Global Automotive E-Axle Market Size, Share, Growth Analysis By Type (Single Axle, Dual Axle, Multi Axle), By Drive Type (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive), By Power Rating (Below 50 kW, 50 kW to 100 kW, 100 kW to 150 kW, Above 150 kW), By Voltage Rating (Below 400 V, 400 V to 800 V, Above 800 V), By Application (Passenger Vehicle, Commercial Vehicle, Two Wheeler, Heavy Duty Vehicle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173947

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

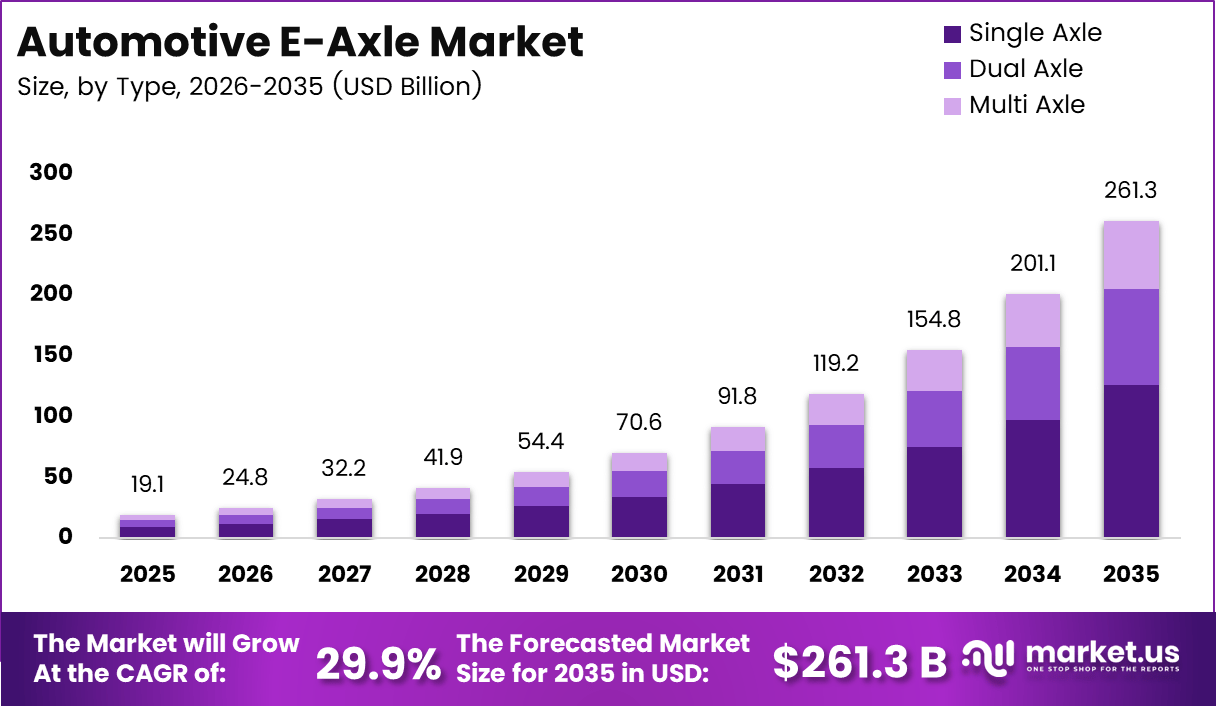

The Global Automotive E-Axle Market size is expected to be worth around USD 261.3 billion by 2035, from USD 19.1 billion in 2025, growing at a CAGR of 29.9% during the forecast period from 2026 to 2035.

The Automotive E-Axle Market refers to integrated electric drive units combining motor, transmission, and axle into a compact system. This architecture simplifies electric powertrain layouts and improves vehicle efficiency. Consequently, OEMs increasingly adopt e-axles to reduce mechanical losses, optimize packaging, and support scalable electric vehicle platforms across segments.

From a market perspective, automotive e-axles support electrification strategies across passenger cars, SUVs, and commercial vehicles. Growth accelerates as manufacturers prioritize modular drivetrains enabling front, rear, or all-wheel drive configurations. Moreover, e-axles reduce system complexity, enabling faster vehicle development cycles and improved cost control.

SUV demand strengthens the market as higher vehicle mass requires efficient torque delivery and compact driveline integration. Meanwhile, technical requirements for commercial vehicles differ substantially due to payload, durability, and duty cycles. As a result, e-axle designs increasingly diversify to address light commercial vans and delivery fleets.

