Global Automotive UPS Market Size, Share, Growth Analysis By Power Supply (Static, Dynamic, Hybrid), By Input Power Range (High Voltage (More than 48V), Mid Voltage (9V to 48V), Low Voltage (Up to 9V)), By Ampere Rating (Below 40 Amp, Above 40 Amp), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles, Battery Electric Vehicles, Hybrid Electric Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170841

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

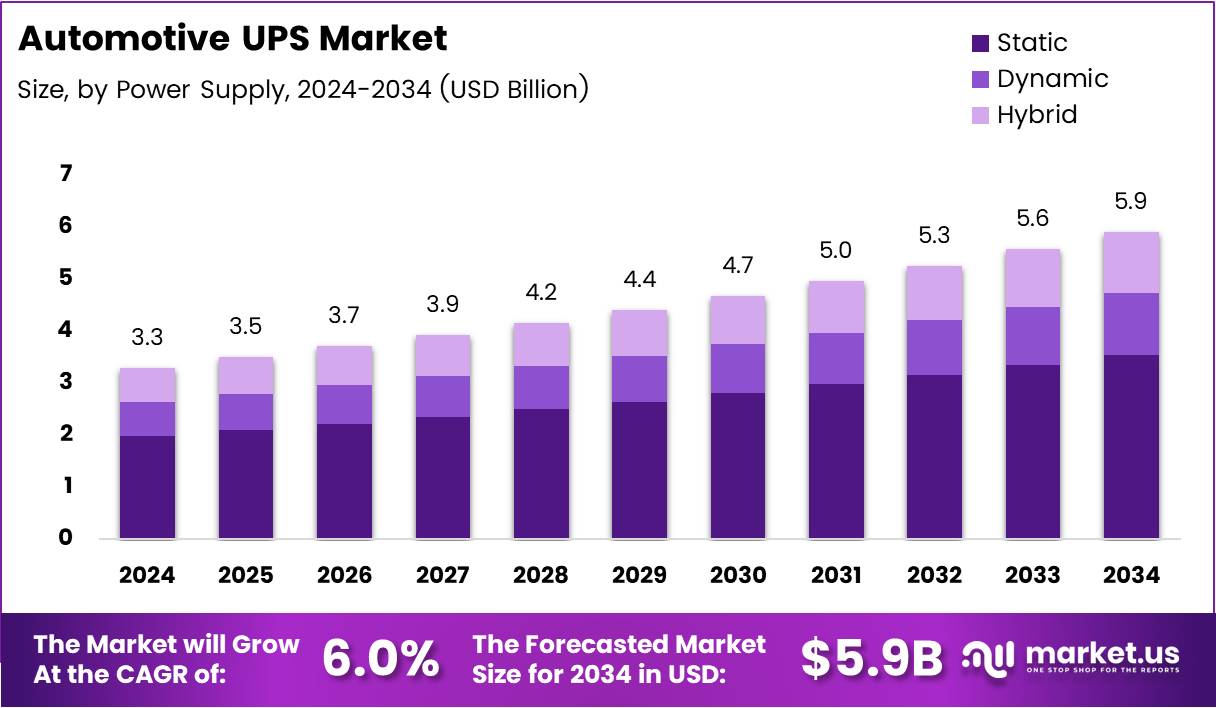

Global Automotive UPS Market size is expected to be worth around USD 5.9 Billion by 2034 from USD 3.3 Billion in 2024, growing at a CAGR of 6.0% during the forecast period 2025 to 2034. The automotive uninterruptible power supply market represents a specialized segment addressing critical power continuity requirements in modern vehicles. These systems ensure stable voltage delivery to sensitive electronic components during power fluctuations or temporary interruptions.

Modern vehicles increasingly rely on sophisticated electronic architectures that demand consistent power delivery. Automotive UPS solutions protect advanced driver assistance systems, telematics platforms, and safety-critical control units from voltage drops and sudden power loss. This technology has become essential as vehicles transform into mobile computing platforms with multiple interconnected electronic systems requiring seamless operation.

