Global Automotive Carbon Ceramic Brake Market Size, Share, Growth Analysis By Vehicle Type (Passenger Cars, Commercial Vehicles – Light Commercial, Heavy Buses & Trucks, Off-road Vehicles), By Sales Channel (Original Equipment Manufacturer (OEM), Original Equipment Supplier (OES), Independent Aftermarket (IAM)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164635

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

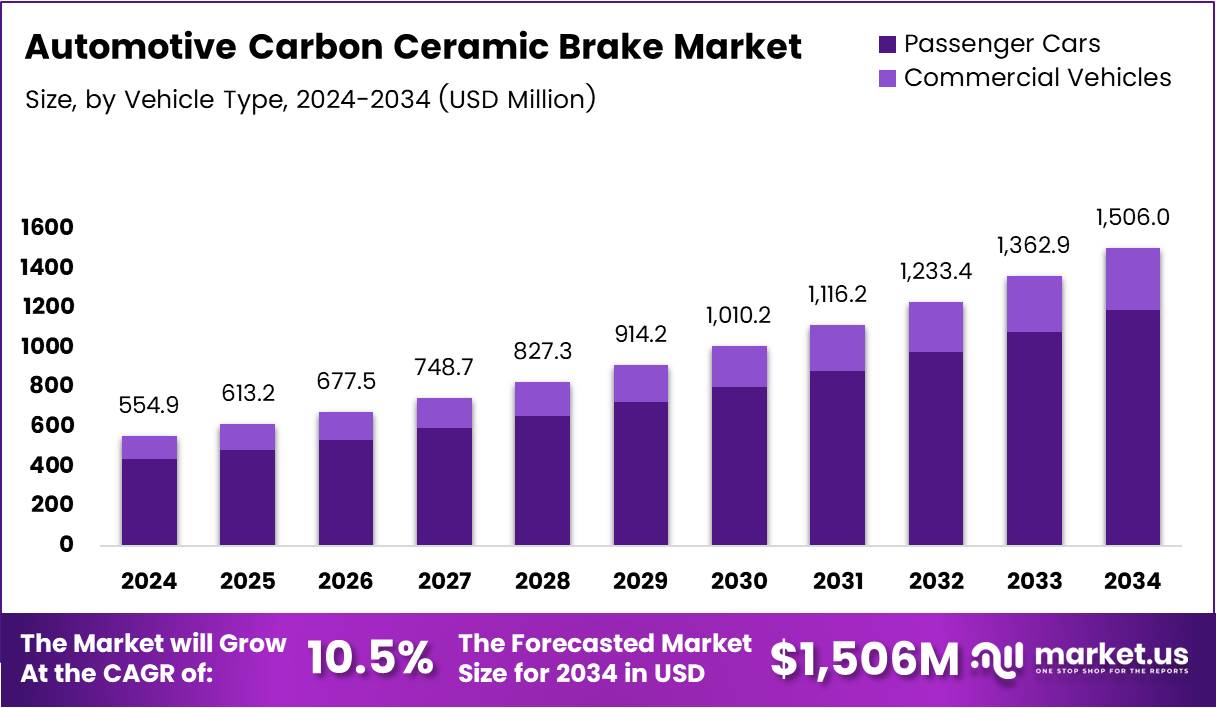

The Global Automotive Carbon Ceramic Brake Market size is expected to be worth around USD 1506.0 Million by 2034, from USD 554.9 Million in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034.

The Automotive Carbon Ceramic Brake Market refers to the industry focused on manufacturing and integrating carbon-ceramic braking systems in vehicles. These brakes use advanced composite materials to deliver higher heat resistance, lighter weight, and longer lifespan than traditional metal brakes. They are commonly used in luxury, performance, and increasingly in electric vehicles seeking efficiency gains.

Automotive Carbon Ceramic Brakes offer strong functional advantages due to reduced brake fade, better thermal control, and improved vehicle handling. Their lightweight design reduces rotational mass, enhancing driving dynamics and fuel or energy efficiency. However, higher production costs and specialized installation requirements still limit broader mass-market adoption across standard vehicle categories.

