Global Autonomous Bus Market Size, Share, Growth Analysis By Autonomy (Level 1, Level 2, Level 3, Level 4), By Fuel (Diesel, Electric, Hybrid), By Application (Intercity, Intracity), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169574

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

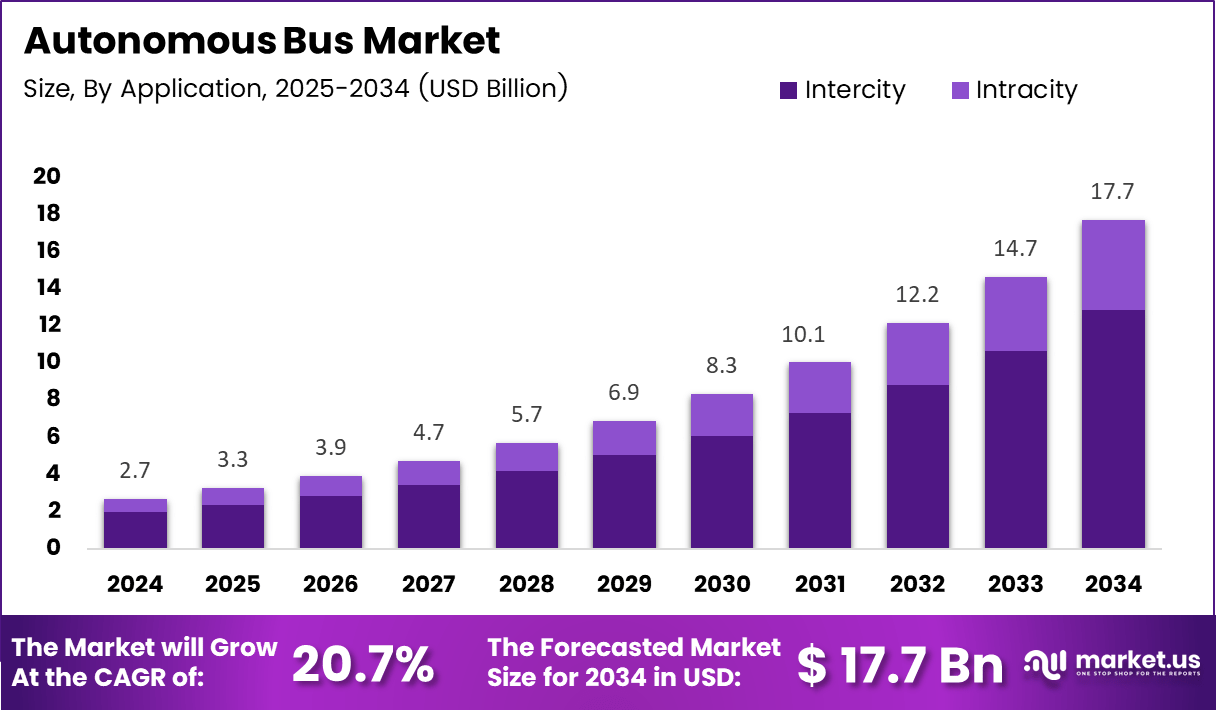

The Global Autonomous Bus Market size is expected to be worth around USD 17.7 billion by 2034, from USD 2.7 billion in 2024, growing at a CAGR of 20.7% during the forecast period from 2025 to 2034.

The autonomous bus market represents an emerging mobility segment focused on self-driving public transport solutions that enhance efficiency, sustainability, and route optimization. The industry increasingly leverages AI navigation, LiDAR perception, and electric drivetrains to streamline urban movement while reducing the operational burden on transit agencies transitioning toward smart, connected mobility ecosystems.

As adoption expands, the market gains momentum through government investments promoting cleaner fleets and modernized transport systems. Cities explore autonomous transit corridors to reduce congestion and improve accessibility. Regulatory agencies gradually refine safety frameworks to support controlled deployments, enabling early-stage commercial services and pilot fleets across structured environments such as campuses and smart districts.

