Global Automotive Spark Plugs And Glow Plugs Market Size, Share, Growth Analysis By Product Type (Hot Spark Plug, Cold Spark Plug, Metal Glow Plug, Ceramic Glow Plug), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Fuel Type (Gasoline, Diesel, Others), By Plug Type (Conventional Spark Plugs, Indium Spark Plugs, Platinum Spark Plugs), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172446

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Vehicle Type Analysis

- By Fuel Type Analysis

- By Plug Type Analysis

- By Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Automotive Spark Plugs And Glow Plugs Company Insights

- Recent Developments

- Report Scope

Report Overview

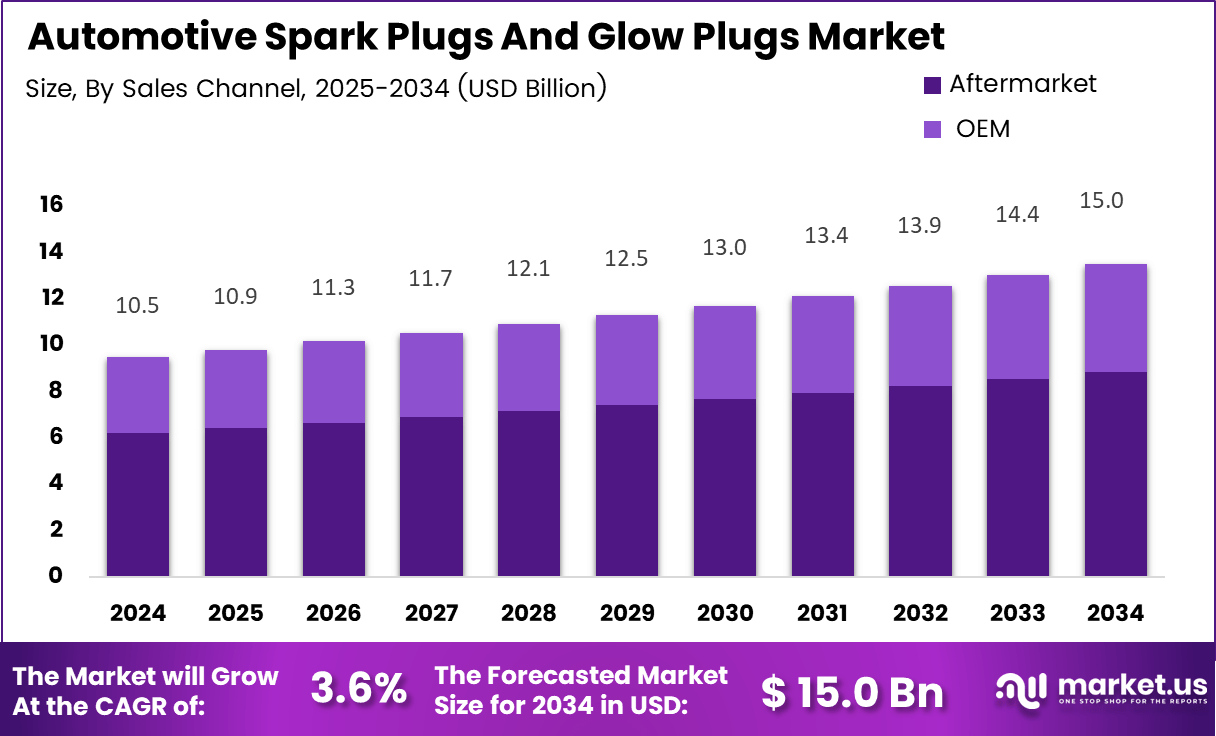

The Global Automotive Spark Plugs And Glow Plugs Market size is expected to be worth around USD 15.0 billion by 2034, from USD 10.5 billion in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034.

Automotive Spark Plugs And Glow Plugs represent a critical engine ignition and cold start component market supporting global internal combustion vehicle operations. These components enable controlled combustion, efficient fuel utilization, and reliable engine starts across passenger and commercial vehicles. Consequently, demand remains structurally linked to global vehicle parc size and maintenance cycles.

