Global Automotive Fascia Market Size, Share, Growth Analysis By Material (Plastic Covered Polystyrene, Plastic Covered Aluminium, Steel & Aluminium, Rubber, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Position Type (Front Fascia, Rear Fascia), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176955

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

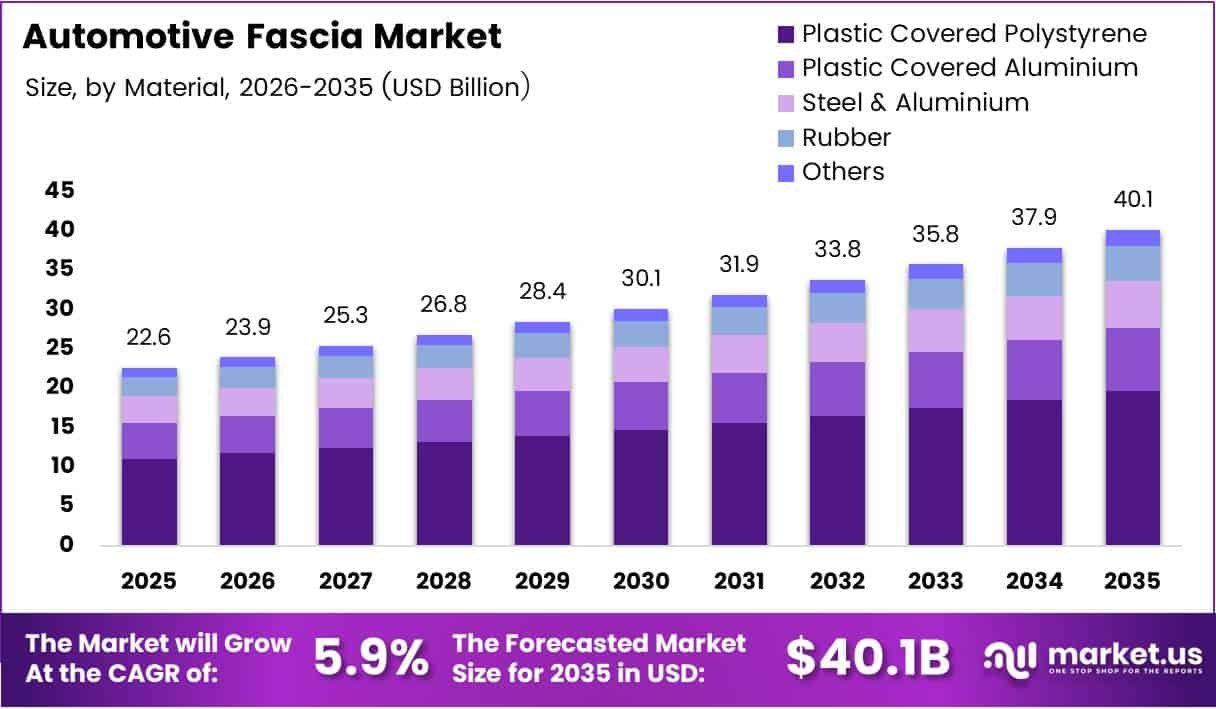

Global Automotive Fascia Market size is expected to be worth around USD 40.1 Billion by 2035 from USD 22.6 Billion in 2025, growing at a CAGR of 5.90% during the forecast period 2026 to 2035.

Automotive fascia components serve as critical structural and aesthetic elements in modern vehicles. These exterior body parts encompass front and rear bumper covers, grilles, and integrated lighting assemblies. Manufacturers design fascia systems to enhance vehicle appearance while providing aerodynamic efficiency and pedestrian safety compliance.

The market experiences robust expansion driven by increasing global vehicle production and technological integration demands. Automakers prioritize lightweight materials and smart sensor integration to meet regulatory standards. Consequently, fascia suppliers invest heavily in advanced manufacturing capabilities and material innovation technologies.

Electric vehicle adoption accelerates demand for specialized fascia designs that optimize battery range and cooling efficiency. Manufacturers develop unique front-end modules incorporating active aerodynamic features and thermal management systems. Therefore, traditional fascia architectures undergo significant redesign to accommodate electric powertrains and sensor arrays.

Consumer preferences shift toward personalized and distinctive vehicle styling, particularly in premium segments. OEMs differentiate their model lineups through signature grille designs and integrated lighting solutions. Moreover, aftermarket customization options expand as vehicle owners seek enhanced aesthetic appeal and performance characteristics.