Government investments and regulations strongly influence adoption. Emission reduction mandates, zero-emission fleet targets, and commercial vehicle electrification incentives accelerate deployment. Additionally, public funding for charging infrastructure and electric logistics corridors improves total cost economics, positioning e-axles as a core electrification technology.

From an engineering study, driveline suppliers historically transmitted power forward before redirecting torque through 90º to the wheels. Modern e-axles replace this complexity with integrated systems. For Class 4, 5, and 6 vehicles ranging from 6,350 to 10,660 kg, drop-in e-axles simplify suspension integration.

Motor characteristics further define segmentation. According to automotive engineering sources, light-duty vehicle motors typically operate between 10,000 and 18,000 rpm, requiring substantial gear reduction. In contrast, commercial vehicle motors peak near 4,000 rpm, delivering higher torque at lower speeds.

According to transportation energy agencies and drivetrain research institutions, parcel delivery trucks with gross vehicle weights of 2.8–3.5 t significantly influence gearbox and axle requirements. These operational realities support rising demand for robust e-axle systems, driving sustained Automotive E-Axle Market expansion.

Key Takeaways

- Global Automotive E-Axle Market size is projected to grow from USD 19.1 billion in 2025 at a CAGR of 29.9% through 2035.

- Single Axle remains the leading segment by type with a market share of 48.5%, driven by cost efficiency and mass-market EV adoption.

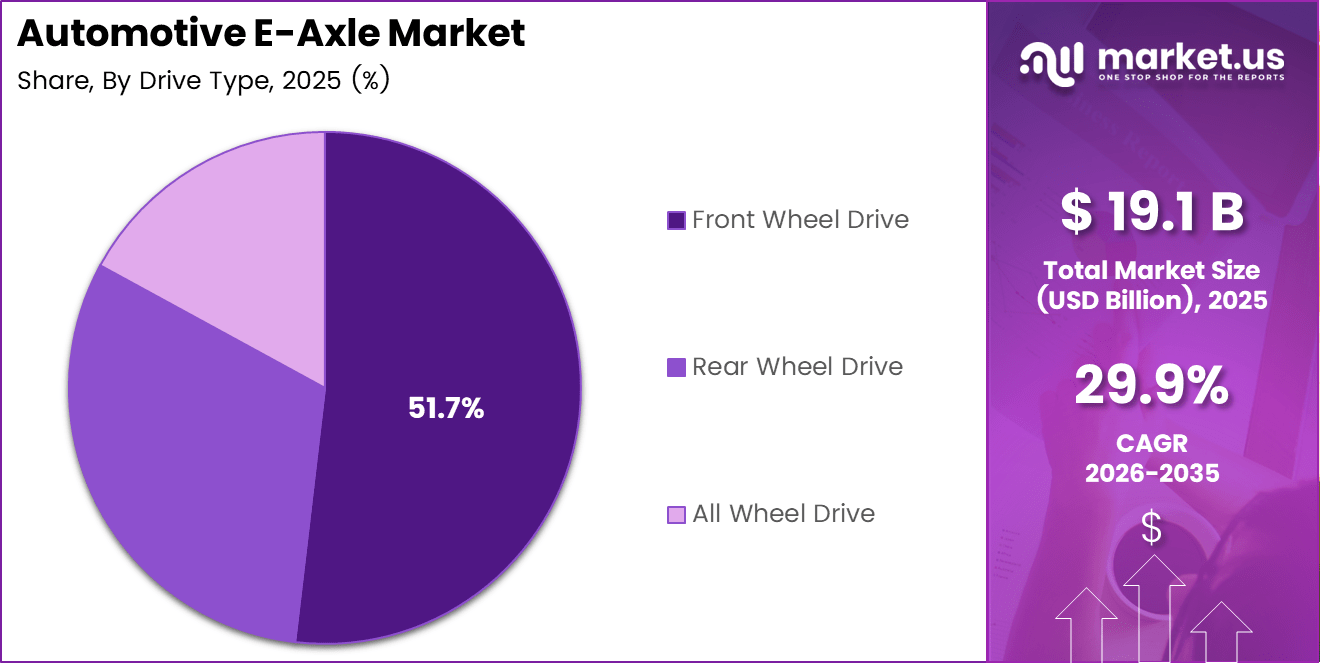

- Front Wheel Drive dominates the drive type segment, accounting for 51.7% share due to packaging simplicity and platform compatibility.