The demand is gradually rising as automakers prioritize premium performance features and sustainable lightweight materials. The increasing shift toward electrification encourages components that support improved driving range. Manufacturers are also investing in scalable production techniques to lower manufacturing costs and expand deployment into mid-range vehicle platforms across global markets.

Market growth is influenced by regulatory pressure for enhanced vehicle efficiency and reduced emissions. Governments are encouraging adoption of advanced materials through R&D grants and stricter safety standards. This environment supports suppliers focusing on material innovation and OEMs integrating performance-oriented braking systems. As market acceptance improves, pricing is expected to gradually normalize, enhancing market penetration.

Additionally, increasing consumer interest in performance-oriented driving experiences presents new commercial opportunities. Premium automotive brands continue to highlight braking precision as a key differentiator. Moreover, motorsport advancements frequently accelerate technology transfer into road vehicles, reinforcing long-term innovation cycles and multi-segment adoption potential.

Rising EV adoption directly strengthens demand for lightweight brake systems. Reduced unsprung mass supports longer range and smoother energy recovery operation. As electrification grows worldwide, suppliers that tailor carbon-ceramic brake solutions for EV platforms will gain strategic advantages. This aligns with emerging mobility trends emphasizing efficiency and durability.

According to industry reports, PCCB carbon-ceramic discs are 50% lighter than traditional grey cast-iron discs, improving ride responsiveness and handling. Furthermore, according to industry findings, battery-electric cars in the EU reached 13.6% market share in 2024 and 16.1% year-to-date by September 2025, highlighting increasing value for lightweight efficiency-oriented components.

Key Takeaways

- The Global Automotive Carbon Ceramic Brake Market is valued at USD 554.9 Million in 2024 and is projected to reach USD 1506.0 Million by 2034, growing at a CAGR of 10.5%.

- Passenger Cars dominate the market with a 79.2% share due to high adoption in luxury and performance vehicles.