Sustainability regulations compel manufacturers to adopt recyclable and bio-based materials in fascia production processes. Automakers collaborate with material science companies to develop environmentally responsible alternatives to petroleum-based plastics. Additionally, circular economy principles influence design strategies for end-of-life vehicle component recovery and reprocessing.

According to National Academies of Sciences, aluminum can reduce vehicle body structure weight by about 40% while maintaining stiffness and performance. This significant mass reduction potential positions aluminum as a strategic material choice for next-generation fascia applications. Furthermore, manufacturers leverage this advantage to improve fuel efficiency and emissions compliance across vehicle platforms.

According to National Academies of Sciences, carbon fiber composites can reduce automotive part mass by about 50-70%. However, cost considerations currently limit widespread adoption to performance and luxury vehicle segments. Industry stakeholders continue developing cost-effective manufacturing processes to enable broader market penetration of composite fascia solutions.

Key Takeaways

- Global Automotive Fascia Market projected to reach USD 40.1 Billion by 2035 from USD 22.6 Billion in 2025 at 5.90% CAGR

- Plastic Covered Polystyrene segment dominates material category with 38.4% market share in 2025

- Passenger Cars segment leads vehicle type category accounting for 78.1% market share

- Front Fascia segment commands 69.2% share in position type category

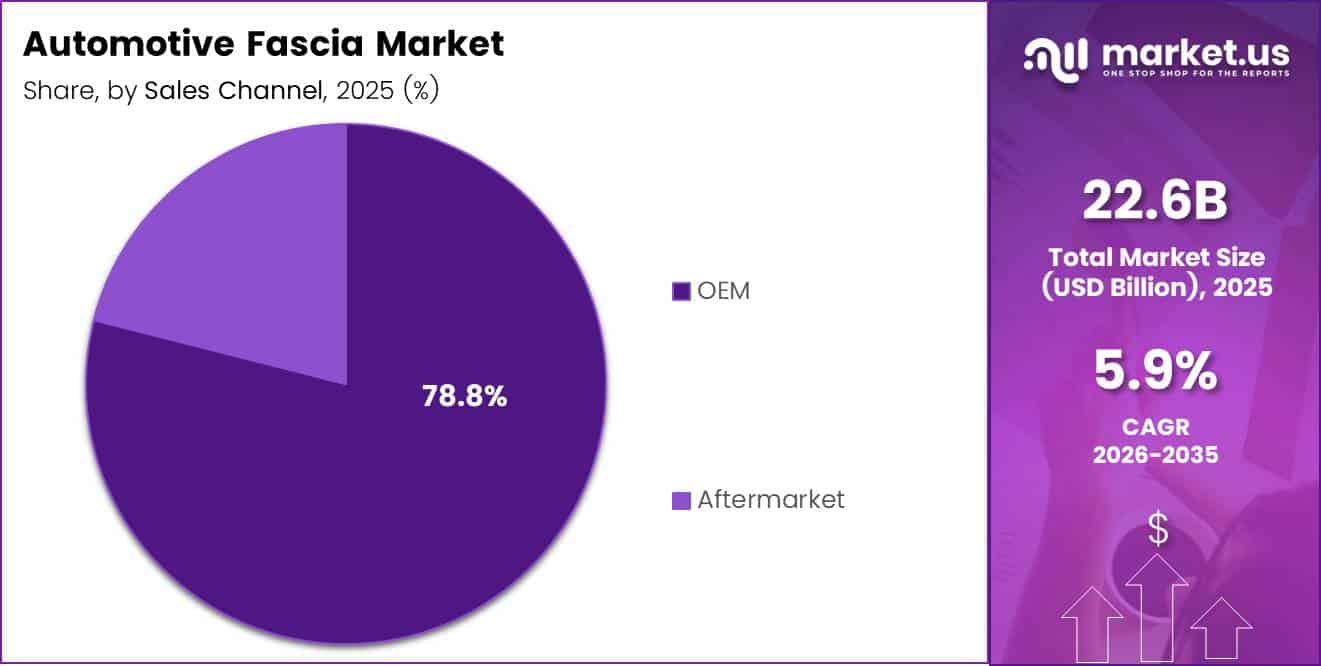

- OEM sales channel holds dominant 78.8% market share in distribution category

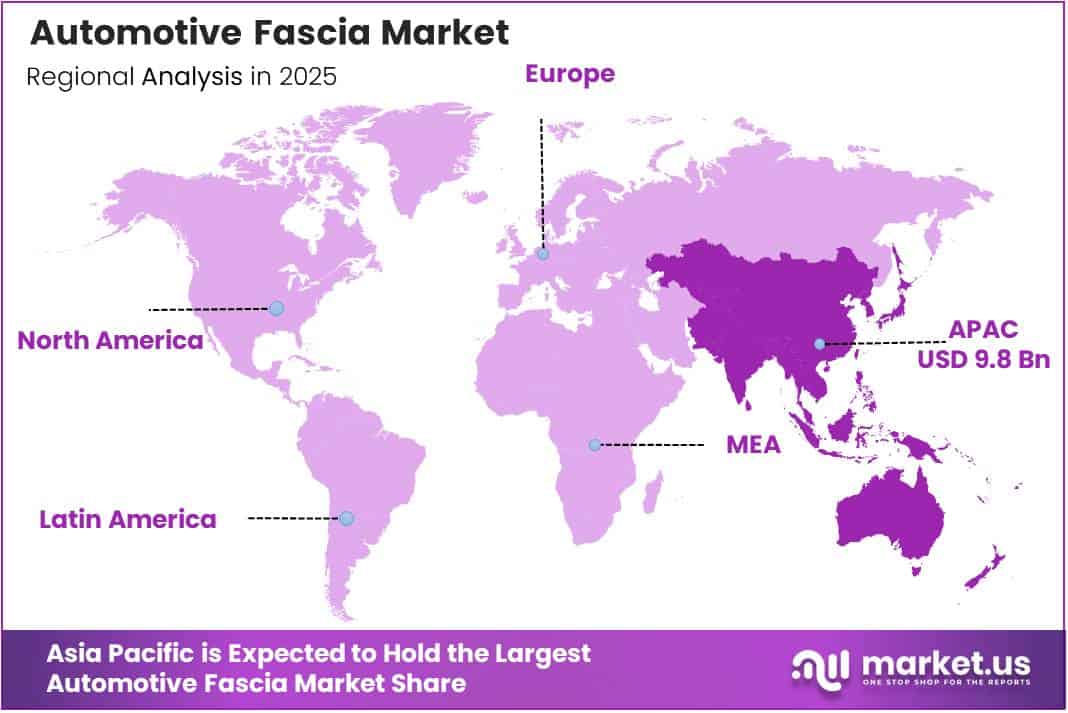

- Asia Pacific region leads globally with 43.70% market share valued at USD 9.8 Billion

Material Analysis

In 2025, Plastic Covered Polystyrene held a dominant market position in the By Material segment of Automotive Fascia Market, with a 38.4% share.

