Global Automotive Insurance Market Size, Share Analysis Report By Policy Type (Third-Party Laibility Insurance, Comprehensive Coverage, Collision Coverage, Personal Injury Protection), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers), By Distribution Channel (Insurance Agents/Brokers, Direct Sales, Bancassurance, Online Aggregators, Digital/Telematics-based Platforms, OEM/Dealer Partnerships), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152136

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

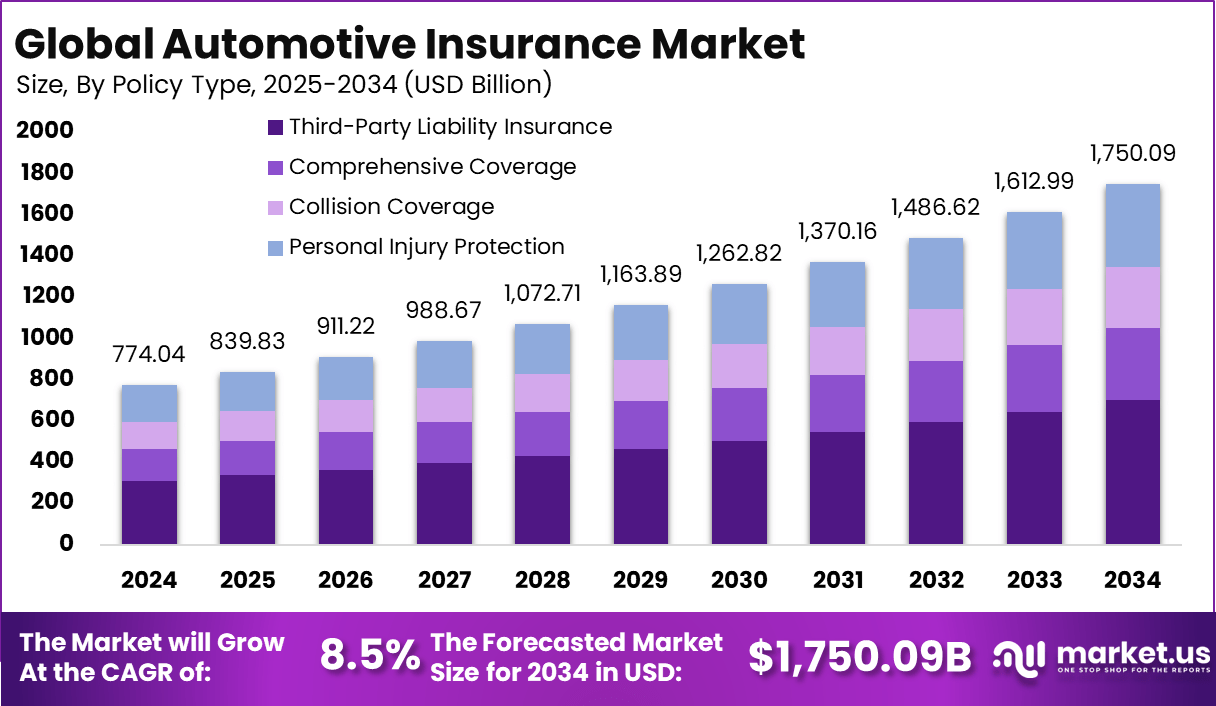

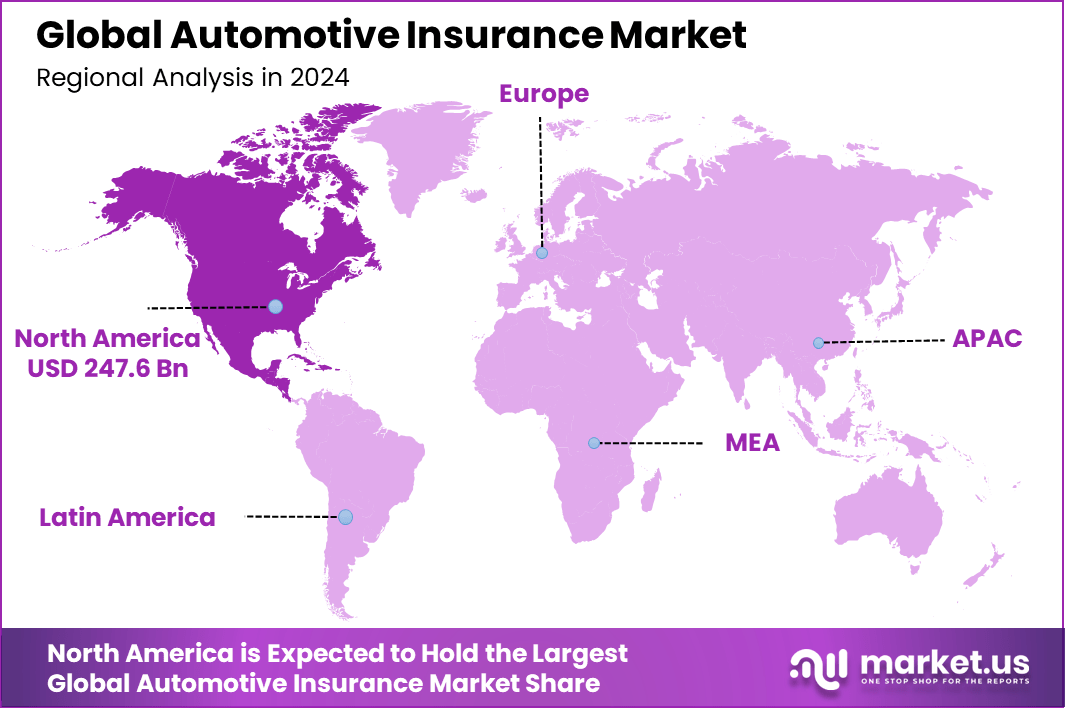

The Global Automotive Insurance Market size is expected to be worth around USD 1,750.09 billion by 2034, from USD 774.04 billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32% share, holding USD 247.6 billion in revenue.

The automotive insurance market is currently marked by a leading segment – usage‑based insurance (UBI) powered by telematics and AI analytics. UBI is gaining predominance due to its capacity to align premiums with actual driving behavior, offering precision risk assessment and personalized pricing. Telematics data -captured via connected vehicle sensors – enables insurers to model risk profiles in real time, fostering a more equitable value exchange between insurers and policyholders.

The top driving factors advancing this market include escalating vehicle ownership, stringent regulatory mandates for insurance, and rising accident rates. The requirement for minimum coverage creates a baseline demand, while the proliferation of cars – especially in emerging markets – enlarges the addressable base. Technology-enabled risk evaluation through telematics further refines pricing and drives adoption.

