Global Automotive Cabin AC Filter Market Size, Share, Growth Analysis By Material (Non-Woven, Meltblown, Nanofiber), By Technology (Conventional, HEPA (High-Efficiency Particulate Air), Activated Carbon Plus (ACP)), By Filter Type (Activated Carbon, Electrostatic, Combination (Electrostatic and Activated Carbon)), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers), By Application (Aftermarket, OEM), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168872

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Material Analysis

- By Technology Analysis

- By Filter Type Analysis

- By Vehicle Type Analysis

- By Application Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Automotive Cabin AC Filter Company Insights

- Recent Developments

- Report Scope

Report Overview

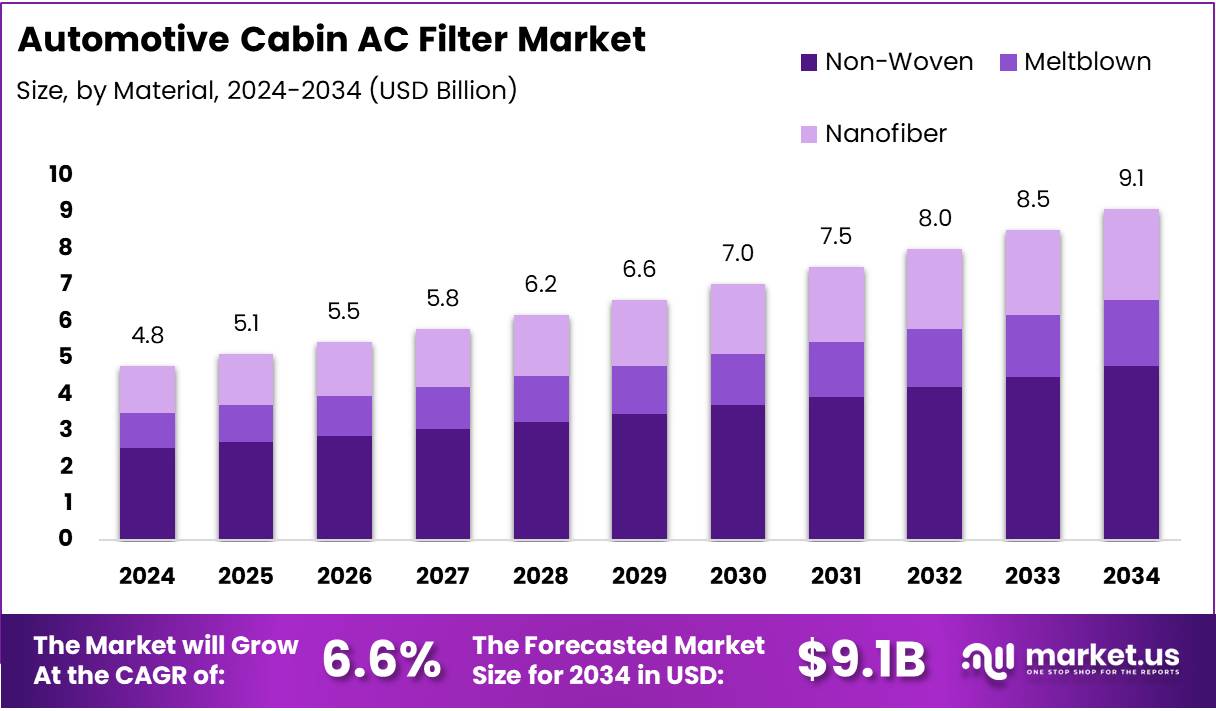

The Global Automotive Cabin AC Filter Market size is expected to be worth around USD 9.1 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

The Automotive Cabin AC Filter is a key vehicle component that cleans incoming air before it enters the cabin. It captures dust, pollen, and pollutants, ensuring a safer and healthier environment for passengers. Efficient filters also improve Heating, Ventilation, and Air Conditioning performance, contributing to comfort and overall vehicle maintenance.

The Automotive Cabin AC Filter market includes production, supply, and replacement demand for both standard and high-efficiency filters. Rising vehicle ownership, awareness about air quality, and mandatory maintenance cycles drive market expansion. The market serves passenger and commercial vehicles, with growing adoption of high-performance media improving filtration efficiency and passenger health.