Automotive Spark Plugs And Glow Plugs Market reflects a mature yet resilient landscape, supported by steady vehicle production and an expanding global aftermarket. Moreover, growth remains visible across gasoline and diesel platforms despite electrification trends. Hybrid vehicle penetration sustains ignition demand, while aging vehicle fleets reinforce recurring replacement cycles through organized and independent service networks.

In terms of growth, the market benefits from rising vehicle ownership in emerging economies and improving road infrastructure. Additionally, stricter emission norms encourage precise combustion control, supporting advanced ignition solutions. Government investments in transport modernization indirectly stimulate engine efficiency upgrades, while regulatory focus on cold start emissions sustains glow plug relevance.

Opportunities increasingly emerge from premiumization trends and extended service life products. Manufacturers focus on durability, thermal resistance, and performance consistency. Furthermore, fleet operators prioritize reliability to minimize downtime, strengthening demand in logistics and public transport. These factors collectively support transactional demand across OEM fitment and aftermarket replacement channels.

Regulatory frameworks continue shaping market evolution through emission and fuel efficiency standards. Governments promote compliance through inspection regimes and vehicle fitness programs. As a result, timely replacement of ignition components gains importance. Incentives for cleaner combustion technologies further align with ignition system optimization, supporting sustained relevance of spark and glow plugs.

From a technical perspective, modern ignition technologies significantly enhance performance expectations. According to manufacturer technical documentation, advanced ceramic glow plugs achieve heating times under 2 seconds while exceeding temperatures of 1,000°C, supporting rapid cold starts and start stop systems. These advancements directly improve diesel engine efficiency and emission control.

Similarly, spark plug performance standards remain essential for petrol engines. According to SAE automotive engineering references, spark plugs generate high voltage electrical discharge ranging between 12,000 and 45,000 volts to ignite air fuel mixtures efficiently. This capability underpins stable combustion, fuel economy optimization, and reduced misfire risks across modern engines.

Overall, Automotive Spark Plugs And Glow Plugs Market continues balancing innovation with volume stability. While electrification reshapes long term outlooks, near to mid term demand remains supported by hybrid growth, emission regulations, and global vehicle servicing needs. Consequently, the market retains strategic importance within the automotive components ecosystem.

Key Takeaways

- Global Automotive Spark Plugs And Glow Plugs Market projected to reach USD 15.0 billion by 2034, growing from USD 10.5 billion in 2024 at a 3.6% CAGR.

