Global Automotive Fleet Leasing Market Size, Share, Growth Analysis By Lease (Close-ended, Open-ended), By Vehicle (Passenger Cars, Commercial Vehicles), By Application (Corporate, Government & Public, Logistics & transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171269

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

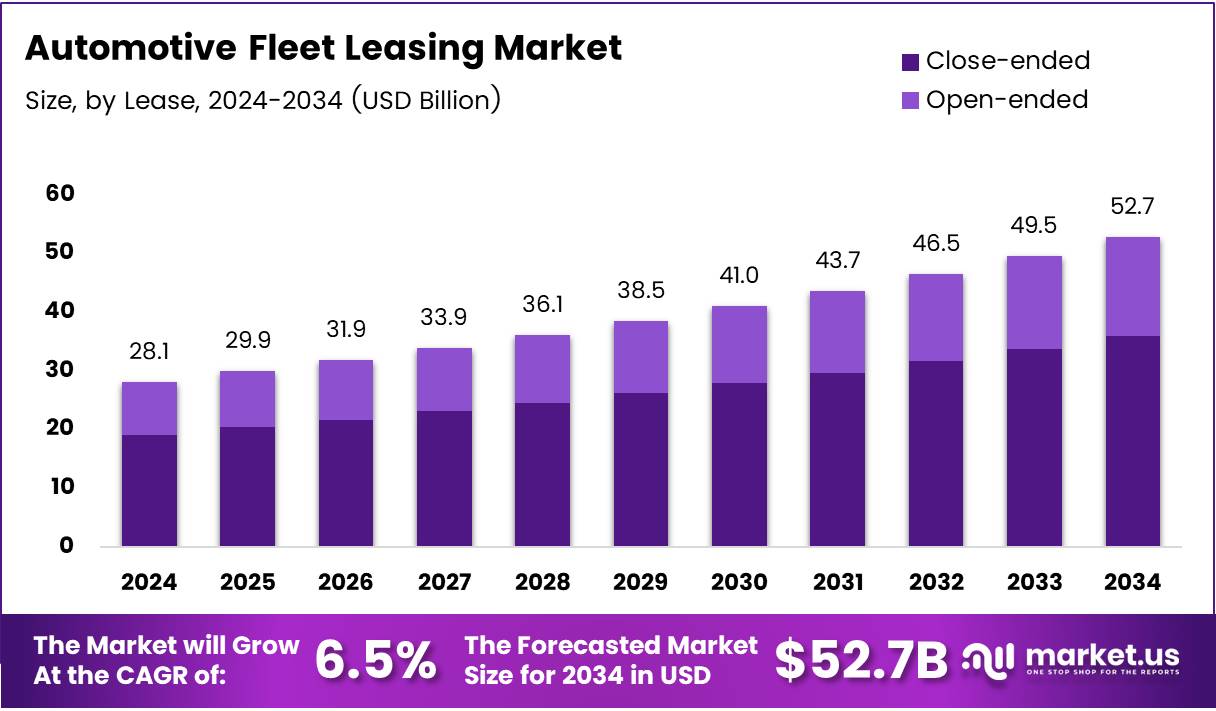

Global Automotive Fleet Leasing Market size is expected to be worth around USD 52.7 Billion by 2034 from USD 28.1 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

Automotive fleet leasing represents a structured mobility solution where businesses acquire vehicles through operational or financial lease agreements rather than outright purchases. This model enables organizations to access modern vehicle fleets while maintaining capital flexibility and predictable monthly expenses. Fleet leasing eliminates upfront acquisition costs and transfers maintenance responsibilities to specialized service providers.

The market continues experiencing robust expansion driven by corporate preferences for asset-light operational strategies. Businesses increasingly recognize the financial advantages of off-balance-sheet fleet management and predictable mobility budgeting. Organizations across industries are transitioning from vehicle ownership to leasing arrangements that offer enhanced flexibility and reduced administrative complexity.

