Global Automotive Perimeter Lighting System Market Size, Share, Growth Analysis By Light Type (Halogen, Xenon, LED, Others), By Material (Fiber, Glass, Plastic), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Sales Channel (OEM, Aftermarket) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172618

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

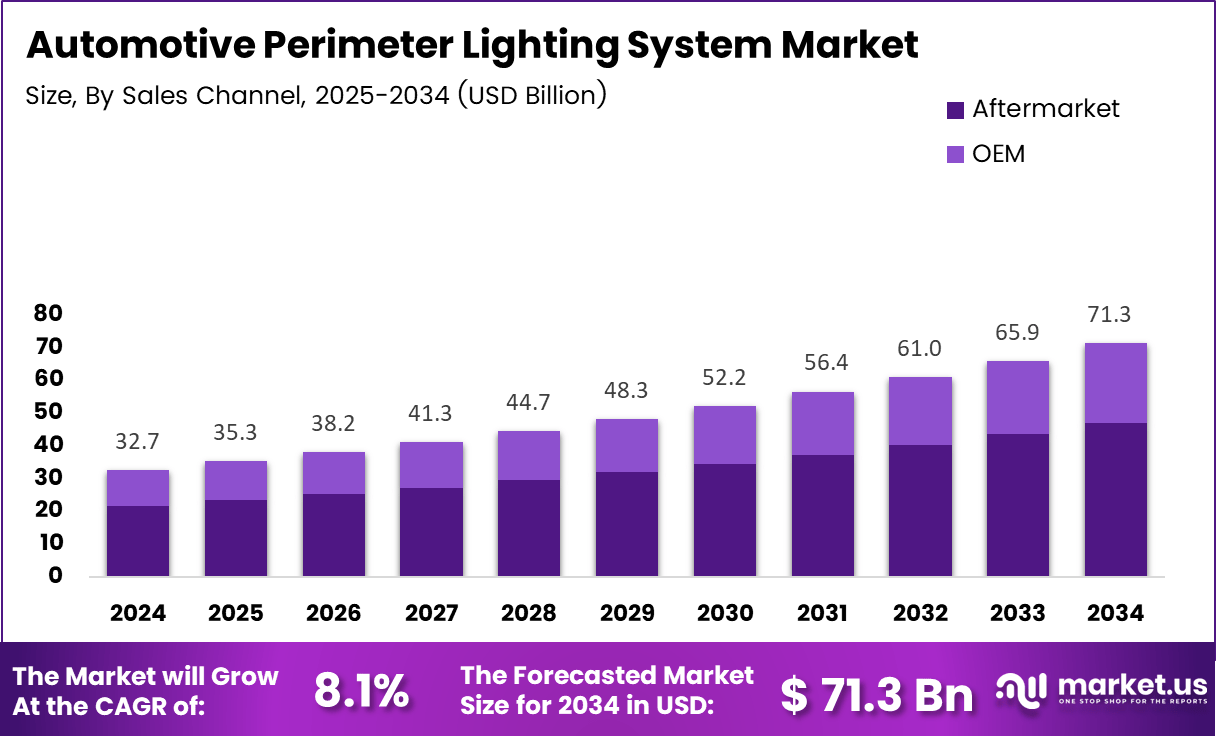

The Global Automotive Perimeter Lighting System Market size is expected to be worth around USD 71.3 billion by 2034, from USD 32.7 billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

The Automotive Perimeter Lighting System refers to exterior vehicle lighting solutions designed to improve safety, visibility, and styling around doors, grilles, mirrors, and underbody zones. These systems use LED lighting, electronic controls, and smart illumination logic to enhance pedestrian awareness and vehicle approach visibility in low light conditions.

From a market standpoint, the Automotive Perimeter Lighting System Market is demonstrating stable growth, supported by increasing premium feature adoption across passenger and electric vehicles. As a result, OEMs are deploying exterior ambient lighting to improve low speed maneuvering safety, strengthen vehicle differentiation, and elevate overall user experience in urban driving environments.

