Global Automotive Hypervisor Market Size, Share, Growth Analysis By Product Type (Type 1 Automotive Hypervisor, Type 2 Automotive Hypervisor), By Mode of Operation (Autonomous Vehicle, Semi-autonomous Vehicle), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By End User (Economy, Mid-Priced, Luxury), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173287

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

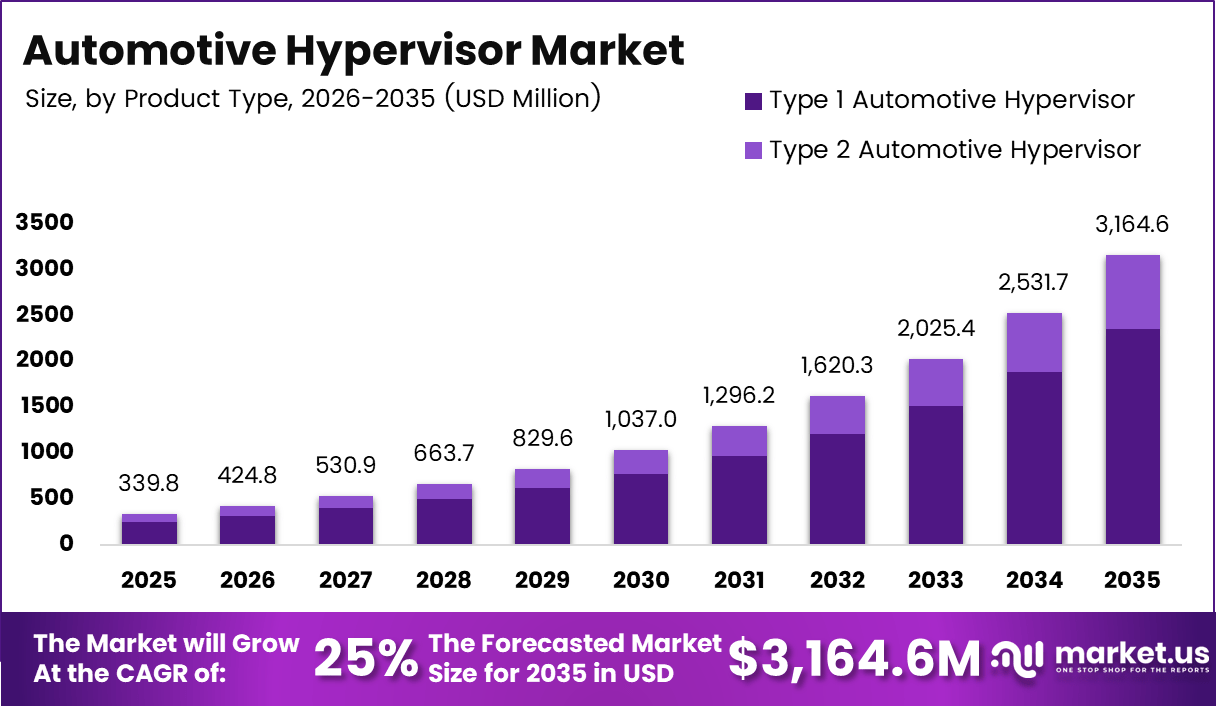

The Global Automotive Hypervisor Market size is expected to be worth around USD 3,164.6 million by 2035, from USD 339.8 Million in 2025, growing at a CAGR of 25% during the forecast period from 2026 to 2035.

The Automotive Hypervisor refers to a virtualization software layer enabling multiple operating systems to run safely on a single automotive hardware platform. It acts as a foundational enabler for software defined vehicles. Therefore, it supports workload isolation, real time performance, and safety compliance across infotainment, ADAS, and body control domains.

The Automotive Hypervisor Market reflects the automotive industry’s transition toward centralized and zonal electronic architectures. Consequently, OEMs increasingly consolidate ECUs into high performance SoCs to reduce cost and complexity. This shift accelerates demand for automotive grade virtualization, real time scheduling, and secure partitioning capabilities.

