Global Automotive Operating System Market Size, Share, Growth Analysis By Type (Android, Linux, QNX, Windows, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Application (Infotainment System, ADAS & Safety System, Connected Services, Body Control & Comfort System, Engine Management & Powertrain Control, Communication & Telematics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165510

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

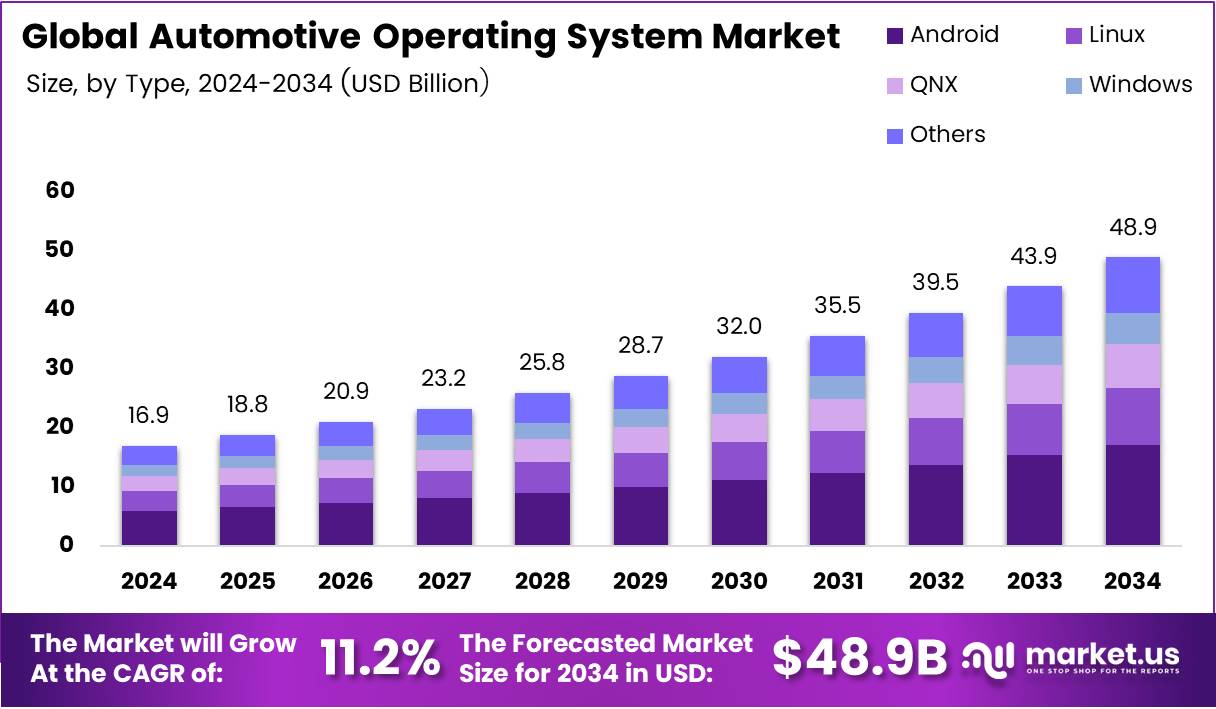

The Global Automotive Operating System Market size is expected to be worth around USD 48.9 Billion by 2034, from USD 16.9 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034.

Automotive operating systems represent embedded software platforms enabling seamless vehicle control, advanced infotainment, and secure over-the-air updates. These systems increasingly integrate real-time data management and vehicle-to-cloud connectivity, supporting modern architectures such as software-defined vehicles. Moreover, automakers rely on these platforms to standardize functions and accelerate digital innovation across evolving automotive ecosystems.

Furthermore, the automotive operating system market is expanding as OEMs shift toward centralized computing and enhanced human-machine interfaces. Rising demand for intelligent cockpit solutions and predictive maintenance tools also accelerates adoption. Additionally, increasing preference for scalable middleware and cloud-native frameworks drives suppliers to invest in more flexible and efficient software stacks.

Consequently, growing electrification and autonomous mobility trends unlock robust opportunities for OS vendors. Automakers seek secure platforms that unify battery management, ADAS functions, and digital services. Therefore, investments in sensor integration, cybersecurity modules, and OTA capabilities continue to strengthen market attractiveness, particularly in emerging software-driven vehicle segments.

Moreover, governments worldwide promote digital mobility infrastructure, prompting higher investment in smart transportation systems. Regulatory support for data security, emission control, and ADAS compliance further reinforces the need for purpose-built automotive operating systems. Consequently, OEMs increasingly prioritize systems supporting regulatory traceability and long-term software lifecycle management.

