Global Automotive Resonator Market Size, Share, Growth Analysis By Material Type (Composite, Metal, Plastic, Rubber, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161317

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

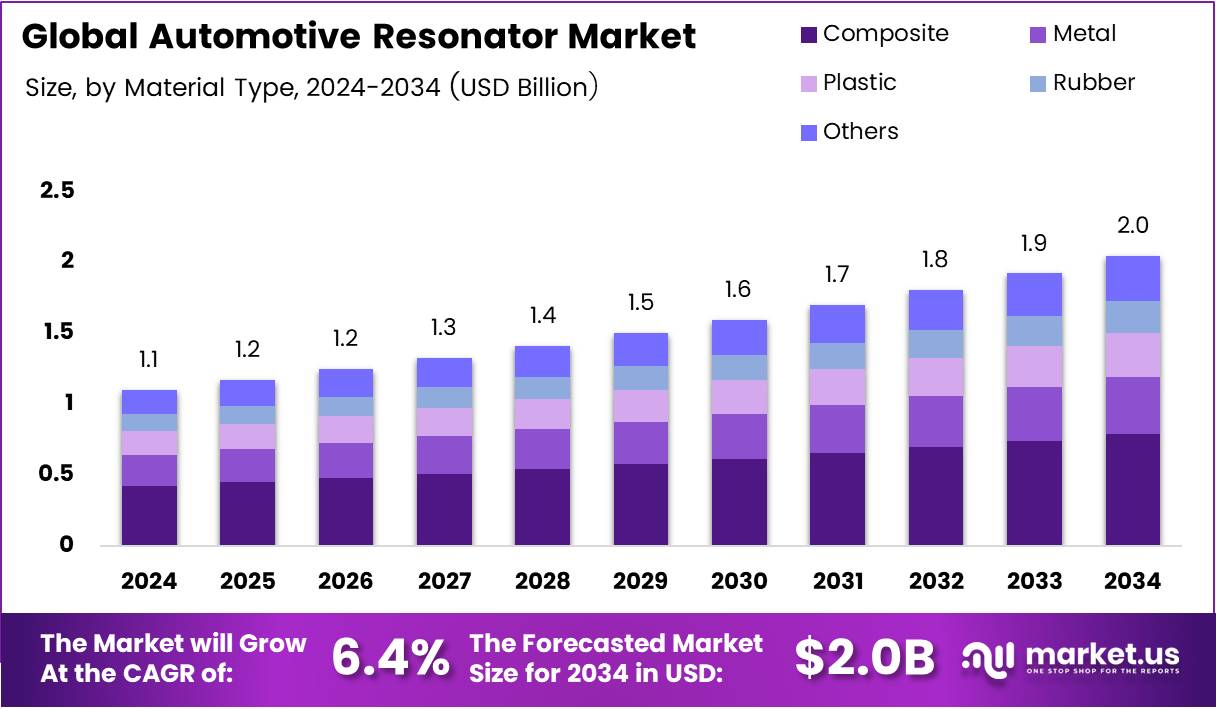

The Global Automotive Resonator Market size is expected to be worth around USD 2.0 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The Automotive Resonator Market represents a key segment within the automotive exhaust and intake systems industry, designed to reduce engine noise and enhance acoustic performance. It plays a critical role in improving vehicle comfort, meeting emission standards, and supporting sustainable mobility trends. Manufacturers are increasingly investing in lightweight, durable resonator materials to enhance efficiency.

Moreover, rising consumer demand for quieter and fuel-efficient vehicles continues to drive technological advancements in acoustic engineering. Automakers are integrating advanced exhaust resonator designs that minimize vibration and noise, improving both performance and driving experience. This innovation is fostering strong competition and partnership opportunities among OEMs and component suppliers.

Furthermore, government initiatives toward emission reduction and stricter regulatory standards are propelling the adoption of advanced resonator systems. With regulations tightening in Europe, North America, and Asia-Pacific, manufacturers are focusing on compliant and cost-effective NVH (Noise, Vibration, and Harshness) control technologies. This regulatory pressure stimulates consistent market growth and product innovation.