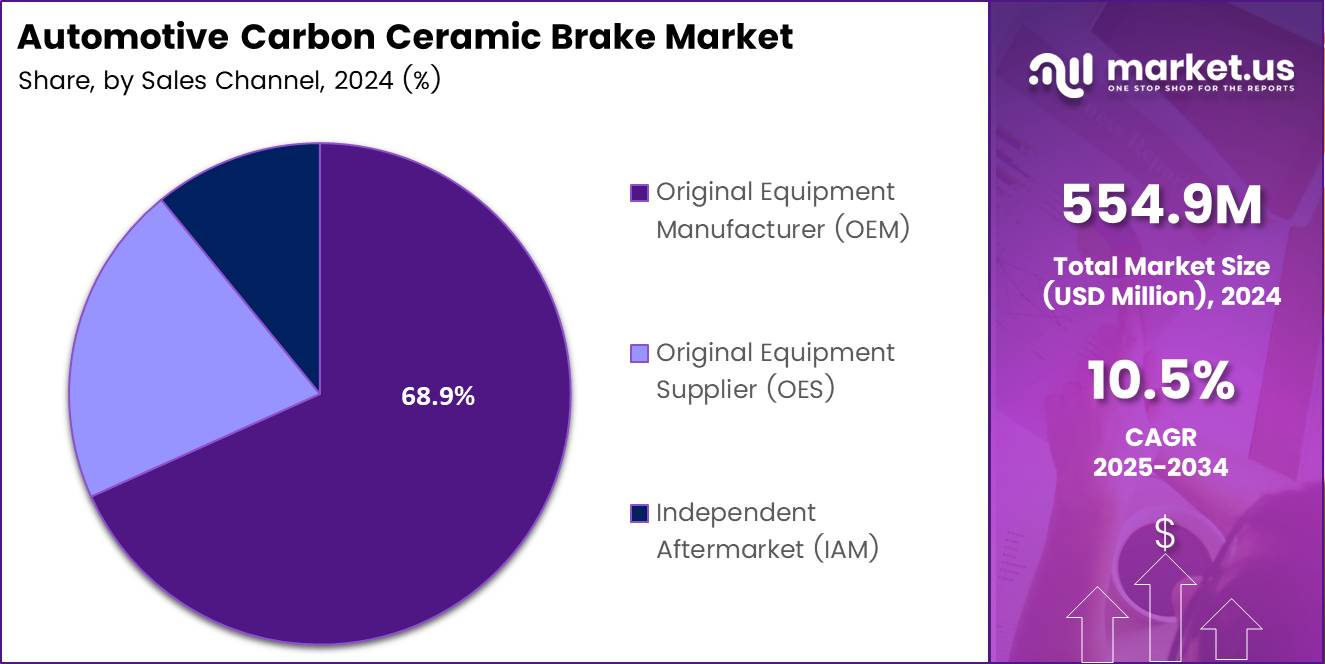

- OEM (Original Equipment Manufacturer) channel leads with a 68.9% share owing to direct factory integration in premium models.

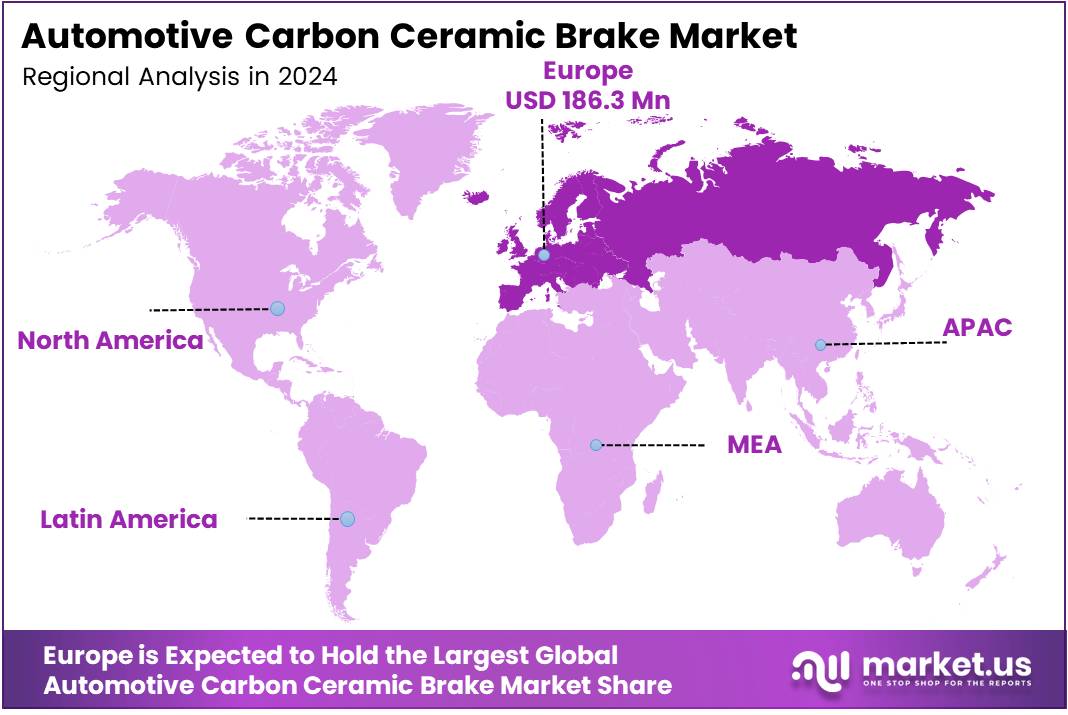

- Europe leads regionally with a 34.9% market share valued at USD 193.6 Million, driven by strong luxury and sports vehicle manufacturing.

By Vehicle Type Analysis

Passenger Cars dominate with 79.2% due to high installation in luxury and performance vehicles.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of the Automotive Carbon Ceramic Brake Market, with a 79.2% share. This dominance is driven by the increasing demand for high-performance braking systems in sports cars, luxury sedans, and premium electric vehicles. Carbon ceramic brakes offer improved durability, reduced weight, and enhanced braking efficiency, appealing to consumers seeking superior driving dynamics and safety. Manufacturers are integrating these brakes as standard or optional features in upscale models, further boosting segment growth.