As competition shifts toward digital value creation, the market benefits from rising consumer expectations for immersive in-car experiences. Automakers now emphasize real-time navigation, personalized UX, and seamless device integration. Hence, scalable automotive OS platforms become essential for delivering enhanced connectivity and service-oriented vehicle features that strengthen customer satisfaction and retention.

In addition, consumer behavior significantly influences market growth. According to research, in a survey of approximately 1,600 automotive customers across China, Germany, and the U.S., 55% of Chinese respondents and 57% of BEV customers indicated willingness to switch brands for better connectivity, reflecting rising demand for software-centric mobility solutions.

Similarly, evolving expectations in mature markets reshape strategic priorities. According to research, 49% of U.S. respondents and 55% of German respondents said they would change brands for superior connected-car services. These insights reinforce the critical role of advanced automotive operating systems in enhancing digital capabilities and strengthening market competitiveness.

Key Takeaways

- Global Automotive Operating System Market expected to reach USD 48.9 Billion by 2034 from USD 16.9 Billion in 2024 at a 11.2% CAGR.

- Android leads the OS type segment with a 34.8% market share.

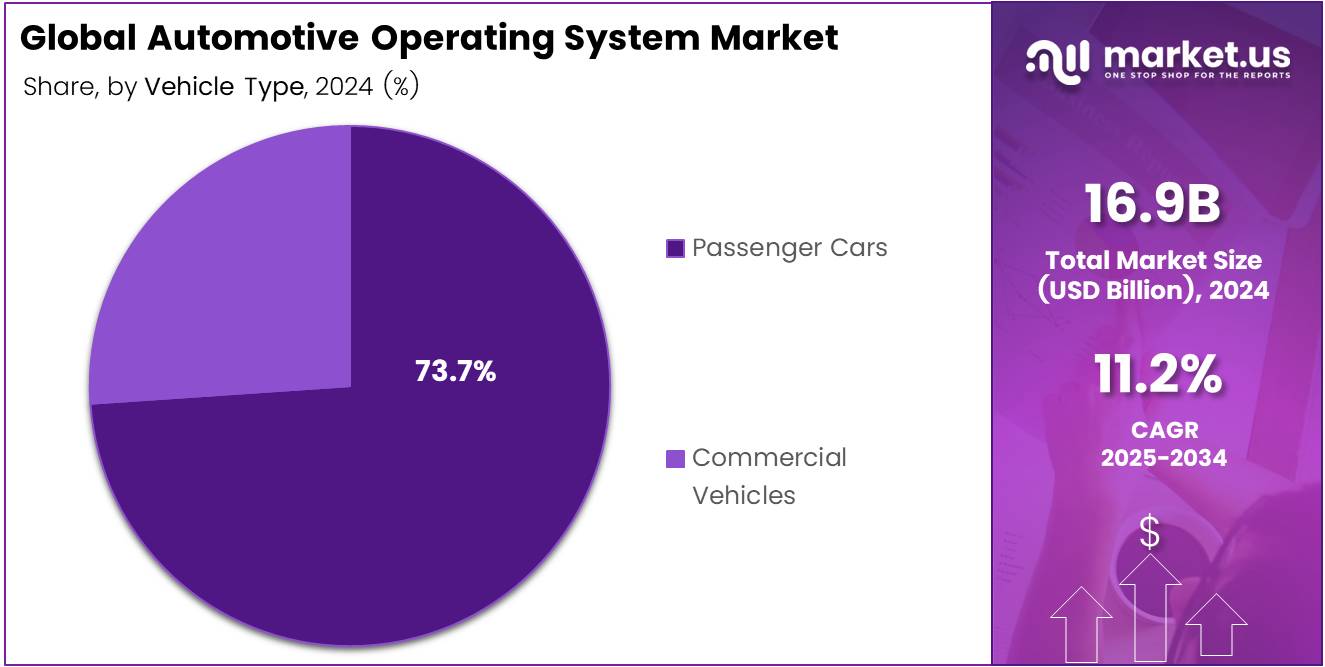

- Passenger Cars dominate the vehicle type segment with 73.7% share.

- Infotainment System is the largest application segment at 28.2%.