Growth opportunities emerge from the accelerating electrification of commercial transportation networks. Fleet operators are leveraging bundled EV leasing packages that include charging infrastructure and maintenance support. According to Qmerit’s 2025 survey, 64% of fleet professionals currently operate EVs, with 36% expecting 20-50% of their fleets to be electric by 2025. Furthermore, 87% are planning electrification within five years, demonstrating strong market momentum toward sustainable mobility solutions.

The logistics and e-commerce sectors are generating substantial demand for flexible leasing arrangements. Last-mile delivery operations require scalable vehicle solutions that adapt to seasonal fluctuations and rapid business expansion. Additionally, subscription-based models are gaining traction among small and medium enterprises seeking simplified fleet access without long-term commitments.

Market dynamics reflect increasing adoption of digitalized fleet management platforms. Operators are integrating telematics systems, predictive maintenance tools, and AI-driven cost optimization technologies into lease agreements. According to Automotive Fleet’s survey, 41% of mid-sized fleet operators with 51-100 vehicles have already partially transitioned to EVs, while 40% remain in exploratory phases.

Government regulations supporting emission reductions are accelerating corporate fleet modernization initiatives. Investment in charging infrastructure and favorable tax incentives are making EV leasing economically viable for commercial operations. The full-service leasing model, which bundles maintenance, insurance, and compliance management, is becoming the preferred choice for enterprises seeking comprehensive mobility solutions.

Regional variations demonstrate diverse adoption patterns influenced by regulatory frameworks and economic conditions. North America maintains market leadership through established leasing ecosystems and strong corporate demand. Meanwhile, emerging markets are witnessing gradual penetration as financial institutions expand credit availability and awareness of total cost of ownership advantages grows across industries.

Key Takeaways

- Global Automotive Fleet Leasing Market projected to reach USD 52.7 Billion by 2034 from USD 28.1 Billion in 2024 at 6.5% CAGR.