Demand analysis reveals that the integration of telematics and advanced analytics is transforming traditional premium models. Telematics-based policies are outperforming conventional models in engagement, with UBI set to account for nearly 47 % of the market by 2025. Consumers are showing growing interest in personalized premiums tied to actual driving behavior.

According to Market.us, The AI in Insurance Market is projected to experience exceptional growth, with its value expected to reach USD 91 Billion by 2033, rising from USD 5 Billion in 2023. This expansion reflects a strong CAGR of 32.7% during the period from 2024 to 2033.

Simultaneously, the Global Online Insurance Market is forecasted to expand significantly, reaching approximately USD 681.2 Billion by 2034, from a base of USD 95.6 Billion in 2024. This growth corresponds to a CAGR of 21.7% between 2025 and 2034.

The increased adoption of ADAS (advanced driver assistance systems), automatic emergency braking (AEB), and V2X technologies is profoundly influencing market dynamics. These safety systems reduce accident frequency, but their integration raises claims complexity and repair costs. AEB alone lowers rear-end crashes by nearly 39 %, creating both opportunities and cost challenges for insurers.

Reasons for adopting these innovations include better risk profiling, retention of safer drivers, and alignment with regulatory safety standards. Telematics and ADAS enable insurers to reduce claims frequency, optimize pricing, and reward responsible behavior. Simultaneously, they help address repair cost inflation stemming from high-value vehicle components.

Key Takeaway

- The market is projected to grow from USD 774.04 billion in 2024 to approximately USD 1,750.09 billion by 2034, registering a healthy CAGR of 8.5%, driven by increasing vehicle ownership, regulatory mandates, and rising awareness of financial protection.