- The 50 kW to 100 kW power rating segment leads with 39.6%, aligning with mainstream electric passenger vehicle performance needs.

- Voltage ratings between 400 V and 800 V hold a dominant share of 56.1%, supported by fast-charging and efficiency advantages.

- Passenger Vehicles represent the largest application segment with a market share of 67.4%, reflecting widespread EV passenger car penetration.

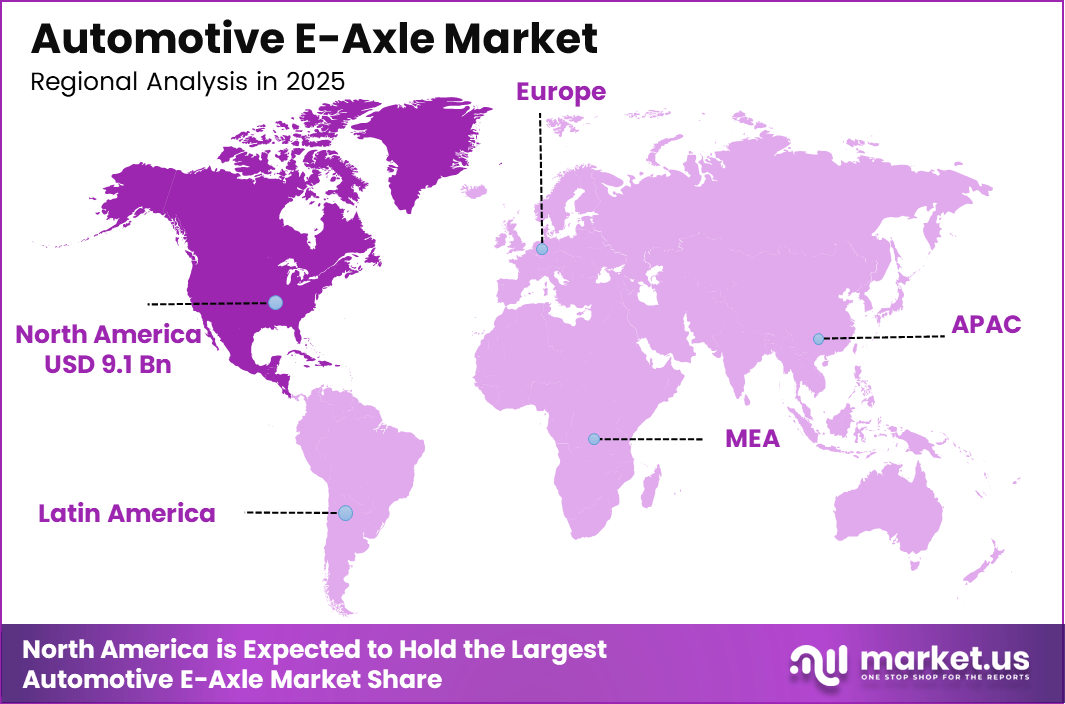

- North America dominates the regional landscape with a market share of 47.7%, valued at USD 9.1 billion.

By Type Analysis

Single Axle dominates with 48.5% due to its balanced performance, cost efficiency, and suitability for mass-market electric vehicles.

In 2025, Single Axle held a dominant market position in the By Main Segment Analysis segment of Automotive E-Axle Market, with a 48.5% share. Single axle systems support compact integration and lower system weight. As a result, manufacturers adopt them to improve efficiency while maintaining affordability across high-volume electric passenger vehicles.

Dual Axle systems gain attention as vehicle platforms advance toward higher torque requirements. These systems distribute power more effectively between axles, improving traction and driving stability. Consequently, premium electric vehicles increasingly consider dual axle configurations to enhance driving dynamics without fully shifting to complex multi-axle architectures.

Multi Axle solutions address specialized performance needs in advanced mobility platforms. These systems enable precise torque vectoring and load distribution across multiple axles. Although adoption remains limited, technological advancements gradually improve feasibility for high-performance and specialty electric vehicle applications.

By Drive Type Analysis

Front Wheel Drive dominates with 51.7% due to packaging efficiency and compatibility with compact electric vehicle platforms.

In 2025, Front Wheel Drive held a dominant market position in the By Main Segment Analysis segment of Automotive E-Axle Market, with a 51.7% share. Automakers favor this configuration for its simplified drivetrain layout. Consequently, it supports efficient power delivery while reducing manufacturing complexity and system costs.

