Global Automotive Battery Rental Market Size, Share, Growth Analysis By Rental Type (Subscription, Pay-Per-Use), By Battery Type (Lithium-Ion, Lead-Acid, Solid-State, Others), By Vehicle Type (Two & Three Wheelers, Passenger Cars, Commercial Vehicles), By End User (Fleet Operators, Private Consumers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176776

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

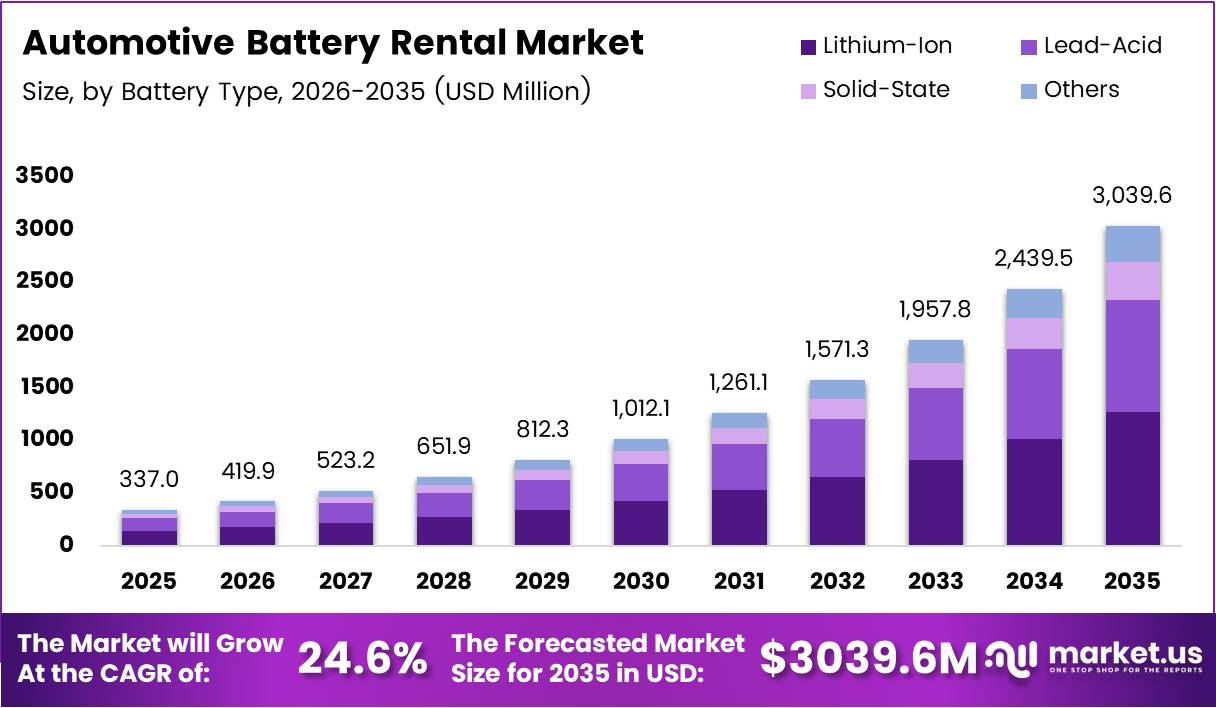

Global Automotive Battery Rental Market size is expected to be worth around USD 3039.6 Million by 2035 from USD 337.0 Million in 2025, growing at a CAGR of 24.6% during the forecast period 2026 to 2035.

Automotive battery rental revolutionizes electric vehicle ownership economics by separating battery costs from vehicle purchase decisions. This model enables consumers and fleet operators to access electric mobility without shouldering upfront battery expenses. Moreover, rental frameworks support rapid battery replacement through swapping infrastructure, eliminating lengthy charging downtimes.

Battery-as-a-Service (BaaS) transforms traditional EV value chains by shifting battery ownership to specialized energy service providers. Subscription models allow users to pay monthly fees based on usage patterns and mileage requirements. Consequently, this approach reduces vehicle acquisition barriers while maintaining predictable operational expenditure structures for commercial fleets.