Market growth is supported by increasing urbanization and worsening pollution levels globally. Greater concern for air quality drives frequent replacement and aftermarket purchases. Expanding automotive fleets in emerging regions also stimulate demand, providing recurring revenue opportunities for manufacturers and suppliers across multiple vehicle segments.

Government regulations and investment in cleaner mobility further strengthen the market. Stricter norms for emissions and cabin air hygiene encourage the adoption of effective filters. Policy initiatives aimed at air quality and sustainable transport reinforce consistent replacement cycles, promoting both standard and high-efficiency filters across new and existing vehicles.

Maintenance practices contribute to steady market demand. Cabin air filters are generally recommended to be replaced every 12,000 miles, or at least once a year. Regular replacement ensures consistent ventilation performance, reduces allergens and pollutants inside vehicles, and maintains driver and passenger comfort across diverse environmental conditions.

Advanced filter technologies such as true High-Efficiency Particulate Air filters improve market potential for premium products. These filters can capture 99.97% of airborne particles as small as 0.3 microns, providing enhanced protection against fine dust, pollen, and other pollutants. Such high-efficiency solutions drive market differentiation and adoption in health-conscious regions.

Key Takeaways

- The global market reached USD 4.8 Billion in 2024 and is projected to hit USD 9.1 Billion by 2034.

- Market expected to grow at a 6.6% CAGR between 2025–2034.

- Non-Woven material leads the segment with a 52.6% share in 2024.

- Conventional Technology dominates with a 59.9% contribution in 2024.

- Activated Carbon Filters account for the highest filter type share at 44.2% in 2024.

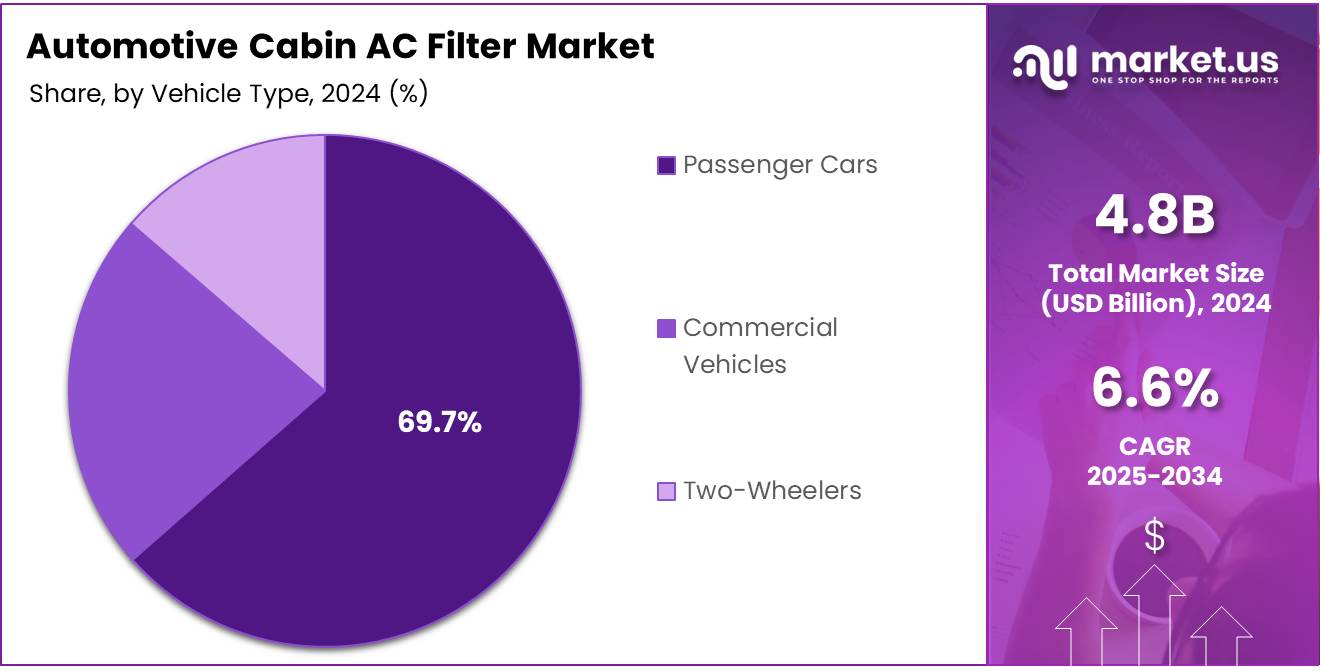

- Passenger Cars represent the largest vehicle segment with 69.7% market share in 2024.