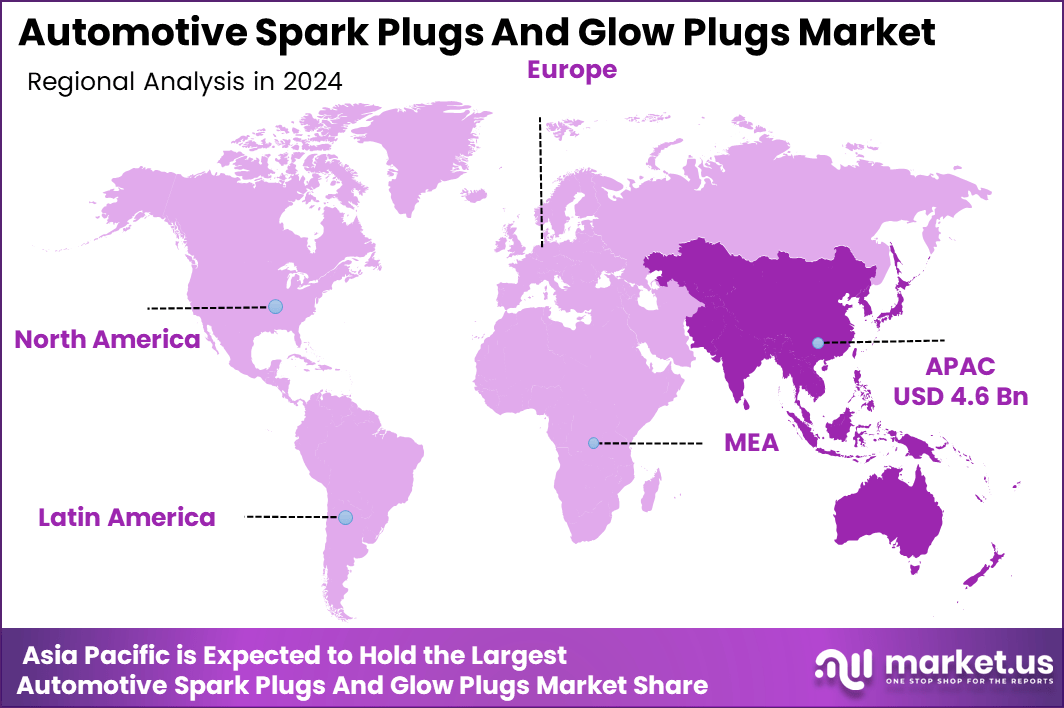

- Asia-Pacific dominates the market with a 43.8% share, representing a regional value of USD 4.6 billion.

- Metal Glow Plug leads the product type segment with a dominant share of 34.7%.

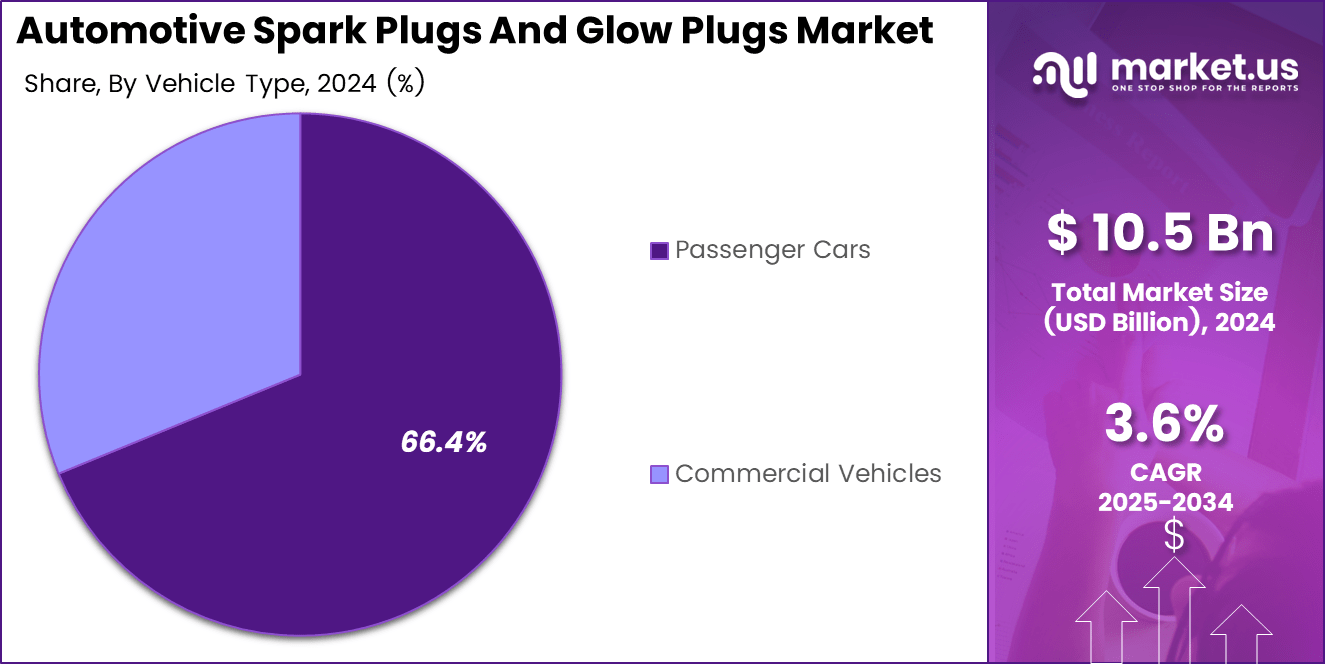

- Passenger Cars remain the largest vehicle type segment, accounting for 66.4% of total market demand.