The market addresses critical challenges in electric vehicle adoption including range anxiety and charging infrastructure limitations. Battery swapping stations provide instant energy replenishment comparable to conventional refueling experiences. Therefore, rental ecosystems particularly benefit high-utilization commercial vehicles requiring continuous operational availability throughout daily service cycles.

Government emission regulations across major automotive markets accelerate battery rental adoption through targeted policy frameworks. Asian countries lead deployment due to concentrated two-wheeler and three-wheeler electrification initiatives supported by national infrastructure programs. Additionally, declining lithium-ion costs improve rental service profitability while expanding addressable customer segments.

Fleet electrification creates substantial recurring demand for battery subscription services across logistics and ride-hailing sectors. Commercial operators prioritize minimizing vehicle downtime to maximize revenue generation from asset utilization. In December 2024, responsAbility provided USD 25 million credit facility to Battery Smart to expand EV battery swapping and BaaS operations, demonstrating strong investor confidence in rental business models.

According to Nature, battery swapping process operation time in academic simulation models averages approximately 5 minutes per swap, enabling efficient fleet turnover. This rapid replacement capability contrasts sharply with conventional fast charging requiring 20-45 minutes for partial replenishment. Furthermore, according to IBSA, battery swapping can reduce unexpected breakdowns by approximately 30-40% due to standardized maintained batteries, improving fleet reliability metrics significantly.

Strategic partnerships between automotive manufacturers and energy companies accelerate battery rental ecosystem development through integrated vehicle-battery-charging service bundles. Technology investments in digital monitoring platforms enable predictive maintenance and optimized battery lifecycle management. Consequently, rental models unlock new revenue streams while supporting circular economy principles through centralized battery recycling and repurposing programs.

Key Takeaways

- Global Automotive Battery Rental Market projected to reach USD 3039.6 Million by 2035 at 24.6% CAGR

- Subscription model dominates rental type segment with 62.3% market share in 2025

- Lithium-Ion batteries command 66.7% share driven by energy density and cost advantages

