Global Automotive Metal Market By Product(Steel, Aluminium, Magnesium), By Technology(Blanking, Embossing, Coining, Bending, Flanging), By Process(Hot stamping, Roll forming, Metal Fabrication, Automotive steel metal forming), By End User(Cars, Light weight commercial vehicles, Heavy weight commercial vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 13949

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

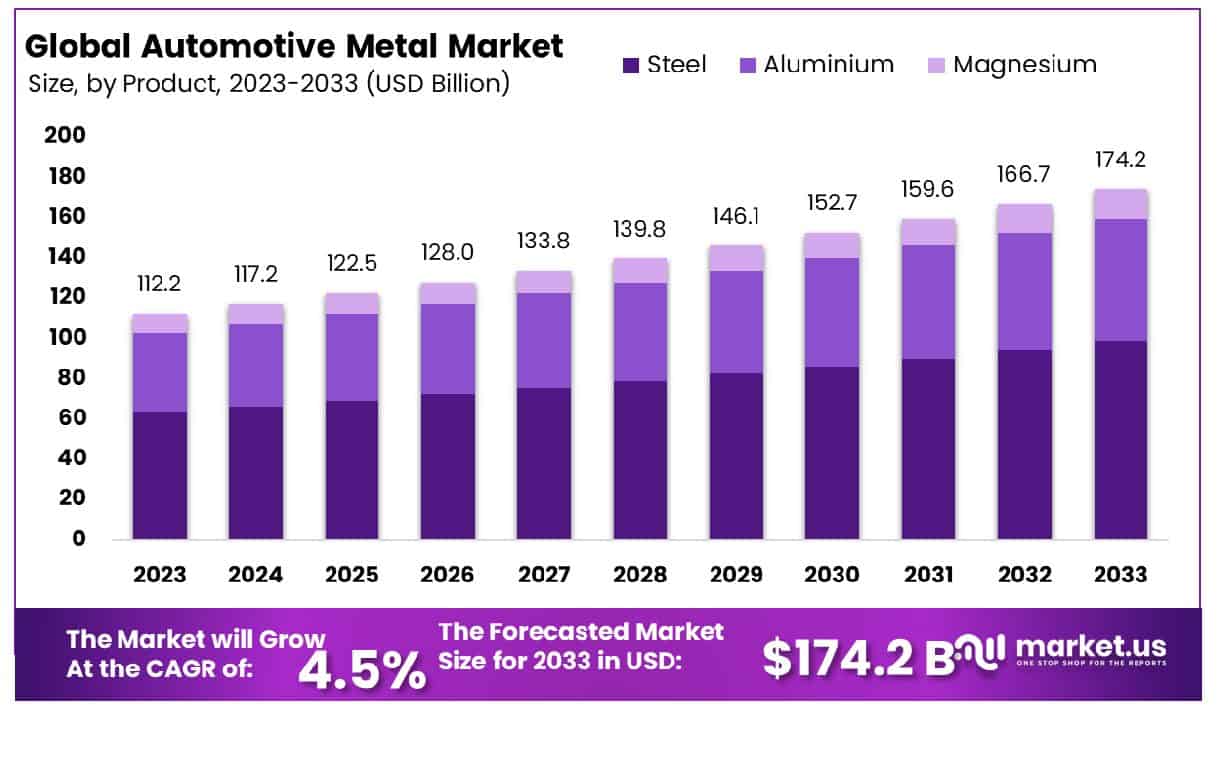

The Global Automotive Metal Market size is expected to be worth around USD 174.2 Billion by 2033, From USD 112.2 Billion by 2023, growing at a CAGR of 4.50% during the forecast period from 2024 to 2033.

The Automotive Metal Market encompasses a wide range of metals utilized in the manufacturing of automotive components and vehicle structures. This market is critical for ensuring the durability, safety, and efficiency of vehicles across the globe. Key metals include steel, aluminum, magnesium, and high-strength steel, each selected for its specific properties that contribute to vehicle performance, fuel efficiency, and emission reductions.

As the automotive industry evolves towards lightweight materials to meet stringent environmental regulations and enhance electric vehicle (EV) ranges, the demand for advanced high-strength steel and aluminum alloys is experiencing significant growth. This market’s dynamics are influenced by global automotive production trends, technological advancements in metal processing, and shifting preferences toward sustainable and efficient transportation solutions. Executives and product managers in the automotive sector closely monitor these trends to strategize product development and competitive positioning.