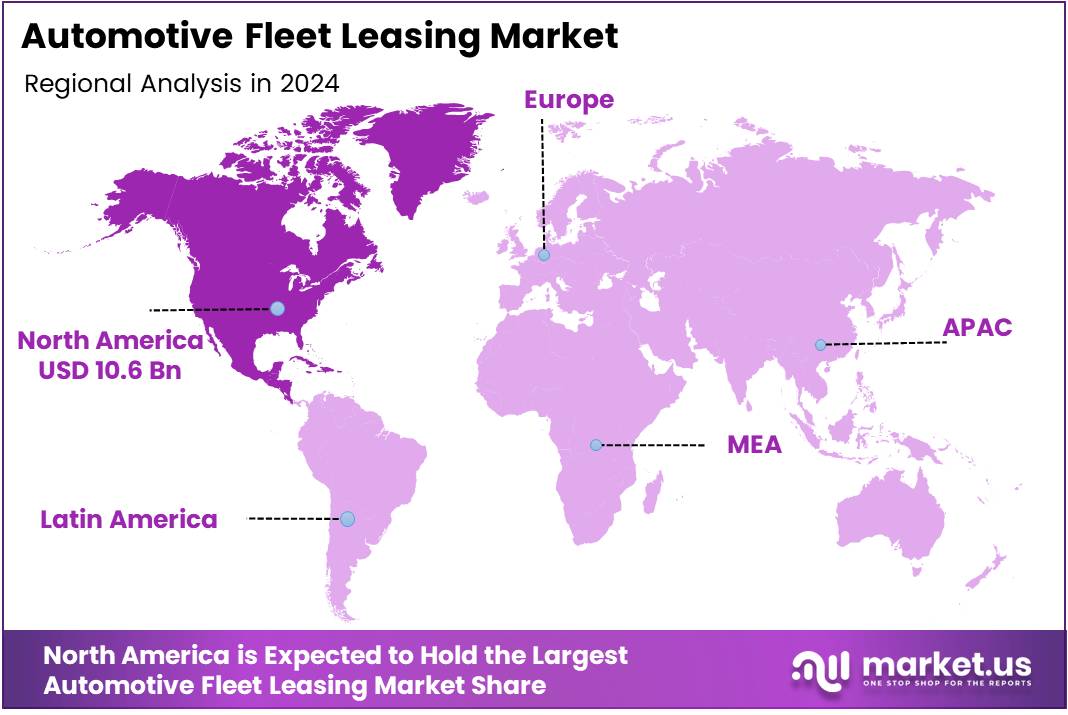

- North America dominates with 37.80% market share valued at USD 10.6 Billion.

- Close-ended leasing segment holds 59.3% share in lease type analysis.

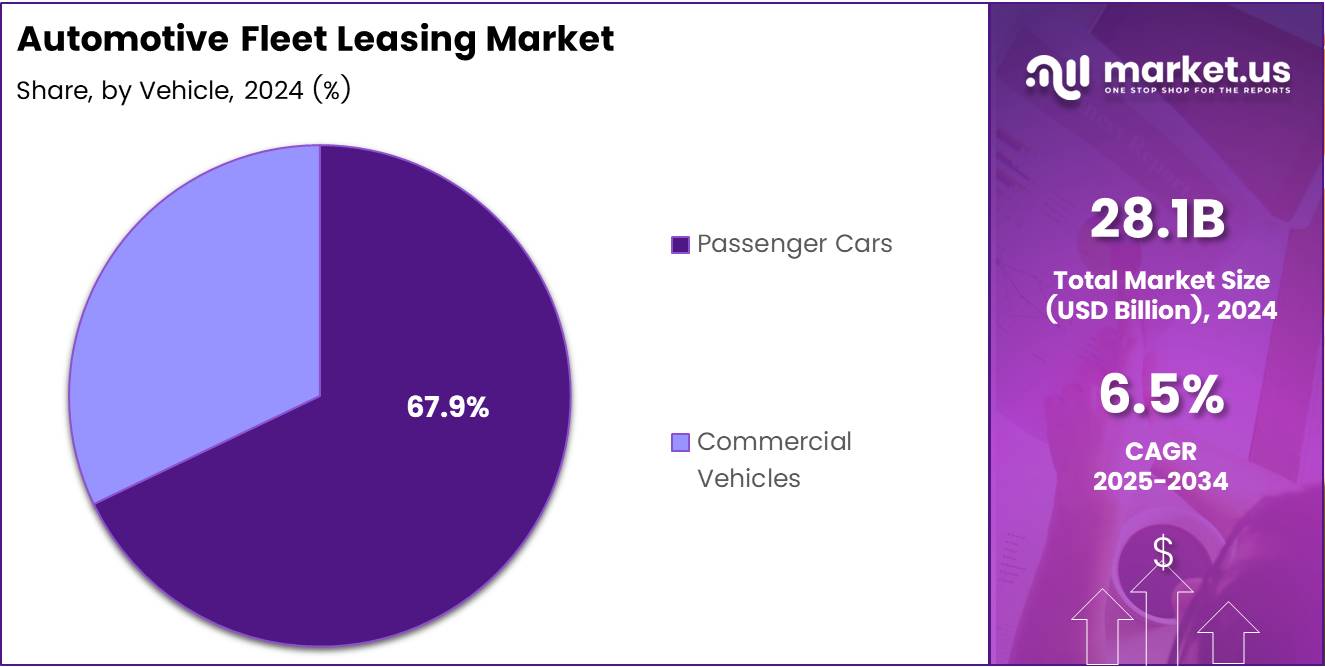

- Passenger cars segment commands 67.9% share in vehicle type segmentation.

- Corporate application segment leads with 45.8% market share.

Lease Type Analysis

Close-ended leasing dominates with 59.3% share due to its predictable cost structure and simplified vehicle return processes.