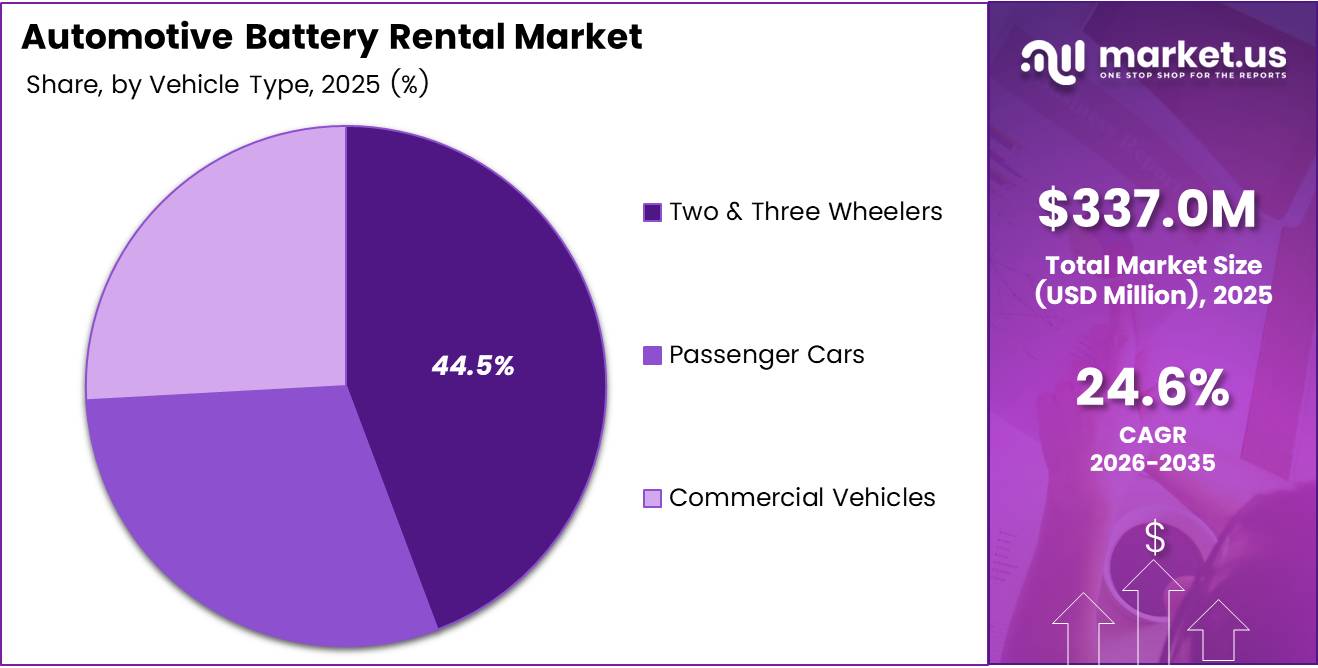

- Two & Three Wheelers segment leads vehicle type with 44.5% share due to Asian market dominance

- Fleet Operators represent 65.2% of end users maximizing operational efficiency through rentals

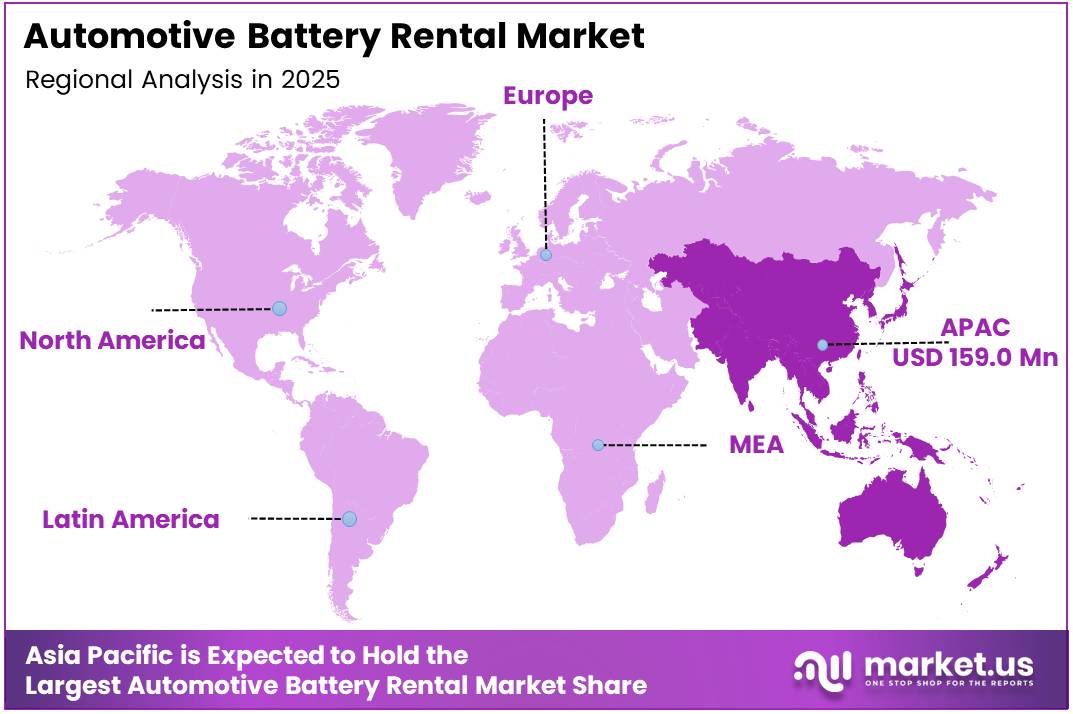

- Asia Pacific region dominates with 47.20% market share valued at USD 159.0 Million

- Battery swapping reduces vehicle downtime to under 5 minutes versus 20-45 minute charging periods

Rental Type Analysis

Subscription dominates with 62.3% due to predictable recurring revenue and enhanced customer retention.