- Gasoline based vehicles dominate the fuel type segment with a 56.3% share globally.

- Conventional Spark Plugs hold the leading plug type position with a 62.9% market share.

- OEM sales channel dominates distribution with a 59.2% share, supported by factory fitted components.

By Product Type Analysis

Metal Glow Plug dominates with 34.7% due to its durability and stable cold start performance in diesel engines.

Hot Spark Plug held a notable market position in the By Product Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market. These plugs support higher engine temperatures and enable efficient combustion at sustained speeds. As a result, they remain widely used in performance oriented gasoline engines across passenger vehicles.

Cold Spark Plug maintained steady demand in the By Product Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market. These plugs dissipate heat faster and support engines operating under heavy loads. Consequently, they are preferred in turbocharged and high compression engines to prevent pre ignition issues.

Metal Glow Plug held a dominant market position in the By Product Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market, with a 34.7% share. Their robust construction supports reliable cold starts, especially in commercial and older diesel vehicles, reinforcing consistent OEM and replacement demand.

Ceramic Glow Plug gained growing attention in the By Product Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market. Faster heating characteristics and improved thermal resistance enhance engine efficiency. Therefore, adoption rises in modern diesel engines aligned with stricter emission standards.

By Vehicle Type Analysis

Passenger Cars dominate with 66.4% supported by higher production volumes and frequent replacement cycles.

Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market, with a 66.4% share. High global ownership levels and routine maintenance requirements sustain strong aftermarket consumption across gasoline and diesel models.

Commercial Vehicles represented a significant share in the By Vehicle Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market. Fleet utilization intensity accelerates wear rates. Consequently, demand remains stable for durable ignition components supporting uptime and operational reliability.

By Fuel Type Analysis

Gasoline dominates with 56.3% driven by widespread petrol engine usage globally.

Gasoline held a dominant market position in the By Fuel Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market, with a 56.3% share. Spark plug replacement frequency and extensive passenger vehicle penetration sustain consistent market activity.

Diesel maintained steady importance in the By Fuel Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market. Glow plug dependency for cold starts and emission control supports recurring demand, particularly in commercial and utility vehicles.

Others fuel types contributed marginally within the By Fuel Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market. Alternative fuel vehicles with auxiliary ignition needs support limited but stable consumption.

By Plug Type Analysis

Conventional Spark Plugs dominate with 62.9% due to cost efficiency and widespread compatibility.

Conventional Spark Plugs held a dominant market position in the By Plug Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market, with a 62.9% share. Their affordability and broad engine compatibility sustain large scale adoption.

Indium Spark Plugs captured selective demand in the By Plug Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market. Improved conductivity and thermal stability support usage in specific engine configurations.

Platinum Spark Plugs continued gaining traction in the By Plug Type Analysis segment of Automotive Spark Plugs And Glow Plugs Market. Extended service life and performance consistency attract premium vehicle owners and long interval maintenance programs.

By Sales Channel Analysis

OEM dominates with 59.2% supported by vehicle production and factory fitted components.

OEM held a dominant market position in the By Sales Channel Analysis segment of Automotive Spark Plugs And Glow Plugs Market, with a 59.2% share. Rising vehicle output and standardized ignition specifications drive stable OEM procurement volumes.

Aftermarket remained a vital contributor in the By Sales Channel Analysis segment of Automotive Spark Plugs And Glow Plugs Market. Aging vehicle fleets and routine servicing cycles sustain replacement driven demand across independent repair networks.

Key Market Segments

By Product Type

- Hot Spark Plug

- Cold Spark Plug

- Metal Glow Plug

- Ceramic Glow Plug

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Fuel Type

- Gasoline

- Diesel

- Others

By Plug Type

- Conventional Spark Plugs

- Indium Spark Plugs

- Platinum Spark Plugs

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Global Passenger and Commercial Vehicle Parc Sustains Replacement Demand

Rising global passenger and commercial vehicle parc directly supports steady replacement demand for spark and glow plugs. As vehicles remain on roads for longer durations, routine maintenance becomes essential. Consequently, ignition components experience regular wear, encouraging periodic replacement across both private and fleet owned vehicles.