Meanwhile, opportunities grow as operators pursue lower lifecycle costs, improved schedule reliability, and integrated fleet-management platforms. Transit authorities evaluate autonomous buses for first-mile and last-mile connectivity, allowing seamless multimodal travel. Continuous software upgrades strengthen operational intelligence, creating long-term potential for scalable, automated public transportation networks serving dense and emerging urban markets.

Furthermore, rising interest in electric autonomous buses accelerates investment due to clear cost-efficiency advantages. Companies explore energy-optimized designs, lightweight structures, and remote monitoring tools to maximize uptime. Governments support these initiatives through incentives for zero-emission fleets, supporting widespread testing environments where autonomous bus technologies can mature rapidly under controlled deployments.

In addition, user acceptance improves as passengers gain familiarity with automated mobility. According to one survey of 576 ride-experienced users, in-vehicle safety, service quality, and riding habits positively influenced willingness to continue using autonomous bus services. This trend highlights growing confidence in vehicle automation and encourages further investment in human-centric safety systems and ride-experience features.

Finally, cost-reduction potential strengthens the market’s long-term outlook. According to published research, employing autonomous bus services is predicted to reduce travel costs by 6%–11%, improving economic viability for public transit operators. Additionally, Volvo’s development of a modified 7900 electric bus demonstrates ongoing innovation in driverless transport platforms, reinforcing market readiness for broader deployment within the global autonomous bus landscape.

Key Takeaways

- The global market reached USD 2.7 billion in 2024 and is projected to hit USD 17.7 billion by 2034.

- The market is projected to grow at a strong 20.7% CAGR from 2025 to 2034.

- Level 2 autonomy leads the segment with a 38.3% share in 2024.