In 2025, Subscription held a dominant market position in the By Rental Type segment of Automotive Battery Rental Market, with a 62.3% share. Fleet operators prefer subscription frameworks providing fixed monthly costs aligned with operational budgeting requirements. Additionally, subscription models enable service providers to maintain steady cash flows while building long-term customer relationships through integrated maintenance and support services.

Pay-Per-Use attracts private consumers seeking flexibility without long-term commitment obligations or fixed recurring expenses. This model suits occasional EV users who require battery access for specific trips or seasonal usage patterns. Moreover, pay-per-use frameworks appeal to markets with lower EV penetration where consumers test electric mobility before transitioning to subscription commitments.

Battery Type Analysis

Lithium-Ion dominates with 66.7% due to superior energy density and declining production costs.

In 2025, Lithium-Ion held a dominant market position in the By Battery Type segment of Automotive Battery Rental Market, with a 66.7% share. Automotive manufacturers standardize lithium-ion chemistry across vehicle platforms ensuring compatibility with rental and swapping infrastructure networks. Furthermore, established supply chains and manufacturing scale economies support competitive rental pricing structures while maintaining adequate service margins for operators.

Lead-Acid batteries serve niche applications in cost-sensitive markets where initial infrastructure investment constraints limit lithium-ion deployment. These conventional chemistries support legacy electric vehicle platforms and low-speed commercial vehicles operating in controlled urban environments. However, limited energy density restricts range capabilities compared to lithium-ion alternatives in rental applications.

Solid-State batteries represent emerging technology with potential to revolutionize rental economics through enhanced safety and energy density characteristics. Early-stage commercial deployments target premium vehicle segments where performance advantages justify higher rental premiums. Consequently, solid-state adoption remains limited pending manufacturing scale-up and cost reduction trajectories over the forecast period.

Others category includes alternative chemistries such as nickel-metal hydride and experimental battery technologies under development. These options address specific regulatory requirements or performance criteria in specialized vehicle applications. Nevertheless, mainstream rental services prioritize proven lithium-ion solutions offering optimal balance between performance, cost, and infrastructure compatibility considerations.

Vehicle Type Analysis

Two & Three Wheelers dominates with 44.5% due to concentrated Asian market electrification and swapping adoption.

In 2025, Two & Three Wheelers held a dominant market position in the By Vehicle Type segment of Automotive Battery Rental Market, with a 44.5% share. Asian markets drive demand through government-supported two-wheeler electrification programs targeting urban mobility and last-mile delivery applications. Additionally, compact battery sizes enable cost-effective swapping infrastructure deployment with lower capital requirements compared to passenger vehicle networks supporting scalable expansion strategies.

Passenger Cars adopt battery rental models to address consumer concerns regarding high upfront electric vehicle acquisition costs. Separating battery ownership reduces vehicle purchase prices making EVs competitive with conventional alternatives in mainstream automotive segments. Moreover, rental frameworks provide flexibility for consumers uncertain about long-term battery performance and replacement cost exposure over vehicle ownership lifecycles.

Commercial Vehicles benefit significantly from battery rental through minimized downtime in high-utilization logistics and transportation operations. Fleet operators require continuous vehicle availability to meet delivery schedules and service commitments throughout operational hours. Therefore, rapid battery swapping capabilities enable commercial fleets to maintain productivity levels comparable to diesel vehicle operations while achieving emission reduction targets.

End User Analysis

Fleet Operators dominates with 65.2% due to operational efficiency gains and total cost optimization.

In 2025, Fleet Operators held a dominant market position in the By End User segment of Automotive Battery Rental Market, with a 65.2% share. Commercial fleets prioritize maximizing vehicle utilization rates through minimized charging downtime using instant battery replacement solutions. Furthermore, subscription-based battery costs transform capital expenditure into predictable operating expenses improving cash flow management and financial planning capabilities for fleet businesses.