Increasing engine efficiency requirements further drive the adoption of advanced ignition and cold start technologies. Automakers focus on better fuel combustion to meet performance and efficiency expectations. As a result, demand grows for spark and glow plugs that deliver consistent ignition and stable engine operation.

Growth in diesel powered vehicles across commercial fleets strongly supports glow plug consumption. Logistics, construction, and public transport fleets rely on diesel engines for durability and torque. Therefore, dependable cold start performance remains critical, reinforcing continued glow plug usage in daily operations.

Stricter emission compliance norms also encourage optimized combustion through reliable ignition components. Governments enforce tighter emission standards to reduce pollutants. Consequently, efficient spark and glow plugs play a key role in improving combustion quality and lowering cold start emissions.

Restraints

Rapid Penetration of Electric Vehicles Battery Limits Ignition Demand

Rapid penetration of electric vehicles battery reduces long term demand for ignition related components. Electric drivetrains eliminate the need for spark and glow plugs entirely. As adoption accelerates in urban markets, conventional ignition component volumes face gradual structural pressure.

Extended service intervals of modern spark plugs also restrain aftermarket growth. Improved materials and engineering enable longer replacement cycles. As a result, vehicles require fewer plug changes over their lifespan, lowering recurring aftermarket sales compared to earlier generations.

Volatility in raw material prices affects production costs and supplier margins. Metals and ceramics used in ignition components experience pricing fluctuations. Consequently, manufacturers face challenges in cost control, which can impact pricing strategies and overall profitability.

Growing adoption of alternative propulsion systems such as fuel cells further limits conventional engine usage. These technologies reduce reliance on internal combustion engines. Over time, this transition narrows the addressable market for traditional spark and glow plug solutions.

Growth Factors

Expansion of Hybrid Vehicle Platforms Maintains Ignition Demand

Expansion of hybrid vehicle platforms maintains demand for high performance spark plugs. Hybrids still rely on internal combustion engines for part of their operation. Therefore, reliable ignition components remain essential to ensure smooth transitions between electric and engine driven modes.

Rising vehicle ownership in emerging economies increases both OEM and aftermarket volumes. Improving income levels and infrastructure boost vehicle sales. As the vehicle base expands, routine servicing requirements grow, supporting sustained demand for spark and glow plugs.

Technological advancements in long life platinum and iridium plug designs enhance value addition. These products offer improved durability and performance. As a result, customers show willingness to invest in premium options that reduce maintenance frequency.

Additionally, increasing awareness of preventive maintenance supports opportunity growth. Vehicle owners and fleet operators prioritize efficiency and reliability. This behavior encourages timely replacement of ignition components, strengthening both organized aftermarket and authorized service channels.

Emerging Trends

Shift Toward Premium Spark Plugs with Extended Durability

The market shows a clear shift toward premium spark plugs with extended durability and improved thermal resistance. Advanced materials support stable performance under high engine stress. Consequently, demand rises for products that deliver longer service life and consistent ignition.

Growing preference for OEM specified ignition components in organized aftermarket channels shapes purchasing behavior. Consumers increasingly trust manufacturer recommended parts. This trend strengthens demand through authorized dealers and service centers, supporting quality focused replacement practices.

Integration of sensor enabled spark plugs for advanced engine diagnostics represents an emerging trend. These solutions support real time engine monitoring. As vehicles become more connected, diagnostic capable ignition components gain strategic importance.

Increasing localization of ignition component manufacturing supports regional automotive hubs. Manufacturers invest in local production to reduce costs and supply risks. This trend aligns with broader automotive localization strategies across major vehicle producing regions.

Regional Analysis

Asia-Pacific Dominates the Automotive Spark Plugs And Glow Plugs Market with a Market Share of 43.8%, Valued at USD 4.6 Billion

Asia-Pacific leads the Automotive Spark Plugs And Glow Plugs Market, accounting for 43.8% share with a valuation of USD 4.6 billion. High vehicle production volumes, large passenger car ownership, and strong two wheeler and commercial vehicle penetration support consistent OEM and aftermarket demand. Rapid urbanization and expanding mobility needs further reinforce replacement cycles across the region.