The electrification wave sweeping through the automotive industry creates substantial growth opportunities for UPS manufacturers. Electric and hybrid vehicles incorporate complex battery management systems and power distribution networks that benefit from backup power protection. Furthermore, connected vehicle platforms generate continuous data streams that require uninterrupted power to maintain communication with cloud infrastructure and fleet management systems.

Autonomous driving technologies represent another significant demand driver for automotive UPS systems. Self-driving vehicles depend on sensor fusion, real-time processing, and instantaneous decision-making capabilities that cannot tolerate power interruptions. Consequently, manufacturers integrate redundant power architectures with UPS components to ensure functional safety compliance and reliable operation under all conditions.

North America demonstrates particularly strong adoption patterns driven by advanced vehicle technology penetration and stringent safety regulations. The region’s emphasis on connected mobility and autonomous vehicle development accelerates UPS integration across passenger and commercial vehicle segments. Additionally, the commercial fleet sector increasingly adopts telematics and monitoring solutions requiring continuous power backup capabilities.

Market expansion also aligns with broader electrification trends evidenced by cumulative sales data. According to Argonne National Laboratory, over 7.6 million plug-in electric vehicles have been sold cumulatively in the United States through October 2025.

Similarly, the Federal Highway Administration reports that cumulative vehicle travel in the United States reached 3,279.1 billion vehicle miles in 2024, representing a 1.0% increase over the previous year. These statistics underscore growing vehicle complexity and electronic content driving automotive UPS adoption across expanding vehicle populations and usage patterns.

Key Takeaways

- Global Automotive UPS Market valued at USD 3.3 Billion in 2024, projected to reach USD 5.9 Billion by 2034

- Market growing at 6.0% CAGR during forecast period 2025-2034

- North America dominates with 45.9% market share, valued at USD 1.5 Billion

- Static power supply segment leads with 49.7% market share

- High voltage input power range holds 49.1% market share

- Below 40 Amp rating captures 31.5% market share

- Passenger cars segment dominates with 67.3% market share

- Over 7.6 million plug-in electric vehicles sold cumulatively in US through October 2025

Power Supply Analysis

Static power supply dominates with 49.7% market share due to its reliability and instantaneous power transfer capabilities.

In 2024, static power supply held a dominant market position in the By Power Supply segment of Automotive UPS Market, with a 49.7% share. Static UPS systems provide continuous power protection through online double-conversion technology that eliminates transfer time during power disturbances. These systems operate continuously, converting AC to DC and back to AC, ensuring zero interruption for critical automotive electronics. The technology proves particularly valuable for advanced driver assistance systems and autonomous driving components requiring absolute power continuity without millisecond-level gaps.

Dynamic UPS solutions offer cost-effective alternatives for applications tolerating brief transfer times during power switching events. These systems utilize mechanical energy storage through rotating components that provide backup power during transitions. Dynamic configurations suit commercial vehicles where telematics and monitoring systems can handle short interruption periods. The technology delivers lower initial investment costs while maintaining adequate protection for non-critical electronic loads across fleet management applications.

Hybrid UPS architectures combine static and dynamic technologies to optimize performance and cost efficiency. These configurations leverage static components for instantaneous protection while incorporating dynamic elements for extended backup duration. Hybrid systems appeal to electric vehicle manufacturers seeking balanced solutions that protect sensitive battery management systems while managing space and weight constraints inherent in vehicle design platforms.

Input Power Range Analysis

High voltage systems above 48V dominate with 49.1% share, driven by electric vehicle architecture requirements.

In 2024, high voltage (more than 48V) held a dominant market position in the By Input Power Range segment of Automotive UPS Market, with a 49.1% share. High voltage UPS systems align with electric and hybrid vehicle power architectures operating at elevated voltage levels for improved efficiency. These configurations support onboard chargers, power distribution modules, and traction battery management systems requiring robust voltage regulation. The segment benefits from ongoing vehicle electrification trends and increasing adoption of 400V and 800V electrical architectures across premium and performance vehicle segments.

Mid-voltage systems ranging from 9V to 48V serve conventional vehicle electronics and emerging mild-hybrid platforms. This power range protects infotainment systems, connectivity modules, and traditional control units operating at standard automotive voltage levels. Mid-voltage UPS solutions integrate seamlessly with existing 12V and 24V electrical architectures while supporting new 48V mild-hybrid systems gaining traction for improved fuel efficiency without full electrification investment.

