Global Automotive Retail Market Size, Share, Growth Analysis By Vehicle Type (SUVs, Hatchback/Sedan, LCVs, HCVs), By Propulsion (ICE, Hybrid, Electric), By Services (Automotive Sales, Insurance Sales, Finance Sales, Spare Parts Sales, Maintenance & Other Services), By End-user (Individual Buyers, Fleet Operators) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173646

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

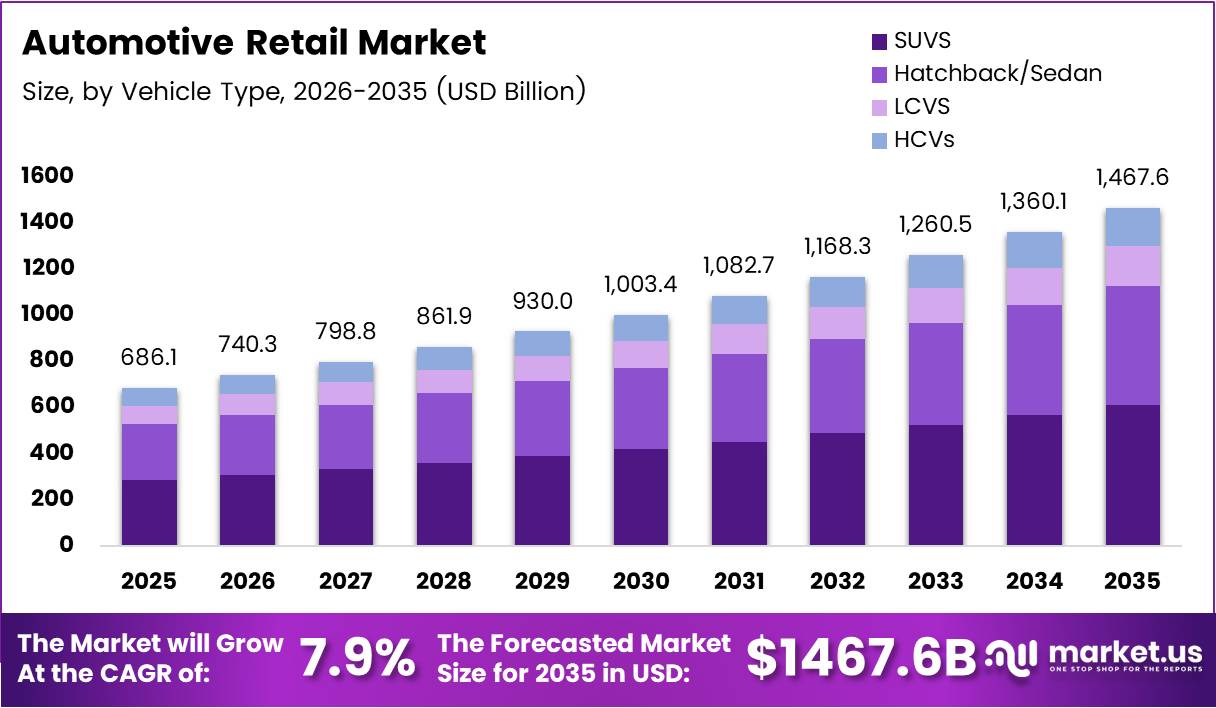

The Global Automotive Retail Market size is expected to be worth around USD 1467.6 Billion by 2033 from USD 686.1 Billion in 2025, growing at a CAGR of 7.9% during the forecast period 2026 to 2033.

The automotive retail market represents the entire ecosystem of vehicle sales through franchised dealerships, multi-brand showrooms, and certified pre-owned networks. This sector encompasses new and used vehicle transactions, financing services, insurance products, and aftersales maintenance solutions. Traditional brick-and-mortar dealerships continue dominating the landscape while digital platforms gradually reshape customer engagement models.

Market growth accelerates through increased replacement cycles in urban markets and expanding vehicle ownership in emerging economies. Dealership networks benefit from rising consumer preference for organized retail channels offering warranty assurance and comprehensive service packages. Furthermore, automotive financing accessibility has improved significantly, enabling broader customer segments to enter the market through flexible payment structures.