North America Automotive Spark Plugs And Glow Plugs Market Trends

North America shows stable demand driven by a large installed vehicle base and strong aftermarket servicing culture. Stringent emission standards encourage efficient combustion and timely ignition component replacement. The region also benefits from steady commercial vehicle operations supporting glow plug consumption.

Europe Automotive Spark Plugs And Glow Plugs Market Trends

Europe maintains a mature market profile supported by strict emission regulations and advanced engine technologies. Regular vehicle inspections promote timely replacement of spark and glow plugs. Diesel powered passenger and light commercial vehicles continue to sustain glow plug demand across several countries.

Middle East and Africa Automotive Spark Plugs And Glow Plugs Market Trends

The Middle East and Africa market grows steadily due to increasing vehicle parc and rising demand for durable ignition components. Harsh climatic conditions elevate replacement frequency. Expansion of transport and logistics activities further supports consistent aftermarket demand.

Latin America Automotive Spark Plugs And Glow Plugs Market Trends

Latin America demonstrates moderate growth supported by improving vehicle ownership and expanding repair networks. Aging vehicle fleets increase replacement driven demand. Gradual recovery in automotive production and aftermarket formalization continues to strengthen market stability across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Spark Plugs And Glow Plugs Company Insights

DENSO Corporation benefits from deep OEM integration and high quality manufacturing discipline across ignition and diesel starting systems. In 2024, the company’s scale and tight engineering alignment with automakers support stable demand across passenger vehicles and light commercial platforms. Its focus on durability, thermal management, and tighter tolerances positions it well as engines operate under higher efficiency and emissions constraints.

NGK Spark Plug Co. Ltd holds a strong position through broad coverage across aftermarket fitments and consistent product standardization. In 2024, replacement driven demand supports the company’s volume resilience, because spark plugs remain a routine service item tied to vehicle parc size and maintenance intervals. Continued innovation around electrode materials and design refinements strengthens performance and longevity expectations.

Robert Bosch GmbH remains strategically placed due to its system level presence in powertrain components and strong distribution reach. In 2024, its strength comes from delivering reliable ignition and glow plug solutions that align with OEM validation requirements and wide regional compliance needs. The company’s emphasis on consistency and large scale supply capability supports both OE programs and the replacement channel.

BorgWarner Inc. maintains relevance through powertrain technology breadth and an ability to support diversified propulsion portfolios. In 2024, the company’s positioning in engine related components supports cross selling opportunities and a pragmatic route to serve mixed fleets. Its operational focus on quality assurance and platform compatibility helps sustain demand where diesel applications and cold start performance remain critical.

Top Key Players in the Market

- DENSO Corporation

- NGK Spark Plug Co. Ltd

- Robert Bosch GmbH

- BorgWarner Inc.

- Autolite

- Tenneco Inc.

- Niterra Co., Ltd.

Recent Developments

In September 2025 Denso and Niterra signed a definitive business transfer agreement for the sale of Denso’s spark plug and exhaust gas sensor business to Niterra Co., Ltd. This agreement formalizes the transfer after earlier negotiations and board approvals, although the official closing is still subject to regulatory approvals from competition authorities worldwide and other closing conditions.

Report Scope

Report Features Description Market Value (2024) USD 10.5 billion Forecast Revenue (2034) USD 15.0 billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hot Spark Plug, Cold Spark Plug, Metal Glow Plug, Ceramic Glow Plug), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Fuel Type (Gasoline, Diesel, Others), By Plug Type (Conventional Spark Plugs, Indium Spark Plugs, Platinum Spark Plugs), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Spark Plugs And Glow Plugs MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Spark Plugs And Glow Plugs MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DENSO Corporation

- NGK Spark Plug Co. Ltd

- Robert Bosch GmbH

- BorgWarner Inc.

- Autolite

- Tenneco Inc.

- Niterra Co., Ltd.

- Others