Global Automotive Advanced High Strength Steel (AHSS) Market Size, Share, Growth Analysis By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles), By Product Type (Dual Phase, Transformation-Induced Plasticity (TRIP), Complex Phase, Others), By Application (Body in White, Suspension, Bumper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172390

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

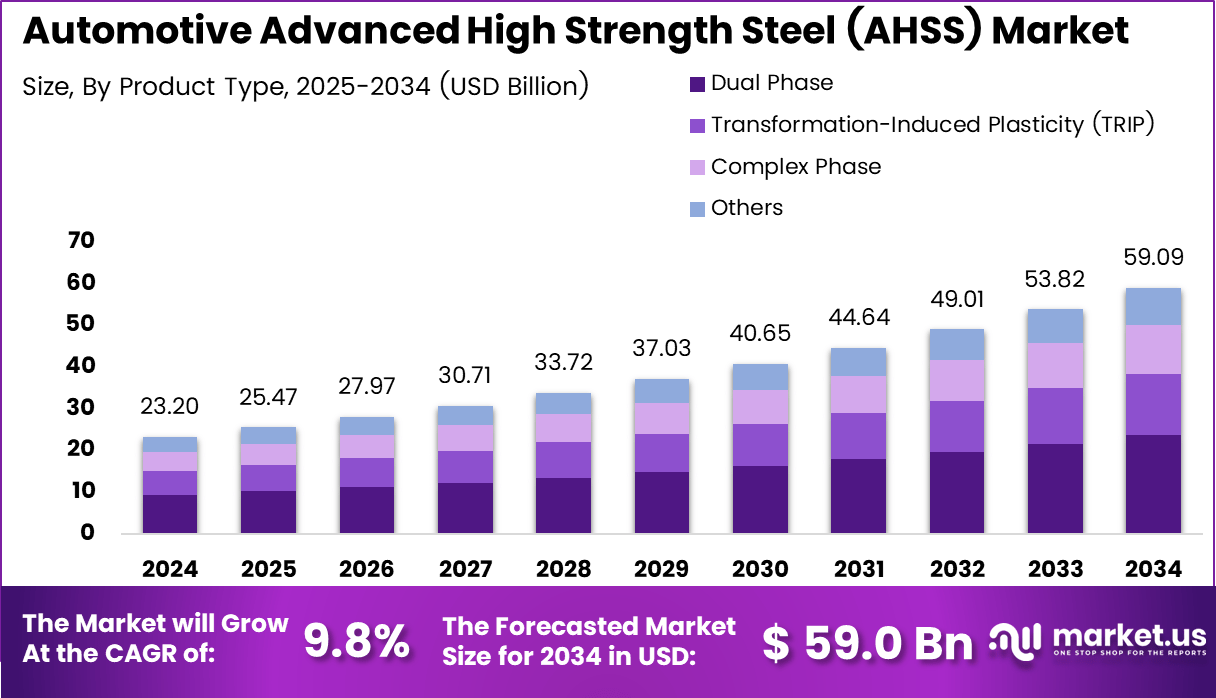

The Global Automotive Advanced High Strength Steel (AHSS) Market size is expected to be worth around USD 59.0 billion by 2034, from USD 23.2 billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034.

The Automotive Advanced High Strength Steel (AHSS) market refers to the ecosystem of steel grades engineered to deliver superior strength, crash performance, and vehicle lightweighting. AHSS supports automakers in reducing overall body weight while maintaining structural integrity. Consequently, it remains critical for safety driven vehicle engineering and regulatory compliance.

Automotive Advanced High Strength Steel (AHSS) represents a materials innovation category rather than a single product. AHSS includes martensitic and multiphase steels designed for demanding structural loads. As vehicle architectures evolve, AHSS increasingly supports body in white optimization, reinforcement strategies, and advanced forming technologies across global automotive production lines.

Market growth remains closely aligned with tightening emissions and safety regulations worldwide. Governments continue strengthening fuel efficiency and crashworthiness mandates. As a result, OEMs increasingly adopt stronger yet lighter steel solutions. AHSS demand expands across passenger car, commercial fleets, and electric vehicles focused on efficiency and occupant protection.