Additionally, the shift toward hybrid and electric vehicles introduces new design challenges and opportunities. While EVs require less exhaust management, manufacturers are developing intake and cabin acoustic resonators to maintain noise balance. Consequently, research investments are expanding in this segment, driving new market potential across evolving automotive platforms.

From a regional perspective, Latin America demonstrates strong momentum in automotive production. According to the International Organization of Motor Vehicle Manufacturers (OICA), Mexico produced 3,989,403 units in 2024, marking a 5.56% increase over 2023. Similarly, Brazil achieved 2.55 million vehicle output in 2024, reflecting a 10% YoY growth, sustaining demand for exhaust NVH hardware.

Key Takeaways

- The Global Automotive Resonator Market is projected to reach USD 2.0 Billion by 2034, growing from USD 1.1 Billion in 2024 at a CAGR of 6.4% (2025–2034).

- Composite materials led the By Material Type segment in 2024 with a 38.4% share, driven by demand for lightweight and noise-reducing materials.

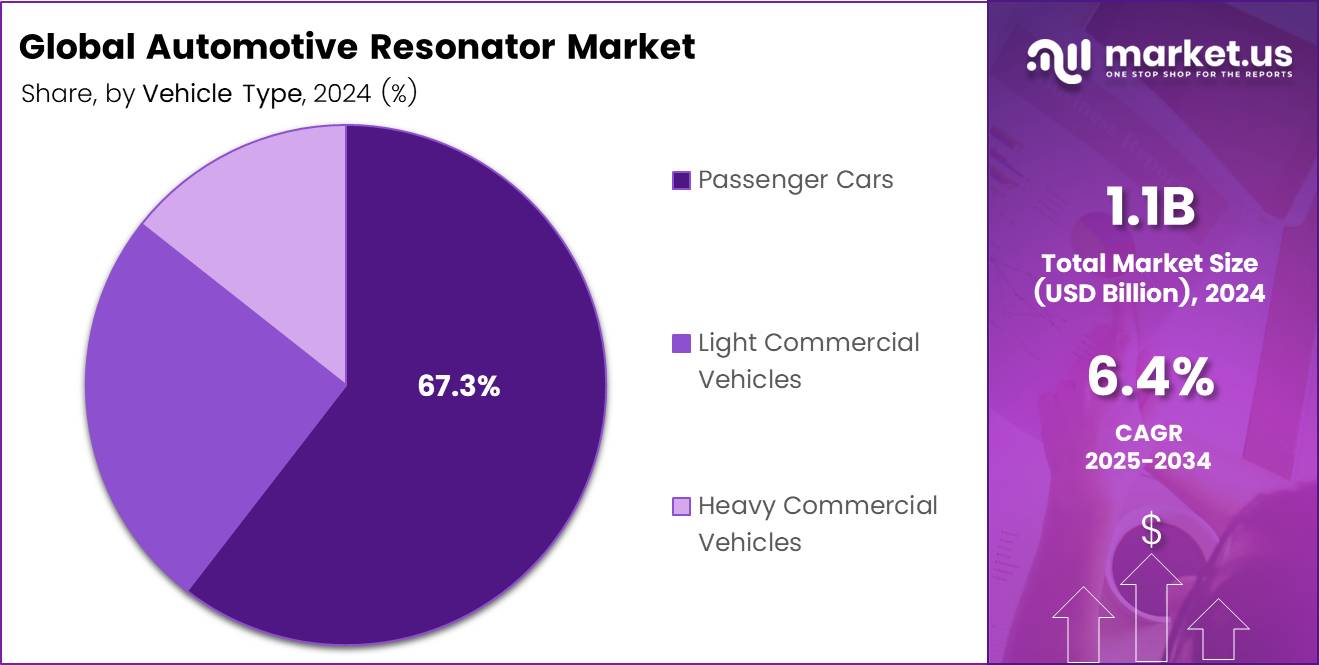

- Passenger Cars dominated the By Vehicle Type segment in 2024 with a 67.3% market share, supported by rising sales and focus on cabin comfort.