In 2024, close-ended leasing held a dominant market position in the By Lease segment of Automotive Fleet Leasing Market, capturing 59.3% share. This model provides organizations with predetermined lease terms and fixed residual values that eliminate disposal risk. Businesses favor this arrangement because it offers budgetary certainty and simplified end-of-lease procedures. The lessee returns the vehicle without concerns about depreciation or resale complications.

Corporate fleet managers appreciate the administrative simplicity and transparent total cost calculations. Close-ended agreements typically include mileage caps and condition requirements that protect lessor interests while providing clear usage guidelines. This structure supports predictable financial planning and aligns with corporate preferences for off-balance-sheet asset management strategies.

Open-ended leasing serves organizations requiring flexible mileage allowances and extended vehicle utilization periods. This model transfers residual value risk to the lessee but offers unrestricted usage parameters. Operators with high-mileage requirements or specialized vehicle applications prefer open-ended arrangements.

The lessee assumes responsibility for the vehicle’s final disposition and absorbs any depreciation variances. This flexibility appeals to logistics companies and transportation services with unpredictable operational demands. Open-ended leases often feature lower monthly payments compensating for the increased end-of-term obligations.

Vehicle Type Analysis

Passenger cars dominate with 67.9% share driven by widespread corporate mobility needs and executive transportation requirements.

In 2024, passenger cars held a dominant market position in the By Vehicle segment of Automotive Fleet Leasing Market, accounting for 67.9% share. Corporate fleets predominantly consist of sedans, SUVs, and executive vehicles serving sales teams and management personnel. These vehicles offer versatility for business travel while maintaining professional appearance standards.

Fleet operators prefer passenger cars for their fuel efficiency, lower maintenance costs, and higher residual values compared to commercial vehicles. The availability of diverse models accommodates various employee levels and usage requirements. Passenger car leasing benefits from established remarketing channels and predictable depreciation curves that reduce lessor risk exposure.

Commercial vehicles serve specialized transportation and logistics operations requiring cargo capacity and utility functionality. This segment encompasses vans, trucks, and specialized equipment supporting delivery services, construction, and industrial applications. Commercial vehicle leasing addresses the substantial capital requirements associated with heavy-duty equipment acquisition.

Operators appreciate the ability to scale fleets according to project demands without permanent asset commitments. These vehicles typically experience accelerated depreciation and higher maintenance costs compared to passenger cars. Lessors structure agreements with usage-based pricing and comprehensive service packages addressing the unique operational demands.

Application Analysis

Corporate application dominates with 45.8% share reflecting widespread business adoption of fleet leasing for operational efficiency.

In 2024, corporate application held a dominant market position in the By Application segment of Automotive Fleet Leasing Market, securing 45.8% share. Private sector organizations across industries utilize leased fleets for sales operations, executive transportation, and employee mobility programs. This segment benefits from corporate preferences for asset-light strategies and off-balance-sheet financing arrangements.

Businesses leverage fleet leasing to maintain modern vehicle inventories without capital expenditure burdens. The corporate sector demands comprehensive service packages including maintenance, insurance, and replacement vehicle provisions. Fleet leasing enables organizations to focus on core business activities while outsourcing vehicle management complexities.

Government and public sector entities employ fleet leasing for administrative operations, law enforcement, and public service delivery. These organizations face budgetary constraints that make leasing attractive compared to direct purchases. Public sector fleets require standardized vehicles meeting specific regulatory and safety requirements. Lessors provide specialized solutions addressing procurement regulations and taxpayer accountability standards.

Logistics and transportation operators rely on fleet leasing to scale delivery networks and meet e-commerce demand surges. This application requires flexible agreements accommodating seasonal fluctuations and rapid business expansion. Transportation companies utilize leasing to access modern fuel-efficient vehicles supporting operational cost reduction initiatives. The segment demands high vehicle availability and rapid replacement capabilities ensuring service continuity.