Plastic Covered Polystyrene dominates the material segment due to superior cost-effectiveness, lightweight properties, and excellent moldability for complex geometric designs. Manufacturers leverage this material for mass-market vehicle applications requiring affordable production costs. Additionally, polystyrene-based fascia components deliver adequate impact resistance while enabling efficient paint adhesion and surface finishing processes across diverse vehicle platforms.

Plastic Covered Aluminium gains traction in premium and performance vehicle segments requiring enhanced strength-to-weight ratios and thermal management capabilities. This hybrid material solution combines aluminum’s structural rigidity with plastic’s design flexibility. Moreover, automakers specify this material for electric vehicles where weight reduction directly impacts battery range and charging efficiency performance metrics.

Steel & Aluminium materials serve specialized applications demanding maximum structural integrity and collision energy absorption characteristics. Heavy commercial vehicles and safety-critical fascia components utilize these metallic solutions despite weight penalties. Furthermore, manufacturers engineer these materials for extreme operating environments requiring superior durability and long-term dimensional stability under mechanical stress conditions.

Rubber components provide essential sealing, vibration dampening, and aesthetic finishing functions within fascia assemblies. Suppliers integrate rubber elements at panel gaps and mounting interfaces to prevent water ingress. Consequently, this material plays a critical supporting role in overall fascia system performance and vehicle quality perception.

Others category encompasses emerging materials including bio-based plastics, carbon fiber composites, and hybrid material systems. Manufacturers experiment with sustainable alternatives to reduce environmental impact and meet regulatory requirements. Therefore, this segment represents innovation-focused applications in luxury and concept vehicle development programs.

Vehicle Type Analysis

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type segment of Automotive Fascia Market, with a 78.1% share.