Market growth remains steady, driven by rising vehicle software content and expanding electrification and autonomy programs. Moreover, connected vehicle services, digital cockpits, and over the air updates depend on hypervisor based platforms. As a result, automotive hypervisor solutions are becoming strategic assets supporting scalability, lifecycle management, and long term software monetization models.

Government investment and regulatory alignment further reinforce market expansion. Functional safety standards, cybersecurity mandates, and software update regulations increasingly favor virtualization approaches. Therefore, public initiatives supporting intelligent transportation systems and vehicle electrification indirectly stimulate hypervisor adoption. These frameworks encourage OEMs to adopt modular, certifiable, and upgradable in vehicle software architectures.

Opportunities continue to emerge as automakers pursue faster development cycles and software reuse efficiencies. Automotive hypervisors enable parallel development of infotainment and safety applications. Thus, engineering teams achieve reduced integration risk and improved validation timelines. This efficiency aligns with growing pressure to shorten vehicle development cycles while maintaining compliance and reliability.

Technology advancements also shape market momentum. Support for real time operating systems, Linux environments, and mixed criticality workloads enhances platform flexibility. Consequently, hypervisors increasingly integrate with middleware, drivers, and basic software stacks. This integration strengthens ecosystem compatibility and supports seamless deployment across diverse automotive computing environments.

In recent platform, advanced SoC software packages demonstrate measurable efficiency gains. According to official product documentation, the R Car S4 solution enables reuse of up to 88%of existing software code from previous automotive platforms. Additionally, it supports real time processing through integrated drivers, Linux BSP, and hypervisor frameworks.

Key Takeaways

- The global Automotive Hypervisor Market is projected to reach USD 3,164.6 million by 2035, growing from USD 339.8 million in 2025 at a CAGR of 25%.

- Type 1 Automotive Hypervisor is the leading segment, accounting for a dominant share of 74.5% in 2025.

- Semi-autonomous vehicles represent the largest mode of operation segment with a market share of 65.2%.

- Passenger cars dominate the vehicle type segment, contributing approximately 68.9% of the total market.

- Luxury vehicles lead the end-user segment with a share of 48.1% in 2025.