- North America led the global market in 2024, securing over 32% share with revenue of about USD 247.6 billion, supported by high vehicle density, stringent insurance laws, and advanced digital distribution networks.

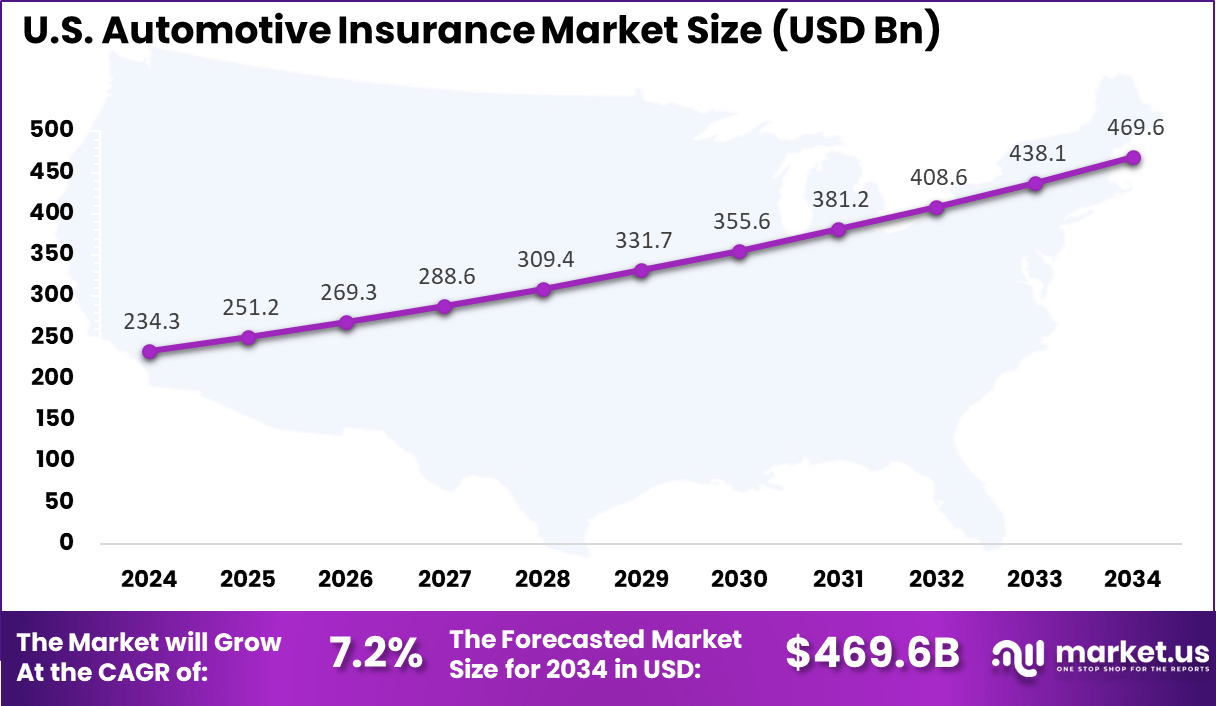

- The U.S. market alone contributed USD 234.3 billion in 2024, and is forecast to grow at a CAGR of 7.2%, reflecting steady demand for both personal and commercial vehicle coverage.

- By policy type, Third-Party Liability Insurance dominated with a 40% share, as regulatory requirements and affordability make it the most common policy choice globally.

