Global Automotive Adaptive Front Lighting System Market Size, Share, Growth Analysis By Vehicle Type (Mid-Segment Passenger Cars, Sports Cars, Premium Vehicles), By Component Type (Lamp Assembly, Controller, Sensors/ Camera, Others), By Sales Channel Type (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170965

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

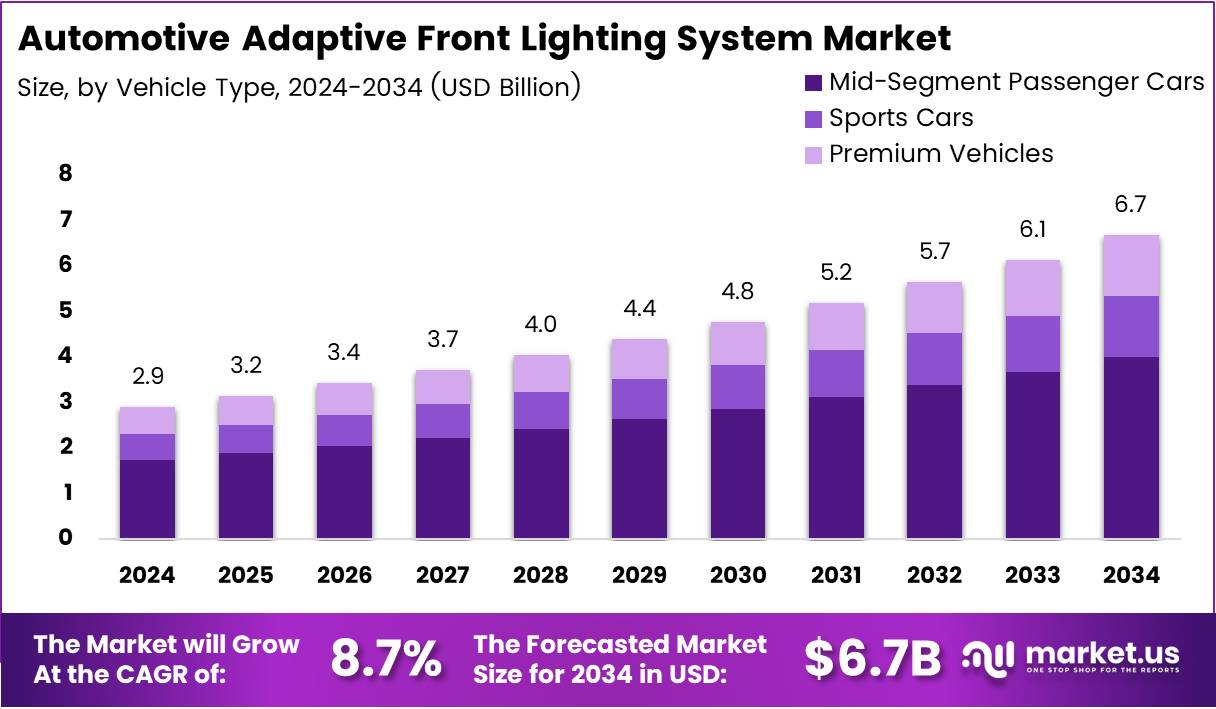

Global Automotive Adaptive Front Lighting System Market size is expected to be worth around USD 6.7 Billion by 2034 from USD 2.9 Billion in 2024, growing at a CAGR of 8.7% during the forecast period 2025 to 2034. This market represents a critical intersection of automotive safety innovation and intelligent vehicle technology advancement.

Automotive Adaptive Front Lighting Systems dynamically adjust headlight direction and intensity based on driving conditions. These systems enhance driver visibility during cornering, adverse weather, and varying road scenarios. As vehicles evolve toward smarter platforms, adaptive lighting has transitioned from luxury features to essential safety components across multiple vehicle segments.