- Aftermarket application leads with a 61.4% share in 2024.

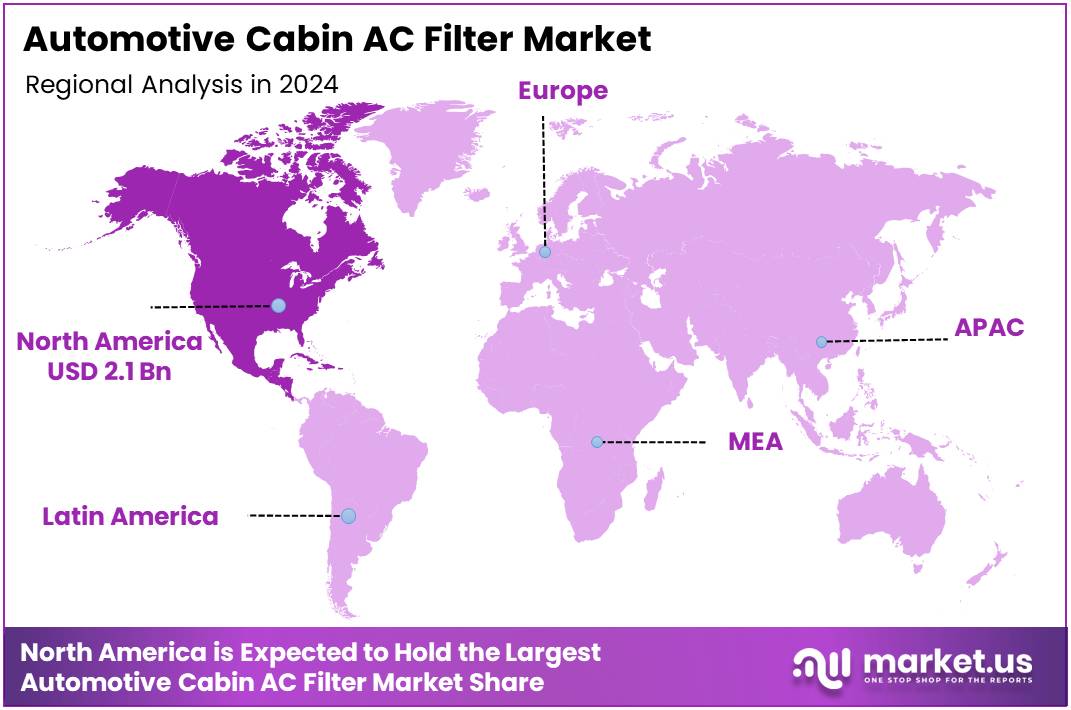

- North America dominates regionally with 45.8% market share valued at USD 2.1 Billion in 2024.

By Material Analysis

Non-Woven dominates with 52.6% due to its strong filtration capability and wide automotive adoption.

In 2024, Non-Woven held a dominant market position in the By Material segment of the Automotive Cabin AC Filter Market, with a 52.6% share. It continued gaining preference as OEMs relied on its durability, balanced airflow, and effective dust retention. This material also ensured cost-efficiency, supporting large-scale manufacturing across diverse vehicle categories.

Meltblown materials increasingly advanced filtration performance by offering finer fiber structures designed to trap smaller contaminants. This sub-segment progressed as consumers demanded improved cabin hygiene and vehicle manufacturers emphasized enhanced filtration efficiency. Its adaptability for multilayer filter construction further elevated its relevance in modern automotive cabins.

Nanofiber filters expanded steadily as vehicle brands adopted premium filtration systems capable of blocking ultrafine particles and allergens. This sub-segment benefited from rising awareness related to air quality and long-term respiratory wellness. Although still emerging, its superior efficiency and compatibility with next-gen filter designs positioned it for continued adoption.

By Technology Analysis

Conventional Technology dominates with 59.9% due to cost-effectiveness and widespread OEM usage.

In 2024, Conventional filters held a dominant market position in the By Technology segment of the Automotive Cabin AC Filter Market, with a 59.9% share. This category remained preferred for balancing filtration performance and affordability. Automakers continued integrating these systems to ensure reliable protection from dust and debris without adding significant vehicle cost.