Low voltage UPS systems up to 9V address specialized applications within vehicle electronics requiring precise voltage regulation at reduced power levels. These compact solutions protect sensitive microcontrollers, memory modules, and communication interfaces susceptible to voltage fluctuations. Low voltage configurations find applications in advanced sensor systems and control modules where stable power delivery ensures data integrity and operational reliability across diverse operating conditions.

Ampere Rating Analysis

Below 40 Amp segment captures 31.5% share, addressing mainstream vehicle electronic protection needs.

In 2024, Below 40 Amp held a dominant market position in the By Ampere Rating segment of Automotive UPS Market, with a 31.5% share. Lower amperage ratings suit majority of passenger vehicle applications where electronic loads remain moderate despite increasing complexity.

These configurations protect infotainment systems, connectivity platforms, and driver assistance features without excessive hardware requirements. The segment benefits from cost optimization and space efficiency considerations critical for mass-market vehicle production where manufacturers balance functionality against manufacturing economics and packaging constraints.

Above 40 Amp UPS systems serve high-power applications in commercial vehicles, electric vehicles, and premium passenger cars with extensive electronic content. These robust configurations support multiple simultaneous loads including advanced computing platforms, comprehensive sensor arrays, and power-intensive telematics systems.

Higher amperage ratings prove essential for commercial fleets operating continuous monitoring and communication equipment requiring sustained power backup. Additionally, autonomous vehicle prototypes incorporate above 40 Amp UPS systems to ensure redundant power supply for safety-critical processing and control functions demanding maximum reliability.

Vehicle Type Analysis

Passenger cars dominate with 67.3% share, reflecting widespread consumer vehicle electronic complexity.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment of Automotive UPS Market, with a 67.3% share. Passenger vehicles incorporate increasingly sophisticated electronic systems including connectivity platforms, driver assistance technologies, and digital cockpit features requiring power protection.

Modern passenger cars function as mobile computing environments with multiple processors, sensors, and communication modules vulnerable to power disturbances. The segment’s dominance reflects global passenger vehicle production volumes significantly exceeding commercial vehicle output while simultaneously experiencing rapid electronic content growth across all price segments.

Light Commercial Vehicles represent growing UPS adoption driven by fleet management and telematics requirements for delivery and service operations. These vehicles operate extended duty cycles with constant connectivity demands for route optimization, cargo monitoring, and driver communication systems. LCV operators prioritize uptime and data continuity, making UPS integration increasingly standard for maintaining operational efficiency and customer service levels across last-mile delivery and urban logistics applications.

Heavy Commercial Vehicles adopt UPS systems to protect complex electronic architectures managing engine controls, transmission systems, and safety features. Long-haul trucks and buses incorporate extensive monitoring and communication equipment requiring continuous operation throughout extended journeys. Furthermore, regulatory compliance systems including electronic logging devices and emissions monitoring depend on uninterrupted power, driving UPS integration across commercial vehicle platforms serving transportation and logistics industries.

Electric Vehicles demand sophisticated UPS solutions protecting critical battery management, power conversion, and thermal regulation systems. BEV platforms rely entirely on electrical energy, making power continuity absolutely essential for maintaining propulsion, safety systems, and vehicle operability.

HEV configurations combine internal combustion and electric powertrains requiring coordinated power management across dual energy sources, with UPS components ensuring seamless transitions and protecting complex control algorithms managing hybrid operation modes throughout diverse driving conditions.

Key Market Segments

By Power Supply

- Static

- Dynamic

- Hybrid

By Input Power Range

- High voltage (More than 48V)

- Mid Voltage (9V to 48V)

- Low voltage (Up to 9V)

By Ampere Rating

- Below 40 Amp

- Above 40 Amp

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- BEV

- HEV

Drivers

Rising Integration of Advanced Driver Assistance Systems Requiring Stable Backup Power

Advanced driver assistance systems represent critical safety technologies demanding uninterrupted power delivery throughout vehicle operation. Modern ADAS features including adaptive cruise control, lane keeping assistance, and automatic emergency braking rely on continuous sensor data processing and instantaneous actuator response. Power interruptions lasting even milliseconds can compromise system functionality and create dangerous situations where safety features become temporarily unavailable during critical moments.