The market is experiencing robust expansion driven by stringent safety regulations and consumer awareness. Governments worldwide are implementing mandatory advanced headlamp standards to reduce nighttime accidents. Consequently, automakers are integrating adaptive lighting as standard equipment rather than optional upgrades, fundamentally reshaping the competitive landscape.

Technology integration continues accelerating with LED and matrix lighting architectures gaining widespread adoption. OEMs are leveraging intelligent exterior lighting systems for brand differentiation. Premium and mid-segment vehicles increasingly feature adaptive lighting, creating substantial market opportunities. Electric vehicle platforms particularly favor advanced lighting due to their technological positioning and consumer expectations.

According to IIHS, vehicles with good headlight visibility ratings experience 19% fewer nighttime single-vehicle crashes and 23% fewer nighttime pedestrian crashes compared to poorly rated headlights. Furthermore, research from AAA indicates that universal ADB implementation could achieve approximately 6% reduction in pedestrian and cyclist crashes at night, potentially preventing around 1,500 injuries and fatalities annually with cost savings exceeding $861 million per year.

Additionally, according to YouGov consumer research, 44% of global consumers identify advanced safety features as a top influence on new car purchase decisions, highlighting strong market demand for adaptive lighting technologies.

Key Takeaways

- Global Automotive Adaptive Front Lighting System Market valued at USD 2.9 Billion in 2024, projected to reach USD 6.7 Billion by 2034.

- Market growing at CAGR of 8.7% during forecast period 2025-2034.

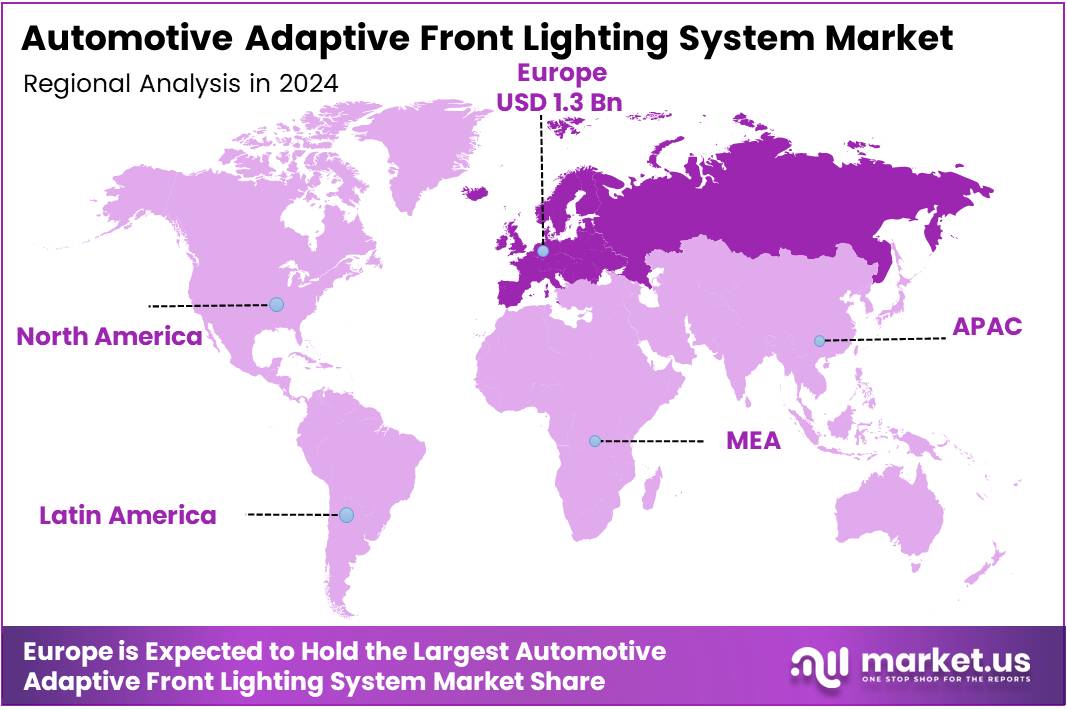

- Europe dominates with 48.2% market share, valued at USD 1.3 Billion.

