Global Automotive Power Inductor Market Size, Share, Growth Analysis By Product (Wire-Wound Inductors, Ferrite Core Inductors, Powdered Iron Core Inductors, Toroidal Inductors, Multilayer Chip Inductors (MLCI), Composite/Nanocrystalline Inductors), By Material (Ferrite, Powdered iron, Nanocrystalline, Amorphous alloys, Advanced composites / ceramic-based), By Mounting (Surface-Mount (SMD) Inductors, Through-Hole / Leaded Inductors, Module-Integrated Embedded Inductors, Planar PCB-Embedded Inductors, Shielded Vs. Unshielded Variants), By Inductance (Very Low Inductance 100 µH), By Frequency of Operation (Low-Frequency Inductors (kHz Range), Mid-Frequency Inductors, High-Frequency Switching Inductors (100 kHz – MHz), Wideband/Broadband Inductors), By Power Rating (Low-Voltage, Medium-Voltage, High-Voltage, Ultra-High-Voltage), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By End-User (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166736

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Analysis

- By Material Analysis

- By Mounting Analysis

- By Inductance Analysis

- By Frequency of Operation Analysis

- By Power Rating Analysis

- By Vehicle Type Analysis

- By End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Automotive Power Inductor Company Insights

- Recent Developments

- Report Scope

Report Overview

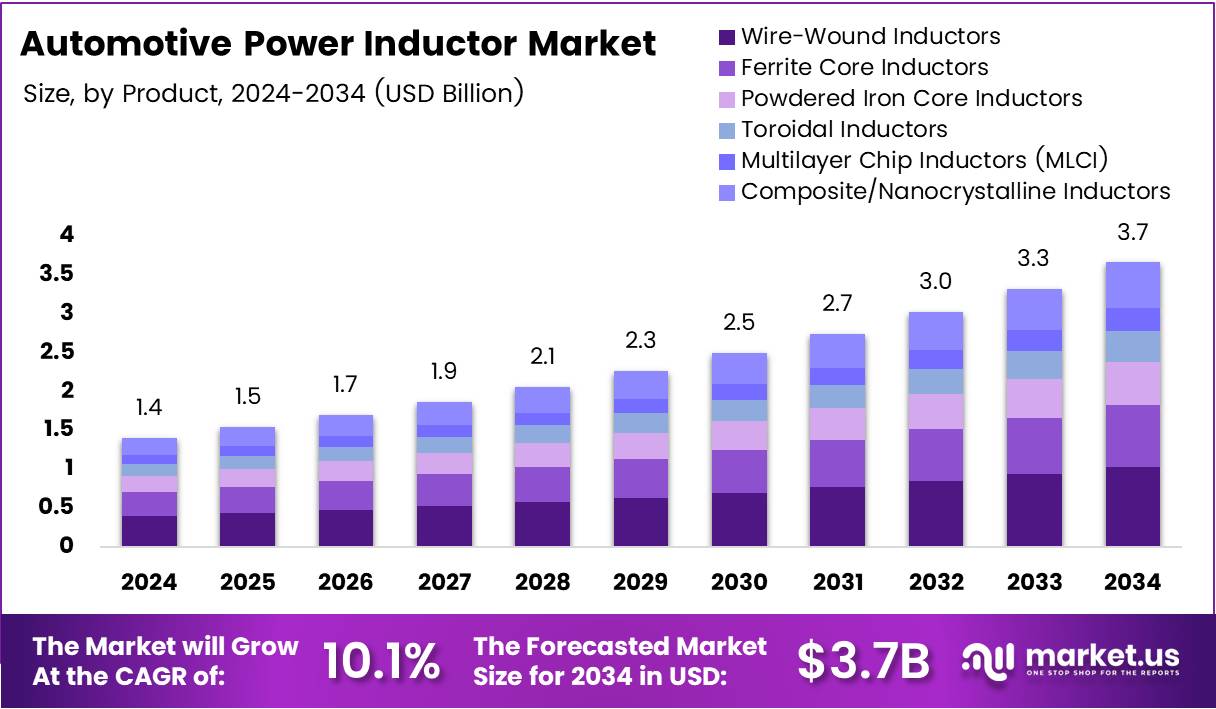

The Global Automotive Power Inductor Market size is expected to be worth around USD 3.7 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034.