Moreover, growth opportunities are expanding with the rise of electric and software defined vehicles. Consequently, adaptive perimeter lighting synchronized with access control, welcome lighting, and driver assistance functions is gaining momentum. This transition supports higher lighting content per vehicle and creates sustained demand across smart exterior lighting and vehicle illumination systems.

In parallel, government safety initiatives and vehicle visibility guidelines are indirectly accelerating adoption. Automotive regulators emphasize enhanced conspicuity during night time operation and low visibility conditions. Accordingly, energy efficient LED perimeter lighting aligns with sustainability objectives and automotive lighting efficiency standards, encouraging long term OEM investment in compliant lighting architectures.

From a design and performance perspective, automotive perimeter lighting increasingly references architectural lighting benchmarks. According to manufacturer published specifications, MIRADA MEDIUM WALL outdoor wall sconces deliver illumination ranging from 3,000 to 21,000 lumens, while MIRADA BOLLARD architectural lights provide controlled output between 1,000 and 3,000 lumens for perimeter visibility.

Additionally, higher intensity lighting references include MIRADA POST TOP area lights delivering 32,000 to 78,000 lumens and SLICE MEDIUM AREA outdoor lights offering between 9,000 and 48,000 lumens, as per manufacturer data. These benchmarks highlight scalable illumination performance for wide area visibility with optimized energy efficiency.

Finally, compact and modular lighting solutions are reflected by V LOCITY AREA LIGHT SMALL producing 6,000 to 27,000 lumens, V LOCITY AREA LIGHT MEDIUM delivering 12,000 to 54,000 lumens, and LINEAR AREA LIGHT ranging from 3,000 to 18,000 lumens, according to manufacturer specifications. Collectively, these references support scalable automotive perimeter lighting system design across exterior ambient lighting, vehicle safety illumination, and smart lighting integration.

Key Takeaways

- The global Automotive Perimeter Lighting System Market is projected to grow from USD 32.7 billion in 2024 to USD 71.3 billion by 2034, registering a CAGR of 8.1%.

- By light type, LED emerged as the leading segment in 2024 with a dominant market share of 56.8%, driven by energy efficiency and system integration advantages.

- By material, Plastic accounted for the largest share at 52.4% in 2024, supported by lightweight properties and flexible design compatibility.