- Mid-Segment Passenger Cars hold 48.9% share in vehicle type segment.

- Lamp Assembly component accounts for 43.7% of component type segment.

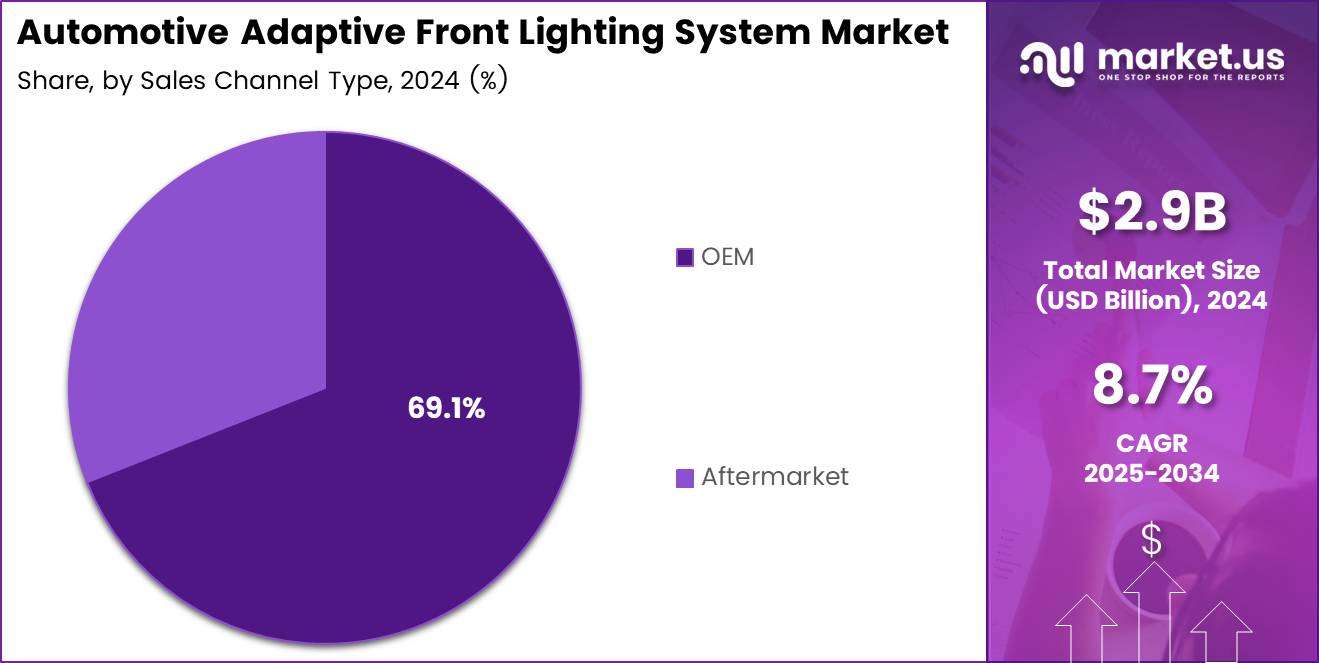

- OEM sales channel commands 69.1% market share.

Vehicle Type Analysis

Mid-Segment Passenger Cars dominate with 48.9% due to mass-market accessibility and safety standardization.

In 2024, Mid-Segment Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of Automotive Adaptive Front Lighting System Market, with a 48.9% share. This segment benefits from increasing regulatory mandates requiring advanced lighting in mainstream vehicles. Automakers are democratizing adaptive lighting technology by integrating it into mid-range models. Consumer demand for enhanced safety features drives adoption across this price-sensitive category. Furthermore, production scale economies enable competitive pricing for adaptive systems in volume segments.