The Commercial Vehicles segment, which includes Light Commercial Vehicles, Heavy Buses & Trucks, and Off-road Vehicles, is experiencing gradual adoption of carbon ceramic braking solutions. Although the upfront cost remains a barrier, long-term benefits such as reduced maintenance, higher heat resistance, and consistent braking performance are encouraging selective deployment.

Light commercial fleets increasingly consider carbon ceramics to minimize downtime, while heavy trucks and buses value their stability during long-haul operations. Off-road and specialty vehicles benefit from durability in harsh environments. As safety regulations tighten and operational efficiency becomes a priority, commercial use of carbon ceramic brakes is expected to expand steadily.

By Sales Channel Analysis

Original Equipment Manufacturer (OEM) dominates with 68.9% due to strong integration into factory-built premium models.

In 2024, Original Equipment Manufacturer (OEM) held a dominant market position in the By Sales Channel Analysis segment of the Automotive Carbon Ceramic Brake Market, with a 68.9% share. OEMs widely integrate carbon ceramic brakes into performance cars and luxury vehicles to ensure compatibility, quality assurance, and enhanced resale value. This direct installation supports superior safety and optimal braking performance.

Original Equipment Supplier (OES) channels provide certified replacement parts after the initial purchase. This segment ensures that vehicle owners maintain factory-grade performance and reliability. Customers prefer OES parts for their authenticity and exact fit, especially when maintaining high-value and premium vehicles where brake performance is critical.

The Independent Aftermarket (IAM) segment offers broader accessibility and cost flexibility. While adoption is comparatively lower due to the specialized nature of carbon ceramic systems, growing awareness of performance upgrades and customization is encouraging gradual expansion. Enthusiast buyers and specialized service centers play a significant role in supporting aftermarket demand.

Key Market Segments

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Light Commercial

- Heavy Buses & Trucks

- Off-road Vehicles

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Original Equipment Supplier (OES)

- Independent Aftermarket (IAM)

Drivers

Rising Adoption of High-Performance and Luxury Vehicles Drives Market Growth

The Automotive Carbon Ceramic Brake Market is gaining momentum due to the growing popularity of high-performance and luxury vehicles. These vehicles demand strong braking power, especially at high speeds, and carbon ceramic brakes provide reliable stopping performance. Their ability to maintain efficiency even during intense driving conditions supports their growing use in premium car segments.

Another key driver is the increasing need for lightweight automotive components to improve fuel efficiency and enhance vehicle handling. Carbon ceramic brakes are significantly lighter compared to traditional steel brakes, helping reduce overall vehicle weight and improving acceleration and mileage.

The rising culture of track racing and performance tuning also contributes to market growth. Enthusiasts prefer brake systems that can withstand repeated high-temperature exposure without losing strength, and carbon ceramic brakes offer excellent heat resistance and durability.

Additionally, modern vehicles require advanced braking systems that ensure safety in extreme driving environments. Carbon ceramic materials resist heat buildup better than conventional brakes, reducing the risk of brake fade and ensuring consistent performance. This makes them suitable for performance cars, sports sedans, and supercars where safety, speed, and precision are top priorities.

Restraints

Limited Compatibility with Economy Vehicle Platforms Restrains Market Expansion

The major restraint in the Automotive Carbon Ceramic Brake Market is the limited suitability of these brake systems for mass-produced economy vehicles. Due to their high manufacturing and installation cost, carbon ceramic brakes are primarily used in premium cars, restricting widespread adoption.

Additionally, carbon ceramic brakes require specialized maintenance and repair services. Their material composition demands experienced technicians and specific tools, which increases service expenses and limits availability in regular automotive repair centers. This can discourage budget-conscious customers and fleet operators.

The market also faces challenges in raw material procurement. Carbon fibers, ceramic powders, and resin compounds used in these brake systems depend on advanced supply chains and precise manufacturing processes. Any disruption in supply channels can affect production and pricing.