- OEMs held an 82.7% share in the By Sales Channel segment in 2024, as automakers integrate resonators directly into new vehicle designs.

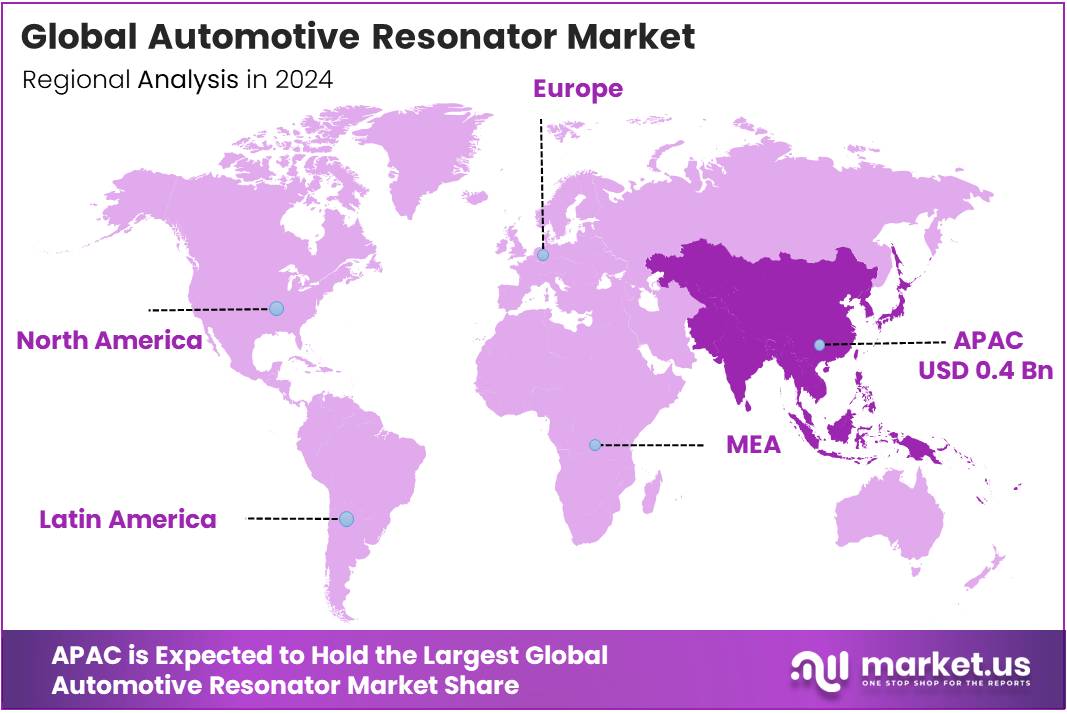

- The Asia-Pacific region led globally with a 43.8% share valued at USD 0.4 Billion, supported by strong automotive production in China, Japan, and South Korea.

By Material Type Analysis

Composite dominates with 38.4% due to its lightweight nature and superior acoustic damping capabilities.

In 2024, Composite held a dominant market position in the By Material Type segment of the Automotive Resonator Market, with a 38.4% share. Its increasing use in advanced vehicle manufacturing is driven by the demand for lightweight materials that enhance fuel efficiency and noise control performance.

The Metal segment continues to play a significant role owing to its high durability and thermal resistance. Metal resonators are preferred in heavy-duty vehicles where structural strength and heat endurance are essential, ensuring consistent acoustic performance under extreme conditions.

The Plastic segment is witnessing steady growth due to cost-effectiveness and ease of production. Automakers are adopting high-grade plastics for resonator designs, as they reduce overall vehicle weight and simplify manufacturing processes while maintaining effective noise attenuation.