HEPA technology progressed as consumers shifted toward enhanced cabin safety and pollutant capture. This segment improved filtration precision by targeting microscopic particles, including allergens and pollutants. Manufacturers adopted HEPA-based solutions to appeal to buyers seeking advanced in-cabin air quality, especially in urban regions with dense pollution levels.

Activated Carbon Plus (ACP) technology grew with rising attention on odor removal and VOC absorption. This filtration approach supported cleaner interiors by targeting gaseous contaminants, smoke, and exhaust traces. As comfort and driving experience became stronger purchase factors, ACP filters advanced within premium and mid-range vehicles.

By Filter Type Analysis

Activated Carbon Filter dominates with 44.2% due to its enhanced odor and gas filtration capability.

In 2024, Activated Carbon filters held a dominant market position in the By Filter Type segment of the Automotive Cabin AC Filter Market, with a 44.2% share. These filters advanced due to their ability to neutralize odors, absorb harmful gases, and improve overall driving comfort. Their multipurpose filtration appeal strengthened adoption across passenger and commercial vehicles.

Electrostatic filters expanded as automakers integrated solutions tailored for capturing fine dust and microscopic particles using electrostatic charge mechanisms. They offered strong value by enhancing allergen protection and maintaining airflow efficiency. This sub-segment benefited from rising consumer preference for cleaner cabin environments in cities with high pollution levels.

Combination filters, merging electrostatic and activated carbon mechanisms, progressed as a premium offering targeting both particulate and gaseous contaminants. This dual-function capability positioned them as preferred solutions in modern vehicle platforms. Their increasing use supported improved in-cabin experience and long-term filtration reliability.

By Vehicle Type Analysis

Passenger Cars dominate with 69.7% due to higher global vehicle ownership and consumer focus on comfort.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Automotive Cabin AC Filter Market, with a 69.7% share. Higher personal vehicle usage, rising health awareness, and demand for advanced comfort features drove this strong adoption. OEMs continued embedding improved filters to enhance driving satisfaction and regulatory compliance.

Commercial Vehicles steadily adopted advanced cabin filters as fleet operators emphasized driver wellbeing and operational efficiency. These vehicles benefited from filtration systems designed to manage dust, pollutants, and long operating hours. Growth in logistics, public mobility, and construction activities further supported uptake of reliable cabin filtration solutions.

Two-Wheelers initiated gradual adoption of compact filtration systems as manufacturers explored premium comfort features. Although at a developing stage, increasing interest in rider protection and evolving urban mobility patterns encouraged innovation in two-wheeler filtration technologies.

By Application Analysis

Aftermarket dominates with 61.4% due to frequent replacement cycles and wider accessibility.

In 2024, Aftermarket held a dominant market position in the By Application segment of the Automotive Cabin AC Filter Market, with a 61.4% share. Rising maintenance awareness and shorter replacement intervals supported market expansion. Consumers increasingly preferred aftermarket options for better availability, cost benefits, and quick installation across various vehicle types.

OEM filters remained essential as vehicle manufacturers continued integrating standard cabin filtration solutions during production. These filters ensured factory-grade performance and aligned with brand-specific quality guidelines. OEM demand advanced with increasing global vehicle production and heightened regulatory focus on in-cabin air quality.

Key Market Segments

By Material

- Non-Woven

- Meltblown

- Nanofiber

By Technology

- Conventional

- HEPA (High-Efficiency Particulate Air)

- Activated Carbon Plus (ACP)

By Filter Type

- Activated Carbon

- Electrostatic

- Combination (Electrostatic and Activated Carbon)

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

By Application

- Aftermarket

- OEM

Drivers

Growing Focus on Vehicle Air Quality Boosts Automotive Cabin AC Filter Market

Increasing public awareness about air pollution is driving demand for better cabin air filters. People in urban areas are becoming more concerned about respiratory health, which is encouraging vehicle owners to choose cars equipped with high-quality filters. This awareness is directly influencing market growth.

Automakers are responding by including high-efficiency cabin filters as standard in mid to premium vehicles. OEM initiatives ensure that more cars are equipped with filters capable of removing harmful particles, improving in-cabin air quality, and enhancing passenger safety. This strategy is pushing the market forward.

Regulatory standards are becoming stricter for in-vehicle air quality and filtration performance. Governments and safety agencies are setting new guidelines that require vehicles to maintain cleaner cabin environments. Compliance with these standards is encouraging manufacturers to adopt advanced filtration technologies.