In the rapidly evolving landscape of the Automotive Metal Market, a discerning analysis reveals a nuanced trajectory of demand, influenced by a confluence of regulatory pressures, technological advancements, and shifting consumer preferences. The market is currently witnessing a strategic pivot towards lightweight materials, underscored by a steadfast commitment to enhancing fuel efficiency and reducing emissions in line with global sustainability targets. This transition is further catalyzed by the burgeoning electric vehicle (EV) sector, which necessitates innovative uses of metals to optimize range and performance.

A critical examination of recent metal statistics underscores this trend. In 2023, steel, a cornerstone material for the automotive industry, is projected to see a demand increase of 2.2%, reaching 1,881.4 million metric tons. This data is emblematic of the broader metal market dynamics. In 2022, substantial volumes of key automotive metals were mined, including Iron ore at approximately 2,600,000,000 tonnes, Aluminum at 69,000,000 tonnes, Chromium at 41,000,000 tonnes, and Copper. These figures not only reflect the scale of global metal production but also hint at the strategic shifts within the automotive sector towards more sustainable and efficient materials.

Key Takeaways

- Market Growth: Global Automotive Metal Market size is expected to be worth around USD 174.2 Billion by 2033, From USD 112.2 Billion by 2023, growing at a CAGR of 4.50% during the forecast period from 2024 to 2033.

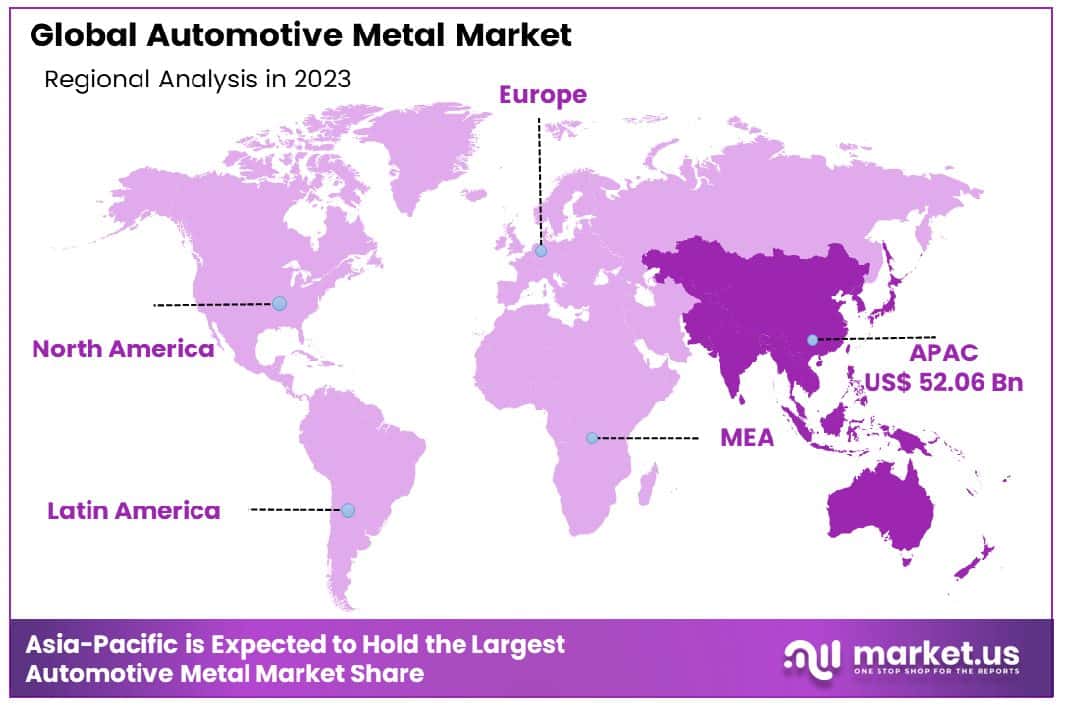

- Regional Dominance: Asia-Pacific leads with a 46.4% market share in the global automotive metal market.

- Segmentation Insights:

- By Product: Steel commands a dominant 56.6% market share, underscoring its pivotal role in automotive construction materials.

- By Technology: Blanking technology holds a 27.9% market share, highlighting its critical importance in shaping automotive metal components.

- By Process: Hot stamping, with a 36.9% market share, is paramount for enhancing metal strength and durability in automotive applications.

