Global Automotive Network Testing Market Size, Share, Growth Analysis By Network Type (CAN Bus Test, Ethernet Test, Others), By Application (Passenger Cars, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166162

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

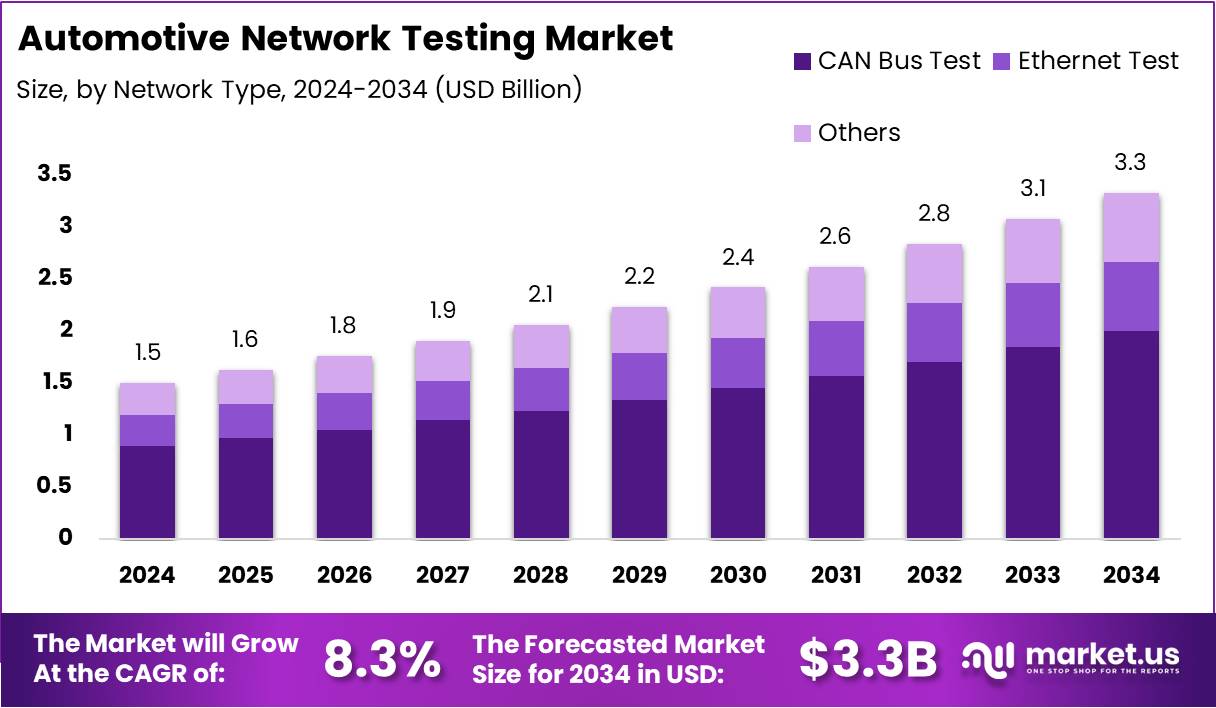

The Global Automotive Network Testing Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034.

The Automotive Network Testing Market refers to solutions that validate in-vehicle communication layers across CAN, LIN, Ethernet, and mixed-protocol architectures. It ensures reliability, cybersecurity, and performance for modern automotive software stacks. It has become essential as vehicles transition toward software-defined and connected mobility ecosystems.

Furthermore, the market is expanding as OEMs accelerate digitalization, integrate high-bandwidth ECUs, and adopt domain- and zonal-based architectures. This shift increases testing complexity, compelling automakers to invest in automated validation, real-time simulation, and protocol conformance tools. These advancements support faster development cycles and improve system interoperability.

Moreover, opportunities are strengthening as governments invest heavily in connected mobility and mandate stringent safety frameworks. Regulatory pushes for ADAS, cybersecurity compliance, and OTA-enabled updates create substantial demand for robust network validation. Additionally, rising EV penetration increases multiprotocol testing requirements, driving continuous technology upgrades across testing platforms.

Additionally, the Automotive Network Testing Market benefits from emerging areas such as digital twins, network virtualization, and cloud-native validation workflows. Vendors are exploring scalable orchestration systems, software-driven testing, and SerDes validation aligned with next-generation vehicle architectures. These trends create a steady pipeline of high-value commercial opportunities for test solution providers.

From an analyst viewpoint, the Automotive Network Testing domain is transitioning into a mission-critical enabler for automotive innovation. The market will grow steadily as OEMs prioritize integration accuracy, cybersecurity hardening, and cross-network reliability. This shift offers strong prospects for solution providers focusing on automation, high-speed validation, and software-centric test frameworks.