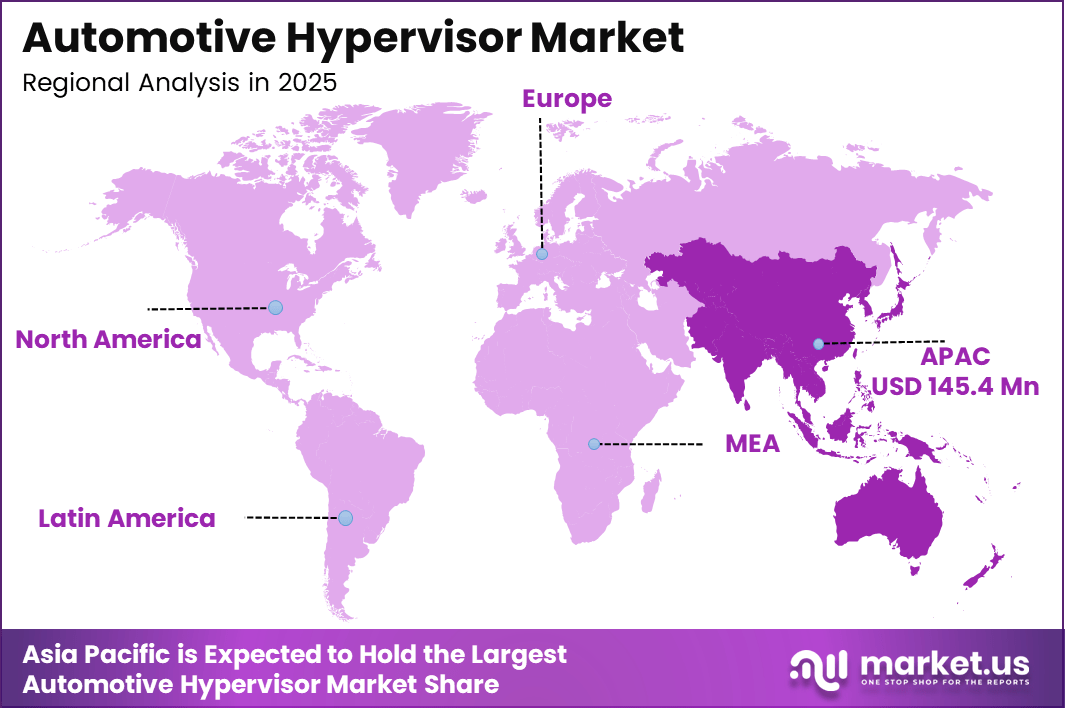

- Asia Pacific is the dominating region, holding 42.8% of the market and valued at USD 145.4 million.

By Product Type Analysis

Type 1 Automotive Hypervisor dominates with 74.5% due to its deep integration capability and suitability for safety critical automotive workloads.

In 2025, Type 1 Automotive Hypervisor held a dominant market position in the By Product Type Analysis segment of Automotive Hypervisor Market, with a 74.5% share. This dominance is driven by its bare metal architecture, which improves system reliability. Consequently, OEMs increasingly adopt it for real time vehicle control.

Type 2 Automotive Hypervisor continues to support non critical automotive applications where flexibility is prioritized. However, it relies on a host operating system, which limits performance predictability. As a result, adoption remains selective, mainly within infotainment and secondary vehicle functions across cost sensitive platforms.