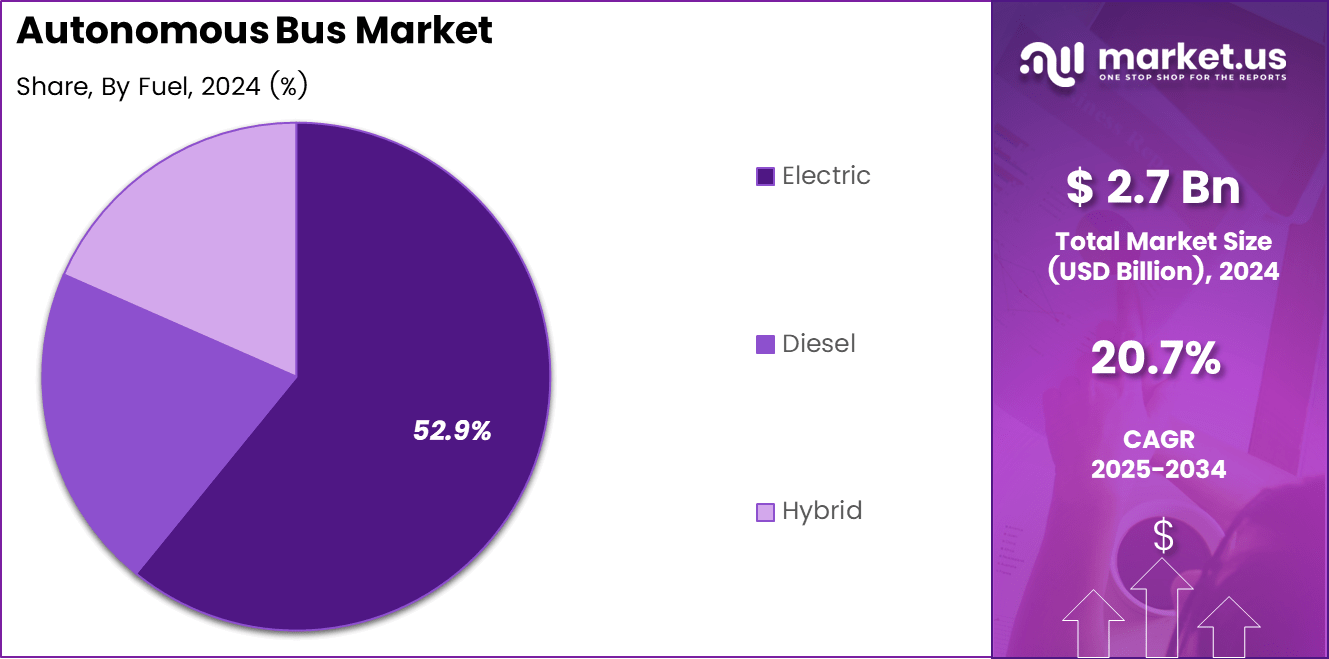

- Electric fuel type is expected to dominate with a 52.9% share in 2024.

- Intracity applications hold the largest share at 72.8% in 2024.

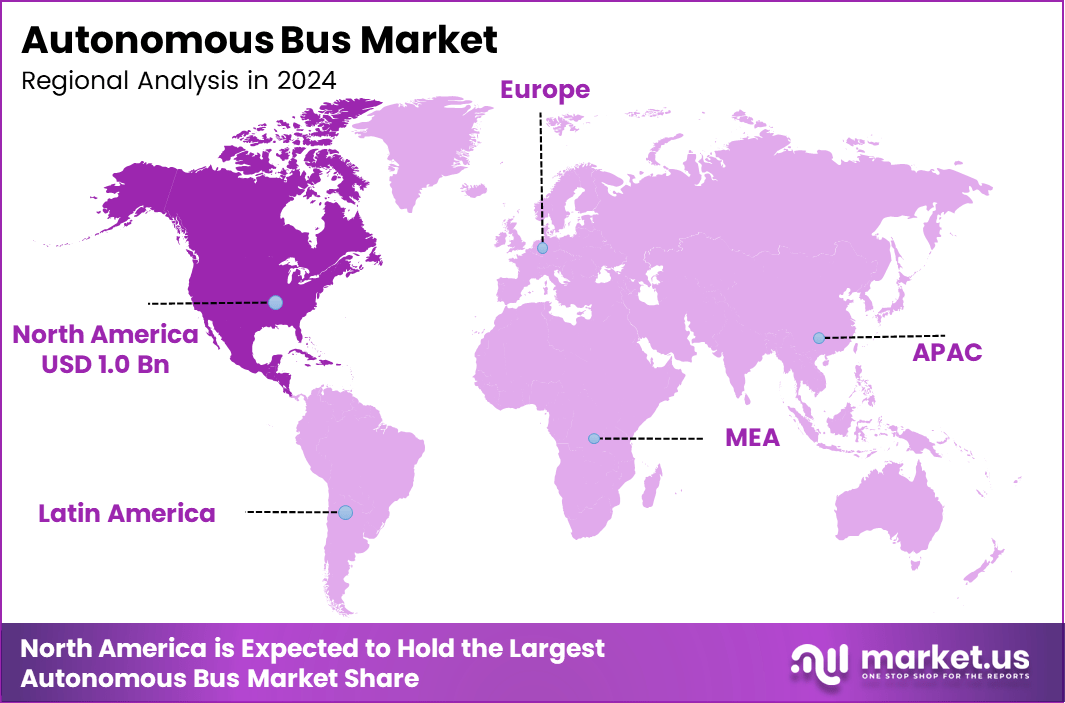

- North America leads regionally with a 38.8% share valued at USD 1.0 billion.

- The US accounts for the largest portion of North American autonomous bus adoption.

Autonomy Analysis

Level 2 dominates the segment with 38.3% due to its wider deployment readiness and improved safety automation.

In 2024, Level 2 held a dominant market position in the By Autonomy Analysis segment of the Autonomous Bus Market, with a 38.3% share. This segment grows as cities adopt partial automation for controlled routes. Moreover, operators prefer Level 2 systems because they reduce driver workload and improve operational efficiency while maintaining regulatory compliance.