From an analyst viewpoint of the Automotive Network Testing Market, growth momentum remains firm due to rising E/E complexity and increasing adoption of connected and infotainment-driven features. Government-led electrification programs and regulatory mandates create a supportive environment for long-term investments, pushing OEMs toward more structured validation ecosystems.

According to an industry report, Android Auto is supported by nearly every major carmaker and will be installed in 200 million cars by the end of this year, highlighting the massive expansion of digital connectivity. Additionally, less than 6% of new vehicles will ship with Android Automotive OS featuring Automotive Services by 2025.

Key Takeaways

- The Global Automotive Network Testing Market is valued at USD 1.5 Billion in 2024 and expected to reach USD 3.3 Billion by 2034.

- The market is projected to grow at a CAGR of 8.3% during 2025–2034.

- CAN Bus Test leads the network type segment with a 49.2% market share in 2024.

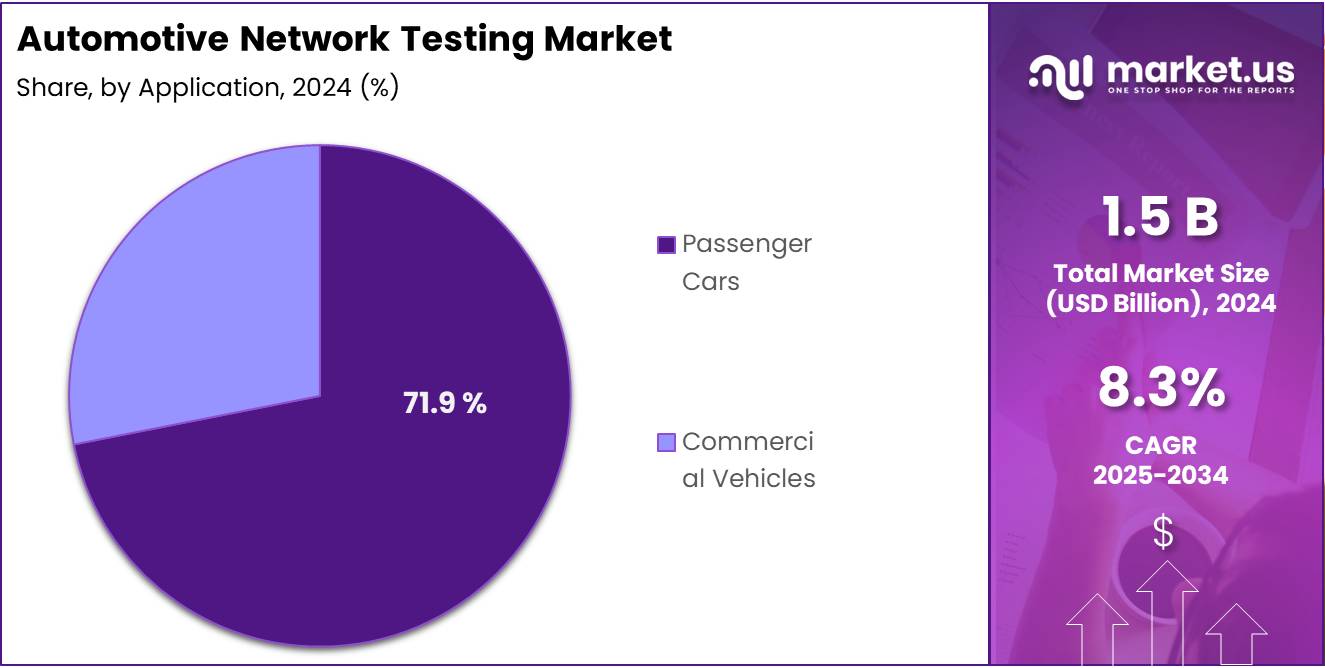

- Passenger Cars dominate the application segment with a 71.9% share in 2024.