Rear Wheel Drive remains essential for performance-oriented electric vehicles. This drive type enhances handling balance and acceleration characteristics. As a result, premium electric sedans and sporty models continue to integrate rear-driven e-axle systems to achieve improved driving engagement.

All Wheel Drive solutions expand adoption in regions demanding enhanced traction. These systems distribute torque across all wheels, improving safety and stability. Although cost and complexity remain higher, growing consumer preference for all-weather capability supports gradual market penetration.

By Power Rating Analysis

50 kW to 100 kW dominates with 39.6% as it aligns with mainstream electric vehicle performance needs.

In 2025, 50 kW to 100 kW held a dominant market position in the By Main Segment Analysis segment of Automotive E-Axle Market, with a 39.6% share. This range balances efficiency and power output. Consequently, it suits urban and mid-size electric vehicles targeting everyday driving requirements.

Below 50 kW systems serve lightweight electric mobility solutions. These include compact vehicles and entry-level electric models prioritizing energy efficiency. As urban mobility expands, this segment maintains relevance in cost-sensitive and low-speed transportation categories.

100 kW to 150 kW systems support higher acceleration demands. Automakers integrate these ratings into performance-focused electric vehicles. As a result, this segment benefits from rising consumer demand for faster acceleration without excessive energy consumption.

Above 150 kW e-axles address high-performance and luxury electric vehicles. These systems deliver substantial torque and speed capabilities. Although niche, continued innovation strengthens their role in advanced electric mobility platforms.

By Voltage Rating Analysis

400 V to 800 V dominates with 56.1% driven by faster charging and improved power efficiency.

In 2025, 400 V to 800 V held a dominant market position in the By Main Segment Analysis segment of Automotive E-Axle Market, with a 56.1% share. This voltage range enables higher power density. Consequently, it supports faster charging and improved thermal management in modern electric vehicles.

Below 400 V systems remain relevant for cost-focused electric vehicles. These configurations support simpler architectures and lower component costs. As a result, manufacturers continue adopting them in entry-level electric models and regional mobility solutions.

Above 800 V systems represent advanced electrification strategies. These systems enable ultra-fast charging and superior efficiency. Although adoption remains limited, premium electric vehicle platforms increasingly explore this voltage range to enhance performance benchmarks.

By Application Analysis

Passenger Vehicle dominates with 67.4% due to widespread electric passenger car adoption.

In 2025, Passenger Vehicle held a dominant market position in the By Main Segment Analysis segment of Automotive E-Axle Market, with a 67.4% share. Rising electric car adoption drives demand. Consequently, automakers prioritize e-axle integration to improve efficiency and vehicle packaging.

Commercial Vehicle applications expand as fleet electrification accelerates. E-axles improve drivetrain efficiency and reduce maintenance requirements. As a result, logistics and delivery operators increasingly adopt electric commercial vehicles for operational optimization.

Two-Wheeler applications adopt compact e-axle designs to support lightweight electric mobility. These systems improve power transmission while maintaining simplicity. Consequently, urban electric two-wheelers benefit from enhanced efficiency and compact drivetrain layouts.

Heavy-Duty Vehicle applications adopt e-axles to support electrification of large vehicles. These systems deliver high torque for demanding loads. Although adoption remains gradual, infrastructure development supports long-term growth in this segment.

Key Market Segments

By Type

- Single Axle

- Dual Axle

- Multi Axle

By Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

By Power Rating

- Below 50 kW

- 50 kW to 100 kW

- 100 kW to 150 kW

- Above 150 kW

By Voltage Rating

- Below 400 V

- 400 V to 800 V

- Above 800 V

By Application

- Passenger Vehicle

- Commercial Vehicle

- Two Wheeler

- Heavy Duty Vehicle

Drivers

Accelerating Global Battery Electric and Hybrid Vehicle Production Drives Market Growth

Accelerating global battery electric and hybrid vehicle production strongly supports the Automotive E-Axle market. Governments promote electrification through long term emission reduction targets and EV incentives. As automakers expand electric portfolios, demand rises for integrated electric drivetrain solutions. E-axles align well with high volume EV production requirements.

