Services

By Power Source

- Solar-Powered

- Electric Grid-Powered

- Hybrid (Solar + Grid)

By End-User

- Construction

- Critical Infrastructure

- Government & Defense

- Industrial & Manufacturing

- Transportation

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Advanced Security Systems

The autonomous security tower market is driven by the growing need for advanced and efficient surveillance systems as security threats become more complex. Organizations and governments are increasingly adopting autonomous towers equipped with AI, sensors, and automated monitoring to improve real time threat detection and reduce dependence on manual patrolling. This shift enhances security coverage and strengthens overall operational efficiency.

The integration of AI and IoT further supports intelligent monitoring, faster incident response, and better perimeter protection, making these solutions valuable in critical infrastructure, defense, and commercial environments. Demand continues to rise globally, particularly in regions with heightened security risks and stronger regulatory requirements for automated surveillance systems.

In October 2025, Axis Communications introduced new multisensory technologies, including a bispectral PTZ camera that combines thermal and visual imaging, AI enabled bullet cameras, and advanced radars with wide detection ranges. These innovations offer AI driven analytics and secure edge processing to strengthen real time threat detection and situational awareness, aligning with the growing demand for smarter and more connected autonomous security systems.

Restraint

High Implementation and Maintenance Costs

A major restraint in this market is the high upfront investment needed to deploy autonomous security towers. The use of AI-ready cameras, advanced sensors, and communication units results in substantial initial expenses, which limits adoption among small and medium organizations with restricted security budgets. The financial challenge becomes more pronounced when these buyers compare autonomous systems with conventional, lower-cost surveillance options.

The burden continues after installation, as routine maintenance, software updates, and hardware upgrades are essential to meet evolving security standards. Compliance with strict data privacy regulations further adds to operational complexity and increases long-term costs. These combined financial and regulatory pressures slow down broad market penetration even though the advantages of autonomous towers are recognized.

In November 2025, Senstar Corporation noted a slight revenue decline linked to the cost and complexity of advanced perimeter protection systems. Their experience reflects how high deployment and maintenance expenses act as a restraint for users considering fully autonomous security towers, demonstrating the operational and financial challenges that continue to limit adoption.

Opportunities

Integration of AI and IoT for Smarter Surveillance

The opportunity in this market is expanding as AI and IoT technologies are increasingly integrated into autonomous security towers. The use of AI-driven analytics improves detection accuracy by lowering false alarms and supporting predictive threat assessment. IoT connectivity strengthens real-time data exchange and remote oversight, allowing these systems to operate with higher precision and reliability across diverse environments.

This progression enables autonomous towers to function as intelligent and adaptable assets beyond traditional perimeter roles. Their deployment is widening across smart city programs, border surveillance, public infrastructure, and environmental monitoring. The alignment of these capabilities with government initiatives for safer and more connected urban development supports sustained market growth.

In August 2025, Dahua Technology introduced its Xinghan large-scale AI models designed to enhance automated configuration and intrusion detection for advanced security systems. This development illustrates how ongoing innovation in AI and IoT continues to reinforce the market opportunity by enabling more context-aware and efficient surveillance solutions.

Challenges

Regulatory and Privacy Concerns

A central challenge for this market involves managing the complex regulatory environment surrounding privacy and data security. Surveillance activities are governed by strict rules intended to protect individual rights, and these regulations differ significantly across regions. Adhering to these requirements demands careful system design and continuous compliance checks, adding to the operational load for organizations deploying autonomous security towers.

This challenge is intensified by rising public concern over intrusive monitoring and the expanding scope of automated surveillance. As a result, companies are required to strengthen ethical practices, improve transparency, and demonstrate responsible data handling to secure public acceptance. These expectations increase the time and resources needed for deployment and slow the pace of large-scale adoption.

In May 2025, Honeywell introduced AI-enabled cybersecurity tools aimed at defending operational environments from growing cyber risks. Its Cyber Proactive Defense software uses behavioral analytics to detect anomalies early, emphasizing how cybersecurity and regulatory compliance remain critical barriers. This example shows the need for continued innovation to protect sensitive data and maintain trust in autonomous security systems.

Key Players Analysis

One of the leading players in September 2025, Axis Communications unveiled a new range of multisensory devices at GSX 2025, including a bispectral PTZ camera that combines thermal and visual imaging, plus AI-powered bullet cameras and advanced radars. These innovations enhance detection capabilities and situational awareness, boosting the effectiveness of autonomous security towers in rapidly identifying threats. The launch marks Axis’s commitment to delivering smarter, IoT-enabled security ecosystems.

Top Key Players in the Market

- Axis Communications

- Dahua Technology

- Hikvision

- Johnson Controls

- Honeywell International

- Bosch Security Systems

- FLIR Systems

- Senstar Corporation

- Magos Systems

- PureTech Systems

- Dedrone

- Thermoteknix Systems

- G4S (Allied Universal)

- Sentry Security Solutions

- Others

Recent Developments

- In June 2025, Hikvision launched next-generation general-purpose servers and tower workstations, emphasizing enhanced performance tailored to AI-powered analytics for autonomous security deployments. These servers support large-scale data processing from multiple sensors onboard security towers, enabling real-time threat detection and operational efficiency.

- In September 2025, Bosch demonstrated an expanded Intelligent Video Analytics Pro suite featuring deep neural network-based video analytics to improve autonomous tower situational awareness and proactive security responses. Their latest software versions enable precise, reliable detection and alerting capabilities critical for autonomous security towers.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 4.8 Bn CAGR(2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Power Source (Solar-Powered, Electric Grid-Powered, Hybrid (Solar + Grid), By End-User (Construction, Critical Infrastructure, Government & Defense, Industrial & Manufacturing, Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Axis Communications, Dahua Technology, Hikvision, Johnson Controls, Honeywell International, Bosch Security Systems, FLIR Systems, Senstar Corporation, Magos Systems, PureTech Systems, Dedrone, Thermoteknix Systems, G4S (Allied Universal), Sentry Security Solutions, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Security Tower MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Autonomous Security Tower MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-