Sports Cars represent a specialized segment where adaptive lighting enhances performance-oriented driving experiences. These vehicles utilize advanced matrix and laser lighting for superior high-speed visibility. Manufacturers position adaptive systems as premium performance differentiators in this category. Additionally, sports car buyers demonstrate higher willingness to pay for cutting-edge lighting technologies that complement vehicle dynamics.

Premium Vehicles showcase the most sophisticated adaptive lighting implementations with AI-driven beam control. This segment pioneered adaptive front lighting adoption before mass-market diffusion began. Luxury automakers continue innovating with high-resolution digital matrix systems and laser technologies. Consequently, premium vehicles serve as testing grounds for next-generation lighting features that eventually cascade to lower segments.

Component Type Analysis

Lamp Assembly dominates with 43.7% due to its core functional role and technological complexity.

In 2024, Lamp Assembly held a dominant market position in the By Component Type Analysis segment of Automotive Adaptive Front Lighting System Market, with a 43.7% share. This component encompasses the physical lighting hardware including LED arrays and optical systems. Advanced lamp assemblies integrate multiple lighting elements for various adaptive functions. Manufacturing complexity and material requirements drive significant value concentration in this segment. Moreover, ongoing transitions from halogen to LED and matrix technologies sustain continuous upgrade cycles.

Controllers serve as the intelligent processing units managing adaptive lighting logic and real-time adjustments. These electronic control units process sensor inputs and execute lighting pattern changes. Advanced controllers integrate with vehicle ADAS systems for coordinated safety responses. Furthermore, software-defined lighting capabilities increasingly rely on sophisticated controller architectures for feature flexibility and over-the-air updates.

Sensors and Cameras provide environmental perception enabling adaptive lighting decision-making processes. Camera systems detect oncoming vehicles, road curvature, and ambient lighting conditions. Sensor fusion combines multiple inputs for accurate beam steering and intensity modulation. Additionally, these perception components represent growing value as adaptive systems become more context-aware and predictive.

Others category includes wiring harnesses, mounting hardware, and diagnostic interfaces supporting system integration. These auxiliary components ensure reliable mechanical and electrical connections throughout the lighting system. Standardization efforts in this category facilitate easier installation and maintenance procedures. Consequently, innovation focuses on reducing complexity while maintaining system robustness across diverse vehicle platforms.

Sales Channel Type Analysis

OEM channel dominates with 69.1% due to factory integration and regulatory compliance requirements.

In 2024, OEM held a dominant market position in the By Sales Channel Type Analysis segment of Automotive Adaptive Front Lighting System Market, with a 69.1% share. Original Equipment Manufacturers integrate adaptive lighting during vehicle production for optimal system calibration. Factory installation ensures proper alignment with vehicle architecture and electronic systems. Regulatory compliance strongly favors OEM channels as adaptive lighting requires homologation testing. Additionally, automakers bundle adaptive systems with other safety packages, creating strong OEM channel preference.

Aftermarket channel addresses retrofit demand and replacement requirements for existing vehicle populations. This segment serves consumers seeking to upgrade older vehicles with modern lighting capabilities. However, aftermarket adoption faces technical challenges including calibration complexity and regulatory restrictions. Nevertheless, specialized aftermarket suppliers develop solutions for popular vehicle models where retrofit demand justifies investment. Growing vehicle parc with aging lighting systems gradually expands aftermarket opportunities despite OEM channel dominance.

Key Market Segments

By Vehicle Type

- Mid-Segment Passenger Cars

- Sports Cars

- Premium Vehicles

By Component Type

- Lamp Assembly

- Controller

- Sensors/Camera

- Others

By Sales Channel Type

- OEM

- Aftermarket

Drivers

Mandatory Advanced Headlamp Regulations Accelerate Market Adoption

Governments globally are implementing stringent regulations mandating advanced headlamp systems to reduce nighttime accidents. These regulatory frameworks establish minimum performance standards that conventional lighting cannot meet. Consequently, automakers must integrate adaptive front lighting to comply with evolving safety requirements. Europe and North America lead regulatory implementation, creating immediate market demand across major automotive regions.