Other applications encompass rental car operations, ride-sharing services, and specialized mobility solutions. These diverse use cases require flexible lease structures and rapid fleet turnover capabilities. Short-term leasing arrangements serve businesses with project-based vehicle requirements. The segment continues evolving with emerging mobility-as-a-service business models and shared transportation platforms requiring adaptable fleet solutions.

Key Market Segments

By Lease

- Close-ended

- Open-ended

By Vehicle

- Passenger Cars

- Commercial Vehicles

By Application

- Corporate

- Government & Public

- Logistics & Transportation

- Others

Drivers

Corporate Shift Toward Asset-Light Mobility and Off-Balance-Sheet Fleet Management Drives Market Expansion

Organizations increasingly adopt fleet leasing to preserve capital and maintain financial flexibility. This strategy removes substantial vehicle assets from corporate balance sheets while ensuring mobility access. Finance departments favor leasing arrangements that convert fixed capital expenditures into predictable operational expenses. Companies redirect freed capital toward core business investments and growth initiatives rather than vehicle depreciation exposure.

Rising awareness of total cost of ownership advantages accelerates commercial adoption across industries. Fleet operators recognize that leasing bundles multiple expenses including maintenance, insurance, and administrative overhead into single monthly payments. This comprehensive cost structure eliminates unexpected repair expenses and residual value uncertainties. Organizations gain transparency in mobility spending and simplified budgeting processes through standardized lease agreements.

The expansion of last-mile delivery networks generates substantial demand for scalable fleet solutions. E-commerce growth requires rapid deployment of delivery vehicles without long-term ownership commitments. Leasing enables logistics operators to adjust fleet sizes according to seasonal demand fluctuations and business expansion requirements. Businesses appreciate the flexibility to upgrade vehicle technology and maintain modern fleets supporting operational efficiency objectives.

Restraints

High Residual Value Risk Exposure During Vehicle De-Fleeting Cycles Constrains Market Growth

Fleet leasing providers face substantial financial exposure from residual value fluctuations during vehicle disposition cycles. Market volatility in used vehicle prices directly impacts lessor profitability and pricing strategies. Unexpected depreciation caused by technological obsolescence or market oversupply creates significant losses. Lessors must accurately predict vehicle values years in advance to structure economically viable lease agreements. This uncertainty increases pricing conservatism and reduces competitive lease rate offerings.

Limited leasing penetration among small enterprises stems from restrictive credit qualification requirements and minimum fleet size thresholds. Financial institutions impose stringent creditworthiness standards that exclude many small businesses from lease approval. Smaller operators often lack the financial documentation and credit histories necessary to secure favorable lease terms. The administrative complexity and contractual obligations deter businesses with limited financial management resources. Lessors prioritize larger corporate accounts offering economies of scale and reduced credit risk exposure.

Growth Factors

Accelerated Adoption of Electric Vehicles Through Bundled Leasing and Charging Packages Creates Expansion Opportunities

Fleet electrification initiatives drive demand for comprehensive EV leasing solutions incorporating charging infrastructure and maintenance support. Lessors bundle charging equipment installation, energy management, and specialized EV servicing into integrated packages. This approach eliminates barriers to electric vehicle adoption by simplifying implementation complexity. Organizations gain access to cutting-edge electric mobility without substantial upfront infrastructure investments. Lessors leverage purchasing power to negotiate favorable EV acquisition costs and charging equipment pricing.

Subscription-based fleet models serve small and medium enterprises seeking simplified vehicle access without long-term commitments. These flexible arrangements offer monthly membership fees covering vehicle usage, maintenance, and insurance. SMEs and gig-economy operators benefit from scalable mobility solutions adapting to fluctuating business requirements. Digital platforms streamline subscription management and vehicle exchanges supporting operational agility. This emerging model expands market addressability beyond traditional corporate lease customers.