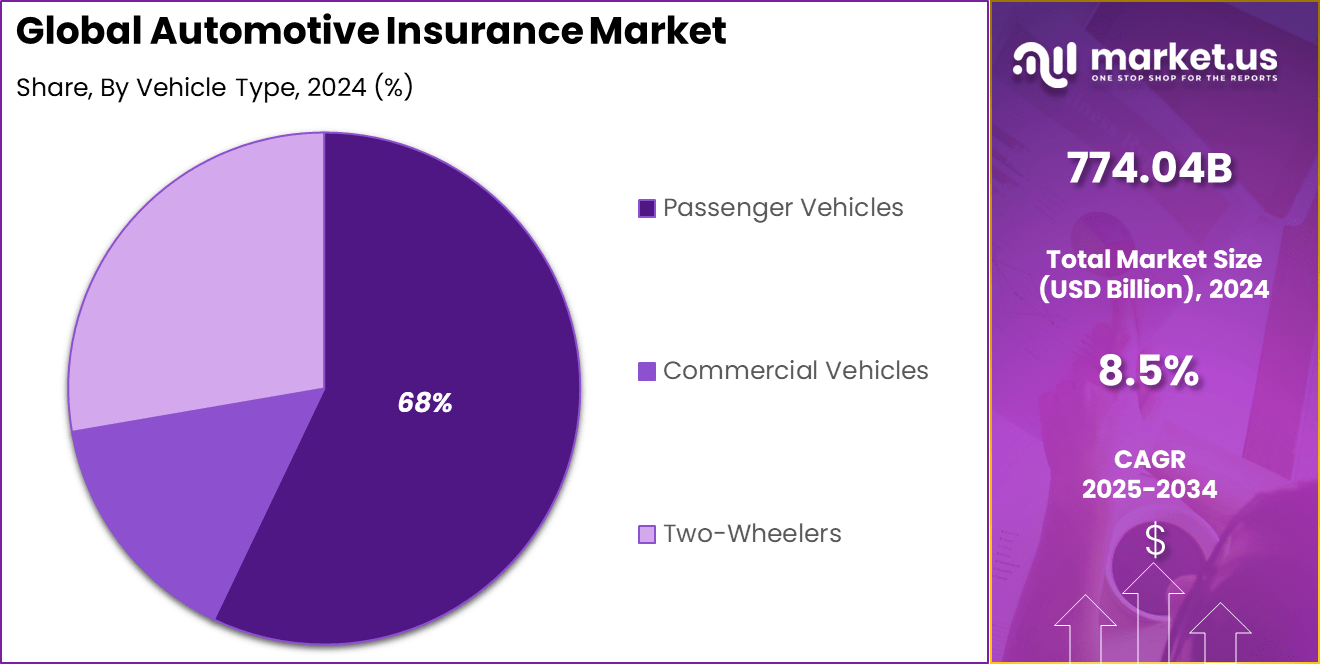

- In terms of vehicle type, Passenger Vehicles accounted for the largest segment at 68%, driven by growing personal mobility, urbanization, and expanding middle-class vehicle ownership.

- By distribution channel, Insurance Agents and Brokers remained the preferred medium, holding 34% share, due to their ability to offer tailored advice, facilitate claims, and build trust with policyholders.

U.S. Market Size

The U.S. Automotive Insurance Market was valued at USD 234.3 Billion in 2024 and is anticipated to reach approximately USD 469.6 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.2% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 32% share, holding USD 247.6 billion in revenue. This leadership can be attributed to the region’s advanced automotive ecosystem, stringent insurance mandates, and widespread adoption of telematics-based policies.

The U.S. in particular has seen a rapid uptake of usage-based insurance (UBI) models, driven by the increasing integration of in-vehicle telematics, smartphone apps, and AI-powered risk assessment tools. Consumers across the U.S. and Canada are embracing behavior-based premium models, which provide financial incentives for safe driving and help insurers manage loss ratios more effectively.

Another critical factor is the maturity of the regulatory environment in North America, which encourages technological innovation while maintaining strong consumer protection. Bodies such as the National Association of Insurance Commissioners (NAIC) have established clear guidelines for data privacy, telematics usage, and premium transparency.

Moreover, the region’s high vehicle ownership rate, urban density, and prevalence of high-value vehicles contribute to a heightened demand for comprehensive and personalized insurance products. These elements, combined with a strong base of leading insurance providers and digital-first insurtech companies, have cemented North America’s position as the top-performing region in the global automotive insurance market.

Policy Type Analysis

In 2024, the Third-Party Liability Insurance segment held a dominant market position, capturing more than a 40% share of the global automotive insurance market. This leadership was largely driven by regulatory mandates in most countries that make third-party coverage a legal requirement for all vehicle owners.

Such regulations ensure consistent demand, particularly in developing and densely populated regions where motorization is rapidly increasing. Third-party policies are typically the first point of entry for new drivers and vehicle owners, ensuring basic protection against damages caused to others during accidents.