The shift toward electric vehicles creates substantial opportunities for retail transformation. Dealerships increasingly integrate charging infrastructure and specialized EV service capabilities into their offerings. Additionally, subscription-based ownership models and certified pre-owned programs provide alternative revenue streams beyond traditional one-time sales transactions.

Digital transformation reshapes the customer journey across the automotive retail sector. Omnichannel strategies combine online research with physical showroom experiences, enhancing buyer convenience and satisfaction. According to NADA, the nation’s 16,957 franchised U.S. light-vehicle dealers sold 15.9 million light-duty vehicles. Meanwhile, Cox Automotive research reveals that 50% of car buyers completed 100% of steps in person, 43% completed steps in a mix of online and in-person, and only 7% completed all steps online in 2023.

Regulatory frameworks increasingly support organized retail structures while maintaining consumer protection standards. Government initiatives promoting electric vehicle adoption further stimulate dealership investment in infrastructure and training. These developments position automotive retail networks as critical intermediaries in the transition toward sustainable mobility solutions.

Key Takeaways

- Global Automotive Retail Market projected to reach USD 1467.6 Billion by 2033 from USD 686.1 Billion in 2025 at 7.9% CAGR

- Asia Pacific dominates with 49.50% market share, valued at USD 339.6 Billion

- SUVs segment leads By Vehicle Type with 39.8% market share

- ICE propulsion holds 73.5% share in By Propulsion segment

- Automotive Sales commands 59.1% share in By Services segment

- Individual Buyers represent 72.9% of By End-user segment

Vehicle Type Analysis

SUVs dominate with 39.8% due to rising consumer preference for spacious utility vehicles.

In 2025, SUVs held a dominant market position in the By Vehicle Type Analysis segment of Automotive Retail Market, with a 39.8% share. Sport utility vehicles continue gaining traction among families and professionals seeking enhanced safety features, cargo capacity, and elevated driving positions. Dealerships prioritize SUV inventory as these vehicles generate higher profit margins compared to compact segments. Additionally, manufacturers expand SUV portfolios across price points, improving accessibility for diverse customer demographics.

Hatchback and Sedan segments maintain steady demand among urban commuters and first-time buyers. These vehicle types offer fuel efficiency and maneuverability in congested metropolitan areas. Furthermore, competitive pricing and lower maintenance costs attract budget-conscious consumers seeking practical transportation solutions.

Light Commercial Vehicles serve small business operators and logistics providers requiring affordable cargo transport. This segment benefits from e-commerce expansion and last-mile delivery requirements. Meanwhile, Heavy Commercial Vehicles cater to industrial and construction sectors with specialized load-carrying capabilities. Both commercial segments demonstrate resilience through infrastructure development projects and economic recovery initiatives.

Propulsion Analysis

ICE dominates with 73.5% due to established infrastructure and vehicle availability.

In 2025, ICE held a dominant market position in the By Propulsion Analysis segment of Automotive Retail Market, with a 73.5% share. Internal combustion engine vehicles maintain market leadership through extensive refueling infrastructure and proven technology reliability. Dealerships benefit from deep technical expertise and established service networks for conventional powertrains. Moreover, ICE vehicles offer broader model selection across all price ranges and body styles.

Hybrid propulsion systems attract environmentally conscious buyers seeking reduced emissions without range anxiety. These vehicles combine electric motors with conventional engines, delivering improved fuel economy during urban driving. Consequently, hybrid sales accelerate in markets with favorable tax incentives and environmental regulations.

Electric vehicles represent the fastest-growing propulsion segment despite current smaller market share. Dealerships invest in charging infrastructure and technician training to support EV adoption. Government subsidies and expanding charging networks gradually reduce traditional barriers to electric vehicle ownership. Therefore, this segment shows significant potential for substantial market share gains throughout the forecast period.

Services Analysis

Automotive Sales dominates with 59.1% due to core vehicle transaction revenue.

In 2025, Automotive Sales held a dominant market position in the By Services Analysis segment of Automotive Retail Market, with a 59.1% share. Vehicle sales transactions generate primary revenue streams for dealership operations and remain central to business models. Dealerships leverage inventory management strategies and manufacturer incentives to optimize unit sales performance. Additionally, new vehicle launches and product refreshes stimulate consistent customer traffic and transaction volumes.