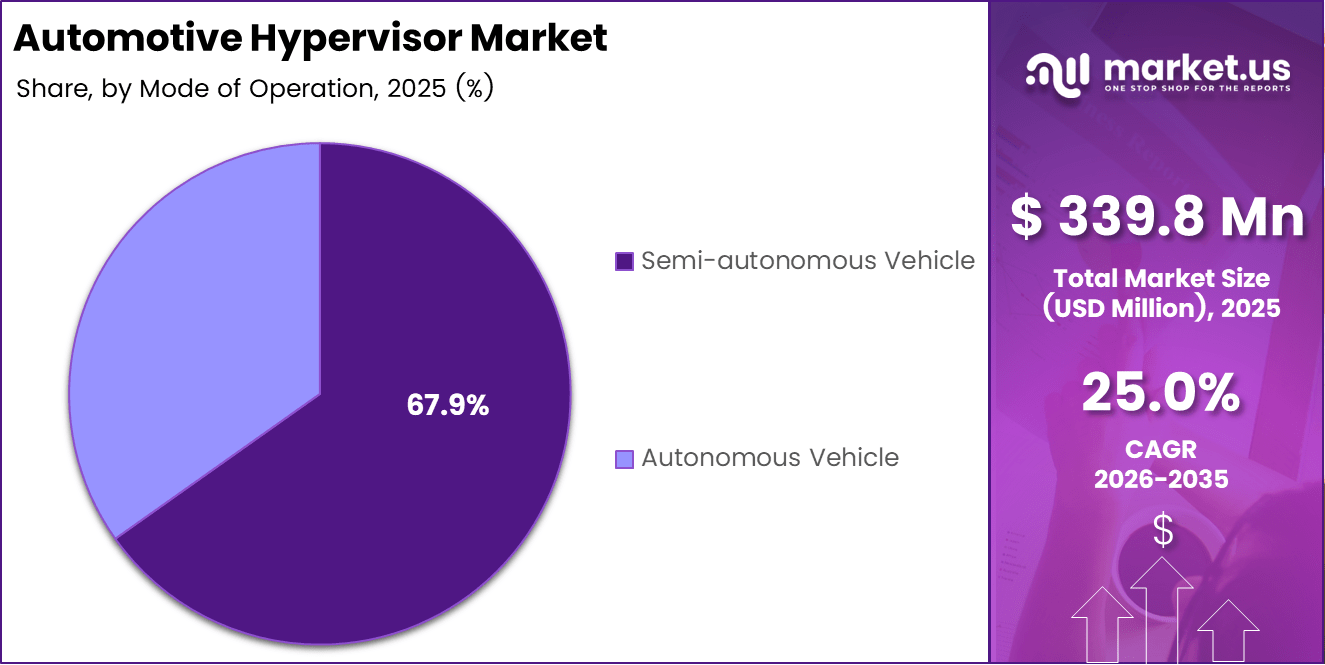

By Mode of Operation Analysis

Semi autonomous vehicle dominates with 65.2% as manufacturers prioritize advanced driver assistance over full autonomy.

In 2025, Semi autonomous vehicle held a dominant market position in the By Mode of Operation Analysis segment of Automotive Hypervisor Market, with a 65.2% share. This leadership reflects strong deployment of ADAS features. Consequently, hypervisors are essential for managing mixed criticality workloads efficiently.

Autonomous vehicle platforms increasingly integrate hypervisors to coordinate perception, planning, and control domains. However, commercialization remains limited due to regulatory and infrastructure constraints. Therefore, deployment is largely restricted to pilot fleets, premium models, and controlled environments with advanced validation requirements.

By Vehicle Type Analysis

Passenger cars dominate with 68.9% due to high production volumes and rapid software defined vehicle adoption.

In 2025, Passenger cars held a dominant market position in the By Vehicle Type Analysis segment of Automotive Hypervisor Market, with a 68.9% share. Rising digital cockpit demand accelerates hypervisor integration. As a result, OEMs leverage virtualization to consolidate ECUs and reduce hardware complexity.

Light commercial vehicles adopt automotive hypervisors to support fleet telematics and driver assistance. However, deployment remains moderate due to cost sensitivity. Meanwhile, Heavy commercial vehicles use hypervisors selectively, focusing on safety, diagnostics, and powertrain optimization rather than extensive infotainment integration.

By End User Analysis

Luxury dominates with 48.1% as premium vehicles adopt advanced virtualization first.

In 2025, Luxury held a dominant market position in the By End User Analysis segment of Automotive Hypervisor Market, with a 48.1% share. Luxury brands prioritize digital cockpits and domain consolidation. Consequently, hypervisors enable seamless integration of safety and comfort systems.

Mid priced vehicles steadily increase hypervisor adoption as software defined architectures mature. In contrast, Economy vehicles adopt hypervisors cautiously due to pricing constraints. Nevertheless, gradual cost reduction and platform standardization are expected to support broader penetration across mass market segments.

Key Market Segments

By Product Type

- Type 1 Automotive Hypervisor

- Type 2 Automotive Hypervisor

By Mode of Operation

- Autonomous Vehicle

- Semi-autonomous Vehicle

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By End User

- Economy

- Mid-Priced

- Luxury

Drivers

Increasing Deployment of Software Defined Vehicle Platforms Drives Market Growth

The automotive hypervisor market is strongly driven by the rising integration of mixed criticality workloads within centralized vehicle computing architectures. Modern vehicles increasingly combine infotainment, ADAS, and core vehicle functions on shared hardware platforms. Hypervisors enable these workloads to run safely together by separating critical and non critical software environments on the same system.

Another key driver is the growing adoption of software defined vehicle platforms across both passenger and commercial vehicles. Automakers are shifting value creation toward software, where functions are upgraded, added, or optimized after vehicle delivery. Hypervisors form the base layer that allows multiple operating systems to coexist and evolve without redesigning hardware.

The demand for secure isolation of infotainment, ADAS, and vehicle control systems on single SoCs further supports market growth. Hypervisors reduce hardware duplication while maintaining safety and reliability, which is essential as vehicles integrate more digital features.