Growth opportunities emerge as electric vehicle manufacturing scales and multi material body strategies mature. Automakers integrate AHSS with aluminum and composites to balance cost, manufacturability, and performance. Moreover, public investments in low carbon steelmaking and sustainable manufacturing further support AHSS adoption across next generation automotive platforms.

Regulatory frameworks strongly influence AHSS penetration. Policies promoting vehicle lightweighting, recyclability, and lifecycle emissions reduction indirectly favor advanced steel solutions. Meanwhile, infrastructure modernization programs and industrial incentives encourage domestic automotive grade steel capacity expansion, strengthening long term AHSS supply security for vehicle manufacturers.

According to study, AHSS includes all martensitic and multiphase steels with a minimum specified tensile strength of at least 440 MPa, defining the baseline automotive classification. Ultra High Strength Steel thresholds vary, with several companies setting the benchmark at 980 MPa, while others apply higher limits of 1180 MPa or 1270 MPa.

According to Study, advanced high strength steels used in vehicles must meet a minimum tensile strength of 440 MPa, equivalent to 64 ksi or 64,000 psi. Grades such as HSLA 430 reference minimum yield strength instead of tensile strength, shaping material selection and forming performance in automotive AHSS applications.

Key Takeaways

- Global Automotive Advanced High Strength Steel (AHSS) Market projected to reach USD 59.0 billion by 2034 from USD 23.2 billion in 2024, expanding at a 9.8% CAGR.

- Passenger Vehicles segment dominates the market with a share of 54.8%, driven by high production volumes and safety focused material adoption.

- Dual Phase steel leads the product type segment, accounting for 39.9% share due to its balance of strength, ductility, and cost efficiency.

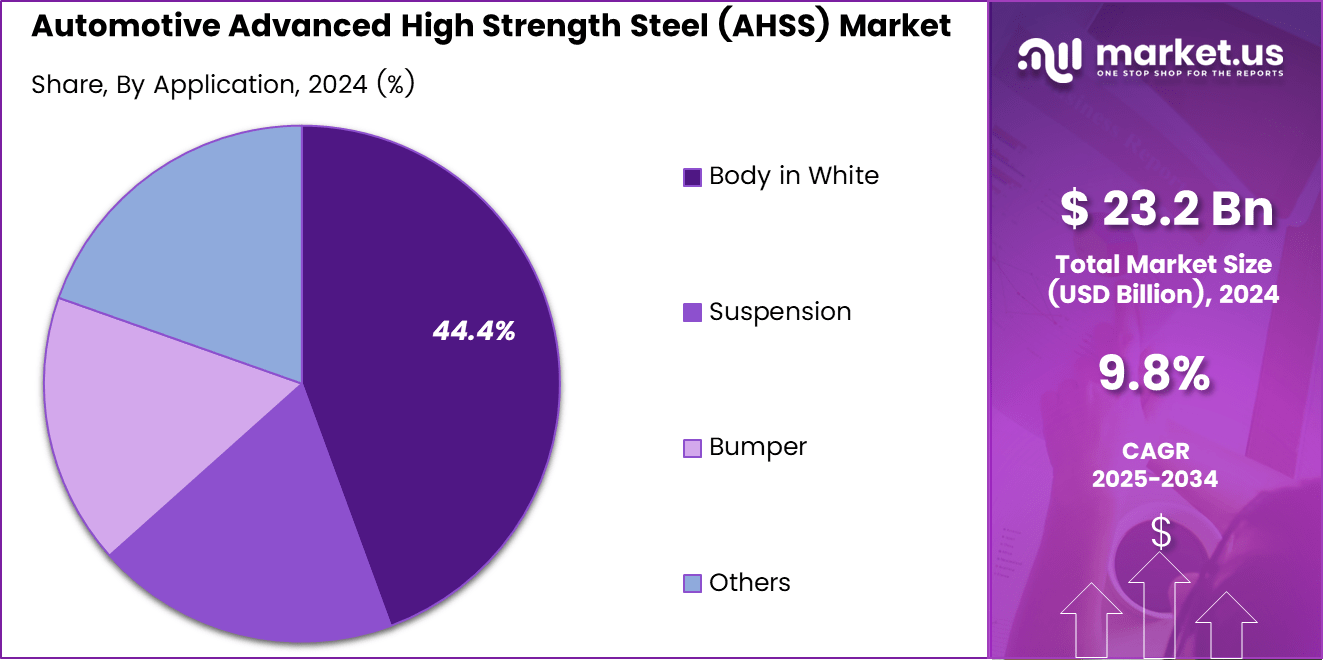

- Body in White represents the largest application segment with 44.4% share, supported by structural safety and vehicle light weighting requirements.