Passenger Cars dominate the vehicle type segment driven by massive global production volumes and continuous model refresh cycles. Automakers prioritize distinctive fascia designs to differentiate competing models in saturated markets. Additionally, passenger vehicle platforms incorporate advanced lighting technologies and sensor integration capabilities that drive fascia component value and complexity.

Commercial Vehicles represent a growing segment as logistics operators modernize fleets with aerodynamic and fuel-efficient designs. Truck and van manufacturers increasingly adopt passenger car-inspired styling elements to enhance brand perception. Moreover, electrification of commercial vehicle platforms creates new fascia design requirements for battery thermal management and charging infrastructure integration.

Position Type Analysis

In 2025, Front Fascia held a dominant market position in the By Position Type segment of Automotive Fascia Market, with a 69.2% share.

Front Fascia commands the dominant position due to critical functional requirements including pedestrian safety compliance, cooling airflow management, and brand identity expression. Manufacturers invest significantly in front-end module engineering to integrate radar sensors, cameras, and active grille systems. Furthermore, regulatory crash testing standards mandate sophisticated energy absorption structures within front fascia assemblies across all vehicle categories.

Rear Fascia components serve essential aesthetic and functional roles including taillight integration, license plate mounting, and rear-impact protection. Automakers differentiate vehicle rear designs through unique lighting signatures and reflector configurations. Additionally, electric vehicles incorporate charging port access and aerodynamic diffuser elements into rear fascia architecture for improved efficiency performance.

Sales Channel Analysis

In 2025, OEM held a dominant market position in the By Sales Channel segment of Automotive Fascia Market, with a 78.8% share.

OEM channel dominates through direct supplier relationships with automotive manufacturers for new vehicle production programs. Tier-1 suppliers establish long-term contracts to deliver fascia systems matching exact OEM specifications and quality standards. Moreover, original equipment installations drive the majority of market volume as vehicle production continues expanding globally across established and emerging markets.

Aftermarket channel serves replacement, repair, and customization demands from vehicle owners and collision repair facilities. Independent distributors and retailers supply compatible fascia components at competitive price points compared to OEM parts. Additionally, performance and styling enthusiasts drive aftermarket demand for upgraded fascia designs featuring enhanced aerodynamics and aggressive aesthetic treatments.

Key Market Segments

By Material

- Plastic Covered Polystyrene

- Plastic Covered Aluminium

- Steel & Aluminium

- Rubber

- Others

By Vehicle Type

By Position Type

- Front Fascia

- Rear Fascia

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Global Vehicle Production and Expansion of Automotive Manufacturing Capacity Drives Fascia Component Demand

Automotive manufacturers expand production facilities across emerging markets to meet growing consumer demand and localize supply chains. This capacity expansion directly increases fascia component procurement from tier-1 suppliers. According to National Academies of Sciences, advanced high-strength steel can provide about 15-25% mass reduction potential in vehicle structures, encouraging manufacturers to invest in next-generation fascia technologies.

Electric vehicle production ramps accelerate as automakers transition portfolios toward electrified powertrains to meet regulatory mandates. Electric platforms require specialized fascia designs incorporating active thermal management and aerodynamic optimization features. Therefore, suppliers develop dedicated EV fascia solutions that differ fundamentally from conventional internal combustion engine vehicle applications.

Lightweight material adoption intensifies as emission regulations tighten globally and fuel efficiency becomes a critical competitive differentiator. Fascia manufacturers invest in advanced composite materials and hybrid construction techniques to reduce component mass. Additionally, automakers specify lighter fascia systems to achieve overall vehicle weight reduction targets without compromising safety or structural performance.

Restraints

Volatility in Petroleum-Based Raw Material Prices Limits Fascia Production Cost Predictability

Polypropylene and polystyrene resin prices fluctuate significantly with crude oil market dynamics, creating cost uncertainty for fascia manufacturers. Suppliers struggle to maintain stable pricing agreements with OEM customers during volatile commodity cycles. Consequently, profit margins compress when raw material costs spike unexpectedly during multi-year production contracts.

Complex tooling and automation systems require substantial capital investment before fascia production commences for new vehicle programs. Manufacturers bear financial risk when investing in dedicated production assets for unproven vehicle models. Moreover, technological transitions toward smart fascia systems incorporating sensors and active components amplify upfront development costs.