Rapid penetration of LED and matrix lighting architectures transforms the technological landscape. These advanced systems offer superior efficiency, longevity, and control granularity compared to traditional halogen units. Matrix LED technology enables precise beam shaping without mechanical movement, reducing complexity. Furthermore, declining LED costs make adaptive systems economically viable across broader vehicle segments, accelerating mass-market adoption.

Rising consumer demand for enhanced visibility and adaptive safety features drives purchasing decisions. Buyers increasingly prioritize active safety technologies when evaluating vehicle options. Adaptive lighting delivers tangible safety benefits that resonate with safety-conscious consumers. Additionally, enhanced nighttime driving comfort positions adaptive systems as valuable quality-of-life improvements beyond basic regulatory compliance.

OEM focus on differentiation through intelligent exterior lighting systems intensifies competitive dynamics. Automakers leverage distinctive lighting signatures for brand recognition and premium positioning. Adaptive capabilities enable manufacturers to showcase technological sophistication and innovation leadership. Consequently, lighting systems evolve from purely functional components to strategic brand differentiation tools in crowded automotive markets.

Restraints

High System Integration Costs Challenge Market Penetration

High system integration costs across sensors, ECUs, and lighting modules constrain widespread adoption. Adaptive lighting requires sophisticated hardware including cameras, controllers, and precision optical assemblies. Integration complexity increases vehicle development costs and extends validation timelines. Consequently, budget-conscious manufacturers hesitate to standardize adaptive systems across entire product portfolios, limiting market penetration velocity.

Limited penetration in entry-level vehicles due to price sensitivity restricts addressable market expansion. Cost-conscious consumers in economy segments prioritize basic transportation over advanced features. The price premium for adaptive lighting often exceeds willingness to pay in value-oriented vehicle categories. Furthermore, competitive pressure in entry segments forces manufacturers to minimize optional content, relegating adaptive lighting to higher trim levels.

Technical complexity creates barriers for smaller manufacturers and emerging market producers. Developing adaptive lighting capabilities requires substantial engineering resources and testing infrastructure. Regulatory compliance demands extensive validation and homologation processes across multiple markets. Additionally, ongoing software development for adaptive algorithms necessitates long-term investment commitments that challenge resource-constrained organizations operating in this specialized technology domain.

Growth Factors

Electric Vehicle Integration Drives Technology Advancement

Expansion of adaptive front lighting in electric and premium hybrid platforms creates significant growth opportunities. Electric vehicles embrace advanced technologies as core brand positioning elements. EV manufacturers leverage adaptive lighting to demonstrate technological leadership and innovation. Furthermore, electric architectures simplify electrical integration of power-intensive adaptive lighting systems, reducing implementation barriers compared to conventional vehicles.

Increasing adoption of AFS in commercial vehicles for long-haul and fleet safety expands market boundaries. Fleet operators recognize adaptive lighting benefits for reducing nighttime accident risks and associated costs. Commercial vehicle applications particularly value enhanced visibility during varied route conditions. Consequently, safety-focused fleet procurement increasingly specifies adaptive lighting as standard equipment, opening substantial new market segments.

Software-defined lighting systems enabling over-the-air feature upgrades transform value propositions. Manufacturers can deploy new lighting patterns and adaptive behaviors without hardware modifications. This capability extends product lifecycles and creates ongoing customer engagement opportunities. Additionally, software-based functionality enables automakers to differentiate vehicles through distinctive lighting behaviors and continuous improvement programs.

Untapped demand in emerging markets following new vehicle safety norms presents expansion opportunities. Developing economies increasingly adopt international safety standards requiring advanced lighting capabilities. Rising middle-class populations in these regions demand modern safety features previously unavailable. Moreover, local production development in emerging markets will eventually drive cost reductions making adaptive lighting accessible to broader consumer segments.