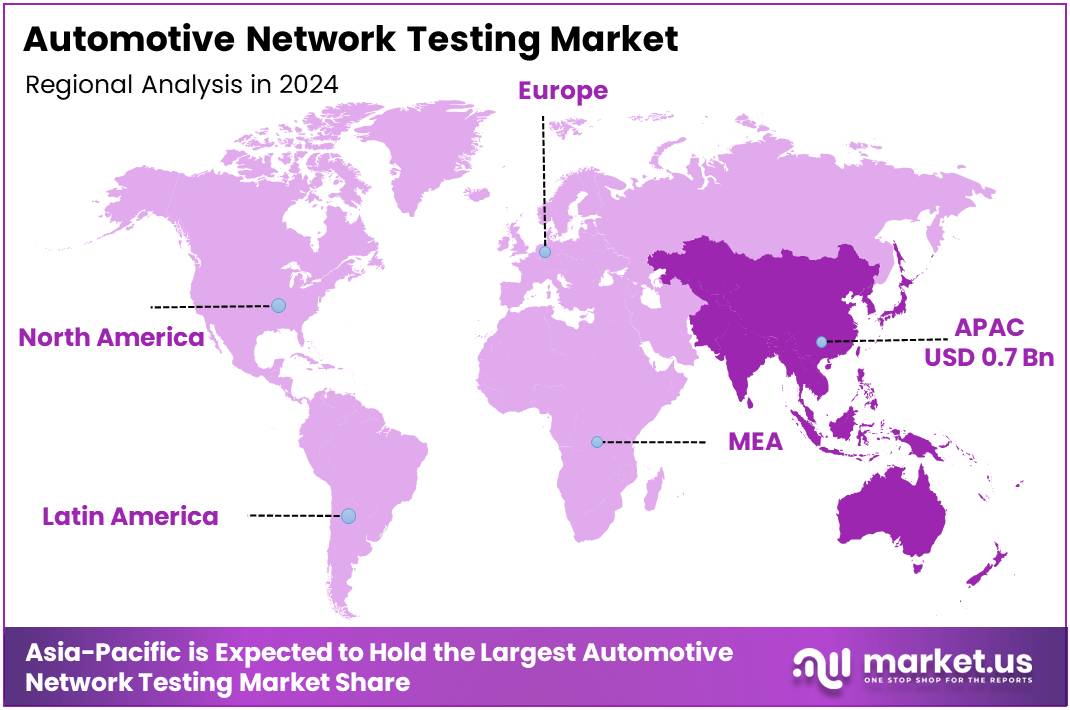

- Asia Pacific is the largest regional market with a 49.2% share valued at USD 0.7 Billion in 2024.

By Network Type Analysis

CAN Bus Test dominates with 49.2% due to its established reliability and broad adoption across vehicle platforms.

In 2024, CAN Bus Test held a dominant market position in the By Network Type Analysis segment of the Automotive Network Testing Market, with a 49.2% share. This segment leads as automakers increasingly rely on CAN-driven validation workflows. It supports streamlined diagnostics, ensures protocol stability, and accelerates ECU-level verification. The rising shift toward scalable embedded networks further boosts its relevance and keeps its dominance intact.

In 2024, Ethernet Test gained momentum in the By Network Type segment as OEMs transitioned toward high-bandwidth architectures. This sub-segment expands rapidly as vehicles integrate ADAS, infotainment, and zonal computing. Ethernet testing enhances data throughput assessments, validates latency-sensitive applications, and supports emerging multi-gig platforms. Automakers increasingly adopt it to future-proof vehicle communication systems.

In 2024, Others maintained steady growth within the By Network Type segment as niche network protocols continued serving specialized automotive domains. This sub-segment includes LIN, FlexRay, and proprietary systems supporting comfort, chassis, and safety controls. It remains essential for validating mixed-network vehicle architectures and complementing mainstream CAN and Ethernet testing requirements.

By Application Analysis

Passenger Cars dominate with 71.9% driven by higher testing intensity across feature-rich vehicle platforms.

In 2024, Passenger Cars held a dominant market position in the By Application Analysis segment of the Automotive Network Testing Market, with a 71.9% share. This dominance results from the rapid integration of ADAS, infotainment, and connectivity functions. Continuous software updates, EV architectures, and safety mandates further elevate testing needs across consumer vehicle lines.

In 2024, Commercial Vehicles advanced steadily in the By Application segment as fleet operators adopted connected diagnostics and telematics-driven performance monitoring. This sub-segment benefits from rising demand for uptime optimization, regulatory compliance validation, and robust communication testing across heavy-duty platforms. Growing electrified commercial fleets also enhance testing complexity and market traction.

Key Market Segments

By Network Type

- CAN Bus Test

- Ethernet Test

- Others

By Application

- Passenger Cars

- Commercial Vehicles

Drivers

Rising Deployment of Ethernet-Based In-Vehicle Architectures Drives Market Growth

The Automotive Network Testing Market is steadily advancing as vehicles adopt high-speed Ethernet communication systems. Automakers are shifting from traditional CAN and LIN networks toward Ethernet to support higher data loads required for ADAS, infotainment, and sensor fusion. As this transition accelerates, companies require more precise, real-time testing tools to ensure reliable data transfer. This shift drives continuous investment in advanced validation platforms.