Increasing integration of telematics, maintenance scheduling, and insurance ecosystems enhances fleet leasing value propositions. Connected vehicle technologies provide real-time monitoring, predictive maintenance alerts, and usage analytics. Lessors incorporate these capabilities into comprehensive fleet management platforms optimizing operational efficiency. Data-driven insights support proactive maintenance reducing downtime and extending vehicle lifecycles. The convergence of leasing and technology services creates differentiated offerings attracting sophisticated fleet operators.

Emerging Trends

Shift Toward Flexible and Short-Tenure Fleet Leasing Agreements Transforms Market Dynamics

Fleet operators increasingly favor shorter lease terms providing greater flexibility to adapt to technological changes and business evolution. Traditional multi-year commitments are giving way to agreements allowing more frequent fleet modernization cycles. This trend reflects rapid advancement in vehicle technology and changing mobility requirements across industries. Lessors develop products accommodating shorter commitment periods while maintaining economic viability through efficient remarketing processes.

Full-service leasing packages bundling maintenance, compliance management, and administrative support gain market traction. Organizations seek comprehensive solutions eliminating internal fleet management burdens and specialized expertise requirements. These all-inclusive arrangements transfer operational responsibilities to lessors possessing scale economies and specialized capabilities. Fleet managers focus on strategic mobility planning while outsourcing tactical execution. The convenience and predictability of full-service models justify premium pricing for many corporate customers.

Digitalization of fleet leasing platforms incorporates artificial intelligence for cost optimization and decision support. Advanced analytics enable dynamic pricing, optimal vehicle selection, and lifecycle management recommendations. Digital marketplaces streamline lease origination, contract management, and vehicle exchanges. AI-driven systems analyze usage patterns identifying opportunities for fleet right-sizing and efficiency improvements.

Regional Analysis

North America Dominates the Automotive Fleet Leasing Market with a Market Share of 37.80%, Valued at USD 10.6 Billion

North America maintains market leadership driven by mature leasing ecosystems and widespread corporate adoption across industries. The region holds 37.80% market share valued at USD 10.6 Billion, reflecting established infrastructure and favorable tax treatments. Strong presence of specialized fleet management companies supports comprehensive service delivery. Robust used vehicle markets facilitate efficient fleet rotation and residual value realization.

Europe Automotive Fleet Leasing Market Trends

Europe demonstrates significant market presence supported by stringent emission regulations accelerating electric vehicle adoption. Government incentives and sustainability mandates drive corporate fleet modernization initiatives. The region features diverse leasing models addressing varied business requirements across member states. Established automotive industries and extensive dealer networks support comprehensive fleet services.

Asia Pacific Automotive Fleet Leasing Market Trends

Asia Pacific exhibits rapid growth potential fueled by expanding commercial sectors and improving financial infrastructure. Emerging economies witness increasing awareness of total cost of ownership advantages among businesses. Urban congestion and environmental concerns drive government support for organized fleet management. Growing middle class and corporate expansion create substantial demand for mobility solutions.

Middle East and Africa Automotive Fleet Leasing Market Trends

Middle East and Africa represent developing markets with gradual leasing penetration across corporate sectors. Oil and gas industries generate demand for specialized commercial vehicle leasing arrangements. Infrastructure investments and economic diversification initiatives support market expansion. Limited credit availability and regulatory variations create regional disparities in adoption rates.

Latin America Automotive Fleet Leasing Market Trends

Latin America shows emerging potential constrained by economic volatility and credit access challenges. Large multinational corporations drive leasing adoption through regional subsidiaries and operations. Logistics sector expansion linked to e-commerce growth generates demand for flexible fleet solutions. Currency fluctuations and inflation concerns influence lease structuring and pricing strategies. Market development requires addressing credit infrastructure limitations and regulatory standardization.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Fleet Leasing Company Insights

The global Automotive Fleet Leasing Market in 2024 features several established players providing comprehensive mobility solutions to corporate and commercial customers worldwide. These organizations leverage extensive service networks, technological capabilities, and financial resources to address diverse fleet management requirements across industries.