The automotive power inductor market refers to components that manage energy storage and filtering inside vehicle electronics. These inductors support key systems such as powertrains, onboard chargers, ADAS units and battery-management modules. Consequently, rising vehicle electrification increases demand for stable, efficient inductive components across EV and hybrid platforms.

Moreover, the market grows as OEMs push higher power density, improved thermal stability and compact design. Automotive-grade power inductors help manufacturers enhance system reliability while meeting strict efficiency benchmarks. Therefore, increasing electronic complexity in modern vehicles directly elevates adoption, strengthening supplier opportunities across powertrain and infotainment applications.

Furthermore, global investments in EV infrastructure and clean-mobility initiatives boost market expansion. Governments encourage energy-efficient vehicles through incentives, stricter emission rules and charging-network development. As regulations tighten, manufacturers rely on advanced inductors to support compliance, reduce losses and maintain performance under harsh automotive environments.

Additionally, expanding semiconductor integration accelerates demand for ruggedized inductive components. Tier-1 suppliers increasingly adopt high-frequency designs to support fast-charging systems, DC-DC converters and advanced battery architectures. As a result, the automotive power inductor landscape benefits from continuous innovation, enabling new opportunities in thermal management, miniaturization and high-current handling.

Finally, industry research confirms rising component intensity per vehicle. According to industry research (2023), a car requires more than 100 power inductors, over twice the count used in a smartphone. Also, according to industry research (2024), electric car sales neared 14 million, with 95% concentrated in China, Europe and the United States, reinforcing strong market potential.

Key Takeaways

- The Global Automotive Power Inductor Market is projected to reach USD 3.7 Billion by 2034, up from USD 1.4 Billion in 2024 at a 10.1% CAGR.

- Wire-Wound Inductors lead the product segment with a 33.8% share in 2024.

- Ferrite material dominates the material segment with a 48.1% share.

- Surface-Mount (SMD) inductors hold the largest mounting share at 61.2%.

- Low Inductance (1–10 µH) inductors account for 41.6% of the inductance segment.

- High-Frequency Switching inductors (100 kHz–MHz) lead the frequency segment with 41.7% share.

- Low-Voltage inductors dominate the power rating segment with 44.3% share.