Consequently, automotive manufacturers integrate UPS solutions to maintain ADAS operation during voltage fluctuations common in vehicle electrical systems. Starting events, load changes, and alternator variations create power disturbances that UPS systems filter and compensate. Furthermore, regulatory requirements increasingly mandate ADAS availability and reliability, driving systematic adoption of backup power architectures ensuring functional safety compliance across global vehicle markets.

Restraints

High Cost of Automotive-Grade UPS Components and Redundant Power Architectures

Automotive-grade UPS systems require specialized components meeting stringent reliability, temperature, and vibration specifications exceeding industrial standards. These ruggedized designs incorporate premium materials, extensive testing protocols, and complex validation processes significantly increasing component costs. Additionally, redundant power architectures multiply hardware requirements, further elevating system expenses that manufacturers must balance against competitive pricing pressures in cost-sensitive vehicle segments.

Design complexity compounds cost challenges as engineers integrate UPS functionality within existing electrical architectures without compromising performance or reliability. Space constraints in compact vehicle platforms limit component placement options and require miniaturized solutions commanding premium pricing. Furthermore, development timelines for automotive applications extend across multiple years, delaying return on investment and deterring smaller suppliers from entering specialized UPS market niches serving vehicle manufacturers.

Growth Factors

Increasing Deployment of Automotive UPS in Electric and Hybrid Vehicle Power Management

Electric and hybrid vehicles create substantial growth opportunities through complex power management requirements spanning battery systems, charging infrastructure, and propulsion controls. These vehicles operate at elevated voltage levels requiring sophisticated protection against power disturbances that could damage expensive battery packs or disrupt critical control functions. UPS integration ensures stable power delivery during regenerative braking transitions, charging operations, and power distribution across multiple vehicle subsystems operating simultaneously.

Moreover, electric vehicle adoption accelerates globally driven by environmental regulations and consumer preferences shifting toward sustainable transportation. This electrification trend directly correlates with automotive UPS demand as manufacturers standardize backup power architectures across electric platforms.

Additionally, autonomous electric vehicle development combines two major technology trends, creating premium applications where UPS systems protect both electrification and autonomy functions through redundant power supply configurations ensuring maximum reliability.

Emerging Trends

Shift Toward Solid-State and Lithium-Based Automotive UPS Technologies

Solid-state and lithium-based UPS technologies emerge as next-generation solutions offering superior performance characteristics compared to traditional designs. Solid-state systems eliminate mechanical components, reducing maintenance requirements while improving reliability through enhanced durability and vibration resistance.

Lithium battery integration provides higher energy density and faster charging capabilities, enabling compact UPS designs fitting constrained vehicle packaging envelopes while delivering extended backup duration for critical electronic systems.

Furthermore, manufacturers increasingly prioritize functional safety compliance aligned with ISO 26262 standards governing automotive electrical systems. This regulatory focus drives systematic integration of diagnostic capabilities and health monitoring functions within UPS architectures.

Predictive diagnostics enable proactive maintenance scheduling and early fault detection, preventing unexpected failures that could compromise vehicle safety. These intelligent UPS systems communicate with vehicle networks, providing real-time status updates and integrating seamlessly with connected vehicle platforms for enhanced fleet management capabilities.

Regional Analysis

North America Dominates the Automotive UPS Market with a Market Share of 45.9%, Valued at USD 1.5 Billion

North America leads global automotive UPS adoption with 45.9% market share valued at USD 1.5 Billion, driven by advanced vehicle technology penetration and stringent safety regulations. The region’s automotive manufacturers prioritize electronic content and connectivity features, creating substantial demand for power protection systems. Additionally, strong autonomous vehicle development activity concentrated in North American technology hubs accelerates UPS integration across prototype and production platforms requiring redundant power architectures for safety-critical functions.