The Rubber segment shows potential as it provides excellent vibration absorption. Rubber-based resonators are being increasingly integrated in compact car designs to minimize road noise and enhance passenger comfort.

The Others category includes hybrid or experimental materials combining multiple composites. These materials are being researched for enhanced sound suppression, environmental sustainability, and recyclability, offering future growth prospects in the market.

By Vehicle Type Analysis

Passenger Cars dominate with 67.3% due to growing consumer demand and rising vehicle production.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Automotive Resonator Market, with a 67.3% share. Increasing sales of passenger cars and emphasis on cabin comfort are fueling the demand for efficient resonator systems worldwide.

The Light Commercial Vehicles segment is expanding as these vehicles increasingly adopt resonators for better noise management. Manufacturers are integrating advanced acoustic technologies to enhance driver comfort and meet stringent regulatory noise standards.

The Heavy Commercial Vehicles segment remains crucial due to growing logistics and freight transportation. These vehicles utilize robust resonators designed to withstand high operational stress while maintaining effective noise reduction over long distances.

By Sales Channel Analysis

OEM dominates with 82.7% due to strong manufacturer partnerships and integration in new vehicles.

In 2024, OEM held a dominant market position in the By Sales Channel segment of the Automotive Resonator Market, with a 82.7% share. Original Equipment Manufacturers integrate resonators directly into new vehicle designs to ensure consistent performance, durability, and compliance with global emission and noise regulations.

The Aftermarket segment, although smaller, is growing steadily due to increasing replacement needs and customization preferences. Consumers are turning to aftermarket suppliers for advanced resonators that enhance sound tuning and driving experience while maintaining affordability.

Key Market Segments

By Material Type

- Composite

- Metal

- Plastic

- Rubber

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Demand for Noise and Vibration Reduction in Passenger Vehicles Drives Market Growth

The automotive resonator market is gaining momentum due to the growing need for quieter and smoother driving experiences. Consumers increasingly prefer vehicles that offer minimal engine and road noise, driving automakers to adopt advanced resonator systems. These components play a key role in reducing vibrations and enhancing cabin comfort, especially in premium and passenger vehicles.

Another major driver is the shift toward lightweight exhaust systems. Automakers are focusing on using lightweight materials such as aluminum and composites to improve fuel efficiency and reduce emissions. Lightweight resonators help achieve better performance while maintaining noise reduction capabilities, aligning with global trends toward sustainable mobility.

Strict government regulations on vehicle noise emissions are also influencing market growth. Regulatory bodies across North America, Europe, and Asia are enforcing stringent noise limits, prompting manufacturers to integrate high-performance resonators into their designs. This compliance-driven demand is pushing innovation in resonator technology.

Moreover, expanding vehicle production in emerging economies like India, China, and Brazil is boosting market growth. These regions are witnessing rapid industrialization, increasing vehicle ownership, and a growing preference for comfort-oriented vehicles. As a result, global automakers are investing heavily in advanced exhaust systems, further driving the automotive resonator market forward.

Restraints

High Cost of Advanced Resonator Materials and Manufacturing Limits Market Expansion

The automotive resonator market faces challenges due to the high cost of advanced materials used in production. Modern resonators often require specialized metals and composites to achieve desired acoustic and thermal properties, increasing manufacturing expenses. This makes it difficult for cost-sensitive vehicle manufacturers to adopt these technologies widely.

Integrating resonators with electric vehicle (EV) architectures also presents technical challenges. Unlike traditional combustion vehicles, EVs have different space constraints and noise profiles, requiring custom resonator designs. This complexity often leads to higher design costs and extended development times, limiting rapid adoption.

Another restraint is the limited aftermarket demand for resonators. Since these components have a long lifespan and rarely require replacement, the aftermarket segment contributes little to revenue growth. This reduces overall market potential, especially for smaller suppliers focusing on replacement parts.