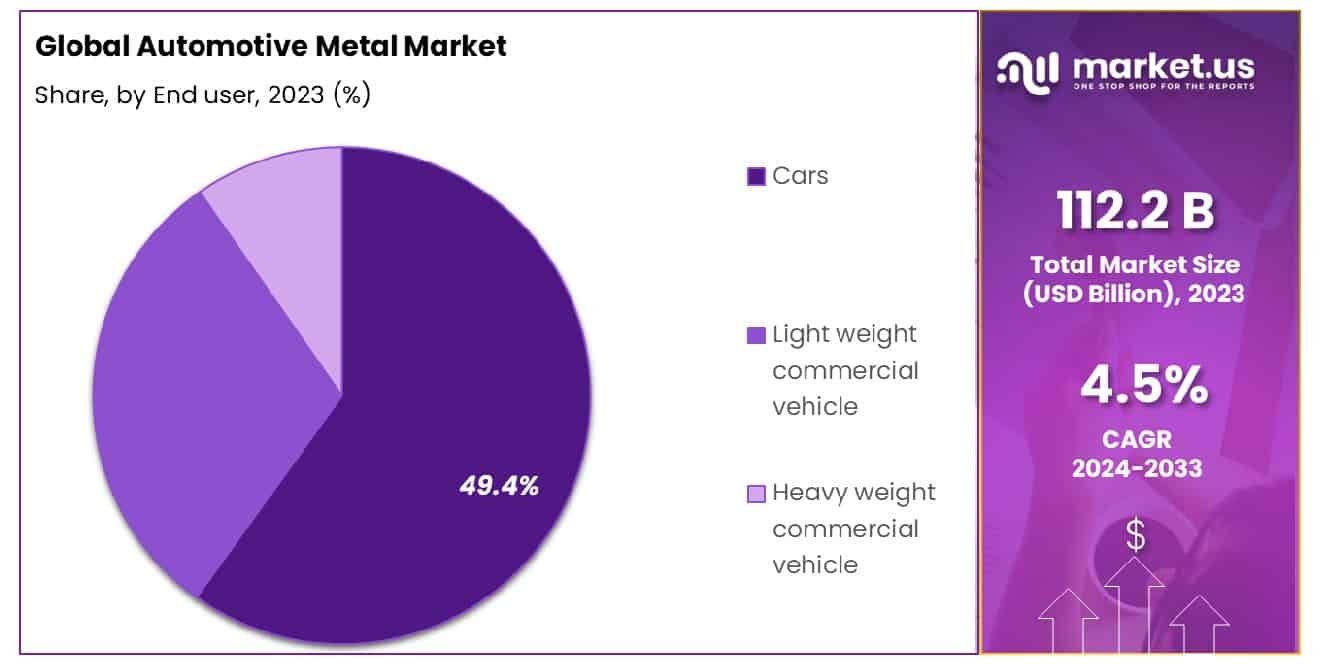

- By End-user: Cars, as the primary end-user, account for 49.4% of the market, reflecting the sector’s significant demand for automotive metals.

- Growth Opportunities: The global automotive metal market growth is driven by the electrification of vehicles and the expansion into emerging markets, fueled by demand for lightweight, efficient materials and increasing vehicle sales.

Driving Factors

Enhanced Maintenance Efficiency and Longevity of Stamped Metal Parts

The ease of maintenance and repair of stamped metal parts significantly contributes to the automotive metal market’s growth. This attribute reduces the lifetime cost of vehicles by facilitating quicker and more cost-effective repairs, making metal-based vehicles more appealing to consumers and fleet operators.

Additionally, the inherent durability and strength of stamped metal parts extend the vehicle’s lifespan, encouraging manufacturers to continue leveraging metal in automotive production. This demand for metal, driven by its maintenance and durability advantages, directly impacts the market’s expansion.

Superior Recyclability of Metals Enhancing Sustainability

The high recyclability of metals compared to plastics and composites stands as a pivotal factor in the automotive metal market’s growth. Metals, being infinitely recyclable without degradation of their properties, align with the global push towards sustainability and circular economy practices.

This recyclability not only reduces the environmental footprint associated with automotive production but also decreases reliance on virgin raw materials, thereby lowering manufacturing costs and conserving resources. The environmental and economic benefits of metal recyclability thus fuel its preference for less sustainable materials, propelling market growth.