Private Consumers increasingly adopt battery rental to overcome barriers associated with high electric vehicle ownership costs. Individual users appreciate flexibility in battery capacity selection matching specific travel requirements without permanent investment commitments. Additionally, rental services eliminate concerns about battery degradation and replacement expenses typically shouldered by vehicle owners over long-term ownership periods.

Key Market Segments

By Rental Type

- Subscription

- Pay-Per-Use

By Battery Type

- Lithium-Ion

- Lead-Acid

- Solid-State

- Others

By Vehicle Type

- Two & Three Wheelers

- Passenger Cars

- Commercial Vehicles

By End User

- Fleet Operators

- Private Consumers

Drivers

Rapid Global Electric Vehicle Adoption Increasing Demand for Battery Leasing and Swapping Solutions

Electric vehicle sales accelerate across global markets driven by emission regulations and consumer environmental consciousness. Governments implement stringent carbon reduction targets requiring automotive manufacturers to transition production toward zero-emission vehicle portfolios. Consequently, battery rental services emerge as critical enablers reducing ownership barriers while supporting infrastructure development necessary for mass EV adoption.

According to Electronics360, some real-world swapping operations demonstrate 3-10 minute swap windows depending on system configuration, significantly reducing vehicle idle time. Fleet operators recognize operational advantages translating into measurable productivity improvements and revenue generation opportunities. In February 2025, Honda announced its e:Swap battery swapping service launch with Activa electric scooter rollout starting in India, demonstrating manufacturer commitment to rental ecosystems.

Battery rental models address range anxiety concerns by providing instant energy replenishment comparable to conventional refueling experiences. Commercial vehicle operators require reliable charging alternatives supporting continuous daily operations across extended service territories. Therefore, swapping infrastructure development accelerates alongside EV market growth creating symbiotic expansion dynamics benefiting both vehicle manufacturers and energy service providers.

Restraints

High Capital Investment Required for Swapping Infrastructure and Battery Inventory Deployment

Battery swapping stations require substantial upfront capital expenditure for facility construction, automated equipment installation, and battery inventory procurement. According to ScienceDirect, typical battery swapping station infrastructure costs reach approximately $500,000+ per station, creating significant financial barriers for new market entrants. Moreover, operators must maintain sufficient battery reserves ensuring availability during peak demand periods adding to working capital requirements.

Infrastructure deployment demands strategic site selection in high-traffic urban locations where real estate acquisition costs escalate total project investments. Energy providers must secure grid connections with adequate capacity supporting simultaneous charging of multiple battery units. Additionally, technology investments in battery management systems and digital monitoring platforms increase capital intensity beyond physical infrastructure components.

Return on investment timelines extend multiple years requiring patient capital and long-term strategic commitment from service providers. Profitability depends on achieving sufficient utilization rates justifying infrastructure investment amortization over asset lifecycles. Consequently, high capital barriers slow market penetration particularly in developing regions with limited access to growth financing and infrastructure development capital.

Growth Factors

Technological Advancements Accelerate Battery Rental Market Expansion and Operational Efficiency

Artificial intelligence integration optimizes battery allocation and charging schedules maximizing infrastructure utilization while minimizing operational costs. According to ArXiv, advanced swap scheduling models achieve approximately 98.57% peak user satisfaction in simulation environments demonstrating technology’s capacity to enhance service quality. Furthermore, optimized battery swap scheduling reduces peak operating costs by approximately 13.96% improving profitability margins for rental service operators significantly.

According to IBSA, fleet case examples demonstrate 50 trucks can save approximately 200 operational hours daily using swapping versus conventional charging, translating into substantial productivity gains. Heavy-duty vehicle charging requires 2-8 hours compared to battery swap completion in approximately 5-8 minutes, eliminating costly vehicle idle periods. In June 2025, Battery Smart raised USD 21 million in Series B extension funding to expand battery swapping infrastructure and BaaS network, reflecting investor recognition of market potential.