Regulatory compliance costs increase as safety testing requirements become more stringent across global automotive markets. Fascia suppliers conduct extensive pedestrian impact testing and certification procedures to meet regional standards. Additionally, environmental regulations regarding material recyclability and end-of-life vehicle processing impose additional design constraints and validation expenses.

Growth Factors

Technological Advancements and Material Innovation Accelerate Automotive Fascia Market Expansion

Sustainable material development accelerates as manufacturers replace petroleum-based plastics with bio-based and recycled alternatives. According to Energy Alternatives India, using agricultural residues for bioplastic production could reduce approximately 5 million tonnes of CO₂ emissions annually, directly supporting automotive component supply chain decarbonization efforts. This environmental benefit drives OEM adoption of sustainable fascia materials.

Autonomous driving technology integration creates demand for sensor-compatible fascia designs with optimized electromagnetic transparency characteristics. Manufacturers engineer fascia surfaces to accommodate radar, lidar, and camera systems without signal interference. In March 2024, Hyundai Mobis unveiled its Integrated Front Face Module, a smart fascia using active air flaps to improve EV range by approximately 20km.

Emerging market automotive sectors expand rapidly as middle-class populations grow and vehicle ownership rates increase substantially. Suppliers establish localized production facilities to serve regional OEM customers with cost-competitive fascia solutions. Furthermore, government incentives for domestic automotive manufacturing encourage foreign investment in fascia component production capabilities.

Emerging Trends

Smart Integration and Sustainable Materials Reshape Automotive Fascia Design Landscape

Lightweight composite materials gain adoption as manufacturers pursue aggressive weight reduction targets for emission compliance. According to National Academies of Sciences, glass fiber composites can reduce automotive part mass by about 25-35% compared to conventional materials. This performance advantage drives increased specification in mid-range vehicle segments seeking cost-effective lightweighting solutions.

Active aerodynamic fascia components emerge as automakers optimize electric vehicle range through dynamic airflow management systems. Manufacturers integrate electronically controlled shutters and adjustable grille elements that respond to thermal and efficiency demands. Therefore, fascia architecture transitions from static structures to intelligent active systems contributing to overall vehicle performance optimization.

Customization and personalization trends intensify as consumers demand unique vehicle aesthetics that reflect individual preferences and brand loyalty. Automakers offer modular fascia designs with interchangeable elements allowing post-purchase modification and seasonal updates. Additionally, digital manufacturing technologies enable cost-effective low-volume production of specialized fascia variants for niche market segments.

Regional Analysis

Asia Pacific Dominates the Automotive Fascia Market with a Market Share of 43.70%, Valued at USD 9.8 Billion

Asia Pacific commands the dominant regional position with 43.70% market share valued at USD 9.8 Billion, driven by massive automotive production volumes concentrated in China, Japan, South Korea, and India. Manufacturers benefit from established supply chain ecosystems and cost-competitive labor rates. Moreover, rapid electric vehicle adoption in China creates substantial demand for specialized fascia components incorporating advanced thermal management and sensor integration technologies.

North America Automotive Fascia Market Trends

North America maintains significant market presence supported by premium vehicle segment strength and advanced technology adoption rates. Manufacturers prioritize lightweight materials and smart fascia systems for pickup trucks and SUVs dominating regional sales. Additionally, stringent safety regulations drive continuous innovation in pedestrian protection and collision energy absorption capabilities.

Europe Automotive Fascia Market Trends

Europe demonstrates strong demand for sustainable fascia materials aligned with circular economy regulations and environmental compliance mandates. Automakers invest heavily in recycled plastic content and bio-based material alternatives to reduce carbon footprints. Furthermore, luxury vehicle production concentration drives premium fascia segment growth incorporating carbon fiber and advanced composite materials.

Middle East & Africa Automotive Fascia Market Trends

Middle East & Africa region experiences moderate growth driven by expanding automotive assembly operations and localization initiatives. Manufacturers establish regional production facilities to serve growing domestic demand and reduce import dependencies. Consequently, fascia suppliers follow OEM customers into these emerging markets with dedicated manufacturing and engineering support capabilities.

Latin America Automotive Fascia Market Trends

Latin America shows steady market development as automotive manufacturers invest in regional production capacity expansion. In March 2024, Stellantis announced a €5.6 billion investment in South America to launch 40 new products, including Bio-Hybrid vehicles with specialized front-end modules. This commitment signals growing regional importance for fascia component suppliers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Magna International Inc. operates as a leading global automotive supplier delivering complete fascia systems and front-end modules to major OEM customers worldwide. The company leverages advanced engineering capabilities and global manufacturing footprint to serve diverse vehicle platforms. Moreover, Magna invests significantly in lightweighting technologies and smart fascia integration to support customer electrification strategies and autonomous driving development programs.