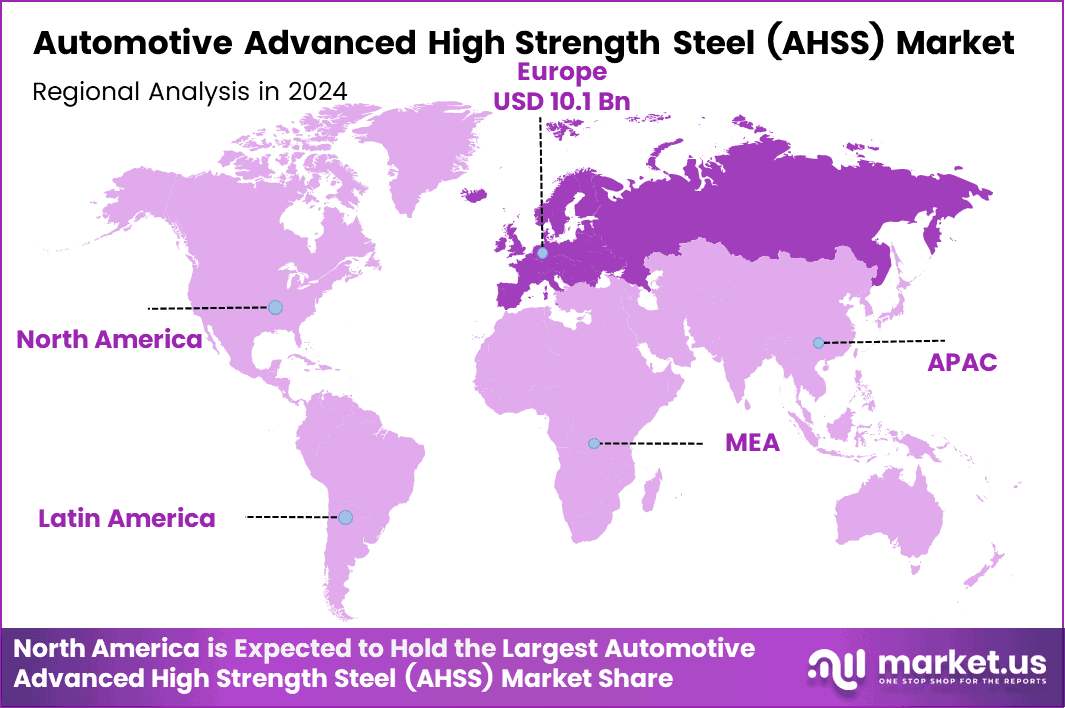

- Europe emerges as the leading region, holding 43.9% market share and valued at USD 10.1 billion due to stringent safety and emission regulations.

By Vehicle Type Analysis

Passenger Vehicles dominates with 54.8% due to higher production volumes and continuous safety focused material adoption.

Passenger Vehicles held a dominant market position in the By Vehicle Type Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market, with a 54.8% share. This dominance reflects rising consumer demand for safer, lighter vehicles. Automakers increasingly integrate AHSS to meet crash standards, enhance fuel efficiency, and support electrification driven design transitions.

Light Commercial Vehicles held a significant position in the By Vehicle Type Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market. Growth remains supported by expanding e commerce logistics and urban delivery fleets. Manufacturers adopt AHSS to balance payload efficiency, durability, and regulatory driven emission reduction requirements across regional markets.

Heavy Commercial Vehicles represented a steady presence in the By Vehicle Type Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market. Adoption continues gradually as fleet operators prioritize structural strength and lifecycle durability. However, higher material costs and slower platform refresh cycles moderate faster AHSS penetration.