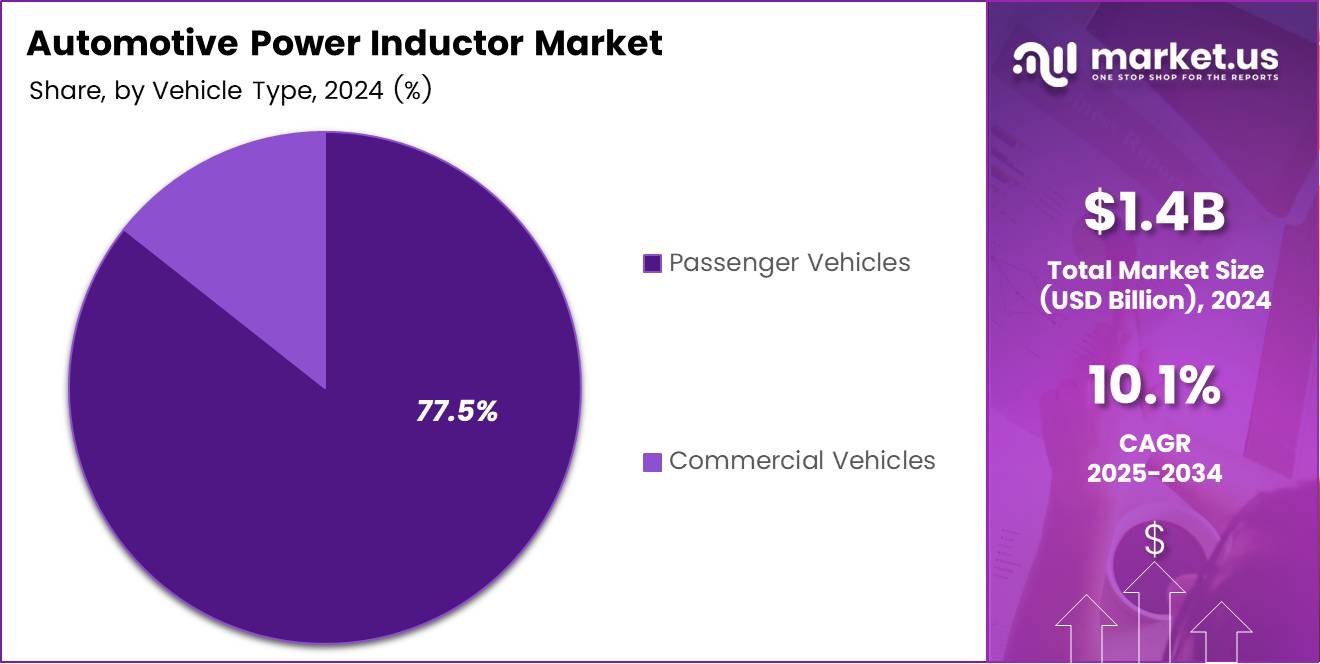

- Passenger Vehicles represent 77.5% of the vehicle type segment.

- OEMs account for 85.3% of the end-user segment.

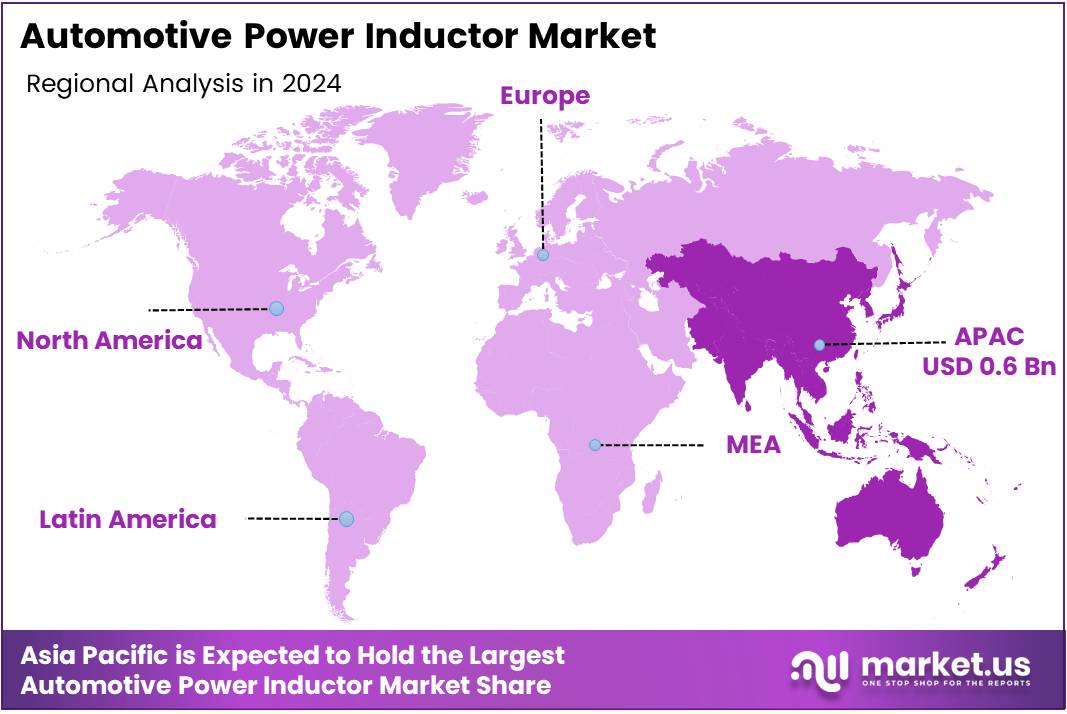

- Asia Pacific leads regionally with a 47.2% share valued at USD 0.6 Billion.