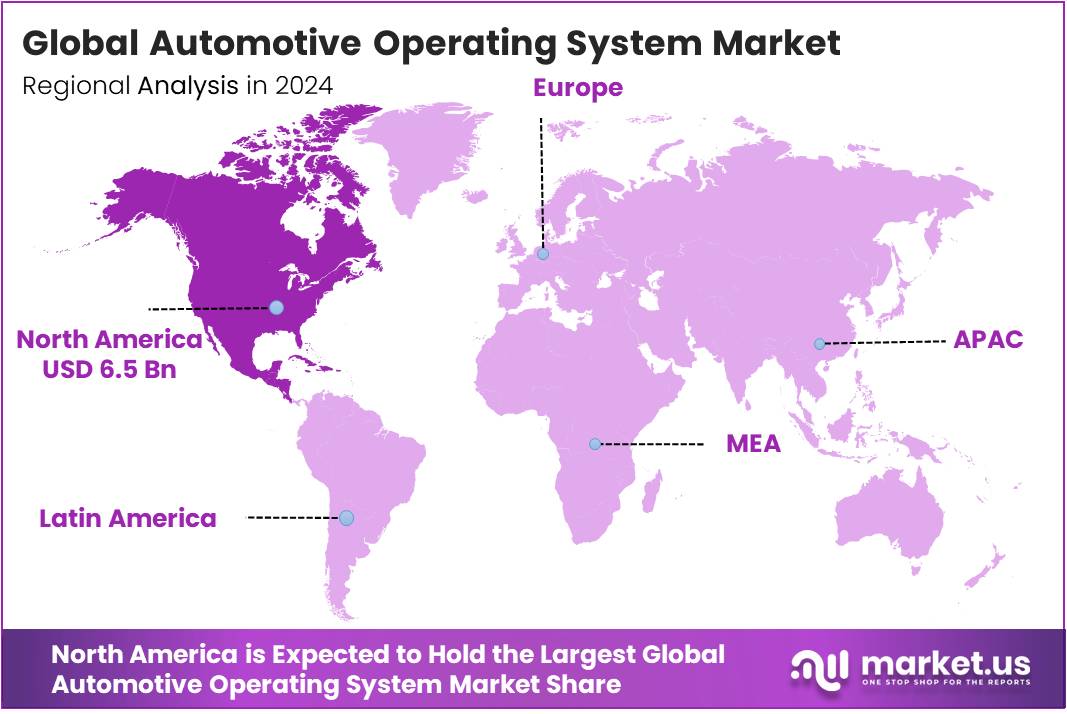

- North America holds the highest regional share at 38.9%, valued at USD 6.5 Billion.

By Type Analysis

Android dominates with 34.8% due to its open-source flexibility and strong developer ecosystem.

In 2024, Android held a dominant market position in the By Type segment of the Automotive Operating System Market, with a 34.8% share. It accelerates innovation, supports scalable integrations, and enhances in-car digital experiences across global automotive platforms.

Linux continued to gain traction as automakers adopted it for its robust security features. It further supports efficient system modularity, enabling OEMs to customize interfaces and performance layers while strengthening long-term vehicle software strategies.

QNX advanced steadily as manufacturers valued its reliability. It provides real-time processing and high safety integrity levels, making it ideal for mission-critical automotive functions that require deterministic performance and proven system stability.

Windows maintained relevance as select OEMs used it for legacy compatibility. It delivers streamlined application support and helps transition traditional automotive interfaces toward more connected, software-defined vehicle architectures.

Others expanded moderately as emerging and proprietary OS platforms gained interest. They supported niche applications and alternative architectures, offering flexibility for specialized automotive requirements and next-generation software ecosystems.

By Vehicle Type Analysis

Passenger Cars dominate with 73.7% due to rising digitalization and premium feature integration.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Automotive Operating System Market, with a 73.7% share. They benefit from increasing consumer demand for advanced infotainment, enhanced connectivity, and integrated safety technologies across global markets.

Commercial Vehicles expanded gradually as fleet operators adopted digital solutions. They relied on improved telematics, safety systems, and efficient powertrain management, helping businesses optimize operations while transitioning toward intelligent mobility ecosystems.

By Application Analysis

Infotainment System dominates with 28.2% due to increasing demand for immersive in-car digital experiences.

In 2024, the Infotainment System segment held a dominant market position in the By Application segment of the Automotive Operating System Market, with a 28.2% share. It enhanced user engagement through seamless connectivity, intuitive interfaces, and continuous software upgrades.

ADAS & Safety System advanced as vehicles integrated predictive technologies. It improved real-time decision-making and strengthened the transition toward higher autonomy levels with reliable software-driven control frameworks.

Connected Services grew rapidly as drivers sought real-time insights. It enabled continuous data exchange, proactive maintenance alerts, and remote operational support across various automotive platforms.

Body Control & Comfort System evolved with consumer expectations for convenience. It optimized cabin functions, introduced automated adjustments, and improved personalized in-car experiences.