According to IBSA, modular swapping improves vehicle energy efficiency by approximately 10-15% through optimized battery load weight management strategies. Battery swapping increases vehicle runtime by approximately 25% versus conventional charging usage patterns enabling operators to maximize revenue generation. Therefore, technological improvements in battery management and swapping automation create compelling value propositions accelerating commercial fleet adoption across transportation sectors.

Emerging Trends

Strategic OEM Partnerships Reshape Battery Rental Value Chains and Service Integration

Automotive manufacturers partner with battery producers and energy companies creating integrated mobility ecosystems bundling vehicles, batteries, and charging services. These collaborations enable seamless customer experiences while optimizing battery lifecycle management through centralized maintenance and recycling operations. Moreover, partnerships accelerate standardization efforts critical for achieving interoperability across multi-manufacturer swapping networks supporting market scalability.

According to Emobility Engineering, typical fast charging duration ranges 10-80% capacity requires approximately 20-45 minutes versus swapping under approximately 5 minutes, demonstrating clear operational advantages. According to ScienceDirect, battery swapping average replenishment time reaches approximately 3-5 minutes, enabling rapid fleet turnover comparable to conventional refueling speeds. Consequently, manufacturers increasingly view battery rental as strategic differentiator enhancing electric vehicle value propositions in competitive automotive markets.

Digital platforms enable real-time battery health monitoring and predictive maintenance optimizing replacement cycles and extending overall battery lifecycles. Smart grid integration allows operators to participate in energy arbitrage and demand response programs generating additional revenue streams. Therefore, technology convergence between automotive, energy, and digital sectors transforms battery rental from simple asset leasing into sophisticated mobility-as-a-service ecosystems.

Regional Analysis

Asia Pacific Dominates the Automotive Battery Rental Market with a Market Share of 47.20%, Valued at USD 159.0 Million

Asia Pacific leads automotive battery rental adoption with a market share of 47.20%, valued at USD 159.0 Million, driven by concentrated two-wheeler and three-wheeler electrification initiatives. Government programs across China, India, and Southeast Asian nations incentivize electric mobility adoption through subsidies and infrastructure development funding. Moreover, dense urban populations and established micro-mobility ecosystems create ideal conditions for battery swapping network deployment supporting rapid market expansion.

North America Automotive Battery Rental Market Trends

North America demonstrates growing interest in battery rental models primarily focused on commercial fleet electrification and ride-hailing applications. Regulatory emission standards in California and northeastern states accelerate electric vehicle adoption creating demand for innovative ownership models. However, established charging infrastructure and consumer preference for vehicle ownership slow battery rental penetration compared to Asian markets.

Europe Automotive Battery Rental Market Trends

European markets pursue battery rental adoption through collaborative frameworks between automotive manufacturers and energy utilities supporting green transition objectives. Stringent emission regulations and urban low-emission zones drive commercial vehicle electrification creating opportunities for battery swapping services. Additionally, circular economy principles embedded in regulatory frameworks align with rental business models emphasizing battery lifecycle management and recycling.

Latin America Automotive Battery Rental Market Trends

Latin American countries explore battery rental solutions addressing limited charging infrastructure and high vehicle acquisition costs constraining electric mobility adoption. Urban delivery and two-wheeler segments present immediate opportunities for swapping network deployment in major metropolitan areas. Nevertheless, economic volatility and infrastructure investment constraints moderate near-term market development compared to established regions.

Middle East & Africa Automotive Battery Rental Market Trends

Middle East and Africa region exhibits early-stage battery rental adoption concentrated in Gulf Cooperation Council nations pursuing economic diversification beyond fossil fuel dependence. Government smart city initiatives incorporate electric mobility solutions including battery swapping infrastructure supporting sustainable urban development goals. However, limited electric vehicle penetration and nascent charging ecosystems require significant investment before achieving meaningful market scale.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

NIO Limited pioneers battery-as-a-service models in premium electric vehicle segments through innovative Power Swap Station networks across China and expanding European markets. The company separates battery ownership from vehicle purchase enabling customers to subscribe to flexible battery packages matching driving requirements. Moreover, NIO’s integrated mobile application provides seamless swap station location services and reservation capabilities enhancing user convenience and operational efficiency throughout ownership experiences.