By Product Analysis

Wire-Wound Inductors dominate with 33.8% due to their superior current-handling capacity and durability.

In 2024, Wire-Wound Inductors held a dominant market position in the By Product segment of the Automotive Power Inductor Market, with a 33.8% share. These inductors are favored for their high efficiency and reliability, supporting advanced automotive electronics, electric drivetrains, and infotainment systems in modern vehicles.

Ferrite Core Inductors exhibit strong demand due to their cost-effectiveness and compact design. They efficiently suppress noise and manage power in low to medium-frequency automotive circuits, making them suitable for applications in DC-DC converters and onboard chargers where size and performance optimization are crucial.

Powdered Iron Core Inductors continue to gain traction for their resilience against magnetic saturation and thermal stability. Their ability to sustain performance under high current loads makes them ideal for EV powertrains and energy storage systems requiring stable inductance over variable operating conditions.

Toroidal Inductors and Multilayer Chip Inductors (MLCI) contribute to compact automotive circuits with improved efficiency and reduced electromagnetic interference. Additionally, Composite/Nanocrystalline Inductors are emerging for high-frequency, high-temperature automotive environments, offering precise energy regulation for next-generation electric and hybrid vehicles.

By Material Analysis

Ferrite dominates with 48.1% due to its magnetic efficiency and low core losses.

In 2024, Ferrite materials held a dominant market position in the By Material segment of the Automotive Power Inductor Market, with a 48.1% share. Widely used for their high permeability and excellent energy conversion efficiency, ferrite inductors are essential for EV control systems and onboard electronics.

Powdered Iron materials remain crucial for balancing performance and cost in automotive power applications. Their distributed air gaps help maintain stability under fluctuating current, making them suitable for high-power modules and converters in internal combustion and hybrid vehicles.

Nanocrystalline materials are growing rapidly, offering superior magnetic flux density and minimal energy loss. These materials are key enablers of miniaturized, high-performance inductors that meet stringent automotive energy-efficiency and thermal requirements.

Amorphous Alloys and Advanced Composites / Ceramic-Based materials are gaining attention for next-generation EV systems. Their lightweight and heat-resistant characteristics contribute to the durability and precision of high-frequency inductor designs, supporting improved energy utilization in powertrain and safety electronics.

By Mounting Analysis

Surface-Mount (SMD) Inductors dominate with 61.2% due to their compactness and manufacturing efficiency.

In 2024, Surface-Mount (SMD) Inductors held a dominant market position in the By Mounting segment of the Automotive Power Inductor Market, with a 61.2% share. Their compatibility with automated assembly and space-efficient design make them ideal for high-density automotive electronics systems and electric drive circuits.

Through-Hole / Leaded Inductors maintain a presence in heavy-duty applications due to their robustness and high current tolerance. They are widely used in commercial vehicles and under-hood environments where vibration resistance and mechanical strength are critical.

Module-Integrated Embedded Inductors are expanding with the evolution of integrated power systems. These inductors improve circuit reliability by minimizing parasitic losses and are increasingly adopted in EV charging and inverter modules.

Planar PCB-Embedded Inductors and Shielded vs. Unshielded Variants serve miniaturized designs. Shielded versions reduce EMI interference, while planar designs support thin, lightweight automotive modules, aligning with trends toward compact vehicle architecture and advanced driver-assistance systems.

By Inductance Analysis

Low Inductance (1–10 µh) dominates with 41.6% due to its versatility in switching circuits.