Engine Management & Powertrain Control expanded with rising efficiency targets. It ensured precise system regulation, enhanced performance, and supported electrification strategies.

Communication & Telematics strengthened fleet and personal mobility operations. It improved navigation accuracy, connectivity stability, and over-the-air update capabilities.

Others progressed modestly with specialized functions. They enabled niche automotive applications and supported the growth of customizable software-defined vehicle technologies.

Key Market Segments

By Type

- Android

- Linux

- QNX

- Windows

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Application

- Infotainment System

- ADAS & Safety System

- Connected Services

- Body Control & Comfort System

- Engine Management & Powertrain Control

- Communication & Telematics

- Others

Drivers

Surge in Demand for Connected and Software-Defined Vehicles Drives Market Growth

The rising need for highly connected and software-driven cars is a major force behind the growth of automotive operating systems. As consumers expect smarter and more interactive driving experiences, automakers rely on advanced OS platforms to support seamless connectivity, infotainment, and digital features.

Another key driver is the rapid integration of Advanced Driver Assistance Systems (ADAS). Features such as lane monitoring, automatic braking, and adaptive cruise control require powerful operating systems capable of processing large amounts of real-time data. This pushes manufacturers to adopt more sophisticated software frameworks.

Over-the-air (OTA) updates are also expanding quickly, enabling automakers to fix issues, add features, and improve performance without requiring a service visit. This capability enhances customer convenience and reduces maintenance costs, making OTA support a critical OS requirement.

Additionally, carmakers are shifting toward centralized vehicle computing architectures. Instead of using many small electronic units, they are combining computing functions into high-performance systems. This approach improves efficiency and makes software management easier, increasing the demand for robust automotive operating systems.

Restraints

High Complexity and Cost of Automotive Software Development Restrains Market Growth

Automotive operating systems are becoming more complex, and developing such advanced software requires significant time, effort, and investment. This high cost creates challenges for smaller manufacturers and slows broader market adoption.

Another restraint is the lack of standardization across vehicle platforms. Different automakers use different software frameworks, making integration more difficult and limiting interoperability between systems. This slows innovation and increases development expenses for suppliers.

Cybersecurity risks also pose major concerns. As vehicles become more connected, they are more exposed to potential cyberattacks. Ensuring strong security requires continuous monitoring and advanced encryption, further increasing development challenges.

The shortage of skilled automotive software engineers adds to these hurdles. The industry needs professionals who understand both vehicle hardware and advanced software, but this talent gap makes it difficult for companies to scale their software capabilities. As a result, the market faces delays and increased development pressures.

Growth Factors

Growing Role of AI-Driven Predictive Vehicle Diagnostics Creates New Opportunities

The growing use of artificial intelligence (AI) in vehicles presents major opportunities for automotive operating systems. AI-driven predictive diagnostics help detect issues before they occur, improving safety and reducing maintenance costs. OS platforms that support AI will gain strong adoption.

Another opportunity lies in the expansion of cloud-native automotive OS platforms. As automakers move more software functions to the cloud, operating systems that enable smooth cloud connectivity will become essential. This shift allows faster updates and improved performance.

The rise of autonomous Mobility-as-a-Service (MaaS) solutions—such as self-driving taxis and shared autonomous shuttles—also creates new demand for reliable operating systems. These vehicles require extremely stable, secure, and high-processing OS platforms to function safely.

Finally, the increased use of open-source automotive software frameworks opens new doors for developers and manufacturers. Open-source systems reduce development costs and speed up innovation, helping automakers build flexible and scalable vehicle software environments.

Emerging Trends

Transition Toward Hypervisor-Based Multi-Domain Vehicle OS Accelerates Market Trends

A major trend in the automotive operating system market is the move toward hypervisor-based platforms. These systems allow multiple functions—such as infotainment, safety, and connectivity—to run independently on the same hardware, making vehicles more efficient and secure.

Blockchain integration is also gaining attention. Automakers increasingly use blockchain to secure vehicle data, support trusted communication, and improve data privacy. This trend strengthens the need for OS platforms that support decentralized security technologies.

The use of digital twins is rising as well. By creating virtual models of vehicle systems, automakers can test performance, optimize operations, and predict failures. Operating systems that support real-time analytics will benefit from this trend.

Additionally, edge computing is becoming essential for real-time in-vehicle processing. Instead of sending data to the cloud, vehicles increasingly process information locally to enable faster reactions and reduce latency. This shift boosts demand for advanced OS solutions capable of supporting high-speed edge computing.