Fluctuating raw material prices further affect production margins. Prices of metals and composites used in resonator manufacturing often vary due to supply chain disruptions or global trade fluctuations. These cost instabilities make it difficult for manufacturers to maintain profitability, creating uncertainty in the market outlook.

Growth Factors

Development of Compact Resonators for Electric and Hybrid Vehicles Creates New Growth Opportunities

The shift toward electric and hybrid vehicles is opening new opportunities for compact and efficient resonator systems. As EVs generate different sound frequencies compared to combustion engines, manufacturers are developing specialized resonators to manage motor and road noise. This creates a new market niche focused on quiet yet lightweight acoustic solutions.

The integration of 3D printing and smart manufacturing is also transforming resonator production. Additive manufacturing allows for complex designs and rapid prototyping, helping automakers produce customized parts at lower costs. This approach enhances design flexibility and accelerates innovation in exhaust component manufacturing.

Growing demand for customizable acoustic solutions in luxury and performance vehicles is another opportunity. Premium car buyers expect refined sound quality and superior comfort, leading automakers to invest in high-end resonator technologies. This trend supports the development of tailored sound management systems.

Furthermore, expanding partnerships between automotive OEMs and NVH (Noise, Vibration, and Harshness) specialists are fostering innovation. Collaborative efforts enable the creation of integrated solutions that improve overall vehicle sound dynamics and efficiency, driving future growth in the automotive resonator market.

Emerging Trends

Growing Use of Computational Acoustic Simulation in Resonator Design Shapes Market Trends

The automotive resonator market is witnessing a strong trend toward using computational acoustic simulation in design and development. This advanced technology allows engineers to predict and optimize sound behavior digitally, reducing prototyping costs and improving design accuracy. It helps manufacturers create resonators that deliver optimal acoustic performance with minimal material waste.

Another major trend is the shift toward sustainable and recyclable materials. Automakers are increasingly adopting eco-friendly metals and composites to reduce the environmental impact of exhaust systems. This aligns with global sustainability goals and supports circular economy practices within the automotive industry.

The rising adoption of Active Noise Control (ANC) technologies is also influencing resonator design. By combining traditional resonators with electronic sound-canceling systems, automakers can achieve superior noise reduction, especially in electric vehicles where mechanical noise is minimal.

Lastly, technological collaboration between automakers and acoustic engineering firms is shaping the market landscape. These partnerships encourage the co-development of next-generation resonator systems, integrating advanced materials, digital simulations, and smart noise control methods, ultimately driving innovation and competitiveness in the automotive resonator market.

Regional Analysis

Asia-Pacific Dominates the Automotive Resonator Market with a Market Share of 43.8%, Valued at USD 0.4 Billion

The Asia-Pacific region leads the global automotive resonator market, accounting for 43.8% of the total share and valued at USD 0.4 billion. The dominance is driven by the region’s robust automotive manufacturing base, expanding vehicle production, and increasing adoption of advanced exhaust systems for emission control. Countries such as China, Japan, and South Korea are at the forefront of technological innovation, fueling market growth through the integration of lightweight materials and enhanced acoustic performance solutions.

North America Automotive Resonator Market Trends

North America holds a substantial position in the automotive resonator market, supported by strong demand for high-performance vehicles and a focus on noise reduction technologies. The presence of advanced automotive infrastructure and stringent noise and emission regulations encourages the adoption of efficient resonator systems. Additionally, rising investments in electric and hybrid vehicles further drive product innovations and applications across the region.

Europe Automotive Resonator Market Trends

Europe’s automotive resonator market is characterized by a strong emphasis on sustainable mobility and advanced exhaust system designs. The region’s commitment to reducing carbon emissions and enhancing vehicle acoustics has prompted manufacturers to adopt innovative resonator technologies. Increasing demand for luxury and premium vehicles, coupled with regulatory compliance requirements, continues to boost market growth across key economies such as Germany, France, and the United Kingdom.