OEM focus on powertrain integration further drives market growth. Automakers aim to combine motor, transmission, and power electronics into compact systems. E-axles improve drivetrain efficiency, reduce mechanical losses, and simplify vehicle architecture. This integration supports better energy utilization and helps OEMs optimize vehicle layout.

Stringent fleet level emission regulations also accelerate adoption. Regulators enforce strict average emission limits across vehicle fleets. E-axles enable zero emission operation and support hybrid configurations. This makes them a critical technology for manufacturers seeking regulatory compliance across global markets.

Rising demand for compact high torque propulsion systems adds further momentum. Passenger and light commercial vehicles require strong torque in limited space. E-axles deliver high torque density while maintaining compact size. This capability supports urban driving, delivery vehicles, and next generation mobility platforms.

Restraints

High System Cost of Integrated E-Axle Assemblies Restrains Market Growth

High system cost remains a major restraint for the Automotive E-Axle market. Integrated e-axle assemblies require advanced materials, power electronics, and precision manufacturing. These factors increase overall drivetrain cost. As a result, adoption remains limited in cost sensitive vehicle segments.

Cost challenges are more pronounced in mass market vehicles. Entry level electric models operate under tight pricing structures. Higher e-axle costs reduce pricing flexibility for OEMs. This limits large scale penetration in affordable passenger vehicle categories.

Thermal management challenges also restrain adoption. E-axles operate under high torque and continuous load conditions. Heat generation affects motors, inverters, and lubrication systems. Managing this heat efficiently requires advanced cooling solutions, increasing system complexity.

Durability concerns further impact market confidence. Sustained high temperatures influence component lifespan and reliability. OEMs must conduct extensive validation testing. Longer development cycles and higher engineering costs slow deployment across broader vehicle platforms.

Growth Factors

Expansion of Electric All Wheel Drive Architectures Creates New Opportunities

Expansion of electric all wheel drive architectures creates strong opportunities for e-axle suppliers. Premium and performance EVs increasingly adopt dual e-axle configurations. This setup improves traction, acceleration, and driving stability. Demand for performance oriented EVs directly supports e-axle integration.

Electric all wheel drive also enables advanced vehicle control functions. Independent e-axles support torque vectoring and dynamic handling control. These features enhance safety and driving comfort. OEMs use these capabilities to differentiate high end electric vehicle models.

Localization of e-axle manufacturing offers additional growth opportunities. Automakers invest in regional production to reduce logistics and import costs. Local manufacturing improves cost competitiveness and shortens supply chains. This strategy supports faster market responsiveness.

Localized production also strengthens supply chain resilience. Reduced dependency on global sourcing lowers disruption risks. Regional partnerships create opportunities for local suppliers. This supports long term expansion of the Automotive E-Axle market.

Emerging Trends

Integration of Silicon Carbide Inverters Shapes Market Trends

Integration of silicon carbide inverters represents a key trend in e-axle development. These inverters improve efficiency and reduce energy losses. Higher switching performance supports compact designs and better vehicle range. Next generation e-axles increasingly adopt this technology.

The market also shifts toward modular e-axle platforms. Modular designs allow the same architecture to serve multiple vehicle segments. This reduces development time and lowers production costs. OEMs benefit from scalable and flexible drivetrain solutions.

Increasing adoption of oil cooled motors is another major trend. Oil cooling enhances heat dissipation and supports higher power density. This allows sustained performance under heavy loads. As power demands rise, oil cooled systems gain traction.

Collaboration between OEMs and Tier 1 suppliers continues to increase. Co-developed e-axle systems align closely with vehicle requirements. These partnerships accelerate innovation and customization. Strong collaboration supports faster commercialization of advanced e-axle technologies.

Regional Analysis

North America Dominates the Automotive E-Axle Market with a Market Share of 47.7%, Valued at USD 9.1 Billion

North America held a dominant position in the Automotive E-Axle Market with a 47.7% share, accounting for a market value of USD 9.1 Billion. Strong penetration of electric passenger vehicles and electrified commercial fleets continues to support regional demand. Government-backed EV incentive programs and tightening emission regulations further accelerate e-axle integration. Advanced automotive manufacturing capabilities also enable faster adoption of high-power and integrated drivetrain architectures.

Europe Automotive E-Axle Market Trends

Europe represents a mature and regulation-driven market for automotive e-axles, supported by stringent CO₂ emission targets across passenger and commercial vehicles. The region benefits from high adoption of electrified drivetrains in premium and mid-range vehicles. Investments in charging infrastructure and electrified public transport further strengthen demand. OEM focus on efficiency and compact powertrain design supports steady market expansion.