Additionally, high performance domain controllers are rapidly replacing distributed ECUs. This transition requires virtualization to manage complexity, scalability, and cost efficiency, positioning automotive hypervisors as a core enabler of next generation vehicle architectures.

Restraints

High Validation Complexity Restrains Market Expansion

One of the major restraints in the automotive hypervisor market is the high validation and certification complexity associated with safety critical virtualization environments. Hypervisors must meet strict automotive safety requirements, which significantly extends development timelines and increases compliance costs for suppliers and OEMs.

Automotive systems supporting braking, steering, or ADAS functions require extensive testing to ensure fault isolation works under all conditions. When multiple workloads share a single SoC, proving system reliability becomes more complex, slowing adoption in mass production programs.

Another restraint is the limited availability of automotive grade SoCs optimized for large scale hypervisor consolidation. Not all chipsets support advanced virtualization features required for stable and secure multi domain operation. This limits design flexibility for automakers targeting centralized compute architectures.

In addition, supply chain constraints and long qualification cycles for new automotive processors restrict rapid deployment. As a result, some OEMs continue using partially distributed architectures, delaying full hypervisor adoption despite long term benefits.

Growth Factors

Expansion of Centralized Compute Platforms Creates New Growth Opportunities

The expansion of centralized compute platforms in electric and autonomous vehicle programs presents a major growth opportunity for the automotive hypervisor market. EVs and autonomous vehicles rely heavily on software intensive functions, making virtualization essential for managing performance, safety, and scalability.

As vehicle architectures consolidate computing resources, hypervisors enable efficient sharing of high performance hardware across multiple applications. This reduces system cost while supporting advanced features such as automated driving, battery management, and real time connectivity.

Another strong opportunity comes from growing OEM investments in in vehicle software monetization and feature on demand models. Automakers increasingly generate recurring revenue by activating features through software updates. Hypervisors support this strategy by allowing secure deployment of new functions without impacting existing systems.

Over time, this software driven business model is expected to increase the strategic importance of hypervisors, encouraging OEMs to standardize virtualization platforms across vehicle portfolios.

Emerging Trends

Shift Toward Zonal Architectures Shapes Market Trends

A key trending factor in the automotive hypervisor market is the rapid shift toward zonal and centralized E E architectures supported by virtualization. This design simplifies wiring, reduces weight, and improves system scalability while increasing reliance on hypervisors for workload separation.

The increasing use of hardware assisted virtualization in next generation automotive chipsets is another important trend. New processors are designed with built in virtualization support, improving performance, security, and reliability of hypervisor based systems.

There is also a rising focus on over the air updatable hypervisor based vehicle platforms. Automakers aim to update core software layers remotely, which requires a stable and secure virtualization foundation.

Additionally, automotive hypervisors are becoming closely aligned with functional safety and cybersecurity standards. This alignment reflects growing regulatory and consumer expectations for safer, more secure, and software resilient vehicles.

Regional Analysis

Asia Pacific Dominates the Automotive Hypervisor Market with a Market Share of 42.8%, Valued at USD 145.4 Million

Asia Pacific held a dominant position in the Automotive Hypervisor Market, accounting for 42.8% of the overall market and reaching a valuation of USD 145.4 Million. This leadership is supported by the rapid expansion of software defined vehicle architectures and increasing integration of centralized computing platforms across regional automotive production hubs. Strong growth in autonomous and semi-autonomous vehicle development, combined with high adoption of advanced in vehicle software frameworks, continues to reinforce the region’s market strength.

North America Automotive Hypervisor Market Trends

North America represents a mature and innovation driven market for automotive hypervisors, supported by early adoption of advanced driver assistance systems and high performance vehicle computing platforms. The region benefits from strong investments in autonomous vehicle testing and software centric vehicle platforms. Regulatory emphasis on vehicle safety and cybersecurity further supports sustained demand for hypervisor based system isolation.