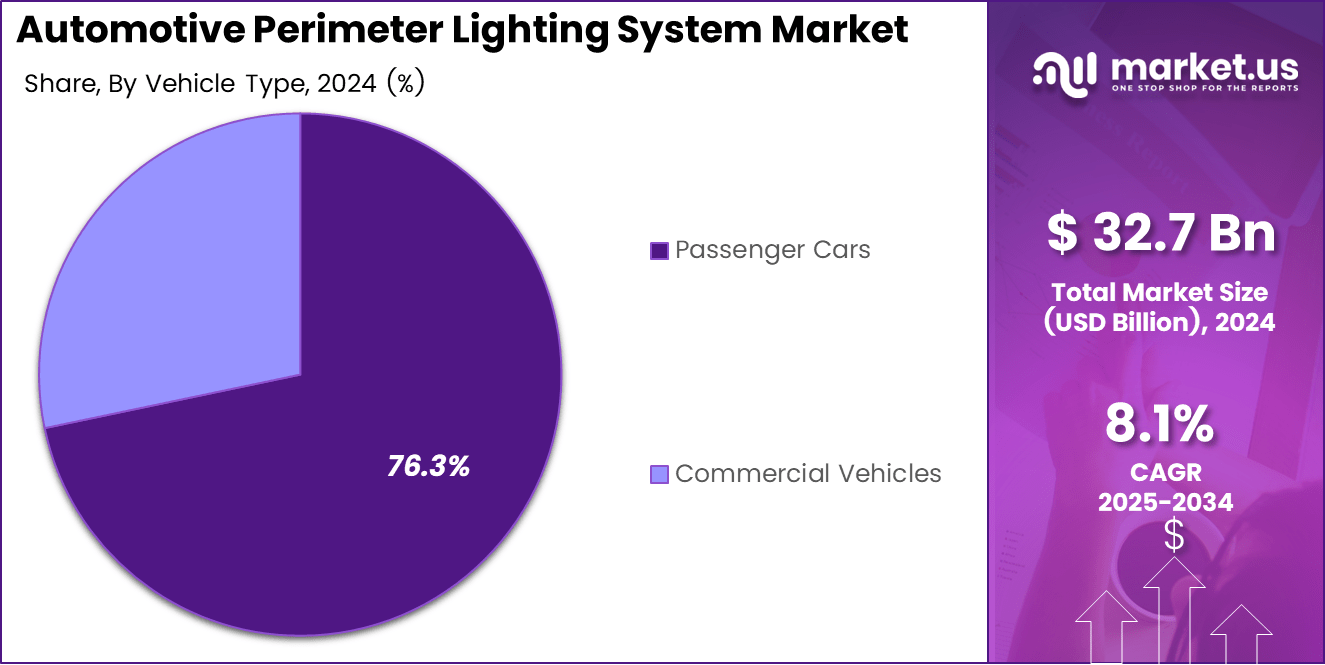

- By vehicle type, Passenger Cars dominated the market with a share of 76.3% in 2024, reflecting higher adoption of exterior comfort and safety features.

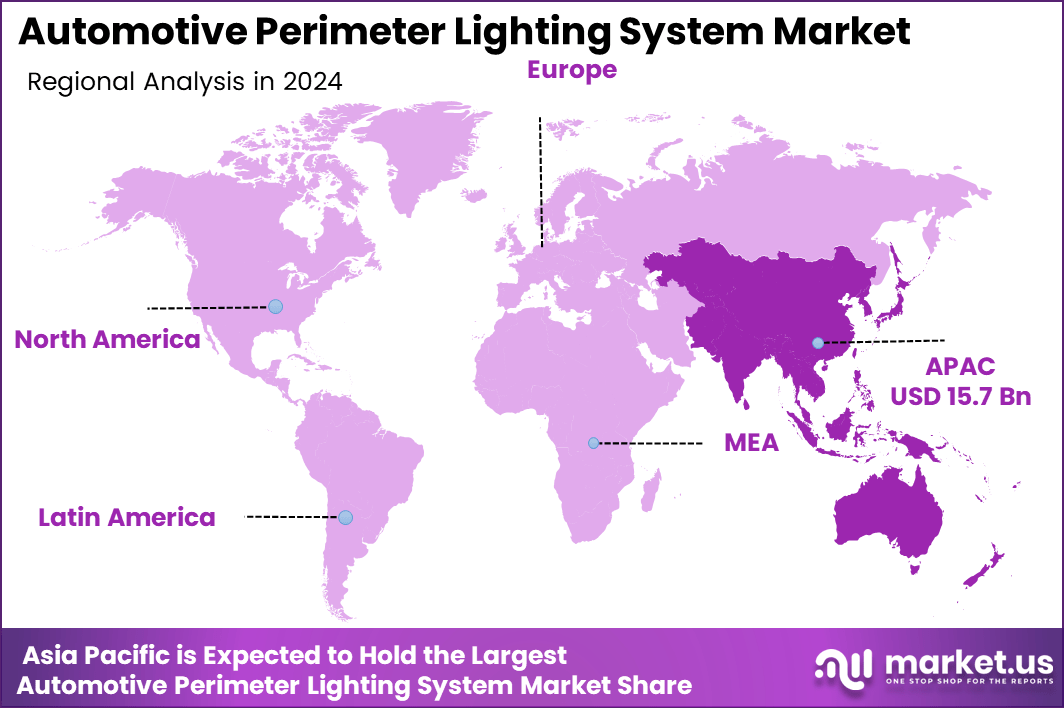

- Asia Pacific led the global market in 2024 with a share of 48.2%, representing a market value of USD 15.7 billion, supported by high vehicle production and rapid feature adoption.