Asia Pacific Automotive E-Axle Market Trends

Asia Pacific demonstrates strong growth momentum due to rising electric vehicle production and cost-competitive manufacturing ecosystems. Expanding urbanization and government-led electrification initiatives support adoption across passenger vehicles and two-wheelers. The region also benefits from increasing localization of electric drivetrain components. Growing demand for affordable EV platforms drives volume-based e-axle deployments.

Middle East and Africa Automotive E-Axle Market Trends

The Middle East and Africa market remains at a developing stage, driven by gradual electrification of passenger fleets and public transport systems. Government sustainability programs and pilot EV projects support early adoption. Infrastructure development and fleet electrification initiatives influence demand patterns. Market growth remains selective and concentrated in urban centers.

Latin America Automotive E-Axle Market Trends

Latin America shows emerging adoption of automotive e-axles, supported by increasing EV imports and regional assembly initiatives. Policy-driven emission reduction efforts encourage gradual electrification of passenger and light commercial vehicles. Expanding awareness of total cost of ownership benefits supports adoption. However, infrastructure readiness continues to shape a moderate growth trajectory.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive E-Axle Company Insights

In the increasingly competitive global Automotive E-Axle market, Continental AG stands out with its integrated system solutions that combine power electronics, electric motors, and transmission technologies. The company focuses on modular and scalable e-axle architectures to support both passenger and commercial electric vehicles. Its emphasis on software integration and thermal efficiency improves drivetrain performance and overall vehicle range.

ZF Friedrichshafen AG leverages its long-standing expertise in driveline and chassis systems to strengthen its e-axle portfolio. The company prioritizes compact, high-efficiency designs that balance performance with cost competitiveness. Strong system integration capabilities enable ZF to deliver flexible e-axle solutions aligned with diverse OEM electrification strategies.

Melrose Industries PLC contributes to the Automotive E-Axle market through precision engineering and performance-oriented component development. The company’s shift toward electric propulsion technologies reflects its ability to adapt to evolving powertrain requirements. Operational efficiency and engineering discipline support consistent product quality and long-term platform relevance.

Dana Limited continues to reinforce its market presence by offering integrated e-propulsion systems that combine e-axles, power electronics, and control technologies. Its global manufacturing footprint supports scalable production for multiple vehicle platforms. Ongoing investments in lightweight materials and system efficiency align with broader electrification and sustainability objectives.

Top Key Players in the Market

- Continental AG

- ZF Friedrichshafen AG

- Melrose Industries PLC

- Dana Limited

- Robert Bosch GmbH

- Meritor, Inc.

- LINAMAR

- NIDEC CORPORATION

- Magna International Inc.

- Schaeffler AG

Recent Developments

- In July 2025, American Axle & Manufacturing completed a $1.4 billion acquisition of GKN Automotive, significantly strengthening its global driveline and e-axle capabilities. This move positions the company to capture higher EV platform volumes as automakers accelerate electrification strategies.

- In October 17, 2024, American Axle & Manufacturing agreed to sell its India-based commercial vehicle axle business to Bharat Forge Limited for $65 million. The divestment, involving assets that generated $156 million in sales over the twelve months ending June 2024 allows AAM to sharpen its focus on higher-growth electrified driveline systems.

Report Scope

Report Features Description Market Value (2025) USD 19.1 billion Forecast Revenue (2035) USD 261.3 billion CAGR (2026-2035) 29.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Single Axle, Dual Axle, Multi Axle), By Drive Type (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive), By Power Rating (Below 50 kW, 50 kW to 100 kW, 100 kW to 150 kW, Above 150 kW), By Voltage Rating (Below 400 V, 400 V to 800 V, Above 800 V), By Application (Passenger Vehicle, Commercial Vehicle, Two Wheeler, Heavy Duty Vehicle) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Continental AG, ZF Friedrichshafen AG, Melrose Industries PLC, Dana Limited, Robert Bosch GmbH, Meritor, Inc., LINAMAR, NIDEC CORPORATION, Magna International Inc., Schaeffler AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Continental AG

- ZF Friedrichshafen AG

- Melrose Industries PLC

- Dana Limited

- Robert Bosch GmbH

- Meritor, Inc.

- LINAMAR

- NIDEC CORPORATION

- Magna International Inc.

- Schaeffler AG