Level 1 held a notable position in the By Autonomy Analysis segment of the Autonomous Bus Market. This segment advances as manufacturers integrate basic driver-assistance features to enhance braking, lane support, and monitoring. Additionally, Level 1 systems continue supporting transitional adoption for regions slowly shifting toward autonomous public transportation models.

Level 3 gained traction in the By Autonomy Analysis segment of the Autonomous Bus Market. This segment strengthens as governments test conditional automation on dedicated lanes. Furthermore, Level 3 enhances service reliability by enabling hands-off functions under monitored conditions, helping public transport agencies reduce operational stress on drivers.

Level 4 expanded gradually in the By Autonomy Analysis segment of the Autonomous Bus Market. This segment progresses as pilot programs explore fully autonomous shuttles for campuses and fixed corridors. Additionally, Level 4 systems attract interest due to their potential to cut labor costs and deliver continuous, uninterrupted mobility operations.

Fuel Analysis

Electric buses dominate with 52.9% due to strong sustainability goals and rapid charging ecosystem improvements.

In 2024, Electric held a dominant market position in the By Fuel Analysis segment of the Autonomous Bus Market, with a 52.9% share. This segment rises as governments invest in clean mobility. Additionally, electric autonomous buses gain acceptance because they lower emissions, reduce noise, and align with long-term urban decarbonization targets.

Diesel maintained relevance in the By Fuel Analysis segment of the Autonomous Bus Market. This segment persists as several regions depend on existing diesel fleets for affordability. Moreover, operators use diesel autonomous conversions on long routes where charging infrastructure remains limited, supporting continuity in daily transit operations.

Hybrid advanced steadily in the By Fuel Analysis segment of the Autonomous Bus Market. This segment benefits from operators seeking fuel savings while transitioning to electric fleets. Additionally, hybrid autonomous buses help reduce emissions on congested routes and provide extended range, making them suitable for city networks, improving flexibility.

Application Analysis

Intracity dominates with 72.8% due to increasing adoption of autonomous shuttles and urban route automation.

In 2024, Intracity held a dominant market position in the By Application Analysis segment of the Autonomous Bus Market, with a 72.8% share. This segment expands as cities deploy autonomous shuttles for last-mile connectivity. Additionally, high passenger demand, short route patterns, and smart-city investments drive intracity automation adoption.

Intercity contributed steadily to the By Application Analysis segment of the Autonomous Bus Market. This segment evolves as long-distance autonomous bus pilots expand on controlled highways. Moreover, intercity routes attract interest for enhancing cross-regional mobility, lowering operational expenses, and offering consistent service quality across larger geographic corridors.

Key Market Segments

By Autonomy

- Level 1

- Level 2

- Level 3

- Level 4

By Fuel

- Diesel

- Electric

- Hybrid

By Application

- Intercity

- Intracity

Drivers

Increasing Deployment of Autonomous Transit Pilots Across Smart City Corridors Drives Market Growth

Growing deployment of autonomous transit pilots across smart city corridors is strengthening market expansion as governments test driverless mobility for smoother public transport. Cities experiment with small autonomous fleets to reduce congestion and evaluate system performance under real-world traffic conditions, creating early adoption momentum.

Rising investment in AI-based perception systems is expected to enhance route safety by improving object detection, lane recognition, and pedestrian monitoring. Transit agencies rely on these technologies to reduce human error and ensure predictable operations, supporting long-term adoption of autonomous buses in structured traffic environments.

Expansion of electric autonomous bus fleets remains a key driver as countries prioritize low-emission mobility. Transport authorities choose electric, self-driving buses to reduce operating costs, meet sustainability goals, and support national emission-reduction targets, which encourages wider deployment across urban and regional routes.

Growing demand for 24/7 on-demand public transportation services accelerates the shift toward autonomous bus systems. Commuters expect more flexible schedules, prompting the need for fleets that operate continuously without driver fatigue. Autonomous platforms offer consistent service and improved availability, boosting overall market attractiveness.