Insurance Sales provide complementary revenue opportunities through partnerships with financial institutions. Dealerships facilitate policy origination during vehicle purchase processes, creating convenience for buyers. Similarly, Finance Sales services connect customers with lending options, enabling affordable payment structures. These financial services enhance overall transaction values while improving customer acquisition rates.

Spare Parts Sales and Maintenance Services deliver recurring revenue streams beyond initial vehicle transactions. Dealerships maintain genuine parts inventory and certified service technicians to support vehicle ownership lifecycles. Furthermore, these aftersales services generate higher profit margins compared to vehicle sales, creating sustainable long-term business value. Other services including accessories, extended warranties, and detailing packages diversify revenue portfolios and strengthen customer retention.

End-user Analysis

Individual Buyers dominate with 72.9% due to widespread personal vehicle ownership.

In 2025, Individual Buyers held a dominant market position in the By End-user Analysis segment of Automotive Retail Market, with a 72.9% share. Personal vehicle ownership remains the predominant use case across global markets for commuting and lifestyle purposes. Dealerships tailor sales strategies toward individual consumer preferences, offering personalized financing and trade-in programs. Moreover, rising disposable incomes in emerging markets expand the addressable individual buyer population significantly.

Fleet Operators represent a concentrated but substantial customer segment for automotive retail networks. Corporate fleets, rental agencies, and ride-sharing platforms purchase vehicles in bulk quantities. These buyers prioritize total cost of ownership, maintenance packages, and standardized vehicle specifications. Consequently, dealerships develop specialized fleet sales divisions offering volume discounts and dedicated account management. Fleet business provides predictable revenue streams and efficient inventory turnover for retail operations.

Key Market Segments

By Vehicle Type

- SUVs

- Hatchback/Sedan

- LCVs

- HCVs

By Propulsion

- ICE

- Hybrid

- Electric

By Services

- Automotive Sales

- Insurance Sales

- Finance Sales

- Spare Parts Sales

- Maintenance & Other Services

By End-user

- Individual Buyers

- Fleet Operators

Drivers

Rising Vehicle Replacement Cycles and Organized Dealership Expansion Drive Market Growth

The automotive retail market experiences substantial growth through accelerating vehicle replacement cycles across urban and semi-urban regions. Consumers increasingly upgrade vehicles within shorter timeframes as disposable incomes rise and financing becomes more accessible. This trend generates consistent demand for both new and certified pre-owned vehicles through established dealership networks.

OEM-certified used car programs gain prominence, offering quality assurance and warranty coverage that traditional secondary markets cannot match. Organized dealerships provide transparent pricing and vehicle history documentation, building consumer trust. These certified programs attract buyers seeking value without compromising reliability or service support.

Furthermore, expansion of auto financing options democratizes vehicle ownership across diverse income segments. Low-down-payment loan programs reduce entry barriers for first-time buyers and enable premium vehicle purchases. Banks and financial institutions partner with dealerships to streamline approval processes and offer competitive interest rates.

Multi-brand dealership showrooms reshape retail landscapes by offering comprehensive product comparisons under one roof. These consolidated facilities provide bundled services including insurance, financing, and maintenance packages. Consequently, customers benefit from convenient one-stop shopping experiences while dealerships optimize operational efficiencies and cross-selling opportunities.

Restraints

Digital Marketplaces and Operating Cost Pressures Constrain Dealership Profitability

The automotive retail sector faces significant margin pressure from online car marketplaces and price comparison platforms. Digital aggregators provide instant price transparency across multiple dealers, intensifying competition and reducing negotiation flexibility. Customers arrive at showrooms with comprehensive market knowledge, limiting dealership pricing power and compressing profit margins on vehicle sales.

Traditional dealerships struggle to differentiate value propositions beyond price in this transparent environment. Online platforms eliminate geographic advantages and expand competitive sets exponentially. Consequently, dealers increasingly compete on service quality and customer experience rather than information asymmetry.

High dealership operating costs further strain profitability amid margin compression. Showroom facilities require substantial investments in real estate, renovations, and compliance with manufacturer standards. Additionally, inventory holding costs tie up significant working capital, especially during slower sales periods or market downturns.