Contemporary Amperex Technology Co., Limited (CATL) leverages dominant global battery manufacturing position to develop comprehensive battery rental and swapping ecosystem solutions. The company collaborates with multiple automotive manufacturers establishing standardized battery platforms compatible across diverse vehicle models supporting network interoperability. Additionally, CATL invests in next-generation battery technologies including solid-state chemistries positioning the company to maintain leadership as rental markets evolve toward advanced energy storage solutions.

Gogoro Inc. establishes extensive battery swapping infrastructure focused on two-wheeler markets throughout Taiwan and expanding Asian territories. The company’s standardized battery design enables widespread adoption across multiple scooter brands creating network effects strengthening market position. Furthermore, Gogoro develops smart energy management platforms optimizing battery charging patterns and extending overall battery lifecycles while supporting grid stability through demand response participation.

Sun Mobility Pvt Ltd targets commercial vehicle electrification in Indian markets through modular battery swapping solutions designed for two-wheelers and three-wheelers. The company addresses unique operational requirements of logistics and delivery fleets requiring rapid energy replenishment throughout daily service routes. Moreover, Sun Mobility establishes strategic partnerships with vehicle manufacturers and fleet operators ensuring battery compatibility and seamless integration supporting India’s ambitious electric mobility transformation goals.

Key players

- NIO Limited

- Ample Inc.

- Contemporary Amperex Technology Co., Limited (CATL)

- Renault Group

- Oyika Pte Ltd

- Sun Mobility Pvt Ltd

- Numocity Technologies Pvt Ltd

- Gogoro Inc.

- Battery Smart

- Aulton New Energy

- Tesla Inc.

Recent Developments

- February 2025 – Volkswagen Group China signed a strategic cooperation agreement with CATL to jointly develop batteries, battery swapping, and recycling solutions, strengthening European-Asian collaboration in battery rental ecosystems and advancing circular economy principles throughout battery lifecycles.

- March 2025 – CATL and NIO signed a strategic partnership to build one of the world’s largest battery swap networks and explore investment up to CNY 2.5 billion, demonstrating significant capital commitment toward infrastructure expansion supporting BaaS market growth across multiple regions.

- April 2025 – CATL launched 10 new Choco-Swap battery-compatible EV models with multiple automakers including GAC, Changan, and BAIC, accelerating standardization efforts and expanding vehicle compatibility across China’s rapidly growing battery swapping network infrastructure.

Report Scope

Report Features Description Market Value (2025) USD 337.0 Million Forecast Revenue (2035) USD 3039.6 Million CAGR (2026-2035) 24.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Rental Type (Subscription, Pay-Per-Use), By Battery Type (Lithium-Ion, Lead-Acid, Solid-State, Others), By Vehicle Type (Two & Three Wheelers, Passenger Cars, Commercial Vehicles), By End User (Fleet Operators, Private Consumers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape NIO Limited, Ample Inc., Contemporary Amperex Technology Co., Limited (CATL), Renault Group, Oyika Pte Ltd, Sun Mobility Pvt Ltd, Numocity Technologies Pvt Ltd, Gogoro Inc., Battery Smart, Aulton New Energy, Tesla Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Battery Rental MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Battery Rental MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- NIO Limited

- Ample Inc.

- Contemporary Amperex Technology Co., Limited (CATL)

- Renault Group

- Oyika Pte Ltd

- Sun Mobility Pvt Ltd

- Numocity Technologies Pvt Ltd

- Gogoro Inc.

- Battery Smart

- Aulton New Energy

- Tesla Inc.