Regional Analysis

North America Dominates the Automotive Operating System Market with a Market Share of 38.9%, Valued at USD 6.5 Billion

North America leads the global automotive operating system market, capturing a significant 38.9% share and generating approximately USD 6.5 Billion in value. The region benefits from early adoption of advanced vehicle technologies, strong investments in connected and autonomous systems, and a mature automotive innovation ecosystem. Increasing integration of software-defined vehicles and enhanced in-car digital experiences further strengthens North America’s dominance in this market.

Europe Automotive Operating System Market Trends

Europe represents a robust market driven by stringent vehicle safety regulations and rapid adoption of electrification technologies. The region’s strong focus on sustainability and intelligent mobility enhances demand for advanced automotive operating systems. Continued development of autonomous driving frameworks and government support for digital mobility further support market expansion across European countries.

Asia Pacific Automotive Operating System Market Trends

Asia Pacific is witnessing accelerated growth fueled by expanding automotive production and rising consumer demand for smart, connected vehicles. The region’s growing investments in EV infrastructure and strong presence of technology-driven automotive manufacturers contribute to market momentum. Increasing urb

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Operating System Company Insights

The global Automotive Operating System Market in 2024 is being shaped significantly by a handful of dominant technology providers, each steering innovation in software-defined mobility.

BlackBerry Limited continues to strengthen its position through its QNX platform, widely adopted for safety-critical automotive applications. Its emphasis on reliability, cybersecurity, and compliance with functional safety standards keeps it at the core of next-generation vehicle architectures.

Microsoft Corporation leverages its cloud, AI, and edge-computing ecosystem to enable scalable automotive software solutions. Through partnerships across the automotive value chain, Microsoft is helping OEMs accelerate digital cockpit development, streamline over-the-air updates, and improve connected-vehicle services using Azure-based tools.

Alphabet Inc. remains a transformative force with its Android Automotive OS, which continues to gain traction as OEMs integrate more consumer-centric digital experiences. By offering a flexible, app-driven infotainment platform, Alphabet enhances in-vehicle personalization while supporting advanced telematics and data-enabled services.

Apple Inc. influences the market more indirectly but powerfully through its expanding CarPlay ecosystem and its push toward deeper integration between personal devices and in-car systems. Although Apple maintains a more controlled approach than its competitors, its software design leadership and seamless UX capabilities continue to drive expectations for next-generation automotive interfaces.

Top Key Players in the Market

- BlackBerry Limited

- Microsoft Corporation

- Alphabet Inc.

- Apple Inc.

- Baidu, Inc.

- Wind River Systems, Inc.

- Hitex GmbH

- Bayerische Motoren Werke AG

- NVIDIA Corporation

- Green Hills Software

Recent Developments

- In December 2024: Accenture agreed to acquire AOX, a German embedded-software company focused on advanced automotive system architectures. This move strengthens Accenture’s capabilities in next-generation vehicle software and embedded engineering services.

- In January 2025: Red Hat announced that its “In-Vehicle Operating System” achieved mixed-criticality functional-safety certification toward ISO 26262 ASIL-B. This certification milestone positions Red Hat as a key player in secure, safety-compliant automotive OS platforms.

- In June 2025: NXP Semiconductors completed the acquisition of TTTech Auto, a leader in safety-critical automotive middleware and system solutions. The integration aims to accelerate NXP’s roadmap for reliable, scalable platforms for automated and software-defined vehicles.

- In April 2025: Marvell Technology, Inc. announced a US $2.5 billion agreement to sell its Automotive Ethernet business to Infineon Technologies AG. The deal enhances Infineon’s portfolio for high-performance automotive connectivity while allowing Marvell to refocus on core markets.

Report Scope

Report Features Description Market Value (2024) USD 16.9 Billion Forecast Revenue (2034) USD 48.9 Billion CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Android, Linux, QNX, Windows, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Application (Infotainment System, ADAS & Safety System, Connected Services, Body Control & Comfort System, Engine Management & Powertrain Control, Communication & Telematics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BlackBerry Limited, Microsoft Corporation, Alphabet Inc., Apple Inc., Baidu, Inc., Wind River Systems, Inc., Hitex GmbH, Bayerische Motoren Werke AG, NVIDIA Corporation, Green Hills Software Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Operating System MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Operating System MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BlackBerry Limited

- Microsoft Corporation

- Alphabet Inc.

- Apple Inc.

- Baidu, Inc.

- Wind River Systems, Inc.

- Hitex GmbH

- Bayerische Motoren Werke AG

- NVIDIA Corporation

- Green Hills Software