Compliance requirements mandate regular facility upgrades and technology investments to maintain franchise agreements. These fixed costs remain constant regardless of sales volumes, creating operational leverage challenges. Therefore, dealerships must achieve higher transaction volumes to maintain profitability thresholds, intensifying pressure on sales teams and marketing expenditures.

Growth Factors

Digital Platforms and Certified Pre-Owned Programs Unlock Market Expansion

Rapid scaling of digital vehicle booking and doorstep delivery platforms revolutionizes automotive retail convenience. Customers complete research, configuration, and financing online before scheduling test drives or home deliveries. This omnichannel approach reduces friction in the buying process and accommodates changing consumer preferences for digital interactions.

Technology integration enables virtual showrooms, 360-degree vehicle visualization, and augmented reality features. These tools enhance remote shopping experiences while reducing the need for extensive physical inventory displays. Consequently, dealerships optimize space utilization and inventory management through data-driven demand forecasting.

Certified pre-owned vehicle programs by OEM dealer groups represent substantial growth opportunities. These programs offer manufacturer-backed warranties and rigorous inspection standards, commanding premium pricing over independent used car sales. Moreover, certified programs improve inventory predictability through trade-in capture and lease returns.

Electric vehicle sales integration creates new service revenue streams through charging infrastructure installation and maintenance. Dealerships bundle EV purchases with home charging solutions and subscription-based charging network access. Additionally, subscription-based car ownership and leasing models provide flexible alternatives to traditional purchases. These programs generate recurring revenue while reducing customer commitment barriers, particularly appealing to younger demographics and urban populations seeking mobility without ownership responsibilities.

Emerging Trends

Omnichannel Integration and AI-Powered Tools Transform Automotive Retail Operations

The automotive retail sector undergoes fundamental transformation through omnichannel strategies combining online research with physical showroom experiences. Customers seamlessly transition between digital platforms and in-person interactions based on purchase stage requirements. Dealerships invest in unified customer relationship management systems to track buyer journeys across multiple touchpoints consistently.

This integrated approach accommodates diverse consumer preferences while maximizing engagement opportunities. Digital channels handle initial research and configuration, while showrooms focus on test drives and transaction finalization. Consequently, dealerships optimize resource allocation and improve conversion rates through specialized channel management.

Adoption of AI-based dynamic pricing and inventory forecasting tools enhances operational efficiency significantly. Machine learning algorithms analyze market conditions, competitor pricing, and historical sales data to recommend optimal pricing strategies. These systems enable real-time adjustments based on demand fluctuations and inventory aging.

Increasing dealership focus on aftersales service revenue diversification reduces dependence on vehicle sales margins. Service departments expand offerings to include accessories, detailing, and extended warranty products. Virtual showrooms and 360-degree vehicle visualization tools reduce physical inventory requirements while expanding product accessibility. These immersive technologies enable customers to explore vehicle features remotely, accelerating purchase decisions and improving satisfaction through transparent product presentation.

Regional Analysis

Asia Pacific Dominates the Automotive Retail Market with a Market Share of 49.50%, Valued at USD 339.6 Billion

Asia Pacific commands the largest automotive retail market share at 49.50%, valued at USD 339.6 Billion, driven by rapid urbanization and expanding middle-class populations. China and India represent massive growth engines with increasing vehicle ownership rates and improving dealership infrastructure. Furthermore, favorable government policies and local manufacturing capabilities enhance market accessibility and affordability across the region.

North America Automotive Retail Market Trends

North America maintains a mature automotive retail landscape characterized by extensive dealership networks and sophisticated financing systems. The United States hosts thousands of franchised dealers offering diverse vehicle portfolios and comprehensive service capabilities. Additionally, strong consumer purchasing power and established automotive culture sustain consistent demand levels despite market cyclicality.

Europe Automotive Retail Market Trends

Europe demonstrates strong automotive retail performance through premium brand concentration and advanced electric vehicle adoption. Stringent environmental regulations accelerate EV sales through dealership networks equipped with charging infrastructure. Moreover, multi-brand retail groups consolidate market presence, offering operational efficiencies and enhanced customer service standards.