Stringent Carbon Emission Regulations Driving Innovation

Stringent regulations aimed at reducing carbon emissions play a crucial role in shaping the automotive metal market. These regulations compel automakers to innovate and invest in lightweight metals that can reduce vehicle weight and, consequently, emissions. The adoption of advanced high-strength steels (AHSS), aluminum, and magnesium alloys for their lightweight properties is a direct response to these regulatory pressures.

By integrating these materials, manufacturers not only comply with environmental standards but also enhance fuel efficiency and performance, making the shift towards lightweight metals a significant growth driver for the market. The combined impact of regulatory compliance and the demand for high-performance, eco-friendly vehicles underscores the critical influence of emission standards on market dynamics.

Restraining Factors

Impact of High Product Costs on the Automotive Metal Market

The automotive metal market faces significant restraint from the high costs associated with premium metals and advanced processing techniques. These elevated prices can be attributed to the complex manufacturing processes and the need for high-quality, durable materials that meet the stringent requirements of the automotive industry. As a result, the demand for automotive metals may be curtailed, especially in markets sensitive to cost pressures.

This scenario encourages manufacturers to seek more cost-effective alternatives or innovative solutions to reduce production costs without compromising quality. The financial barrier posed by high-priced products necessitates a strategic approach from market players to balance cost and performance, thereby influencing the market’s growth trajectory.

Regulatory Pressures Shaping the Automotive Metal Market

Stringent government regulations focusing on reducing carbon emissions significantly impact the automotive metal market. These regulations compel automotive manufacturers to innovate and adopt lighter, more efficient materials that contribute to lower vehicle emissions. As a consequence, there’s an accelerated shift towards metals like aluminum and magnesium alloys, which, despite their higher cost, offer the benefit of weight reduction and enhanced fuel efficiency. This regulatory environment not only drives innovation but also reshapes supply chains and manufacturing processes in the automotive sector.

The dual pressures of compliance with environmental standards and the need to remain economically competitive foster a market environment where sustainability and efficiency become key drivers of growth. The integration of regulatory compliance with market demand for eco-friendly and high-performance vehicles creates opportunities for advancements in metal processing technologies and the development of new alloys, further stimulating market expansion.

By Product Analysis

Steel commands a significant 56.6% share of the automotive metal market, leading in preference.

In 2023, Steel held a dominant market position in the By Product segment of the Automotive Metal Market, capturing more than a 56.6% share. Aluminium followed, with a substantial contribution to the market, and Magnesium, though holding a smaller share, indicated a growing interest due to its lightweight and high-performance characteristics.

The preference for Steel can be attributed to its exceptional strength, durability, and cost-effectiveness, making it an indispensable choice for a wide range of automotive applications, from body structures to engine components. The robust demand for steel in the automotive sector underscores its pivotal role in ensuring vehicle safety and performance, despite the automotive industry’s evolving landscape towards lighter materials.

Aluminum, with its lightweight properties, has been increasingly adopted to enhance fuel efficiency and reduce carbon emissions, marking a significant shift in manufacturers’ material selection criteria. This trend is driven by stringent environmental regulations and a growing consumer preference for environmentally friendly and fuel-efficient vehicles. Aluminium’s versatility and corrosion resistance further bolster its application in automotive manufacturing, positioning it as a key material in the drive toward lightweight and sustainable automotive solutions.

Magnesium, although a minor player in the current market landscape, is witnessing a gradual uptick in adoption due to its even lighter weight compared to aluminum and its potential to significantly contribute to vehicle weight reduction. Its application, primarily in high-performance and luxury vehicles, signals an emerging trend that may see metal magnesium playing a more prominent role in the future of automotive metals.

By Technology Analysis

Blanking technology, holding 27.9% of the market, is pivotal in shaping automotive components.

In 2023, Blanking held a dominant market position in the By Technology segment of the Automotive Metal Market, capturing more than a 27.9% share. This was followed closely by Embossing, Coining, Bending, and Flanging, each contributing significantly to the market dynamics within this segment.

Blanking’s leading position can be primarily attributed to its critical role in the initial stages of metal forming processes, where precision and efficiency are paramount. This technology’s capability to cut precise shapes from metal sheets with minimal wastage has made it indispensable in automotive manufacturing, particularly in producing parts that require high levels of accuracy and repeatability.