Emerging Trends

Digital Technologies Transform Adaptive Lighting Capabilities

Integration of camera-based road perception with adaptive beam control enhances system intelligence. Advanced camera systems recognize specific road scenarios and proactively adjust lighting patterns. Machine learning algorithms improve recognition accuracy over time through continuous data collection. Consequently, adaptive systems become increasingly predictive rather than purely reactive, delivering superior driver assistance through anticipatory lighting adjustments.

Shift from mechanical swivel systems to fully digital matrix lighting eliminates moving parts. Digital matrix architectures enable faster response times and more precise beam control. Solid-state solutions improve reliability while reducing maintenance requirements over vehicle lifespans. Furthermore, digital systems support virtually unlimited lighting patterns, enabling future functionality expansion without hardware changes.

AI-driven lighting algorithms linked with ADAS and navigation data create holistic vehicle intelligence. Integrated systems use route information to preemptively adjust lighting for upcoming road conditions. ADAS sensor fusion provides comprehensive environmental awareness for optimal lighting configuration. Additionally, navigation integration enables location-specific lighting adaptations based on historical road characteristic data and traffic patterns.

Growing use of laser and micro-LED technologies enables high-resolution beam shaping capabilities. Laser lighting delivers exceptional range and precision for high-speed driving scenarios. Micro-LED arrays provide unprecedented control granularity for detailed beam pattern generation. These emerging technologies push adaptive lighting toward communication functions, potentially displaying warnings or information through programmable light projection on road surfaces.

Regional Analysis

Europe Dominates the Automotive Adaptive Front Lighting System Market with a Market Share of 48.2%, Valued at USD 1.3 Billion

Europe commands 48.2% market share, valued at USD 1.3 Billion, driven by stringent safety regulations and early technology adoption. European regulations pioneered adaptive lighting requirements, creating mature supplier ecosystems. Premium automakers headquartered in this region drive continuous innovation and feature proliferation. Furthermore, established automotive clusters in Germany, France, and Italy concentrate adaptive lighting expertise and production capacity.

North America Automotive Adaptive Front Lighting System Market Trends

North America demonstrates accelerating adoption following recent regulatory approvals for advanced adaptive lighting technologies. The market benefits from strong consumer preference for safety features and technology-rich vehicles. Major automakers increasingly standardize adaptive systems across model lineups to meet competitive pressures. Additionally, growing electric vehicle production in this region creates favorable conditions for adaptive lighting integration and market expansion.

Asia Pacific Automotive Adaptive Front Lighting System Market Trends

Asia Pacific exhibits the fastest growth potential driven by expanding automotive production and rising safety awareness. China, Japan, and South Korea lead regional adoption through domestic OEM capabilities and technology development. Emerging middle-class consumers increasingly demand advanced safety features in new vehicle purchases. Moreover, local governments progressively implement stricter vehicle safety standards that mandate or encourage adaptive lighting adoption across vehicle segments.

Middle East and Africa Automotive Adaptive Front Lighting System Market Trends

Middle East and Africa represent emerging markets with growing interest in premium vehicle features. Affluent consumers in GCC countries demonstrate strong preference for vehicles equipped with latest technologies. However, overall market penetration remains limited by economic constraints and vehicle fleet composition. Nevertheless, increasing vehicle imports from markets with standard adaptive lighting gradually expand regional presence and consumer awareness.

Latin America Automotive Adaptive Front Lighting System Market Trends

Latin America shows gradual adoption constrained by economic volatility and price-sensitive vehicle markets. Brazil and Mexico lead regional demand through local automotive production facilities. Premium vehicle segments demonstrate higher adaptive lighting penetration than mass-market categories. Furthermore, improving safety regulations in major markets create long-term growth foundations despite near-term economic challenges affecting consumer purchasing power.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Adaptive Front Lighting System Company Insights

HELLA KGaA Hueck & Co. maintains strong market position through comprehensive lighting system portfolios and established OEM relationships across European and global automakers. The company leverages extensive automotive electronics expertise to develop integrated adaptive lighting solutions with advanced sensor fusion capabilities.