Furthermore, scaling up production while maintaining consistent quality can be complex, which may slow down expansion efforts. These cost and maintenance limitations continue to confine carbon ceramic brakes to niche markets rather than mainstream vehicle platforms.

Growth Factors

Expansion of Electric and Hybrid Sports Cars Creates New Growth Opportunities

A significant growth opportunity lies in the increasing development of electric and hybrid sports cars. These vehicles require advanced braking systems capable of handling frequent deceleration and higher torque output. Carbon ceramic brakes provide excellent durability and heat control, making them suitable for high-performance electric vehicles.

The market is also benefiting from rising collaboration between original equipment manufacturers (OEMs) and carbon ceramic brake suppliers. Partnerships allow cost optimization, better integration of brake systems, and improved performance consistency, supporting broader usage in upcoming vehicle models.

Customization trends in the aftermarket performance segment offer additional opportunities. Car enthusiasts are increasingly upgrading braking systems to improve vehicle handling and aesthetics. Carbon ceramic brake kits, known for their premium appearance and performance, are becoming a desirable upgrade option.

Moreover, commercial high-speed fleets such as luxury ride services, VIP transport vehicles, and performance-oriented rental fleets are adopting carbon ceramic brakes to ensure reliability under continuous usage. These segments prioritize low maintenance frequency and long brake life, both of which align with the benefits of carbon ceramic brake systems.

Emerging Trends

Integration of Smart Brake Diagnostics Shapes Key Trending Factors

The Automotive Carbon Ceramic Brake Market is witnessing strong interest in smart brake diagnostics and predictive maintenance technologies. These systems help monitor brake wear, temperature, and performance, allowing early detection of issues and reducing unexpected repair costs.

Another notable trend is the development of next-generation composite materials. Engineers are improving resin and fiber blends to make carbon ceramic brakes even more heat-resistant and durable. These innovations help reduce brake dust, improve safety, and extend component lifespan.

Sustainability is also influencing market trends. Manufacturers are exploring recyclable and eco-friendly ceramic and carbon fibers to lower environmental impact during production. This aligns with the automotive industry’s broader move toward greener material sourcing.

Lastly, the push for ultra-lightweight brake kits is becoming more crucial for electric vehicles. Reducing overall vehicle weight directly increases driving range in EVs. Carbon ceramic brakes support this goal by being lighter than traditional metal brake systems, making them a preferred choice for future EV performance models.

Regional Analysis

Europe Dominates the Automotive Carbon Ceramic Brake Market with a Market Share of 34.9%, Valued at USD 193.6 Million

Europe leads the Automotive Carbon Ceramic Brake Market, driven by high adoption of luxury and high-performance vehicles that prioritize advanced braking systems. The presence of established automotive manufacturing hubs and strong focus on lightweight and heat-resistant materials further increases product usage. Additionally, emission regulations and growing preference for premium vehicle upgrades support continuous demand across Germany, Italy, the U.K., and France.

North America Automotive Carbon Ceramic Brake Market Trends

North America shows steady market growth due to increasing consumer preference for performance-oriented vehicles and the presence of active sports-car tuning communities. Technological upgrades in braking systems and rising investments toward vehicle customization trends contribute to adoption. Additionally, growth in high-speed road networks and luxury car ownership strengthens market development.

Asia Pacific Automotive Carbon Ceramic Brake Market Trends

Asia Pacific is experiencing rapid growth due to increasing disposable incomes and consumer shift toward premium vehicles in markets such as China, Japan, and South Korea. Automotive OEM expansion and regional production capabilities support cost advantages and faster adoption. Growing motorsport culture and performance aftermarket upgrades further enhance product penetration.

Middle East and Africa Automotive Carbon Ceramic Brake Market Trends

The Middle East and Africa market is influenced by strong demand for luxury cars and high-performance SUVs, particularly in urban hubs with developed road infrastructure. Harsh climatic conditions increase the need for brakes with heat stability and durability. Although adoption is currently limited, growing premium vehicle imports continue to drive market potential.