Element Fleet Management Corp. operates as a leading provider serving clients across North America with integrated fleet management services including leasing, maintenance, and telematics solutions. The company focuses on digital platform development and connected fleet capabilities to enhance operational efficiency and customer experience.

LeasePlan Corporation N.V. maintains a significant global presence offering full-service leasing arrangements and fleet management solutions across multiple markets. The organization emphasizes sustainable mobility initiatives and electric vehicle integration supporting corporate decarbonization objectives.

ARI delivers comprehensive fleet management services including vehicle acquisition, maintenance coordination, and driver safety programs for large enterprise clients. The company leverages data analytics and technology integration to optimize fleet performance and cost management.

Merchants Fleet provides flexible leasing solutions tailored to commercial and government sector requirements with emphasis on asset utilization and lifecycle management. The organization focuses on consultative approaches helping clients optimize fleet composition and operational strategies.

Additional market participants include AutoFlex AFV, Caldwell Leasing, Emkay, Ewald Automotive Group, Glesby Marks, Hertz Global Holdings, and Jim Pattison Lease, each contributing specialized capabilities and regional expertise. These organizations collectively support market growth through product innovation, service expansion, and geographic diversification strategies addressing evolving customer mobility requirements.

Key Companies

- ARI

- AutoFlex AFV

- Caldwell Leasing

- Element Fleet Management Corp.

- Emkay

- Ewald Automotive Group

- Glesby Marks

- Hertz Global Holdings

- Jim Pattison Lease

- LeasePlan Corporation N.V.

- Merchants Fleet

Recent Developments

- December 2025: Element Fleet Management Corp. announced a definitive agreement to acquire Car IQ, a San Francisco-based vehicle-initiated payments technology company, to expand its connected fleet and digital payments capabilities across North America. The transaction is expected to close in December 2025, enhancing Element’s technology-driven service offerings and strengthening its position in the digital fleet management ecosystem.

- December 2025: BNP Paribas through its Arval unit entered exclusive talks to acquire Mercedes-Benz’s car-leasing subsidiary Athlon in a deal valued at approximately €1 billion. This strategic acquisition would significantly strengthen BNP’s position in the European vehicle leasing market with regulatory approval and closing anticipated in 2026-2027, expanding Arval’s service capabilities and geographic reach.

- August/September 2025: Brussels-based digital leasing company LIZY secured €75 million in combined equity and debt financing to further scale its circular electric vehicle leasing model. The funding supports expansion of used EV leasing operations across Europe, backed by investors including D’Ieteren, Alychlo, and NewAlpha Asset Management, advancing sustainable mobility solutions.

- February 2024: Ayvens reached a frame agreement with Stellantis to purchase up to 500,000 vehicles, representing one of the industry’s largest fleet acquisition commitments. This partnership ensures substantial vehicle supply supporting Ayvens’ European leasing operations and reinforcing strategic relationships between lessors and automotive manufacturers for long-term fleet provisioning.

Report Scope

Report Features Description Market Value (2024) USD 28.1 Billion Forecast Revenue (2034) USD 52.7 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Lease (Close-ended, Open-ended), By Vehicle (Passenger Cars, Commercial Vehicles), By Application (Corporate, Government & Public, Logistics & transportation, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ARI, AutoFlex AFV, Caldwell Leasing, Element Fleet Management Corp., Emkay, Ewald Automotive Group, Glesby Marks, Hertz Global Holdings, Jim Pattison Lease, LeasePlan Corporation N.V., Merchants Fleet Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Fleet Leasing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Fleet Leasing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ARI

- AutoFlex AFV

- Caldwell Leasing

- Element Fleet Management Corp.

- Emkay

- Ewald Automotive Group

- Glesby Marks

- Hertz Global Holdings

- Jim Pattison Lease

- LeasePlan Corporation N.V.

- Merchants Fleet