Restraints

Limited Readiness of Urban Infrastructure Restrains Market Expansion

Limited readiness of urban infrastructure often slows the scale-up of autonomous bus operations because many cities lack connected traffic systems, high-definition mapping, or dedicated autonomous lanes. These gaps reduce reliability and hinder seamless navigation in mixed traffic environments.

High upfront procurement and validation costs create additional restraints for transit operators. Autonomous bus platforms require expensive sensors, redundant control systems, and extensive safety testing, which increases financial pressure on agencies evaluating long-term investment viability.

Lack of standardized regulatory frameworks across major transit regions further restricts growth. Different approval processes, safety norms, and operational guidelines complicate fleet deployment. Companies face delays in rolling out services across borders due to uncertainty around compliance requirements.

Validation protocols for autonomous systems increase cost and time-to-market, adding complexity for early adopters. Operators must conduct continuous software updates and reliability validation, affecting the pace of full-scale commercialization.

Growth Factors

Integration of V2X Communication Creates New Market Opportunities

Integration of V2X communication is expected to create strong growth opportunities as autonomous buses connect with traffic lights, road infrastructure, and other vehicles. This ecosystem improves route efficiency, reduces collision risks, and supports coordinated traffic movement, making fleets more reliable in busy corridors.

Development of autonomous shuttle services for university and corporate campuses presents another promising opportunity. These controlled environments simplify deployment, enabling companies to introduce fully autonomous shuttles for short-distance mobility. Institutions use these services to improve campus transport and reduce reliance on conventional vehicles.

Campus and private-facility deployments also allow vendors to gather real-world performance data, accelerating commercial readiness. These early-stage deployments act as testbeds for broader public transport adoption.

V2X-enabled features help optimize fleet management, supporting predictive routing and energy-efficient driving patterns. The combination of communication networks and autonomous platforms strengthens business models for shared mobility operators.

Emerging Trends

Shift Toward Sensor-Fusion Architectures Shapes Market Trends

Shift toward sensor-fusion architectures is becoming a major trend as manufacturers combine LiDAR, radar, and vision AI to improve perception accuracy. This integration enhances object recognition in complex environments, supporting safer autonomous bus navigation.

Increasing collaboration between OEMs and software companies is also reshaping the industry. Automakers rely on specialized autonomous software developers to build scalable, real-time decision-making systems. These partnerships accelerate innovation and reduce development timelines.

Rise of remote-operation command centers supports fleet supervision by enabling human operators to monitor autonomous buses, intervene during unusual events, and manage route-level decisions. This hybrid model improves safety and builds public confidence in autonomous mobility.

Growing reliance on centralized analytics cloud for fleet optimization also influences market direction. Operators use data to improve energy usage, maintenance planning, and real-time fleet coordination, reinforcing the long-term adoption of autonomous buses.

Regional Analysis

North America Dominates the Autonomous Bus Market with a Market Share of 38.8%, Valued at USD 1.0 Billion

North America leads the Autonomous Bus Market due to strong government funding, large-scale pilot programs, and rapid deployment of smart mobility infrastructure. The region’s share of 38.8%, valued at USD 1.0 billion, strengthens as cities adopt autonomous shuttles for intracity and campus transportation. Supportive regulations and advanced R&D ecosystems further accelerate adoption.

Europe Autonomous Bus Market Trends

Europe shows strong momentum as countries expand low-emission zones and invest in autonomous public transport corridors. High urbanization, sustainability policies, and large-scale trials in Nordic and Western European cities drive adoption. The region progresses rapidly as governments focus on decarbonization and smart mobility integration across metropolitan networks.

Asia Pacific Autonomous Bus Market Trends

Asia Pacific grows quickly due to rising megacities, large public transport networks, and government support for autonomous mobility pilots. Countries in East Asia and Southeast Asia test autonomous shuttles across universities, airports, and business districts. Infrastructure modernization and investment in AI-driven urban transport continue to accelerate regional demand.

Middle East and Africa Autonomous Bus Market Trends

The Middle East and Africa market expands gradually, supported by smart city projects, autonomous mobility zones, and government-led innovation programs. Gulf countries conduct high-visibility autonomous bus trials to improve tourism and urban connectivity. Infrastructure enhancements and controlled-route deployment models help the region gain steady adoption.