Affordability also plays a key role in the segment’s dominance. Compared to comprehensive or collision coverage, third-party liability policies involve lower premium costs, making them attractive to cost-sensitive consumers, especially in markets with high uninsured motorist rates. These policies are especially favored by owners of older vehicles or those not seeking extensive coverage.

Vehicle Type Analysis

In 2024, the Passenger Vehicles segment held a dominant market position in the automotive insurance landscape, capturing an estimated 68% share globally and in leading regional markets. This supremacy can be attributed to several structural factors.

First, passenger vehicles constitute the vast majority of vehicles on the road, outnumbering commercial fleets and two‑wheelers, which naturally results in greater insurance penetration and premium volumes. Second, regulatory frameworks in key markets often mandate comprehensive and third-party liability coverage for personal cars, driving both awareness and uptake.

Consequently, insurers allocate a significant portion of underwriting resources to this segment, underpinning its market dominance. The leadership of passenger vehicles in automotive insurance is further reinforced by consumer behavior and insurer strategies.

Private vehicle owners tend to seek broad, customizable insurance policies that include add-ons such as collision, theft, and personal injury protection- options less commonly demanded in commercial or two‑wheeler segments. Insurers respond by developing tailored, value‑rich products that cater to this demand, enhancing retention and profitability.

Distribution Channel Analysis

In 2024, Insurance Agents/Brokers segment held a dominant market position, capturing more than a 34 % share. This leadership can be attributed to the personalized advisory model that agents and brokers provide.

As trusted intermediaries, they offer tailored consultation, guide policyholders through complex product structures, and align coverage with individual risk profiles. This customized approach remains highly valued by clients who prefer human interaction to navigate available options and make informed choices.

Furthermore, deep market expertise and negotiation capability underpin the segment’s advantage. Agents and brokers leverage comprehensive understanding of underwriting criteria, regional regulatory frameworks, and insurer-specific offerings.

This enables them to secure competitive premiums and coverage terms. Additionally, strong relationships with carriers enhance the capacity to advocate for clients during claims processing, contributing to high service satisfaction and retention.

Key Market Segments

By Policy Type

- Third-Party Laibility Insurance

- Comprehensive Coverage

- Collision Coverage

- Personal Injury Protection

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Distribution Channel

- Insurance Agents/Brokers

- Direct Sales

- Bancassurance

- Online Aggregators

- Digital/Telematics-based Platforms

- OEM/Dealer Partnerships

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Rise of Telematics-Based Personalization

A major trend shaping the automotive insurance market is the increasing adoption of telematics-based solutions. Insurers are gradually shifting from traditional pricing models to behavior-based approaches that use real-time driving data.

By tracking acceleration, braking, distance, and time of travel, insurance providers can tailor premiums more accurately to individual driving habits. This shift supports fairer pricing and encourages safer behavior among policyholders, helping reduce accidents and improve claim ratios.

The rise of connected cars and smartphone telematics apps has made it easier for insurers to collect this data without costly infrastructure. Several studies indicate that drivers who receive real-time feedback on their behavior tend to improve over time. This not only lowers the risk profile but also enhances customer loyalty.

Key Driver

Growth in Advanced Driver-Assistance Systems (ADAS)

The growing integration of ADAS technologies in modern vehicles is driving a significant shift in the insurance market. Features such as adaptive cruise control, collision warning, and lane departure alerts are helping to reduce accident frequency.

As these technologies become standard in new models, the risk exposure for insurers is being lowered, which supports better loss ratios and premium stability over time. This shift is particularly important in countries where safety regulations mandate such systems in passenger cars.

However, it is also creating complexity in claim management, especially when sensors or cameras are damaged. Despite this, the overall safety benefits of ADAS are contributing to a long-term positive impact on the automotive insurance industry by minimizing collision-related claims and improving risk forecasting.

Key Restraint

Escalating Claim Severity and Repair Costs

A major restraint facing the automotive insurance industry is the sharp increase in claim severity. As vehicles become more complex, even minor accidents often require expensive repairs due to the involvement of electronics, sensors, and embedded systems. This has led to higher average claim payouts, putting pressure on underwriting profitability.