As a result, consumers are increasingly prioritizing vehicles with better air quality features. The combination of public concern, OEM adoption, and regulatory support is creating strong momentum for the cabin AC filter market. This trend is expected to continue, especially in urban regions with high pollution levels.

Restraints

Limited Awareness About the Health Benefits of Cabin Air Filtration Drives Market Challenges

One of the key restraints in the Automotive Cabin AC Filter market is the limited awareness among vehicle owners regarding the health benefits of cabin air filtration. Many consumers do not realize that high-quality filters can significantly reduce exposure to dust, pollen, and harmful pollutants. This lack of understanding affects the adoption rate of advanced filters.

Additionally, vehicle owners often overlook regular replacement of cabin filters. Without proper knowledge, they may assume that standard air circulation is sufficient, which reduces demand for aftermarket or high-efficiency filters. This behavior slows market growth despite the clear benefits for respiratory health.

Another challenge is the incompatibility of aftermarket cabin filters with certain vehicle models. Some filters are designed for universal use, but they may not fit specific car makes or models accurately. This can lead to installation issues or reduced filtration efficiency, discouraging consumers from purchasing these products.

Manufacturers also face the burden of educating customers about proper filter selection and maintenance. Without sufficient awareness campaigns, vehicle owners continue to rely on factory-installed filters or skip replacements altogether, which hampers the potential market expansion for high-efficiency cabin AC filters.

Growth Factors

Integration of Advanced Technologies and Eco-Friendly Solutions Drives Market Growth

The integration of smart sensors in cabin air filters is creating new growth opportunities. These sensors can monitor air quality and filter performance in real-time, allowing vehicle owners to maintain healthier in-car environments. This technology also enhances convenience and encourages regular filter replacement.

Eco-friendly and biodegradable cabin air filters are gaining attention among environmentally conscious consumers. Manufacturers focusing on sustainable materials can tap into this growing segment. Such products not only reduce environmental impact but also align with increasing regulatory pressure for greener automotive solutions.

Premium vehicle segments are driving demand for cabin air filters with antimicrobial and anti-allergen properties. These filters enhance passenger comfort by reducing exposure to bacteria, viruses, and allergens. As health awareness rises, consumers are willing to invest in high-performance filtration systems for improved in-car air quality.

Expanding product portfolios to include smart, eco-friendly, and health-focused filters opens multiple avenues for growth. Companies adopting these innovations can differentiate themselves in a competitive market. This strategy also helps in meeting evolving consumer expectations while addressing urban air pollution challenges.

Emerging Trends

Rising Focus on Advanced Cabin Air Filtration Drives Market Growth

In recent years, there has been a noticeable rise in the preference for multi-layered HEPA and activated carbon cabin filters in passenger vehicles. These filters help remove dust, pollen, and harmful gases more effectively, improving in-car air quality and passenger comfort.

Additionally, consumers are increasingly interested in real-time monitoring of cabin air quality through connected car systems. This trend reflects a growing awareness of air pollution’s impact on health and the desire for smart solutions that enhance driving experience.

The shift towards electric vehicles (EVs) is also influencing cabin filter design. EV-specific filters are being developed with enhanced filtration efficiency to address unique airflow patterns and the absence of traditional engine ventilation, ensuring passengers still receive clean air.

Moreover, automakers are integrating advanced filtration systems as a standard feature in mid to premium vehicles. This not only enhances the vehicle’s value proposition but also aligns with regulatory requirements for better in-vehicle air quality.

Regional Analysis

North America Dominates the Automotive Cabin AC Filter Market with a Market Share of 45.8%, Valued at USD 2.1 Billion

In 2024, North America held a dominant position in the Automotive Cabin AC Filter Market, driven by growing consumer awareness about in-vehicle air quality. The market in this region accounts for a significant 45.8% share, valued at USD 2.1 Billion. High adoption of premium vehicles with advanced cabin filtration systems supports steady growth. Regulatory standards for air quality and increasing urban pollution also contribute to market expansion.

Europe Automotive Cabin AC Filter Market Trends

Europe shows consistent growth in the cabin AC filter market due to stringent vehicle emission and air quality regulations. Premium vehicle penetration and rising consumer focus on health contribute to higher demand. Market growth is further supported by innovations in multi-layered filters and integration of smart filtration systems across passenger vehicles.