Middle East and Africa Automotive Retail Market Trends

Middle East and Africa exhibit growth potential through infrastructure development and rising disposable incomes in key markets. Luxury vehicle segments perform particularly well in Gulf nations, while affordable compact segments drive volume growth in African markets. However, economic volatility and currency fluctuations create intermittent demand challenges across certain territories.

Latin America Automotive Retail Market Trends

Latin America shows recovery momentum following economic stabilization in major economies like Brazil and Mexico. Dealership networks expand into secondary cities as urbanization progresses and financing accessibility improves. Nevertheless, import tariffs and local content requirements influence vehicle pricing and model availability across different countries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Retail Company Insights

AutoNation maintains its position as one of America’s largest automotive retailers through extensive dealership networks spanning multiple states and brand franchises. The company leverages scale advantages in inventory procurement and operational efficiencies while investing heavily in digital customer engagement platforms. AutoNation’s omnichannel strategy integrates online vehicle browsing with in-store experiences, improving customer convenience and satisfaction.

Penske Automotive Group operates a geographically diversified portfolio of premium and luxury brand dealerships across North America and international markets. The company focuses on high-margin luxury segments while maintaining disciplined acquisition strategies for dealership expansion. Penske’s commercial vehicle distribution operations complement its retail business, providing exposure to fleet and industrial customers.

Lithia Motors pursues aggressive growth through strategic acquisitions and geographic market expansion across the United States. The company implements standardized operating procedures across acquired dealerships to achieve rapid integration and performance improvements. Lithia invests in technology platforms enabling seamless online-to-offline customer journeys and streamlined back-office operations.

Group 1 Automotive concentrates on luxury and premium brand dealerships in key metropolitan markets across the United States and United Kingdom. The company’s portfolio emphasizes brands with strong aftersales service requirements, generating recurring revenue opportunities. Group 1 maintains disciplined capital allocation strategies, balancing organic growth investments with strategic acquisitions.

Key Companies

- AutoNation

- Penske Automotive Group

- Lithia Motors

- Group 1 Automotive

- Sonic Automotive

- Asbury Automotive Group

- CarMax Inc.

- Carvana Co

- Lookers Plc

- Vertu Motors

Recent Developments

- In May 2025, Group 1 Automotive announced the acquisition of three luxury brand dealerships including a Lexus and an Acura in Fort Myers, Florida, and Mercedes-Benz of South Austin in Texas, expected to generate approximately USD 330 million in annual revenues for the company.

- In July 2025, Asbury Automotive Group completed the acquisition of The Herb Chambers Companies, expanding its portfolio with 33 dealerships, 52 franchises, and three collision centers in the Northeastern United States in a transaction valued at approximately USD 1.45 billion.

- In August 2025, Group 1 Automotive acquired Mercedes-Benz of Buckhead in Atlanta, Georgia, which is expected to generate roughly USD 210 million in annual revenues and expands the company’s luxury dealership presence in the Southeastern United States.

- In December 2025, Colorado’s Motor Vehicle Dealer Board granted Scout Motors, a Volkswagen Group-backed electric vehicle brand, a direct-to-consumer dealer license in Colorado, allowing the company to sell vehicles directly to customers without traditional franchised dealers.

Report Scope

Report Features Description Market Value (2025) USD 686.1 Billion Forecast Revenue (2035) USD 1467.6 Billion CAGR (2026-2035) 7.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (SUVs, Hatchback/Sedan, LCVs, HCVs), By Propulsion (ICE, Hybrid, Electric), By Services (Automotive Sales, Insurance Sales, Finance Sales, Spare Parts Sales, Maintenance & Other Services), By End-user (Individual Buyers, Fleet Operators) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AutoNation, Penske Automotive Group, Lithia Motors, Group 1 Automotive, Sonic Automotive, Asbury Automotive Group, CarMax Inc., Carvana Co, Lookers Plc, Vertu Motors Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AutoNation

- Penske Automotive Group

- Lithia Motors

- Group 1 Automotive

- Sonic Automotive

- Asbury Automotive Group

- CarMax Inc.

- Carvana Co

- Lookers Plc

- Vertu Motors