In 2024, Low Inductance (1–10 µh) held a dominant market position in the By Inductance segment of the Automotive Power Inductor Market, with a 41.6% share. These inductors are essential in power converters and motor control systems, offering quick response and efficient energy transfer.

Very Low Inductance (<1 µh) inductors cater to ultra-fast switching automotive circuits. They are primarily used in high-speed controllers and signal filtering applications where minimal delay and accurate power flow are vital.

Medium Inductance (10–100 µh) solutions balance current capacity and filtering ability. They serve as reliable components in EV power management and infotainment units requiring stable current regulation.

High Inductance (>100 µh) components support systems needing sustained energy storage and filtering, such as DC link circuits and electric motor drives, ensuring reduced ripple and improved voltage stability.

By Frequency of Operation Analysis

High-Frequency Switching Inductors (100 Khz–Mhz) dominate with 41.7% due to their role in modern EV power circuits.

In 2024, High-Frequency Switching Inductors (100 Khz–Mhz) held a dominant market position in the By Frequency of Operation segment of the Automotive Power Inductor Market, with a 41.7% share. Their compact design and efficiency make them crucial for advanced converters and fast-charging systems.

Low-Frequency Inductors (Khz Range) remain relevant in analog automotive systems and audio circuits, where stable filtering and noise suppression are essential for sound quality and system reliability.

Mid-Frequency Inductors bridge low and high-frequency operations, supporting moderate switching systems such as power steering modules and hybrid vehicle electronics where consistent efficiency is required.

Wideband/Broadband Inductors are gaining interest with evolving communication and telematics systems. They support a wide frequency spectrum, improving signal clarity and electromagnetic compatibility within connected vehicle networks.

By Power Rating Analysis

Low-Voltage dominates with 44.3% owing to its widespread use in vehicle electronics and sensors.

In 2024, Low-Voltage inductors held a dominant market position in the By Power Rating segment of the Automotive Power Inductor Market, with a 44.3% share. They are widely used in infotainment systems, lighting, and communication circuits due to their stability and efficiency at moderate power levels.

Medium-Voltage inductors serve hybrid systems requiring higher energy transfer and efficiency. Their role in electric drivetrain converters ensures steady current flow and minimizes losses during acceleration and regenerative braking.

High-Voltage inductors cater to electric vehicle propulsion systems and high-performance modules, offering durability and improved energy conversion efficiency under elevated load conditions.

Ultra-High-Voltage inductors support next-generation charging infrastructure and battery management systems, ensuring robust performance and safety in extreme conditions associated with fast-charging and grid-integrated EV systems.

By Vehicle Type Analysis

Passenger Vehicles dominate with 77.5% as electrification and electronics integration surge globally.

In 2024, Passenger Vehicles held a dominant market position in the By Vehicle Type segment of the Automotive Power Inductor Market, with a 77.5% share. The rising demand for EVs and hybrid passenger cars has accelerated inductor adoption in safety, infotainment, and powertrain applications.

Commercial Vehicles continue to integrate high-power inductors for load-bearing and endurance applications. They focus on enhancing reliability and efficiency across heavy-duty power systems, contributing to fleet electrification and fuel economy goals.

By End-User Analysis

OEM dominates with 85.3% due to large-scale integration in factory-installed vehicle systems.

In 2024, OEM held a dominant market position in the By End-User segment of the Automotive Power Inductor Market, with a 85.3% share. Automakers increasingly use advanced inductors in EV architectures, infotainment systems, and ADAS modules to achieve compactness and energy efficiency.

Aftermarket demand remains consistent as older vehicles upgrade to modern electronics and efficient power components. The segment benefits from the growing trend of retrofitting electric modules and battery management solutions in conventional vehicles.