By Product Type Analysis

Dual Phase dominates with 39.9% due to its balanced strength, ductility, and cost efficiency.

Dual Phase held a dominant market position in the By Product Type Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market, with a 39.9% share. This leadership reflects its versatility in forming complex shapes while maintaining crash energy absorption. Automakers prefer Dual Phase steel for structural and safety critical components.

Transformation Induced Plasticity (TRIP) steel maintained a notable position in the By Product Type Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market. Its superior elongation supports improved crash performance. Consequently, usage continues in applications demanding higher formability without compromising tensile strength.

Complex Phase steel accounted for a stable share in the By Product Type Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market. Demand stems from its high yield strength and fatigue resistance. These properties suit reinforcements and load bearing structures requiring dimensional stability under stress.

Others category held a niche position in the By Product Type Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market. Adoption remains application specific, often driven by customized performance requirements or emerging vehicle architectures under development.

By Application Analysis

Body in White dominates with 44.4% due to its critical role in vehicle safety and weight reduction.

Body in White held a dominant market position in the By Application Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market, with a 44.4% share. This reflects automakers’ focus on structural integrity and crashworthiness. AHSS enables thinner gauges while maintaining rigidity and occupant protection performance.

Suspension applications represented a meaningful share in the By Application Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market. Usage increases as manufacturers target improved load handling and durability. AHSS supports lighter suspension components without compromising mechanical strength or fatigue resistance.

Bumper applications maintained steady adoption within the By Application Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market. High energy absorption capability drives its use in impact zones. This supports compliance with pedestrian safety and low speed collision regulations.

Others applications held a supplementary position in the By Application Analysis segment of Automotive Advanced High Strength Steel (AHSS) Market. These include localized reinforcements and emerging design elements, where AHSS adoption aligns with evolving vehicle safety and light weighting strategies.

Key Market Segments

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Product Type

- Dual Phase

- Transformation-Induced Plasticity (TRIP)

- Complex Phase

- Others

By Application

- Body in White

- Suspension

- Bumper

- Others

Drivers

Accelerating Vehicle Lightweighting Mandates Drives Market Growth

Accelerating vehicle lightweighting mandates strongly drive the Automotive Advanced High Strength Steel market. Governments continue tightening fleet level fuel efficiency and emissions norms. Automakers respond by reducing vehicle weight, and AHSS offers a practical solution by delivering high strength with thinner gauges, supporting compliance without compromising durability.

Rising demand for better crash safety performance further supports AHSS adoption. Passenger and commercial vehicle manufacturers prioritize occupant protection as safety ratings influence purchasing decisions. AHSS absorbs impact energy effectively, helping vehicles meet stricter crash regulations while maintaining structural rigidity.

Increasing adoption of multi material body architectures also fuels demand. Modern vehicle platforms combine AHSS with aluminum and composites to balance strength, weight, and cost. AHSS remains critical for structural and load bearing sections where reliability and manufacturability remain essential.

Expansion of global automotive production in cost competitive regions strengthens market growth. Emerging manufacturing hubs increase vehicle output and local sourcing needs. These regions favor AHSS because it aligns with global safety standards while supporting large scale, cost efficient production.

Restraints

High Production and Processing Costs Limit Market Expansion

High production and processing costs represent a major restraint for the Automotive Advanced High Strength Steel market. Complex alloy designs and controlled heat treatments raise manufacturing expenses. These higher costs make AHSS less attractive for price sensitive vehicle segments.

Limited formability and joining challenges also restrict broader adoption. Compared to conventional steels, AHSS requires precise forming control to avoid defects. Welding and joining often need advanced techniques, increasing production complexity for automakers and suppliers.

The need for advanced tooling and stamping infrastructure adds further pressure. OEMs and Tier 1 suppliers must invest in upgraded presses, dies, and welding systems. Such investments create barriers, especially for smaller manufacturers with limited capital budgets.

Volatile raw material pricing creates uncertainty across the supply chain. Fluctuations in iron ore, alloys, and energy costs impact steel pricing stability. This volatility affects profit margins and complicates long term procurement planning.