Moreover, the growth of Over-the-Air (OTA) update ecosystems strengthens the need for robust network testing. Automakers now deliver remote software patches, performance upgrades, and security fixes through OTA channels. To make these updates safe and error-free, manufacturers must validate bandwidth performance, cyber-resilience, and multi-protocol communication. This requirement fuels demand for automated and scalable test systems across global automotive R&D centers.

Additionally, rising integration of advanced telematics and connectivity solutions is creating further momentum. Connected services such as vehicle tracking, remote diagnostics, and V2X communication require highly stable and secure in-vehicle networks. As connectivity layers become more sophisticated, engineers need improved testing frameworks to verify network latency, protocol compliance, and communication robustness. Together, these factors significantly boost the market’s long-term growth and technological advancement.

Restraints

Limited Technical Expertise in Handling Complex Multi-Protocol Systems Restrains Market Growth

The Automotive Network Testing Market faces major pressure due to the lack of sufficient technical expertise required to manage advanced, multi-protocol in-vehicle communication systems. As vehicle architectures become more complex, engineers must work with CAN, LIN, FlexRay, Automotive Ethernet, and emerging high-speed interfaces. This growing complexity creates a skills gap that slows testing efficiency and increases the chances of errors. Many manufacturers struggle to find trained professionals who can operate advanced diagnostic tools, which limits the speed of network development and validation.

Another significant restraint is the fragmentation of global standards for in-vehicle network validation. Different regions and automakers follow varying protocols and compliance requirements, making it difficult for testing companies to establish unified testing frameworks. This inconsistency forces suppliers to customize test setups for each market, increasing costs and lengthening development cycles. It also delays the introduction of new technologies, as manufacturers must navigate multiple approval processes before deployment.

Together, limited expertise and inconsistent standards create operational barriers for industry players. They slow innovation, raise integration costs, and make it harder for companies to scale testing solutions across global markets. As a result, these factors continue to restrain overall market growth despite rising demand for advanced vehicle connectivity.

Growth Factors

Adoption of AI-Driven Network Diagnostics & Predictive Testing Platforms Accelerates Market Growth

The Automotive Network Testing Market is experiencing strong expansion as automakers increasingly shift toward AI-driven diagnostics and predictive testing platforms. These solutions help identify network faults before they affect vehicle performance, making testing faster, smarter, and more accurate. As vehicles become more software-defined, AI tools offer higher efficiency and lower testing costs, creating a major growth opportunity for vendors.

Cloud-based network emulation and simulation platforms are also opening new possibilities for market growth. These cloud solutions enable remote validation, faster testing cycles, and scalable test environments without heavy hardware investment. Automakers and suppliers are adopting cloud platforms to handle complex network architectures, especially as electronic control units (ECUs) multiply. This trend is expected to boost platform development and adoption across global R&D teams.

Additionally, the rising demand for 5G-enhanced V2X network certification services is creating another significant growth avenue. As connected and autonomous vehicles require reliable communication, 5G-enabled V2X testing becomes essential. Automakers are increasingly investing in certification services that assure safety, low latency, and interoperability. This shift is pushing test providers to expand their 5G capabilities, supporting long-term growth in the automotive network testing landscape.

Emerging Trends

Shift Toward Virtualized Network Testing and Digital Twin Environments Drives Market Growth

The automotive network testing market is witnessing strong traction as companies increasingly adopt virtualized testing and digital twin environments. This shift allows automakers to simulate complex vehicle networks without relying on physical prototypes. It reduces testing time, cuts costs, and supports faster validation of new connectivity features.

At the same time, cybersecurity has become a top priority. With vehicles becoming more connected, the integration of cyber-resilience validation in network test suites is rising quickly. Automakers now test networks for potential hacking risks, data breaches, and communication vulnerabilities. This trend ensures safer digital architectures and boosts confidence in advanced automotive electronics.

Additionally, the use of automated test orchestration is expanding across validation pipelines. Automation helps manage the growing number of ECUs, software functions, and communication protocols in modern vehicles. By improving test accuracy and reducing human intervention, automated workflows speed up product development and enhance overall testing efficiency.

Together, these trends reflect a clear industry move toward smarter, software-driven testing systems. They are reshaping how vehicle networks are validated and ensuring readiness for future technologies such as autonomous driving and vehicle-to-everything (V2X) communication.