Europe Automotive UPS Market Trends

Europe demonstrates robust automotive UPS growth fueled by aggressive electrification targets and premium vehicle production concentrated in the region. European manufacturers lead global electric vehicle development with sophisticated power management architectures incorporating advanced UPS solutions. Furthermore, stringent functional safety requirements and comprehensive vehicle testing protocols drive systematic backup power integration across passenger and commercial vehicle segments serving European markets.

Asia Pacific Automotive UPS Market Trends

Asia Pacific represents the fastest-growing automotive UPS market driven by massive vehicle production volumes and rapid technology adoption across emerging economies. Chinese electric vehicle manufacturers particularly drive regional demand through aggressive electrification strategies and government incentives promoting clean transportation. Additionally, Japan and South Korea contribute advanced UPS technologies through established electronics and automotive component suppliers serving global vehicle manufacturers with innovative power protection solutions.

Latin America Automotive UPS Market Trends

Latin America shows gradual automotive UPS adoption primarily concentrated in commercial vehicle and premium passenger car segments. Regional growth remains constrained by economic factors limiting advanced technology penetration in mass-market vehicles. However, commercial fleet operators increasingly recognize telematics and connectivity benefits, driving UPS integration for maintaining continuous communication and monitoring capabilities across transportation and logistics operations throughout the region.

Middle East and Africa Automotive UPS Market Trends

Middle East and Africa automotive UPS markets develop slowly but steadily, supported by luxury vehicle imports and emerging commercial vehicle fleets. The region’s harsh operating conditions including extreme temperatures and challenging infrastructure create unique reliability requirements favoring UPS integration. Additionally, government fleet modernization initiatives in Gulf nations and South Africa drive adoption of connected vehicle technologies requiring backup power systems for maintaining operational effectiveness across diverse applications.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive UPS Company Insights

Siemens AG leverages extensive power systems expertise to deliver automotive-grade UPS solutions supporting vehicle electrification and connectivity initiatives. The company’s automotive division integrates backup power technologies with broader electronic architecture offerings serving global vehicle manufacturers.

General Electric Company applies industrial power management capabilities to automotive applications, providing robust UPS systems for commercial vehicles and heavy-duty platforms. Their solutions emphasize reliability and durability for demanding transportation environments requiring continuous operation.

Schneider Electric offers comprehensive automotive power protection portfolios combining UPS hardware with intelligent management software for connected vehicle applications. The company focuses on scalable architectures supporting diverse vehicle platforms from passenger cars through commercial fleets.

ABB Ltd delivers advanced power electronics and control systems incorporating UPS functionality for electric and hybrid vehicle applications. Their automotive solutions emphasize integration with battery management and charging systems requiring sophisticated power regulation capabilities.

Key Companies

- Siemens AG

- General Electric Company

- Panasonic Corporation

- Schneider Electric

- ABB Ltd

- Fujitsu Limited

- Toshiba Corporation

- Johnson Controls

- Eaton Corporation

- Delta Electronics

Recent Developments

- December 2024, PULS becomes a major provider of DC UPS systems with the acquisition of Adelsystem. This strategic acquisition expands PULS’s portfolio in specialized power backup solutions, strengthening their position in automotive and industrial applications requiring reliable DC power continuity systems.

- December 2024, Pearce Services Announces Acquisition of Unified Power. The acquisition enhances Pearce Services’ capabilities in power protection and management solutions, enabling expanded service offerings across multiple sectors including automotive applications requiring sophisticated backup power architectures and maintenance support.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 5.9 Billion CAGR (2025-2034) 6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Supply (Static, Dynamic, Hybrid), By Input Power Range (High Voltage (More than 48V), Mid Voltage (9V to 48V), Low Voltage (Up to 9V)), By Ampere Rating (Below 40 Amp, Above 40 Amp), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles, Battery Electric Vehicles, Hybrid Electric Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Siemens AG, General Electric Company, Panasonic Corporation, Schneider Electric, ABB Ltd, Fujitsu Limited, Toshiba Corporation, Johnson Controls, Eaton Corporation, Delta Electronics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens AG

- General Electric Company

- Panasonic Corporation

- Schneider Electric

- ABB Ltd

- Fujitsu Limited

- Toshiba Corporation

- Johnson Controls

- Eaton Corporation

- Delta Electronics