Growth Factors

Growing Electric Vehicle Adoption Creates New Opportunities

Growing penetration of electric vehicles creates strong opportunities for the AHSS market. EV platforms require lightweight structures to balance heavy battery packs. AHSS supports body in white and battery protection designs by improving strength while reducing overall mass.

Increasing collaboration between steelmakers and OEMs further expands opportunities. Joint development programs focus on customized AHSS grades for specific vehicle platforms. These partnerships accelerate innovation and improve manufacturability across different vehicle categories.

Expansion of automotive manufacturing capacity in North America and Southeast Asia also supports growth. Investments in new plants and regional supply chains increase demand for advanced materials. AHSS fits well with local production strategies focused on safety, efficiency, and scalability.

Additionally, policy support for domestic manufacturing encourages long term material demand. This environment positions AHSS as a key material in next generation vehicle programs.

Emerging Trends

Development of Advanced Processing Technologies Shapes Market Trends

Development of third generation AHSS represents a major market trend. These grades offer improved balance between strength and ductility. Automakers benefit from easier forming while maintaining high crash resistance and design flexibility.

Increased use of hot stamping and press hardening technologies continues gaining momentum. These methods allow precise control of strength in critical vehicle zones. As a result, manufacturers optimize safety performance while reducing material thickness.

Integration of digital simulation and AI driven forming optimization also trends upward. Advanced tools help predict material behavior, reducing trial cycles and scrap rates. This improves production efficiency and cost control.

Growing focus on low carbon and green steel production further influences the market. Automakers prioritize sustainability, encouraging steel producers to reduce emissions. This shift strengthens the long term relevance of AHSS in automotive manufacturing.

Regional Analysis

Europe Dominates the Automotive Advanced High Strength Steel (AHSS) Market with a Market Share of 43.9%, Valued at USD 10.1 billion

Europe holds a leading position in the Automotive Advanced High Strength Steel market, driven by strict vehicle safety norms and aggressive emission reduction targets. In the current landscape, the region accounts for a dominant 43.9% share, with the market valued at USD 10.1 billion, reflecting strong adoption across passenger and commercial vehicles. Automakers increasingly integrate AHSS to balance light weighting with structural strength, supporting fuel efficiency and crash performance. In addition, sustained investments in electric vehicle platforms and advanced manufacturing processes continue strengthening regional demand.

North America Automotive Advanced High Strength Steel Market Trends

North America represents a mature and technology driven AHSS market, supported by steady vehicle production and rising demand for light trucks and SUVs. OEMs across the region emphasize high strength materials to meet safety standards while managing vehicle weight. The shift toward electrification further supports AHSS usage in battery protection structures and chassis components. Ongoing investments in advanced stamping and joining technologies enhance long term market stability.

Asia Pacific Automotive Advanced High Strength Steel Market Trends

Asia Pacific continues to expand as a high growth region due to increasing automotive production volumes and cost competitive manufacturing hubs. Automakers in the region actively adopt AHSS to comply with tightening fuel efficiency and safety regulations. Rapid urbanization and rising vehicle ownership support sustained material demand. Additionally, localization of advanced steel manufacturing capabilities accelerates regional market penetration.

Middle East and Africa Automotive Advanced High Strength Steel Market Trends

The Middle East and Africa market shows gradual adoption of AHSS, supported by growing vehicle imports and localized assembly operations. Infrastructure development and rising commercial vehicle demand contribute to material usage in structural applications. Although adoption remains at an early stage, improving regulatory frameworks and safety awareness are expected to support future growth. Industrial diversification efforts further enhance long term prospects.

Latin America Automotive Advanced High Strength Steel Market Trends

Latin America demonstrates moderate growth in the AHSS market, driven by recovery in automotive manufacturing and regional export activities. Automakers increasingly adopt high strength steel to improve vehicle durability and meet international standards. Economic stabilization in key countries supports investment in modern vehicle platforms. Over time, gradual technology transfer and capacity expansion are anticipated to improve regional adoption rates.