By Light Type Analysis

LED dominates with 56.8% due to its superior energy efficiency, longer lifespan, and design flexibility.

LED held a dominant market position in the By Light Type Analysis segment of Automotive Perimeter Lighting System Market, with a 56.8% share. Consequently, OEMs increasingly prefer LED solutions for perimeter lighting due to lower power consumption, compact integration, and compatibility with intelligent lighting control systems.

Halogen remained relevant in the By Light Type Analysis segment, particularly in entry level vehicles. However, its adoption is gradually declining as automakers shift toward more energy efficient lighting technologies to meet evolving vehicle efficiency and sustainability expectations.

Xenon lighting continued to serve niche automotive perimeter lighting applications. Although it offers higher brightness than halogen, its higher cost and complexity limit widespread adoption compared to modern LED based perimeter lighting architectures.

Others category included emerging and hybrid lighting technologies. These solutions are primarily explored for specialized styling applications but currently face scalability and cost challenges within mass production vehicle platforms.

By Material Analysis

Plastic dominates with 52.4% owing to its lightweight properties and manufacturing flexibility.

In 2024, Plastic held a dominant market position in the By Material Analysis segment of Automotive Perimeter Lighting System Market, with a 52.4% share. As a result, manufacturers increasingly adopt plastic housings to reduce vehicle weight while supporting complex lighting shapes and integrated designs.

Glass remained an important material choice for perimeter lighting where optical clarity and thermal resistance are prioritized. However, higher weight and breakage risks limit its broader use compared to engineered automotive grade plastics.

Fiber based materials gained moderate attention for specialized lighting applications. These materials support light diffusion and styling innovation, though higher production complexity restricts large scale adoption across mainstream vehicle models.

By Vehicle Type Analysis

Passenger Cars dominate with 76.3% driven by higher feature adoption and premiumization trends.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of Automotive Perimeter Lighting System Market, with a 76.3% share. Accordingly, rising consumer demand for enhanced aesthetics and safety features continues to accelerate perimeter lighting integration.

Commercial Vehicles represented a smaller yet stable share of the market. Adoption is primarily driven by safety focused lighting requirements and fleet visibility, although cost sensitivity limits widespread deployment of advanced perimeter lighting features.

By Sales Channel Analysis

OEM dominates with 66.1% supported by factory level integration and system standardization.

OEM held a dominant market position in the By Sales Channel Analysis segment of Automotive Perimeter Lighting System Market, with a 66.1% share. Therefore, integrated lighting solutions are increasingly installed during vehicle assembly to ensure design consistency and system compatibility.

Aftermarket segment continued to grow steadily as consumers seek customization and retrofitting options. However, limited compatibility and regulatory constraints restrict aftermarket penetration compared to OEM installed perimeter lighting systems.

Key Market Segments

By Light Type

- Halogen

- Xenon

- LED

- Others

By Material

- Fiber

- Glass

- Plastic

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Sales Channel

- OEM

- Aftermarket

Drivers

Increasing OEM Focus on Pedestrian Visibility Drives Market Growth

Rising integration of vehicle exterior illumination with ADAS and autonomous safety architectures is a major driver for the Automotive Perimeter Lighting System Market. As vehicles become more automated, exterior lighting helps communicate vehicle presence and movement intent. Therefore, perimeter lighting is increasingly treated as a functional safety component rather than only a styling feature.

Increasing OEM focus on pedestrian visibility during low speed and night time operations further supports market growth. In urban environments, vehicles frequently interact with pedestrians in parking zones and residential streets. Consequently, perimeter lighting improves awareness around doors, mirrors, and vehicle edges, reducing low speed collision risks.

Expanding adoption of premium comfort and convenience lighting packages across mid segment cars is also accelerating demand. Features previously limited to luxury car are now offered in mass market models. As a result, perimeter lighting benefits from higher production volumes and wider platform integration.

Growing regulatory emphasis on vehicle conspicuity and roadside safety strengthens this trend. Authorities increasingly encourage better vehicle visibility in dense traffic zones. Accordingly, OEMs adopt perimeter lighting to align with safety expectations and future regulatory direction.