Regional Analysis

Asia Pacific Dominates the Automotive Network Testing Market with a Market Share of 49.2%, Valued at USD 0.7 Billion

In 2024, Asia Pacific led the Automotive Network Testing Market with a strong 49.2% share, reaching a valuation of USD 0.7 Billion. The region’s dominance is driven by rapid vehicle production growth, rising adoption of connected car technologies, and large-scale deployment of advanced in-vehicle communications. Increasing government support for intelligent transportation and mobility innovation continues to strengthen the region’s leadership.

North America Automotive Network Testing Market Trends

North America shows strong demand for automotive network testing due to the increasing integration of ADAS, telematics, and OTA update capabilities in vehicles. The region benefits from early adoption of digital automotive technologies and robust investments in connected mobility infrastructure. Regulatory focus on vehicle safety and communication reliability further accelerates testing needs across OEMs and tech developers.

Europe Automotive Network Testing Market Trends

Europe maintains steady growth supported by stringent automotive safety norms and widespread implementation of high-bandwidth in-vehicle networks. The region’s strong EV and autonomous vehicle ecosystem drives continuous upgrades in communication protocols and network validation tools. Emphasis on cybersecurity and compliance testing also fuels market expansion across major European automotive hubs.

Middle East & Africa Automotive Network Testing Market Trends

The Middle East & Africa region is gradually expanding its automotive network testing landscape as smart mobility projects and connected vehicle initiatives gain traction. Growing investments in digital infrastructure and modern transportation systems contribute to rising demand. Although still emerging, the market shows potential due to increasing technology adoption in premium vehicle segments.

Latin America Automotive Network Testing Market Trends

Latin America experiences moderate development in automotive network testing, driven by the rising penetration of connected cars and improved ICT capabilities. Countries are increasingly adopting advanced diagnostics and network validation frameworks to enhance vehicle performance and safety. While market growth is steady, evolving automotive modernization efforts continue to create new opportunities in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Network Testing Company Insights

The global Automotive Network Testing Market in 2024 is shaped strongly by leading technology providers that continue to advance in-vehicle communication validation, high-speed data testing, and cybersecurity assurance. Among the top contributors, Teledyne LeCroy remains influential due to its deep portfolio in protocol analyzers and oscilloscopes. The company strengthens OEM capabilities by supporting high-bandwidth automotive Ethernet and ensuring robust error-detection across complex ECUs.

Spirent plays a central role in accelerating virtualized and automated automotive network testing. Its focus on simulation-driven validation and cybersecurity stress testing positions it as a preferred partner for connected vehicle programs, particularly those requiring large-scale performance benchmarking.

Anritsu maintains strong momentum with its advanced compliance test solutions for Ethernet, radar, and V2X networks. The company benefits from rising demand for real-time interference detection and harmonized communication standards across autonomous and semi-autonomous platforms.

FEV Group continues expanding its footprint through its specialized engineering services and tailored network validation frameworks. Its strengths lie in delivering end-to-end test environments for ADAS communication stacks and powertrain-network integration.

Other notable participants also support market resilience. Molex Avnet enhances the ecosystem through high-reliability connectors and testing modules optimized for increasing vehicle bandwidth. NextGig Systems contributes niche but essential capabilities in high-speed protocol testing hardware. Elektrobit drives value via its software-centric tools that validate automotive communication middleware and AUTOSAR-based systems. Xena Networks remains recognized for its cost-efficient Ethernet testing platforms tailored for automotive performance and stress conditions.

Top Key Players in the Market

- Teledyne LeCroy

- Spirent

- Anritsu

- FEV Group

- Molex Avnet

- NextGig Systems

- Elektrobit

- Xena Networks

- Spirent Communications

Recent Developments

- In December 2024 — Accenture announced it will acquire AOX to help automotive clients accelerate development of software-defined vehicles and scale software engineering capabilities.

- In November 2024 — An automotive systems division announced a strategic partnership with a major processor-IP company to help standardize software architectures and accelerate interoperability for software-defined vehicles.

- In May 2024 — Daimler Truck and Volvo Group revealed intentions to form a joint venture to build a software-defined vehicle platform aimed at amplifying digital transformation across commercial vehicles.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Network Type (CAN Bus Test, Ethernet Test, Others), By Application (Passenger Cars, Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Teledyne LeCroy, Spirent, Anritsu, FEV Group, Molex Avnet, NextGig Systems, Elektrobit, Xena Networks, Spirent Communications Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Network Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Network Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Teledyne LeCroy

- Spirent

- Anritsu

- FEV Group

- Molex Avnet

- NextGig Systems

- Elektrobit

- Xena Networks

- Spirent Communications