Latin America Automotive Carbon Ceramic Brake Market Trends

Latin America shows moderate market growth, supported by a rising interest in sports and performance vehicles among upper-income segments in Brazil, Mexico, and Argentina. The market is still emerging due to cost limitations and limited local production. However, expanding auto parts distribution networks and aftermarket customization culture are gradually supporting product uptake.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Carbon Ceramic Brake Company Insights

BREMBO S.p.A. continues to play a dominant role in the global automotive carbon ceramic brake market in 2024 due to its strong integration with premium and high-performance vehicle manufacturers. The company’s expertise in developing lightweight, thermally stable braking systems aligns with the industry shift toward efficiency and performance. By investing in composite material innovation and strategic OEM collaborations, Brembo maintains a competitive leadership position across luxury and motorsport segments.

Surface Transforms PLC is gaining increased visibility as a specialist producer of carbon ceramic brake discs with proprietary next-generation manufacturing techniques. The company focuses on scalable production and durability improvements, allowing it to form new supply agreements with supercar and performance EV brands. Its continuous R&D focus on reducing heat distortion and extending disc lifespan positions it well amid rising demand from electrified performance vehicles.

MAT Foundry Group Ltd leverages its metallurgical and precision casting capabilities to support carbon composite and high-end brake component manufacturing. The company collaborates closely with automotive OEMs for custom product design, aiming to deliver enhanced braking efficiency and wear resistance. Its ability to adapt production processes based on new lightweight materials supports OEM transitions from traditional cast iron systems to advanced carbon-ceramic counterparts.

Audi AG plays a pivotal role as both an OEM integrator and end-user of carbon ceramic brake technologies across its performance and luxury vehicle lineup. By standardizing lightweight braking systems in select models, Audi reinforces consumer demand for premium driving dynamics. The company’s push toward electrification also increases the importance of thermally stable, low-maintenance braking solutions, further driving adoption within the segment.

Top Key Players in the Market

- BREMBO S.p.A.

- Surface Transforms PLC

- MAT Foundry Group Ltd

- Audi AG

- BRABUS GmbH

- AKEBONO BRAKE INDUSTRY CO., LTD.

- Rotora

- Lamborghini

Recent Developments

- In September 2025, Brembo SGL Carbon Ceramic Brakes (BSCCB) expanded its production capacity by ~50% at its Stezzano (Italy) and Meitingen (Germany) plants. This expansion supports growing global demand for high-performance carbon-ceramic brake discs in luxury and sports vehicle applications.

- In October 2024, Brembo S.p.A. agreed to acquire Öhlins Racing of Sweden for US$405 million. The acquisition strengthens Brembo’s position in integrated advanced cornering solutions, combining premium braking and suspension technologies.

- In September 2024, Brembo showcased carbon-ceramic material (CCM) brake discs for the aftermarket at the Automechanika 2024 trade fair. This move expands CCM accessibility beyond OEM-equipped supercars, enabling wider adoption across performance tuning and specialist workshops.

- In July 2025, Surface Transforms (UK-based) secured undisclosed funding to enhance its carbon-ceramic brake material development and production scale. The investment is expected to accelerate process optimization, reduce lead times, and strengthen its competitive positioning against global suppliers.

Report Scope

Report Features Description Market Value (2024) USD 554.9 Million Forecast Revenue (2034) USD 1506.0 Million CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Cars, Commercial Vehicles – Light Commercial, Heavy Buses & Trucks, Off-road Vehicles), By Sales Channel (Original Equipment Manufacturer (OEM), Original Equipment Supplier (OES), Independent Aftermarket (IAM)) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BREMBO S.p.A., Surface Transforms PLC, MAT Foundry Group Ltd, Audi AG, BRABUS GmbH, AKEBONO BRAKE INDUSTRY CO., LTD., Rotora, Lamborghini Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Carbon Ceramic Brake MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Carbon Ceramic Brake MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BREMBO S.p.A.

- Surface Transforms PLC

- MAT Foundry Group Ltd

- Audi AG

- BRABUS GmbH

- AKEBONO BRAKE INDUSTRY CO., LTD.

- Rotora

- Lamborghini