Restraints

High System Integration Complexity Restrains Market Expansion

High system integration complexity with vehicle body control modules and electrical architectures is a key restraint. Perimeter lighting must work seamlessly with access systems and sensors. Therefore, development timelines increase and engineering efforts become more intensive for OEMs.

Elevated material and installation costs for multi zone LED perimeter lighting configurations also limit adoption. Additional wiring, controllers, and protective housings raise overall system cost. As a result, cost sensitive vehicle segments face slower penetration.

Limited standardization of exterior lighting regulations across global markets further restricts scalability. Different compliance requirements increase validation complexity. Consequently, global rollouts become slower and more expensive for manufacturers.

Increased risk of durability issues due to moisture, dust, and temperature exposure also impacts adoption. Exterior lighting systems require robust protection. Hence, reliability concerns influence design decisions and supplier selection.

Growth Factors

Rising Demand for Perimeter Lighting in Electric Vehicles Creates Opportunities

Rising demand for perimeter lighting in electric vehicles presents strong growth opportunities. Silent vehicle operation increases the need for visual safety cues. Therefore, perimeter lighting supports pedestrian awareness and aligns with evolving EV safety needs.

Expansion of customizable and software controlled lighting features enables brand differentiation. OEMs increasingly use lighting patterns to create unique user experiences. As a result, software driven lighting adds value without major hardware changes.

Increasing penetration of perimeter lighting systems in commercial and fleet vehicles also supports opportunity growth. Fleet operators prioritize visibility during loading and night operations. Consequently, perimeter lighting adoption expands beyond passenger vehicles.

Together, these opportunities position perimeter lighting as a scalable feature across multiple vehicle categories. As vehicle electronics mature, adoption is expected to accelerate steadily.

Emerging Trends

Shift Toward Low Power LED Technologies Shapes Market Trends

A shift toward low power consumption LED and OLED perimeter lighting technologies is shaping market trends. These solutions support energy efficiency and compact design. Therefore, they are well suited for electric and hybrid vehicles.

Integration of perimeter lighting with vehicle unlock, approach, and welcome functions is becoming common. This enhances user experience and perceived vehicle quality. As a result, lighting is closely linked with convenience features.

Adoption of dynamic lighting patterns synchronized with driver assistance alerts is also increasing. Visual signals help communicate safety information. Consequently, lighting becomes an interactive element of vehicle systems.

Increasing use of smart lighting systems enabled by connectivity and software updates further defines the market. Over the air updates allow feature enhancement. Hence, perimeter lighting evolves as a software enabled vehicle function.

Regional Analysis

Asia Pacific Dominates the Automotive Perimeter Lighting System Market with a Market Share of 48.2%, Valued at USD 15.7 billion

Asia Pacific leads the Automotive Perimeter Lighting System Market, supported by high vehicle production volumes and rapid adoption of exterior lighting features. In 2024, the region accounted for 48.2% of the market, valued at USD 15.7 billion, driven by strong demand for passenger vehicles and growing electrification. OEM focus on styling differentiation and pedestrian safety further strengthens regional adoption.

North America Automotive Perimeter Lighting System Market Trends

North America represents a mature market characterized by early adoption of safety oriented vehicle technologies. Demand is supported by increasing integration of perimeter lighting with advanced driver assistance systems and premium vehicle packages. Strong consumer preference for feature rich vehicles continues to sustain steady market expansion across the region.

Europe Automotive Perimeter Lighting System Market Trends

Europe shows consistent growth due to stringent vehicle safety norms and a strong emphasis on pedestrian protection. Automakers in the region increasingly integrate exterior lighting to improve vehicle conspicuity in urban environments. The presence of electric vehicle focused regulations further encourages adoption of energy efficient perimeter lighting solutions.