Key Market Segments

By Product

- Wire-Wound Inductors

- Ferrite Core Inductors

- Powdered Iron Core Inductors

- Toroidal Inductors

- Multilayer Chip Inductors (MLCI)

- Composite/Nanocrystalline Inductors

By Material

- Ferritea

- Powdered iron

- Nanocrystalline

- Amorphous alloys

- Advanced composites / ceramic-based

By Mounting

- Surface-Mount (SMD) Inductors

- Through-Hole / Leaded Inductors

- Module-Integrated Embedded Inductors

- Planar PCB-Embedded Inductors

- Shielded Vs. Unshielded Variants

By Inductance

- Very Low Inductance (<1 µH)

- Low Inductance (1–10 µH)

- Medium (10–100 µH)

- High (>100 µH)

By Frequency of Operation

- Low-Frequency Inductors (kHz Range)

- Mid-Frequency Inductors

- High-Frequency Switching Inductors (100 kHz – MHz)

- Wideband/Broadband Inductors

By Power Rating

- Low-Voltage

- Medium-Voltage

- High-Voltage

- Ultra-High-Voltage

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By End-User

- OEM

- Aftermarket

Drivers

Rising Adoption of High-Efficiency Power Electronics in EV Drivetrains Drives Market Growth

The automotive power inductor market is expanding as electric vehicles increasingly rely on high-efficiency power electronics. Power inductors help regulate energy flow, making EV drivetrains more efficient and reliable. As automakers push for better battery performance and longer driving ranges, the demand for inductors that support stable and low-loss power conversion continues to grow.

Advanced driver-assistance systems (ADAS) are also boosting the need for dependable power management components. Features like lane-keeping, adaptive cruise control, and automated braking require clean and stable electrical signals, making power inductors a key part of modern safety systems. Their role in reducing noise and ensuring consistent performance is becoming more critical.

The expansion of on-board charging systems is another important driver. Vehicles are now equipped with higher-power charging modules, which require inductors that can withstand greater loads while maintaining compact size. This is pushing manufacturers to develop components with superior thermal and electrical properties.

Lastly, the industry’s move toward lightweight and compact components is creating steady demand. Automakers continue to shrink electronic modules, and smaller inductors help reduce overall vehicle weight while supporting higher power density. This shift enhances efficiency and supports better design flexibility across EV platforms.

Restraints

Fluctuating Raw Material Prices Impacting Magnetic Core Production Restrains Market Growth

The automotive power inductor market faces challenges from unstable raw material prices, especially those used in magnetic cores like ferrite and powdered metals. These fluctuations increase production costs and reduce profit margins for manufacturers. Since inductors rely heavily on specialized magnetic materials, even small price shifts can impact overall supply chain planning and product affordability.

Complex qualification and testing standards also restrain market adoption. Automotive inductors must meet strict reliability and safety requirements before being approved for vehicle use. These processes often take several months and require extensive evaluation under harsh environmental conditions. As a result, the development cycle becomes longer, slowing down the integration of new inductor technologies.

Manufacturers must also invest heavily in certification and validation, adding to operational expenses. Smaller suppliers may find it difficult to meet these regulatory demands, limiting broader market participation. This concentrated supplier base can lead to supply bottlenecks and delayed product launches.

Additionally, constant updates to automotive electronics standards require frequent redesigns and compliance checks. This further slows down adoption cycles as companies must continuously adjust their inductor designs. Overall, these restraints create barriers that may limit the rapid scaling of high-performance inductors in modern automotive applications.

Growth Factors

Development of Inductors Optimized for Wide-Bandgap Semiconductors Drives Market Opportunities

The automotive power inductor market is seeing strong growth opportunities with the rise of wide-bandgap semiconductors such as SiC and GaN. These technologies enable faster switching and higher efficiency, creating demand for inductors designed to operate at greater frequencies and temperatures. Manufacturers that innovate in this area can capture significant market share as EV powertrains continue to evolve.

Autonomous vehicle systems are another major opportunity. As compute modules become more powerful, they require inductors that deliver reliable performance under constant high loads. High-reliability inductors help maintain stable voltage regulation, making them essential components for self-driving technologies.