Embossing, capturing the next substantial market share, is favored for its ability to add strength and rigidity to metal sheets without compromising their weight. This technology is crucial in the production of aesthetic and functional components, enhancing the visual appeal and structural integrity of automotive parts.

Coining, noted for its precision in creating detailed features on metal surfaces, is essential for manufacturing complex parts that require exact specifications. This process’s ability to achieve high levels of detail and surface finish has solidified its importance in automotive applications where precision is critical.

Bending and ranging technologies, while holding smaller market shares, play pivotal roles in shaping metal components for automotive assemblies. Bending is fundamental in forming curves and angles in metal parts, whereas Flanging is vital for creating flanges for easy assembly and structural enhancement.

By Process Analysis

Hot stamping, with a 36.9% process market share, is crucial for high-strength parts.

In 2023, Hot stamping held a dominant market position in the By Process segment of the Automotive Metal Market, capturing more than a 36.9% share. This was followed by Roll forming, Metal Fabrication, and Automotive steel metal forming, each playing a crucial role in shaping the market landscape within this segment.

The prominence of Hot stamping can be attributed to its unparalleled ability to enhance the strength and lightweight properties of automotive metals. This process, vital for producing ultra-high-strength steel components, allows manufacturers to meet stringent safety and environmental regulations by enabling the production of lighter, more fuel-efficient vehicles without compromising on safety or performance.

Roll forming, securing the next significant position, is recognized for its efficiency in creating long, uniform shapes with a consistent cross-section, which is essential for automotive frames and structural components. Its ability to produce parts with excellent surface finish and dimensional accuracy, while minimizing material wastage, underscores its value in automotive manufacturing.

Metal Fabrication, encompassing a broad range of processes including cutting, bending, and assembling, remains integral for its flexibility and adaptability in producing a diverse array of automotive parts. This segment’s importance is magnified by the automotive industry’s need for complex, custom-designed components.

Automotive steel metal forming, though holding a smaller share, is crucial for the mass production of steel parts that form the skeleton of most vehicles. This process’s ability to produce durable, high-quality components efficiently plays a pivotal role in the automotive supply chain.

By End-user Analysis

Cars, as the primary end-user, dominate the market, consuming 49.4% of automotive metals.

In 2023, Cars held a dominant market position in the end-user segment of the Automotive Metal Market, capturing more than a 49.4% share. This segment was closely followed by Light Weight Commercial Vehicles and Heavy Weight Commercial Vehicles, each playing a critical role in the market’s dynamics.

The substantial market share occupied by Cars can be attributed to the sustained demand for passenger vehicles across the globe, driven by increasing urbanization, rising disposable incomes, and the growing preference for personal mobility solutions. The automotive metal market has significantly benefited from this trend, as metals such as steel, aluminum, and magnesium are integral to car manufacturing, offering the necessary strength, durability, and lightweight properties to meet modern automotive standards.

Light Weight Commercial Vehicles (LWCVs) also command a significant portion of the market, reflecting the critical role these vehicles play in urban logistics and transportation. The rise of e-commerce and the expansion of service industries have fueled the demand for LWCVs, which, in turn, drives the need for automotive metals tailored to these vehicles’ specific requirements for efficiency and payload capacity.

Heavy Weight Commercial Vehicles (HWCVs), although holding a smaller share compared to Cars and LWCVs, are essential for long-haul transport and heavy-duty applications. The demand for automotive metals in HWCVs focuses on durability, strength, and resistance to wear and tear, reflecting the rigorous demands placed on these vehicles.

Key Market Segments

By Product

- Steel

- Aluminium

- Magnesium

By Technology

- Blanking

- Embossing

- Coining

- Bending

- Flanging

By Process

- Hot stamping

- Roll forming

- Metal Fabrication

- Automotive steel metal forming

By End User

- Cars

- Light weight commercial vehicles

- Heavy weight commercial vehicles

Growth Opportunities

Electrification of Vehicles and Advanced Material Adoption

The transition towards electrification in the automotive industry presents a significant growth opportunity for the global automotive metal market. The shift is driven by the increasing global demand for electric vehicles (EVs), propelled by environmental concerns and stringent emission regulations. Metals such as aluminum, high-strength steel, and magnesium are in the spotlight due to their lightweight properties, which are crucial for improving EV range and efficiency.