US Automotive Perimeter Lighting System Market Trends

The US market is driven by rising consumer demand for premium comfort and convenience features in passenger vehicles. Perimeter lighting adoption is supported by growing interest in vehicle personalization and safety enhancements. Additionally, increasing electric vehicle penetration contributes to broader use of exterior lighting for visibility and user experience.

Middle East and Africa Automotive Perimeter Lighting System Market Trends

The Middle East and Africa market is gradually expanding, supported by growing vehicle parc and urban infrastructure development. Demand is primarily driven by premium vehicle imports and increasing awareness of vehicle safety features. However, adoption remains selective due to cost sensitivity in several countries.

Latin America Automotive Perimeter Lighting System Market Trends

Latin America exhibits moderate growth as automakers introduce enhanced exterior lighting features in newer vehicle models. Rising urbanization and improving road safety awareness support gradual adoption. Nevertheless, price sensitivity and uneven regulatory enforcement continue to influence market penetration levels across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Perimeter Lighting System Company Insights

From an analyst viewpoint, the Automotive Perimeter Lighting System Market in 2024 is shaped by rising safety integration, premium exterior styling demand, and increasing adoption across electric and software driven vehicles. Suppliers with strong electronics integration, optical engineering, and OEM alignment are better positioned to capture value as perimeter lighting shifts from aesthetic enhancement to functional safety support.

Gentex Corporation benefits from its expertise in vision based electronics and automotive lighting related technologies that align well with perimeter illumination requirements. In 2024, its strength lies in integrating lighting with sensing and control systems, supporting advanced vehicle safety and user experience functions within premium and mid segment vehicle platforms.

HELLA GmbH & Co. maintains a strong position through its deep capabilities in automotive lighting systems and vehicle electronics integration. In 2024, the company’s focus on intelligent exterior lighting supports perimeter illumination applications linked with vehicle access, visibility enhancement, and safety driven lighting architectures across global OEM programs.

KOITO MANUFACTURING CO., LTD. leverages its optical engineering expertise and large scale automotive lighting production capabilities to support perimeter lighting adoption. In 2024, its strength is rooted in delivering high reliability lighting solutions that meet durability, efficiency, and regulatory expectations, particularly for high volume passenger vehicle applications.

Magna International Inc. brings system level integration capabilities that support perimeter lighting as part of broader vehicle body and electronics architectures. In 2024, its ability to align lighting with vehicle access systems, electrification platforms, and modular designs positions it well for scalable perimeter lighting deployment across multiple vehicle categories.

Top Key Players in the Market

- Gentex Corporation

- HELLA GmbH & Co.

- KOITO MANUFACTURING CO., LTD.

- Magna International Inc.

- Motherson Group

- Feniex Industries

- Setina Manufacturing

- OSRAM GmbH

- Marelli Holdings Co. Ltd

Recent Developments

- In October 2024, Remsons Industries acquired a 51% equity stake in UK based BEE Lighting, marking its strategic entry into the automotive lighting segment, This acquisition supports Remsons’ diversification beyond control cables and gear systems into advanced automotive lighting solutions.

- In August 2025, Infineon Technologies AG completed the acquisition of Marvell Technology, Inc.’s Automotive Ethernet business, following regulatory approvals announced in April 2025. The deal strengthens Infineon’s capabilities in software defined vehicles and reinforces its leadership in automotive microcontrollers.

Report Scope

Report Features Description Market Value (2024) USD 32.7 billion Forecast Revenue (2034) USD 71.3 billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Light Type (Halogen, Xenon, LED, Others), By Material (Fiber, Glass, Plastic), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Gentex Corporation, HELLA GmbH & Co., KOITO MANUFACTURING CO., LTD., Magna International Inc., Motherson Group, Feniex Industries, Setina Manufacturing, OSRAM GmbH, Marelli Holdings Co. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Perimeter Lighting System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Perimeter Lighting System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Gentex Corporation

- HELLA GmbH & Co.

- KOITO MANUFACTURING CO., LTD.

- Magna International Inc.

- Motherson Group

- Feniex Industries

- Setina Manufacturing

- OSRAM GmbH

- Marelli Holdings Co. Ltd