Europe Automotive Hypervisor Market Trends

Europe demonstrates steady growth in the automotive hypervisor market, driven by strict functional safety regulations and a strong focus on vehicle software reliability. The region’s transition toward centralized electronic architectures and domain controllers supports wider hypervisor deployment. Increasing emphasis on electrification and software compliance frameworks continues to shape regional adoption patterns.

Middle East and Africa Automotive Hypervisor Market Trends

The Middle East and Africa automotive hypervisor market is at a developing stage, with growth primarily linked to gradual adoption of connected and intelligent vehicle technologies. Rising investments in smart mobility initiatives and improving automotive software infrastructure contribute to moderate market expansion. Adoption remains selective, focused mainly on premium and technologically advanced vehicle segments.

Latin America Automotive Hypervisor Market Trends

Latin America shows emerging potential in the automotive hypervisor market, supported by gradual modernization of vehicle electronics and increasing penetration of semi autonomous features. Market growth is driven by improving vehicle production capabilities and rising interest in software enabled safety and infotainment systems. Adoption remains incremental, aligned with broader automotive digital transformation trends.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Hypervisor Company Insights

BlackBerry Limited holds a strategically important position in the Automotive Hypervisor Market due to its strong focus on safety certified and real time virtualization platforms. Its offerings are widely associated with secure separation of critical and non critical workloads, supporting the industry’s transition toward centralized vehicle architectures. The company’s emphasis on functional safety and cybersecurity aligns closely with evolving regulatory and OEM requirements.

Continental AG contributes significantly to the market through its deep integration of hypervisor technologies within advanced electronic architectures. The company’s system level expertise enables efficient consolidation of multiple vehicle domains onto high performance computing platforms. Its strong alignment with next generation vehicle software frameworks supports scalable deployment across different vehicle classes.

Green Hills Software is recognized for its strong specialization in safety critical software environments within automotive systems. The company’s hypervisor solutions are closely aligned with high assurance requirements, making them suitable for applications involving ADAS and vehicle control. Its focus on certification readiness strengthens its relevance in safety regulated automotive programs.

Infineon Technologies AG plays a key role in shaping the Automotive Hypervisor Market through its close alignment between hardware platforms and virtualization support. The company emphasizes secure processing, hardware assisted isolation, and performance optimization for automotive grade systems. This integrated approach supports efficient deployment of hypervisors within high performance domain controllers and centralized computing units.

Top Key Players in the Market

- BlackBerry Limited

- Continental AG

- Green Hills Software

- Infineon Technologies AG

- NXP Semiconductor N.V.

- Panasonic Holdings Corporation

- Renesas Electronics Corporation

- Sasken Technologies Ltd

- Siemens

- Visteon Corporation

Recent Developments

- In May 2025, QNX, a division of BlackBerry,introduced QNX Hypervisor 8.0, an advanced embedded virtualization platform designed to simplify and accelerate complex software development workflows across automotive and industrial systems.

Report Scope

Report Features Description Market Value (2025) USD 339.8 Million Forecast Revenue (2035) USD 3,164.6 million CAGR (2026-2035) 25% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Type 1 Automotive Hypervisor, Type 2 Automotive Hypervisor), By Mode of Operation (Autonomous Vehicle, Semi-autonomous Vehicle), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By End User (Economy, Mid-Priced, Luxury) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BlackBerry Limited, Continental AG, Green Hills Software, Infineon Technologies AG, NXP Semiconductor N.V., Panasonic Holdings Corporation, Renesas Electronics Corporation, Sasken Technologies Ltd, Siemens, Visteon Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Hypervisor MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Hypervisor MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- BlackBerry Limited

- Continental AG

- Green Hills Software

- Infineon Technologies AG

- NXP Semiconductor N.V.

- Panasonic Holdings Corporation

- Renesas Electronics Corporation

- Sasken Technologies Ltd

- Siemens

- Visteon Corporation