Furthermore, the adoption of advanced high-strength steel (AHSS) can be observed to enhance vehicle safety while minimizing weight. The market is expected to benefit from the research and development of new alloys and composite materials, designed to meet the specific needs of electric vehicle structures and battery enclosures. The growth in this sector can be attributed to the automotive industry’s commitment to sustainability and fuel efficiency, fostering innovation in metal usage and fabrication techniques.

Expansion into Emerging Markets

Emerging markets represent a fertile ground for the expansion of the global automotive metal market. The rise in vehicle production and sales in countries such as China, India, and Brazil is underpinned by growing economic prosperity and a burgeoning middle class. This demographic shift is anticipated to increase demand for passenger vehicles, subsequently driving the need for automotive metals.

Moreover, the adoption of more stringent safety and emission standards in these markets mirrors those of developed countries, necessitating the use of advanced materials for vehicle manufacturing. The strategic establishment of new manufacturing facilities, alongside partnerships with local entities, can facilitate market penetration and leverage local market dynamics. The opportunity in emerging markets is characterized by a combination of increasing automotive production capabilities and the adoption of greener, more efficient vehicle technologies.

Latest Trends

Sustainability and Recycling Initiatives

Sustainability and recycling have emerged as prominent trends within the global automotive metal market in 2023. The industry is witnessing a significant shift towards the use of recycled metals and the implementation of circular economy principles. This trend is driven by growing environmental awareness, regulatory pressures, and consumer demand for eco-friendly products. Automakers and metal suppliers are increasingly adopting sustainable practices, including the recycling of aluminum and steel, to reduce the carbon footprint of vehicle production.

The use of recycled materials not only diminishes the reliance on virgin resources but also significantly lowers energy consumption and greenhouse gas emissions during the manufacturing process. The growth of sustainability initiatives can be attributed to the automotive sector’s efforts to align with global climate goals and enhance environmental stewardship, positioning recycled metals as a key component of future vehicle designs.

Advanced High-Strength Steels (AHSS) for Vehicle Lightweighting

The adoption of Advanced High-Strength Steels (AHSS) represents a notable trend in the automotive metal market, aimed at vehicle lightweighting without compromising safety or performance. As fuel efficiency standards become more stringent and the electric vehicle (EV) range becomes a critical factor, the demand for AHSS is rising. These materials offer an optimal balance between weight reduction and structural integrity, enabling automakers to design lighter, more fuel-efficient vehicles.

The innovation in steel manufacturing technologies and the development of new steel grades are facilitating the wider application of AHSS in automotive structures, including body, chassis, and safety components. This trend reflects the industry’s ongoing pursuit of materials that can enhance vehicle performance while adhering to environmental and safety regulations, underscoring AHSS’s pivotal role in the future of automotive design and manufacturing.

Regional Analysis

Asia-Pacific dominates the automotive metal market with a 46.4% share, driven by robust vehicle production and demand.

The Automotive Metal Market is segmented across various regions, each displaying unique trends and opportunities influenced by regional industrial dynamics, economic policies, and technological advancements. In North America, the market is characterized by a robust demand for lightweight and high-strength metals, driven by stringent emission regulations and a growing preference for fuel-efficient vehicles.

This region benefits from advanced manufacturing technologies and a strong presence of major automotive players. Europe’s market is similarly advanced, with a strong emphasis on sustainability and innovation. The region’s commitment to reducing carbon emissions and the high adoption rate of electric vehicles (EVs) significantly contribute to the demand for advanced automotive metals.

The Asia-Pacific region, holding a dominating market share of 46.4%, is the epicenter of growth for the Automotive Metal Market. This dominance is attributed to rapid industrialization, increasing automotive production, and investments in automotive manufacturing technologies, particularly in China, Japan, and South Korea. The demand in this region is propelled by the expansion of the middle class, resulting in increased vehicle ownership, and by governments’ initiatives to promote EVs.

In contrast, the Middle East & Africa, and Latin America regions, though smaller in market size, are witnessing gradual growth. These regions benefit from urbanization and economic development, which spur automotive demand. However, the growth in these areas is tempered by factors such as political instability and less developed automotive industries compared to their global counterparts.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the highly competitive landscape of the global Automotive Metal Market in 2023, key players have showcased strategic advancements, innovation, and geographical expansion to strengthen their market positions. Tata Steel, with its extensive portfolio and emphasis on sustainable steel production, continues to lead with innovation, catering to the evolving needs of the automotive industry. Hyundai Steel, leveraging its integrated steel production capabilities, has focused on developing high-strength, lightweight steel to meet the stringent requirements of modern automotive manufacturers.