Asia Pacific Automotive Cabin AC Filter Market Trends

Asia Pacific is emerging as a key growth region driven by rising vehicle production and increasing air pollution in urban areas. Rapid adoption of electric vehicles and enhanced cabin air filtration technologies are supporting market expansion. Consumer preference for multi-functional filters is also driving adoption in this region.

Middle East and Africa Automotive Cabin AC Filter Market Trends

The Middle East and Africa region shows moderate growth due to rising vehicle sales and increasing awareness about cabin air quality. Harsh climatic conditions in some areas drive demand for high-efficiency filters. Market expansion is supported by infrastructure development and growing adoption of mid- to premium-segment vehicles.

Latin America Automotive Cabin AC Filter Market Trends

Latin America is witnessing steady growth in the cabin AC filter market, supported by gradual urbanization and rising health awareness. Increasing replacement cycles for cabin filters in existing vehicles and expanding automotive production contribute to market demand. Consumers are gradually adopting advanced filtration solutions for improved in-car air quality.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Cabin AC Filter Company Insights

In 2024, the global Automotive Cabin AC Filter Market continues to be shaped by a few prominent players who are driving innovation and market penetration through advanced filtration technologies and strategic collaborations.

Ahlstrom-Munksjo Oyj remains a front-runner, leveraging its expertise in high-performance filtration media to deliver cabin filters that effectively remove pollutants, enhancing in-vehicle air quality for passenger vehicles globally. The company’s focus on sustainable materials also aligns with the growing demand for eco-friendly automotive components.

DENSO Corp. has strengthened its market position by integrating cutting-edge sensor technology into cabin filters, enabling real-time air quality monitoring and improved filtration efficiency. Their robust R&D capabilities allow them to consistently introduce high-quality filters tailored for both conventional and electric vehicles, meeting rising consumer expectations for cleaner cabin environments.

Donaldson Co. Inc. maintains a competitive edge by emphasizing durability and performance in its cabin air filtration solutions. The company’s global manufacturing footprint and focus on innovation allow it to address diverse regulatory standards and customer requirements, particularly in regions with stringent emission and air quality regulations.

Freudenberg SE has distinguished itself by offering a wide range of multi-layered and activated carbon cabin filters, catering to premium and mid-segment vehicles. Their strategic collaborations with OEMs enable them to embed advanced filtration solutions in new vehicle models, reinforcing their strong presence in both established and emerging markets.

Top Key Players in the Market

- Ahlstrom-Munksjo Oyj

- DENSO Corp.

- Donaldson Co. Inc.

- Freudenberg SE

- General Motors Co.

- MAHLE GmbH

- MANN+HUMMEL

- Parker Hannifin Corp.

- Robert Bosch GmbH

- Sogefi Spa

Recent Developments

- In Nov 2025, Atmus Filtration Technologies announced its plan to acquire Koch Filter Corporation, aiming to expand its product portfolio and strengthen its market presence in advanced filtration solutions.

- In Feb 2025, Thermo Fisher Scientific revealed its acquisition of Solventum’s Purification and Filtration Business, focusing on enhancing its capabilities in high-performance filtration and purification technologies.

- In Jan 2024, Bosch replaced its FILTER+ with the upgraded FILTER+pro for vehicle cabins, providing improved air purification efficiency and advanced protection against dust and allergens.

- In Feb 2024, Smart Parts officially launched its new line of washable and reusable cabin air filters, emphasizing sustainability and cost-effective solutions for vehicle owners.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Billion Forecast Revenue (2034) USD 9.1 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Non-Woven, Meltblown, Nanofiber), By Technology (Conventional, HEPA (High-Efficiency Particulate Air), Activated Carbon Plus (ACP)), By Filter Type (Activated Carbon, Electrostatic, Combination (Electrostatic and Activated Carbon)), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers), By Application (Aftermarket, OEM) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ahlstrom-Munksjo Oyj, DENSO Corp., Donaldson Co. Inc., Freudenberg SE, General Motors Co., MAHLE GmbH, MANN+HUMMEL, Parker Hannifin Corp., Robert Bosch GmbH, Sogefi Spa Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Cabin AC Filter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Cabin AC Filter MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ahlstrom-Munksjo Oyj

- DENSO Corp.

- Donaldson Co. Inc.

- Freudenberg SE

- General Motors Co.

- MAHLE GmbH

- MANN+HUMMEL

- Parker Hannifin Corp.

- Robert Bosch GmbH

- Sogefi Spa