Hyundai Mobis expands adaptive lighting presence through vertical integration within Hyundai-Kia ecosystem and growing third-party OEM partnerships. The company invests significantly in next-generation matrix LED and laser lighting technologies positioned for electric vehicle platforms.

Valeo Group leads innovation through strategic partnerships developing laser projection and high-definition lighting systems for autonomous vehicle applications. The company demonstrated advanced adaptive and communication lighting technologies at major industry events throughout 2025.

Magneti Marelli SpA provides comprehensive lighting solutions emphasizing cost-effective adaptive systems for mass-market vehicle segments across diverse global markets. The company focuses on scalable architectures enabling adaptive lighting democratization beyond premium vehicle categories.

These market leaders collectively drive technological advancement while competing intensely for OEM design wins. Companies invest heavily in software-defined lighting architectures enabling over-the-air updates and feature differentiation. Strategic partnerships with sensor suppliers and semiconductor companies strengthen system integration capabilities. Furthermore, industry consolidation continues as lighting specialists seek scale advantages necessary for sustained innovation investment in rapidly evolving adaptive lighting technologies.

Key Automotive Adaptive Front Lighting System Companies

- HELLA KGaA Hueck & Co.

- Hyundai Mobis

- Valeo Group

- Magneti Marelli SpA

- Koito Manufacturing Co. Ltd

- Koninklijke Philips N.V.

- Texas Instruments

- Stanley Electric Co. Ltd

- OsRam Licht AG

- ZKW Group

- General Electric Company

Recent Developments

- In January 2024, Tesla began rolling out a new adaptive headlight feature on the updated Tesla Model 3 via a 2024 software update in European markets.

- In April 2025, Valeo and Appotronics announced a strategic partnership to develop next-generation front lighting systems integrating advanced laser video projection technology for adaptive lighting enhancements.

- In July 2025, Valeo showcased its latest vehicle technologies including advanced adaptive and high-definition lighting solutions at IAA Mobility 2025 as part of its next-generation vehicle tech portfolio reveal.

- In September 2025, Valeo and Ennostar launched an advanced Mini LED high-definition exterior display system demonstrated at IAA Mobility 2025, indicating progress in smart exterior lighting and communication technologies that build on adaptive lighting innovations.

- In September 2025, Opel showcased AI-powered light communication concepts for autonomous vehicles at the International Symposium on Automotive Lighting, demonstrating adaptive lighting integration with vehicle-to-road-user communication functions.

- In March 2025, the 2025 Tesla Model Y was reported to adopt matrix LED headlights with controllable pixel technology in the U.S., enabling adaptive beam shaping to avoid glaring oncoming traffic.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Billion Forecast Revenue (2034) USD 6.7 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Mid-Segment Passenger Cars, Sports Cars, Premium Vehicles), By Component Type (Lamp Assembly, Controller, Sensors/ Camera, Others), By Sales Channel Type (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape HELLA KGaA Hueck & Co., Hyundai Mobis, Valeo Group, Magneti Marelli SpA, Koito Manufacturing Co. Ltd, Koninklijke Philips N.V., Texas Instruments, Stanley Electric Co. Ltd, OsRam Licht AG, ZKW Group, General Electric Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Adaptive Front Lighting System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Adaptive Front Lighting System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- HELLA KGaA Hueck & Co.

- Hyundai Mobis

- Valeo Group

- Magneti Marelli SpA

- Koito Manufacturing Co. Ltd

- Koninklijke Philips N.V.

- Texas Instruments

- Stanley Electric Co. Ltd

- OsRam Licht AG

- ZKW Group

- General Electric Company