Essar Steel has demonstrated resilience and adaptability, focusing on cost-effective production and high-quality products to maintain its competitiveness. Novalis has distinguished itself in the aluminum sector by investing in R&D to produce advanced automotive aluminum solutions, reducing vehicle weight and enhancing fuel efficiency. Posco, with its global presence, has been at the forefront of developing advanced high-strength steels (AHSS), positioning itself as a leader in materials innovation.

Voestalpine Group has strategically positioned itself through its high-quality steel products and innovative solutions, targeting niche markets within the automotive sector. United Steel Corporation and ArcelorMittal have heavily invested in technological advancements to improve their product offerings, focusing on sustainability and efficiency. UACJ Corporation, with its aluminum expertise, has expanded its reach in the automotive market, capitalizing on the growing demand for lightweight materials.

Kobe Steel, with its scandal recovery efforts, has emphasized quality and transparency, rebuilding its brand and trust within the industry. Massey Ferguson Ltd, traditionally known for agricultural machinery, has ventured into the automotive metal market, leveraging its expertise in durable and high-strength materials. Nippon Steel & Sumitomo Metal Corporation, through strategic mergers and acquisitions, has expanded its global footprint, focusing on innovative steel products for the automotive sector.

Market Key Players

- Tata Steels

- Hyundai Steels

- Essar Steel

- Novalis

- Posco

- Vo estalpine Group

- United steel Corporation

- Ar cellar Mittal

- UACJ Corporation

- Kobe Steel

- Massey Furguson Ltd

- Nippon steel and somitomo metal corporation

Recent Development

- In February 2024, UKRI’s Made Smarter Innovation challenge awarded £3.7m to projects like Brom-Bot for robotic Brompton bicycle production and Rivelin Robotics for 3D-printed metal part processing.

- In February 2024, Heraeus Precious Metals and Sibanye-Stillwater partner to explore palladium applications in the hydrogen economy, aiming to develop markets beyond automotive, supporting the hydrogen sector with technical innovations.

- In February 2024, Vedanta Aluminium launches Vedanta Metal Bazaar, the world’s largest online store for aluminum products, featuring over 750 variants and AI-based price discovery, aiming to revolutionize the aluminum procurement process.

Report Scope

Report Features Description Market Value (2023) USD 112.2 Billion Forecast Revenue (2033) USD 174.2 Billion CAGR (2024-2033) 4.50% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Steel, Aluminium, Magnesium), By Technology(Blanking, Embossing, Coining, Bending, Flanging), By Process(Hot stamping, Roll forming, Metal Fabrication, Automotive steel metal forming), By End User(Cars, Light weight commercial vehicles, Heavy weight commercial vehicles) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Tata Steels, Hyundai Steels, Essar Steel, Novalis, Posco, Vo estalpine Group, United Steel Corporation, Ar cellar Mittal, UACJ Corporation, Kobe Steel, Massey Furguson Ltd, Nippon steel and somitomo metal corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Automotive Metal Market in 2023?The Global Automotive Metal Market size is USD 112.2 Billion in 2023.

What is the projected CAGR at which the Global Automotive Metal Market is expected to grow at?The Global Automotive Metal Market is expected to grow at a CAGR of 4.50% (2024-2033).

List the segments encompassed in this report on the Global Automotive Metal Market?Market.US has segmented the Global Automotive Metal Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product(Steel, Aluminium, Magnesium), By Technology(Blanking, Embossing, Coining, Bending, Flanging), By Process(Hot stamping, Roll forming, Metal Fabrication, Automotive steel metal forming), By End User(Cars, Light weight commercial vehicles, Heavy weight commercial vehicles)

List the key industry players of the Global Automotive Metal Market?Tata Steels, Hyundai Steels, Essar Steel, Novalis, Posco, Vo estalpine Group, United Steel Corporation, Ar cellar Mittal, UACJ Corporation, Kobe Steel, Massey Furguson Ltd, Nippon steel and somitomo metal corporation

Name the key areas of business for Global Automotive Metal Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Automotive Metal Market.

-

-

- Tata Steels

- Hyundai Steels

- Essar Steel

- Novalis

- Posco

- Vo estalpine Group

- United steel Corporation

- Ar cellar Mittal

- UACJ Corporation

- Kobe Steel

- Massey Furguson Ltd

- Nippon steel and somitomo metal corporation