In addition to repair costs, legal settlements in some markets have shown a significant upward trend, especially for personal injury cases. This has forced insurers to raise premiums or revise coverage terms. While insurers are investing in digital claims processing and predictive analytics to control costs, the rising complexity of modern vehicles remains a structural challenge that is difficult to offset quickly.

Key Opportunity

Embedded Insurance through OEM Collaboration

Embedded insurance, where coverage is bundled at the point of vehicle purchase, is emerging as a strong opportunity. Automotive manufacturers are collaborating with insurance companies to offer policies directly through their sales channels. This model simplifies the insurance buying process and creates a seamless customer experience, especially appealing to younger, tech-savvy consumers.

With access to vehicle data from day one, insurers can also offer dynamic pricing and real-time risk assessment. This not only boosts distribution efficiency but also allows for more accurate underwriting. As digital ecosystems mature, the potential for embedded insurance to expand into connected services, maintenance, and even real-time claim support presents a clear growth path for insurers and automotive partners alike.

Key Challenge

Regulatory and Liability Uncertainty for Autonomous Vehicles

The shift toward autonomous and semi-autonomous vehicles presents a significant challenge for the insurance sector. Traditional liability models that place responsibility on the driver are being questioned, as decisions may increasingly be made by software. This creates uncertainty around who is at fault in the event of a crash involving autonomous systems.

Alongside this, data privacy and cybersecurity regulations are becoming stricter. Insurers that rely on telematics and vehicle data must navigate complex legal frameworks while ensuring compliance and transparency. The lack of a uniform global regulatory standard further complicates matters, especially for multinational insurers. This uncertainty may slow innovation in policy design and delay the adoption of new technologies in insurance offerings.

Key Players Analysis

In the global automotive insurance landscape, Allianz SE, AXA SA, and State Farm Mutual continue to lead through diversified product portfolios and strong underwriting performance. These insurers have maintained large customer bases across Europe and North America by offering personalized policies, telematics integration, and efficient claims handling systems.

Progressive Corporation, GEICO (Berkshire Hathaway), and Liberty Mutual Insurance have gained considerable market share by leveraging direct-to-consumer channels and price-competitive strategies. With aggressive marketing and adoption of real-time data analytics, these companies have optimized risk evaluation and reduced fraud. Their mobile-first policy management tools and fast claims resolution attract tech-savvy drivers.

Zurich Insurance Group, Tokio Marine Group, Mapfre S.A., and Admiral Group represent strong global players with a growing presence in both emerging and mature markets. Their localized offerings and strategic alliances help address region-specific needs. In Asia, firms like Bajaj Allianz General Insurance and ICICI Lombard General Insurance play a pivotal role in driving motor insurance penetration.

Top Key Players in the Market

- Allianz SE

- AXA SA

- State Farm Mutual

- Progressive Corporation

- GEICO (Berkshire Hathaway)

- Liberty Mutual Insurance

- Zurich Insurance Group

- Tokio Marine Group

- Mapfre S.A.

- Admiral Group

- Allstate Corporation

- Bajaj Allianz General Insurance

- ICICI Lombard General Insurance

- Others

Report Scope

Report Features Description Market Value (2024) USD 774.0 Bn Forecast Revenue (2034) USD 1,750.0 Bn CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Policy Type (Third-Party Laibility Insurance, Comprehensive Coverage, Collision Coverage, Personal Injury Protection), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers), By Distribution Channel (Insurance Agents/Brokers, Direct Sales, Bancassurance, Online Aggregators, Digital/Telematics-based Platforms, OEM/Dealer Partnerships) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz SE, AXA SA, State Farm Mutual, Progressive Corporation, GEICO (Berkshire Hathaway), Liberty Mutual Insurance, Zurich Insurance Group, Tokio Marine Group, Mapfre S.A., Admiral Group, Allstate Corporation, Bajaj Allianz General Insurance, ICICI Lombard General Insurance, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Insurance MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Insurance MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz SE

- AXA SA

- State Farm Mutual

- Progressive Corporation

- GEICO (Berkshire Hathaway)

- Liberty Mutual Insurance

- Zurich Insurance Group

- Tokio Marine Group

- Mapfre S.A.

- Admiral Group

- Allstate Corporation

- Bajaj Allianz General Insurance

- ICICI Lombard General Insurance

- Others