Smart inductors with built-in sensing capabilities offer new possibilities for predictive maintenance and real-time system monitoring. By providing temperature, current, or magnetic field data, they help enhance automotive system diagnostics and improve long-term reliability. This trend supports the wider shift toward intelligent and connected vehicle architectures.

Custom inductor designs for ultra-fast DC-DC converters in EVs also present a promising growth path. As carmakers develop faster-charging and higher-density power modules, tailored inductors will play a key role in achieving optimal efficiency. This customization trend opens new revenue streams for component manufacturers focused on advanced EV platforms.

Emerging Trends

Miniaturization of High-Current Inductors for Compact Powertrains Drives Market Trends

A key trend in the automotive power inductor market is the push toward miniaturized high-current inductors that fit into increasingly compact powertrain designs. Automakers are reducing the size of electronic units while demanding higher performance, encouraging suppliers to create smaller inductors without sacrificing power handling capability.

Another important trend is the growing use of shielded inductors to reduce electromagnetic interference (EMI). With more electronic systems operating simultaneously—including ADAS, infotainment, and battery management—shielded inductors help ensure stable operation and minimize noise between components. This is becoming essential for next-generation vehicle architectures.

The expansion of high-temperature inductor materials is also reshaping the market. Under-hood environments expose components to extreme heat, requiring inductors capable of maintaining performance under thermal stress. New material innovations are enabling inductors to operate safely and efficiently in harsh conditions.

Lastly, the adoption of surface-mount inductors is rising as modern automotive ECUs transition to highly integrated circuit designs. Surface-mount devices offer better automation compatibility, improved reliability, and reduced space requirements. This trend supports the growing demand for compact, lightweight, and thermally efficient electronic modules across all vehicle segments.

Regional Analysis

Asia Pacific Dominates the Automotive Power Inductor Market with a Market Share of 47.2%, Valued at USD 0.6 Billion

The Asia Pacific region leads the automotive power inductor market, accounting for 47.2% of the global share and reaching a valuation of USD 0.6 Billion. This dominance is supported by extensive automotive manufacturing capabilities, rapid electrification of vehicles, and strong government initiatives promoting EV adoption. The region’s expanding supply chain ecosystem and rising production of advanced electronic components further enhance its competitive position.

North America Automotive Power Inductor Market Trends

North America demonstrates steady growth in the automotive power inductor market, driven by rising investment in electric and autonomous vehicle technologies. The region benefits from strong R&D activities and increasing integration of advanced electronics in modern vehicles. Supportive regulatory frameworks and the presence of technologically advanced automotive infrastructure fuel sustained demand for high-performance inductive components.

Europe Automotive Power Inductor Market Trends

Europe’s automotive power inductor market is propelled by stringent emission regulations and a strong push toward green mobility. The region is a major hub for premium vehicle manufacturing, which increases the adoption of efficient power management components. Its rapid transition toward hybrid and fully electric vehicles continues to create consistent demand for high-quality power inductors.

Middle East and Africa Automotive Power Inductor Market Trends

The Middle East and Africa region shows gradual growth in the automotive power inductor market, supported by rising vehicle modernization and increasing adoption of connected automotive technologies. Although emerging, the market is gaining momentum through infrastructure development and the introduction of energy-efficient mobility solutions. Growing interes

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Power Inductor Company Insights

The global Automotive Power Inductor Market in 2024 continues to expand as vehicle electrification, power-dense electronics, and advanced safety systems increase demand for compact, high-efficiency inductive components. Leading manufacturers are focusing on thermal stability, automotive-grade reliability, and miniaturization to support next-generation EV/HEV architectures and high-frequency power modules.

Würth Elektronik eiSos GmbH & Co. KG remains a prominent supplier due to its extensive lineup of AEC-Q qualified inductors. The company emphasizes high-reliability designs suited for harsh automotive environments, enabling strong adoption in DC-DC converters and onboard control units.