U.S. Automotive Advanced High Strength Steel Market Trends

The U.S. market remains a key contributor within North America, supported by strong demand for pickup trucks, SUVs, and electric vehicles. Manufacturers emphasize AHSS to achieve lightweighting targets without compromising safety performance. Federal efficiency standards and consumer preference for durable vehicles continue shaping material selection. Investments in advanced forming technologies further reinforce long term market momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Advanced High Strength Steel (AHSS) Company Insights

From an analyst viewpoint, the global Automotive Advanced High Strength Steel market in 2024 reflects a strong shift toward lightweight yet high performance materials, driven by safety regulations, fuel efficiency targets, and electric vehicle platform evolution. Leading producers focus on advanced metallurgical innovation, scalable production, and close alignment with automotive OEM requirements.

Arcelor Mittal S.A. continues to play a strategic role in shaping the AHSS landscape through its deep expertise in multiphase and ultra high strength steel grades. The company emphasizes material solutions that support vehicle light weighting while maintaining crash resistance. Its focus on sustainable steelmaking further strengthens long term positioning amid tightening environmental regulations.

BAOSTEEL remains a key force in the AHSS market, supported by large scale production capabilities and strong integration with automotive manufacturing ecosystems. The company prioritizes advanced flat steel products tailored for modern vehicle architectures. Its ability to supply consistent quality at scale supports widespread AHSS adoption across mass production vehicle segments.

HOWCO ADDITIVE brings a differentiated perspective to the AHSS market by aligning advanced steel development with additive and precision manufacturing trends. The company supports niche automotive applications requiring high strength, durability, and design flexibility. This targeted approach enhances its relevance in specialized and next generation vehicle components.

JSW Steel Limited strengthens its market presence through continuous investment in high strength automotive steel grades and process optimization. The company aligns AHSS development with evolving safety and emission standards, particularly in emerging automotive markets. Its focus on cost efficiency and localized supply supports broader adoption among regional OEMs.

Overall, these key players collectively influence technology direction, material performance benchmarks, and supply chain resilience within the Automotive Advanced High Strength Steel market. Their strategies in innovation, scalability, and regulatory alignment continue shaping market growth dynamics in 2024.

Top Key Players in the Market

- Arcelor Mittal S.A.

- BAOSTEEL

- HOWCO ADDITIVE

- JSW Steel Limited

- POSCO

- SSAB

- Tata Steel Limited

- Thyssenkrupp AG

- United States Steel Corporation

- voestalpine Stahl GmbH

Recent Developments

- In June 2025, USD 14.9 billion acquisition, Nippon Steel Corporation finalized the takeover of United States Steel Corporation, making U.S. Steel a wholly owned subsidiary while retaining its historic name and headquarters in Pittsburgh, Pennsylvania.The transaction followed extensive regulatory and national security reviews and included a U.S. government “golden share” arrangement, ensuring oversight while strengthening Nippon Steel’s global automotive and AHSS production footprint.

- In June 2025, ArcelorMittal completed the acquisition of Nippon Steel’s 50% equity stake in the AM/NS Calvert joint venture, securing full ownership of the Calvert steel mill in Alabama.The facility, now renamed ArcelorMittal Calvert, serves as a major flat-rolled steel finishing hub, supporting the production of advanced high-strength steels for automotive lightweighting and safety-critical applications.

Report Scope

Report Features Description Market Value (2024) USD 23.2 billion Forecast Revenue (2034) USD 59.0 billion CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles), By Product Type (Dual Phase, Transformation-Induced Plasticity (TRIP), Complex Phase, Others), By Application (Body in White, Suspension, Bumper, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Arcelor Mittal S.A., BAOSTEEL, HOWCO ADDITIVE, JSW Steel Limited, POSCO, SSAB, Tata Steel Limited, Thyssenkrupp AG, United States Steel Corporation, voestalpine Stahl GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Advanced High Strength Steel (AHSS) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Advanced High Strength Steel (AHSS) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arcelor Mittal S.A.

- BAOSTEEL

- HOWCO ADDITIVE

- JSW Steel Limited

- POSCO

- SSAB

- Tata Steel Limited

- Thyssenkrupp AG

- United States Steel Corporation

- voestalpine Stahl GmbH