Plastic Omnium positions itself as a premier fascia and exterior systems supplier with comprehensive design and manufacturing expertise across global markets. In March 2024, Plastic Omnium officially rebranded as OPmobility to reflect its transition into connected mobility and smart exterior systems provider. Additionally, the company partners with technology firms to integrate artificial intelligence into fascia design processes and manufacturing optimization initiatives.

Gestamp Automoción S.A. specializes in metal and hybrid fascia solutions combining steel and aluminum components for structural applications. The company serves premium automotive brands requiring high-performance fascia systems with superior crash energy absorption characteristics. Furthermore, Gestamp develops advanced hot-forming technologies enabling complex fascia geometries while maintaining exceptional strength-to-weight ratios for safety-critical applications.

FLEX-N-GATE CORPORATION delivers comprehensive fascia systems to North American automotive manufacturers through vertically integrated design and production capabilities. The company supplies complete painted fascia assemblies reducing OEM manufacturing complexity and assembly line integration requirements. Consequently, FLEX-N-GATE maintains strong customer relationships through just-in-time delivery performance and continuous cost reduction initiatives.

Key Players

- Dongfeng Electronic Technology Co. Ltd.

- SANKO GOSEI

- FLEX-N-GATE CORPORATION

- Eakas Corporation

- Chiyoda Manufacturing

- MRC Manufacturing

- Inhance Technologie

- Magna International Inc.

- Gestamp Automoción S.A.

- Plastic Omnium

Recent Developments

- March 2024 – Plastic Omnium officially rebranded as OPmobility to reflect its strategic transition into a connected mobility and smart exterior systems provider, signaling the company’s commitment to intelligent fascia solutions and digital integration capabilities.

- January 2025 – OPmobility partnered with Neural Concept to leverage 3D artificial intelligence technologies for designing complex front-end modules and vehicle bodies, accelerating development cycles and optimizing aerodynamic performance through computational design methodologies.

- February 2024 – Aston Martin launched the new Vantage featuring a comprehensively redesigned fascia with a 38% larger grille for significantly improved cooling performance, demonstrating the critical role of fascia engineering in high-performance vehicle thermal management systems.

- November 2024 – Mahindra launched the BE 6e and XEV 9e electric SUVs, debuting a sensor-integrated fascia design on the new INGLO architecture, showcasing advanced integration of autonomous driving technology and aesthetic design in next-generation electric vehicle platforms.

- January 2025 – MG Motor unveiled the MG Majestor at the Bharat Mobility Global Expo, featuring a more upright and aggressive front fascia with vertically stacked LEDs, reflecting evolving design language trends in competitive SUV segments targeting emerging markets.

- February 2025 – Bentley Motors opened its Excellence Centre for Quality & Launch in Crewe, specifically to prepare for the assembly of its first battery-electric vehicle, requiring specialized fascia manufacturing capabilities for luxury electric vehicle applications and quality validation processes.

- July 2025 – Bentley opened a new Design Studio dedicated to the collaborative development of future vehicle exteriors and user interfaces, emphasizing the strategic importance of fascia design in luxury brand differentiation and customer experience enhancement initiatives.

Report Scope

Report Features Description Market Value (2025) USD 22.6 Billion Forecast Revenue (2035) USD 40.1 Billion CAGR (2026-2035) 5.90% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic Covered Polystyrene, Plastic Covered Aluminium, Steel & Aluminium, Rubber, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Position Type (Front Fascia, Rear Fascia), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Dongfeng Electronic Technology Co. Ltd., SANKO GOSEI, FLEX-N-GATE CORPORATION, Eakas Corporation, Chiyoda Manufacturing, MRC Manufacturing, Inhance Technologie, Magna International Inc., Gestamp Automoción S.A., Plastic Omnium Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dongfeng Electronic Technology Co. Ltd.

- SANKO GOSEI

- FLEX-N-GATE CORPORATION

- Eakas Corporation

- Chiyoda Manufacturing

- MRC Manufacturing

- Inhance Technologie

- Magna International Inc.

- Gestamp Automoción S.A.

- Plastic Omnium