Vishay Intertechnology, Inc. continues to advance its portfolio with inductors engineered for high-current, high-temperature automotive applications. Its focus on low DCR and compact, rugged packaging helps address the efficiency and space constraints of modern EV powertrains and ADAS systems.

TDK Corporation stands out with innovations in thin-film, multilayer, and wire-wound inductors tailored for high-frequency switching. Its push toward smaller, more efficient components supports increasing ECU density and the broader industry shift toward miniaturized, thermally robust automotive electronics.

Taiyo Yuden Co., Ltd. maintains strategic relevance through its strong passive-component expertise and global manufacturing footprint. The company continues to expand its role in automotive power circuits, supplying inductors suited for high-voltage converters, onboard chargers, and compact vehicle control systems.

Top Key Players in the Market

- Würth Elektronik eiSos GmbH & Co. KG

- Vishay Intertechnology, Inc.

- TDK Corporation

- Taiyo Yuden Co., Ltd.

- Sumida Corporation

- Samsung Electro-Mechanics Co., Ltd.

- Pulse Electronics Corporation

- Panasonic Industry Co., Ltd.

- Murata Manufacturing Co., Ltd.

- KEMET

Recent Developments

- In August 2024: Delta Electronics announced an agreement for its Japan and Korea subsidiaries to acquire the power inductor and powder materials business and assets from Alps Alpine and Alps Electric Korea. This deal enhances Delta’s magnetic-component capabilities for automotive and other high-growth sectors, adding production equipment, R&D tools, patents, and related IP.

- In February 2024: Niron Magnetics secured a US$25 million strategic funding round led by Samsung Ventures, with Magna and Allison Transmission participating. The investment supports scaling production of rare-earth-free permanent magnets used in EV and automotive applications, strengthening next-generation magnet supply chains.

- In January 2024: Murata Manufacturing introduced its automotive-grade DFE2MCPH_JL series power inductors featuring improved DC resistance and current-handling capability. These components are optimized for demanding automotive systems such as powertrain control units and safety-critical electronic modules.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 3.7 Billion CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Wire-Wound Inductors, Ferrite Core Inductors, Powdered Iron Core Inductors, Toroidal Inductors, Multilayer Chip Inductors (MLCI), Composite/Nanocrystalline Inductors), By Material (Ferrite, Powdered iron, Nanocrystalline, Amorphous alloys, Advanced composites / ceramic-based), By Mounting (Surface-Mount (SMD) Inductors, Through-Hole / Leaded Inductors, Module-Integrated Embedded Inductors, Planar PCB-Embedded Inductors, Shielded Vs. Unshielded Variants), By Inductance (Very Low Inductance <1 µH, Low Inductance 1–10 µH, Medium 10–100 µH, High >100 µH), By Frequency of Operation (Low-Frequency Inductors (kHz Range), Mid-Frequency Inductors, High-Frequency Switching Inductors (100 kHz – MHz), Wideband/Broadband Inductors), By Power Rating (Low-Voltage, Medium-Voltage, High-Voltage, Ultra-High-Voltage), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By End-User (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Würth Elektronik eiSos GmbH & Co. KG, Vishay Intertechnology, Inc., TDK Corporation, Taiyo Yuden Co., Ltd., Sumida Corporation, Samsung Electro-Mechanics Co., Ltd., Pulse Electronics Corporation, Panasonic Industry Co., Ltd., Murata Manufacturing Co., Ltd., KEMET Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Power Inductor MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Power Inductor MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Würth Elektronik eiSos GmbH & Co. KG

- Vishay Intertechnology, Inc.

- TDK Corporation

- Taiyo Yuden Co., Ltd.

- Sumida Corporation

- Samsung Electro-Mechanics Co., Ltd.

- Pulse Electronics Corporation

- Panasonic Industry Co., Ltd.

- Murata Manufacturing Co., Ltd.

- KEMET