Middle East and Africa Automotive Resonator Market Trends

The Middle East and Africa region shows steady development in the automotive resonator market, driven by growing automobile imports and the gradual establishment of regional manufacturing hubs. Rising urbanization and improving road infrastructure are supporting the adoption of passenger and commercial vehicles equipped with advanced exhaust technologies. Moreover, increasing awareness regarding vehicle performance and maintenance is enhancing demand for high-quality resonator components.

Latin America Automotive Resonator Market Trends

In Latin America, the automotive resonator market is expanding gradually due to the recovery of the automotive industry and growing focus on vehicle efficiency. Economic improvements and government initiatives to modernize transportation systems are contributing to market growth. Moreover, an increasing number of consumers are seeking vehicles with enhanced sound quality and reduced emissions, fostering the demand for advanced resonator solutions across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Resonator Company Insights

The global Automotive Resonator Market in 2024 is witnessing steady growth driven by advancements in noise reduction technologies, emission control systems, and lightweight materials.

Among the leading companies, Faurecia continues to strengthen its position through innovation in exhaust and acoustic systems. The company’s focus on sustainable materials and efficient design integration aligns with the growing demand for eco-friendly vehicles, giving it a competitive edge in OEM partnerships worldwide.

MANN+HUMMEL remains a prominent player, leveraging its expertise in filtration and air management systems to develop high-performance resonators that enhance vehicle acoustics and efficiency. The company’s strong R&D base and global presence allow it to cater to both internal combustion and hybrid vehicle segments effectively, ensuring resilience amid industry transitions.

AISIN CORPORATION showcases technological excellence through its precision-engineered components that contribute to vibration reduction and sound quality optimization. With a strategic emphasis on electrification and advanced materials, AISIN is well-positioned to serve next-generation vehicle platforms, particularly in the Asian automotive markets.

K&N Engineering, Inc. maintains its reputation as a leader in performance aftermarket solutions, focusing on air intake systems and resonators designed to improve airflow and acoustic tuning. Its strong brand identity and loyal customer base in the performance vehicle sector continue to drive growth, particularly in North America and Europe.

Overall, the market outlook in 2024 reflects a strong balance between OEM innovation and aftermarket demand, with major players investing in acoustic efficiency, sustainability, and lightweight design to meet evolving automotive standards.

Top Key Players in the Market

- Faurecia

- MANN+HUMMEL

- AISIN CORPORATION

- K&N Engineering, Inc.

- Tenneco Inc.

- Donaldson Company, Inc.

- ContiTech Deutschland GmbH

- Emerson Electric Co.

- Toyoda Gosei Co., Ltd.

Recent Developments

- In September 2025, AutoDukan secured $1 million in Pre-Series A funding to accelerate its mission of transforming India’s auto aftermarket through digital innovation and supply chain optimization. The investment will support product expansion, tech development, and strategic partnerships across the automotive ecosystem.

- In May 2025, Autoneum announced the acquisition of Chinese automotive supplier Chengdu FAW-Sihuan Automobile Interior Parts, strengthening its presence in Asia. The move enhances Autoneum’s capabilities in acoustic and thermal management solutions for the automotive industry.

- In April 2024, Vehicle Accessories completed the acquisition of Maxton Group, a leading manufacturer of car styling and performance parts. This deal expands Vehicle Accessories’ product portfolio and international market reach within the premium automotive segment.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Composite, Metal, Plastic, Rubber, Others), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Faurecia, MANN+HUMMEL, AISIN CORPORATION, K&N Engineering, Inc., Tenneco Inc., Donaldson Company, Inc., ContiTech Deutschland GmbH, Emerson Electric Co., Toyoda Gosei Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Resonator MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Resonator MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Faurecia

- MANN+HUMMEL

- AISIN CORPORATION

- K&N Engineering, Inc.

- Tenneco Inc.

- Donaldson Company, Inc.

- ContiTech Deutschland GmbH

- Emerson Electric Co.

- Toyoda Gosei Co., Ltd.