Latin America Autonomous Bus Market Trends

Latin America experiences emerging adoption driven by urban congestion challenges and interest in cost-efficient, technology-enabled public transport. Pilot deployments in select metropolitan areas enhance awareness of autonomous mobility benefits. Although infrastructure limitations persist, increasing smart transport investments strengthen the region’s long-term market potential.

U.S. Autonomous Bus Market Trends

The U.S., as the core contributor to North America’s leadership, accelerates adoption through robust federal mobility programs and state-level autonomous pilot approvals. Universities, airports, and tech-driven cities deploy autonomous shuttles to enhance safety and reduce transit operational costs. Continuous innovation and strong regulatory support sustain market momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Autonomous Bus Company Insights

AB Volvo strengthens market confidence by advancing electric autonomous bus prototypes designed for depot automation and controlled-route mobility. Its commitment to improving perception systems and battery efficiency positions the company as a frontrunner in long-term autonomous fleet deployment trends. The company continues refining safety algorithms to support wider city-level adoption.

Apollo Baidu accelerates ecosystem development through large-scale autonomous driving pilots across urban corridors. Its strong AI stack, real-time mapping, and scalable cloud systems enhance route stability and commercial fleet readiness. Continuous software optimization enables smoother Level 4 operations across mixed-traffic environments, improving deployment feasibility for public operators.

Easymile SAS expands deployment of low-speed autonomous shuttles across campuses, industrial zones, and controlled city segments. Its focus on safety redundancy, remote supervision, and modular vehicle platforms supports steady adoption across early-stage mobility programs. The company’s strategy centers on enabling practical, short-distance autonomous mobility with predictable cost structures.

MAN Truck & Bus advances autonomous bus capabilities through integrated ADAS systems and electric drivetrain upgrades aimed at improving fleet uptime. The company evaluates autonomous corridor operations to support mass transit digitalization. Its engineering expertise enhances braking automation, sensor fusion, and stability controls, strengthening reliability for future commercial rollouts.

Collectively, these companies shape the competitive landscape by refining AI-based navigation, enhancing electric propulsion, and enabling controlled-environment deployments that accelerate global autonomous transit adoption. Their investments support safer, cleaner, and more efficient mobility systems, encouraging governments and transit agencies to scale autonomous bus pilots toward mainstream public transportation models.

Top Key Players in the Market

- AB Volvo

- Apollo Baidu

- Easymile SAS

- MAN Truck & Bus

- Mercedes Benz

- Navya

- New Flyer

- Toyota Motor

- Yutong Group

Recent Developments

- In May 2024, Volvo Autonomous Solutions (V.A.S.) unveiled Volvo’s first production ready autonomous truck, the Volvo VNL Autonomous, at the ACT Expo inLas Vegas. The truck combines Volvo’s commercial vehicle expertise with Aurora Innovation’s autonomous driving technology, aiming to increase freight capacity across the United States.

- In Jan 2025, autonomous vehicle technology provider May Mobility entered a partnership with Italian minibus manufacturer Tecnobus, announced at CES 2025 in Las Vegas. The collaboration introduces a new autonomous minibus platform based on the Gulliver model, expanding May Mobility’s autonomous vehicle use cases.

Report Scope

Report Features Description Market Value (2024) USD 2.7 billion Forecast Revenue (2034) USD 17.7 billion CAGR (2025-2034) 20.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Autonomy (Level 1, Level 2, Level 3, Level 4), By Fuel (Diesel, Electric, Hybrid), By Application (Intercity, Intracity) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AB Volvo, Apollo Baidu, Easymile SAS, MAN Truck & Bus, Mercedes Benz, Navya, New Flyer, Toyota Motor, Yutong Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AB Volvo

- Apollo Baidu

- Easymile SAS

- MAN Truck & Bus

- Mercedes Benz

- Navya

- New Flyer

- Toyota Motor

- Yutong Group